Huawei's Ascend 910C Challenges Nvidia's AI Dominance with 60% H100 Inference Performance

4 Sources

4 Sources

[1]

Can Huawei break Nvidia's stranglehold on AI? DeepSeek says so!

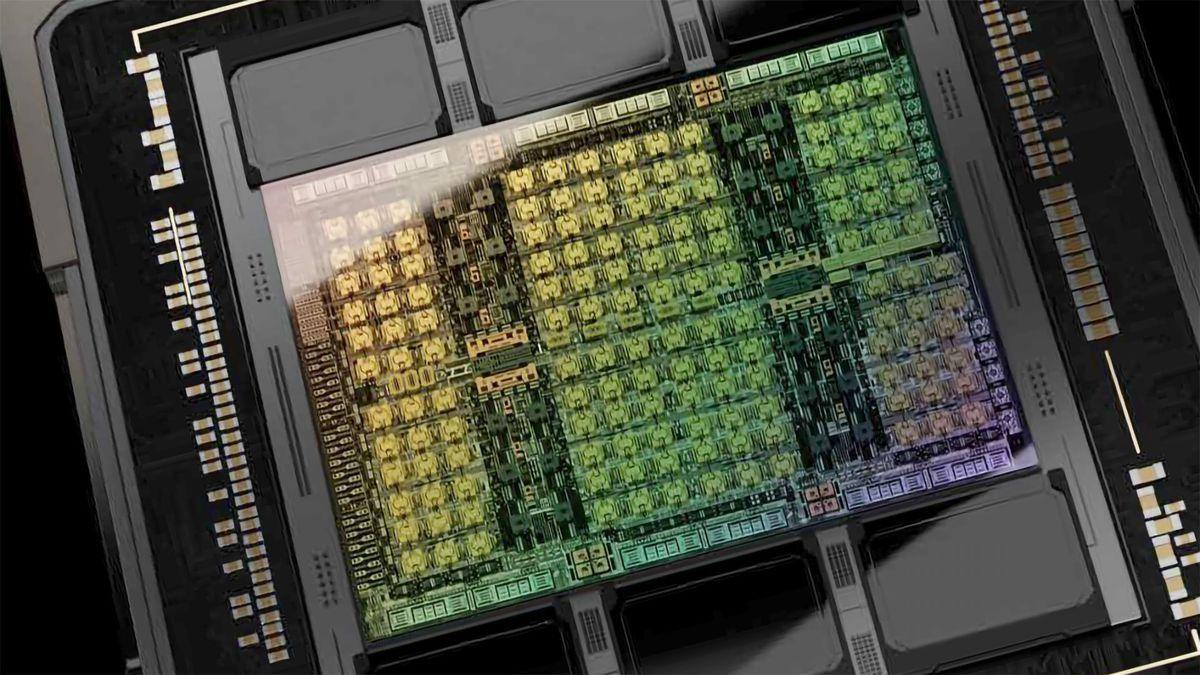

Is Huawei finally catching up to Nvidia in the AI arms race? DeepSeek's research reveals that Huawei's Ascend 910C delivers 60% of the inference performance of Nvidia's flagship H100 GPU -- a striking achievement for a chip born under U.S. sanctions and made without TSMC's cutting-edge technology. While Nvidia has long dominated the AI hardware world with its CUDA-powered GPUs, Huawei's chip could be the first step in reducing China's dependence on U.S. tech. The Ascend 910C, built on SMIC's 7nm N+2 process, punches well above its weight. With 53 billion transistors and chiplet packaging, the processor is optimized for inference tasks, making it a cost-effective alternative for companies eager to sidestep Nvidia's premium pricing. But Huawei isn't just relying on hardware specs -- DeepSeek's CUDA-to-CUNN conversion tools make it easier for developers to switch from Nvidia's ecosystem to Huawei's. How does it compare to Nvidia's H100 and H200 you ask? Well, in short: The Ascend 910C proves that Huawei is advancing quickly despite sanctions, but hurdles remain. Long-term training reliability and a lack of software integration are Achilles' heels for Chinese processors. Nvidia's CUDA ecosystem, perfected over decades, gives it a major advantage for now. However, as AI models increasingly converge on Transformer architectures, Nvidia's grip on the industry might loosen. Huawei is betting big on that shift, and DeepSeek's optimization tools could tip the scales. If Huawei continues to refine its AI chips, the Ascend 910C could be a stepping stone to breaking Nvidia's dominance. With cost-effective hardware, improved inference performance, and domestic manufacturing, it's clear that Huawei is positioning itself as a serious player. The real question: Will this be enough to disrupt Nvidia's global stronghold, or is Huawei still playing catch-up in an Nvidia-led world? It's best to stay tuned as this AI showdown unfolds.

[2]

Huawei's Upcoming Ascend 910C AI Chip Could Trigger Another Market Sell-Off; Rumored To Come Pretty Close With NVIDIA's H100

Well, if DeepSeek wasn't enough, it seems like we might see a massive AI hardware breakthrough from China, as Huawei's next AI chip might disrupt the competition coming from NVIDIA. The AI race is up and running, and in recent days, we have seen the balance tilt massively towards China, especially after DeepSeek's R1 AI model. Despite a challenging round of regulations and sanctions by the US, China has made surprising progress in the industry, not only introducing an in-house model capable of rivaling OpenAI's o1 but also with newer methods and techniques. To top it off, the Chinese AI segment is now focused on improving hardware computational capabilities, and the Ascend 910C from Huawei might kick-start this bandwagon as well. We recently reported on how DeepSeek utilized chips from Huawei for inferencing workloads. Now, Chinese media sources are claiming that Huawei's upcoming Ascend 910C AI chip offers competitive performance compared with NVIDIA's H100. The 910C has reached a 60% equivalence to Team Green's flagship Hopper AI accelerator, with inference tasks giving great output. It is argued that firms like DeepSeek have several advantages in utilizing a compute portfolio around Huawei's chips, and that's what we'll discuss next. It is claimed that Huawei's Ascend 910C is a complete "in-house" product, reportedly employing SMIC's 7nm process, along with 53 billion transistors. Moreover, Huawei has managed to bring support for DeepSeek's AI models since day one and even supports cross-compatibility with compute stacks like NVIDIA's CUDA, making it easier for developers to work on them. However, computational power isn't everything that matters since Huawei needs to establish the right software stack if it is eager to dethrone the CUDA ecosystem dominance. Interestingly, it is claimed (via @Jukanlosreve) that Huawei's Ascend 910C might be unveiled alongside NVIDIA's GTC 2025 keynote, which will feature next-gen architectures from Team Green. This is said to be China's response to NVIDIA's growing computational capabilities, and if Huawei manages to nail the release, it could possibly trigger a negative retail reaction. On our sell-off statement, it seems like NVIDIA is now witnessing a far more significant impact when its revenue streams are narrowed down. We recently discussed how the US is eager to patch trade loopholes in nations like Singapore, which accounts for 20% of NVIDIA's revenue. Additionally, the Trump administration is considering further regulating the sale of Team Green's AI chips to hostile nations, which will impact NVIDIA's quarterly revenue, ultimately creating the cascading effect on the stock market which we saw a few days ago. China has evolved tremendously, and the nation is a statement that US regulations haven't brought domestic industries down; rather, they have fueled in-house innovation, which we are seeing in the form of DeepSeek and Huawei.

[3]

DeepSeek research suggests Huawei's Ascend 910C delivers 60% Nvidia H100 inference performance

Aging chip could succeed in reducing China's reliance on Nvidia GPUs. Huawei's HiSilicon Ascend 910C is a version of the company's Ascend 910 processor for AI training introduced in 2019. By now, the performance of the Ascend 910 is barely sufficient for the cost-efficient training of large AI models. Still, when it comes to inference, it delivers 60% of Nvidia's H100 performance, according to researchers from DeepSeek. While the Ascend 910C is not a performance champion, it can succeed in reducing China's reliance on Nvidia GPUs. Testing by DeepSeek revealed that the 910C processor exceeded expectations in inference performance. Additionally, with manual optimizations of CUNN kernels, its efficiency could be further improved. DeepSeek's native support for Ascend processors and its PyTorch repository allows for seamless CUDA-to-CUNN conversion with minimal effort, making it easier to integrate Huawei's hardware into AI workflows. This suggests that Huawei's AI processor's capabilities are advancing rapidly, despite sanctions by the U.S. government and the lack of access to leading-edge process technologies of TSMC. While Huawei and SMIC have managed to catch up with TSMC's capabilities in the 2019 - 2020 era and produce a chip that can be considered competitive with Nvidia's A100 and H100 processors, the Ascend 910C is not the best option for AI training. AI training remains a domain where Nvidia maintains its undisputable lead. DeepSeek's Yuchen Jin said that long-term training reliability is a critical weakness of Chinese processors. This challenge stems from the deep integration of Nvidia's hardware and software ecosystem, which has been developed over two decades. While inference performance can be optimized, sustained training workloads require further improvements in Huawei's hardware and software stack. Just like the original Ascend 910, the new Ascend 910C chip uses chiplet packaging, and its main compute SoC has around 53 billion transistors. While the original compute chiplet of the Ascend 910 was made by TSMC using its N7+ fabrication technology (7nm-class with EUV), the compute chiplet of the Ascend 910C is made by SMIC on its 2nd Generation 7nm-class process technology known as N+2. Looking ahead, some experts predict that as AI models converge to Transformer architectures, the importance of Nvidia's software ecosystem may decline. DeepSeek's expertise in the optimization of hardware and software can also significantly reduce dependency on Nvidia, offering AI companies a more cost-effective alternative, particularly for inference. However, to compete at a global scale, China must overcome the challenge of training stability and further refine its AI computing infrastructure.

[4]

DeepSeek Could Use Domestic Chinese Chips After Learning From NVIDIA's GPUs - Report

China's AI lab DeepSeek, whose AI models wreaked havoc on Wall Street last week, can use Chinese GPUs for future models, suggests a report. DeepSeek's ability to purportedly reduce costs significantly over American models while using GPUs from chip giant NVIDIA Corporation upended markets as investors wondered whether billions of dollars in capital expenditure for AI development were needed. At the heart of the firm's model development is its ability to use low-level programming language on NVIDIA's GPUs called Parallel Thread Execution (PTX) instead of NVIDIA's offered language called Compute Unified Device Architecture (CUDA). Chinese semiconductor fabrication has been a frequent target of US sanctions which have prevented its largest foundry, the Semiconductor Manufacturing International Corporation (SMIC) from acquiring the latest chip making machines from Dutch giant ASML. These machines are indispensable for making the most advanced chips, with several reports suggesting that SMIC is restricted to manufacturing chips via the older 7-nanometer process technology family. A key factor in DeepSeek's ability to match performance of some Western AI models while using fewer and less performant NVIDIA GPUs has been the firm's ability to use a programming language called Parallel Thread Execution or PTX. PTX allows engineers to control a chip's basic functions more deeply than other languages, and there are relatively fewer engineers that are capable of using it. DeepSeek's decision to use the notoriously hard PTX stemmed from US GPU sanctions as the firm was able to secure either limited quantities of GPUs or only those chips that had lower performance. However, its expertise in using PTX can allow the firm to rely on domestic Chinese GPUs for future models suggests a report from the Hong Kong press. The report believes that since PTX allows programmers to tightly control a GPU's operations, it will enable DeepSeek's engineers to extract more performance from domestic Chinese GPUs. NVIDIA's Hopper H800 GPUs that DeepSeek claims to use are built using the 5-nanometer manufacturing process node. Launched in 2023, they had used the latest manufacturing process technology in the industry at the time. The report adds that by understanding NVIDIA's PTX implementation and how drivers control a chip's functions, DeepSeek can use similar programs with the Chinese GPUs. Any Chinese GPUs will likely be built with older manufacturing process technologies and offer significantly lower performance than NVIDIA's latest Blackwell GPUs.

Share

Share

Copy Link

Huawei's Ascend 910C AI chip, developed under US sanctions, achieves 60% of Nvidia H100's inference performance. This breakthrough could reduce China's reliance on US tech and disrupt the global AI hardware market.

Huawei's Ascend 910C: A Challenger to Nvidia's AI Dominance

In a significant development for the AI hardware industry, Huawei's Ascend 910C chip has demonstrated impressive performance capabilities, achieving 60% of the inference performance of Nvidia's flagship H100 GPU. This breakthrough, revealed by AI research firm DeepSeek, marks a potential shift in the global AI chip market and highlights China's progress in reducing its dependence on US technology

1

.Technical Specifications and Manufacturing

The Ascend 910C, built on SMIC's 7nm N+2 process, boasts 53 billion transistors and utilizes chiplet packaging. Despite being manufactured without access to TSMC's cutting-edge technology due to US sanctions, the chip has managed to punch above its weight, particularly in inference tasks

3

.Performance and Optimization

DeepSeek's research indicates that the Ascend 910C's performance exceeded expectations, especially in inference workloads. The chip's efficiency can be further improved through manual optimizations of CUNN kernels. DeepSeek's native support for Ascend processors and its PyTorch repository facilitates seamless CUDA-to-CUNN conversion, easing the integration of Huawei's hardware into AI workflows

3

.Market Implications

The emergence of the Ascend 910C could potentially disrupt Nvidia's stronghold on the AI chip market. As a cost-effective alternative for inference tasks, it may appeal to companies looking to avoid Nvidia's premium pricing. This development has led to speculation about potential market sell-offs and negative retail reactions, particularly if Huawei times the release of the Ascend 910C to coincide with Nvidia's GTC 2025 keynote

2

.Challenges and Limitations

While the Ascend 910C shows promise in inference tasks, it still faces challenges in AI training capabilities. Long-term training reliability remains a critical weakness for Chinese processors, largely due to the deep integration of Nvidia's hardware and software ecosystem developed over two decades

3

.Related Stories

Future Prospects

As AI models increasingly converge on Transformer architectures, the importance of Nvidia's software ecosystem may decline. This shift, coupled with DeepSeek's optimization tools and expertise, could further reduce dependency on Nvidia, offering AI companies a more cost-effective alternative, particularly for inference tasks

4

.Geopolitical Implications

The development of the Ascend 910C underscores China's progress in domestic chip production despite US sanctions. This advancement may fuel further innovation in China's AI industry, potentially altering the global AI landscape and challenging US technological dominance

2

.References

Summarized by

Navi

[3]

Related Stories

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy