Nvidia's AI Chip Dominance Challenged as China Accelerates Domestic Production

11 Sources

11 Sources

[1]

Jensen Huang says China is 'nanoseconds behind' the US in chipmaking, calls for reducing US export restrictions on Nvidia's AI chips

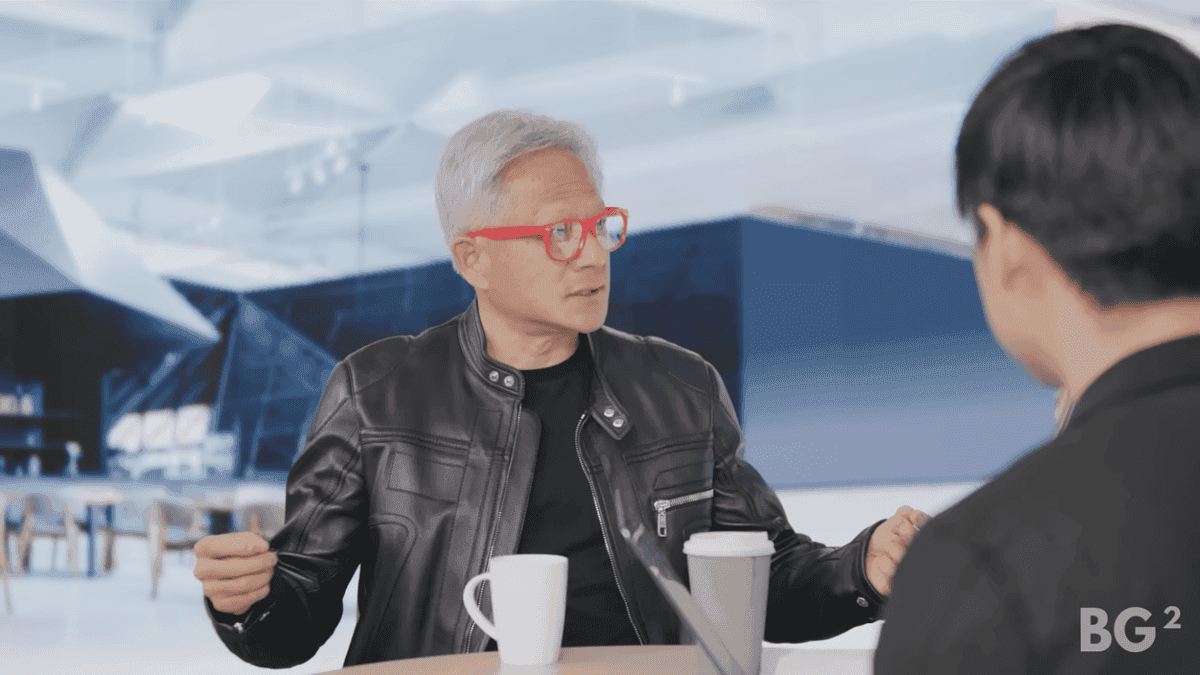

As Chinese firms scale and U.S. export rules tighten, Nvidia is fighting to keep a foothold in China. Nvidia CEO Jensen Huang says China is just "nanoseconds behind" the U.S. in chipmaking and that Washington should stop trying to wall off the market. Speaking on the BG2 podcast, Huang argued that allowing companies like Nvidia to sell into China would serve American interests by spreading U.S. technology and extending its geopolitical influence. "We're up against a formidable, innovative, hungry, fast-moving, underregulated [competitor]," Huang said, talking about the pedigree of China's engineers and controversial 9-9-6 working culture. His comments come as Nvidia hopes to ship its H20 AI GPU to Chinese customers again, following a months-long pause tied to new U.S. export rules. The Commerce Department is understood to have begun issuing licenses for the H20 in August, and Nvidia is already working on a successor chip designed to comply with current restrictions while offering better performance. The company has not confirmed specs, but it would be Nvidia's second attempt to tailor an AI accelerator specifically for the Chinese market since the original A100 and H100 bans took effect. China, meanwhile, is accelerating its own plans to become self-sufficient. Huawei's new Atlas 900 A3 SuperPoD systems, powered by the company's Ascend 910B chips, are now shipping in volume. The company has laid out an ambitious roadmap through 2027 with next-gen Ascend silicon that aims to match or exceed current-gen performance. These systems are CUDA-free by design and optimized for Chinese-built software stacks, a shift that puts real pressure on Nvidia's dominance, which, according to Huang, previously held a 95% market share in China. Chinese hyperscalers are backing that roadmap with capital. Baidu, Alibaba, Tencent, and ByteDance are all investing in custom silicon, either through internal chip teams or by funding startups. That includes firms like Tencent, which has announced it has fully adapted its infrastructure to support homegrown silicon. Asked what he sees in the near future, Huang said, "They [China] publicly say... they want China to be an open market, they want... companies to come to China and compete in the marketplace... and I believe and I hope that we return to that." Nvidia's approach to that is to maintain a foothold in China and play both sides of the geopolitical divide. The H20 may be hobbled compared to the company's leading chips, but it gives Chinese companies a path to stay within the Nvidia ecosystem -- at least for now.

[2]

Huawei to Double Output of Top AI Chip as Nvidia Wavers in China

Huawei Technologies Co. is preparing to sharply ramp up production of its most advanced artificial intelligence chips over the next year, aiming to win customers in the world's biggest semiconductor market while Nvidia Corp. struggles with geopolitical headwinds. The Chinese company plans to make about 600,000 of its marquee 910C Ascend chips next year, roughly double this year's level, people familiar with the matter said, asking for anonymity to discuss private information. Huawei had struggled to get those products out the door for much of 2025 because of US sanctions. Overall, the Shenzhen-based company will raise output for its Ascend product line in 2026 to as many as 1.6 million dies, the people said, describing the basic silicon components that house chip circuitry.

[3]

Huawei Plans Three-Year Campaign to Overtake Nvidia in AI Chips

Huawei Technologies Co. openly admits its silicon can't match Nvidia Corp.'s in raw power and speed. So to pack the same punch, China's national champion is counting on its traditional strengths: brute force, networking, and policy support. Huawei on Thursday took the rare step of publicizing a three-year vision for eroding Nvidia's dominance in the AI boom. Rotating Chairman Eric Xu outlined the technology the Shenzhen-based company envisions in painstaking detail during its annual Huawei Connect conference, triggering wall-to-wall media coverage.

[4]

Nvidia Is Quaking in Its Boots

"We're up against a formidable, innovative, hungry, fast-moving, underregulated [competitor]." The chip manufacturer Nvidia might be one of the most valuable companies in history for now, but that could change in a heartbeat. In a recent appearance on the podcast "BG2," Nvidia CEO Jensen Huang agonized that China is now "nanoseconds behind" US chipmakers, the companies building the hardware undergirding the multi-billion dollar AI boom. Just weeks ago, China's internet regulator, the Cyberspace Administration of China (CAC) announced a ban on large Chinese tech firms purchasing Nvidia chips. The ban follows a broader effort by Chinese lawmakers to lessen dependency on foreign companies and promote domestic manufacturing -- a similar goal to the worker-led "Keep it Made in America" movement of 2009. For Huang, the loss of Chinese buyers is a major threat. Not only is Nvidia losing one of its most valuable markets, but it's also gaining a powerful competitor that threatens its near-monopoly on the global chip trade. "We're up against a formidable, innovative, hungry, fast-moving, underregulated [competitor]," Huang stewed. "This is a vibrant, entrepreneurial, high-tech, modern industry." "What we need to do as a country," the CEO continued, "is to enable our technology industry, which today is our national treasure... to go and proliferate the technology around the world. So that we can have the world to be built on top of American technology, so we can maximize our economic success, our geopolitical influence." Nvidia isn't the only Western company trembling about the increasingly independent PRC, but it is a powerful bellwether. In fact, Huang's lust for economic superiority and geopolitical dominance over China follows over 125 years of US meddling in the country's affairs. When it became clear that post-revolutionary China would resist Western colonialization, the US' response was to exert immense economic pressure on the nation. By 1962, president John F. Kennedy's foreign policy advisor Walt Rostow was able to brag that a US-led trade embargo was devastating the PRC, delaying its economic development for at least "tens of years." Now the chickens have come home to roost. For decades, China has been running an experiment to allow limited foreign investment into the country, a strategy known as "reform and opening up." Throughout this process, China's political leadership maintained strict regulations over the rights of foreign companies, leveraging the country's vast workforce to avoid the economic disasters which came to define similar projects in Russia and the former Yugoslavia. While an entire generation in China was subjected to horrifying work conditions typical of other nations exploited by international corporations, the People's Republic in turn gained access to the cutting-edge technologies of the West. It has since used those resources to develop an increasingly independent tech industry which now threatens the once-dominant US, while lifting some 800 million people out of poverty. In other words, Nvidia's CEO seems to be feeling the crunch of China's long-term strategy for economic independence. How this chip competition looks a year from now is difficult to say -- but as Huang shrugs off the best efforts of Intel and AMD, it's striking to see China making him nervous.

[5]

Nvidia CEO Jensen Huang says the US needs to 'go compete' with AI chips against China because 'they're nanoseconds behind us'

Nvidia CEO Jensen Huang claims that China is "nanoseconds behind" the US in terms of AI technology and chipmaking. During an interview on the BG2 podcast, a tech and investment focused bi-weekly program, the CEO of Nvidia echoed a sentiment similar to that of comments he made back in May of this year about how his company and the wider American tech industry needs to "go compete" in China. Huang emphasises, "We're up against a formidable, innovative, hungry, fast-moving, underregulated [competitor in China]" (via Tom's Hardware). These comments follow a podcast passage where Huang is generally complementary about the current US administration. Huang said, "[President Trump] wants America to win the AI race. This is going to be a very long-term race, and he understands this is a pivotal time. He wants the technology industry to run. He wants everybody in the world to be built on American technology." But China has been busy, accelerating its own AI infrastructure plans with a reported mandate that its domestic data centres source at least 50% of their chips from similarly domestic manufacturers to avoid a reliance on US-made tech. Huawei, and the company's Ascend 910B chips and CUDA-free systems, are arguably at the forefront of that push. "People think that they're centrally governed but, remember that the genius of China was distributed economic systems," Huang goes on to elaborate, "And so all of these 33 provinces and all the mayor economy has driven an enormous amount of internal competition, internal economic vibrancy, which of course has some of its side effects. But this is a vibrant entrepreneurial, high tech, modern industry." These latest comments are spoken amid an incredibly complex geopolitical stage. For one thing, it's a strange state of play on the home field of the US; though the Trump administration appears to be all in on AI with infrastructure projects like Stargate, the latest beat in the tech tariff saga is a plan to hit US companies that don't equally source their chips from the States as well as China with yet another tariff fee. During the BG2 podcast interview, Huang himself offers further context about Nvidia's place in China, saying the company had previously held a "95% market share" there but was now losing out to home-grown tech competitor Huawei. Though Huang comments in the BG2 podcast that his guidance to investors reassures that there are plenty of opportunities for growth outside of China, the country is still hugely important to Nvidia. Huang says, "I believe it is in the best interests of China that Nvidia is able to serve that market and compete in that market. [...] It is of course in the fantastic interest of the United States. But those two truths can coexist. It is possible for both to be true and I believe it is both true." Nvidia has 30 years of history with China and its tech industry -- but the company's H20 chips have become something of a flashpoint in this relationship. Nvidia announced back in July that it was applying to export its H20 GPUs to China again. These chips were originally designed to comply with the prior Biden administration's AI diffusion rule (which Nvidia's VP of government affairs, Ned Finkle, was not a fan of). But despite tech firms in China wanting these chips, Nvidia had to pause production of H20 back in August amid security concerns raised by the Chinese government (some choice remarks from President Trump may not have helped). China's internet regulator, the Cyberspace Administration of China, has also apparently banned some of the country's biggest tech companies from picking up Nvidia's RTX Pro 6000D, a product specifically designed with the Chinese market in mind. Is it any wonder then that major Chinese firm Tencent has moved to build its systems upon homegrown silicone? With such challenging markets on either side of the geopolitical divide, will the good, profitable-AI-times continue to roll for Nvidia? Or is the company's recent $100 billion deal with OpenAI the beginning of the snake eating its own tail? Time can only tell.

[6]

Huawei Ascend Roadmap Could Challenge Nvidia AI Leadership

Nvidia's CEO Jensen Huang isn't mincing words about the state of global chipmaking. In a recent BG2 podcast interview, he said China is only "nanoseconds behind" the U.S. when it comes to semiconductor technology. According to him, trying to wall off China from American AI chips doesn't slow them down -- it just limits U.S. influence. His argument is simple: if companies like Nvidia can sell into China, U.S. tech stays relevant in one of the biggest markets in the world. Right now, Nvidia is trying to get its H20 AI GPU back into Chinese data centers. Shipments were on hold for months due to new U.S. export restrictions, but licenses started being issued again in August. The H20 isn't Nvidia's most powerful chip, but it's been redesigned to comply with U.S. trade rules while still giving Chinese firms access to Nvidia's software ecosystem. The company is already developing a successor chip that fits the same mold -- not cutting-edge by global standards, but strong enough to keep Chinese customers tied to Nvidia. Meanwhile, Chinese tech companies are moving fast to close the gap. Huawei has started shipping its Atlas 900 A3 supercomputing systems powered by the Ascend 910B processor, and it has a roadmap stretching through 2027 for even more advanced chips. These systems are built without relying on CUDA, Nvidia's proprietary software stack, and are designed to support China's own AI frameworks. That shift alone poses a long-term risk for Nvidia's market dominance. The momentum isn't just coming from Huawei. Giants like Baidu, Alibaba, Tencent, and ByteDance are all investing in homegrown chips, either through their own teams or by funding startups. Tencent has even said its infrastructure is now fully ready to run on domestic silicon. Not long ago, Nvidia controlled roughly 95% of China's AI accelerator market. With this kind of coordinated investment, that dominance is already under pressure. Huang's hope is that the U.S. and China can return to a more open trading environment. From his perspective, selling into China is about more than short-term revenue -- it's about keeping Nvidia at the center of global AI development. The H20 may not match Nvidia's top-of-the-line hardware, but it gives Chinese companies a reason to stay connected to the Nvidia ecosystem. Whether U.S. policymakers agree with that strategy is another question. For now, Nvidia is trying to balance compliance with growth in a market it can't afford to ignore. Source: BG2 podcast

[7]

NVIDIA CEO Jensen Huang says China is 'nanoseconds behind' the US in chip development

TL;DR: NVIDIA CEO Jensen Huang states China is only nanoseconds behind the US in chip development, emphasizing the need for global competition, including in China, to drive technological innovation and maximize America's economic and geopolitical influence. Geopolitical tensions have impacted NVIDIA's AI GPU sales in China. China is just "nanoseconds behind" the United States in chip development according to NVIDIA CEO Jensen Huang. US companies like NVIDIA have been working to compete in China for a while now, which benefits both Beijing and Washington, as Chinese companies have been working around the clock to be "NVIDIA-free". The US government should allow its technology industry to compete around the world -- including China -- to "proliferate the technology around the world" so that it can "maximize America's economic success and geopolitical influence" says Jensen. The NVIDIA founder said that China is "nanoseconds behind" the US, adding "so we've got to compete". Jensen said during a podcast hosted by tech investors Brad Gerstner and Bill Gurley: "This is a vibrant, entrepreneurial, hi-tech, modern industry". Jensen continued: "What's in the best interest of China is for foreign companies to invest in China, compete in China and for them to also have vibrant competition themselves. They would also like to come out of China and participate around the world". NVIDIA's growing family of AI GPUs are the foundation of AI training and models, helping boost its market capitalization to the highest levels, making it the most valuable company on the planet. But, its sales into China have been hurt from geopolitical tensions between the US and China, with the US government banning exports of its H20 AI GPU earlier this year, before taking a knee for a 15% tax to the US government, to which NVIDIA agreed.

[8]

Huawei Challenges Nvidia's AI Chip Dominance In China - NVIDIA (NASDAQ:NVDA)

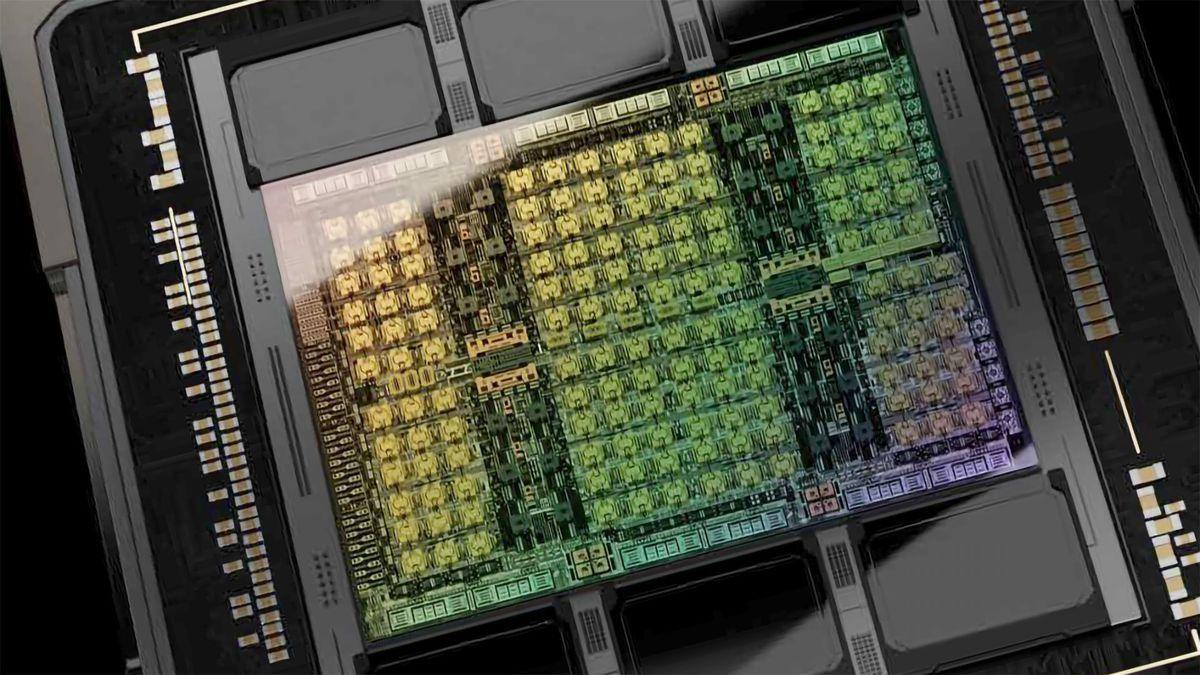

Huawei Technologies plans to challenge Nvidia's (NASDAQ: NVDA) next-generation artificial intelligence chips in China. According to Bloomberg, Huawei aims to double the output of its Ascend 910C chips to approximately 600,000 units in 2026. That's up from roughly 300,000 units this year. Including other products in the Ascend line, the company intends to produce up to 1.6 million dies in 2026, indicating that it and its partner, Semiconductor Manufacturing International Corp. (SMIC), have found ways to overcome bottlenecks caused by U.S. sanctions. Still, Nvidia stock remains resilient, trading upwards on Monday close to its 52-week high of $184.55. Also Read: Will Alibaba's New Chip Finally Unseat Nvidia In China? The push highlights Huawei's role as China attempts to cut its reliance on foreign chips. Beijing prioritized semiconductor self-sufficiency after the 2020 pandemic-induced chip crisis highlighted its importance across autos, defense, and artificial intelligence sectors. Huawei introduced new Ascend models slated through 2028. The company expects to launch a successor to the 910C, referred to as the 910D, in late 2026, with an initial target of 100,000 units. Long-term, it plans to launch the Ascend 950, 960, and 970 chips as it pushes to build competitive alternatives to Nvidia's products. Despite these ambitions, Huawei's chips still trail Nvidia's in performance. Analysts estimate the Ascend 950 will reach only 6% of Nvidia's next-generation VR200 superchip. Huawei currently produces dies using SMIC's enhanced 7-nanometer process, compared to Nvidia's 4-nanometer Blackwell GPUs, which are manufactured by Taiwan Semiconductor Manufacturing Co (NYSE: TSM). Nvidia continues to generate billions from China despite U.S. export curbs. Chinese firms ordered around one million H20 chips -- worth more than $16 billion in a single quarter -- driving $17 billion of Nvidia's $18 billion H20 sales since 2025. That demand accounted for 13% of its fiscal 2024 revenue. Bernstein expects Nvidia's China market share to fall to 55% this year from 66% in 2024. Still, Bank of America analyst Vivek Arya projects $6 billion to $10 billion in potential China sales through January, though $3 billion to $4 billion may face delays due to supply constraints. CEO Jensen Huang has described China as a $50 billion opportunity if Nvidia continues supplying sanction-compliant chips. Price Action: At last check Monday, NVDA stock were trading higher by 2.88% to $183.32. Read Next: Huang Breaks Silence On Beijing Move Targeting Nvidia AI Chips Image: Shutterstock NVDANVIDIA Corp$182.152.22%OverviewTSMTaiwan Semiconductor Manufacturing Co Ltd$275.760.88%Market News and Data brought to you by Benzinga APIs

[9]

Huawei to double output of top AI chip as Nvidia wavers in China

Huawei Technologies is preparing to sharply ramp up production of its most advanced artificial intelligence chips over the next year, aiming to win customers in the world's biggest semiconductor market while Nvidia struggles with geopolitical headwinds. The Chinese company plans to make about 600,000 of its marquee 910C Ascend chips next year, roughly double this year's level, people familiar with the matter said, asking for anonymity to discuss private information. Huawei had struggled to get those products out the door for much of 2025 because of U.S. sanctions. Overall, the Shenzhen-based company will raise output for its Ascend product line in 2026 to as many as 1.6 million dies, the people said, describing the basic silicon components that house chip circuitry. If Huawei can hit those targets, it would represent a technical breakthrough for a company regarded as China's best hope of weaning itself off the foreign chips that power the world's No. 2 economy. It suggests Huawei and main partner Semiconductor Manufacturing International Corp. have found a way to relieve some of the bottlenecks that have hindered not just its AI business, but also Beijing's self-reliance objectives. The projections for 2025 and 2026 include dies that Huawei has in inventory, as well as internal estimates of yields or the rate of failure during production, the people said.

[10]

Nvidia CEO Jensen Huang Warns US Export Controls On China May Have Backfired: 'They're Nanoseconds Behind Us' - Alibaba Gr Hldgs (NYSE:BABA), NVIDIA (NASDAQ:NVDA)

Nvidia Corp. (NASDAQ: NVDA) CEO Jensen Huang has hinted that U.S. policies aimed at slowing China's artificial intelligence progress might have instead accelerated domestic competitors like Huawei Technologies. Huang Says China's AI Push Cannot Be Underestimated Speaking on the Open Source podcast with Bill Gurley and Brad Gerstner that was posted last week, Huang pushed back against assumptions that China lags years behind U.S. innovation. Instead, he described Chinese firms as "formidable, innovative, hungry, fast-moving" and operating under lighter regulation. "Some of the things I heard, they could never build AI chips. That just sounded insane," Huang said, adding that people also said China can't manufacture. "China can't manufacture? If there's one thing they could do, is manufacture," the Nvidia CEO stated. He then went on to add that some also thought that China was "years behind us. Is it two years, three years? Come on. They're nanoseconds behind us. We've got to go compete." He pointed to China's 996 work culture -- 9 a.m. to 9 p.m., six days a week -- as evidence of the intensity driving its technology sector. From Dominance To Displacement In China Huang revealed Nvidia once held 95% market share in China's AI chip market before U.S. export controls forced the company to scale back. Following this, the hosts said that Washington's measures "handed China monopoly markets" that allow rivals like Huawei and Alibaba Group Holdings (NYSE: BABA) to build data centers globally. Call For The US To Compete, Not Constrain In response, Huang said, "We should acknowledge that China rightfully should want its companies to do well," adding that the U.S. must empower its technology industry, which he described as the nation's most valuable asset. He argued that restricting its ability to compete globally would weaken both economic and geopolitical influence at a time when American innovation is at a pivotal stage. Huang stressed that allowing U.S. technology to spread worldwide is essential for ensuring the industry's survival, growth, and long-term leadership. He dismissed critics who say his stance is motivated by a desire to sell more chips. "Just because I want America's ecosystem and economy to grow doesn't make me wrong," Huang said. Nvidia's Momentum Amid China Setbacks Earlier this month, reports emerged that China's Cyberspace Administration has banned major firms from buying Nvidia's China-specific chips, such as the H20 and RTX Pro 6000D, citing domestic alternatives. Regulators have also launched an antitrust probe into Nvidia, deepening its challenges in the country. Despite the turbulence in China, Nvidia continues to post record growth. In August, the company reported second-quarter revenue of $46.74 billion, up 56% year-over-year and above Wall Street's consensus estimate of $46.02 billion. For the third quarter, Nvidia has guided revenue between $52.92 billion and $55.08 billion, excluding any shipments of H20 chips to China. Benzinga's Edge Stock Rankings show that NVDA is maintaining an upward trend across short, medium and long-term horizons, with more performance insights accessible here. Read Next: Cathie Wood Dumps Palantir As Stock Touches Peak Prices, Bails On Soaring Flying-Taxi Maker Archer Aviation Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Image via Hepha1st0s/ Shutterstock BABAAlibaba Group Holding Ltd$177.863.46%OverviewNVDANVIDIA Corp$179.670.83%Market News and Data brought to you by Benzinga APIs

[11]

Huawei Bets On Brute Force To Outpace Nvidia - NVIDIA (NASDAQ:NVDA)

Nvidia NVDA shares pulled back in premarket trading on Tuesday, surrendering some of Monday's gains following reports that Huawei is aggressively pursuing an alternative path to challenge the U.S. chip designer's dominance. At its annual Huawei Connect conference, Huawei's rotating Chairman Eric Xu unveiled a three-year plan to erode Nvidia's leadership in artificial intelligence. The strategy centers on clustering a massive number of Ascend processors via a new UnifiedBus interconnect system. Also Read: Nvidia's Bold Move Catapults Intel To The Heart Of AI Innovation According to a Bloomberg report on Tuesday, the company claimed this design could move data up to 62 times faster than Nvidia's upcoming NVLink144 technology. Last week, Huawei unveiled a multiyear roadmap to challenge Nvidia by clustering thousands of its Ascend AI chips into powerful SuperPod systems. Eric Xu said the new design will connect up to 15,488 processors and scale into super clusters with about 1 million cards. The company also introduced self-designed high-bandwidth memory and outlined future Ascend 950, 960, and 970 chips. Huawei argues that while its processors trail Nvidia in single-chip performance, massive clustering and faster interconnects can deliver competitive results, Bloomberg reported. Interestingly, so far, Huawei has voiced that its chips lag Nvidia's in raw power and speed. This unusually high-profile rollout marks a significant shift for Huawei, which has maintained a low profile since U.S. sanctions in 2020 cut it off from Taiwan Semiconductor Manufacturing Co. TSM. The announcement also aligns with Washington's tightening curbs on Chinese access to advanced semiconductors and Beijing's push for national champions like Huawei to develop domestic alternatives. Nvidia's stock had climbed on Monday after the company deepened its collaboration with OpenAI, signing a letter of intent for a strategic partnership. Nvidia committed up to $100 billion to supply at least 10 gigawatts of systems to power OpenAI's next-generation AI infrastructure, beginning with the Vera Rubin platform in 2026. This deal establishes Nvidia as OpenAI's preferred compute and networking partner, ensuring the companies align their hardware and software roadmaps. The rally pushed Nvidia shares near a 52-week high, extending year-to-date gains of more than 36% and outperforming the Nasdaq 100. This highlights Nvidia's pivotal role in Big Tech's AI buildout, despite rivals like Broadcom AVGO also securing chip orders from OpenAI. However, analysts from Bernstein and Jefferies told Bloomberg that Huawei still lags technologically, with a next-generation Ascend chip delivering only a fraction of Nvidia's performance. The company has also not progressed beyond 7-nanometer designs due to a lack of advanced chipmaking equipment. Nevertheless, Huawei insists that its brute force, networking know-how, and government support can narrow the gap. Price Action: NVDA stock was trading lower by 1.00% to $181.77 at last check Tuesday. Read Next: Meta Teams Up With US Government To Bring Llama AI Models To Every Federal Agency Image via Shutterstock NVDANVIDIA Corp$181.77-1.00%OverviewAVGOBroadcom Inc$340.630.54%TSMTaiwan Semiconductor Manufacturing Co Ltd$282.333.56%Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Nvidia CEO Jensen Huang acknowledges China's rapid progress in AI chip development, calling for reduced US export restrictions. Meanwhile, Huawei plans to significantly increase production of its advanced AI chips, posing a serious threat to Nvidia's market share in China.

Nvidia's CEO Acknowledges China's Rapid Progress

Jensen Huang, CEO of Nvidia, has made a startling admission about China's progress in AI chip development. In a recent interview on the BG2 podcast, Huang stated that China is now just 'nanoseconds behind' the United States in chipmaking capabilities

1

. This acknowledgment comes as Nvidia faces increasing challenges in maintaining its dominant position in the Chinese market.Huang emphasized the formidable nature of Chinese competition, describing it as 'innovative, hungry, fast-moving, and underregulated'

4

. He argued that allowing companies like Nvidia to sell into China would serve American interests by spreading U.S. technology and extending its geopolitical influence1

.Huawei's Ambitious Plans to Challenge Nvidia

As Nvidia grapples with export restrictions, Chinese tech giant Huawei is seizing the opportunity to expand its presence in the AI chip market. Huawei has announced plans to significantly increase production of its advanced AI chips, aiming to double the output of its marquee 910C Ascend chips to about 600,000 units in the coming year

2

.Huawei's strategy involves leveraging its traditional strengths in networking and policy support to compensate for any performance gaps compared to Nvidia's chips

3

. The company has outlined a three-year vision to erode Nvidia's dominance in the AI boom, signaling its commitment to becoming a major player in the global AI chip market.Geopolitical Tensions and Export Restrictions

The ongoing geopolitical tensions between the United States and China have significantly impacted the AI chip industry. U.S. export restrictions have forced Nvidia to pause shipments of its H20 AI GPU to Chinese customers, despite the company's efforts to design chips specifically for the Chinese market

1

.In response, China has accelerated its plans for technological self-sufficiency. The country's internet regulator, the Cyberspace Administration of China (CAC), has reportedly banned large Chinese tech firms from purchasing Nvidia chips

4

. This move aligns with China's broader effort to reduce dependency on foreign companies and promote domestic manufacturing.Related Stories

Shifting Market Dynamics

The evolving situation has led to significant changes in the Chinese AI chip market. Nvidia, which previously held a 95% market share in China according to Huang, is now facing stiff competition from domestic players like Huawei

5

.Chinese tech giants such as Baidu, Alibaba, Tencent, and ByteDance are investing heavily in custom silicon, either through internal chip teams or by funding startups

1

. Tencent, for example, has announced that it has fully adapted its infrastructure to support homegrown silicon1

.Future Outlook

As the AI chip race intensifies, the global market is likely to see increased competition and innovation. Nvidia's CEO remains hopeful that China will return to being an open market, allowing foreign companies to compete freely

1

. However, the current trajectory suggests that China's domestic AI chip industry is poised for significant growth, potentially reshaping the global AI landscape in the coming years.References

Summarized by

Navi

[1]

[4]

Related Stories

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy