Navitas Semiconductor Pivots to AI Data Centers Amid Revenue Challenges

4 Sources

4 Sources

[1]

Navitas Semiconductor Shares Drop Nearly 16% After Weak Q3 Guidance Despite AI Push - Navitas Semiconductor (NASDAQ:NVTS)

Navitas Semiconductor Corp. NVTS shares are trading sharply lower on Tuesday after the company issued third-quarter revenue guidance below Wall Street expectations. What To Know: While Navitas highlighted progress in AI data center initiatives and partnerships with key players like Nvidia, the immediate financial outlook weighed heavily on investor sentiment. For the second quarter of 2025, Navitas reported $14.5 million in revenue, slightly up from the prior quarter but down significantly from $20.5 million a year earlier. The company posted a GAAP operating loss of $21.7 million and a non-GAAP operating loss of $10.6 million. Despite narrowing losses and improved cash reserves, now totaling $161.2 million, the company's forecast disappointed the market. Navitas expects third-quarter revenue of just $10 million, plus or minus $0.5 million, well below investor expectations. The weak forecast was attributed to China tariff risks and a shift toward a more selective mobile strategy. The company is making a strategic pivot toward AI data centers and energy infrastructure, aiming to reduce dependence on consumer and mobile sectors. It raised $100 million in fresh capital and formed a new manufacturing partnership with Powerchip to lower costs and increase capacity. Trending Investment OpportunitiesAdvertisementArrivedBuy shares of homes and vacation rentals for as little as $100. Get StartedWiserAdvisorGet matched with a trusted, local financial advisor for free.Get StartedPoint.comTap into your home's equity to consolidate debt or fund a renovation.Get StartedRobinhoodMove your 401k to Robinhood and get a 3% match on deposits.Get Started Navitas said it is working with Nvidia on power solutions for next-generation 800V AI data centers using its GaN and SiC technologies, targeting a $2.6 billion market opportunity by 2030. However, the benefits of these initiatives are expected to materialize later, with volume production not projected until 2027. While long-term prospects may be promising, the immediate revenue drop and cautious third-quarter outlook triggered a selloff. Investors appear concerned that near-term financials remain weak despite strategic announcements and partnerships. NVTS Price Action: Navitas shares were down 15.90% at $6.77 at market close on Tuesday, according to Benzinga Pro. Read Next: Stocks Drop As Trump Tariffs Fuel Inflation, Palantir Hits $400 Billion Value: What's Moving Market Tuesday? Image Via Shutterstock. NVTSNavitas Semiconductor Corp$6.73-16.4%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum97.81GrowthN/AQualityN/AValue14.90Price TrendShortMediumLongOverview This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Market News and Data brought to you by Benzinga APIs

[2]

Here's Why Navitas Semiconductor Shares Slumped This Week | The Motley Fool

Shares in Navitas Semiconductor (NVTS 6.69%) fell by 14.7% in the week to Friday morning. The move comes in a week when the company released its second-quarter results. The earnings were in line with analyst expectations, but the magnitude of the losses may have reminded investors that it will be a while before Navitas turns profitable. In addition, the need to raise capital to support investment resulted in the sale of 20 million shares. As such, investors need to get used to the idea that the company will make losses over the next few years, and raising capital via equity sales can dilute existing shareholders' claim on future profits and cash flows. The points above help remind investors that Navitas is a growth stock in its early stages. Still, that's no bad thing. The case for buying the stock is based on its partnership with Nvidia to support the next generation of 800V data centers. The new data centers have a fundamentally different architecture, notably in terms of how power is converted from the grid to the IT rack, and Navitas' silicon carbide (SiC) and gallium nitride (GaN) solutions can play a key role in the power train architecture. CEO Gene Sheridan believes Navitas' technologies "can support a 100x increase in server rack power capacity for AI data centers" -- a significant enhancement and one that will help address the question of power demand to fuel AI data centers. According to the earnings release, "initial customer evaluations are complete with final engineering samples expected in Q4," and management anticipates "final supplier selections and system designs completed in 2026 in advance of volume production in 2027." That's when investors can start to think about profitability for Navitas.

[3]

Navitas (NVTS) Q2 Revenue Drops 29%

Navitas Semiconductor (NVTS 0.69%), a developer of gallium nitride (GaN) and silicon carbide (SiC) power semiconductors, reported results for the quarter ended June 30, 2025, on August 4, 2025. Navitas posted GAAP revenue of $14.5 million, precisely matching analyst expectations, but saw a 29.3% year-over-year decline in GAAP revenue from the same period last year. Non-GAAP loss from operations improved to $10.6 million from $13.3 million in Q2 2024, showing progress on cost control. However, GAAP net loss per share was a steeper $(0.25), EPS (GAAP) of $(0.25) was worse than the analysts' estimate of $(0.05). Cash and cash equivalents were $161.2 million, bolstered by a successful $100 million capital raise. The period reflected meaningful steps toward strategic repositioning, but near-term profitability remained elusive as the company deepened its focus on growing AI data center and energy infrastructure markets. Source: Analyst estimates provided by FactSet. Management expectations based on management's guidance, as provided in Q1 2025 earnings report. Business Overview and Strategic Priorities Navitas Semiconductor designs power semiconductors using advanced materials like GaN and SiC. These chips enable faster, more energy-efficient conversion and control of electrical power across a wide range of applications. The company started by targeting mobile fast-charging, but its technology is now moving into data centers, electric vehicles (EVs), solar power systems, and energy storage. Navitas' expertise is in creating integrated circuits that combine functions like drive, control, and protection, all on a single chip. This approach reduces size and complexity, allowing device makers to develop smaller, more efficient products. The company operates a fabless model, meaning it designs chips but uses third-party manufacturers for fabrication. Continued innovation in GaN and SiC, expanding strategic partnerships, and securing intellectual property through patents are seen as keys to the company's long-term competitive position. Quarter Review: Key Drivers and Developments GAAP revenue matched analyst expectations but Revenue declined 29.3% year over year, with continued weakness in end markets such as EVs and solar power. Non-GAAP gross margin slipped to 38.5%, down from 40.3% in Q2 2024, as pricing and one-off inventory reserves for China-related SiC products weighed on results. The GAAP loss from operations remained sizable, largely due to a $3.2 million write-down on China SiC inventory and $4.7 million in amortization expense for intangible assets (GAAP). The bottom-line GAAP net loss of $49.1 million was notably affected by a $28.0 million accounting loss related to earnout liabilities, distorting traditional year-over-year comparability. Management highlighted that, absent these items, the non-GAAP operational loss trajectory was less severe. Navitas completed a $100 million capital raise by selling approximately 20 million new shares, nearly doubling its cash position to $161.2 million (GAAP) versus $86.7 million (GAAP) as of December 31, 2024. The extra capital is targeted to support expansion into AI data centers and energy infrastructure. A manufacturing partnership was secured with Powerchip to obtain more foundry capacity for 200mm GaN chip production, which the company expects will lead to lower costs and increased scalability. On the technology and product front, Navitas reported ongoing traction for its GaN bidirectional switches, a new product type that controls power flow in both directions. In automotive, the company's GaNSafe chips were adopted in a leading Chinese electric vehicle maker's onboard charger, with production anticipated to start in 2026. The mobile and consumer segment also saw new launches, especially in partnership with Xiaomi, touting a compact and high-speed charger powered by Navitas chips. Looking Ahead: Guidance and Focus Areas For the next quarter, management guided to revenue near $10.0 million, plus or minus $0.5 million, reflecting a further sequential decline in revenue. The company expects non-GAAP gross margin to hold steady near 38.5%. Management cited continued China tariff risks and a shift to a more selective strategy in its mobile business as reasons for the weaker short-term outlook. Longer term, Navitas plans to resume growth as new design wins in AI data centers and energy infrastructure transition to production in late 2025 and 2026. Revenue and net income presented using U.S. generally accepted accounting principles (GAAP) unless otherwise noted.

[4]

Navitas outlines $2.6B AI data center opportunity as it sharpens strategic focus and anticipates near-term revenue softness (NASDAQ:NVTS)

Create a free Seeking Alpha account to access breaking news and valuable research tools " Earnings Call Insights: Navitas Semiconductor Corporation (NVTS) Q2 2025 Management View * Eugene A. Sheridan, CEO, reported Q2 revenues of $14.5 million, in line with guidance, while highlighting "a number of headwinds that continue to challenge near-term results," including a semiconductor industry downturn, a slowdown in solar, industrial, and EV sectors, ongoing tariff conflicts, and the removal of tax credits for solar and EV. Sheridan emphasized a strategic shift: "We have decided to more aggressively transition and invest in a leadership position for AI data centers." * Sheridan announced, "NVIDIA has selected Navitas to support their vision for next-generation 800-volt data centers," and the company raised nearly $100 million in new capital during the quarter. Sheridan also detailed the new partnership with Powerchip as a GaN foundry partner, enabling an 8-inch, low-cost manufacturing platform: "Over the next 2 plus years, we expect our high-voltage customers to transition to Powerchip's 8-inch factory, which can produce nearly 80% more chips per wafer compared to 6-inch for little incremental cost." * The company will "sharpen our focus on the high-end performance applications of the mobile, consumer and appliance sectors" and "reduce our focus, investment and revenue expectations around the more mainstream, price-sensitive applications." * CFO Todd H. Glickman stated, "Revenue in the second quarter of 2025 was at the midpoint of guidance at $14.5 million. As expected, revenue and the industry environment remained relatively static compared to the first quarter of 2025." * Glickman added, "Gross margin in the second quarter was 38.5%, which was up sequentially compared to 38.1% in the first quarter, primarily due to a slight favorable change in product mix," and highlighted operating expenses reduction to $16.1 million in Q2 from $17.2 million in Q1 "as we reduced operating expenses sequentially." Outlook * Glickman provided Q3 2025 guidance: "We currently expect revenue of $10 million plus or minus $500,000." He explained this reduction reflects "adverse impacts from China tariff risks for our silicon carbide business and our strategic decision to de-prioritize lower margin China mobile business while we accelerate our investment and leadership in AI data centers and associated new energy infrastructure." * Gross margin for Q3 is expected to be "flat compared to the second quarter, with our guidance at 38.5% plus or minus 50 basis points." Operating expenses are anticipated at $15.5 million for Q3. * Management indicated, "this transition toward AI data center and energy infrastructure markets will take multiple quarters," and emphasized the company is "well-positioned with the resources and runway to execute on opportunities for our next wave of growth." Financial Results * Q2 2025 revenue was $14.5 million, gross margin was 38.5%, and operating expenses declined to $16.1 million. The operating loss from operations improved to $10.6 million from $11.8 million in Q1. * Accounts receivable was $12.5 million and inventory declined to $15.1 million, including a $3 million China SiC inventory reserve. Cash and cash equivalents at quarter end were $161 million with no debt. * The company raised approximately $97 million from at-the-market offerings during Q2. Q&A * Ross Clark Seymore, Deutsche Bank: Asked about revenue trajectory until the expected ramp in late '26. Sheridan responded, "some softer quarters over the next 1 or 2 quarters, but sets us up well as we shift all of our investment... into the AI data center." * Seymore followed up on the margin structure of AI data center business. Sheridan replied, "the AI data center and the energy infrastructure markets should be very high-value markets...our same long-term margin model north of 50 points." * Blayne Peter Curtis, Jefferies: Inquired about the mobile business reduction and transition to Powerchip. Sheridan specified focus on "ultrafast chargers, 100-watt and plus," and confirmed, "No supply at all. In fact, by bringing up 8-inch, that gets you 80% more die per wafer...No shortages or supply chain issues on our mobile decisions in the short term." * Kevin Edward Cassidy, Rosenblatt Securities: Asked if NVIDIA's announcement is influencing 48-volt data center adoption. Sheridan said, "it's a little too early to call it fully...we're hopeful that as we prove it out with an eye towards 800-volt, we could get some upside next year." * Jack Egan, Charter Equity: Questioned the drivers of Q3 revenue decline. Sheridan explained, "they're almost equal weight," citing China tariffs, mobile business selectivity, and slow new design win ramp-ups. * Joseph Lawrence Moore, Morgan Stanley: Asked about competition for NVIDIA products. Sheridan said, "we have the best performance, the best reliability, in our opinion...we're investing aggressively to expand that lead." * Jonathan E. Tanwanteng, CJS Securities: Asked about design and engineering revenue during transition. Sheridan emphasized 2026 ramps in 48-volt data centers and referenced "great announcements, great design wins" ahead. Glickman stated operating cash flow usage was "around $11 million" and expects this level to continue. Sentiment Analysis * Analysts pressed management on revenue declines, exposure to tariffs, and the timeline for AI data center ramp, reflecting a slightly negative to neutral tone focused on near-term challenges and clarification of strategic shifts. * Management maintained a confident tone regarding long-term growth, repeatedly emphasizing strategic positioning and cost discipline. Sheridan stated, "We believe we are at the right time, in the right place, with the right leading-edge technology." * Compared to the previous quarter, analyst tone shifted from cautious optimism about design wins to increased concern about immediate revenue softness and execution risk. Management's tone moved from highlighting broad-based design win momentum to focusing on strategic repositioning and managing through transitionary headwinds. Quarter-over-Quarter Comparison * Guidance for Q3 2025 now projects a significant revenue decline from Q2, reflecting both adverse China tariff impacts and a deliberate reduction in lower-margin mobile revenues. Previous quarter guidance anticipated more stability with revenue in the $14 million to $15 million range. * The strategic focus has shifted further toward AI data center and energy infrastructure markets, with explicit plans to "reduce our focus, investment and revenue expectations" in price-sensitive consumer sectors, accelerating the transition from earlier, more balanced market diversification. * Analysts in the current quarter focused more on the timing and magnitude of revenue softness, supply chain resilience, and execution risk, compared to broader questions about design wins and market diversity in the previous quarter. * Management's confidence in long-term market leadership and gross margin expansion has remained consistent, but there is a more pronounced acknowledgment of near-term financial softness and transition challenges. Risks and Concerns * Management identified industry-wide semiconductor downturn, continued tariff conflicts, the removal of solar and EV tax credits, and exposure to China as ongoing challenges. * The company took a $3 million inventory reserve on China SiC products due to tariff instability. * Analysts raised concerns about the impact of these risks on near-term revenues and the execution of the transition toward higher-margin markets. * Management's mitigation strategies include focusing investments in AI data centers, transitioning manufacturing partnerships to Powerchip for improved cost and capacity, and maintaining strong liquidity with $161 million in cash and no debt. Final Takeaway Navitas Semiconductor Corporation is executing a major strategic shift, prioritizing leadership in the fast-growing AI data center and energy infrastructure sectors while reducing exposure to lower-margin consumer markets. Despite near-term revenue softness driven by industry headwinds, China tariffs, and selective mobile business reduction, the company is leveraging partnerships, new capital, and manufacturing efficiencies to position itself for substantial growth as AI data center opportunities ramp in late 2026 and beyond. Management maintains confidence that these actions will yield higher margins and set the stage for the next wave of company expansion. Read the full Earnings Call Transcript More on Navitas Semiconductor Today's chaos. Tomorrow's opportunity Seeking Alpha helps you make sense of the headlines. New! Get unlimited breaking stock news for free -- so you can stay on track for a stronger financial future.

Share

Share

Copy Link

Navitas Semiconductor faces short-term revenue decline but strategically shifts focus to AI data centers, partnering with Nvidia and raising capital for future growth.

Navitas Semiconductor's Strategic Pivot

Navitas Semiconductor Corp. (NASDAQ: NVTS) is undergoing a significant strategic shift, focusing on AI data centers and energy infrastructure amid challenging market conditions. The company, known for its gallium nitride (GaN) and silicon carbide (SiC) power semiconductors, reported a 29.3% year-over-year decline in Q2 2025 revenue to $14.5 million

1

3

. Despite this setback, Navitas is positioning itself for future growth in the burgeoning AI sector.Source: Benzinga

Financial Performance and Market Reaction

The company's Q2 results met analyst expectations, but its Q3 guidance disappointed investors, leading to a nearly 16% drop in share price

1

. Navitas expects Q3 revenue of just $10 million, citing China tariff risks and a shift towards a more selective mobile strategy1

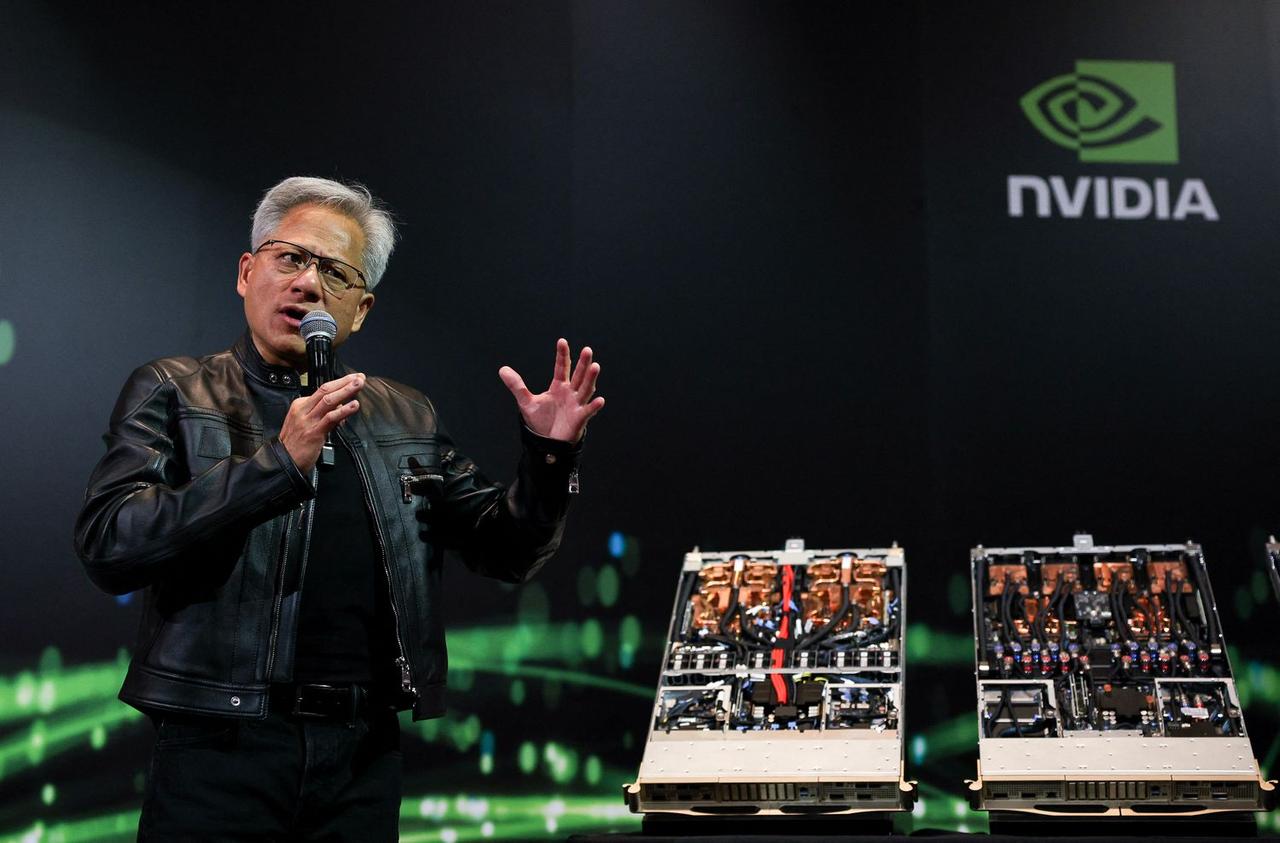

. The weak near-term outlook overshadowed the company's long-term potential, resulting in a significant market selloff.Strategic Partnership with Nvidia

In a major development, Navitas announced its collaboration with Nvidia to support next-generation 800V AI data centers

2

4

. This partnership aims to leverage Navitas' GaN and SiC technologies to address the growing power demands of AI infrastructure. CEO Gene Sheridan believes their solutions "can support a 100x increase in server rack power capacity for AI data centers"2

.

Source: Motley Fool

Capital Raise and Manufacturing Partnership

To fuel its strategic pivot, Navitas successfully raised $100 million by selling approximately 20 million new shares

2

3

. This capital injection nearly doubled the company's cash position to $161.2 million3

. Additionally, Navitas formed a manufacturing partnership with Powerchip to increase foundry capacity for 200mm GaN chip production, which is expected to lower costs and improve scalability1

4

.Market Opportunity and Future Outlook

Navitas is targeting a $2.6 billion market opportunity in AI data centers by 2030

1

. However, the benefits of these initiatives are not expected to materialize immediately, with volume production projected to begin in 20271

2

. The company anticipates final supplier selections and system designs to be completed in 20262

.Related Stories

Challenges and Transition Period

While Navitas' long-term prospects appear promising, the company faces near-term challenges. The semiconductor industry downturn, slowdowns in solar, industrial, and EV sectors, and ongoing tariff conflicts are impacting current performance

4

. Management acknowledges that the transition toward AI data center and energy infrastructure markets will take multiple quarters4

.Investor Considerations

Source: Motley Fool

Investors should be prepared for continued losses and potential dilution as Navitas invests in its future. The company's non-GAAP loss from operations improved to $10.6 million in Q2 2025, down from $13.3 million in Q2 2024

3

. However, profitability remains a distant goal, with the focus now on securing a leadership position in the AI data center market.As Navitas navigates this transition, its success will largely depend on the execution of its AI-focused strategy and the broader adoption of its GaN and SiC technologies in next-generation data centers. The partnership with Nvidia and the substantial capital raise provide a solid foundation, but investors will need to exercise patience as the company works towards realizing its ambitious goals in the AI infrastructure space.

References

Summarized by

Navi

[3]

Related Stories

Recent Highlights

1

Samsung unveils Galaxy S26 lineup with Privacy Display tech and expanded AI capabilities

Technology

2

Anthropic refuses Pentagon's ultimatum over AI use in mass surveillance and autonomous weapons

Policy and Regulation

3

AI models deploy nuclear weapons in 95% of war games, raising alarm over military use

Science and Research