China's AI Chip Challenge: Racing to Match Nvidia's Dominance

6 Sources

6 Sources

[1]

How China is challenging Nvidia's AI chip dominance

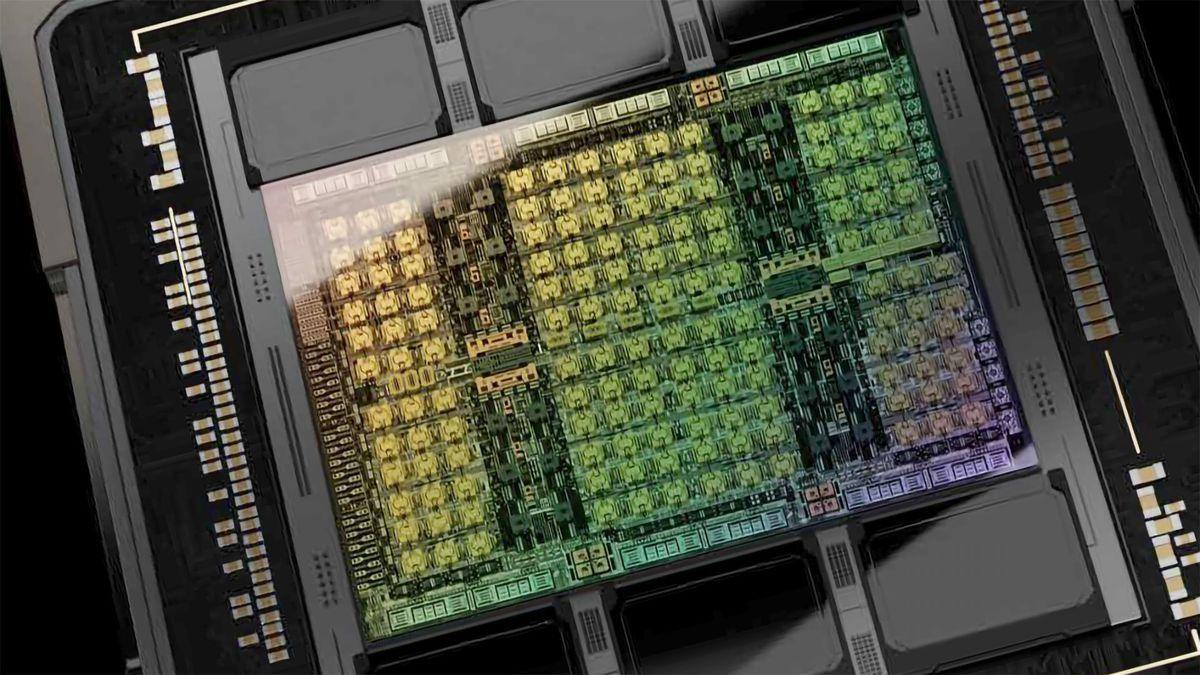

So can Beijing match American technology and break its reliance on imported high-end chips? China's DeepSeek sent shockwaves through the tech world in 2024 when it launched a rival to OpenAI's ChatGPT. The announcement by a relatively unknown startup was impressive for a number of reasons, not least because the company said it cost much less to train than leading AI models. It was said to have been created using far fewer high-end chips than its rivals, and its launch temporarily sank Silicon Valley-based Nvidia's market value. And momentum in China's tech sector has continued. This year, some of the country's big tech firms have made it clear that they aim to take on Nvidia and become the main advanced chip suppliers for local companies. In September, Chinese state media said a new chip announced by Alibaba can match the performance of Nvidia's H20 semiconductors while using less energy. H20s are scaled-down processors made for the Chinese market under US export rules. Huawei also unveiled what it said were its most powerful chips ever, along with a three-year plan to challenge Nvidia's dominance of the AI market. The Chinese tech giant also said it would make its designs and computer programs available to the public in China in an effort to draw firms away from their reliance on US products.

