Memory prices surge 300% as AI demand creates supply shortage for consumers and PC makers

4 Sources

4 Sources

[1]

SSD prices could spike as NAND makers reportedly eye steep cost increase

* Samsung, SK hynix, and Sandisk reportedly plan to double NAND prices in 2026, increasing the cost of SSDs. * SSD prices are already rising at retailers -- buy now before supplier hikes push costs higher. * GPU launches have been delayed as DRAM/VRAM stock prioritizes AI data centers over PCs. The ongoing memory crisis continues to begin to make its way to other PC components. According to a recent report from Digitimes, SSDs are about to get hit with a substantial cost increase. According to the report, three of the biggest players in the NAND chip space -- Samsung, SK hynix, and Sandisk -- are planning to double their prices amid the ongoing RAMpocalypse. Digitimes goes on to say that Samsung plans to more than double the price of its NAND chips in the first quater of 2026, "amid tightening supply and surging demand driven by the expansion of artificial intelligence applications." On the other hand, "SK Hynix has implemented NAND price increases of a similar magnitude, while Sandisk has previously been reported to be planning a 100% NAND price hike in 2026," says the publication's report. With this in mind, it's not surprising that Samsung recently posted extremely strong financial results, with revenue up by 22% to $65 billion in the first quarter of 2025. Profits during the same period also doubled to just under $14 billion. AMD is reportedly pausing new GPU launches until 2027 It's going to be awhile before we see new graphics cards from the industry's second biggest graphics card maker. Posts 5 By Patrick O'Rourke The memory crisis shows no signs of slowing down New AMD and Nvidia GPUs have reportedly been delayed What's notable about Digitimes report is that the retail cost of SSDs has already increased substantially. This could be anticipation of an impending supplier price increase, or PC hardware retailers trying to make more profit and blaming it on the memory crisis. Either way, if you're planning to pick up a new SSD, buying it as soon as possible is a smart move as costs are likely to increase substantially. In other memory shortage and GPU-related news, David McAfee, AMD's vice president of Ryzen, recently told Gizmodo that his company wants to keep its GPU prices down amid the ongoing memory shortage, though he also emphasized that he can't predict where memory prices will go next, hinting that prices could still shift. Adding to this, a recent report indicated that AMD won't launch new GPUs until 2027. There are also reports that Nvidia will slash overall GPU production by as much as 40% in 2026 due to the VRAM shortage. Subscribe to the newsletter for SSD & memory insights Gain clearer insight by subscribing to the newsletter for focused coverage and analysis of NAND shortages, SSD price spikes, and GPU supply shifts, providing market context and buying-focused guidance on these trends. Subscribe By subscribing, you agree to receive newsletter and marketing emails, and accept Valnet's Terms of Use and Privacy Policy. You can unsubscribe anytime. Over the past few months, the price of DRAM has grown significantly, with the industry's biggest manufacturers, like Samsung, SK Hynix, and Micron, allocating the bulk of their resources to AI data centers instead of PC manufacturers and consumers. In SK hynix's case, the company completely killed off its consumer DRAM brand Crucial. Memory suppliers are playing favorites with RAM, and only 4 PC makers are getting priority This strategy is squeezing smaller PC makers in a big way, says a recent report. Posts 3 By Patrick O'Rourke

[2]

Samsung RAM prices have doubled -- and the worst is yet to come

* Samsung's DRAM and SSD prices have doubled in South Korea since November 2025 * Samsung is reportedly focusing on producing memory for AI enterprises * An analyst predicts that 30% of the total cost of manufacturing products could be on memory The PC hardware market is arguably in its worst state in years due to the ongoing memory crisis, leading to price increases nearly across the board - and with a troubling case from a popular manufacturer, consumers may fear the worst. That popular manufacturer is Samsung, and prices for its DRAM and SSDs have doubled or 'sometimes even tripled' in the last two months in South Korea, according to TheElec. This is reportedly due to Samsung's focus on producing memory for AI enterprises, ultimately leading to a supply shortage for consumers, which sounds similar to Micron's approach in its push towards AI. For example, a DDR5 RAM module was sold at 100,000 won in November, which is around $69. However, recently, the same Samsung RAM stick was sold for 400,000 won, placing it at around $278. That's a 300% price increase for only 16GB of memory. Distributors are also buying both RAM and SSDs from Samsung at higher prices, which directly impacts consumer prices - and while this report focuses on the crisis in South Korea (where Samsung is based), it's not unreasonable to believe this will extend to other regions. A Counterpoint Research analyst, MS Hwang, predicts that 30% of the total manufacturing cost for products will be on memory alone, as reported by TweakTown. If this estimate is correct, we could essentially see all hardware that uses memory skyrocket in price, and with the current state of affairs, where most manufacturers are pushing for a greater focus on AI, it's not looking very positive for consumers in 2026 and beyond. Analysis: I hope the AI push fails, and I'm not afraid to say it There's no denying that AI has been beneficial for PC hardware, specifically for gamers, with Nvidia improving its DLSS upscaling models for better performance and image quality. However, I think AI is currently doing more damage than good for consumers, and I'm hoping the bubble bursts. Prices are increasing at unprecedented rates for RAM and now, SSDs, with Best Buy's 2TB options far above normal pricing. A prime example is the Samsung 990 Pro 2TB SSD available for $399.99, which is the price you would normally find for a 4TB option. AI is taking the reins of the PC hardware market and its trajectory, and I fear that the longer this continues, the more normalized it could become, until high prices for such hardware become irreversible. Follow TechRadar on Google News and add us as a preferred source to get our expert news, reviews, and opinion in your feeds. Make sure to click the Follow button! And of course, you can also follow TechRadar on YouTube and TikTok for news, reviews, unboxings in video form, and get regular updates from us on WhatsApp too.

[3]

New report claims Samsung, SK Hynix and Sandisk are all planning to double the price of NAND memory chips this year

If you were hoping that, somehow, this whole AI bubble thing would quietly go away and PC component prices would return to normal, well, there's bad news. A new report says that three of the biggest players in NAND chips, the flash memory that goes into PC SSDs, are all planning on doubling their prices. Digitimes claims that Samsung is planning on more than doubling the price of its NAND chips in the first quarter of this year, "amid tightening supply and surging demand driven by the expansion of artificial intelligence applications." The site further says that, "SK Hynix has implemented NAND price increases of a similar magnitude, while Sandisk has previously been reported to be planning a 100% NAND price hike in 2026." That means three of the biggest players in NAND chips for SSDs all plan to double their prices, or thereabouts. Perhaps unsurprisingly, Digitimes also notes that Samsung recently reported very strong financial results, with revenues up by over 22% to roughly $65 billion for the final quarter of 2025. Samsung's profits for the same period doubled to a little under $14 billion. As they say, nice work if you can get it. Exactly how much impact this will all make on the actual price of SSDs is tricky to say. Looking at the current prices of SSDs, you could argue that prices have already doubled or more of late. To take just one example, the WD BLACK SN850X 2TB was available on Amazon for around $150 last summer. By the end of last year, it was up to well over $250. Right now? It's available for $399, which Amazon rather laughably indicates is at a 31% discount on a purported list price of $574.99 Anyway, the question is, have the increases Digitimes is referring to here already been priced into the likes of that WD drive on Amazon? You really have to hope so. Because if they haven't, the price of SSDs in the coming months doesn't bear thinking about. Personally, I'd guestimate that at least some of the mooted NAND chip increases probably are priced in, and we're not about to see a WD BLACK SN850X 2TB priced up at $800. But the fact that you can't be truly confident that it won't happen says everything about our current predicament. It ain't good, peeps.

[4]

Memory will be 30% of the total cost of the product that uses it following incoming price hikes

TL;DR: DRAM and NAND flash memory prices have surged nearly 300% since early 2025 due to AI companies dominating supply for data center expansion. This high demand is expected to keep prices rising through 2028, making memory a significant cost-up to 30%-in electronic device manufacturing. DRAM memory prices have skyrocketed since the beginning of 2025, with estimates now estimating that prices have increased by nearly 300%. In addition to DRAM, NAND flash prices have already increased, and these hikes can be attributed to AI companies pulling manufacturing supply away from the consumer market. The thirst for more memory from AI companies isn't expected to be quenched for some time, as billions of dollars have been thrown into the global race to create the most sophisticated AI model possible, and no company participating is expected to just stop building and upgrading the data centers that provide more power to their infrastructure. Counterpoint Research, a global technology market research firm in the TMT industry, was recently cited by The Wall Street Journal, and explained that AI firms are crowding out other buyers of memory, and the disproportionate supply allocation is due to builders of data centers who are happy paying a premium. MS Hwang, a research director at Counterpoint Research, who has been in the industry for more than 30 years, stated prices are expected to continue increasing, with supply already being allocated to companies for 2026, 2027, and 2028. "You gotta buy a plane ticket and get that allocation from manufacturers right now. Those guys are now selling their capacity not only for 2026, but also 2027 and 2028," stated Hwang Additionally, Hwang predicts that memory will soon become one of the most expensive components in any electronic device that requires it, with the analyst stating that memory will become as much as 30% of the total cost to build the product.

Share

Share

Copy Link

Memory prices have skyrocketed nearly 300% since early 2025, with Samsung, SK hynix, and Sandisk planning to double NAND chip prices in 2026. The surge stems from AI companies dominating supply for data center expansion, creating a supply shortage for consumers. Analysts predict memory will soon account for 30% of total manufacturing costs across electronic devices.

Memory Prices Spike Nearly 300% Amid AI Data Centers Boom

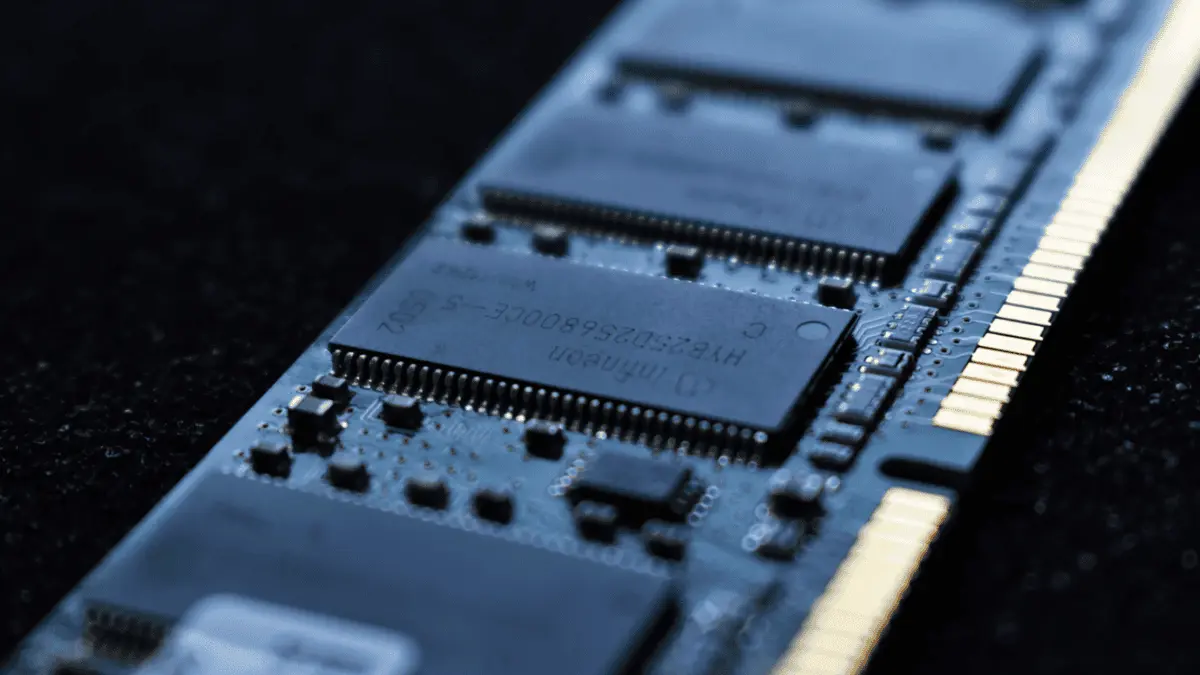

The PC hardware market faces an escalating memory crisis as DRAM and NAND flash memory prices have surged nearly 300% since early 2025

4

. This dramatic increase stems from tightening supply and escalating demand driven by AI companies pulling manufacturing capacity away from consumer markets to fuel massive data center expansions. The impact on PC component affordability has been severe, with Samsung DRAM and SSD prices doubling or "sometimes even tripling" in South Korea over just two months2

. A DDR5 RAM module that sold for 100,000 won (around $69) in November 2024 now commands 400,000 won (approximately $278), representing a staggering 300% increase for just 16GB of memory2

.

Source: TechRadar

Major Manufacturers Plan Doubling the Price of NAND Memory

According to Digitimes, three dominant players in the NAND chip space—Samsung, SK hynix, and Sandisk—are planning to double their prices amid the ongoing supply shortage for consumers

1

. Samsung plans to more than double the price of its NAND chips in the first quarter of 2026, while SK hynix has implemented NAND price increases of similar magnitude3

. Sandisk has also been reported planning a 100% NAND flash price increase in 20261

. These moves come as Samsung recently posted extremely strong financial results, with revenue up 22% to $65 billion and profits doubling to just under $14 billion in the first quarter of 20251

.SSD Prices Already Reflecting Supply Chain Disruption

The retail cost of SSDs has already increased substantially, potentially anticipating the supplier price increases or reflecting early impacts of prioritizing memory for AI enterprises

1

. The WD BLACK SN850X 2TB, which was available for around $150 last summer, climbed to over $250 by year-end and now sells for $399 on Amazon3

. Similarly, the Samsung 990 Pro 2TB SSD now retails for $399.99, a price typically associated with 4TB options2

. Distributors are purchasing both RAM and SSDs from manufacturers like Samsung at higher prices, directly impacting consumer hardware prices across the board2

.

Source: PC Gamer

Related Stories

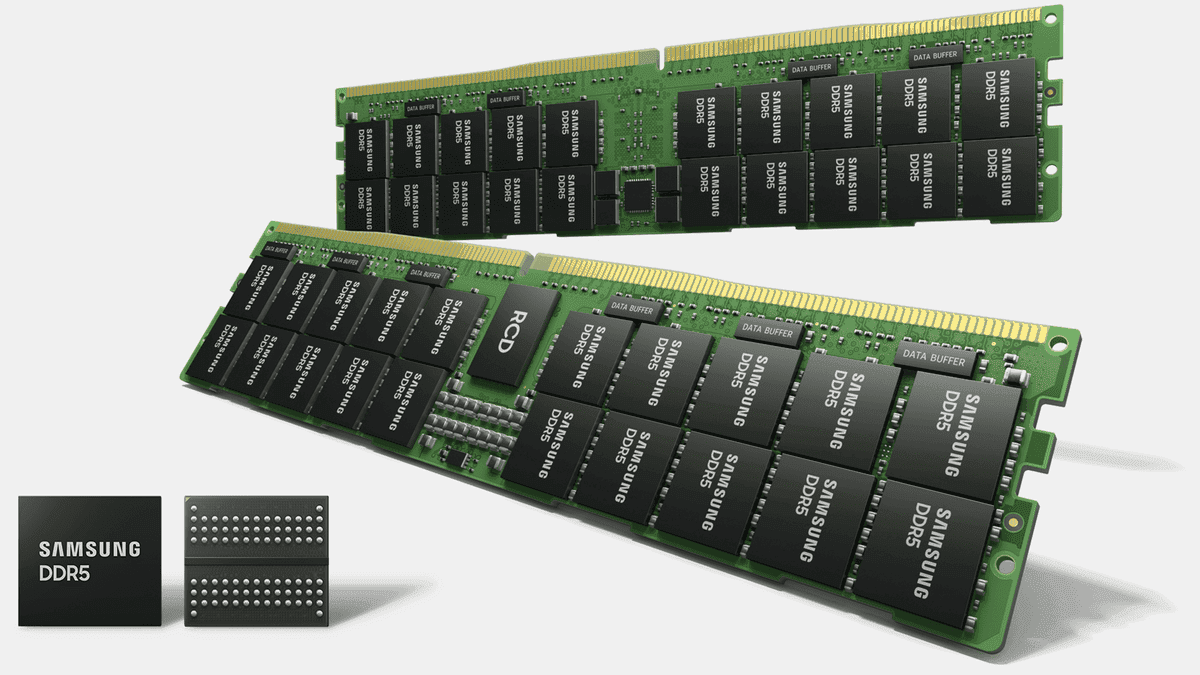

AI Demand Reshapes Memory Allocation Through 2028

MS Hwang, a research director at Counterpoint Research with over 30 years in the industry, explains that AI firms are crowding out other buyers of memory, with data center builders willing to pay premium prices

4

. "You gotta buy a plane ticket and get that allocation from manufacturers right now. Those guys are now selling their capacity not only for 2026, but also 2027 and 2028," Hwang stated4

. This represents a fundamental shift in how memory manufacturers like Samsung, SK hynix, and Micron allocate resources, with the bulk directed toward AI data centers instead of PC manufacturers and consumers1

.

Source: TweakTown

Increased Manufacturing Cost Could Reach 30% for Memory Components

Hwang predicts that memory will soon become one of the most expensive components in any electronic device requiring it, with memory accounting for as much as 30% of the total cost to manufacture products

4

. This projection suggests that virtually all hardware using memory could see dramatic price increases. The ripple effects extend beyond storage, with reports indicating that AMD won't launch new GPUs until 2027, while Nvidia plans to slash overall GPU production by as much as 40% in 2026 due to the VRAM shortage1

. AMD's vice president of Ryzen, David McAfee, told Gizmodo that while the company wants to keep GPU prices down, he cannot predict where memory prices will go next1

. For consumers and smaller PC makers, the strategy of memory suppliers prioritizing AI enterprises means the impact on PC component affordability will likely persist through 2028, fundamentally altering profit margins and revenue growth expectations across the consumer hardware sector.References

Summarized by

Navi

[1]

Related Stories

RAM and Storage Prices Surge 500% as AI Demand Triggers Global Memory Crisis

26 Nov 2025•Business and Economy

Memory shortage to persist beyond 2026 as AI demand reshapes chip industry and drives prices up

16 Jan 2026•Business and Economy

AI Demand Triggers Component Shortage as Dell and Lenovo Plan 15% Price Increases for Servers

03 Dec 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology