Nvidia prepares to ship up to 80,000 H200 AI chips to China as political hurdles loom

10 Sources

10 Sources

[1]

Nvidia prepares shipment of 82,000 AI GPUs to China as chip war lines blur -- H200 shipments with 25% tax to begin as US loosens restrictions

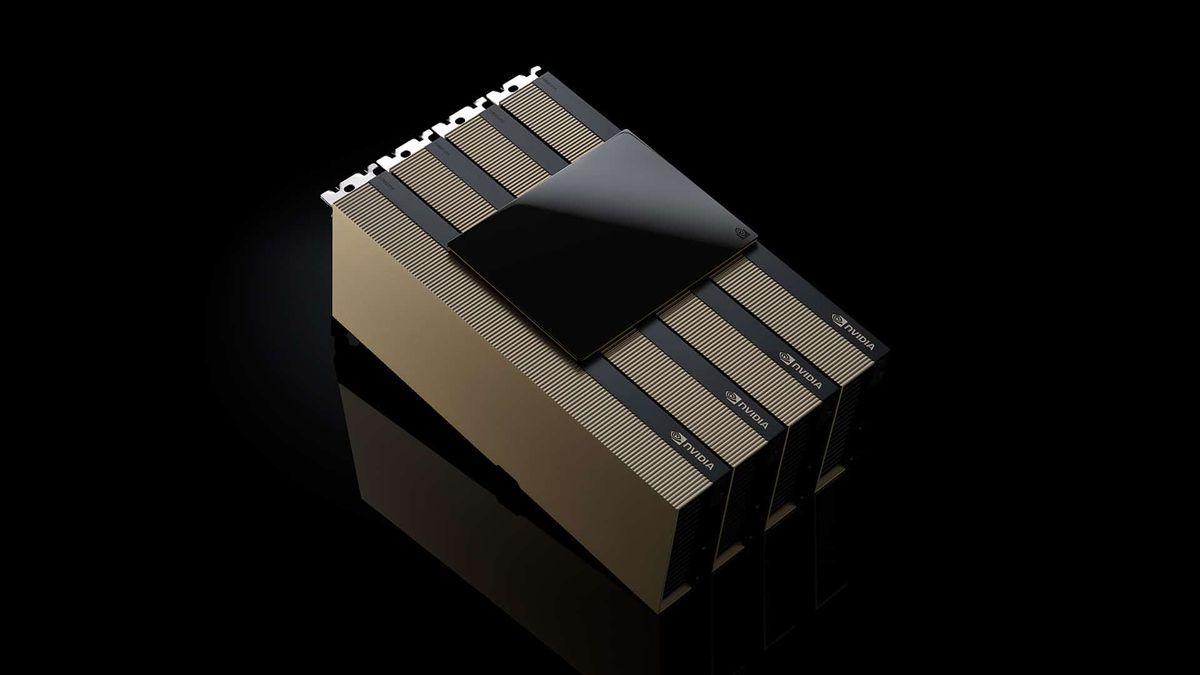

Nvidia is preparing to deliver up to 80,000 H200 AI chips to China before the Lunar New Year holiday, marking the first time this level of silicon would be legally exported to the country since 2022. According to Reuters, the shipments are scheduled for mid-February and will be drawn from existing inventory. The company says it can meet initial demand for 5,000 to 10,000 H200 modules, pending government approval in Beijing. The deal would give Chinese firms access to a GPU that dramatically outpaces the H20 variant, which was designed to bypass U.S. restrictions. The H200 is a Hopper-based part that Nvidia had mostly sidelined in favor of its newer Blackwell and Rubin architectures. But following a recent policy reversal by the Trump administration, the H200 has reemerged as a politically viable and commercially strategic export part, provided recipients are vetted, and a 25% revenue share is paid to the U.S. Treasury. Chinese authorities have not yet cleared the shipments, but the scale of interest and Nvidia's offer to open new H200 production capacity in 2026 suggest that they expect capitulation from Beijing authorities, which, given how far ahead the H200 is of anything Chinese fabs can produce, is understandable. The Biden administration's export controls on AI chips to China, which began in 2022 and expanded through 2023, had cut off access to Nvidia's A100, H100, and H200 silicon. In response, Nvidia designed lower-performing parts specifically for the Chinese market. The H20 was the most powerful of these, but still underperformed relative to the training needs of large foundation models. Chinese firms adapted, turning to Huawei's Ascend series and other local vendors, but none of those efforts matched the performance envelope of Hopper-based GPUs. In early December, Trump overrode the existing restrictions, allowing H200 chips to be sold into China, provided each deal is subject to inter-agency approval and includes a 25% levy. The decision does not extend to Nvidia's current Blackwell or upcoming Rubin GPUs. In effect, the U.S. is granting limited access to older silicon under strict financial and procedural oversight, while keeping cutting-edge hardware firmly out of reach. The Trump administration's backtracking also gives Nvidia a reason to reintroduce H200 production. The company had largely transitioned away from Hopper-class manufacturing to focus on next-gen designs, but in light of demand from China and a green light from Washington, Nvidia has signaled that it will take new H200 orders starting in 2026. While modest in scale compared to Blackwell, this production would serve a lucrative niche: international buyers whose political or technical environments preclude access to newer chips. All this has created a dilemma for China's domestic chip ambitions. The H200 is far more powerful than any domestically produced alternative, but reliance on it may hinder progress toward a self-sufficient AI hardware stack. Huawei's Ascend 910C, for instance, trails the H200 significantly in both raw throughput and memory bandwidth. Biren's BR104 is similarly constrained, and the underlying Chinese software ecosystem remains heavily CUDA-dependent. Switching to Nvidia's Hopper parts offers immediate compatibility with existing workflows, whereas transitioning to local chips will require building a software infrastructure from the ground up. This performance and integration gap is one reason the H200 is so attractive to buyers in China. We already know that the chip is being used unofficially, and there have been several high-profile attempts to skirt around import restrictions through black- and grey-market channels. Even university labs and medical research institutions with ties to the military have reportedly acquired H200s through indirect channels, sometimes via foreign subsidiaries or offshore procurement. In terms of policy, Chinese officials have held emergency meetings to determine how to respond. One proposal would require all H200 purchases to be bundled with a minimum ratio of domestic chips, thereby preserving demand for homegrown vendors like Cambricon and Moore Threads. The extent to which such a bundling rule could be enforced, especially across private-sector cloud providers, remains unclear. But the idea reflects concern that an influx of H200s could tilt the domestic market away from Chinese silicon just as it begins to mature. That concern is not unwarranted. Despite clear progress, the Chinese AI chip ecosystem remains a generation behind in key areas. Approving large-scale imports of Hopper-class hardware risks creating a dependency on foreign training infrastructure, the most critical layer of the AI stack. Resuming H200 shipments will address multiple short-term problems for Nvidia, providing an opportunity to monetize inventory that might otherwise depreciate and to address pent-up demand in a restricted yet technically important market. And it can do this without violating export rules, which still draw a hard line between the H200 and next-gen architectures. In terms of U.S. policy, the 25% tariff creates a mechanism to extract value from technology transfers that would otherwise be banned outright. It positions the federal government to benefit from Nvidia's China business, while nominally maintaining a security buffer. Yet this arrangement also weakens the original logic of the export controls. If older chips are still sufficiently powerful to close the AI compute gap, or worse yet, to enable military applications, then allowing them in any quantity may undermine the broader goal of tech containment. The Institute for Progress has warned that expanding China's access to Hopper-class hardware could significantly increase the country's aggregate training capacity. Even if Blackwell remains off the table, the volume of H200s in play -- up to 80,000 from existing stock alone -- could enable more advanced model training than domestic chips currently support. That, in turn, would affect both commercial competition and military readiness in fields where AI performance is critical. No public statements from Chinese regulators have confirmed or denied approval of the pending shipments. But based on the scale of the order and the timing aligned with the Lunar New Year, Nvidia appears confident enough to begin staging deliveries. Should the plan proceed, it would mark the most significant legal export of high-end AI silicon to China since the restrictions were first imposed. And with new H200 production capacity now in planning, the repercussions are likely to stretch well into 2026.

[2]

Nvidia wastes no time lining up H200 sales in China

Now that it can legally export them, Nvidia has reportedly informed its Chinese customers that it'll begin shipping H200s, one of its most potent graphics accelerators for AI training and inference, in time for Chinese New Year. One caveat: Beijing could spike the deal before then. Citing persons familiar with the matter, Reuters reports that initial orders will be fulfilled using existing stock with between 5,000 and 10,000 HGX boards totaling 40,000 to 80,000 GPUs up for grabs. This suggests that Nvidia will be prioritizing the more powerful SXM variant of the H200, which is better suited for training applications than its PCIe-based NVL cards. Nvidia recently received the go-ahead from the Trump administration to begin selling its older H200 accelerators to the Middle Kingdom for the first time. The decision marked a significant reversal of long-standing trade policy earlier this month. In exchange, Nvidia will cut Uncle Sam in on 25 percent of the revenues from the sale. Nvidia's most powerful Blackwell-based chips remain unobtainium in the Chinese market, with little indication that'll change any time soon. The Trump administration had previously proposed a 15 percent sales tax to restore sales of H20s, a nerfed version of the H200, in China back in July. Despite this, Hopper sales have fallen off considerably over the past year, accounting for $2 billion in sales in Q3. Of that, H20 sales only account for $50 million, with CFO Colette Kress placing the blame on "geopolitical issues and the increasingly competitive market in China." According to Reuters, Nvidia has warned its customers that the timing of shipments will depend heavily on approval by authorities in Beijing. The Middle Kingdom has become increasingly hostile towards Nvidia in recent months, with government authorities reportedly pressuring hyperscalers to drop Nvidia in favor of domestic alternatives. The nation has also moved to block state-funded datacenters from deploying foreign AI chips. But if these hurdles can be overcome, the Chinese market represents a massive opportunity for Nvidia. On the company's Q2 earnings call, CEO Jensen Huang estimated that China would have been a $50 billion market in 2025 if it'd been allowed to sell competitive products in the region. If Nvidia is successful in convincing China to approve H200 shipments, Reuters reports that production of Hopper GPUs could resume at foundry partner TSMC with additional capacity available starting in the second half of 2026. The Register reached out to Nvidia for comment but had not heard back at the time of publication. ®

[3]

Nvidia hopes to ship first H200 GPUs to China by February, report claims - SiliconANGLE

Nvidia hopes to ship first H200 GPUs to China by February, report claims Nvidia Corp. has told Chinese companies that it's hoping to be able to ship its first H200 graphics processing units to the country by the middle of February, according to a report by Reuters. The report cited two people familiar with the chipmaker's dealings as saying that the first shipment will amount to between 5,000 and 10,000 chip modules, or around 40,000 to 80,000 H200 chips in total. It also quoted a third anonymous source that said Nvidia plans to increase production capacity for the H200 chips in order to accelerate shipments to China by the second quarter of next year. However, any shipments remain contingent on the Chinese government giving domestic companies the green light to buy Nvidia's chips. While Chinese technology giants such as Alibaba Group Ltd. and ByteDance Ltd. have expressed a desire to buy the H200, Beijing has not yet approved any purchases of the chips as it's still considering the implications any decision would have on its domestic chipmaking industry. The proposed February shipments would be the first delivery of H200 GPUs to China since U.S. President Donald Trump approved their shipment to the country, with the government set to receive a 25% cut. The White House has reportedly launched an inter-agency review of new license applications for the chips, making good on a promise earlier this month to allow Nvidia to sell its second-most powerful artificial intelligence processors to China. Trump's move represents a dramatic U-turn for the U.S. following the previous Biden administration's decision to ban all advance chip sales to China over national security concerns. He said at the time of the announcement that the new policy will "support American jobs, strengthen U.S. manufacturing and benefit American taxpayers," but analysts say economic considerations have likely taken precedence over issues of national security. Semiconductors have emerged as one of the key sticking points at the heart of the rocky trade relationship between the U.S. and China. In response to U.S. attempts to restrict its access to advanced AI chips, China imposed export restrictions on so-called "rare-earth" materials, which are essential ingredients of processors and other electronics, such as batteries. Trump then met with Chinese President Xi Jinping in South Korea in October, where it appears an agreement was negotiated. "It's really a 'chips for precious rare-earth materials' deal and it provides advantages for both sides, so we can expect China to relax its restrictions on rare-earth materials soon," Constellation Research analyst Holger Mueller told SiliconANGLE. However, any shipments of the H200 chips to China will face scrutiny. On Monday, Democratic Senator Elizabeth Warren and Representative Gregory Meeks wrote a letter to the U.S. Commerce Department asking it to disclose the details of any licenses it approves for sales to Chinese entities. The lawmakers also demanded a briefing on the issue before any approvals are issued, including an "assessment of the military potential of the chips for export and the reaction of allies and partners to the decision to export these chips". In addition, Warren and Meeks say they want to see the text of any agreement signed by the Trump administration with regard to the H200 deal, as well as an assessment of "the most advanced chips China is producing indigenously". The Nvidia H200 GPUs are widely used in AI deployments, although they are an older-generation processor that has since been superseded by the company's newer Blackwell chips. Because the chipmaker has been more focused on Blackwell, supplies of the H200 chips are thought to be scarce, hence the need for Nvidia to ramp up production for Chinese customers. Chinese officials are reportedly weighing up whether or not to allow domestic companies to import the H200 chips, as they're concerned that doing so could stall its own chipmaking efforts. The country has been pushing hard to develop its own semiconductor industry in response to U.S. restrictions. But there are fears that innovation may slow if Chinese companies can access Nvidia's accelerators. One possible solution for China might be to insist that Chinese firms buy a set number of domestically produced chips for each H200 they purchase, Reuters said.

[4]

Nvidia prepares first H200 shipments to China by February

According to Reuters, Nvidia has informed Chinese clients of plans to ship H200 AI chips to China before the mid-February Lunar New Year holiday, using existing stock for initial orders totaling 5,000 to 10,000 chip modules, equivalent to 40,000 to 80,000 chips, pending Beijing approval. Three people familiar with the matter disclosed these details to Reuters. The first and second sources specified the shipment volumes from current inventory. This initiative follows U.S. President Donald Trump's announcement allowing such sales with a 25 percent fee, marking the first potential deliveries of these chips to China. Nvidia additionally communicated plans to expand production capacity for the H200. According to the third source, orders for this new capacity will open in the second quarter of 2026. These steps aim to meet anticipated demand from authorized Chinese customers. Significant uncertainties surround the timeline and execution. Beijing has not approved any H200 purchases to date. Government decisions could alter schedules or volumes. The third source emphasized, "Nothing is certain until we get the official go‑ahead." In response to Reuters inquiries, Nvidia issued a statement affirming its supply chain management practices. The company declared, "we continuously manage our supply chain. Licensed sales of the H200 to authorised customers in China will have no impact on our ability to supply customers in the United States." China's Ministry of Industry and Information Technology did not immediately respond to a request for comment. The planned shipments align with recent U.S. policy developments. Reuters reported last week that the Trump administration initiated an inter-agency review of license applications for H200 sales to China. This action fulfills Trump's pledge and contrasts with the Biden administration's ban on advanced AI chip sales to China, imposed due to national security concerns. The H200 belongs to Nvidia's previous-generation Hopper architecture. It continues to see widespread use in artificial intelligence applications. Production has shifted toward the newer Blackwell chips and the upcoming Rubin line, resulting in limited H200 availability globally. Trump's policy adjustment occurs as China accelerates development of its domestic AI chip sector. Local companies have not yet produced processors matching the H200's capabilities. Officials express concerns that importing these chips might hinder progress in building indigenous technology. Earlier this month, Chinese officials convened emergency meetings to address the potential influx of H200 chips. Discussions focused on approval conditions for shipments. Reuters reported one proposal under consideration: requiring each H200 purchase to include a specified ratio of domestically produced chips. Prominent Chinese technology firms have shown strong interest in acquiring H200 units. Alibaba Group, listed as 9988.HK, and ByteDance number among those clients. For these companies, the H200 offers processors approximately six times more powerful than the H20, a version Nvidia specifically adapted and downgraded for the Chinese market.

[5]

Nvidia's H200 AI Chips Get Trump's Nod for China Sales. Will Political Hurdles Derail the Plan?

However, the chip's export to China could still face challenges in the U.S., as well as in China, injecting uncertainty into expectations around sales. Nvidia finally won President Donald Trump's approval to sell its H200 AI chips in China, but will it be able to seal the deal? The company looks to sell the chip in China as soon as February, Reuters reported Monday, after President Trump greenlighted the chip earlier this month in exchange for a 25% revenue-sharing agreement. But uncertainty over whether U.S. lawmakers or China's government will allow the sales has weighed on investor confidence that the sales will happen. The H200 chip, which is a generation behind Nvidia's Blackwell line, had been banned for sale to China on national security concerns, and its export to the country still faces vocal bipartisan opposition in the U.S., along with potential challenges in China. Since Trump announced the H200 deal in early December, U.S. lawmakers from both parties have pushed back with demands for more oversight and bills that could block sales. On Friday, House Republicans introduced a bill that would allow Congress to block advanced AI chip exports, a day after House Democrats proposed a bill that would prohibit sales of America's most advanced chips to China and other countries of concern. Chinese officials also have yet to approve H200 sales in the country, with analysts warning China's government could discourage firms from buying the chips, as it has with the H20, a weaker chip that Trump approved for export earlier this year. In a note to clients Monday, analysts at Jefferies voiced some skepticism about whether the chip would be allowed, and that if it is, whether it could come with additional requirements for Chinese firms or a limited quota system. "We do expect there is considerable opportunity for [Nvidia] if they are permitted to re-enter the market, but at this point it still seems unlikely to happen," Jefferies said following the announcement earlier this month. Nvidia shares were up 2% in late-morning trading Tuesday. The stock has gained 40% in 2025, handily outpacing the performance of major stock indexes, but has lost 12% of its value since hitting an all-time high in late October.

[6]

Nvidia aims at shipments of H200 chips to China by mid-February

Nvidia aims to send its powerful AI chips to China before the Lunar New Year holiday. Initial shipments will use existing stock, totaling thousands of chip modules. The company also plans new production capacity for these chips in 2026. Nvidia has told Chinese clients it aims to start shipping its second-most powerful artificial intelligence chips to China before the Lunar New Year holiday in mid-February, three people familiar with the matter told Reuters. The US chipmaker plans to fulfil initial orders from existing stock, with shipments expected to total 5,000 to 10,000 chip modules - equivalent to about 40,000 to 80,000 H200 AI chips, the first and second sources said. Nvidia has also told Chinese clients that it plans to add new production capacity for the chips, with orders for that capacity opening in the second quarter of 2026, the third source said. Significant uncertainty remains, as Beijing has yet to approve any H200 purchases and the timeline could shift depending on government decisions, the sources said. MAJOR POLICY SHIFT "The whole plan is contingent on government approval," the third source said. "Nothing is certain until we get the official go-ahead." Nvidia said in a statement "we continuously manage our supply chain. Licensed sales of the H200 to authorised customers in China will have no impact on our ability to supply customers in the United States." Last week, the Trump administration had launched an inter-agency review of license applications for H200 chip sales to China, making good on his pledge to allow the sales. Chinese technology giants as Alibaba Group and ByteDance, which have expressed interest in buying H200 chips. (You can now subscribe to our Economic Times WhatsApp channel)

[7]

NVIDIA Plans to Make the H200 AI Chip an Appealing Option By Offering a Price That Is Too Difficult To Ignore For Chinese Customers

NVIDIA aims to offer competitive prices for the H200 AI chips, according to a new report, which suggests that the newer chips for China will feature a minimal price increase over the H20. When the Trump administration lifted the restrictions on NVIDIA exporting the H200 AI chips to China, the industry was uncertain about whether Beijing would seek to acquire the newer chips, given the nation's pursuit of transitioning to a domestic tech stack. Additionally, NVIDIA technically introduced Hopper for the second time in China, despite promising a Blackwell option, which created skepticism about whether there would be sufficient demand. However, according to the analyst Jukan, citing Chinese sources, it appears that NVIDIA plans to address this gap by offering a price that would simply be too hard to ignore. Chinese media suggest that the price of an 8-chip cluster around the H200 AI chips will be around $200,000, which is similar to the price of a comparable H20 configuration. To top it off, the H200 AI chip features significantly upgraded specifications, with estimates suggesting a performance difference of more than six times. This is how NVIDIA plans to make the H200 a much more competitive option in the Chinese market, despite its launch in Q4 2024. Here's a rundown on how the H200 compares to the H20 in terms of on-paper specifications: Interestingly, reports claim that NVIDIA plans to ship the first batch of H200 AI chips to China by mid-February, pending regulatory approval from the US. And, based on a report from the Taiwan Economic Daily, it is claimed that Chinese AI giants like Alibaba, Tencent, and ByteDance are looking to be on a "spending spree" after getting access to the H200 AI chips, and they plan to invest up to $31 billion in infrastructure, mainly consisting of compliant hardware from NVIDIA and AMD. It appears that the notion that China won't be interested in NVIDIA's H200 is not accurate. We do know that China cannot train frontier AI models without access to hardware from NVIDIA, which is why domestic CSPs and hyperscalers are scrambling to obtain the H200 and MI308 AI chips, as they are the dominant source of compute in the region. Companies like Huawei, despite showing strong advancements, still cannot compete with Western alternatives, as they are held back by capacity constraints and lack a software ecosystem as robust as those of NVIDIA or AMD.

[8]

NVIDIA & AMD Are Back in China Once Again -- This Time With Far More Powerful AI Chips, But Regulatory Guardrails Have Tightened Significantly

The China bandwagon for US chip manufacturers has started to roll once again, with NVIDIA and AMD introducing aggressive solutions in the market, but this time, the dynamics are different. By now, the reports of NVIDIA offloading the Hopper H200 AI chips to China have become mainstream, but there's also a breakthrough with AMD, which we'll discuss ahead as well. During the initial quarters of 2025, American chip manufacturers faced significant challenges selling their products to China, as geopolitical tensions led to policy changes that heavily impacted firms like NVIDIA and AMD. The situation reached a point where NVIDIA's CEO, Jensen Huang, declared that their market share in China was at 'zero percent', indicating that the regional business had been completely disrupted. Politics has played a significant role in shaping the Chinese business landscape for AI chip manufacturers, and as a result, both NVIDIA and AMD have had to consistently work with the current US administration to ensure that their chip offerings comply with the relevant architectural regulations. We saw a breakthrough in policy restrictions back in August, when President Trump declared that the US government would be taking a 15% cut of the total shipments being sent to China by AMD and NVIDIA, which allowed the tech giants to sell chips like the Hopper H20 and Instinct MI308 AI chips. However, in a twist of events, Beijing actually showed resistance towards the H20 AI accelerators, even launching a regulatory investigation to determine whether the chips contain a security backdoor. China enforced a 'national policy' that forced domestic AI giants to focus on adopting chips from companies like Huawei, Cambricon, and BirenTech, which eventually meant that the prospect of NVIDIA and AMD re-entering China had significantly diminished. Here's what Jensen had to say around this timeline. At the moment, we are 100% out of China, and so China is 0%. We went from a 95% market share to 0%, and so I can't imagine any policymaker thinking this is a good idea. In all our forecasts, we assume zero for China. If anything happens in China, it will be a bonus. Meanwhile, China continued to make rapid advancements in the AI segment, with firms like Huawei introducing impressive chip roadmaps which focused on shifting towards self-built elements, and this prompted a massive wave of skepticsm within the AI industry, since Beijing had been rapidly gaining ground against the US, to the point where NVIDIA's CEO Jensen Huang revealed that the China is now just "nanoseconds" away from America. Such statements eventually paved the way for another regulatory breakthrough for NVIDIA/AMD, which we saw a few weeks ago. President Trump announced in the second week of December that NVIDIA would be allowed to sell its Hopper H200 AI chips to China, subject to a 25% tax, a higher percentage compared to what we saw with the H20. The development was seen as both optimistic and a concern for NVIDIA, considering that it meant that Team Green would be coming back to China with a more powerful option, but at the same time, the approval has brought in supply chain complexities and added costs, which we'll summarize in this image: We'll dive into how the H200 and Instinct MI308 AI chips would turn out for China moving ahead, but the important point out of this section alone is the fact that NVIDIA and AMD are back in the region, and while AMD is yet to still with the MI308 accelerators, Team Green is now coming with a much more aggressive option, which is why the interest around the chip is massive, according to earlier reports. According to a report by Reuters, NVIDIA's H200 AI shipments are expected to begin rolling out by mid-February, following an "extensive review" of license applications for H200 chip sales to China, which will provide insight into the end customers of these AI chips. It is estimated that the first batch could offload up to 40,000 to 80,000 H200 AI chips, and NVIDIA plans to add more capacity to meet the demand from Chinese customers. We do know that, despite H200 being several years old, it's still heavily sought after in the region, mainly because China has faced challenges in training frontier models on domestic AI chips, and NVIDIA's tech stack is the undisputed choice for training workloads. Similarly, according to a report by MLex, AMD plans to provide the Chinese tech giant Alibaba with up to 50,000 Instinct MI308 AI chips, marking one of the company's largest orders for the region, even during the pre-export control era. This indicates that China is seeking all the computing power it can get. It would be interesting to see how the Chinese AI market turns out for American chip manufacturers, since the 'floodgates' have now been opened, after, of course, the regulatory process works out, and for NVIDIA, which has ruled out "billions" in chip demand from China, the H200 approval and demand would be a sigh of relief.

[9]

Nvidia aims to ship H200 AI chips to Chinese clients by February says Reuters By Investing.com

Invesitng.com -- Nvidia plans to begin shipping its H200 AI chips to Chinese clients before the Lunar New Year in mid-February, Reuters reported on Monday, citing sources familiar with the matter. The shipments would mark the first deliveries of the second-most powerful AI chips to China, following a policy shift allowing sales with a 25% fee under the Trump administration. Initial orders are expected to draw from existing stock, with 5,000 to 10,000 chip modules slated for delivery, equivalent to roughly 40,000 to 80,000 H200 chips, Reuters stated. Nvidia has reportedly informed clients that new production capacity will be added, with orders for that capacity opening in the second quarter of 2026, one source said. However, uncertainty remains. Beijing has yet to approve any H200 purchases, and the timeline could change depending on government decisions. "The whole plan is contingent on government approval," a source is said to have told Reuters. The H200, part of Nvidia's previous-generation Hopper line, continues to be widely used despite the newer Blackwell chips. Supply remains limited, as Nvidia has focused production on Blackwell and its upcoming Rubin line. Chinese companies such as Alibaba and ByteDance have expressed interest in acquiring H200 chips, which offer roughly six times the processing power of Nvidia's downgraded H20 chip designed for the Chinese market.

[10]

Nvidia aims to begin H200 chip shipments to China by mid-February, sources say

Dec 22 (Reuters) - Nvidia has told Chinese clients it aims to start shipping its second-most powerful AI chips to China before the Lunar New Year holiday in mid-February, three people familiar with the matter told Reuters. The U.S. chipmaker plans to fulfil initial orders from existing stock, with shipments expected to total 5,000 to 10,000 chip modules - equivalent to about 40,000 to 80,000 H200 AI chips, the first and second sources said. Nvidia has also told Chinese clients that it plans to add new production capacity for the chips, with orders for that capacity opening in the second quarter of 2026, the third source said. Significant uncertainty remains, as Beijing has yet to approve any H200 purchases and the timeline could shift depending on government decisions, the sources said. MAJOR POLICY SHIFT "The whole plan is contingent on government approval," the third source said. "Nothing is certain until we get the official go-ahead." The sources declined to be identified as the discussions are private. Nvidia and China's Ministry of Industry and Information Technology did not immediately respond to requests for comment. The planned shipments would mark the first deliveries of H200 chips to China after U.S. President Donald Trump said this month that Washington would allow such sales with a 25% fee. Reuters reported last week that the Trump administration had launched an inter-agency review of license applications for H200 chip sales to China, making good on his pledge to allow the sales. The move represents a major policy shift from the Biden administration, which banned advanced AI chip sales to China citing national security concerns. The H200, part of Nvidia's previous-generation Hopper line, remains widely used in AI despite being superseded by the firm's newer Blackwell chips. Nvidia has focused production on Blackwell and its upcoming Rubin line, making H200 supply scarce. Trump's decision comes as China pushes to develop its domestic AI chip industry. Local firms have yet to match the H200's performance, raising concerns that allowing imports could slow domestic progress. Chinese officials held emergency meetings earlier this month to discuss the matter and are weighing whether to allow shipments, Reuters reported this month. One proposal would require each H200 purchase to be bundled with a set ratio of domestic chips, according to the report. For Chinese technology giants such as Alibaba Group and ByteDance, which have expressed interest in buying H200 chips, the potential shipments would provide access to processors roughly six times more powerful than the H20, a downgraded chip Nvidia designed for China. (Reporting by Reuters newsroom. Editing by Miyoung Kim and Mark Potter)

Share

Share

Copy Link

Nvidia plans to deliver up to 80,000 H200 AI chips to China before the Lunar New Year, marking the first legal export of this caliber since 2022. The shipments follow Donald Trump's policy reversal allowing sales with a 25% revenue share to the US Treasury. But Beijing hasn't approved purchases yet, and bipartisan opposition in Washington threatens the deal as China weighs the impact on its domestic chipmaking industry.

Nvidia H200 Shipments to China Mark Major Policy Shift

Nvidia is preparing to deliver between 40,000 and 80,000 H200 AI chips to China before the mid-February Lunar New Year holiday, marking the first time high-end AI chips of this caliber would be legally exported to the country since 2022. According to Reuters, the Nvidia H200 shipments will be drawn from existing inventory, with the company indicating it can meet initial demand for 5,000 to 10,000 H200 modules pending government approval in Beijing

1

2

. The deal follows a dramatic policy reversal by the Donald Trump administration, which overrode existing US export controls in early December to allow AI chip sales to China under strict conditions3

.

Source: SiliconANGLE

Trump Administration Enables Sales With 25% Tax Requirement

The Biden administration's export controls on AI chips to China, which began in 2022 and expanded through 2023, had cut off access to Nvidia's A100, H100, and H200 silicon over national security concerns. In response, Nvidia designed lower-performing parts specifically for the Chinese market, with the H20 being the most powerful of these restricted variants

1

. The Trump policy reversal now allows H200 chips to be sold into China provided each deal is subject to inter-agency approval and includes a 25% tax paid to the US Treasury. The decision does not extend to Nvidia's current Blackwell or upcoming Rubin GPUs, effectively granting limited access to older silicon while keeping cutting-edge hardware firmly out of reach1

3

.Political Hurdles Threaten Deal on Both Sides

Significant political hurdles remain despite Trump's approval. Beijing has not yet cleared the shipments, and Chinese officials have convened emergency meetings to determine how to respond to the potential influx of advanced AI processors

4

. One proposal under consideration would require all H200 purchases to be bundled with a minimum ratio of domestic chips, thereby preserving demand for China's domestic chipmaking industry vendors like Cambricon and Moore Threads1

. On the US side, bipartisan opposition has emerged with vocal pushback from lawmakers. Democratic Senator Elizabeth Warren and Representative Gregory Meeks wrote to the Commerce Department demanding disclosure of license details and a briefing before any approvals are issued3

. House Republicans introduced a bill that would allow Congress to block advanced AI chip exports, while House Democrats proposed legislation prohibiting sales of America's most advanced chips to China5

.Related Stories

H200 Performance Creates Dilemma for China's Tech Ambitions

The H200 is a Hopper-based GPU that dramatically outpaces the H20 variant, offering approximately six times more power than the downgraded chip Nvidia designed to bypass restrictions

4

. Chinese technology giants including Alibaba and ByteDance have expressed strong interest in acquiring the chips for AI training applications3

4

. The H200 is far more powerful than any domestically produced alternative, including Huawei's Ascend 910C, which trails significantly in both raw throughput and memory bandwidth1

. This performance gap creates a dilemma for China's domestic chip ambitions, as reliance on Nvidia's technology may hinder progress toward a self-sufficient AI hardware stack just as it begins to mature.

Source: Tom's Hardware

Production Restart and Market Implications

Nvidia had largely transitioned away from Hopper-class manufacturing to focus on next-generation designs, but the company has signaled it will take new H200 orders starting in 2026 following the green light from Washington

1

. According to Reuters, production of Hopper GPUs could resume at foundry partner TSMC with additional capacity available starting in the second half of 20262

. CEO Jensen Huang estimated that China would have been a $50 billion market in 2025 if the company had been allowed to sell competitive products in the region2

. However, Hopper sales have fallen off considerably, accounting for $2 billion in sales in Q3, with H20 sales only representing $50 million due to geopolitical issues and the increasingly competitive market in China2

. Analysts at Jefferies voiced skepticism about whether the chip would ultimately be allowed, noting considerable uncertainty around investor confidence despite the potential opportunity5

. The chip war dynamics suggest that while the deal addresses short-term problems for Nvidia by monetizing inventory that might otherwise depreciate, the long-term implications for both US-China tech relations and China's semiconductor self-sufficiency remain unclear.References

Summarized by

Navi

[1]

[2]

[3]

Related Stories

Trump approves Nvidia H200 exports to China with 25% revenue cut, sparking national security debate

04 Dec 2025•Policy and Regulation

Nvidia's Next-Gen AI Chip for China: Geopolitical Tensions and Market Demand

29 Aug 2025•Technology

Nvidia scrambles to meet surging China demand for H200 chips as orders hit 2 million units

31 Dec 2025•Technology

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation