Micron commits $24 billion to Singapore plant as AI demand strains global memory supply

8 Sources

8 Sources

[1]

Micron plans $24-billion memory chipmaking plant in Singapore

SINGAPORE, Jan 27 (Reuters) - U.S. memory chipmaker Micron Technology (MU.O), opens new tab said on Tuesday it plans to build a $24-billion chip manufacturing plant in Singapore, as it races to boost output in the face of an acute global shortage. The news, reported earlier by Reuters, comes amid an industry scramble to build AI infrastructure that has left sectors from consumer electronics to AI service providers battling a severe scarcity of all types of memory chips. Micron said the new investment to build an advanced wafer fabrication facility over the next decade will help it meet growing market demand for NAND memory chips, fuelled by the rise of AI and data-centric applications. Wafer output is set to begin in the second half of 2028 in a cleanroom space sprawling over 700,000 square feet (65,000 sq m), it added in a statement. Micron makes 98% of its flash memory chips in Singapore where it is also building a $7-billion advanced packaging plant for high bandwidth memory (HBM), used in artificial intelligence chips, due to start production in 2027. The HBM chip packaging facility in Singapore is on track to contribute to supply in 2027, it added on Tuesday. Analysts said the memory supply shortfall could run through late 2027, although the chipmaker and its main rivals, South Korea's Samsung (005930.KS), opens new tab and SK Hynix (000660.KS), opens new tab, plan new production lines and are advancing dates to start production. TrendForce analyst Bryan Ao said that as demand outstrips supply, contract prices for enterprise solid-state drives are expected to rise by 55% to 60%. "The market's demand for high-performance storage equipment has been growing much faster than expected amidst the expansion of AI inference applications, and major North American cloud service providers have been exhibiting robust order pulls since the end of last year to seize on opportunities of the AI agent market," he said. TrendForce data shows that Micron was the fourth largest flash memory chip supplier in the third quarter of 2025 with a 13% market share. Last week, Micron said it was in talks to buy a fabrication site from Powerchip (6770.TW), opens new tab in Taiwan for $1.8 billion, which would boost its DRAM wafer output. This month, SK Hynix told Reuters it plans to hasten the opening of a new factory by three months and begin operating another new plant in February. Reporting by Jun Yuan Yong, Wen-Yee Lee; Editing by Tom Hogue and Miyoung Kim Our Standards: The Thomson Reuters Trust Principles., opens new tab

[2]

Micron to invest $24 billion in Singapore plant as AI boom strains global memory supply

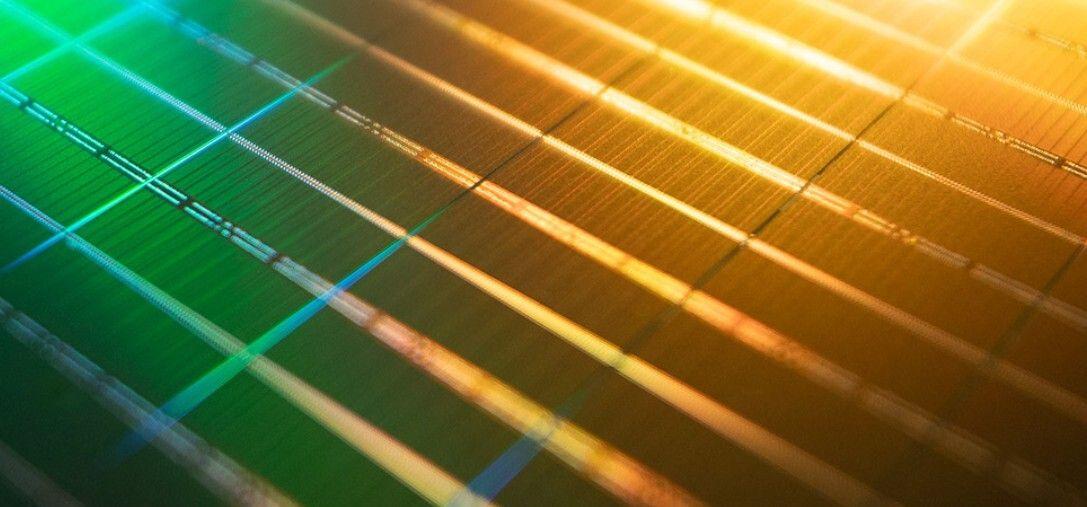

Micron Technology on Tuesday committed approximately $24 billion to expand its wafer manufacturing operations in Singapore, as the American memory chipmaker moves to expand production amid global shortages. In a press release, Micron said the investment would add 700,000 square feet of cleanroom space -- highly-controlled manufacturing areas designed to prevent contamination -- at an existing NAND manufacturing complex. Production of NAND, a type of memory chip widely used in personal computers, servers and smartphones, is expected to start in the second half of 2028. Demand for NAND technology has been skyrocketing in recent months, driven by the rapid expansion of artificial intelligence and data-centric applications. In response to the shortage, Micron and its memory competitors, including Samsung Electronics and SK Hynix, have been increasing output. Micron operates manufacturing facilities in Singapore as part of its broader Asian production network, which also includes sites in China, Taiwan, Japan, and Malaysia. The company is also building a $7 billion advanced packaging plant in Singapore to produce high-bandwidth memory, a type of dynamic random-access memory, or DRAM, used in AI applications.

[3]

Micron's Singapore expansion shows how far memory makers must go

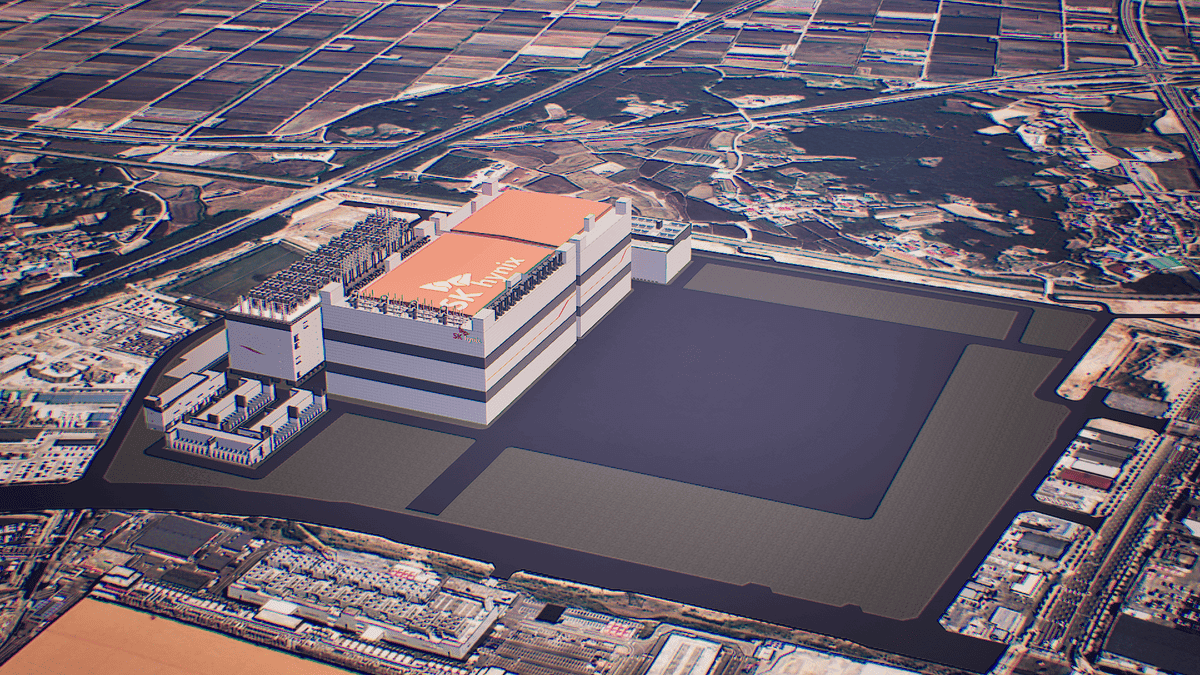

AI infrastructure demand continues to strain global memory supply chains Micron has announced a $24 billion investment to expand memory manufacturing in Singapore, adding a large wafer fabrication facility intended to increase global NAND supply. The project comes as the global chip crisis continues to affect multiple technology sectors, driven largely by sustained demand from AI infrastructure and data-intensive computing. The company says the new plant will support rising NAND demand over the next decade, although production is not expected to begin until the second half of 2028. The new wafer facility will add more than 700,000 square feet of cleanroom space at Micron's existing Singapore manufacturing complex. Wafer output is scheduled to begin several years from now, reflecting the long timelines involved in bringing advanced memory fabrication capacity online. Micron already produces most of its flash memory chips in Singapore, making the country a central pillar of its global manufacturing strategy. Alongside the NAND expansion, Micron is also constructing a $7 billion advanced packaging plant at the same site to support high-bandwidth memory production. That facility is expected to begin contributing to supply in 2027. However, analysts expect tight memory supply conditions to persist through late 2027, even as manufacturers announce new capacity. The push toward high-bandwidth memory has absorbed manufacturing resources that might otherwise support conventional NAND and DRAM output. This shift has contributed to shortages across several memory categories, including those used in consumer electronics and enterprise storage. Micron's competitors are also accelerating capacity plans. Samsung and SK Hynix have both disclosed efforts to bring new production lines online earlier than previously planned. Micron is also exploring additional expansion options, including talks to acquire a fabrication site in Taiwan that could increase DRAM wafer output. The expanded Singapore complex is expected to create roughly 1,600 jobs linked to NAND fabrication, following earlier hiring tied to the high-bandwidth memory plant. Micron has said the facility will incorporate automation, robotics, and smart manufacturing systems. Singapore's government has welcomed the investment as reinforcement of its role in the global semiconductor supply chain. While Micron's investment signals confidence in long-term demand, the delayed production start raises questions about how much relief it can provide in the near term. The scale of industry-wide shortages suggests that no single facility, even one of this size, is likely to resolve supply constraints on its own. Via Nikkei Asia

[4]

Micron starts building new Singapore NAND fab, production planned for 2028

Micron has kicked off construction of a new semiconductor manufacturing facility in Singapore that will expand the company's NAND flash memory output. NAND is the core storage technology behind SSDs and many embedded storage devices, and Micron is positioning the new site as a capacity increase aimed at longer-term demand rather than a short-term market response. The project is framed as a multi-year investment program, with funding and ramp activities spread across roughly the next decade. Micron's current schedule targets the first NAND-bearing wafers in the second half of 2028, which places the factory firmly in the "late-decade supply" category. In practice, that means the near-term NAND market will still be shaped by existing factories, node transitions, and inventory cycles, while this new Singapore build acts as a larger capacity lever once it reaches volume production. Micron points to AI-driven data center expansion as the main demand signal behind the move. Storage requirements continue to grow alongside AI compute deployments: training and fine-tuning pipelines need large datasets, inference services generate extensive logs and telemetry, and modern data centers increasingly treat fast flash storage as a performance layer rather than just cold capacity. Even with aggressive compute growth, that storage layer can become a limiting factor if supply is constrained or pricing becomes unstable, so memory makers are making longer-term bets to keep up. A key point in Micron's messaging is that the facility is intended for NAND, not DRAM. That distinction matters because DRAM products like DDR5 follow different demand cycles and have different capacity planning pressures. By focusing the announcement on NAND, Micron is signaling that it sees storage demand as a primary driver for expansion, particularly on the enterprise and hyperscaler side. Singapore is also a logical extension of Micron's existing footprint. The company already produces a significant portion of its NAND output in the country, and the new factory is planned as part of its established local manufacturing complex. T hat typically helps with ramp efficiency, since infrastructure and operational experience are already in place. Micron's broader Singapore plans include another memory category as well. The company has described a separate local facility planned to open in 2027 for HBM production, a stacked high-bandwidth memory used with AI accelerators. With both NAND and HBM expansion centered in Singapore, Micron appears to be concentrating growth around memory segments most closely tied to AI infrastructure. Micron has not stated whether the new NAND output will be aimed directly at consumer-branded products. The company ended its Crucial-branded consumer SSD and memory module business, but it continues to supply memory components to other vendors. That keeps the door open for the factory's NAND to show up in consumer SSDs indirectly through partner and OEM channels, even if Micron does not sell the finished drives under its own label.

[5]

Micron Plans Nearly $24 Billion Singapore Investment To Address AI-Driven Demand - Micron Technology (NASDAQ:MU)

Micron Technology Inc. (NASDAQ:MU) has begun building a state-of-the-art wafer fabrication plant in Singapore, with plans to invest about $24 billion (SG$31 billion) over the next ten years amid strong AI-driven demand for its memory chips. Expanding the NAND Center Of Excellence The new plant, situated within Micron's existing memory chip manufacturing campus in Singapore, will add approximately 700,000 square feet of cleanroom space. Wafer production is slated to begin in the latter half of 2028. The project is expected to generate approximately 1,600 new jobs, in addition to the 1,400 roles announced earlier for the high-bandwidth memory (HBM) advanced packaging facility, bringing Micron's total planned job creation in Singapore to around 3,000. Capacity Expansion Amid Memory Chip Shortage The new facility's construction comes at a time when Micron is ramping up its efforts to address the global memory chip shortage exacerbated by a surge in AI data center spending, which has significantly increased the demand for memory chips, especially high-bandwidth memory used in AI servers. This trend has led to a shift in the memory supply heavily towards AI workloads, leaving fewer chips available for consumer electronics such as smartphones, PCs, and laptops. Micron CEO Sanjay Mehrotra emphasized the company's long-term investment in new capacity to meet the growing demand for memory chips, a process that requires a significant lead time for construction. In December, the company reported strong Q1 results, with a revenue of $8.27 billion, surpassing the $8.23 billion consensus estimate. The company also provided an upbeat outlook for Q2, expecting a revenue of $8.2 billion, compared to the $7.58 billion consensus estimate. Benzinga's Edge Rankings place Micron in the 98th percentile for quality and the 99th percentile for momentum, reflecting its strong performance. Benzinga's screener allows you to compare Micron's performance with its peers. Price Action: Over the past year, Micron stock climbed 327.06%, as per data from Benzinga Pro. On Monday, the stock declined 2.64% to close at $389.09. Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Image via Shutterstock MUMicron Technology Inc $389.230.04% Overview Market News and Data brought to you by Benzinga APIs

[6]

Micron builds $24 billion facility

Micron builds $24 billion facility New dedicated NAND factory set to expand existing facility Shortly after having closed its consumer memory division Micron announced via a press release that it is building a new wafer fabrication facility in Singapore to expand its existing fabrication plant that produces memory modules. This is a massive 10 year investment costing Micron $24 billion and as expected it is aimed at AI. The memory fabrication plant should be fully operational this year with the new NAND facility starting construction in the second half of 2028 providing 700000 square feet of cleanroom space for wafer production. The facility will be double story the first in Singapore and will provide 1600 jobs on top of the 1400 created by the existing memory production operations. "Micron's leadership in advanced memory and storage is enabling the AI driven transformation reshaping the global economy. We are grateful for the longstanding support and successful partnership with the Singapore government including EDB and JTC. This investment underscores Micron's long term commitment to Singapore as an important hub in our global manufacturing network enhancing supply chain resiliency and fostering a vibrant ecosystem for innovation." Manish Bhatia executive vice president of global operations at Micron Technology. Micron's investment appears to strongly suggest that demand for memory and storage within the AI industry will continue to take priority which may further strain the consumer market and contribute to higher prices for gamers.

[7]

Micron Doubles Down on Singapore as AI Memory Demand Rewrites Capacity Math

Micron Technology's (NASDAQ:MU) decision to commit roughly US$24.41 billion to expand its Singapore manufacturing footprint over the next 10 years is a direct response to one of the tightest constraints emerging in the AI supply chain, memory availability. By breaking ground on an advanced wafer fabrication plant inside its existing NAND complex, the company is signaling that the current AI investment cycle is no longer just about compute; it is increasingly about securing the high-performance storage infrastructure required to sustain data-centric workloads at scale. Wafer output is scheduled to begin in the 2nd half of 2028, underscoring both the long lead times and the capital intensity involved in pushing NAND capacity forward in a market where supply has struggled to keep pace with accelerating demand. The strategic weight of the investment is amplified by Micron's existing concentration in Singapore, where it already produces about 98% of its top-end NAND flash chips, according to the Economic Development Board. This makes the expansion less about geographic diversification and more about deepening a proven manufacturing base at a moment when AI-driven applications are redefining memory requirements across hyperscale and enterprise systems. The company's framing is explicit; the facility is intended to meet growing market demand for NAND technology driven by the rapid expansion of AI and data-centric use cases, placing memory directly alongside compute as a limiting factor in the next phase of semiconductor scaling. Micron's broader capital agenda reinforces this shift. Its advanced packaging facility for high-bandwidth memory in the same Singapore complex remains on track to contribute meaningfully to HBM supply in 2027, backed by an additional investment of about US$7 billion through the end of the decade. That sequencing matters for investors, with HBM tied more immediately to AI data-center demand, while NAND capacity expansion carries a longer runway toward 2028 production. The company's December outlook upgrade, based on demand growth across its major products and the admission that supply is not keeping up, provides the clearest market signal that memory is entering a structurally tighter cycle rather than a short-term rebound. Recent moves, including the planned US$1.8 billion acquisition of a Taiwanese chip-making site and the groundbreaking of a US$100 billion facility in New York, show Micron building redundancy and scale across key nodes of the memory ecosystem. The base case for investors is that sustained AI infrastructure buildout keeps both NAND and HBM demand firm enough to justify this level of long-duration capital deployment, supporting tighter pricing conditions and higher strategic value for advanced memory supply. The key risk scenario remains execution and timing, with wafer output only beginning in 2028, leaving Micron exposed to potential cycle shifts, project complexity, or demand normalization if AI spending becomes more uneven. From here, investors will be watching the pace of HBM ramp into 2027, signs of continued supply tightness, and whether Micron's expanded manufacturing timeline aligns with the durability of AI-driven memory consumption rather than a temporary surge.

[8]

Micron plans $24-billion memory chipmaking plant in Singapore

SINGAPORE, Jan 27 (Reuters) - U.S. memory chipmaker Micron Technology announced on Tuesday a $24-billion investment plan to build a new memory chip making facility in Singapore, as it races to boost output in the face of an acute global shortage. The news, reported earlier by Reuters, comes amid an industry scramble to build AI infrastructure that has left sectors from consumer electronics to AI service providers battling a severe scarcity of all types of memory chips. Micron said the new investment to build an advanced wafer fabrication facility over the next decade will help it meet growing market demand for NAND memory chips, fuelled by the rise of AI and data-centric applications. Wafer output is set to begin in the second half of 2028 in a cleanroom space sprawling over 700,000 square feet (65,000 sq m), it added in a statement. Micron makes 98% of its flash memory chips in Singapore where it is also building a $7-billion advanced packaging plant for high bandwidth memory (HBM), used in artificial intelligence chips, due to start production in 2027. The HBM chip packaging facility in Singapore is on track to contribute to supply in 2027, it added on Tuesday. Analysts said the memory supply shortfall could run through late 2027, although the chipmaker and its main rivals, South Korea's Samsung and SK Hynix, plan new production lines and are advancing dates to start production. Last week, Micron said it was in talks to buy a fabrication site from Powerchip in Taiwan for $1.8 billion, that stands to boost its DRAM wafer output. This month, SK Hynix told Reuters it plans to hasten the opening of a new factory by three months and begin operating another new plant in February. (Reporting by Jun Yuan Yong; Editing by Tom Hogue and Miyoung Kim)

Share

Share

Copy Link

U.S. chipmaker Micron Technology announced a $24-billion wafer fabrication plant in Singapore to address acute memory chip shortages driven by AI infrastructure demand. The facility will add 700,000 square feet of cleanroom space with production starting in 2028, but analysts warn supply constraints may persist through late 2027.

Micron Singapore Plant Gets $24 Billion Boost Amid Industry Crisis

U.S. chipmaker Micron Technology has committed approximately $24 billion to build an advanced wafer fabrication plant in Singapore, marking one of the semiconductor industry's largest capacity expansion efforts as memory chips face unprecedented demand

1

. The $24 billion investment will unfold over the next decade at Micron's existing manufacturing campus, adding roughly 700,000 square feet of cleanroom space dedicated to NAND flash memory production2

. Wafer output is scheduled to begin in the second half of 2028, though this timeline places the facility firmly in the category of long-term supply solutions rather than immediate relief4

.

Source: Benzinga

AI Demand Drives Acute Memory Chip Shortage

The expansion comes as AI infrastructure demand continues to strain global memory supply chains across multiple sectors. Industries from consumer electronics to cloud service providers are battling severe scarcity of all types of memory chips, with AI data center spending significantly increasing requirements for both NAND storage and high-bandwidth memory (HBM) used in AI accelerators

3

. TrendForce analyst Bryan Ao noted that as demand outstrips supply, contract prices for enterprise solid-state drives are expected to rise by 55% to 60%, driven by robust order pulls from major North American cloud service providers seizing opportunities in the AI agent market1

. The shift toward high-bandwidth memory has absorbed manufacturing resources that might otherwise support conventional NAND and DRAM output, contributing to shortages across several memory categories3

.

Source: GameReactor

Singapore Becomes Central Hub for Memory Production

Micron already produces 98% of its flash memory chips in Singapore, making the country a central pillar of its global manufacturing strategy

1

. The company is simultaneously building a $7-billion advanced packaging plant for high-bandwidth memory (HBM) at the same site, which is on track to contribute to supply in 20271

. The capacity expansion is expected to generate approximately 1,600 new jobs related to NAND fabrication, adding to the 1,400 roles announced earlier for the HBM facility, bringing total planned job creation to around 3,000 positions5

. The facility will incorporate automation, robotics, and smart manufacturing systems as Micron concentrates growth around memory segments most closely tied to AI infrastructure3

.

Source: TechRadar

Related Stories

Industry-Wide Race to Expand Capacity

Micron's competitors Samsung and SK Hynix are also accelerating their capacity plans in response to the semiconductor supply chain crisis. SK Hynix told Reuters it plans to hasten the opening of a new factory by three months and begin operating another new plant in February

1

. Micron itself is exploring additional expansion options, including talks to acquire a fabrication site from Powerchip in Taiwan for $1.8 billion, which would boost its DRAM wafer output1

. TrendForce data shows Micron held a 13% market share as the fourth largest flash memory chip supplier in the third quarter of 20251

.Supply Constraints Expected Through 2027

Despite industry-wide announcements of new capacity, analysts expect tight memory supply conditions and the shortage to persist through late 2027

3

. The delayed production start at Micron's new facility raises questions about how much relief it can provide in the near term, with the scale of industry-wide shortages suggesting that no single facility, even one of this size, is likely to resolve supply constraints on its own3

. Micron CEO Sanjay Mehrotra emphasized the company's long-term investment approach, noting that meeting growing demand for memory chips requires significant lead time for construction5

. In December, Micron reported strong Q1 results with revenue of $8.27 billion, surpassing the $8.23 billion consensus estimate, and provided an upbeat outlook for Q2 with expected revenue of $8.2 billion compared to the $7.58 billion consensus5

.References

Summarized by

Navi

Related Stories

Micron Invests $7 Billion in Singapore for Advanced HBM Packaging Facility to Meet AI Demand

08 Jan 2025•Business and Economy

SK Hynix commits $13 billion to world's largest HBM plant as AI demand creates historic shortage

13 Jan 2026•Business and Economy

Micron Announces $9.6 Billion Investment in Japan AI Memory Chip Plant

29 Nov 2025•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy