Microsoft's Record $35 Billion AI Investment Signals Infrastructure Race as Stock Falls Despite Strong Earnings

14 Sources

14 Sources

[1]

Microsoft Increases Investments Amid A.I. Race

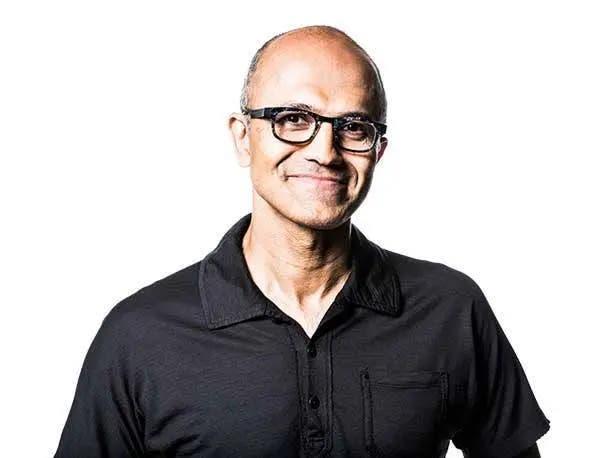

Microsoft's big spending on artificial intelligence shows no signs of letting up. On Wednesday, the company reported spending a larger-than-expected $34.9 billion on new projects in the three months through Sept. 30 as it races to build data centers that provide computing power to fuel the A.I. boom, a l74 percent increase from the same period a year ago. Microsoft reported sales of $77.7 billion, up 18 percent from the same period last year. The company reported $ 27.7 billion in profits, up 12 percent. Driving much of the company's growth was its flagship cloud computing product Azure, as well as a partnership with the A.I. start-up OpenAI. The company's A.I. offerings are driving "real-world impact," Satya Nadella, Microsoft's chief executive, said in a statement. "It's why we continue to increase our investments in A.I. across both capital and talent to meet the massive opportunity ahead." The earnings report was largely in line with Wall Street's expectations. Microsoft's shares sank more than 3 percent in after-hours trading. On Tuesday, OpenAI announced that it had hammered out the details to convert into a for-profit entity, including a new agreement with Microsoft to restructure their relationship. Under the terms, Microsoft will get a roughly $135 billion stake in OpenAI. The companies also extended an agreement to give Microsoft unfettered access to all OpenAI technology that it could sell to customers and use in its own products until 2032. And OpenAI committed to buying $250 billion in computing power from Microsoft -- more than three times Azure's sales in Microsoft's last fiscal year. Already, Microsoft's A.I. sales included selling access to the systems created by ChatGPT's creator, OpenAI, and provided computing power when customers used OpenAI products directly from the start-up. Microsoft reported that Azure sales rose 40 percent in its most recent quarter. The company has cautioned that the demand for its cloud computing services outpaces its available data centers. As a result, the company has been furiously expanding. Still, some analysts have warned that tariffs and a less optimistic economic outlook could cause some customers to pull back spending. Sales were up 17 percent, to $33 billion, for commercial subscriptions to Microsoft's productivity tools for businesses, which include Excel, Teams and Word, as well as its A.I. assistant tool Copilot. Microsoft saw a 4 percent increase in sales, to $13.8 billion, in its personal computing business. This year, Microsoft had an uptick in demand for its PC laptops, which analysts think was the result of companies and consumers front-loading purchases before new tariffs kicked in. (The New York Times has sued OpenAI and Microsoft, claiming copyright infringement of news content related to A.I. systems. The two companies have denied the suit's claims.)

[2]

Microsoft Claims It Will Double Its Data Center Footprint in Two Years

The data center industry is the backbone of the AI business, and the AI business, as we all know, is where the money's at these days. As AI becomes the unstable center of America's weird new economy, the infrastructure necessary to keep the AI going and the money flowing has become all-important, and that's exactly why Microsoft now appears poised to go on a data-center-building rampage. During Wednesday's earnings call, Microsoft's CEO, Satya Nadella, told investors that the company plans to double its data center footprint over the next two years, the Wall Street Journal reports. At the same time, Nadella said that his company would "boost its AI capacity by more than 80% this year," the newspaper writes. According to its earnings report released Wednesday, the company's revenue during the first fiscal quarter of 2026 was $77.7 billionâ€"an 18 percent increase from where it was last year at this time. Its operating income, meanwhile, was $38.0 billion, which is a 24 percent increase from this time last year. It seems like further proof that, while studies seem to show that most businesses that are rolling out AI programs aren't really profiting from them, somebody is still getting paid. Indeed, the AI boom has been majorly profitable for big fish like Microsoft because everyone and their mother now wants to start an AI-centric business and, to make AI work, you need cloud. It's previously been noted that other Big Tech giantsâ€"like Google and Amazonâ€"are also capitalizing on the current frenzy to suck up vast amounts of computing real estate, so to speak. If Microsoft is making big bucks from Azure, it's no wonder it wants to expand it. Azure already lays claim to some 400 data centers in 70 regions around the world. For a time, Microsoft was also the exclusive cloud provider to its special business partner, OpenAI. However, it lost that privilege in January, as OpenAI sought to diversify its cloud relationships. During Wednesday's earnings call, Nadella reportedly said that his company's relationship with OpenAI was “one of the most successful partnerships and investments our industry has even seen†and that the two companies would "continue to benefit mutually from each other’s growth across multiple dimensions.†Despite the big uptick in revenue, Microsoft's stock still dropped 4 percent today, upon the news that the company planned to spend more in the coming year on its AI business, CNBC reports. To continue the AI-ification of the economy, companies will still need to invest.

[3]

Microsoft's record capex shows AI is hitting real-world limits

The cloud still sells the dream of weightlessness, but Microsoft's latest quarter landed heavily. You could almost hear the hum of substations behind the earnings call -- the quiet admission that software has become infrastructure, and that the bottleneck isn't code but current. The company that once scaled the internet on clever abstractions is now helping pace the buildout of the U.S. power grid. The quarterly numbers were textbook triumph. Revenue climbed 18% to $77.7 billion; adjusted earnings hit $4.13 a share, clearing estimates; Azure revenue grew about 40%; and operating income rose 24% to $38 billion. But despite the beat and the eyebrow-raising numbers, shares drifted around 3% lower in Thursday morning trading. And that's because what defined the quarter wasn't code, it was concrete: roughly $35 billion in capital spending -- a record, up 74% year over year -- poured into data centers, transformers, and land. Microsoft used to scale at the speed of software; every quarter brought new products, new users, new profits. Now the limits are physical. The company warned investors on the post-earnings call that it would remain "capacity-constrained through the end of the fiscal year," a phrase that would have sounded alien in its software-licensing days. Transformers, cooling systems, and land permits are the new chokepoints of growth. Each dollar of AI revenue now drags behind it a dollar of construction. Even an almost-$4-trillion company can't buy more electricity on command. So when perfection is already priced in, even close-to flawless execution can feel like a miss. A decade ago, the cloud's constraint was imagination; now it's infrastructure. Even a record outlay can't conjure megawatts or fast-track substation permits. The brief Azure outage hours before results hit -- triggered by an "inadvertent configuration change" -- landed as the perfect metaphor for a company stretching the limits of its own infrastructure. When your balance sheet looks like the GDP of a midsize nation, a blip reads like a stress test. The physics are inescapable. Each AI deployment now drags behind it a convoy of equipment, cooling, and grid hookups. Every leap in capability arrives with a power bill. And for all the talk of generative intelligence, Microsoft's smartest move might simply be keeping the lights on. "Microsoft isn't short on cash, it's short on capacity," said Jake Behan, Direxion's head of capital markets. "[AI is] eating into margins. ... If the cloud bellwether isn't immune, the rest of the sector should be on notice." His point is less complaint than diagnosis: Scaling intelligence now costs real money and real metal. Traders, he added, "aren't just tolerating heavy capex anymore -- they're demanding it. And despite Microsoft's best efforts, even a $35B quarter isn't enough to satisfy the AI appetite." The company's plan to double its data-center footprint within two years reads less like an aspiration than an industrial schedule. "FY26 remains the true inflection year of AI growth," Wedbush analysts wrote in a note, predicting Microsoft will join the $5 trillion market-cap club once the buildout catches up. It's an argument investors increasingly accept: The surest way to defend market share is to overbuild it. In Wedbush's view, Microsoft's massive infrastructure investments aren't optional but foundational -- the price of leadership in an arms race where speed of buildout equals market share. And while margins may be bending under the cost of capacity, they're not breaking. Zacks senior equity strategist Bryan Hayes said, "While we're still seeing some of that margin compression, which in the past was not sustainable, [the $38 billion operating income] really showcased Microsoft's operational efficiency and ability to translate it to revenue growth into bottom line profitability despite all this funding of aggressive growth investments and cloud and AI capabilities." Still, the paradox persists. Microsoft did everything right -- its 13th-consecutive EPS beat, double-digit growth, strong guidance -- and the stock dipped. When companies behave like utilities but are valued like unicorns, even perfect execution feels mortal. The selloff wasn't about doubt; it was about gravity. What those numbers disguise is a deeper transformation. Microsoft is no longer selling only software; it's selling capacity -- measured in racks, megawatts, and latency. The backlog is real money, but it's also a stress test of whether any company can scale physical output fast enough to meet digital demand. That cost is visible on multiple fronts. Each new AI region requires long-term power contracts and water rights; each data-center campus depends on a local grid that wasn't built for exponential load. The supply chain that supports all this -- chips, cooling systems, fiber -- resembles less a tech ecosystem than a modern utility build-out. Hayes looked at the numbers and saw real earnings, not dot-com hype, on the balance sheet. "This revolution in AI is going to be backed by sales and earnings growth," he said. "It's not like the '90s when stocks were skyrocketing with zero profit. These are real earnings backed by some of the biggest companies in the world." Microsoft's leadership seems to understand that the next era of growth won't be defined by innovation alone but by infrastructure mastery. CEO Satya Nadella has reframed the company's mission around capacity: building the plants, supply chains, and grid connections that make AI possible. The scale rivals national infrastructure projects -- hyperscale campuses in Iowa and Sweden, grid partnerships across the U.S. South, contracts stretching into the 2030s. Redmond has become both tenant and builder in a global race for power. The irony of this moment is that it feels both unprecedented and familiar. Silicon Valley once prided itself on weightlessness -- products that scaled without factories, profits that arrived without sweat. Now, Microsoft's growth reads like a public works project. The cloud is no longer a metaphor; it's a skyline of substations and scaffolding, a ledger of gigawatts and glass fiber. This is what industrial policy looks like in corporate form: capital, concrete, and control over the next layer of global infrastructure. It's also what faith looks like when rendered in steel: investors willing to fund a multitrillion-dollar power expansion on the assumption that intelligence itself can be monetized. The digital revolution was supposed to make everything lighter, faster, and cheaper. Microsoft's quarter suggests the opposite: a digital economy becoming heavier, slower, and vastly more expensive. If the future belongs to whoever controls the energy and the infrastructure to run it, Redmond's biggest challenge may also be its clearest advantage -- the patience and the power to keep building.

[4]

Microsoft beats revenue expectations and invests a further €30bn in AI

Microsoft beat forecasts on both sales and profit in the last quarter, posting $77.7 billion (€6.62bn) in revenue and $30.8bn (€26.52bn) in income. The firm nonetheless surprised some investors by the scale of its spending on cloud and AI infrastructure, sending shares down more than 3% after hours. Microsoft's results also came as the company's Azure services recovered from an outage on Wednesday. The tech giant said it spent nearly $35bn (€30.13bn) in the July to September quarter on capital expenditures to support AI and cloud demand. Nearly half of that was allocated to computer chips and much of the rest was related to data centre real estate. The spending overshadowed Microsoft's report of a 22% increase in quarterly profit to $30.8bn (€26.52bn), or $4.13 per share. Microsoft said those results excluded the impacts of money it invested in OpenAI -- an attempt to "help clarify" how those losses affected Microsoft's core business. Microsoft was expected to earn $3.67 per share on revenue of $75.38bn (€64.90bn), according to analysts surveyed by FactSet Research. The results came a day after a new deal with OpenAI pushed Microsoft to a $4 trillion (€3.44tn) valuation for the second time this year. But shares in Microsoft then dropped in the hours before it disclosed its earnings on Wednesday as the company battled the outage affecting its Azure cloud computing platform. They dropped further -- by more than 3% -- in after-hours trading on Wednesday as investors considered the significance of the earnings report. Driving investor enthusiasm on Tuesday was the announcement of Microsoft's revised business deal with its longtime partner OpenAI, maker of ChatGPT and now the world's most valuable start-up. While no longer OpenAI's exclusive cloud provider, a relationship that helped bankroll the start-up's early growth, Microsoft will retain commercial rights to OpenAI products through 2032 and get a roughly 27% stake in OpenAI's new for-profit arm. Microsoft also said on Wednesday that it has already invested $11.6bn (€9.99bn) of the total $13bn (€11.19bn) it has committed to OpenAI. Microsoft's valuation previously passed $4 trillion (€3.44tn) in July, making it the second company after Nvidia to reach the milestone. Microsoft again and Apple for the first time crossed $4tn (€3.44tn) this week, while Nvidia went on to achieve a different milestone: the first $5tn (€4.31tn) company. The sky-high valuations highlight the investor frenzy around artificial intelligence, which some fear could turn into a bust if AI products aren't as transformative or profitable as promised. Quarterly revenue from Microsoft's cloud-focused business segment was $30.9bn (€26.60bn), up 28% from the same time last year and just slightly above what analysts were expecting. Revenue from Microsoft's workplace software, which includes its email and word-processing tools, was up 17% to $33bn (€28.41bn). Microsoft's recent focus has centred around pitching its flagship AI assistant Copilot to help with a variety of work tasks, and last week gave it a new animated avatar exterior called Mico.

[5]

Microsoft's stock falls on AI spending concerns and lack of clarity about OpenAI - SiliconANGLE

Microsoft's stock falls on AI spending concerns and lack of clarity about OpenAI Microsoft Corp. beat expectations again for its latest quarterly results, helped by a 40% increase in its Azure cloud business. But the company's stock fell almost 4% in late-trading after it revealed the scale of its investment in OpenAI and told analysts it intends to hike its capital expenditures again this fiscal year. The company reported fiscal first-quarter earnings before certain costs such as stock compensation of $3.72 per share, easing past Wall Street's target of $3.67, while its total revenue rose 18%, to $77.67 billion, ahead of the $75.33 billion analyst forecast. However, Microsoft revealed a major drop in profit due to what it termed was an "equity method investment" in OpenAI Group PBC, resulting in a 41-cents-per-share hit to its earnings and a $3.1 billion drop in its net income. Even so, the company's bottom line was still healthy at $27.7 billion, up from $24.67 billion in the year-ago quarter. The most impressive result came from Microsoft's Intelligent Cloud unit, which includes the Azure cloud business. It delivered total revenue of $30.9 billion in the quarter, up 28% from a year earlier and above the Street's estimate of $30.25 billion. The cloud business continues to be one of the biggest drivers of Microsoft's growth, as it's benefiting immensely from the rising demand for artificial intelligence services. Last quarter, the company revealed the true scale of Azure's infrastructure business in dollar terms for the first time, saying it generated $75 billion in revenue during its fiscal 2025 year, up 34% from a year prior. Looking to the current quarter, Microsoft said it's calling for revenue of between $79.5 billion and $80.6 billion. The midpoint of that range is just ahead of the Street's forecast for $79.95 billion in revenue. Microsoft Chairman and Chief Executive Satya Nadella (pictured) likened the company's "planet-scale cloud" to an "AI factory" and said it's driving broad diffusion and real-world impact for thousands of customers. "It's why we continue to increase our investments in AI across both capital and talent to meet the massive opportunity ahead." What the company's confusing relationship with OpenAI will mean for that opportunity still remains unclear, though. On a conference call with analysts, Nadella explained that the AI firm's recent recapitalization, which cemented its structure as a nonprofit with a controlling stake in its for-profit business, means that Microsoft now holds a 27% stake in the public benefit corporation that's valued at $135 billion. Nadella told analysts that the relationship between the two firms is "one of the most successful partnerships and investments our industry has even seen," and said the two will continue to enjoy mutual benefits from each other's growth. He also revealed that OpenAI has agreed to spend an additional $250 billion on Azure's cloud infrastructure, though he said Microsoft no longer has the first right of refusal should the company need additional cloud computing capacity. Microsoft's partnership with OpenAI predates the arrival of ChatGPT, and though it was initially seen to enjoy massive benefits from the relationship, the companies have become increasingly at odds, competing in various aspects of the AI industry. Just over a year ago, Microsoft confirmed it sees OpenAI as a competitor in its annual report to shareholders, listing it alongside peers such as Google LLC, Meta Platforms Inc. and Amazon Web Services Inc. Valoir analyst Rebecca Wettemann told SiliconANGLE that there's still a lack of clarity around Microsoft's partnership with OpenAI that raises concern about the future impact on its profitability in AI. "Although this week's deal gives both sides more flexibility in the short term, a lot depends on how AGI plays out, and who gets to decide when we actually get there," she said, referring to artificial general intelligence, or AI systems that surpass the reasoning capabilities of humans. One advantage Microsoft has over OpenAI is money, and on the conference call, its Chief Financial Officer Amy Hood confirmed that it plans to spend much more of it on building out the cloud infrastructure it needs to support its AI services. Capex came to $34.9 billion in the first quarter, above the $30 billion figure she had told analysts the company would spend in July. Hood also said the company will continue to grow its expenditures throughout fiscal 2026, adding that the growth rate will be higher than what it was in 2025. Three months ago, she had said the company was likely to slow its rate of capex growth. Wettemann said the increased spending plans have caused concerns among some investors, who are worried about the eventual outcomes. "While Microsoft beat estimates, the volume of chatter about an AI bubble is going up day by day, and it has made some big bets without showing a lot of real results for customers at this point, compared to some of its competitors," she said. However, not everyone agreed with that view. Bryan Hayes of Zacks Investment Research told SiliconANGLE that Microsoft's investments in Copilot were one of the main drivers of growth in its Productivity and Business Processes segment, which includes its Officer productivity suite and LinkedIn. That business delivered revenue of $33 billion in the quarter, beating the Street's forecast of $32.33 billion. Microsoft 365 Commercial cloud revenue was up 17%, while Consumer revenue jumped 26%. According to Hayes, those numbers make it clear that the company is capitalizing on its investments in Copilot, which has been tightly integrated with Office, GitHub, Windows and other software services "During the last fiscal year, Copilot applications achieved significant milestones, surpassing 100 million monthly active users across commercial and consumer segments," Hayes said. "By reframing Microsoft as a platform that enables AI-native innovation, Nadella aims to extend the company's dominance beyond cloud and productivity into the AI-native economy." Microsoft's More Personal Computing unit, which includes revenue from Windows, search advertising, devices and the Xbox console, also grew. Revenue there was up 4% to $13.8 billion, surpassing the Street's consensus estimate of $12.83 billion. The company delivered its financial results just hours after Azure and Microsoft 365 experienced a major outage, taking down various websites and services across the globe. Microsoft promised it would fully recover before the day is out, but it probably did little to ease the concerns of shaky investors. Despite today's after-hours slump, Microsoft's stock is still up 28% in the year to date.

[6]

Microsoft's 900 Million AI Users Push Revenue to $77.7 Billion | AIM

Microsoft reported stronger-than-expected results for the first quarter of fiscal year 2026, driven by accelerating demand for its cloud and AI services. Revenue rose 18% year over year to $77.7 billion, while operating income grew 24% to $38 billion. Net income was $27.7 billion on a GAAP basis, up 12%, and $30.8 billion on a non-GAAP basis, up 22%. Microsoft's overall cloud revenue reached $49.1 billion, up 26%, with commercial remaining performance obligations (RPO) climbing 51% to $392 billion, nearly double over two years. Commercial bookings surged 112%, driven by large Azure contracts, including those with OpenAI. "Our planet-scale cloud and AI factory, together with Copilots across high-value domains, is driving broad diffusion and real-world impact," said Satya Nadella, chairman and CEO. "We continue to increase our investments in AI across both capital and talent to meet the massive opportunity ahead." Chief financial officer Amy Hood said the company "delivered a strong start to the fiscal year," adding that Microsoft's cloud business continues to show "growing customer demand for our differentiated platform." Intelligent Cloud revenue rose 28% to $30.9 billion, led by Azure and other cloud services, which grew 40% in constant currency. Nadella said Azure "took share again this quarter," noting that Microsoft now has "the most expansive data centre fleet for the AI era," and plans to increase total AI capacity by over 80% this year and double its global data centre footprint over the next two years. Microsoft announced a new long-term agreement with OpenAI, extending Azure's exclusive rights until 2030 and model and product IP rights through 2032. Nadella called it "one of the most successful partnerships our industry has ever seen," adding that OpenAI has now contracted an additional $250 billion of Azure services, not yet reflected in reported results. Capital expenditures reached $34.9 billion, with roughly half allocated to short-lived assets such as GPUs and CPUs to expand Azure capacity. The company said 900 million users now use its AI features each month, with 150 million using first-party Copilots across products. Adoption of Microsoft 365 Copilot continues to rise rapidly, with usage up 50% quarter over quarter, and more than 90% of the Fortune 500 now deploying it. In software development, GitHub Copilot reached 26 million users, with over 180 million developers active on the platform. Nadella said GitHub is "adding a developer every second," underscoring the momentum of AI-driven productivity tools.

[7]

Microsoft delivers another blockbuster quarter amid AI bubble fears

Microsoft beat Wall Street expectations on Wednesday, delivering financial results that shows steady demand for its cloud computing and artificial intelligence platforms. The Redmond-based software maker reported almost $77.7 billion in revenue for its first fiscal quarter of 2026, which ran from July through September. On top of that, the company brought in $27.7 billion in profit. Analysts were expecting $75.3 billion in revenue. Microsoft also reported growth in its Azure cloud division, a figure the company kept hidden until its last quarter's earnings report in July. Azure's revenue increased by 40% during the first quarter compared to last year, though that may be overshadowed by a widespread Azure outage that affected much of the internet for most of the day. In a news release, Microsoft CEO Satya Nadella and CFO Amy Hood both chalked the results up to increased demand for the company's cloud services and its AI-powered Copilot models. "Our planet-scale cloud and AI factory, together with Copilots across high value domains, is driving broad diffusion and real-world impact," Nadella said. "It's why we continue to increase our investments in AI across both capital and talent to meet the massive opportunity ahead." Microsoft's earnings came the day after the company and ChatGPT maker OpenAI announced that Microsoft would own 27% of OpenAI with a $135 billion stake. Under the terms of the deal, Microsoft has exclusive intellectual property rights with OpenAI until 2032, while OpenAI is purchasing $250 billion worth of Microsoft cloud computing services. This is a developing story and will update.

[8]

Microsoft Is Dramatically Boosting AI Investments as It Races to Keep Up With Demand

Microsoft's quarterly earnings topped analysts' estimates, as AI continued to drive sales for its cloud computing service Azure. Microsoft reported a massive spike in its spending as the tech giant works to meet booming demand for artificial intelligence. The tech giant said Wednesday that its capital expenditures surged to $34.9 billion in its fiscal first quarter, up from $24.2 billion in the fourth quarter, with most of the funds going toward investments in building out its AI infrastructure. CEO Satya Nadella told investors on Wednesday's earnings call that the company expects to double its data center footprint over the next two years, "reflecting the demand signals" the company is seeing for AI, according to a transcript provided by AlphaSense. Microsoft's cloud and AI offerings helped drive better-than-expected results in the fiscal first quarter, with earnings per share of $3.72 on revenue that jumped 18% year-over-year to $77.7 billion. Both figures topped analysts' estimates compiled by Visible Alpha. Revenue from Microsoft's Intelligent Cloud division, which includes its cloud computing service Azure, rose 28% to $30.9 billion, slightly ahead of the $30.3 billion analysts had called for. Looking ahead, Microsoft said it expects current-quarter revenue of $79.5 billion to $80.6 billion. Analysts were looking for $80.14 billion. Microsoft shares were down about 2% in extended trading following the results. They were up nearly 30% for 2025 through Wednesday's close.

[9]

Microsoft CFO Amy Hood Says Cloud Revenue Figures 'Could Be Higher,' But Azure Is 'Short On Capacity' As AI Demand Soars - Microsoft (NASDAQ:MSFT)

Microsoft Corporation's (NASDAQ:MSFT) booming AI business is stretching its cloud infrastructure to the limit, with CFO Amy Hood acknowledging that Azure's capacity shortfall likely capped revenue growth in the latest quarter. Azure Capacity Crunch Hits Growth During the company's fiscal first-quarter earnings call on Wednesday, Deutsche Bank analyst Brad Zelnick asked whether Microsoft could quantify the "revenue impact of Azure being short on capacity." In response, Hood said that Microsoft has been short in Azure due to surging AI demand across its ecosystem -- from Microsoft 365 Copilot and GitHub to its expanding security portfolio. "It's always hard to quantify precisely what would have been the revenue impact in the quarter," adding, "But I would offer a way to think about it is Azure probably does bear most of the revenue impact." "It is safe to say that the number could be higher," she said, referring to the revenue impact. The executive noted that Microsoft has prioritized allocating resources to its fast-growing AI-driven products first, including Copilot and GitHub, as adoption and usage surge. "We've seen very different patterns, which we're encouraged by. It's the adoption of security features. It's the GitHub momentum. When you're thinking about it, that is where, and it is a priority for us, to allocate resourcing there first," she said. See Also: AMD, Nvidia, Broadcom's Combined Value Surges 1000% In Just Three Years -- And Bulls Want More Balancing Demand And AI Priorities Hood also added that the company has made it a priority to ensure its product teams and AI researchers have access to computing power, even as demand outpaces supply. "We've worked very hard to try to mitigate it as best we can, but we have been short in Azure." Microsoft Beats Estimates With $77.7 Billion In Q1 Revenue Microsoft posted first-quarter revenue of $77.7 billion, marking an 18% year-over-year increase and surpassing the Street consensus estimate of $75.3 billion. Revenue from Azure and other cloud services climbed 40% compared to the same period last year. For the second quarter of fiscal 2026, Microsoft expects revenue between $79.5 billion and $80.6 billion, reflecting 14% to 16% growth. The company also anticipates ongoing commercial cloud gross margin pressure, elevated capital expenditures and capacity constraints continuing through the end of the fiscal year. Price Action: According to Benzinga Pro data, Microsoft shares fell 3.98% in after-hours trading, slipping to $519.99. Benzinga's Edge Stock Rankings position Microsoft (MSFT) in the 97th percentile for Growth, highlighting its robust long-term fundamentals and strong investor confidence. Click here to see how it stacks up against its peers. Read Next: After Google's $2.7B Acquisition Of Founders And Staff, This AI Startup Abandons Large Language Model Plans And Shifts Focus Away From Chatbots Photo Courtesy: katuSka on Shutterstock.com Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors. MSFTMicrosoft Corp$519.99-4.07%OverviewMarket News and Data brought to you by Benzinga APIs

[10]

Microsoft Q1 Earnings: CEO Nadella Says 'Fungible' Asset Strategy Key In AI Race

'We have to fund our own R&D and model capability because in the long run that's what's going to differentiate us,' Microsoft CEO Satya Nadella said. Microsoft executives assured analysts worried about an artificial intelligence bubble that the vendor is avoiding too much spending, with AI demand still exceeding supply and Microsoft prioritizing "fungible" data center assets applicable to multiple geographies, first-party products, third-party products and research. Answering questions Wednesday during the Redmond, Wash.-based technology giant's latest quarterly earnings call, Microsoft CEO Satya Nadella said the vendor is willing to walk away from business that is too concentrated, Nadella said. "There's compute, there's storage-and so if all of the demand just comes for just one meter, that's really not a long-term business we want to be in," he said. "We have to fund our own R&D and model capability because in the long run that's what's going to differentiate us. ... We feel very, very good about the decisions. In some sense, I feel even, each time we say no to (some business), the day after, I feel better." [RELATED: Zones' New CEO Yehia Omar On How The Company Has Restructured For The Future] Microsoft reported results Wednesday for the first quarter of its 2026 fiscal year. The quarter ended Sept. 30. The vendor revealed to analysts that AI demand helped fuel an eye-popping commercial remaining performance obligation (RPO) business backlog of $392 billion, up 51 percent year on year. That backlog covers "numerous products" and "covers customers of all sizes," Microsoft Chief Financial Officer Amy Hood said on the call in response to a question about the concentration of customers contributing to the backlog. Microsoft's RPO has a weighted average duration of about two years, Hood said, meaning "that these are contracts being signed by customers who intend to use it in relatively short order." "At that type of scale, I think that's a pretty remarkable execution," she said. The customer concentration question might bring to mind one of the criticisms around Microsoft cloud rival Oracle's $500 billion-plus backlog of business, which some analysts said had a relatively small number of companies contributing to the business-including Microsoft-backed OpenAI. Speaking of OpenAI, Nadella told analysts that he is happy with the new contract Microsoft signed with ChatGPT maker OpenAI, saying that the agreement "creates more certainty" around the companies' intellectual property relationship. Nadella described Microsoft's infrastructure investments as "building a planet-scale cloud and an AI factory, maximizing tokens per dollar per watt while supporting the sovereignty needs of customers and countries." The vendor plans to increase our total AI capacity by more than 80 percent this year and roughly double its total data center footprint over the next two years. Microsoft's Fairwater, "the world's most powerful AI data center," will go online next year and scale to 2 gigawatts, he said. Hood told analysts on the call that Microsoft continues to need to invest in building data centers for AI customers because it is still constrained, with demand exceeding supply, saying that her confidence is "very high" that Microsoft needs to use all of the infrastructure. Microsoft has invested in graphics processing units (GPUs), central processing units (CPUs) and other "short-lived assets" just to meet the duration of a customer contract, which cuts down on risk of overinvesting, she said. "We've spent the past few years not actually being short GPUs and CPUs, per se, we were short the space or the power-is the language we use-to put them in," she said. Microsoft has been embracing more leases to meet demand-Oracle co-founder and Chief Technology Officer Larry Ellison has previously pointed to his company's embrace of leases instead of owning buildings as a way it has quickly expanded capacity to meet demand. Those Microsoft leases can last up to 20 years as "long-lived assets," Hood said. Microsoft has a high confidence in the signals from usage patterns and bookings to justify its infrastructure spending. "We've been short (of infrastructure) now for many quarters," she said. "I thought we were going to catch up. We are not. Demand is increasing. It is not increasing in just one place. It is increasing across many places. We're seeing usage increases in products. We are seeing new products launch that are getting increasing usage-and increasing usage very quickly." Nadella added that the vendor is "building out a very fungible fleet" where data centers are built across the world for pre-training, post-training, reinforcement learning and other use cases. Microsoft also continually modernizes its fleet of semiconductors and leverages software across different types of semiconductors. For better efficiency over time, the CEO said. Per Microsoft's new OpenAI agreement, the upstart stays Microsoft's frontier model partner and Microsoft continues to have exclusive IP rights and Azure application programming interface (API) exclusivity until OpenAI achieves artificial general intelligence as verified by an independent expert panel. AGI is usually defined as AI that is as good as human intelligence. Nadella told analysts on Wednesday's call that he feels "pretty good" about AI's progress and that he doesn't think AGI "as defined, at least by us in our contract, is ever going to be achieved anytime soon." The new agreement allows Microsoft to independently pursue AGI alone or in partnership with third parties and extends Microsoft's IP right for models and products through 2032 and includes models post-AGI. Microsoft also has IP rights to research until AGI or through 2030, whichever happens first. The new agreement marks "the next chapter in what is one of the most successful partnerships and investments our industry has ever seen," the CEO said. Microsoft has seen 10 times the return on its OpenAI investment, and OpenAI has contracted an incremental $250 billion of Azure services. "This is a great milestone for both companies," Nadella said. "We continue to benefit mutually from each other's growth across multiple dimensions." Nadella and his team are focused on how users will deploy AI systems in the real world and create a return on the investment by the customer and the provider, the CEO said on the call. A problem with the AI era is jagged intelligence, where an AI tool performs well at a particular task but fails at tasks just outside of its proficiency even as model versions improve, Nadella said. Nadella told analysts on the call to look to Microsoft's GitHub, security stack, Microsoft 365 Copilot and Azure AI Foundry as not just products, but systems that give AI models guardrails. A system like those acts as an organizing layer for multi-agent systems "smooths out those jagged edges and really helps the capability," Nadella said. "That's the type of construction that will be needed, even when the model is magical-all powerful," Nadella said. "We will be in this jagged intelligence space for a long time." Even without AGI in the short term, "I do believe we can drive a lot of value for customers with advances in AI models by building these systems," Nadella said. Microsoft agent systems are aimed at high-value domains including information work and coding, he said. Copilot expands the M365 average revenue per user (ARPU), similar to how cloud proved more expansive to server sales despite initial zero-sum fears. The "coding business is going to be one of the most expansive AI systems," Nadella said. "We feel very good about being in that category. Same thing with security, same thing with health." Consumer AI products by Microsoft will monetize through ads and subscriptions, Nadella added. The revenue opportunities helps give Microsoft executives "the confidence to invest both the capital and the R&D talent to go after this opportunity." "The enterprise adoption cycle is just starting," he said. Per usual, Nadella shared a host of new user milestones on the call to illustrate the growth of Microsoft's AI and cloud products. Some of the highlights that might interest solution providers include: Milestones in the GitHub, coding and security space include: Among Microsoft's data, analytics and health care products: During the quarter, Microsoft also increased the token throughput for GPT-4.1 and GP-5 by more than 30 percent per GPU, Nadella said. Microsoft reported $77.7 billion for the quarter, up 17 percent year on year ignoring foreign exchange. The vendor saw operating income of $38 billion, up 22 percent. Net income using Generally Accepted Accounting Principles (GAAP) was $27.7 billion, up 12 percent year on year. Non-GAAP net income came in at $30.8 billion, up 21 percent ignoring foreign exchange. The non-GAAP results ignore the effects of investments in ChatGPT maker OpenAI, according to Microsoft. The vendor lost $3.1 billion in net income from its investment losses in OpenAI in the first quarter. In the first quarter of fiscal year 2025, Microsoft lost $523 million in net income from the investments. Microsoft's new OpenAI agreement did not affect first quarter numbers, Hood said on the call. Microsoft cloud revenue came in at $49.1 billion, up 25 percent year on year. Microsoft's productivity and business processes (PBP) segment brought in $33 billion for the quarter, up 14 percent year on year. Within this segment, Microsoft 365 commercial cloud revenue grew 15 percent year on year. M365 consumer grew 25 percent. Dynamics 365 grew 16 percent. This segment also includes revenue from social media network LinkedIn. The intelligent cloud (IC) segment saw $30.9 billion in revenue for the quarter, up 27 percent ignoring foreign exchange. Azure and other cloud services saw a 39 percent increase in revenue year on year. Microsoft's more personal computing (MPC) segment brought in $13.8 billion for the quarter, up 4 percent year on year. Within this segment, Windows original equipment manufacturer (OEM) and devices revenue grew 6 percent. This segment also includes revenue from gaming console Xbox, search and news advertising. Microsoft's stock traded at $520 a share after market close Wednesday, down about 4 percent.

[11]

The Most Impressive Number in Microsoft's Q1 Earnings Report | The Motley Fool

Microsoft (MSFT 1.45%) delivered another strong quarterly report last week, though the stock ticked lower in after-hours trading following its release. The price dropped 3% on concerns about the tech giant's enormous capital expenditures on AI. It slid another 1% on the day after the release. Nonetheless, Microsoft still delivered an impressive set of numbers for its fiscal 2026 first quarter. For the period, which ended Sept. 30, revenue jumped 18% to $77.7 billion, topping the analyst consensus at $75.4 billion. Its operating margin remained strong, hovering near 50%, and adjusted earnings per share jumped 23% to $4.13, well ahead of the analysts' consensus figure of $3.66. Like its peers, Microsoft is showing no signs of slowing down its AI-related spending as it responds to increasing demand for Copilot and other AI products. Management said on the earnings call that it's "adding AI capacity at an unprecedented scale," and that it plans to increase its AI capacity by more than 80% in its fiscal 2026, which will end in June. However, one number stood head-and-shoulders above the rest in Microsoft's latest report. Microsoft may be best known for its Windows operating systems and its Office productivity suite, but its most important product these days is likely Azure, its cloud infrastructure business. Azure is the cornerstone of its AI strategy, and AI is a large reason for Azure's recent success and its rapid growth. In fact, in the quarter, Microsoft said revenue from Azure jumped 40%, though it doesn't report specific dollar figures for Azure. That growth rate represents a significant acceleration from recent periods. Revenue from its intelligent cloud division, which includes Azure, could soon surpass revenue from its productivity division. Azure's growth is also outpacing that of Google Cloud and Amazon Web Services, the biggest cloud infrastructure service. Spending on Azure creates a virtuous feedback loop for Microsoft: As its customers spend more on the platform, that enables Microsoft to invest in increased capacity and new features. The success of Azure also gives Microsoft cover to hike its capital expenditures, though investors seem skeptical of those growing outlays. CFO Amy Hood noted on the earnings conference call that demand for Azure services is "significantly ahead of the capacity we have available." Given that outlook, taking advantage of the stock's small sell-off this week makes sense for investors. Microsoft not only has the fastest-growing cloud computing business of the big three, but it's the most diversified business of any "Magnificent Seven" company. OpenAI's recent restructuring also solidifies its partnership and recognizes that Microsoft's stake in it is worth $135 billion. With all that in its favor, Microsoft has earned the credibility to ramp up its spending on AI.

[12]

Microsoft's AI Bet Keeps Paying Off Across Cloud, Copilot and Code | PYMNTS.com

For proof, look no further than the tech giant's successfully restructured relationship with OpenAI, one that on Tuesday (Oct. 28) gave Microsoft a 27% stake and pushed its valuation north of $4 trillion. On Wednesday (Oct. 29), Microsoft reported for its first quarter 2026 earnings nearly $78 billion in quarterly revenue, fueled by 40% cloud growth and an expanding AI moat built atop a foundation of trust and technical scale. The company also took a $3.1 billion hit from its investment in OpenAI. "Our planet-scale cloud and AI factory, together with Copilots across high value domains, is driving broad diffusion and real-world impact," said Satya Nadella, chairman and chief executive officer of Microsoft. "It's why we continue to increase our investments in AI across both capital and talent to meet the massive opportunity ahead." Of course, even that "planet-scale" cloud can still wobble and impact its denizens. Also on Wednesday, before Microsoft reported its earnings, an Azure outage struck, leaving cloud customers unable to access Microsoft services, including airlines like Alaska and Hawaiian. But aside from that blip, which as of reporting was still ongoing, across every financial metric Microsoft outperformed analyst expectations and even its own guidance for the quarter. "We delivered a strong start to the fiscal year, exceeding expectations across revenue, operating income, and earnings per share," said Amy Hood, Microsoft EVP and CFO. "Continued strength in the Microsoft Cloud reflects the growing customer demand for our differentiated platform." The company's stock was trading down around 4% after hours. Read more: Microsoft CEO Hands Off Some Duties to Be 'Laser Focused' on AI The Microsoft Cloud segment, encompassing Azure, Microsoft 365, Dynamics and other enterprise services, generated $49.1 billion in revenue, a 26% increase from the prior year. This figure represents nearly two-thirds of Microsoft's total business. More striking is the 51% growth in commercial remaining performance obligations (future contracted revenue), which now totals $392 billion. That backlog is likely to point to durable demand from corporate clients eager to embed AI into their daily workflows. In Azure, growth continues to accelerate despite macroeconomic headwinds that have slowed IT spending elsewhere. Revenue from "Azure and other cloud services" rose 40%, underscoring the platform's dominance in enterprise AI adoption. Azure's rapid scaling has been fueled by partnerships with OpenAI, Nvidia and Fortune 500 firms building custom generative AI models. Microsoft's ability to turn foundational AI models into recurring enterprise revenue through its Copilot suite -- spanning Office, Dynamics, GitHub and Windows -- is potentially setting the pace for an industrywide transformation. Microsoft's dominance in cloud and AI comes amid intensifying competition from Amazon, Google, and a fast-emerging ecosystem of open-source AI players. But by embedding Copilot features into virtually every product category, Microsoft is effectively monetizing AI at scale. Each new feature, whether it's Copilot in Excel, Windows or GitHub, feeds demand for Azure compute and reinforces the platform's network effects. The result is a virtuous cycle where usage drives infrastructure revenue, which in turn funds further AI innovation. Unlike the cloud adoption curve of the 2010s, which required convincing enterprises to move workloads, AI adoption is being pulled by demand. Businesses are now asking how fast they can deploy these tools, not whether they should. Read more: Microsoft Rides 'AI Infrastructure Wave' as Cloud Services Demand Jumps If there was one division where Microsoft's growth narrative was more tempered, it was the More Personal Computing segment: Windows, Surface devices and gaming. The segment posted $13.8 billion in revenue, a modest 4% increase. The highlights were incremental: Windows OEM and Devices revenue rose 6%, suggesting that PC demand is stabilizing after two years of contraction, whereas gaming -- Xbox Content & Services -- was essentially flat, rising just 1% (or unchanged in constant currency). With the Activision Blizzard acquisition now fully integrated, Wall Street observers had potentially expected stronger synergies between Microsoft's Game Pass ecosystem and new releases. That payoff has yet to materialize, though Microsoft's broader entertainment strategy remains tethered to long-term ambitions: converging gaming and AI through personalized experiences and generative world-building tools. Overall, Microsoft reported that it expects total spending to increase sequentially, and that the growth rate of spend in fiscal 2026 will outpace fiscal 2025. Specifically, management noted that higher capital expenditures will focus on GPUs, CPUs and data centers, an indication that the company is doubling down on infrastructure now that enterprise customers are demanding ever-larger AI compute contracts.

[13]

Microsoft's Surging AI Spending Raises Investor Concerns Despite Strong Azure Cloud Growth

Azure Cloud Revenue Soars 40% in Microsoft Q1 2025 Results Amid Rising AI Investment and $35B Capex Microsoft has increased capital expenditures to approximately $34.9 billion to $35 billion in fiscal Q1 (July-September), a staggering 74% increase. Management said spending will rise further this year to expand AI infrastructure. The company pointed to ongoing capacity constraints that it expects to persist through June 2026. Azure revenue grew 40% in the quarter, topping Visible Alpha's 38.4% consensus. guided Azure growth of nearly 37% for the current quarter, a touch above expectations. The company forecast total revenue of $79.5 billion - $80.6 billion for the December quarter. Total revenue rose 18% year over year to $77.7 billion. Earnings came in at $3.72 per share, beating estimates. about 3% - 4% in after-hours trading as investors weighed the higher capital expenditures.

[14]

Microsoft's high capital spending overshadows cloud business surge

(Reuters) -Microsoft said on Wednesday it spent nearly $35 billion on artificial intelligence in its fiscal first quarter, surpassing market expectations and overshadowing blockbuster growth in its cloud-computing business. Shares of the company dipped 3% in extended trading, as the higher-than-expected capital expenditure number spooked investors who are growing increasingly concerned about an AI bubble. Microsoft's capital expenditures in the quarter stood at $34.9 billion, compared with Visible Alpha estimates of $30.34 billion. CLOUD BUSINESS GROWS 40% Microsoft said the Azure cloud business, its key AI unit, grew 40% in the July-September period, outpacing Visible Alpha estimates of about 38.4%. Total revenue rose 18% to $77.7 billion, beating expectations of $75.33 billion, according to data compiled by LSEG. The results still highlight the growing returns from Microsoft's massive AI investments. They come as a web of circular deals, soaring valuations and limited evidence of AI productivity gains have raised doubts about how long the boom will last. The results follow Microsoft's revised deal with OpenAI this week that gave it a 27% stake worth about $135 billion, as well as a cut of sales and access to intellectual property, clearing up uncertainty about the collaboration with the company synonymous with the AI boom. The partnership, which gives Microsoft exclusive access to the models behind ChatGPT, has been key to Azure's rapid growth in recent quarters and strengthened its challenge to top cloud provider Amazon.com. It is also crucial to Microsoft's other AI services, such as 365 Copilot for businesses. That AI push has turned Microsoft into the world's second-most valuable firm with a $4 trillion market value, trailing only the $5 trillion chip company Nvidia. The stock, up nearly 30% this year, is among the best performers in the "Magnificent 7." Some analysts have praised Microsoft's decision in recent months to let some OpenAI contracts go to Oracle, saying it shows discipline in steering limited AI capacity toward more profitable enterprise customers. The move is part of a broader strategy to lessen its dependence on OpenAI by building its own models and partnering with other AI firms, including Anthropic. Still, capacity limits have hampered Microsoft's ability to fully cash in on AI. The company and other major cloud providers are expected to spend about $400 billion on data centers and AI chips this year, with executives and analysts saying such spending is necessary to harness the technology's potential. (Reporting by Aditya Soni and Deborah Sophia in Bengaluru; Editing by Maju Samuel and Rod Nickel)

Share

Share

Copy Link

Microsoft reported strong quarterly results with $77.7 billion in revenue and 40% Azure growth, but shares fell 3% as the company revealed record $35 billion AI infrastructure spending and plans to double data center capacity within two years.

Record Infrastructure Investment Drives Growth

Microsoft reported exceptional quarterly results for the three months ending September 30, with revenue climbing 18% to $77.7 billion and operating income surging 24% to $38 billion

1

. The standout performance was driven primarily by the company's Azure cloud computing platform, which saw revenue growth of approximately 40% year-over-year3

.

Source: PYMNTS

However, what truly defined this quarter was Microsoft's unprecedented capital expenditure of $34.9 billion, representing a staggering 74% increase from the same period last year

1

. This record spending was primarily allocated to AI and cloud infrastructure, with nearly half dedicated to computer chips and much of the remainder focused on data center real estate4

.Ambitious Expansion Plans Despite Market Concerns

During Wednesday's earnings call, CEO Satya Nadella announced Microsoft's ambitious plan to double its data center footprint over the next two years

2

. The company also committed to boosting its AI capacity by more than 80% this year, underscoring the massive scale of investment required to maintain competitiveness in the AI race.

Source: CRN

Despite these impressive financial results and growth projections, Microsoft's stock fell more than 3% in after-hours trading

1

. Investors expressed concerns about the sustainability of such massive spending levels and the physical constraints now limiting the company's growth. Chief Financial Officer Amy Hood confirmed that capital expenditure growth would continue throughout fiscal 2026 at an even higher rate than the previous year5

.OpenAI Partnership Evolution and Financial Impact

The earnings report coincided with significant developments in Microsoft's relationship with OpenAI. The companies announced a restructured partnership that gives Microsoft approximately a 27% stake in OpenAI's new for-profit entity, valued at roughly $135 billion

1

. Under the new agreement, Microsoft retains commercial rights to OpenAI products through 2032, while OpenAI committed to purchasing $250 billion in computing power from Microsoft over the coming years.This partnership restructuring had immediate financial implications, with Microsoft reporting a $3.1 billion drop in net income due to what it termed an "equity method investment" in OpenAI, resulting in a 41-cents-per-share hit to earnings

5

. Despite this impact, the company's bottom line remained robust at $27.7 billion.Related Stories

Infrastructure Constraints Challenge Growth

Analysts noted a fundamental shift in Microsoft's business model, from a software company that scaled through code to one constrained by physical infrastructure. The company warned investors that it would remain "capacity-constrained through the end of the fiscal year"

3

, highlighting how power grids, cooling systems, and land permits have become the new bottlenecks for growth in the AI era.

Source: Quartz

This transformation was symbolically reinforced by an Azure outage that occurred hours before the earnings announcement, triggered by an "inadvertent configuration change"

3

. The incident served as a reminder of the infrastructure challenges facing even the most well-resourced technology companies as they scale AI operations.Microsoft's commercial productivity segment, including Office applications and the AI assistant Copilot, generated $33 billion in revenue, up 17% from the previous year

1

. The company's personal computing division saw more modest growth of 4%, reaching $13.8 billion in sales, partly driven by increased PC laptop demand ahead of anticipated tariff implementations.References

Summarized by

Navi

Related Stories

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research