Intel-Nvidia Alliance Reshapes AI Chip Landscape, Challenges AMD

5 Sources

5 Sources

[1]

Analysis: After Big Nvidia Win, Will Intel Ever Escape Its Rival's Shadow?

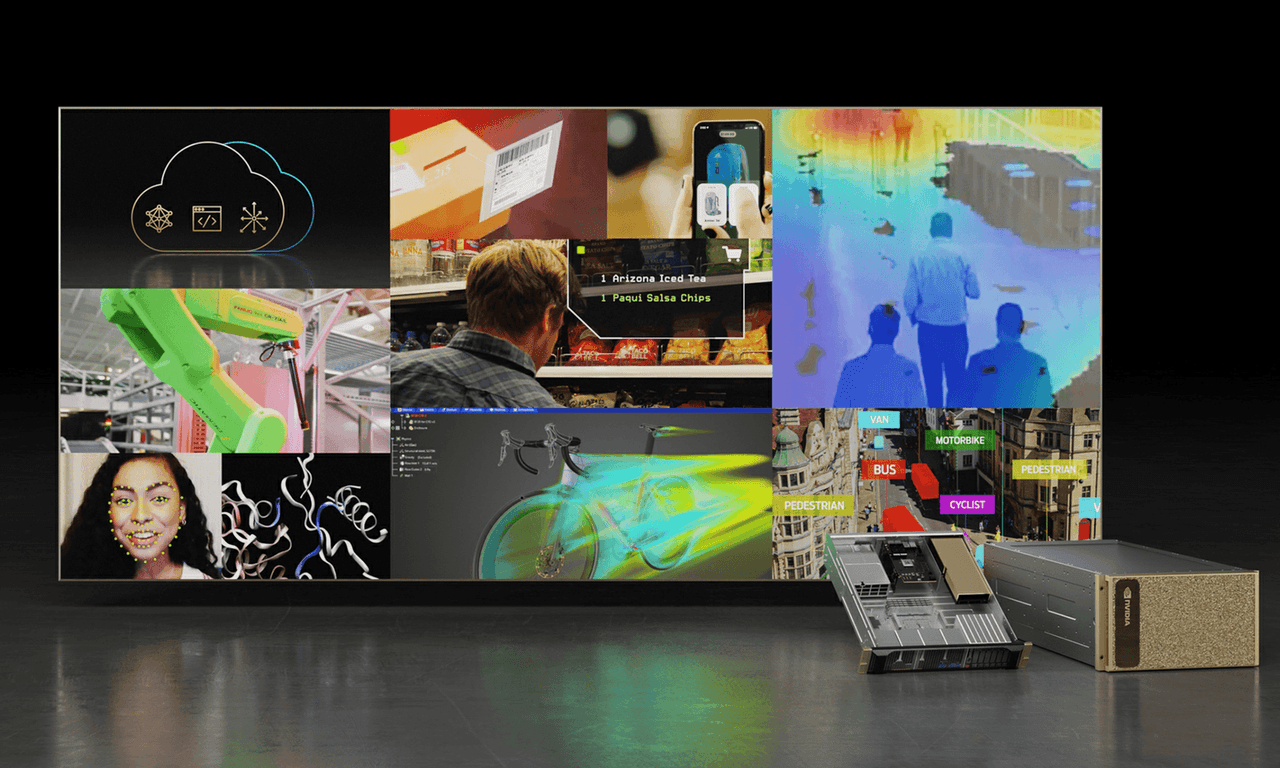

While the Intel-Nvidia deal will help drive CPU sales for Intel, the agreement will nevertheless keep the CPU in the back seat as the GPU drives greater interest and benefit for Nvidia -- a point that Nvidia CEO Jensen Huang emphasized in remarks last Thursday. Nvidia CEO Jensen Huang has come a long way from viewing Intel as an existential threat to his company and calling for his employees to "go kill Intel" back in 1997. As recalled in last year's book "The Nvidia Way" by reporter Tae Kim, Huang was responding then to Intel, armed with significantly more resources at the time, announcing the i740 graphics chip with double the frame buffer over the Riva 128 processor it put out months before. Nvidia, only four years old then, had been on very fragile financial footing. [Related: Nvidia Channel Chief Calls RTX Pro Servers Its 'Largest Scale-Out Opportunity'] Fast forward roughly 28 years later to last week, and the two companies are in radically different positions: Nvidia's annual revenue and profitability have far surpassed Intel's, giving it a big enough war chest to invest $5 billion in Intel common stock. This growth has been fueled by its full-stack computing platform that has been widely adopted for AI workloads, giving it the cachet to land a joint development deal with Intel -- now struggling in part because of its failure to execute a successful AI strategy -- that keeps Nvidia's GPUs at the center. Nvidia and Intel have called the investment and co-development deal, announced last Thursday, a "historic" agreement that will, in Huang's words, expand the market for Intel "very significantly" in addition to expanding Nvidia's opportunities. The news sent Intel's struggling stock price sky high that day, with the company's shares growing by 22.8 percent. Meanwhile, Nvidia -- whose market capitalization was roughly 27 times larger than its rival's at $4.3 trillion as of Thursday afternoon this week -- saw its stock price grow by 3.5 percent last Thursday. While the deal is a meaningful development for Intel, particularly as CEO Lip-Bu Tan seeks to stabilize Intel's waning CPU market share -- particularly on the server side -- it validated how foundational Nvidia has become to the modern technology world, where the concept of accelerated computing has gripped developers big and small, particularly for AI. Deal Creates x86 Option For Nvidia Rack-Scale Platforms In the lead up to the agreement, Intel had fought hard to achieve the status of host CPU provider for recent Nvidia platforms such as the DGX B300, for which it designed a custom Xeon chip. This is noteworthy considering the fierce competition Intel has faced from AMD, which won the socket for an earlier DGX design before ceding the space to its rival. Now, as part of the deal, Intel is designing a custom CPU to serve as the host for an x86 version of Nvidia's power-hungry rack-scale computing platforms, which have traditionally run on custom Arm-based CPUs. These platforms provide the fastest possible computing performance in a server rack by using Nvidia's NVLink interconnect technology to form high-speed connections between many GPUs -- a total of 72 for the latest offerings. What Intel and Nvidia are essentially doing here is giving customers more options for the kind of Nvidia platforms they want to power AI workloads. Currently, if customers wanted the most powerful Nvidia platform right now, they would have to choose the GB300 NVL72, whose host CPU is Nvidia's Arm-based Grace chip. In the future, customers will have the option for an Nvidia platform with what will likely provide a similar performance level but instead use a host CPU from Intel that is based on the x86 instruction set architecture. Nvidia is doing this because many enterprise customers continue to prefer x86, a legacy architecture that has long served as the underpinnings of their computing environments, including data center infrastructure. "The vast majority of the world's enterprises [are] still x86-based. They now have state-of-the-art AI infrastructure," Huang said last Thursday. Intel Opens Big, New PC Market For Nvidia The second part of the Intel-Nvidia deal covers the other area where enterprises have great preference for x86 over Arm: PCs. As part of the agreement, Intel will design a system-on-chip for laptops that will fuse an x86-based Intel CPU chiplet with an Nvidia RTX GPU chiplet, bringing the two companies on the same silicon package for the first time. Huang said that this jointly developed product will create a "new class of integrated graphics laptops," exposing Nvidia to a major segment of the laptop "that has been largely unaddressed" by his company and sees roughly 150 million shipments every year. This will mark a major expansion for Nvidia in the laptop market because the company has traditionally focused on providing discrete GPUs for gaming laptops and mobile workstations, leaving integrated graphics mostly to Intel and AMD. Like the data center side of the deal, the PC side will put Nvidia at the center of appeal for future computers that use these jointly developed products. That's because of the significant reputation Nvidia has built for itself as the computing platform of choice for developers creating AI and machine learning applications. While this has largely benefited Nvidia in the data center market, the company has been investing in software and hardware to unleash a wave of new AI and machine learning capabilities with its RTX GPUs for PCs. The company made clear last year that it sees this as a big opportunity by labeling RTX-powered computers as "RTX AI PCs." With the new deal, Nvidia is getting the opportunity to significantly expand the number of people who can take advantage of its RTX GPUs for PCs to accelerate a growing number of AI-powered applications -- or develop their own applications using Nvidia's NIM microservices, which works with several AI developer tools. How The Deal Could Feed Into Nvidia's 'Virtuous Cycle' This could all feed into what Huang has called the "virtuous cycle" of Nvidia's CUDA parallel computing platform, which is the foundational programming layer of many applications that take advantage of Nvidia GPUs. This cycle has been critical to Nvidia's success, allowing it to attract over 6 million developers and more than 27,700 startups to design GPU-bound programs. The cycle starts with Nvidia's install base, which counts the total number of devices -- including PCs, servers and edge devices -- powered by Nvidia GPUs. The idea put forward by Huang is that by selling more Nvidia-powered devices, the company can increase its investments in research and development. This speeds up the performance of applications and, in turn, reduces the costs of computing. As a result, developers can unleash new capabilities, further increasing demand for Nvidia-powered devices. "Install base is growing, computing costs [are] coming down, which causes more developers to come up with more ideas, which drives more demand, and now we're in the beginning of something very, very important," Huang said at last year's Computex event. This means that by enabling new x86 options for Nvidia's rack-scale platforms and a new wave of mainstream laptops with Nvidia integrated graphics, Intel is playing a bigger role than before to help Nvidia grow the rival's install base and aid with the tech industry's ongoing transition from CPU- to GPU-bound workloads that Huang sees as inevitable. While the deal will help drive CPU sales for Intel, the agreement will nevertheless keep the CPU in the back seat as the GPU drives greater interest and benefit for Nvidia -- a point that Huang emphasized in his opening remarks discussing the partnership last Thursday. "General-purpose computing has reached its limits. To keep advancing, we invented a new way forward. Nvidia pioneered GPU-accelerated computing, increasing performance by orders of magnitude -- tens, hundreds, thousands of times faster -- while dramatically improving energy and cost efficiency," he said. Deal Keeps Intel's Rival Strategy Out Of The Spotlight The deal comes with knock-on effect for Intel: In reinforcing Nvidia's dominance, it keeps the company's competing accelerated computing strategy out of the spotlight, putting some extra hurdles between Intel and any virtuous cycle that could take hold should its accelerator chip products ever catch on like they have for Nvidia. The company has struggled significantly over the past several years in defining and executing its accelerated computing strategy on the data center side. After failing to meet its modest revenue goal of $500 million for its line of Gaudi accelerator chips last year, the company scrapped a successor product originally due this year to focus on a next-generation GPU code-named "Jaguar Shores" designed for rack-scale platforms further in the future. Outside of Jaguar Shores, the company has an additional, unannounced GPU design with a lower power requirement for servers on its road map that could arrive next year at some point, according to a source familiar with the company's plans. Intel has experienced some success in the PC market with its Xe GPU architecture. While most of this success has come from Xe's integrated graphics prowess, Intel recently eked out a win on the discrete GPU side with the Intel Arc Pro B50 reportedly becoming the best-selling workstation GPU at online retailer Newegg earlier this month. (There is an exception to these concerns about Nvidia taking the accelerated computing spotlight from Intel in this deal. It's not yet known if Intel's custom system-on-chip with Nvidia will feature its neural processing unit (NPU), for which the company has directed substantial resources to attract developers as part of its AI PC strategy. If the NPU is involved, Intel could benefit from these broader investments and grow developer mind share in this area) An Intel spokesperson told CRN in a statement last Friday that the company remains "committed" to its GPU road map, adding that "everything we discussed aligns with and complements Intel's existing strategy." "We'll be collaborating with Nvidia to serve specific market segments, but we're also continuing to execute on our own path," the representative said, adding that the company does not comment on rumors regarding unannounced products on its road map. While Intel will likely continue down this path in Nvidia's shadow for the years to come, the company's ability to win custom chip design projects with a company as significant as Nvidia shows the opportunity it faces down an adjacent path, where Tan is making moves for Intel to become a substantial player in custom chip design services. Between this and the wait-and-see status of its push to gain a major customer for the Intel Foundry contract chip manufacturing business, the semiconductor giant could eventually find itself in a different position than Nvidia and cast a shadow over others with a new shape. But future success isn't guaranteed, so down these paths Intel will continue.

[2]

AMD's Underdog Moment: Nvidia-Intel Alliance Raises The AI Stakes - NVIDIA (NASDAQ:NVDA), Intel (NASDAQ:INTC), Advanced Micro Devices (NASDAQ:AMD)

Nvidia Corp NVDA just handed Advanced Micro Devices Inc AMD a fresh headache. The chip giant is teaming up with Intel Corp INTC in a sweeping $5 billion collaboration to co-develop custom CPUs, GPUs, and AI infrastructure, leaving AMD on the outside looking in at a new two-horse race in both data centers and PCs. Track AMD stock here. Why This Matters For AMD For years, AMD has positioned itself as the alternative to Nvidia in AI GPUs and Intel in CPUs, carving out share with its EPYC server processors and Radeon Instinct accelerators. But Nvidia's decision to effectively endorse Intel's CPUs -- and even integrate RTX GPU chiplets into Intel SOCs -- sidelines AMD's value proposition. Investors worry this could blunt AMD's push into AI servers just as demand surges, particularly since Nvidia's CUDA ecosystem remains the industry standard. Read Also: Nvidia Vs. AMD: Who Gets Hit Harder By The 15% China Revenue Tax? The Market Dynamics The Nvidia-Intel alliance doesn't just carry technical weight; it carries financial heft. Nvidia's $5 billion investment in Intel underscores its commitment to building a rival CPU-GPU powerhouse. That means AMD now faces a duopoly with a formidable moat -- Nvidia's AI stack fused with Intel's manufacturing scale and x86 dominance. While AMD has made strides with MI300 accelerators and Xilinx integration, the perception of being the "third wheel" could weigh on sentiment unless it delivers breakthrough wins in AI adoption. For AMD, the message is clear: the AI arms race just got more crowded. With Nvidia betting on Intel, the pressure is on CEO Lisa Su's team to prove that AMD can still play kingmaker in both AI infrastructure and next-gen PCs -- or risk being squeezed by two industry giants closing ranks. Read Next: AMD Aims To Dethrone Nvidia In AI Race -- Here's How Photo: Shutterstock AMDAdvanced Micro Devices Inc$157.60-0.98%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum78.79Growth94.30Quality77.35Value9.80Price TrendShortMediumLongOverviewINTCIntel Corp$30.4622.3%NVDANVIDIA Corp$176.253.50%Market News and Data brought to you by Benzinga APIs

[3]

Intel vs. Nvidia: Which Stock Wins More From This $5 Billion Investment? | The Motley Fool

Just weeks after the U.S. government made an $8.9 billion investment in Intel, a rare move by the federal government to invest in a private company, Nvidia (NVDA 0.34%) is following suit. The chip giants announced Thursday that Nvidia would invest $5 billion in Intel at a share price of $23.28. As part of the deal, the two companies will partner on a range of products across the data center and PCs. They will connect architectures through Nvidia NVLink, Nvidia's high-speed interconnect for CPU and GPU processors, combining Nvidia's strength in AI and accelerated computing with Intel's CPUs and x86 architecture. Additionally, Intel is planning to build custom x86 CPUs that Nvidia will put into AI infrastructure platforms in data centers. In PCs, Intel plans to build x86 system-on-chips to integrate with Nvidia RTX GPU chiplets, going into a wide range of PCs. The partnership does not include Intel's foundry division. Both stocks rose on the news, with Intel surging 23% in afternoon trading on Thursday, while Nvidia was up 4%. By market cap, Nvidia had the bigger gains of the two. What was also notable about the news is that competitors' stocks broadly fell, a sign that investors believe they are getting locked out by the alliance, and it could give Nvidia and Intel a competitive advantage. For example, Arm Holdings, a competitor to Intel in CPU architecture and also a partner of Nvidia, fell 4% on the news. Advanced Micro Devices, a competitor of both Intel and Nvidia, lost as much as 6% before recovering most of those losses. Taiwan Semiconductor Manufacturing, the world's biggest chip manufacturer, was also down 2% at the open but swung into positive territory. Based on the gains in each stock and the business prospects for the move, the deal looks like a win-win for both companies. But who's the bigger winner here between the two? Let's take a closer look. For Nvidia, the Intel investment is its latest movement to build a portfolio of other AI stocks, which now includes Arm, Intel, CoreWeave, Nebius, and Applied Digital. Intel needs Nvidia much more than Nvidia needs Intel here, and the deal helps Nvidia put a struggling rival in its pocket. Intel's future is likely to be reliant on the new partnership and potential growth from it, and Nvidia's investment has already paid off, gaining more than $1 billion in just a day. From a product perspective, the deal gives Nvidia more flexibility in the data center and should strengthen its presence in the PC market. While Nvidia's results have boomed during the AI era, Intel has fallen far behind. At a time when nearly every chip company is reporting soaring growth, Intel posted flat revenue growth in the second quarter and an adjusted loss. It needs any help it can get, and tying its wagon to Nvidia's star seems like a can't-miss move, especially as the deal gives Intel exposure to the data center, an area in which it's struggled, through the x86 CPUs it will make for Nvidia data centers. Despite the launch of its Gaudi AI accelerator, Intel's revenue from its data center and AI segment rose just 4% to $3.9 billion in the second quarter. Finally, the deal also looks like a coup for Intel's new CEO, Lip-Bu Tan, especially coming on the heels of the U.S. government's investment. The Nvidia deal is the kind of bold move that can get Intel back on its feet, and Intel stock reached a 52-week high on the news. The deal means much more to Intel than Nvidia, and it could make the difference between Intel continuing to fall behind in AI or regaining its footing, returning to solid growth and profitability. While the deal looks like a smart move for Nvidia, it doesn't quite pack the same punch as it does for Intel. Partnering with Nvidia, along with the $5 billion cash infusion, could be a game-changer for Intel.

[4]

The Intel-Nvidia Deal Looks Like Terrible News for AMD | The Motley Fool

On Thursday, Intel (INTC -3.22%) and Nvidia (NVDA 0.34%) announced a shocking deal that will pair the two companies' technologies in PC and data center central processing units (CPUs). This news looks problematic for Advanced Micro Devices (AMD -0.23%). AMD has made an extraordinary comeback over the past decade in both markets, with a unit market share across PCs and servers of around 24% in the second quarter, up from 11% in 2016. Those gains could come under pressure once the Intel-Nvidia partnership bears fruit. In the PC market, Intel and Nvidia will develop systems-on-a-chip (SOCs) that integrate Intel's CPU cores with an Nvidia RTX graphics processing unit (GPU) chiplet. In the data center market, custom Intel CPUs with Nvidia's NVLink technology will be used directly by Nvidia, and the GPU giant will also offer the chips to third-party customers. NVLink is Nvidia's proprietary high-speed connection technology that's a more performant alternative to the standard PCI Express interface. In the PC market, in particular, AMD will have a fight on its hands as it looks to preserve its market share. The PC CPUs that come out of this deal are targeting "a wide range of PCs that demand integration of world-class CPUs and GPUs," according to Intel's press release. Gaming laptops and gaming handhelds would be the natural form factors for the new CPUs, given the gaming performance that Nvidia's GPU technology will enable. But Nvidia's GPUs will also provide hefty artificial intelligence (AI) computing horsepower. As a category, AI PCs aren't particularly impressive right now. PCs running Intel, AMD, and Qualcomm CPUs with enough AI computing capacity to run some AI workloads locally get lumped into this category, but they're just not capable enough for AI to be a strong selling point. Microsoft's Copilot+ initiative, which puts that label on certain AI PCs, was a disappointment when it debuted last year. The AI features included brought little to the table, and anything useful still required calling out to a cloud service. For AI PCs to truly take off, they need to be powerful enough to run capable AI models locally that can perform useful tasks for the user. Once a PC can handle running a competent AI writing assistant or a useful AI coding assistant, the appeal of the AI PC expands dramatically. The CPUs that will emerge from the Intel-Nvidia deal appear to be squarely aimed at the AI PC opportunity. Nvidia's GPU technology has become the industry standard for AI computing, and the GPU chiplet included in these new CPUs could provide enough AI computing capacity to handle more complex AI workloads. Some of AMD's Ryzen PC CPUs include both a neural processing unit and a GPU to accelerate AI workloads. The high-end Ryzen AI Max+ 395, for example, offers overall AI performance of 126 TOPs, or trillions of operations per second. That's nothing compared to dedicated GPUs, and it's certainly not enough to run truly capable AI models. Nvidia's midrange RTX 5060 laptop GPU, for example, offers 440 TOPS, while its high-end RTX 5090 laptop GPU clocks in at 1,824 TOPS. We don't know exactly what the Intel-Nvidia CPUs will look like, but they could push the envelope when it comes to AI computing capacity, thanks to Nvidia's GPUs. By putting an Nvidia GPU on the same chip as the CPU, rather than pairing the CPU with a discrete GPU, latency can be reduced, power efficiency can be improved, and costs can be brought down. AMD makes competitive products, but the PC CPU market is a whole new ball game when Intel CPUs integrated with Nvidia GPUs start shipping. AMD's presence in gaming laptops and gaming handhelds will likely come under pressure, and the larger battle for AI PC market will be much tougher with Intel and Nvidia teaming up.

[5]

AMD Shares Drop After $5B Intel-Nvidia Alliance Targets AI and PC Markets | Investing.com UK

AMD shares fell 5% in premarket trading on Thursday following the announcement of a major strategic partnership between rivals Intel and Nvidia. The collaboration, which includes a $5 billion Nvidia investment in Intel, aims to co-develop AI infrastructure and personal computing products that could directly challenge AMD's market position. Intel's stock surged nearly 30% on the news, highlighting the significance of this alliance in the competitive semiconductor landscape. The Intel-Nvidia collaboration centers on integrating Nvidia's AI expertise with Intel's CPU technologies using Nvidia's NVLink technology. Under the agreement, Intel will manufacture custom x86 CPUs for Nvidia's AI infrastructure platforms while developing x86 system-on-chips that integrate Nvidia RTX GPU chiplets for the consumer PC market. This partnership creates products that directly compete with AMD's offerings in both data center and consumer segments. Nvidia's $5 billion investment in Intel common stock at $23.28 per share further strengthens the alliance between the two companies. The collaboration represents a significant shift in the semiconductor industry's competitive dynamics, as it unites two of AMD's primary rivals in both the CPU and GPU markets. Mizuho analyst Jordan Klein characterized the development as "BAD FOR AMD," noting that Nvidia could have partnered with AMD instead but chose Intel, creating additional competitive pressure. As of Thursday afternoon, AMD shares were trading at $154.79, down 2.75% from the previous close of $159.16. The stock has shown mixed performance this year, with a year-to-date return of 28.16% compared to the S&P 500's 12.83%, though its one-year return of 4.40% significantly trails the broader market's 18.12%. AMD maintains a market capitalization of approximately $251 billion with analyst price targets ranging from $125.10 to $230.00, averaging $185.77. The partnership announcement poses a multi-faceted challenge for AMD, which has been gaining ground against both Intel in CPUs and Nvidia in GPUs, particularly in AI applications. AMD now faces intensified competition as its two main rivals combine their strengths, potentially limiting AMD's market share growth in the rapidly expanding AI chip market. The collaboration particularly threatens AMD's data center ambitions and its positioning in the gaming and consumer PC markets where it competes with both companies' products. *** Looking to start your trading day ahead of the curve?

Share

Share

Copy Link

Nvidia's $5 billion investment in Intel and their strategic partnership to develop AI and PC technologies sends shockwaves through the semiconductor industry, potentially altering competitive dynamics and putting pressure on AMD.

Nvidia and Intel Form Historic Alliance

In a surprising turn of events, Nvidia and Intel have announced a groundbreaking partnership that promises to reshape the semiconductor landscape. The deal, which includes a $5 billion investment by Nvidia in Intel common stock, aims to co-develop cutting-edge AI infrastructure and personal computing products

1

2

.

Source: CRN

Strategic Collaboration Details

The collaboration centers on integrating Nvidia's AI expertise with Intel's CPU technologies using Nvidia's NVLink technology. Key aspects of the partnership include:

- Intel will design custom x86 CPUs for Nvidia's AI infrastructure platforms in data centers

1

3

. - Development of x86 system-on-chips (SOCs) that integrate Nvidia RTX GPU chiplets for a wide range of PCs

1

4

. - Creation of a new class of integrated graphics laptops, potentially addressing a market of around 150 million shipments annually

1

.

Market Impact and Competitive Dynamics

The announcement sent shockwaves through the industry, with Intel's stock surging by 22.8% and Nvidia's rising by 3.5%

1

. The alliance is seen as a significant threat to Advanced Micro Devices (AMD), which has been gaining ground against both Intel in CPUs and Nvidia in GPUs, particularly in AI applications4

5

.Challenges for AMD

The Intel-Nvidia partnership poses several challenges for AMD:

- Increased competition in the data center market, where AMD has been making strides with its EPYC processors and Radeon Instinct accelerators

2

4

. - Potential loss of market share in the PC segment, especially in gaming laptops and AI-capable PCs

4

5

. - Risk of being perceived as the "third wheel" in the industry, potentially impacting investor sentiment

2

.

Source: Benzinga

Related Stories

Future of AI Computing

The collaboration is expected to drive innovation in AI computing, particularly in the realm of AI PCs. By combining Nvidia's GPU technology with Intel's CPUs, the partnership aims to create more powerful AI-capable systems that can run complex AI models locally

4

.

Source: Motley Fool

Industry Reactions

The news has been met with mixed reactions from other industry players. Competitors' stocks, including Arm Holdings and Taiwan Semiconductor Manufacturing, experienced initial declines following the announcement

3

. Analysts view the deal as a potential game-changer for Intel, which has been struggling to keep pace with the AI boom3

5

.As the semiconductor industry evolves rapidly, the Intel-Nvidia alliance marks a significant shift in competitive dynamics. The partnership's success could redefine AI and personal computing, leaving competitors like AMD facing new challenges in their market positions

2

4

5

.References

Summarized by

Navi

[3]

Related Stories

Nvidia's $5 Billion Intel Investment Reshapes AI Chip Landscape

18 Sept 2025•Technology

Nvidia's $5 billion Intel investment already gains $2.5B as AI chip partnership takes shape

29 Dec 2025•Business and Economy

Nvidia's $5 Billion Investment in Intel Reshapes AI Chip Landscape

09 Oct 2025•Business and Economy

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research