[2]

China's chip challenge: the race to match US tech

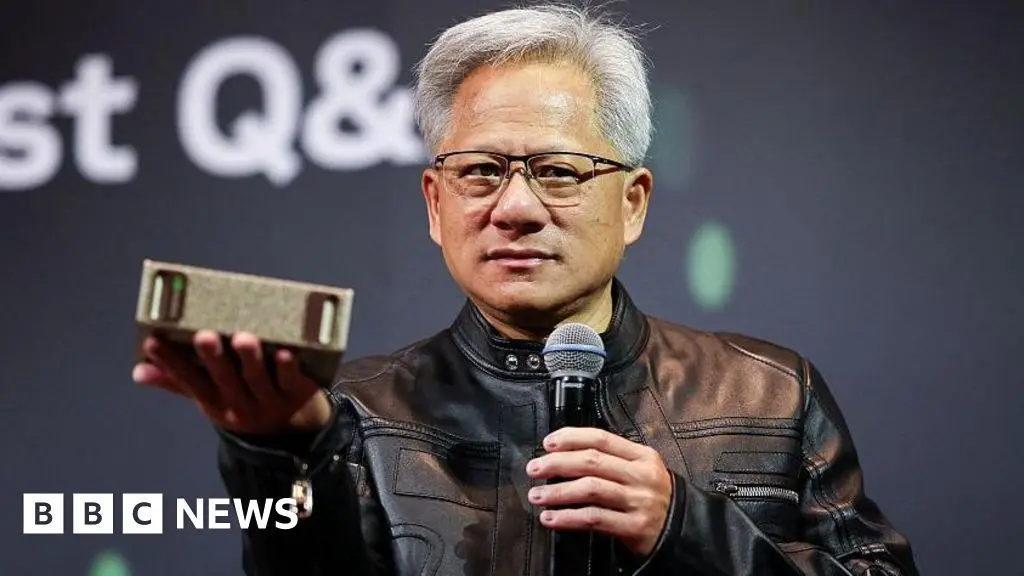

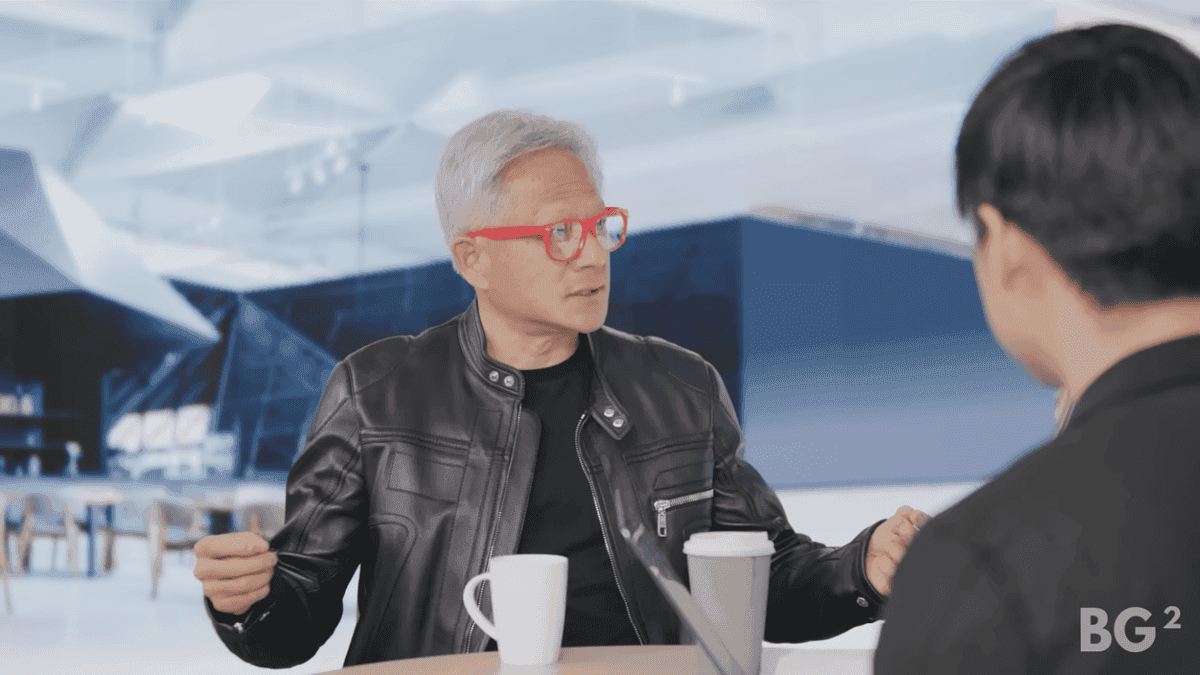

China's push to develop top-end artificial intelligence microchips is gaining momentum, but analysts say it will struggle to match the technical might of US powerhouse Nvidia within the current decade. Ramping up its chip industry is a way for Beijing to beat restrictions imposed by Washington on exports of the most advanced chips -- used to power AI systems -- to China. The United States cites national security concerns, such as the risk of giving China a military advantage, for the block, a geopolitical bind that shows no sign of easing. "China wants chips that policy cannot take away," said Stephen Wu, a former AI software engineer and founder of the Carthage Capital investment fund. However, "full end-to-end parity with Nvidia's best chips, memory packaging, networking and software is not guaranteed" by 2030 or even beyond, Wu told AFP. Announcements of computing upgrades by Chinese companies and reports of plans to dramatically increase output of advanced semiconductors have driven up chip-related shares in the country. But to catch up with Nvidia, China needs to make fast progress on high-bandwidth memory and packaging -- "the hardest and most complex parts of the chip", Wu said. Other challenges include building the right software to harness the chips' power, and upgrading manufacturing tools. "These chips are extremely advanced and tiny, so imagine carving a stone sculpture with a hammer instead of a chisel," Wu said. 'Only way' to succeed "The industry consensus is China at least needs five to ten years to catch up," said George Chen of The Asia Group, a view reflected by Dilin Wu, research strategist at Pepperstone. "The future is bright, but not yet," she told AFP. "It's maybe a 2030 story", as "significant gaps remain in terms of performance, and also in terms of energy efficiency and ecosystem maturity". Public demand for AI services is booming in China, and while government support for new chips is "substantial", the investment required is "immense", she added. Shares in Alibaba, the e-commerce titan plowing billions of dollars into AI tech, have more than doubled since January. And Chinese chip industry leader Huawei will reportedly double output of its top Ascend 910C chip in the next year. The hype has also sharply driven up stocks in the smaller chipmaker Cambricon, sometimes dubbed "China's Nvidia". "I think this rally can be sustained", partly because it is driven by Chinese government policy, Pepperstone's Wu said. Even Xiaomi, whose 2014 venture into chip design was a self-confessed flop, is turning back to semiconductors. "Chips are the only way for Xiaomi to succeed," the company's CEO Lei Jun said in Beijing last month, referring to the production of high-end smartphone chips. 'Best in China' China, the world's biggest consumer of semiconductors, is a huge market for California-based Nvidia. Nvidia chips are still "the best... to train large language models", the systems behind generative AI, said Chen Cheng, general manager for AI translation software at tech firm iFLYTEK. Faced with US restrictions, "we overcame that difficulty" by shifting to Chinese-made tech, she said in a group interview. "Now our model is trained on Huawei chips" -- currently the best in China, Cheng said. Meanwhile Nvidia, the world's largest company by market capitalization, is under pressure from both sides. The Financial Times reported last month that Beijing had barred major Chinese firms from buying a state-of-the-art Nvidia processor made especially for the country. And the company must now pay the US government 15% of revenue from certain AI chip sales in China. Nvidia boss Jensen Huang has warned that restrictions on exporting his most cutting-edge semiconductors to China will only fuel the country's rise. "They're nanoseconds behind us," the leather jacket-clad Huang said on a tech business podcast. "So we've got to go compete."

[3]

China's chip challenge: the race to match US tech

Beijing (AFP) - China's push to develop top-end artificial intelligence microchips is gaining momentum, but analysts say it will struggle to match the technical might of US powerhouse Nvidia within the current decade. Ramping up its chip industry is a way for Beijing to beat restrictions imposed by Washington on exports of the most advanced chips -- used to power AI systems -- to China. The United States cites national security concerns, such as the risk of giving China a military advantage, for the block, a geopolitical bind that shows no sign of easing. "China wants chips that policy cannot take away," said Stephen Wu, a former AI software engineer and founder of the Carthage Capital investment fund. However, "full end-to-end parity with Nvidia's best chips, memory packaging, networking and software is not guaranteed" by 2030 or even beyond, Wu told AFP. Announcements of computing upgrades by Chinese companies and reports of plans to dramatically increase output of advanced semiconductors have driven up chip-related shares in the country. But to catch up with Nvidia, China needs to make fast progress on high-bandwidth memory and packaging -- "the hardest and most complex parts of the chip", Wu said. Other challenges include building the right software to harness the chips' power, and upgrading manufacturing tools. "These chips are extremely advanced and tiny, so imagine carving a stone sculpture with a hammer instead of a chisel," Wu said. 'Only way' to succeed "The industry consensus is China at least needs five to ten years to catch up," said George Chen of The Asia Group, a view reflected by Dilin Wu, research strategist at Pepperstone. "The future is bright, but not yet," she told AFP. "It's maybe a 2030 story", as "significant gaps remain in terms of performance, and also in terms of energy efficiency and ecosystem maturity". Public demand for AI services is booming in China, and while government support for new chips is "substantial", the investment required is "immense", she added. Shares in Alibaba, the e-commerce titan ploughing billions of dollars into AI tech, have more than doubled since January. And Chinese chip industry leader Huawei will reportedly double output of its top Ascend 910C chip in the next year. The hype has also sharply driven up stocks in the smaller chipmaker Cambricon, sometimes dubbed "China's Nvidia". "I think this rally can be sustained", partly because it is driven by Chinese government policy, Pepperstone's Wu said. Even Xiaomi, whose 2014 venture into chip design was a self-confessed flop, is turning back to semiconductors. "Chips are the only way for Xiaomi to succeed," the company's CEO Lei Jun said in Beijing last month, referring to the production of high-end smartphone chips. 'Best in China' China, the world's biggest consumer of semiconductors, is a huge market for California-based Nvidia. Nvidia chips are still "the best... to train large language models", the systems behind generative AI, said Chen Cheng, general manager for AI translation software at tech firm iFLYTEK. Faced with US restrictions, "we overcame that difficulty" by shifting to Chinese-made tech, she said in a group interview. "Now our model is trained on Huawei chips" -- currently the best in China, Cheng said. Meanwhile Nvidia, the world's largest company by market capitalisation, is under pressure from both sides. The Financial Times reported last month that Beijing had barred major Chinese firms from buying a state-of-the-art Nvidia processor made especially for the country. And the company must now pay the US government 15 percent of revenue from certain AI chip sales in China. Nvidia boss Jensen Huang has warned that restrictions on exporting his most cutting-edge semiconductors to China will only fuel the country's rise. "They're nanoseconds behind us," the leather jacket-clad Huang said on a tech business podcast. "So we've got to go compete."

[4]

China's chip challenge: the race to match US tech

China pushes to develop top AI microchips. Analysts state China will struggle to match Nvidia's technical might this decade. US restrictions on advanced chips drive this effort. China needs progress in memory, packaging, software, and manufacturing tools. Industry experts predict five to ten years for China to catch up. Huawei increases chip output. Chinese companies invest heavily in AI technology. China's push to develop top-end artificial intelligence microchips is gaining momentum, but analysts say it will struggle to match the technical might of US powerhouse Nvidia within the current decade. Ramping up its chip industry is a way for Beijing to beat restrictions imposed by Washington on exports of the most advanced chips -- used to power AI systems -- to China. The United States cites national security concerns, such as the risk of giving China a military advantage, for the block, a geopolitical bind that shows no sign of easing. "China wants chips that policy cannot take away," said Stephen Wu, a former AI software engineer and founder of the Carthage Capital investment fund. However, "full end-to-end parity with Nvidia's best chips, memory packaging, networking and software is not guaranteed" by 2030 or even beyond, Wu told AFP. Announcements of computing upgrades by Chinese companies and reports of plans to dramatically increase output of advanced semiconductors have driven up chip-related shares in the country. But to catch up with Nvidia, China needs to make fast progress on high-bandwidth memory and packaging -- "the hardest and most complex parts of the chip", Wu said. Other challenges include building the right software to harness the chips' power, and upgrading manufacturing tools. "These chips are extremely advanced and tiny, so imagine carving a stone sculpture with a hammer instead of a chisel," Wu said. 'Only way' to succeed "The industry consensus is China at least needs five to ten years to catch up," said George Chen of The Asia Group, a view reflected by Dilin Wu, research strategist at Pepperstone. "The future is bright, but not yet," she told AFP. "It's maybe a 2030 story", as "significant gaps remain in terms of performance, and also in terms of energy efficiency and ecosystem maturity". Public demand for AI services is booming in China, and while government support for new chips is "substantial", the investment required is "immense", she added. Shares in Alibaba, the e-commerce titan ploughing billions of dollars into AI tech, have more than doubled since January. And Chinese chip industry leader Huawei will reportedly double output of its top Ascend 910C chip in the next year. The hype has also sharply driven up stocks in the smaller chipmaker Cambricon, sometimes dubbed "China's Nvidia". "I think this rally can be sustained", partly because it is driven by Chinese government policy, Pepperstone's Wu said. Even Xiaomi, whose 2014 venture into chip design was a self-confessed flop, is turning back to semiconductors. "Chips are the only way for Xiaomi to succeed," the company's CEO Lei Jun said in Beijing last month, referring to the production of high-end smartphone chips. 'Best in China' China, the world's biggest consumer of semiconductors, is a huge market for California-based Nvidia. Nvidia chips are still "the best... to train large language models", the systems behind generative AI, said Chen Cheng, general manager for AI translation software at tech firm iFLYTEK. Faced with US restrictions, "we overcame that difficulty" by shifting to Chinese-made tech, she said in a group interview. "Now our model is trained on Huawei chips" -- currently the best in China, Cheng said. Meanwhile Nvidia, the world's largest company by market capitalisation, is under pressure from both sides. The Financial Times reported last month that Beijing had barred major Chinese firms from buying a state-of-the-art Nvidia processor made especially for the country. And the company must now pay the US government 15 percent of revenue from certain AI chip sales in China. Nvidia boss Jensen Huang has warned that restrictions on exporting his most cutting-edge semiconductors to China will only fuel the country's rise. "They're nanoseconds behind us," the leather jacket-clad Huang said on a tech business podcast. "So we've got to go compete."

[5]

Nvidia's China Nightmare Deepens -- Huawei's Chip Army Is Coming - NVIDIA (NASDAQ:NVDA)

Nvidia's dominance in AI chips just hit a serious test. Huawei is ramping up production at breakneck speed, signaling that the Chinese tech giant isn't just competing -- it's mobilizing a full-fledged "chip army" to challenge Nvidia in its own backyard. Track NVDA stock here. Huawei Doubles Down Huawei plans to double the production of its Ascend 910C AI chips in 2026, targeting about 600,000 units, and scale its Ascend series to around 1.6 million dies overall, reported Bloomberg. This isn't just a volume play -- it's a strategic strike. Beijing-backed subsidies and billions of dollars invested in semiconductor self-sufficiency are giving Huawei a structural edge, allowing it to compete directly with Nvidia's GPUs both in China and potentially in export markets. Its new CloudMatrix 384 cluster, bundling 384 Ascend chips, is already being delivered to domestic clients as a high-performance alternative to Nvidia systems. Read Also: Nvidia Gives. Nvidia Gets. Nvidia Grows -- Jensen Huang's $100 Billion Brainwave Nvidia's Fortress Under Pressure Nvidia still dominates the AI accelerator market globally, but China remains its most lucrative and contested region. Export restrictions limit Nvidia's ability to sell to the country, creating a unique opening for Huawei. Analysts note that while Nvidia enjoys an unmatched software ecosystem, such as CUDA, and a strong developer base, Huawei's chips are gaining traction with cost-conscious enterprises and state-supported cloud infrastructure. The combination of high-volume production, government backing, and aggressive local integration is raising alarms across Silicon Valley. Investor Takeaway For investors, the message is clear: Nvidia's China exposure is riskier than many realize. Huawei's chip ramp is not just a headline -- it's a tangible challenge that could reshape market share in one of the world's largest AI hardware markets. Nvidia remains the global leader in AI, but in China, the landscape is shifting rapidly. Read Next: Alibaba's $53 Billion AI Push Is The Threat Nvidia Can't Ignore Photo: Shutterstock NVDANVIDIA Corp$183.650.99%OverviewMarket News and Data brought to you by Benzinga APIs

[6]

Huawei ramps up AI chip production to fill in Nvidia's falling market share in China: report

China-based Huawei plans to nearly double the production of its artificial intelligence chip, the 910C, in 2026 as it attempts to fill in the gaps left in the wake of Nvidia's (NASDAQ:NVDA) dwindling shipments to the country, according to Bloomberg. Huawei's plan to produce more 910C chips aims to fill gaps left by Nvidia and provide needed supply for domestic AI firms, potentially supporting China's AI ecosystem despite lower chip performance relative to Nvidia. Chinese AI companies like Alibaba and DeepSeek face advanced chip shortages due to Nvidia's halt, possibly slowing training and deployment of AI models until local alternatives scale up. Huawei's Ascend 950 chip offers only 6% of the performance of Nvidia's upcoming VR200, lagging significantly behind Nvidia's chips.

Share

Share

Copy Link

China is accelerating its efforts to develop advanced AI chips, aiming to compete with US tech giant Nvidia. Despite progress, analysts suggest China may need 5-10 years to catch up fully.

China's AI Chip Ambitions

In a bold move to challenge the dominance of US-based Nvidia in the artificial intelligence (AI) chip market, China is rapidly accelerating its efforts to develop advanced semiconductors. This push comes in response to US export restrictions on high-end chips to China, citing national security concerns

1

2

.Key Players and Developments

Chinese tech giants are at the forefront of this technological race. Alibaba recently announced a new chip that reportedly matches the performance of Nvidia's H20 semiconductors while using less energy

1

. Huawei, a leader in China's chip industry, plans to double the production of its top Ascend 910C chip in the coming year and has unveiled what it claims are its most powerful chips to date2

5

.Challenges and Timeframe

Despite the momentum, analysts suggest that China faces significant hurdles in matching Nvidia's technical prowess within the current decade. Stephen Wu, founder of Carthage Capital, notes that achieving full parity with Nvidia's best chips, memory packaging, networking, and software is not guaranteed even by 2030

2

3

.The industry consensus is that China needs at least five to ten years to catch up. Key challenges include:

- Making progress on high-bandwidth memory and packaging

- Building the right software to harness the chips' power

- Upgrading manufacturing tools

2

3

Related Stories

Market Impact and Government Support

The push for AI chip development has driven up chip-related shares in China. Alibaba's stock has more than doubled since January, and smaller chipmakers like Cambricon have seen sharp increases in their stock prices

3

4

.The Chinese government is providing substantial support for new chip development, recognizing it as a strategic priority. However, the investment required is immense, and public demand for AI services in China is booming

3

4

.Nvidia's Response and Global Implications

Nvidia, currently the world's largest company by market capitalization, faces pressure from both US restrictions and Chinese competition. The company must now pay the US government 15% of revenue from certain AI chip sales in China

3

.Nvidia's CEO, Jensen Huang, has warned that restrictions on exporting cutting-edge semiconductors to China will only fuel the country's technological rise. He acknowledged the tight competition, stating, "They're nanoseconds behind us. So we've got to go compete"

3

5

.As this technological race intensifies, it has far-reaching implications for global AI development, market dynamics, and geopolitical relations in the semiconductor industry.

References

Summarized by

Navi

[2]

[3]

Related Stories

Nvidia's AI Chip Dominance Challenged as China Accelerates Domestic Production

23 Sept 2025•Technology

Huawei's Ascend 910D AI Chip Challenges NVIDIA Amid US Export Restrictions

21 Apr 2025•Technology

Alibaba Develops AI Inference Chip Amid China's Push for Semiconductor Independence

28 Aug 2025•Technology

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation