Intel's Resurgence: AI Demand Drives Supply Shortages and Strategic Shifts

3 Sources

3 Sources

[1]

Intel's tick-tock isn't coming back, and everything else I just learned

With Windows 10 on its last legs, Intel is looking forward to the PC industry growing more than it has in years -- the most since 2021, when the covid-19 pandemic revived the industry by creating a huge surge in demand. But it seems the struggling Intel, which just received lifelines from Nvidia, Softbank, and the US government, isn't fully ready to take advantage and is prioritizing AI instead. Today on the company's Q3 2025 earnings call, where Intel saw its first profit in nearly two years due primarily to those lifelines, CEO Lip-Bu Tan and CFO David Zinsner explained how the company doesn't yet have the chips. It's currently seeing shortages that it expects to peak in the first quarter of next year -- in the meantime, leaders say they're going to prioritize AI server chips over some consumer processors as it deals with supply and demand. "We expect CCG to be down modestly and DCAI to be up strongly as we prioritize capacity for server shipments over entry level client parts," Intel says. Tan revealed today that Intel will also release new AI GPUs each and every year, following Nvidia and AMD in shaking up their traditional cadence to address the huge demand for AI servers. It's not clear what that might mean for those hoping for more Intel gaming GPUs. While all eyes are on Intel's hot new Panther Lake and its 18A process to show the world it can still make the most potent consumer PC chips and make them in-house, the company reiterated it's only launching one SKU this year and slowly rolling out others in 2026. Here's another possible reason why: Zinsner hinted today that Panther Lake will be a "pretty expensive" product to start with, and Intel's going to have to push its existing Lunar Lake chips instead "in at least the first half of the year." While Intel has repeatedly pushed back against the idea that its 18A process had poor yields, the company admitted to investors and analysts today that it's not ready to be a huge financial success either: yields "adequate to address the supply but not where we need them to be to drive the appropriate level of margins," says Zinsner, suggesting that it might be 2026, or even 2027 for an "acceptable level of yields" there. For now, Intel will be "working closely with customers to maximize our available output, including adjusting pricing and mix, to shift demand towards products where we have supply and they have demand" -- which sounds like playing with the prices it charges PC makers to stick Intel inside their computers and pointing them at Lunar Lake parts instead of hot new ones. Tan reiterated today that he's not going to invest in more capacity unless there's "committed external demand," and Zinsner says investments in capacity next year won't "significantly change expectations". Intel says that 18A will be a "long-lived node" that will power "at least the next three generations of client and server products." If you were hoping for a return to the "tick-tock" days where Intel would alternate between shrinking its chips and releasing new architectures every generation, that's not happening here. But that doesn't mean Intel will cancel its next node, Intel 14A, as it warned it might. Tan suggested today that customers have stepped in to save 14A, and Intel, that the company is "delighted and more confident" in it, and Zinsner says it's not only "off to a good start," but better than 18A was at this point "in terms of performance and yields."

[2]

Despite Struggles, Intel Reports Supply Shortages Due to High CPU Demand

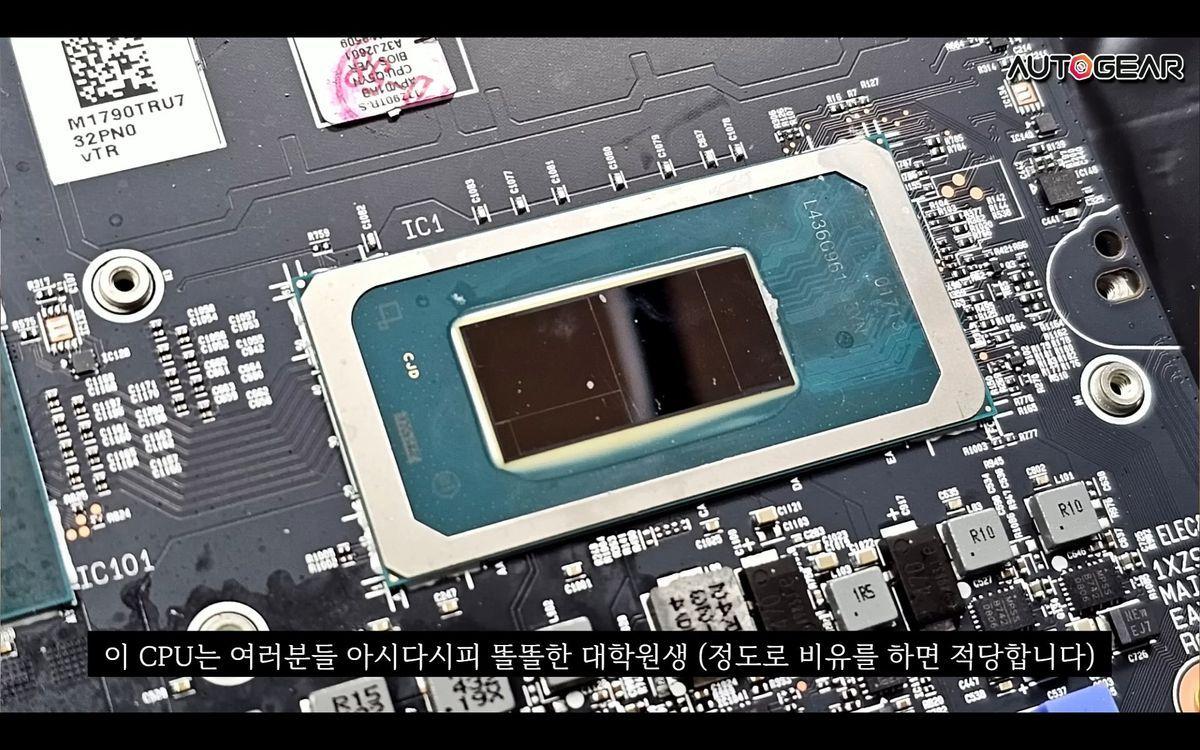

When he's not battling bugs and robots in Helldivers 2, Michael is reporting on AI, satellites, cybersecurity, PCs, and tech policy. Don't miss out on our latest stories. Add PCMag as a preferred source on Google. It's no secret that Intel has lost its competitive edge in the chip manufacturing industry. But the company is still facing enough demand for its processors that it's talking about a shortage. During a Q3 earnings call, Intel executives noted that customer demand has outpaced supply for server and PC CPUs. "The shortage is pretty much across our business," said Intel CFO David Zinsner. The company also expects the tight supplies to persist into next year. Specifically, the shortage involves the company's older chip manufacturing tech, Intel 10 and then Intel 7, which has been used to fabricate "Raptor Lake" desktop CPUs, along with server-grade CPUs. Since the company isn't investing in the older chip nodes, Zisner said, "as we get more demand, we're constrained. In some ways, we're living off of inventory." The demand is surprising since buyers typically want the latest chip tech; Intel itself has been using rival TSMC to build some of its newest chips, including last year's laptop-focused Lunar Lake processors and the desktop-focused Arrow Lake line. However, Intel says customers have been purchasing its server CPUs as companies rush to build new data centers to meet the surging demand for AI computing. The same AI demand has created shortages for the wafer substrate necessary to build computer chips. Another factor is businesses migrating from Windows 10 to Windows 11, which may require new PC hardware. "The Windows refresh is happening more significantly than I think we expected," Zisner said when asked why customers are focusing on Intel's older products. "And so Raptor Lake is also a product that addresses that," he added. (We should note that Raptor Lake chips have been known to suffer from a voltage bug, although the company has addressed the problem.) For customers seeking the latest technology, Team Blue is preparing to release new PC processors utilizing its Intel 18A process -- or what it hopes will turn around the company's fortunes. During the earnings call, Intel CEO Lip-Bu Tan said the company remains on track to launch the first Intel 18A chip for PCs, "Panther Lake," by year's end, followed by additional processors during 2026's first half. For desktops, Tan added: "Our next-generation Nova Lake product will bring new architecture and software upgrades to further strengthen our offerings, particularly in the PC gaming halo space. With this lineup, we believe we will have the strongest PC portfolio in years." However, Nova Lake isn't expected to arrive until next year. The desktop chips will also reportedly use Intel's 18A node and rival TSMC's chip manufacturing tech.

[3]

Intel says server CPUs will be hot again, thanks to AI

Chipzilla returns to profit and suggests customers are primed to sign for foundry services once it nails 18A process Intel has returned to profitability, grown revenue, and suggested demand for AI will ensure its struggling foundry business wins customers and boosts its datacenter CPU business. Chipzilla advised investors of the above on Thursday when it announced its Q3 FY 2025 results, which saw it win $13.7 billion in revenue - a three point year-over-year jump - and return to profitability with net income of $4.1 billion, a welcome turnaround from Q2's $2.9 billion of red ink. The news wasn't all good, because sales of Intel's datacenter products fell one percent, and its Foundry business shed four percent of revenue. Client products led the way with $8.5 billion revenue, up five percent. "The Windows refresh is happening more significantly than I think we expected," CFO David Zinsner said on the company's earnings call, and Intel is therefore doing well on the desktop as buyers shell out for new hardware to run Windows 11 now that Microsoft has ended support for Windows 10. PCs remain an important market, but all the growth in hardware right now is in AI and Intel has missed the boat there - rivals Nvidia and AMD have cornered the market for GPUs. Intel's chipmaking Foundry business is also nowhere in AI, because it can't match TSMC's manufacturing prowess and is yet to perfect the 18A process that will bring it closer to its Taiwanese rival. On its earnings call, execs said Intel is addressing those issues. CEO Lip Bu Tan said Intel "made tremendous good progress ... on 18A", and ticked off the key milestone of fully operationalizing Fab 52, the Arizona facility where it will make silicon wafers for chips built using the process. But Zinsner cautioned that Intel won't rush 18A, because it doesn't want to invest in chipmaking capacity until it has clients, even as it works to satisfy clients that 18A is a safe bet. "18A, we still have to ramp this," he said on the company's earnings call. "I wouldn't expect significant capacity increases in the near term. But I think as we said, we are not at peak supply for 18A. In fact, we don't get there until the end of the decade." Execs didn't directly address the fact that buyers are not confident in 18A - only Microsoft has signed up to build chips on the process - and said Intel is working with customers to give them confidence it should be their foundry of choice. The company is also talking to chip design firms about its next process - named 14A - and said that effort is already more mature than 18A was at the same point in its evolution. Discussing GPUs, Lip Bu Tan said Intel plans to launch "successive generations of inference-optimized GPUs on the annual cadence that features enhanced memory and bandwidth to meet enterprise needs." That's a nod to the fact that analysts believe the market for hardware to run AI workloads - which requires inferencing capabilities - will grow fast and become colossal as more businesses deploy AI-infused applications. CFO Zinsner also suggested Intel's server CPU business, which has been its cash cow for years, will also benefit from the AI boom. "In data center, the accelerating build-out of AI infrastructure is positive for server CPU demand from head nodes, inference, orchestration layers and storage," he said. "We are cautiously optimistic that the CPU TAM [total addressable market] will continue to grow in 2026 even as we have work to do to improve our competitive position." "It is increasingly clear that CPUs play a critical role today, and will going forward within the AI data center as AI usage expands and especially as inference workloads outpace that of training," the CFO added. "Some data center customers are beginning to ask about longer-term strategic supply agreements to support their business goals due to the rapid expansion of AI infrastructure. This dynamic, combined with the underinvestment in traditional infrastructure over the last couple of years should enable the revenue TAM for server CPUs to comfortably grow going forward." The company warned not all is rosy: It can't build enough chips on its existing Intel 7 and Intel 10 processes to meet demand and won't invest to increase capacity. "In some ways, we're living off of inventory," Zinsner said. The company is also struggling to secure some chipmaking supplies. But the company has improved its balance sheet, in part by paying down debt, which means it will have the cash needed to invest. CEO Tan said Intel is therefore hiring the people it needs to get its chipmaking business into good shape. Investors liked what they heard, as Intel's share price popped in after-hours trading from just over $38 to beyond $41. ®

Share

Share

Copy Link

Intel reports a return to profitability and growing demand for AI-related products, despite ongoing challenges in chip manufacturing. The company is prioritizing AI server chips and preparing for future innovations with its 18A process.

Intel's Financial Turnaround and AI-Driven Strategy

Intel reported its first profit in nearly two years in Q3 2025, with revenue reaching $13.7 billion and a net income of $4.1 billion, largely attributed to strategic partnerships and rising AI demand

3

1

.

Source: PC Magazine

Supply Shortages and Prioritization

Despite its profitability, Intel faces supply shortages across server and PC CPUs, especially for older chip technologies. Consequently, the company is prioritizing AI server chip production over entry-level consumer products due to high demand

2

1

.AI-Driven Market Dynamics

The accelerating demand for AI computing is a key driver, boosting server CPU demand for various AI infrastructure applications like inference and orchestration layers. This has led to inquiries for long-term strategic supply agreements from data center clients

3

.18A Process and Future Innovations

Intel's crucial 18A manufacturing process is progressing, with Fab 52 in Arizona now fully operational for production. However, peak supply for 18A is not anticipated until the end of the decade as capacity scales up

3

.New Product Roadmap

The company plans to launch its first 18A PC chip, 'Panther Lake,' by late 2025, followed by more processors in early 2026. 'Nova Lake' is also in development for desktops to bolster its PC gaming market presence

2

.

Source: The Verge

Related Stories

AI GPU Strategy

Intel is adopting an annual release cycle for new AI GPUs, mirroring Nvidia and AMD, to meet the surging demand for AI servers and remain competitive in the fast-evolving AI hardware market

1

.Challenges and Outlook

Despite the positive financial outlook, challenges persist, particularly with 18A process yields needing improvement for optimal margins. Intel is collaborating with customers to maximize output and remains optimistic about future inference-optimized GPUs and meeting enterprise AI needs

1

3

.References

Summarized by

Navi

[3]

Related Stories

Intel prioritizes Xeon processors over PC chips as AI demand strains foundry capacity

23 Jan 2026•Business and Economy

Intel Faces Unexpected Demand Shift: AI PC Chips Struggle as Older Models Surge

25 Apr 2025•Business and Economy

Intel's Strategic Shift: Panther Lake, Nova Lake, and the Return of Hyper-Threading Amid Restructuring

25 Jul 2025•Technology

Recent Highlights

1

ByteDance Faces Hollywood Backlash After Seedance 2.0 Creates Unauthorized Celebrity Deepfakes

Technology

2

Microsoft AI chief predicts artificial intelligence will automate most white-collar jobs in 18 months

Business and Economy

3

Google reports state-sponsored hackers exploit Gemini AI across all stages of cyberattacks

Technology