NVIDIA CEO Reacts to AMD's Surprising 10% Stake Deal with OpenAI

5 Sources

5 Sources

[1]

Nvidia CEO surprised by AMD's deal giving OpenAI a 10% stake

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. Big quote: Nvidia CEO Jensen Huang said he was caught off guard by AMD's decision to give OpenAI the option to acquire a significant stake in the company, describing the move as both unusual and inventive for a firm still preparing its next major chip release. In an interview on CNBC's Squawk Box, Huang called the arrangement "unique and surprising," given AMD's excitement about its upcoming hardware. "I'm surprised they would give away 10 percent of the company before they even built it," he said. "It's clever, I guess." AMD's deal with OpenAI, announced this week, commits the ChatGPT maker to purchasing six gigawatts of computing power over several years, including future shipments of AMD's upcoming MI450 series accelerators. In this context, gigawatts refer to the total energy capacity required to operate the chips, highlighting the massive scale of the deployment. As part of the agreement, OpenAI has received warrants for up to 160 million AMD shares. The warrants will vest based on the extent of chip deployment and AMD's stock performance. Exercising the full allotment would make OpenAI one of AMD's largest shareholders. The partnership is widely seen as an attempt to challenge Nvidia's dominance in the AI semiconductor market. Nvidia's H100 and forthcoming Blackwell GPU architectures currently power most large-scale AI training operations - a lead AMD has sought to narrow through aggressive pricing, higher memory bandwidth designs, and tighter integration with custom cloud hardware. The deal also comes as major cloud providers, including Amazon and Google, ramp up development of their own in-house AI chips to reduce dependence on Nvidia's supply chain. Huang contrasted AMD's approach with Nvidia's own investment package announced in late September. Nvidia has committed up to $100 billion to OpenAI over the next decade, tied to a requirement that OpenAI deploy systems consuming 10 gigawatts of electrical capacity - equivalent to between 4 million and 5 million GPUs. Huang noted that Nvidia's deal structure allows it to sell directly to OpenAI, avoiding some of the equity-based conditions present in AMD's agreement. The scale of the investment has sparked industry discussion about what Huang described as the "circular nature" of certain AI infrastructure deals, a reference to arrangements in which funding from major tech firms is largely used to purchase the same companies' hardware. Asked how OpenAI plans to finance its commitment to Nvidia, Huang said the company has yet to secure the funds and will likely raise capital through expanding revenue streams, equity sales, or debt financing. He added that Nvidia has been invited to invest alongside other partners when the opportunity arises. Reflecting on Nvidia's early investment in OpenAI several years ago, Huang said his "only regret" was not committing more capital at the time. Beyond OpenAI, Nvidia is positioning itself within other marquee AI ventures. Bloomberg reported Tuesday that Elon Musk's xAI is seeking roughly $20 billion in new funding, including about $2 billion from Nvidia. Huang confirmed Nvidia's participation, calling the project "super exciting" and adding, "Almost everything that Elon is part of, you really want to be part of as well." Nvidia's investment portfolio also includes CoreWeave, an AI-focused cloud infrastructure provider specializing in high-density GPU deployments for model training and inference. Huang described CoreWeave as one of several "terrific investments" aimed at building an ecosystem of companies supporting global AI infrastructure. "They're really special companies," he said, "and they're part of our ecosystem building out the AI infrastructure for the world."

[2]

NVIDIA CEO responds to AMD signing 10% of its company over to OpenAI

TL;DR: NVIDIA CEO Jensen Huang reacted to AMD's multibillion-dollar deal with OpenAI, where AMD granted over 10% equity to supply Instinct MI450 GPUs for AI systems. Huang called the move surprising and clever, contrasting it with NVIDIA's own partnership providing 10 gigawatts of GPU power without equity stakes. NVIDIA's CEO Jensen Huang has commented on the recent deal between AMD and OpenAI, where Team Red signed over 10% of the company to provide next-generation AI GPUs to OpenAI to power upcoming artificial intelligence programs. It was only recently that AMD and OpenAI announced a multibillion-dollar partnership that involved AMD signing over 10% of itself to OpenAI to provide AMD Instinct GPUs, specifically the AMD Instinct MI450 GPUs to OpenAI to provide 6 gigawatts of power for upcoming AI systems. As for 10% of the company, the way the deal is structured is the shares are scheduled to vest when specific milestones are achieved, with the first tranche of the stock set to vest after the initial gigawatt is successfully deployed. Furthermore, share vesting is also tied to AMD reaching specific share price targets, OpenAI achieving technical and commercial milestones, and OpenAI purchasing waves of AMD GPUs. The deal between AMD and OpenAI comes only a week after OpenAI announced a similar deal with NVIDIA, except NVIDIA didn't sign over any of its shares, and instead of agreeing to provide 6 gigawatts of power with its GPUs, it will be powering 10 gigawatts. Now, NVIDIA's CEO Jensen Huang has commented on the deal between OpenAI and NVIDIA's competitor, with the CEO saying in an interview with CNBC, "It's imaginative, it's unique and surprising, considering they were so excited about their next generation product. I'm surprised that they would give away 10% of the company before they even built it. And so anyhow, it's clever, I guess."

[3]

Altimeter Capital CEO Brad Gerstner Breaks Down AMD-OpenAI GPU Bet, Says Lisa Su Is Betting The Farm To Catch Up To Rival Nvidia - Advanced Micro Devices (NASDAQ:AMD)

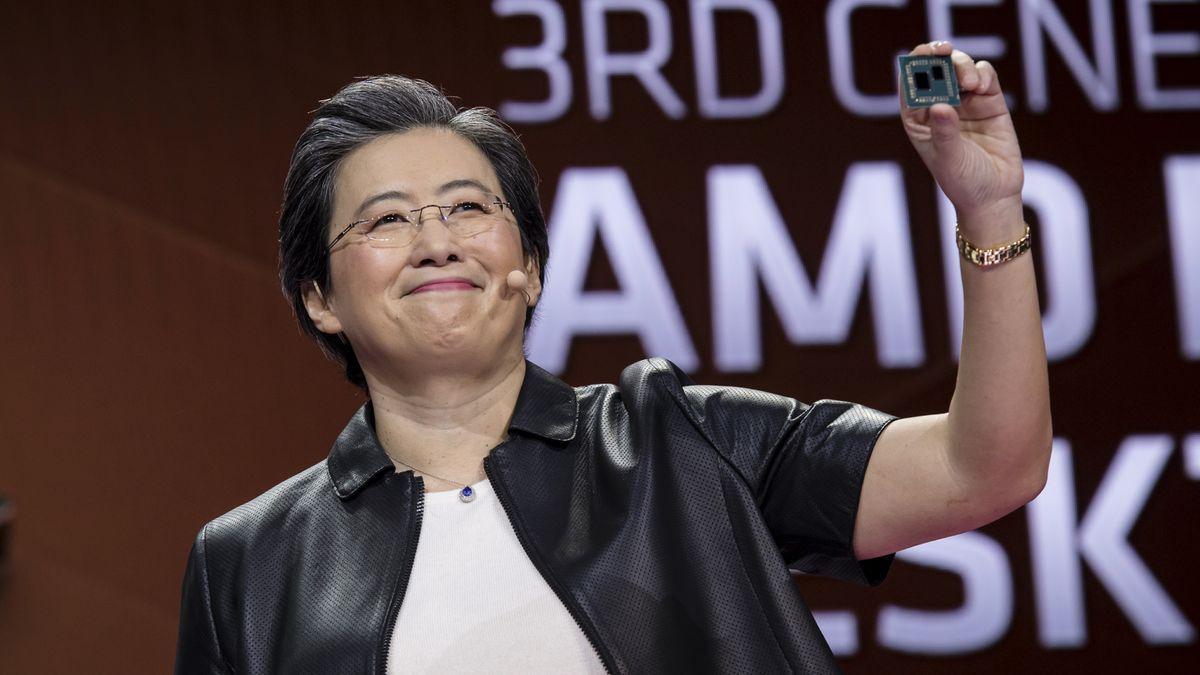

Last week, Altimeter Capital CEO Brad Gerstner described Advanced Micro Devices Inc.'s (NASDAQ:AMD) multi-billion-dollar deal with Sam Altman's OpenAI as a "bet-the-farm" moment for CEO Lisa Su -- one that could reshape the balance of power in the AI chip race currently dominated by Nvidia Corp. (NASDAQ:NVDA). Gerstener Calls AMD's Move A High-Risk, High-Reward Gamble Speaking on The All-In Podcast, Gerstner said Su's decision to grant OpenAI warrants for up to 160 million AMD shares -- worth nearly 10% of the company -- in exchange for a massive GPU purchase commitment shows how much is at stake. "This is a bet-the-farm bet by Lisa Su," Gerstner said. "She's given away 10% of the company, if the compute gets deployed." Under the deal, OpenAI will purchase up to six gigawatts of AMD's next-generation Instinct MI450X GPUs over the next five years -- a contract analysts estimate could generate over $100 billion in revenue. "Either the MI450 gets adopted and they get back into the game, or they're out," Gerstner added, noting that AMD's previous generation, the MI350, "was just not competitive" with Nvidia's offerings. "She's a total warrior. I think she believes in the MI450. She went to her board and she said, 'Listen, we got to take the shot here. We got to bet the farm.' If it works, she's going to get 150 billion of incremental revenue just from OpenAI," he stated. See Also: Tom Lee Sees 'Powerful Tailwinds' Despite Goverment Shutdown, 'Most Hated V-Shaped Rally' AMD Aims To Regain Ground Lost To Nvidia Gerstner illustrated how Nvidia has surged far ahead since 2022. "Two and a half years ago, Nvidia and AMD had basically the same revenue, around $25 billion," he said. This year, Nvidia will do about $210 billion and AMD will do roughly $33 billion, he stated, adding that Nvidia has captured nearly 100% of the incremental AI data center revenue. He credited Nvidia's dominance to its "ecosystem of software, networking and extreme co-design," saying the "unit of compute is no longer the chip -- it's the entire data center." AMD's partnership with OpenAI, he said, is a bold attempt to validate its new GPU architecture and claw back share in the booming AI accelerator market. Energy And Supply Chains Become The New Bottlenecks Co-host Chamath Palihapitiya added that the AI race is shifting toward control over energy and critical chip ingredients. The companies that control those elements of the supply chain will come into power, he said, referencing OpenAI's deals with South Korean memory giants SK Hynix and Samsung Electronics Co. (OTC:SSNLF). Analysts See Massive Upside If AMD Executes Wall Street analysts have also reacted positively to the OpenAI deal. Bank of America's Vivek Arya projected over $100 billion in potential revenue from the deployment, with EBIT margins of up to 35% and raised AMD's price target to $250. Goldman Sachs' James Schneider called the partnership "a strong positive" for AMD's long-term GPU business and lifted the stock's target to $210, saying it could unlock as much as $135 billion in new sales while finally challenging Nvidia's dominance. AMD scores strongly in Benzinga's Edge Stock Rankings for Momentum, Growth and Quality, reflecting robust short, medium and long-term trends. Explore a full stock analysis, including comparisons with its peers and competitors. Read Next: Nvidia CEO Jensen Huang Says He's 'Surprised' AMD Would Give Away 10% Of The Company In Its Deal With OpenAI: 'It's Clever, I Guess' Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Photo: Algi Febri Sugita / Shutterstock AMDAdvanced Micro Devices Inc$223.884.18%OverviewNVDANVIDIA Corp$189.883.67%SSNLFSamsung Electronics Co Ltd$42.480.34%Market News and Data brought to you by Benzinga APIs

[4]

"Clever, I Guess": NVIDIA CEO Jensen Huang Reacts to AMD's Decision to Offer OpenAI a 10% Ownership Stake For an Unfinished Product

NVIDIA's CEO, Jensen Huang, has reacted to the deal made between AMD and OpenAI, presenting rather interesting remarks about the partnership. For those unaware, AMD recently entered into a massive deal with OpenAI, which involved supplying over six gigawatts worth of AMD chips, including the Instinct MI450 AI chip, which is yet to be released. The deal came just a few days after the announcement of a blockbuster collaboration between NVIDIA and OpenAI; hence, the 'heat of competition' between two major compute providers is definitely there. Now, Jensen has reacted to AMD's OpenAI partnership, speaking with CNBC, and said he's surprised that AMD plans to give a portion of its firm, around a lineup that has yet to be released. It's imaginative, it's unique and surprising, considering they were so excited about their next generation product. I'm surprised that they would give away 10% of the company before they even built it. And so anyhow, it's clever, I guess. These are some 'cheeky' remarks by NVIDIA's CEO, and more importantly, he also claimed that AMD's partnership with OpenAI was completely unknown at the time when the ChatGPT creator went into a deal with NVIDIA. One of the primary reasons why OpenAI's announcements matter so much for compute providers is that now, both NVIDIA and AMD are on equal footing when it comes to interest in next-gen AI solutions like Vera Rubin and the Instinct MI450. This also means that for Jensen, the competition will intensify. In a previous report, we discussed how AMD's CEO Lisa Su expects to generate a massive $100 billion from this partnership over the upcoming years, and the deal will be driven by lineups such as the Instinct MI450, which is also a significant aspect to consider. Reports around the industry suggest that with the upcoming AI products from AMD, NVIDIA will face competition at its peak, both in the GPU and rack-scale segments, which means Jensen will need to accelerate the company's progress. Of course, a competition is always healthy for the AI industry, but for NVIDIA, it is important to consider AMD's growing stance, since for several years now, Team Green has enjoyed a partial 'monopolistic' market, which Big Tech has been focusing solely on adopting the tech stack provided by Jensen & Co.

[5]

Nvidia CEO Jensen Huang Says He's 'Surprised' AMD Would Give Away 10% Of The Company In Its Deal With OpenAI: 'It's Clever, I Guess' - NVIDIA (NASDAQ:NVDA), Advanced Micro Devices (NASDAQ:AMD)

On Wednesday, Nvidia Corp. (NASDAQ:NVDA) CEO Jensen Huang weighed in on Advanced Micro Devices, Inc.'s (NASDAQ:AMD) partnership with OpenAI, calling the move "imaginative" but "surprising." Huang Says AMD's 10% Stake Giveaway To OpenAI Was 'Surprising' Speaking on CNBC's Squawk Box, Huang was asked about AMD's newly announced deal with OpenAI, which includes a warrant granting the ChatGPT-maker up to 160 million AMD shares -- roughly 10% of the company -- tied to deployment milestones for AI chips. "I saw the deal. It's imaginative. It's unique and surprising considering they were so excited about their next-generation product," Huang said. "I'm surprised that they would give away 10% of the company before they even built it. Anyhow, it's clever, I guess." AMD's deal with OpenAI followed the AI startup's $100 billion infrastructure partnership with Nvidia, announced last month. See Also: Nvidia Reportedly Bets $2 Billion On Elon Musk's xAI -- And Its Own GPUs Will Fuel 'Colossus 2' Gigawatt-Scale AI Supercluster Nvidia's Direct Partnership With OpenAI During the conversation, Huang also explained that Nvidia's own partnership with OpenAI is structured differently. "This is the first time we're going to sell directly to them," he said, referring to OpenAI. "Until now, we've been largely selling through the cloud ... by selling directly to them, we can help prepare them for a day when they're self-hosted, hyperscaler." He added that Nvidia's comprehensive infrastructure -- spanning CPUs, GPUs, networking chips and software stacks -- makes it the only company capable of building complete AI supercomputers. "We're the only company in the world today that really focuses on building the entire AI infrastructure," Huang said. AMD's Risky Bet Amid Fierce AI Chip Competition Huang's remarks come as competition intensifies between Nvidia and AMD for dominance in the rapidly expanding AI chip market. AMD CEO Lisa Su, who is a distant cousin of Huang, previously described the company's MI300X accelerator as a strong alternative to Nvidia's GPUs. However, industry analysts, including short-seller James Chanos, have questioned the AMD-OpenAI deal's structure, suggesting that giving away equity in exchange for revenue commitments may be risky. Despite these dynamics, Huang praised AMD as "a really good company" that Nvidia takes "very seriously." Price Action: Nvidia currently holds a market cap of about $4.6 trillion, making it the world's most valuable company. AMD's shares, meanwhile, have surged over 95.27% year-to-date amid the AI hardware boom. Nvidia shares rose 2.20% on Wednesday, closing at $189.11, and were up 0.074% in after-hours trading, according to Benzinga Pro. The stock ranks highly in Benzinga's Edge Stock Rankings for Momentum, Growth and Quality, showing strong price trends across short, medium and long-term horizons. Explore a detailed breakdown of the stock, along with its peers and competitors. Read More: Nvidia CEO Jensen Huang Says Intel Spent 33 Years 'Trying To Kill Us' But Now Calls The Chip Rival A Partner: 'We're Lovers, Not Fighters' Photo: jamesonwu1972 on Shutterstock.com Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. AMDAdvanced Micro Devices Inc$240.8513.9%OverviewNVDANVIDIA Corp$189.252.28%Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

NVIDIA CEO Jensen Huang expresses surprise at AMD's decision to offer OpenAI a 10% stake in exchange for a major GPU purchase commitment. The deal intensifies competition in the AI chip market, with both companies vying for dominance.

NVIDIA CEO's Reaction to AMD-OpenAI Deal

NVIDIA CEO Jensen Huang has expressed surprise at AMD's recent deal with OpenAI, which involves granting the AI company warrants for up to 160 million AMD shares - approximately 10% of the company - in exchange for a massive GPU purchase commitment

1

2

. Huang described the move as "imaginative, unique and surprising," adding, "I'm surprised they would give away 10% of the company before they even built it. It's clever, I guess"1

4

.Deal Structure and Implications

The AMD-OpenAI partnership commits the ChatGPT maker to purchasing six gigawatts of computing power over several years, including future shipments of AMD's upcoming MI450 series accelerators

1

. This deal is seen as a strategic move by AMD to challenge NVIDIA's dominance in the AI semiconductor market1

3

.Altimeter Capital CEO Brad Gerstner characterized the deal as a "bet-the-farm" moment for AMD CEO Lisa Su, highlighting the high-stakes nature of the agreement

3

. The partnership could potentially generate over $100 billion in revenue for AMD if successful3

.Contrasting Approaches: NVIDIA vs. AMD

Huang contrasted AMD's approach with NVIDIA's own investment package announced earlier. NVIDIA has committed up to $100 billion to OpenAI over the next decade, tied to a requirement that OpenAI deploy systems consuming 10 gigawatts of electrical capacity

1

. Unlike AMD's equity-based deal, NVIDIA's agreement allows for direct sales to OpenAI1

5

.Market Dynamics and Competition

The deals with OpenAI highlight the intensifying competition between NVIDIA and AMD in the rapidly expanding AI chip market. NVIDIA currently dominates the sector, with its H100 and upcoming Blackwell GPU architectures powering most large-scale AI training operations

1

3

.AMD's partnership with OpenAI is seen as a bold attempt to validate its new GPU architecture and regain market share. Bank of America analyst Vivek Arya projected over $100 billion in potential revenue for AMD from the deployment, with EBIT margins of up to 35%

3

.Related Stories

Industry Implications and Future Outlook

The AI chip race is shifting towards control over energy and critical chip ingredients, according to industry experts

3

. Companies that control these elements of the supply chain are likely to gain significant power in the market3

.As competition intensifies, both NVIDIA and AMD are positioning themselves within marquee AI ventures. NVIDIA has confirmed its participation in Elon Musk's xAI project, which is seeking roughly $20 billion in new funding

1

. The company is also investing in AI-focused cloud infrastructure providers like CoreWeave1

.Conclusion

The AMD-OpenAI deal has sparked significant industry discussion and represents a major shift in the AI chip landscape. As both NVIDIA and AMD continue to innovate and forge strategic partnerships, the competition in the AI semiconductor market is set to intensify further, potentially reshaping the balance of power in the industry.

References

Summarized by

Navi

Related Stories

AMD Challenges Nvidia's AI Dominance with New Chips and Global Strategy

06 Aug 2025•Technology

AMD Unveils Next-Generation AI Chips and Roadmap, Challenging Nvidia's Dominance

13 Jun 2025•Technology

Meta secures $60 billion AMD deal for AI chips, acquires 10% stake to diversify compute strategy

25 Feb 2026•Technology

Recent Highlights

1

Samsung unveils Galaxy S26 lineup with Privacy Display tech and expanded AI capabilities

Technology

2

Anthropic refuses Pentagon's ultimatum over AI use in mass surveillance and autonomous weapons

Policy and Regulation

3

AI models deploy nuclear weapons in 95% of war games, raising alarm over military use

Science and Research