Man Group Pioneers Agentic AI for Quant Trading Signal Generation

2 Sources

2 Sources

[1]

Man Group Says Agentic AI Is Now Devising Quant Trading Signals

Man Group's quant equity unit says it has begun using a new artificial-intelligence system that can generate, code and backtest trading ideas -- marking the arrival of agentic AI at the world's largest listed hedge fund. Boston-based Man Numeric says it built the tool -- known internally as AlphaGPT -- to mimic how its researchers develop new investment signals. It digs into data for ideas, writes the code for potential strategies and then tests them on historic data. Such a system that can autonomously perform multi-step tasks is known as agentic AI, one of the hottest trends right now in Silicon Valley.

[2]

Man Group says Agentic AI is now devising quant trading signals

Gift 5 articles to anyone you choose each month when you subscribe. Man Group's quant equity unit says it has begun using a new artificial-intelligence system that can generate, code and back test trading ideas -- marking the arrival of agentic AI at the world's largest listed hedge fund. Boston-based Man Numeric says it built the tool -- known internally as AlphaGPT -- to mimic how its researchers develop new investment signals. It digs into data for ideas, writes the code for potential strategies and then tests them on historic data. Such a system that can autonomously perform multi-step tasks is known as agentic AI, one of the hottest trends right now in Silicon Valley.

Share

Share

Copy Link

Man Group's quant equity unit introduces AlphaGPT, an agentic AI system capable of autonomously generating, coding, and backtesting trading ideas, marking a significant advancement in AI application in hedge fund management.

Man Group Introduces Agentic AI for Quant Trading

Man Group, the world's largest listed hedge fund, has taken a significant leap in the application of artificial intelligence to financial trading. The company's quant equity unit, Man Numeric, has announced the implementation of a groundbreaking AI system capable of autonomously generating, coding, and backtesting trading ideas

1

2

.AlphaGPT: The Next Generation of Quant Trading Tools

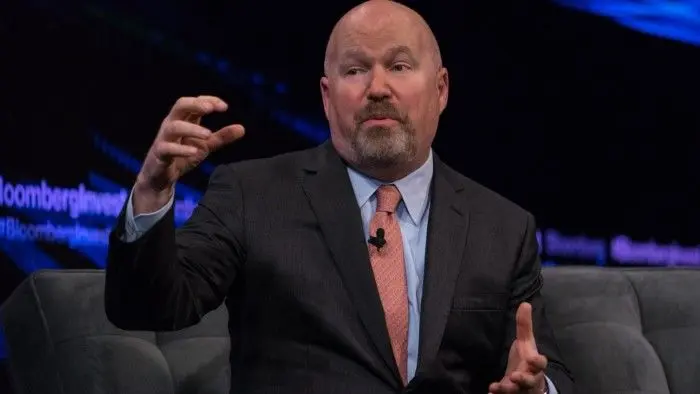

Source: Bloomberg

The new AI system, internally dubbed AlphaGPT, represents a major advancement in the use of agentic AI in the financial sector. Agentic AI, currently one of the hottest trends in Silicon Valley, refers to AI systems that can independently perform complex, multi-step tasks

1

.AlphaGPT has been designed to mimic the process human researchers use to develop new investment signals. The system's capabilities include:

- Data mining for potential trading ideas

- Writing code for possible trading strategies

- Backtesting these strategies using historical data

This autonomous approach to strategy development marks a significant shift in how quantitative trading signals are generated and tested

2

.Implications for the Hedge Fund Industry

The introduction of AlphaGPT at Man Group signals a new era in the hedge fund industry. By leveraging agentic AI to perform tasks traditionally carried out by human researchers, Man Group is potentially increasing its capacity to identify and exploit market opportunities

1

.This development raises important questions about the future role of human researchers in quantitative finance and the potential competitive advantage that advanced AI systems might provide to firms that successfully implement them.

Related Stories

The Rise of AI in Financial Markets

Source: Financial Review

Man Group's adoption of agentic AI for quant trading is part of a broader trend of increasing AI integration in financial markets. As AI systems become more sophisticated, they are taking on increasingly complex tasks in areas such as:

- Risk assessment

- Portfolio management

- High-frequency trading

- Market analysis

The success of AlphaGPT could potentially accelerate this trend, encouraging other hedge funds and financial institutions to invest more heavily in AI research and development

2

.Challenges and Considerations

While the potential benefits of systems like AlphaGPT are significant, their implementation also raises important considerations:

- Regulatory compliance: Ensuring that AI-generated trading strategies comply with existing financial regulations

- Risk management: Developing robust systems to monitor and control the risks associated with AI-driven trading

- Ethical considerations: Addressing concerns about the increasing automation of financial decision-making

As agentic AI systems become more prevalent in the financial sector, these challenges will likely become increasingly important topics of discussion among industry leaders, regulators, and policymakers

1

2

.References

Summarized by

Navi

[2]

Related Stories

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology