Nvidia Reaches Historic $5 Trillion Valuation Amid Growing AI Investment Concerns

46 Sources

46 Sources

[1]

Nvidia hits record $5 trillion mark as CEO dismisses AI bubble concerns

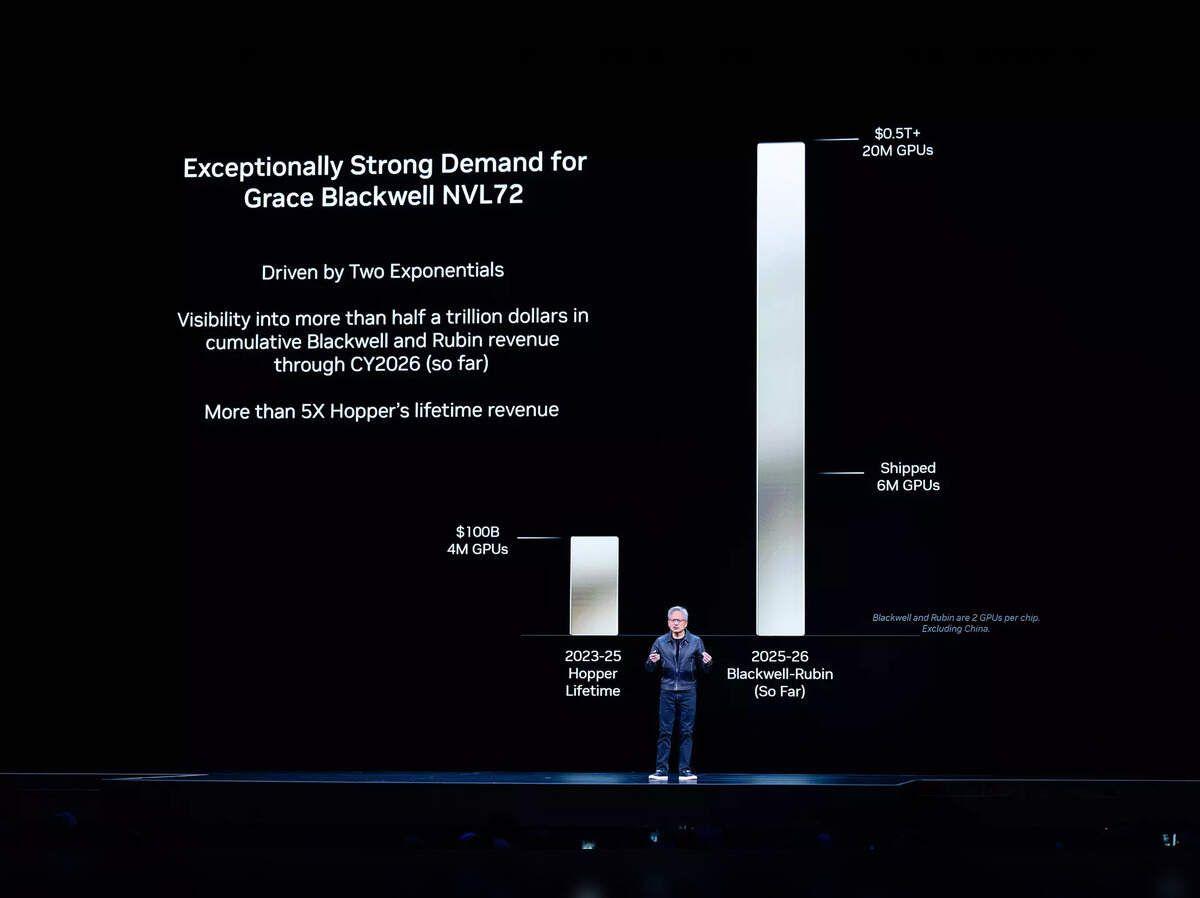

On Wednesday, Nvidia became the first company in history to reach a $5 trillion market capitalization, fresh on the heels of a GTC conference keynote in Washington, DC, where CEO Jensen Huang announced $500 billion in AI chip orders and plans to build seven supercomputers for the US government. The milestone comes a mere three months after Nvidia crossed the $4 trillion mark in July, vaulting the company past tech giants like Apple and Microsoft in market valuation but also driving continued fears of an AI investment bubble. Nvidia's shares have climbed nearly 12-fold since the launch of ChatGPT in late 2022, as the AI boom propelled the S&P 500 to record highs. Shares of Nvidia stock rose 4.6 percent on Wednesday following the Tuesday announcement at the company's GTC conference. During a Bloomberg Television interview at the event, Huang dismissed concerns about overheated valuations, saying, "I don't believe we're in an AI bubble. All of these different AI models we're using -- we're using plenty of services and paying happily to do it." Nvidia expects to ship 20 million units of its latest chips, compared to just 4 million units of the previous Hopper generation over its entire lifetime, Huang said at the conference. The $500 billion figure represents cumulative orders for the company's Blackwell and Rubin processors through the end of 2026, though Huang noted that his projections did not include potential sales to China. While it probably feels like glory days for Nvidia at the moment, the success comes with a large dose of caution. Even prior to the latest valuation boom of the past 24 hours, the rapid rise in AI-related investments has fueled persistent concerns that market enthusiasm has outstripped the technology's ability to deliver immediate economic value. Some analysts warn that valuations may be overheated. Matthew Tuttle, CEO of Tuttle Capital Management, told Reuters that "AI's current expansion relies on a few dominant players financing each other's capacity. The moment investors start demanding cash flow returns instead of capacity announcements, some of these flywheels could seize."

[2]

The AI industry is running on FOMO

For Big Tech, a penny invested in AI is a penny earned... Maybe. After an indeterminate amount of time. Investors hope. On earnings calls last week, Amazon, Google, Microsoft, and Meta reported more than $350 billion this year on capital expenditures, or longer-tail investments in a company's future. All four told investors to expect the number to skyrocket even further next year: Microsoft said "higher," Amazon an "increase," Google a "significant increase," and Meta "notably larger." That probably translates to more than $400 billion total for the four companies next year, according to Joe Fath, partner and head of growth at Eclipse VC. The return on investments for these companies so far is opaque. Dedicated AI companies are burning through cash in the meantime: OpenAI reportedly hit $12 billion in annualized revenue this summer -- while reportedly being on track to burn through $115 billion through 2029. Tension over this mismatch, Fath said, is ratcheting up. There's a "push and pull between those companies and investors," he added. "Investors are saying, 'Am I going to get a return on this spend?'" It's one of the increasingly clear indicators that some parts of the AI industry are a bubble -- but it doesn't yet tell us what happens after it pops. AI hype has remained extremely high for several years, and startup valuations have hit eye-popping numbers. OpenAI, for instance, is reportedly hoping for a $1 trillion IPO in 2026 or 2027 and planning to raise $60 billion or more. But AI companies insist there's still not enough money for chips, data centers, and other resources. In a Q&A with reporters at OpenAI's annual DevDay event last month, executives repeatedly emphasized their concern over lack of compute to expand services like Sora's video-generation AI and ChatGPT's daily Pulse feature, and discussed the need to eventually turn a profit from such services. Amazon, Google, and Microsoft -- which provide cloud services on a quickly growing scale -- have "all called out being pretty capacity-constrained," Molly Alter, a partner at Northzone VC, told The Verge. If these claims are accurate, they indicate that simply coming up with good products won't be enough to make AI companies profitable -- because they can't afford to scale those products to support a huge user base. Even if they're exaggerated, the systems are incredibly costly to operate. OpenAI is still thought to be losing money on even the $200 monthly subscription tier of its ChatGPT service, thanks to the cost of running queries. OpenAI's rumored IPO is a perfect example of the conundrum, Alter added. The company wants to secure about 26 gigawatts of computing capacity for data centers (which translates to about $1.5 trillion at current costs, per Alter) -- meaning that even with the company's current revenue, an up to $100 billion investment from Nvidia, and other "circular deals," Alter says she still hasn't been able to understand how the company's clear funding gap gets solved. Some investors in the company are asking the same questions. Brad Gerstner, an OpenAI investor and CEO of Altimeter Capital, asked OpenAI CEO Sam Altman on his podcast Friday about how a company with $13 billion in revenue can make $1.4 trillion in spending commitments. "First of all, we're doing well more revenue than that; second of all, Brad, if you want to sell your shares, I'll find you a buyer," Altman replied. "I just... Enough." In past quarters, Big Tech executives have presented customizable models and AI agents as a saving grace that will surely, eventually, turn a profit -- reiterating that they need to spend money to make money, including by cutting costs elsewhere and diverting the resources to AI. Now, though, agents from OpenAI, Google, and others are in users' hands. And though companies promise they'll steadily improve at automating "tedious tasks," in their current state, they're not taking the world by storm. Investors seemed concerned with the details of Meta's projected expansion, and their demands for specifics weren't always met with clear answers. "There are lots of moving pieces in the budget. It's not baked yet. It's still sort of in the process of coming together," responded CFO Susan Li to one question. "We don't have, you know, specific targets to share." Some investors seemed wary about whether there's a coherent plan at all. Meta made headlines in 2025 for spending billions to lure AI engineers and researchers away from competitors for its brand-new Superintelligence team, then announced internal restructuring and layoffs soon after. Meta's AI initiative comes on the heels of a quixotic quest for the virtual reality "metaverse," in which it's so far spent and lost tens of billions through its Reality Labs division. "I don't think they're getting any results there that would lead you to believe that that's good spend," Fath told The Verge, speaking about Reality Labs. Some of the same concerns were present on other company earnings calls, with investors asking about the AI industry's hype levels, capacity constraints, and feature adoption. On Microsoft's earnings call, one investor asked, "Frankly, are we in a bubble?" Even tech executives have admitted some aspects of the industry may be overblown. OpenAI's Altman told reporters last month that there are "many parts of AI that I think are kind of bubble-y right now." And on Microsoft's latest earnings call, CEO Satya Nadella told investors, "I don't think AGI as defined, at least by us in our contract, is ever going to be achieved anytime soon." But bubbles are largely driven by sentiment and behavior, as well as fear of missing out and expertly marketed corporate narratives. If it is a bubble, the consensus seems to be that it's one that won't explode the industry; rather, it'll just lead to fewer players and more consolidation. Alter said the funding gaps within the industry keep her up at night, especially since a company's investment in its future growth has to ideally lead to, well, real growth and profit in the end. The companies that succeed may not be the most glamorous or consumer-facing -- think coding agents, customer service AI, and potentially creative content generation, rather than solely AI social networks and all-purpose chatbots. But there's no fighting AI FOMO, and so any bubble-y parts of the industry have no sign of slowing down just yet -- but Fath said he's watching for if or when OpenAI slows down for any reason, and the same goes for Nvidia's data center business. "My sense is, when a board is sitting there, they're asking the CEO, 'What are you doing about AI?'" Fath said. "That's the question they're getting. And they need to come in with an answer prepared to say how they're going to spend on that. And if the business starts to deteriorate, and they're not spending in AI, there's going to be a lot of criticism of those executives... even if we really don't know what the returns will look like right now." "This gets into that whole 'FOMO' that's building across industries and across companies to make sure that you're not on the wrong side of change." And if over-investing in AI becomes the wrong side of change? Well, at least everyone was doing it.

[3]

Nvidia's market capitalization hits $5.12 trillion -- AI powerhouse is the first company in history to hit seismic milestone

The market capitalization of Nvidia passed the $5 trillion mark on Wednesday, following a host of potentially lucrative deals and projects the company announced at its GPU Technology Conference event on Tuesday. The company's stock price continues to be driven by the broad interest towards artificial intelligence and Nvidia's unique position in the AI supply chain that now spans from humble chips for inference to gigawatt-scale data centers for massive AI training. At its GTC 2025 conference in Washington, D.C., Nvidia made a number of announcements that could potentially bring tens, if not hundreds, of billions of dollars in revenue to the company in the coming years. Among the highlights announced by Nvidia are reference designs for gargantuan gigawatt-scale AI data centers that will let newcomers to build new AI factories using Nvidia blueprints and hardware; partnership with Palantir to build an integrated stack for operational AI; the deal with Uber to use Nvidia's Level 4 AGX Drive Hyperion platform for its fleet of autonomous robotaxis as well as adoption of the same platform by Mercedes, Stellantis, Volvo, Lucid, and Foxconn; NVQLink technology to attach Nvidia GPUs to quantum computers; partnership to build AI-RAN products with Nokia; contracts to build seven AI supercomputers for the U.S. government; and plans to build AI-native 6G networks in the U.S. together with partners. The new announcements place Nvidia at the center of the large-scale AI supply chain, which will drive demand for the company's hardware and software solutions. Nvidia's AI platform comprises numerous products, including GPUs, CPUs, DPUs, NVLink switches, and Ethernet and Infiniband solutions. If one wants to build an Nvidia-based cluster or data center for AI, they will inevitably procure plenty of Nvidia-designed hardware and software to build it and operate it. While for now Nvidia supplies AI hardware to companies like AWS, Alphabet, Google, Microsoft, OpenAI, and xAI, in the coming years, it is going to expand its total addressable market to both established players across industries (e.g., Lilly is already building its own AI data center) and new players that have yet to become significant in their realms. Even established companies are increasing their demands for AI GPUs. For example, Nvidia supplied about four million Hopper-based AI GPUs throughout the architecture's active lifetime, and shipments of Blackwell stand at six million units now and yet have to peak. With new participants entering the AI field, sales of Nvidia's hardware are poised to skyrocket. Nvidia's unique position in the growing AI supply chain places it well above other semiconductor and high-tech companies as far as market capitalization is concerned. The company at press time cost over a trillion dollars more than Apple ($4.011 trillion) and Microsoft ($3.995 trillion), nearly two trillion dollars more than Alphabet ($3.257 trillion), and two times more than Amazon ($2.444 billion). Interestingly, TSMC -- the key supplier to Nvidia that produces all of its silicon -- now has a market capitalization of $1.582 trillion, whereas ASML -- the key supplier to TSMC -- now costs $416.5 billion. Market capitalization of Nvidia's traditional rivals -- AMD and Intel -- stands at $429 billion and $197 billion, respectively.

[4]

Nvidia, OpenAI, and the trillion-dollar loop

How to build a trillion-dollar industry: Step 1, invest in your customers. Step 2, sell them stuff Feature In late 2025, a series of multi-billion-dollar deals in the artificial intelligence sector is causing déjà vu among industry veterans. Money, computer chips, and cloud credits are rotating in a closed loop among a handful of companies: Nvidia, OpenAI, Microsoft, Oracle, AMD, CoreWeave, xAI, and a few others. This has fueled a trillion-dollar AI boom or bubble built on intertwined investments and contracts. The arrangement of these deals is so circular that dollars spent by one player often return as revenue for another. This gives the impression of breakneck growth. Critics are increasingly comparing this AI money-go-round to the late 1990s dot-com bubble. They question whether today's AI valuations are inflated by self-reinforcing deals rather than organic user demand. At the heart of this circular economy is Nvidia, the world's most valuable semiconductor company, which recently reached a $5 trillion market capitalization. Nvidia's GPUs, moreso than any other company's, have become the critical hardware that powers advanced AI models like ChatGPT. Surrounding Nvidia is an expanding constellation of partners and customers, many of which have also become its investors and investees. No deal epitomizes the circular AI economy better than the agreement between Nvidia and OpenAI announced in fall 2025. In September, Nvidia agreed to invest up to $100 billion in OpenAI to finance a massive buildout of AI data centers. The plan is for OpenAI to construct at least 10 gigawatts of new data center capacity (enough electricity to power a major city). In return for Nvidia's funding, OpenAI committed to purchasing and deploying millions of Nvidia GPUs at those facilities. This investment-for-hardware swap means Nvidia is bankrolling its own future sales. The startup gets the cash to expand, and Nvidia is guaranteed to be the supplier for that expansion. Critics immediately flagged the arrangement as circular, essentially moving money in circles to pad revenues. It is different from the dot-com era, where companies bought each other's ads with no real product. Here, physical assets (AI chips and data centers) are being built. Both companies are doing what they are set up to do: OpenAI needs chips, Nvidia sells chips, just with intertwined balance sheets. Still, the sheer scale of the deal has raised eyebrows. $100 billion is an unprecedented sum for one tech company to invest in a startup. For context, OpenAI was valued at around $30 billion in early 2023. This latest deal implied a far higher valuation and a massive bet on future AI demand. It also cemented Nvidia's role not just as a supplier but as one of OpenAI's most prominent backers. Nvidia boss Jensen Huang, in a recent podcast with Bill Gurley and Brad Gerstner on Bg2, said, "I think that OpenAI is likely going to be the next multi-trillion-dollar hyperscale company. If that's the case, the opportunity to invest before they get there, this is one of the smartest investments we can possibly imagine. And you've got to invest in things you know. The return on that money is going to be fantastic." Just weeks after the Nvidia pact, OpenAI struck another massive agreement, this time on the cloud service side. OpenAI confirmed a $300 billion deal (dubbed as Project Stargate) with Oracle Corporation to purchase cloud computing capacity over the next five years. The deal would see OpenAI use Oracle's cloud infrastructure to run and train AI models at scale, with Oracle adding 4.5 GW of new data center capacity by 2027. The circular twist? To fulfill OpenAI's compute demand, Oracle must spend heavily on hardware, primarily buying Nvidia's chips. According to the Financial Times, Oracle plans to spend around $40 billion to acquire roughly 400,000 of Nvidia's top-tier GB200 chips to power Stargate's flagship data center in Abilene, Texas. This Stargate triangle created instantaneous value on paper. When news of the OpenAI-Oracle deal broke, Oracle stock spiked 36 percent in a day, its most significant jump in decades. Even Oracle co-founder Larry Ellison's net worth swelled by $88 billion virtually overnight, briefly making him the world's richest person. Nvidia's stock also popped 4 percent on the Oracle news to add another $170 billion to its market cap. These deals provide planning security for all parties involved and help dominate AI infrastructure. Still, they also raise important questions about self-dealing and systemic risk if one link in the chain falters. Nvidia isn't the only chipmaker in OpenAI's orbit. In October 2025, OpenAI announced an alliance with Nvidia's main rival, AMD. This announcement signifies the considerable demand for compute chips and the need to diversify its hardware suppliers. The terms of the deal were for OpenAI to deploy 6 gigawatts of AMD's Instinct GPUs in its future infrastructure. This commitment could translate to tens of billions of dollars in chip purchases. In return, AMD granted OpenAI a warrant to purchase up to 160 million AMD shares, roughly a 10 percent equity stake, vesting in tranches aligned with the GPU deployment rollout. If OpenAI follows through on using all 6 GW of AMD hardware, it gets to become one of AMD's largest shareholders at a steep discount. Strategically, this deal secures a marquee customer for AMD and validates its AI chip as an alternative to Nvidia's dominant GPUs. "This partnership brings the best of AMD and OpenAI together to create a true win-win, enabling the world's most ambitious AI buildout and advancing the entire AI ecosystem," said Dr. Lisa Su, chair and CEO of AMD. "Our partnership with OpenAI is expected to deliver tens of billions of dollars in revenue for AMD while accelerating OpenAI's AI infrastructure buildout. This agreement creates significant strategic alignment and shareholder value for both AMD and OpenAI and is expected to be highly accretive to AMD's non-GAAP earnings-per-share," said Jean Hu, EVP, CFO, and treasurer of AMD. The agreement highlights the frenzy in AI chip demand. OpenAI is so hungry for capacity that it's willing to tie itself financially to its suppliers to secure supply. No discussion of the AI circular economy is complete without CoreWeave, a once-small cloud startup that has become a major infrastructure partner for both OpenAI and Nvidia. Starting in early 2025, OpenAI began shifting some of its AI training workloads to CoreWave and signed an initial contract worth up to $11.9 billion for GPU cloud services, followed by a $4 billion expansion in May. By September 2025, a third expansion of $6.5 billion brought OpenAI's total CoreWeave commitments to $22.4 billion. CoreWeave's rapid scaling was enabled by Nvidia's backing. Nvidia took an equity stake of more than 5 percent in the company during its funding rounds. In September 2025, Nvidia agreed to purchase $6.3 billion in cloud services from CoreWeave. This unusual agreement by Nvidia to pre-purchase capacity on CoreWeave served as a guarantee. Nvidia would pay for any of CoreWeave's GPU time that wasn't sold to other customers. With Nvidia's safety net, CoreWeave would confidently buy even more Nvidia chips to build data centers. In simple terms, Nvidia was funding a customer and propping up the supplier that served that customer, thereby increasing its chip supply. The initial partnership of Microsoft and OpenAI in 2019-23 helped set the stage for today's loop. Microsoft invested $1 billion in 2019, then reportedly $10 billion in early 2023, in OpenAI, eventually obtaining a roughly 49 percent stake (with profit-sharing terms). In exchange, OpenAI agreed to use Microsoft Azure as its computing platform for several years. Fast forward to 2025, and the landscape has shifted. OpenAI's new mega deals with Oracle, CoreWeave, and others signaled that Microsoft's once exclusive hold on OpenAI's compute needs has loosened. Microsoft quietly allowed OpenAI out of certain exclusivity to pursue its own cloud buildout. Microsoft itself has diversified, integrating AI models from other startups like Anthropic and even open-source models like Meta's Llama. The circular deal dynamic here is subtler but present. Microsoft gave OpenAI funding and cloud credits. OpenAI returns value by driving Azure usage and requires more infrastructure, which means Microsoft buys more Nvidia GPUs for its data centers. It's not just corporations that are intertwined in the AI economy. The United States government itself has become both an enabler and a gatekeeper in these dealings. As part of the federal CHIPS Act initiative, the US government took an equity stake of roughly 9.9 percent in Intel, valued at $8.9 billion, and funded an additional $2.2 billion in grants to build domestic semiconductor manufacturing capacity. In exchange, the Commerce Department received 274.6 million Intel shares, with an option to acquire an additional 240 million shares under certain conditions. Traditionally, government incentives are not taken in the stock market, yet this shows how strategically important chip production is to national security. In the context of the AI circular economy, the government stake is a reminder that not all money in the loop is private. Public funds are being poured into shoring up the supply side rather than directly into AI companies, but it still feeds the broader ecosystem. If Intel succeeds in making advanced AI chips domestically, it could become a counterweight buyer/seller in the loop. Washington regulates market access (like restricting China) in ways to constrain where the loop's money can flow. This forces Nvidia, OpenAI, and others to focus inward and on allies. This may intensify the circular deal pattern, but it could also mitigate some bubble risk by preventing over-exuberant expansion into geopolitically risky matters. It's a thin balance between enabling innovation and preventing policy-driven artificial inflation of demand. All these arrangements, with OpenAI at the center, might not please accountants, who tend to view trade of this nature as deeply flawed. This is an industry sector getting fatter by eating itself. The levels of funding are unprecedented. The web OpenAI is spinning means its own success is inextricably linked to its suppliers. It's a clever move by CEO Sam Altman. However, if it backfires, he will set the industry back decades in terms of trust. It took years for tech to recover from the dotcom bust, and with the level of investment in AI infrastructure currently propping up the US economy, keeping it is out of recession, there's a lot more at stake. ®

[5]

Nvidia poised to become world's first $5tn company

Nvidia is set to become the world's first $5tn company after the US chip giant's stock was propelled by strong sales of its artificial intelligence systems and the prospect of expanded access to the Chinese market. The Silicon Valley-based company, which has been the biggest beneficiary of booming AI investment, was more than 3 per cent higher in pre-market trading on Wednesday, enough to push it over a $5tn market capitalisation when the market opens in New York. US President Donald Trump said on Wednesday that he planned to discuss Nvidia's Blackwell chip with China's President Xi Jinping when the two leaders meet later this week, raising the prospect that Nvidia could regain access to a lucrative market for its semiconductors. Nvidia's current generation of graphics processing units is not currently available in China because of US export controls. The chipmaker's shares had closed up 5 per cent on Tuesday, adding more than $200bn to its market capitalisation, after chief executive Jensen Huang said Nvidia had already secured half a trillion dollars in orders of its AI chips "so far" for the next five quarters. The stock milestone comes just three months after Nvidia became the first public company to hit a $4tn market capitalisation, and as shares in other US tech groups have also rocketed to record highs in recent months. Apple hit a $4tn valuation for the first time on Tuesday, while Microsoft hit the benchmark again after previously reaching it in July, propelled by the restructuring of OpenAI, in which it has a 27 per cent stake. Three years ago, before the debut of OpenAI's ChatGPT, Nvidia was valued at about $400bn. Its stock has grown explosively since then, fuelled by demand for its AI chip technology, which dominates the market for training and running large language models such as OpenAI's. The AI chipmaker surpassed $1tn in market value within months of ChatGPT's launch, hitting $2tn in February 2024 and $3tn in June last year. Nvidia's shares have risen more than 85 per cent in the past six months alone. Confidence in Nvidia's ability to sustain its growth has been boosted by a barrage of long-term, multibillion-dollar deals around the world this year to build the vast data centre infrastructure to train and run artificial intelligence models. "I think we are probably the first technology company in history to have visibility into half a trillion dollars of cumulative Blackwell and early ramps of Rubin through 2026," Huang said on Tuesday, referring to its current generation of chips and new chips it is set to launch next year. Bernstein analysts said Huang's projection meant Nvidia was on course for well over $300bn in chip sales in the 2026 calendar year, compared with Wall Street expectations of $258bn. The chipmaker's growth has been driven by huge spending by a small group of large tech companies seeking to build the infrastructure to power AI models. But Nvidia's competitors, including its own customers, are looking to seize a larger share of that hardware market. Nvidia has also moved to pump billions of dollars into its own customers, including a planned $100bn investment in OpenAI announced in September, raising questions about the circular financing arrangements used by the companies driving the AI boom. Capital spending by the top six cloud computing companies alone -- Amazon, Meta, Google, Microsoft, Oracle and CoreWeave -- would rise to $632bn by 2027, Huang said. Nvidia's growth has come despite tensions between Washington and Beijing this year that have choked off its access to China, costing the chipmaker billions of dollars in revenue from China-specific AI chips that were designed to comply with US export controls. Beijing in turn has mounted a backlash against Nvidia's chips as it seeks to decouple itself from American chip technology. On Tuesday, Huang conceded that Nvidia was locked out of the China AI chip market for now and would need to "wait until [China] wants us to be there". "Do they want to be open market or selectively open market?" asked Huang. "That's a question that they have to answer." Nvidia is also waiting for a 15 per cent revenue-sharing deal with the US government, struck earlier this year to allow it to continue exporting its chips to China, to be codified into a law. Huang has forged a close relationship with Trump, confirming this week that he had contributed to the US president's roughly $300mn White House ballroom project.

[6]

Nvidia nearly went under 3 years into its existence -- now it's the world's first-ever $5 trillion company

Nvidia CEO Jensen Huang gestures as U.S. President Donald Trump (not pictured) delivers remarks during the "Winning the AI Race" Summit in Washington D.C., U.S., July 23, 2025. Nvidia CEO Jensen Huang has said he "had no idea how" to start a business when he co-founded the computer chip company from a Denny's booth in 1993. His lack of experience didn't stop him from making history by building Nvidia into the world's first $5 trillion company, a benchmark it achieved on Wednesday. The tech giant's stock rose by 3% on Wednesday, closing with a record market value of $5.03 trillion, following Huang's Tuesday announcement of plans to build a series of supercomputers for the U.S. government. In the announcement, Huang forecasted an additional $500 billion in orders for Nvidia's AI chips. Nvidia's stock is up nearly 50% since the start of 2025, reflecting investors' enthusiasm for an artificial intelligence boom that's seen Huang's Santa Clara, California-based company explode into an industry behemoth, from a relatively small video game processor manufacturer. It's been a dizzying ascent for a company that only first reached a $100 billion valuation in July 2017, and overcame significant early struggles that nearly put it out of business in the mid-1990s. Huang was a 30-year-old engineer at Sun Microsystems in 1993 when he gathered with friends and future co-founders Chris Malachowsky and Curtis Priem in a booth at a Denny's diner to plot what would become Nvidia. "Frankly, I had no idea how to do it, nor did they. None of us knew how to do anything," Huang told CBS' "60 Minutes" about the company's origins in an April 2024 interview. DON'T MISS: The ultimate guide to using AI to communicate better At the time, Huang believed the co-founders could develop a graphics processing unit (GPU) that would revolutionize computer graphics for video games. The company got off to a rough start when, in 1996, Nvidia's experimental chips turned out to be "technically poor" -- jeopardizing an essential contract with gaming company Sega, Huang said in a May 2023 commencement speech at National Taiwan University. The failure forced Huang to lay off nearly half of his staff. He prevented the company from going under by convincing Sega to buy out their contract, and he used that money to fund the development of a completely new series of chips from scratch. Those new chips became the company's first hit product in 1997, selling 1 million units in just four months. Huang has discussed how the difficult experience helped him, and the company, develop enough resilience to become successful. "Greatness is not intelligence. Greatness comes from character. And character isn't formed out of smart people, it's formed out of people who suffered," Huang told students at his alma mater, Stanford University, at a March 2024 event. Today, Nvidia is a major player in the AI boom after diversifying beyond serving only the gaming industry in the 2010s. Companies including Google, Microsoft and OpenAI use Nvidia's computer chips to power complex AI models, and the AI investment boom has seen Nvidia's stock skyrocket in recent years. The company's market capitalization topping $1 trillion for the first time just two years ago, in May 2023. For his part, Huang never imagined when he launched Nvidia that his company's chips could one day help usher in a potential AI revolution. "That was luck founded by vision," he said in the "60 Minutes" interview. "We invented this capability and then one day, the researchers that were creating deep learning discovered this architecture. Because this architecture turned out to be perfect for them ... Perfect for AI." While AI excitement has spurred U.S. stocks to record levels, some analysts have warned of a potential bubble caused by ever-climbing valuations and an increasingly complex web of companies investing in each other, with Nvidia near the center of it. But unsurprisingly, Huang is bullish on AI's potential and eager for U.S. developers to be at the forefront of the industry's ascent. "We are at the dawn of the AI industrial revolution that will define the future of every industry and nation," Huang said in Nvidia's press release on Tuesday. "It is imperative that America lead the race to the future -- this is our generation's Apollo moment." Want to level up your AI skills? Sign up for Smarter by CNBC Make It's new online course, How To Use AI To Communicate Better At Work. Get specific prompts to optimize emails, memos and presentations for tone, context and audience.

[7]

Chipmaker Nvidia on track to become first $5 trillion company

Nvidia is on track to become the first $5 trillion company, just three months after the Silicon Valley chipmaker was first to break through the $4 trillion barrier. Hitting the new benchmark puts more emphasis on the upheaval being unleashed by an artificial intelligence craze that's widely viewed as the biggest tectonic shift in technology since Apple co -- founder Steve Jobs unveiled the first iPhone 18 years ago. Apple rode the iPhone's success to become the first publicly traded company to be valued at $1 trillion, $2 trillion and eventually, $3 trillion. But there are concerns of a possible AI bubble, with officials at the Bank of England earlier this month flagging the growing risk that tech stock prices pumped up by the AI boom could burst. The head of the International Monetary Fund has raised a similar alarm. The ravenous appetite for Nvidia's chips is the main reason that the company's stock price has increased so rapidly since early 2023. On Wednesday the shares touched $207.80 in premarket trading with 24.3 billion shares outstanding, putting its market cap at $5.05 trillion. On Tuesday Nvidia CEO Jensen Huang disclosed $500 billion in chip orders. The company is also teaming with the Department of Energy to build seven new AI supercomputers. Last month Nvidia announced that it will invest $100 billion in OpenAI as part of a partnership that will add at least 10 gigawatts of Nvidia AI data centers to ramp up the computing power for the owner of the artificial intelligence chatbot ChatGPT. In August Huang said that Nvidia was discussing a potential new computer chip designed for China with the Trump administration. Multiple media reports state that President Donald Trump is likely to speak with Chinese President Xi Jinping about Nvidia's chips on Thursday.

[8]

The Building at the Center of the Economy

The AI boom is visible from orbit. Satellite photos of New Carlisle, Indiana, show greenish splotches of farmland transformed into unmistakable industrial parks in less than a year's time. There are seven rectangular data centers there, with 23 more on the way. Inside each of these buildings, endless rows of fridge-size containers of computer chips wheeze and grunt as they perform mathematical operations at an unfathomable scale. The buildings belong to Amazon and are being used by Anthropic, a leading AI firm, to train and run its models. According to one estimate, this data-center campus, far from complete, already demands more than 500 megawatts of electricity to power these calculations -- as much as hundreds of thousands of American homes. When all the data centers in New Carlisle are built, they will demand more power than two Atlantas. The amount of energy and money being poured into AI is breathtaking. Global spending on the technology is projected to hit $375 billion by the end of the year and half a trillion dollars in 2026. Three-quarters of gains in the S&P 500 since the launch of ChatGPT came from AI-related stocks; the value of every publicly traded company has, in a sense, been buoyed by an AI-driven bull market. To cement the point, Nvidia, a maker of the advanced computer chips underlying the AI boom, yesterday became the first company in history to be worth $5 trillion. Here's another way of thinking about the transformation under way: Multiplying Ford's current market cap 94 times over wouldn't quite get you to Nvidia's. Yet 20 years ago, Ford was worth nearly triple what Nvidia was. Much like how Saudi Arabia is a petrostate, the U.S. is a burgeoning AI state -- and, in particular, an Nvidia-state. The number keeps going up, which has a buoying effect on markets that is, in the short term, good. But every good earnings report further entrenches Nvidia as a precariously placed, load-bearing piece of the global economy. America appears to be, at the moment, in a sort of benevolent hostage situation. AI-related spending now contributes more to the nation's GDP growth than all consumer spending combined, and by another calculation, those AI expenditures accounted for 92 percent of GDP growth during the first half of 2025. Since the launch of ChatGPT, in late 2022, the tech industry has gone from making up 22 percent of the value in the S&P 500 to roughly one-third. Just yesterday, Meta, Microsoft, and Alphabet all reported substantial quarterly-revenue growth, and Reuters reported that OpenAI is planning to go public perhaps as soon as next year at a value of up to $1 trillion -- which would be one of the largest IPOs in history. (An OpenAI spokesperson told Reuters, "An IPO is not our focus, so we could not possibly have set a date"; OpenAI and The Atlantic have a corporate partnership.) Many people believe that growth will only continue. "We're gonna need stadiums full of electricians, heavy equipment operators, ironworkers, HVAC technicians," Dwarkesh Patel and Romeo Dean, AI-industry analysts, wrote recently. Large-scale data-center build-outs may already be reshaping America's energy systems. OpenAI has announced that it intends to build at least 30 gigawatts' worth of data centers -- more power than all of New England requires on even the hottest day -- and CEO Sam Altman has said he'd eventually like to build a gigawatt of AI infrastructure every week. Other major tech firms have similar ambitions. Listen to the AI crowd talk enough, and you'll get a sense that we may be on the cusp of an infrastructure boom. And yet, something strange is happening to the economy. Even as tech stocks have skyrocketed since 2022, the companies' share of net profits from S&P 500 companies has hardly budged. Job openings have fallen despite a roaring stock market, 22 states are in or near a recession, and despite data centers propping up the construction industry, U.S. manufacturing is in decline. It's clear that AI is both drowning out and obscuring other stories about the wobbling American economy. That's a concern. But even worse: What if AI's promise for American business proves to be a mirage? What happens then? The yawning gap between data-center expenditures and the rest of the economy has caused whispers of bubble to rise to a chorus. A growing number of financial and industry analysts have pointed out the enormous divergence between the historic investments in AI and the tech's relatively modest revenues. For instance, according to The Information, OpenAI likely made $4 billion last year but lost $5 billion (making the idea of a $1 trillion IPO valuation that much more staggering). From July through September, Microsoft's investments in OpenAI resulted in losses totaling more than $3 billion. For that same time period, Meta reported rapidly growing costs due to its AI investments, spooking investors and sending its stock down 9 percent. Much is in flux. Chatbots and AI chips are getting more efficient almost by the day, while the business case for deploying generative-AI tools remains shaky. A recent report from McKinsey found that nearly 80 percent of companies using AI discovered that the technology had no significant impact on their bottom line. Meanwhile, nobody can say, beyond a few years, just how many more data centers Silicon Valley will need. There are researchers who believe there may already be enough electricity and computing power to meet generative AI's requirements for years to come. The economic nightmare scenario is that the unprecedented spending on AI doesn't yield a profit anytime soon, if ever, and data centers sit at the center of those fears. Such a collapse has come for infrastructure booms past: Rapid construction of canals, railroads, and the fiber-optic cables laid during the dot-com bubble all created frenzies of hype, investment, and financial speculation that crashed markets. Of course, all of these build-outs did transform the world; generative AI, bubble or not, may do the same. This is why OpenAI, Google, Microsoft, Amazon, and Meta are willing to spend as much as possible, as rapidly as possible, to eke out the tiniest advantage. Even if a bubble pops, there will be winners -- each company would like to be the first to build a superintelligent machine. For now, many of these tech companies have cash to burn from their other ventures: Alphabet and Microsoft both made more than $100 billion in profit over the previous fiscal year, while Meta and Amazon both made more than $50 billion. But at some point in the near future, data-center spending will likely outpace even these enormous cash flows, reducing Big Tech's liquidity and worrying investors. And so, as the AI arms race continues to escalate, the companies are beginning to raise outside money -- in other words, take on debt. Here is where the bubble dynamics get complicated. Tech firms don't want to formally take on debt -- that is, directly ask investors for loans -- because debt looks bad on their balance sheets and could reduce shareholder returns. To get around this, some are partnering with private-equity titans to do some sophisticated financial engineering, Paul Kedrosky, an investor and a financial consultant, told us. These private-equity firms put up or raise the money to build a data center, which a tech company will repay through rent. Data-center leases from, say, Meta can then be repackaged into a financial instrument that people can buy and sell -- a bond, in essence. Meta recently did just this: Blue Owl Capital raised money for a massive Meta data center in Louisiana by, in essence, issuing bonds backed by Meta's rent. And multiple data-center leases can be combined into a security and sorted into what are called "tranches" based on their risk of default. Data centers represent an $800 billion market for private-equity firms through 2028 alone. (Meta has said of its arrangement with Blue Owl that the "innovative partnership was designed to support the speed and flexibility required for Meta's data center projects.") In this way, the data-center financing ends up being a real-estate deal as much as an AI deal. If this sounds complicated, it's supposed to: The complexity, investment structure, and repackaging make exactly what is going on hard to parse. And if the dynamics also sound familiar, it's because not two decades ago, the Great Recession was precipitated by banks packaging risky mortgages into tranches of securities that were falsely marketed as high-quality. By 2008, the house of cards had collapsed. Data-center build-outs aren't the same as subprime mortgages. Still, there is plenty of precarity baked into these investments. Data centers deteriorate rapidly, unlike the more durable infrastructure of canals, railroads, or even fiber-optic cables. Many of the chips inside these buildings become obsolete within a few years, when Nvidia and its competitors release the next wave of bleeding-edge AI hardware. Meanwhile, the returns on scaling up chatbots are, at present, diminishing. The improvements made by each new AI model are becoming smaller and smaller, making the idea that Silicon Valley can spend its way to superintelligence more tenuous by the day. The people who are paying attention to this cycle are getting anxious. On a scale from one to 10, the AI-bubble concern is: people posting memes of Christian Bale's character from The Big Short, squinting in disbelief at his computer monitor. If tech stocks fall because of AI companies failing to deliver on their promises, the highly leveraged hedge funds that are invested in these companies could be forced into fire sales. This could create a vicious cycle, causing the financial damage to spread to pension funds, mutual funds, insurance companies, and everyday investors. As capital flees the market, non-tech stocks will also plummet: bad news for anyone who thought to play it safe and invest in, for instance, real estate. If the damage were to knock down private-equity firms (which are invested in these data centers) themselves -- which manage trillions and trillions of dollars in assets and constitute what is basically a global shadow-banking system -- that could produce another major crash. For now, money is still pouring into the AI industry. But there's also something circular about these investments. To wit: OpenAI has agreed to pay $300 billion to Oracle for new computing capacity, Oracle is paying Nvidia tens of billions of dollars for chips to install in one of OpenAI's data centers, and Nvidia has agreed to invest up to $100 billion in OpenAI as it deploys Nvidia chips. Attempts to illustrate these circular investments have produced a series of byzantine charts that one software engineer referred to on X as "the technocapital hyperobject at the end of time." The consensus seems to be that although this is legal, it likely cannot go on forever. Maybe it will all work out. Three years ago, the generative-AI industry made functionally no revenue; today, it produces tens of billions of dollars annually, a rate of growth that, eventually, could catch up with all of this spending. Generative-AI tools are currently used by hundreds of millions of people, and it's hard to imagine that simply ceasing overnight. Perhaps OpenAI or Anthropic will pull off superintelligence, allowing them to, in the words of the Bloomberg columnist Matt Levine, "create God and then ask it for money." Data centers take time to approve and build; power plants and transmission lines take perhaps even more. Labor is limited, supply chains hit snags, investment waxes and wanes -- meaning that even if these data centers are built at the tremendous scale desired by Altman and his competitors, construction and energy constraints may keep the boom from growing too irresponsibly. In any case, as we approach the end of 2025, data centers have become a peculiar cultural object. Their immense scale is a physical reminder of the economic dominance of Silicon Valley companies and their seemingly unchecked ambition. The uneasiness they inspire economically is rooted in memories of 2008 but also of the tech industry's own financial chicanery, specifically the 2022 crypto crash, which was facilitated by a circular-payment scheme of its own. (FTX, a crypto exchange, and Alameda Research, a hedge fund, both co-founded by Sam Bankman-Fried, were found to be propping each other up: Alameda bought FTX's bespoke cryptocurrency, and FTX lent Alameda money from its customers' accounts.) And so, in some way, the externalities of the data-center boom, be they environmental or economic, are tied up in fears of what happens not when these tech companies fail, but when they succeed. Boom and bust can feel like two sides of the same coin: Consider also that if AI companies deliver on their massive investments, it would likely mean producing a technology so capable and revolutionary that it wipes out countless jobs and sends an unprecedented shock wave through the global economy before humans have time to adapt. (Perhaps we will be unable to adapt at all.) If they fail, there will likely be unprecedented financial turmoil as well. The biggest lesson of the past two decades of Silicon Valley is that Meta, Amazon, and Google -- and even the newer AI labs such as OpenAI -- have remade our world and have become unfathomably rich for it, all while being mostly oblivious or uninterested in the fallout. They have chased growth and scale at all costs, and largely, they've won. The data-center build-out is the ultimate culmination of that chase: the pursuit of scale for scale itself. In all scenarios, the outcome seems only to be real, painful disruption for the rest of us.

[9]

Nvidia Is Now Worth $5 Trillion as It Consolidates Power in A.I. Boom

As Jensen Huang, the chief executive of the chip making giant Nvidia, traveled to Asia to meet with President Trump on Wednesday, his company's value topped $5 trillion. It was a show of wealth that would have been unthinkable a few years ago. But that was before the ChatGPT chatbot ignited an artificial intelligence boom that is remaking the global economy. It was before other tech titans began spending hundreds of billions of dollars on construction projects on almost every continent. And it was before Nvidia's computer chips, the most essential and expensive component in almost every A.I. scheme, became a linchpin of the Trump administration's foreign policy. Nvidia's milestone, the first publicly traded company to top $5 trillion in market value, is indicative not only of the astonishing levels of wealth consolidating among a handful of Silicon Valley companies but also the strategic importance of this company, which added $1 trillion in market value in just the past four months. Nvidia has become a driving force behind the U.S. economy. Spending on data centers, which are filled with the company's chips, accounted for 92 percent of the country's gross domestic product growth in the first half of the year, according to Jason Furman, a professor of economic policy at Harvard. Without it, the economy would have grown 0.1 percent. But Nvidia's stunning growth also comes with a warning to investors, from the biggest banks on Wall Street to small-time traders on Main Street, that the stock market is becoming more and more dependent on a group of technology companies that are churning out billions in profits and splurging to develop an unproven technology that needs to deliver enormous returns. "There's unbridled optimism about where this technology is going to go," said Gene Munster, a managing partner at Deepwater Asset Management, which invests in emerging technology companies. "But the question is: Will it deliver? The usefulness of A.I. is still limited today." There have been periods of market concentration before but none as stark as the one created by A.I. Nvidia alone makes up more than 8 percent of the S&P 500, according to Howard Silverblatt, a senior index analyst for S&P Dow Jones Indices. Apple and Microsoft now top $4 trillion. Those companies combined with Meta, Amazon, Alphabet and Tesla make up more than a third of the entire index. Nvidia's A.I. chips, which account for more than 90 percent of the market, are highly coveted by businesses and governments around the world. Mr. Trump has put them at the forefront of America's trade strategy, striking deals to sell A.I. chips to the United Arab Emirates, Saudi Arabia, South Korea and Japan. As the president traveled across Asia this week, he signaled that Nvidia would be a factor in U.S.-China trade talks. Sales of its chips to China were suspended over the summer as tensions flared between those countries. The nations have been wrestling with how to deal with a powerful technology that can be used to develop advanced weaponry and drive economic opportunity. Mr. Huang, 62, has spent much of the year bouncing between Washington and Beijing trying to find a solution. In the process, he has become a valuable conduit between China's top leader, Xi Jinping, and Mr. Trump, who is eager to strike a trade deal between the countries, said two people familiar with the confidential trade talks who spoke on the condition of anonymity. "Nvidia works with governments across the world," said John Rizzo, a company spokesman. "We do not engage in geopolitical or diplomatic discussions between governments." The White House didn't immediately provide comment. Nvidia has further endeared itself to Mr. Trump by shifting some of its manufacturing to the United States. This month, the company started making its latest A.I. chip, known as Blackwell, at Taiwan Semiconductor Manufacturing Company's plant in Arizona. Last week, Mr. Huang delivered Mr. Trump a signed version of the chip in a red case during a private meeting at the Oval Office. Mr. Trump praised the product in Tokyo this week and called Mr. Huang "brilliant." Speaking at a news conference after Nvidia's first major conference in Washington on Tuesday, Mr. Huang said that the United States and China would benefit from allowing Nvidia to sell its technology in China. The United States would see its technology providers become the foundation for A.I. and American A.I. companies in the world's most populous nation. China would receive more-efficient chips that make their A.I. companies more productive. He said the question for China was: "Do they want to be open market or selectively open market? Our job is to wait until they want us to be there." During a media appearance on Wednesday ahead of the highly anticipated U.S.-China trade talks, Mr. Trump said that he and Mr. Xi would speak about Nvidia's Blackwell chip, which he called "super duper." The prospects of Nvidia's return to China pushed its market value above $5 trillion on Wednesday. The company could make more than $50 billion in sales in China over the next year, analysts estimate. Nvidia has agreed to pay the U.S. government 15 percent of the money it makes from selling A.I. chips to China, as a result of an agreement Mr. Huang and Mr. Trump reached in July. Mr. Huang said Tuesday that the Trump administration was working on a new regulation to make those payments possible. Additional sales to China would be the latest good news for Nvidia. Speaking onstage at Nvidia's event on Tuesday, Mr. Huang said that A.I. was as essential to the future as electricity and the internet. "Every company will use it," said Mr. Huang, who spoke to several thousand people in his trademark black leather jacket. "Every nation will build it." Mr. Huang highlighted how companies like Microsoft and the software company Oracle are pouring hundreds of billions of dollars into building data centers for A.I. To a room full of a thousand people, he showed a chart projecting that the companies' spending would top $549 billion this year, more than double what they spent in 2023, according to Morgan Stanley. He said that Nvidia had orders to ship 20 million of its newest chips through the end of next year, up from four million of its previous generation shipped between 2023 to 2025. The orders are worth about $500 billion in sales, far more than analysts had previously estimated. But Mr. Huang's speech also stoked skepticism about whether the A.I. spending boom was justified. Some investors have questioned whether A.I. will increase productivity and sales. Mr. Huang offered few concrete examples of that, pointing primarily to how software engineers at Nvidia use it to automate computer programming. "We're still really, really early in this process, and there have been enough little examples from early artificial intelligence businesses that have made people say, 'Wow,'" said Bob O'Donnell, president of TECHnalysis Research, a technology research firm. "But converting those examples that have shown promise into something that changes how people work is taking much longer than people have expected." Mr. Huang put Nvidia in position to lead the A.I. transformation by betting that his company's chips -- known as graphics processing units, or GPUs -- would be essential to building artificial intelligence. Before then they were popular for powering video game computers and the machines for creating cryptocurrencies. He plowed money into a custom programming language to control those chips that became critical to building A.I. systems. The combination of the chips and software have allowed Nvidia to dominate what has become the next wave in computing, much as Intel and Microsoft controlled the PC era and Apple the shift to mobile devices like the iPhone. Nvidia has seen a sevenfold increase in sales since OpenAI's ChatGPT set off an A.I. arms race in late 2023. It expects to post more than $26 billion in profit for the current quarter, which would eclipse Wall Street projections for other tech heavyweights like Apple and Meta. The speed of Nvidia's rise left longtime Wall Street watchers at a loss for words. "It's incredible," David Faber, one of the hosts of the CNBC show "Squawk on the Street," said on Wednesday morning. "Did you ever think in our lifetime we'd see a $5 trillion company?" Joe Rennison contributed reporting in New York.

[10]

Nvidia becomes the first $5 trillion public company in history

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. Update, October 29: Nvidia hits $5 trillion market cap just three months after topping $4 trillion Nvidia has become the world's first publicly traded company to surpass a $5 trillion valuation, climbing to $5.13 trillion in early morning trading, just three months after crossing the $4 trillion mark. The record-setting jump follows CEO Jensen Huang's disclosure at this week's GTC keynote that Nvidia has secured more than $500 billion in AI chip orders through 2026. While this provides an unprecedented level of revenue visibility for a technology firm, it's also called into question the dense network of deals between companies that depend on Nvidia, triggering criticism of so called circular investment, a classic warning sign of a market bubble. The company's stock has risen more than 50% in 2025 and over 85% in the past six months, fueled by global investment in AI infrastructure where Nvidia is a sole major player. Nvidia's Blackwell GPUs remain the backbone of hyperscale data center buildouts, with the company controlling an estimated 90% of the market for high-performance AI chips. Nvidia also announced expanded domestic manufacturing in Arizona and new partnerships with Nokia and Oracle to support telecommunications and federal supercomputing projects. Apple and Microsoft each rejoined the $4 trillion club this week, but Nvidia's latest surge has set a new benchmark for market leadership in the AI era. Update, July 9: Nvidia becomes the world's first $4 trillion public company, surpassing Apple's record Nvidia has become the first publicly traded company to reach a $4 trillion market valuation, underscoring its position at the center of the generative AI market. Its chips are used in the data centers that support AI models and cloud services from major firms like Microsoft, Amazon, and Google. The company's stock has risen about 20% this year, driven by sustained demand for AI infrastructure. This development also marks a shift in market leadership. Nvidia surpassed both Apple and Microsoft, which had previously alternated as the most valuable companies. Apple, which started the year near a $3.9 trillion valuation, has declined amid broader market and policy concerns. Meanwhile, Nvidia reported $44.1 billion in revenue for the quarter ending in April, a 69% increase from the prior year, reflecting continued growth in AI-related demand. The original story from July 4th follows below: Nvidia came within striking distance of setting a new record for the most valuable company in history on Thursday, as its market capitalization soared to $3.92 trillion during intraday trading, just shy of the $4 trillion mark. The chipmaker's rapid ascent, fueled by relentless demand for its advanced AI chips, briefly pushed it past Apple's previous record closing value of $3.915 trillion set in late 2024. By the end of the trading session, Nvidia's value settled at $3.89 trillion, slightly below the all-time high but still underscoring its extraordinary run. "When the first company crossed a trillion dollars, it was amazing. And now you're talking four trillion, which is just incredible. It tells you that there's this huge rush with AI spending and everybody's chasing it right now," Joe Saluzzi, co-manager of trading at Themis Trading, told Reuters. The surge in Nvidia's stock reflects a broader wave of optimism on Wall Street about the future of AI. The company's latest chips have become essential for training and running the largest and most sophisticated AI models, fueling a race among technology giants to build powerful data centers and dominate the next era of computing. Microsoft, Amazon, Meta, Alphabet, and Tesla are all competing to expand their AI infrastructure, and Nvidia's specialized hardware sits at the heart of this transformation. According to LSEG data, Nvidia's current valuation now exceeds the combined market capitalization of all publicly listed companies in Canada and Mexico, and even surpasses the total value of all publicly traded firms in the United Kingdom. Four years ago, the company was valued at $500 billion and was largely known for its graphics technology used in video games. Since then, its market capitalization has grown nearly eightfold, propelled by the explosive growth in AI applications and the company's ability to deliver the high-performance chips that power them. The company's financial performance has been equally impressive. In the most recent quarter, Nvidia reported $44.1 billion in revenue, a 69 percent increase from the previous year, with data center sales alone contributing $39.1 billion. This puts Nvidia on track to approach $170 billion in annual revenue for fiscal 2026, up from $130.5 billion in 2025. Analysts expect the company's next-gen Blackwell Ultra GPUs to further accelerate growth, with Wall Street anticipating that Nvidia could soon reach, and potentially surpass, the $4 trillion market cap milestone. Nvidia's rise has also reshaped the broader stock market. The company now represents a significant portion of the S&P 500 index, and its performance has left many investors, including those saving for retirement through index funds, increasingly exposed to the fortunes of the AI sector. Microsoft, currently valued at $3.7 trillion, and Apple, at $3.19 trillion, round out the top three most valuable companies. But Nvidia's momentum has set a new benchmark for what is possible in the technology industry. Despite its dominance, Nvidia faces challenges, including ongoing trade restrictions that limit the sale of its most advanced chips to China, as well as rising competition from rivals developing custom AI hardware. However, the company's innovation pipeline remains robust, with expansion into new markets such as autonomous vehicles and physical AI systems, signaling that its influence in the tech world is likely to persist.

[11]

Nvidia Becomes First $5 Trillion Company as AI Demand Surges

Nvidia today became the first public company to reach a $5 trillion market capitalization, hitting the milestone 3.5 months after surpassing $4 trillion. Over the past week, Nvidia's shares have climbed 14.5 percent due to demand for its GPUs and the possibility that it might be able to sell its most advanced chips in China. As of now, the U.S. prevents Nvidia from selling its Blackwell AI chips to China, and China has also restricted Chinese companies from importing some Nvidia chips because of national security concerns. Trump said that he would discuss Nvidia's "super duper chip" with Chinese president Xi Jinping on October 30, leading to hopes that the situation might change. Nvidia's AI chips are key for developing and training large language AI models, and almost every major tech company is working on some kind of AI product. Apple, for example, is building out AI infrastructure to power Apple Intelligence and other future AI capabilities. Apple is using Apple Silicon chips, but it has also reportedly invested in Nvidia server technology. Nvidia's growth has outpaced Apple, Microsoft, and other tech companies, but Apple reached a milestone of its own yesterday. Just ahead of Thursday's earnings call, Apple briefly reached a $4 trillion valuation. Apple's stock price has dropped slightly since then, but the company is close to hitting that target again. Apple is pumping out its own artificial intelligence servers, and the first units started shipping out this month. It is unlikely that Apple will compete with Nvidia in the server market because its servers are designed for internal use.

[12]

'A lot of this is speculative': faith and fear mix amid $3tn global datacentre boom

Many believe planned investment will bring prosperity, while others worry its debt-fuelled exuberance will backfire The global investment spree in artificial intelligence is producing some remarkable numbers and a projected $3tn (£2.3tn) spend on datacentres is one of them. These vast warehouses are the central nervous system of AI tools such as OpenAI's ChatGPT and Google's Veo 3, underpinning the training and operation of a technology into which investors have poured vast sums of money. Despite concerns that the AI boom could be a bubble waiting to burst, there are few signs of it at the moment. The Silicon Valley AI chipmaker Nvidia last week became the world's first $5tn company and Microsoft and Apple's valuations hit $4tn, the latter for the first time. A restructuring at OpenAI has valued the company at $500bn and a stake owned by Microsoft at more than $100bn. This could lead to a $1tn flotation as early as next year. On top of that, Google's owner Alphabet has reported revenues of $100bn in a single quarter for the first time, helped by growing demand for its AI infrastructure, while Apple and Amazon have also just reported strong results. It is not just the financial world, politicians and tech companies who have faith in AI: it is also the communities hosting the infrastructure behind it. In the 19th century, demand for coal and steel from the Industrial Revolution shaped the destiny of Newport. Now the Welsh city is hoping for a new chapter of growth from the latest transformation of the global economy. On the outskirts of Newport, on the site of a former radiator factory, Microsoft is building a datacentre that will help meet what the tech industry hopes will be exponential demand for AI. Standing on a concrete floor that will soon host thousands of humming servers, the Labour leader of Newport city council, Dimitri Batrouni, says the Imperial Park datacentre is a chance to tap into the economy of the future. "With cities like mine, what do you do? Do you worry about the past and try to bring steel back with 10,000 jobs - it's unlikely. Or do you embrace the future?" he says. But despite the market's current positivity about AI, questions remain about the sustainability of the tech industry's outlay. Four of the biggest players in AI - Amazon, Facebook parent Meta, Google and Microsoft - have increased spending on AI. Over the next two years they are expected to spend more than $750bn on AI-related capital expenditure, meaning non-staff items such as datacentres and the chips and servers inside them. It is a spending spree that Manning & Napier, a US investment company, describes as "nothing short of incredible". The Newport site alone will cost hundreds of millions of dollars. Last week, the California-based Equinix said it was planning to invest £4bn on a centre in Hertfordshire. In March, the chair of the Chinese e-commerce group Alibaba, Joe Tsai, warned he was seeing signs of excess in the datacentre market. "I start to see the beginning of some kind of bubble," he said, pointing to projects raising funds for construction without commitments from potential customers. There are 11,000 datacentres globally already, up 500% over the past 20 years. And more are coming. How this will be funded is a source of concern. Analysts at Morgan Stanley, the US investment bank, estimate that global spending on datacentres will reach nearly $3tn between now and 2028, with $1.4tn covered by the cashflow of the big US tech companies - also known as "hyperscalers". That means $1.5tn needs to be covered from other sources such as private credit - a growing part of the shadow banking sector that is raising the alarm at the Bank of England and elsewhere. Morgan Stanley believes private credit could plug more than half of the funding gap. Mark Zuckerberg's Meta has tapped the private credit market for $29bn of financing for a datacentre expansion in Louisiana. Gil Luria, the head of technology research at the US investment firm DA Davidson, says the hyperscaler investment is the "healthy" part of the boom - the other part less so, which he describes as "speculative assets without their own customers". The debt they are using, he says, could trigger ramifications beyond the tech industry if it goes sour. "The providers of this debt are so eager to deploy capital into AI, that they may not be properly assessing the risks of investing in a new unproven category supported by very quickly depreciating assets," he says. "While we are at the early stages of this influx of debt capital, if it does rise to the level of hundreds of billions of dollars it could end up representing structural risk to the overall global economy." Harris Kupperman, a hedge fund founder, said in a blogpost in August that datacentres will depreciate twice as fast as the revenue they generate. Underpinning this expenditure are some lofty revenue expectations from Morgan Stanley, with revenues from generative AI - chatbots, AI agents, image generators - expected to grow from $45bn last year to $1tn by 2028. Tech companies are relying on businesses, the public sector and individuals to produce enough demand for AI - and to pay for it - to justify those revenue expectations. OpenAI's ChatGPT, the emblematic product of the AI boom, now has 800 million active weekly users, which is a boon for the optimists. But doubts have been raised over business takeup so far. For instance, investor faith in the AI boom was rattled in August when the Massachusetts Institute of Technology published research showing that 95% of organisations are getting zero return from their investments in generative AI pilots. The Uptime Institute, which inspects and rates datacentres, says many projects will not be built - an indicator that some are part of the hype machine and won't get off the ground. "An important point to understand is that a lot of this speculative," says Andy Lawrence, the executive director of research at Uptime. "Many of the datacentres, often announced with a fanfare, either will never be built, or will be built and populated only partially, or gradually, over a decade." He adds that many of the datacentres announced in this multitrillion-dollar programme will be "either specifically intended to support AI workloads, or will mainly do so". Microsoft points out that its Newport datacentre will not be used solely for AI. As well as being the central nervous systems for AI systems such as ChatGPT and Microsoft's Copilot, datacentres do all the day-to-day IT work we take for granted - as providers of "cloud" services where companies rent out servers instead of buying their own: handling email traffic, storing company files and hosting Zoom calls. "We have a lot of ways to use this infrastructure. It becomes very much a general purpose technology," says Alistair Speirs, a general manager at Microsoft's cloud business. Elsewhere, though, are massive projects that are all-in on AI. The Stargate venture in the US is a $500bn joint venture between OpenAI, Oracle and SoftBank that aims to build a network of AI datacentres across the US. A UK version of Stargate is also coming to North Tyneside in north-east England. Microsoft is building the word's most powerful AI datacentre in Fairview, Wisconsin, and is backing an AI-dedicated site in Loughton, Essex, while Elon Musk's xAI has built the "colossus" project in Memphis, Tennessee. Work on an estimated 10GW of new datacentre capacity around the world - representing roughly a third of the UK's power demand - is expected to start this year, according to the property group JLL. However, this is the aggregate maximum capacity and datacentres typically operate at about 60%. A further 7GW will reach completion this year, according to JLL. Currently, global datacentre capacity is 59GW, so the pace of expansion is rapid and Goldman Sachs expects it to double by the end of 2030. This carries a further infrastructure cost of its own, according to Goldman, with $720bn of grid spending needed to meet that energy demand. At the Newport site, a native of the city, the construction safety specialist Mike O'Connell, has returned as a consultant. After a career that has spanned oil rigs, offshore wind and datacentres around the world, he is back at his birthplace - now a tech hub that hosts datacentres and semiconductor companies. "I am looking to stay in the local community," he says. O'Connell's teenage grandson is starting work at the Newport site under an electrical apprenticeship. There is a belief, and hope, that datacentres such as this represent a generational employment opportunity for the area. Investors and tech companies, having pledged trillions of dollars, are counting on a long-term return, too.

[13]

AI boom powers new-school Nvidia and old-school Caterpillar to new heights

The big picture: Nvidia passed $5 trillion in value Wednesday, while Caterpillar's stock soared. The burgeoning AI economy is fueling insatiable demand for the modern form of picks and shovels -- the types of AI chips that Nvidia designs -- and for the actual picks and shovels needed to build that new capacity. * Nvidia's stock rose 3% Wednesday, propelling it to become the first company ever to pass $5 trillion in market cap, as investors welcomed CEO Jensen Huang's revelation that it has booked $500 billion in sales for its two newest chips through 2026. * At the same time, Caterpillar reported surging orders for construction equipment needed to build AI data centers. Nvidia added another $1 trillion in value in just over 100 days, illustrating the feverish nature of the global frenzy for AI. * Not only do Nvidia's chips power that historical shift -- the company, as an investor, increasingly has a piece of several other major players in the space, too, Axios' Ben Berkowitz reports. Stunning stat: At $5 trillion, Nvidia is now worth about $1 trillion more than the next-closest company, Microsoft. * Or put another way: Nvidia is worth roughly double JPMorgan Chase, Walmart, Exxon Mobil, and Johnson & Johnson -- combined. * "They've just defied gravity," Melissa Otto, head of research at S&P Global Visible Alpha, tells Axios. Zoom in: The chips that Nvidia sells are powering the data centers that Caterpillar's equipment is helping to build. * Caterpillar CEO Joe Creed said on an earnings call today that sales of equipment in the company's power generation segment soared 33%, "primarily due to demand for reciprocating engines for data center applications." * The manufacturing and construction boom stemming from the AI surge amounts to a "massive reindustrialization of the U.S.," Otto says. What we're watching: Are Nvidia shares becoming overinflated? * Huang himself dismissed chatter of an AI bubble in an appearance Tuesday at the Nvidia GTC event in Washington, D.C. * S&P's Otto says the company's valuation is not out of whack when considering that demand still exceeds supply of the company's chips: "That's not a bubble. That's just a growing business," she says. Yes, but: Huang said Tuesday that the AI boom could be hampered by a "severe shortage of labor," citing the need for mechanical engineers, electrical engineers, plumbers, construction workers and other skilled laborers.

[14]

Nvidia Just Became the World's First $5 Trillion Company

Not even four months after American technology company Nvidia rode the AI surge to become the world's first $4 trillion company, it has become the first ever to cross the $5 trillion threshold. As of early this morning, Nvidia's share price reached over $212, which put its total market cap well over $5 trillion. At the time of writing, the company's stock price has decreased slightly to just under $207, keeping its market cap at $5.02 trillion. The company's 52-week high stock price is $212.19, which Bloomberg reports was achieved around 11 AM ET today. This is just the latest chapter in Nvidia's meteoric rise. While long a successful technology company and chipmaker, Nvidia has significantly benefited from the ongoing AI arms race. The company's stock price has increased from around $12 to its high watermark of $212.19 over the past five years, with the largest total value gains occurring since the start of 2024, when Nvidia's stock was around $50. Since 2022, Nvidia's stock has gone up by over 1,300 percent. Nvidia went from dramatically trailing the valuations of monolithic presences in the tech space like Alphabet, Microsoft, and Apple to beating them all across $4 trillion and now $5 trillion valuation thresholds. The landmark accomplishment this morning is hot on the heels of Nvidia's announcement that it had bought $1 billion in Nokia shares to help accelerate Nvidia's AI-RAN innovations and help the company transition from 5G to 6G networking infrastructure. Obviously, buying $1 billion in shares of a company like Nokia instantly increases Nvidia's own value by a commensurate amount, but this is nonetheless a monumental moment in the U.S. corporate landscape. "Nvidia has become the most-important stock in a bull market that's been driven by optimism for AI to revolutionize the global economy," Bloomberg reports. The publication adds that Nvidia's stock accounts for about 20% of the S&P 500 Index's 17% gains so far this year. The market is clearly putting significant faith in artificial intelligence's value and its potential transformational power. However, it remains unclear whether AI will primarily create positive cultural and societal change and who will benefit the most from it. Perhaps as importantly, there is justifiable concern about who will be harmed by its continued development. There remains significant skepticism surrounding AI and ongoing worry that it is just another, bigger dot-com-esque bubble waiting to burst.

[15]

Nvidia is officially the world's first $5 trillion company. CEO Jensen Huang says it's on track for 'half a trillion dollars' in revenue | Fortune