Nvidia's $5 Billion Investment in Intel Reshapes AI Chip Landscape

2 Sources

2 Sources

[1]

Does Nvidia's $5 Billion Investment in Intel Make One of These Stocks a Buy? | The Motley Fool

Meanwhile, Intel has fallen on hard times. This stark reality led to Nvidia's $5 billion investment in Intel shares in September. But it also heralds a new era for both companies, one where they play a larger role in the AI ecosystem. Nvidia CEO Jensen Huang described the decision to invest in Intel by stating, "This historic collaboration tightly couples Nvidia's AI and accelerated computing stack with Intel's CPUs and the vast x86 ecosystem -- a fusion of two world-class platforms." This could mean now is the time to buy shares in one or both companies. A deeper dive into Nvidia and Intel can provide insights into which to invest in. Nvidia's decision to join forces with ailing Intel is a bet on the latter's ability to bounce back from its current struggles. Intel's fall from grace started in the early 2000s when it decided against developing chips for mobile devices. Then, it was caught flat-footed when artificial intelligence emerged, forcing the company to catch up. These missteps resulted in a share-price decline that brought Intel stock's price-to-book (P/B) ratio to a multiyear low last year. But things are looking up for Intel in 2025. In March, the company brought in a new CEO, Lip-Bu Tan, to right the ship. Then in August, the Trump administration took the unusual approach of investing $8.9 billion in Intel stock in support of President Donald Trump's vision to build up U.S. manufacturing. In September, Nvidia added to the government's investment with its own $5 billion stock buy. But its share price purchase wasn't just to benefit from a low valuation. Intel owns foundries to manufacture semiconductor components. As a fabless chip company, Nvidia lacks this capability. Together, they plan to produce data center and PC products with the computing power necessary for the AI era. That's just the tip of the iceberg. Nvidia's Huang sees a future where the entire cloud computing industry must transform to support the rigorous computational needs of AI systems. He described this transformation: "Companies and countries are partnering with Nvidia to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center -- AI factories." These AI factories will be responsible for producing the various artificial intelligence products used by organizations and individuals. The shift Huang articulated isn't just a marketing boast or some future state that will occur years down the road. It's happening now. One example is the British government's efforts to increase AI computing capacity by 20 times over the next five years. Another is the Stargate project, which aims to invest $500 billion in U.S. AI infrastructure by 2029. Nvidia's Intel partnership not only aspires to get ahead of this transition, it seeks to enable the transformation as broadly and quickly as possible. As a result, Intel now finds itself armed with Nvidia's cutting-edge technology, and the opportunity to deliver it to businesses and governments hungry for AI. The deal between Nvidia and Intel holds exciting implications for each's future. So does this mean it's time to buy one or both stocks? Although Nvidia and Intel shares took off since the deal's announcement, the latter's stock remains reasonably valued. Because Intel isn't profitable, this can be assessed using the price-to-sales (P/S) ratio, which measures how much investors are willing to pay for every dollar of revenue produced over the trailing 12 months. Intel's P/S multiple is just a fraction of Nvidia's. This suggests Intel stock is a great value, while Nvidia shares are at a premium. In fact, Nvidia stock hit a record high of $191.05 on Oct. 2. This doesn't necessarily mean you should avoid buying shares. Nvidia's ambition to transform the data center industry with Intel's help is a potential game changer. But Nvidia's lofty share price indicates it's best to watch for the stock to pull back before deciding to buy. As for Intel, given the prospects in front of it and its reasonable share-price valuation, the veteran semiconductor giant looks like a worthwhile investment as well. Lip-Bu Tan will have to ensure Intel executes, but with the new opportunities presented by Nvidia, Intel is poised for a comeback.

[2]

Nvidia CEO drops bombshell on 68-year-old chip giant

Once upon a time, a chipmaker didn't matter unless it was Intel (INTC) . In the 1990s and early 2000s, Intel dominated the PC CPU market, with a market share routinely falling in the 70% to 80% range, generating tens of billions in annual sales. Over the years, Intel solidified its control through scale, manufacturing prowess, and integration with Microsoft's Windows ecosystem. At the same time, Nvidia (NVDA) was a relatively small GPU player, focusing more on graphics cards and niche applications, particularly in the video gaming space. Fast forward to today, and Nvidia's now commanding the lion's share of the AI accelerator and data center GPU market. Some experts peg its hold in those sectors between 70% and 95%, leaving legacy chip giants like Intel scrambling to catch up. Also, Nvidia's Q2 2026 sales hit an eye-popping $46 billion, and its data center arm alone posted $21.9 billion, over 50% of that quarter's total. In light of that reversal, Nvidia CEO Jensen Huang's latest comment about Intel in his conversation with Jim Cramer didn't read like business as usual. His sharp take was not only bold, but also surprising enough to shift the tone of the tech war in one line. Image source: Berry/Getty Images Nvidia CEO Jensen Huang delivers shock take on Intel In a candid exchange on CNBC's "Mad Money," Nvidia CEO Jensen Huang stunned viewers and perhaps the investing world with perhaps one of the most blunt remarks of his career. Intel dedicated 33 years of our lives trying to kill us, Huang told host Jim Cramer, before adding with a grin, That was actually a mission. Not dead yet. The comment marked a reversal for two businesses that arguably defined Silicon Valley's fiercest rivalry. Intel, founded in 1968, has been the world's most prolific chipmaker, generating nearly $55.3 billion in sales for 2024. Nvidia, by comparison, has grown to over $130 billion in fiscal 2025, with its market cap skyrocketing to $4.5 trillion, more than 25 times that of Intel. But Huang wasn't taking a victory lap. We're lovers, not fighters, he said. If you have an imagination about the future, it's possible to bring other people along. That "imagination" now entails an unlikely partnership. Nvidia recently invested a head-turning $5 billion in Intel, as part of which Intel's foundry division will develop custom microprocessors for Nvidia. Also, Nvidia co-develops a new powerful chip for emerging markets. The nifty move also gives Nvidia an added manufacturing option beyond TSMC. Further, Huang confirmed that Nvidia may take a stake in OpenAI. More importantly, he revealed that for the first time, Nvidia may sell GPUs directly to the ChatGPT creator, rather than opting for cloud partners such as Microsoft Azure or Oracle as a middleman. That tightens Nvidia's grip on the AI supply chain, where it's already commanding margins north of 75%. As for China, Huang said Nvidia's near-term forecast assumes "China's zero." He did say, though, that any relaxation of export restrictions would be a bonus. Still, he cautioned policymakers against a complete ban, warning it would negatively impact American businesses in the long term. Quick Takeaways * Nvidia CEO Jensen Huang said Intel "tried to kill us for 33 years" before calling it a partner. * Nvidia has invested a whopping $5 billion in Intel to co-develop custom chips and expand manufacturing options. * Huang confirmed Nvidia may take a stake in OpenAI and sell GPUs directly to the ChatGPT maker. * Nvidia's latest guidance assumes "China's zero," which means no contribution from that market in the near term. Jim Cramer believes Nvidia CEO plans decades ahead of Wall Street's timeline Jim Cramer didn't mince words when describing Nvidia's visionary leader after hosting him at CNBC's "Mad Money" Investing Club meeting. Jensen Huang has a view 20 years ahead, not two quarters ahead, Cramer said, calling the Nvidia CEO one of the few executives in tech who teaches more like a Socratic philosopher than a salesman. Cramer reminded viewers that he first recommended Nvidia stock back in 2009, and since then, it has surged over 4,600%, turning $20,000 into roughly $1 million. "Nvidia has minted many millionaires," he said, "and some of them were in that room." Cramer also reflected on what made him go all-in on the stock years ago. He reminisced about discovering Nvidia's technology inside an Audi showroom and subsequently realizing it wasn't purely a gaming chip company. That moment, he added, convinced him Huang was "building something no one else saw coming." When asked about whether AI stocks were in a bubble, Cramer pushed back, saying that, If you actually read up on what Jensen's doing, you realize it's a $4 trillion company no one thought could ever be a trillion. It can go higher. The Arena Media Brands, LLC THESTREET is a registered trademark of TheStreet, Inc. This story was originally published October 8, 2025 at 2:33 PM.

Share

Share

Copy Link

Nvidia's significant investment in Intel marks a turning point in the AI chip industry. This collaboration aims to transform data centers and accelerate AI computing capabilities, potentially altering the competitive landscape in the semiconductor sector.

Nvidia's Strategic Investment in Intel

In a surprising turn of events, Nvidia has made a $5 billion investment in Intel, marking a significant shift in the landscape of the AI chip industry. This move, announced in September 2025, signals a new era of collaboration between two tech giants that were once fierce competitors .

The Changing Dynamics of the Chip Industry

Nvidia, once a relatively small GPU player, has risen to dominate the AI accelerator and data center GPU market with a market share between 70% and 95%. This growth has been reflected in Nvidia's financials, with Q2 2026 sales reaching $46 billion, of which $21.9 billion came from its data center arm alone .

In contrast, Intel, the former undisputed leader in the chip industry, has faced challenges in recent years. The company's struggles began in the early 2000s when it decided against developing chips for mobile devices and was later caught unprepared for the emergence of artificial intelligence .

A New Era of Collaboration

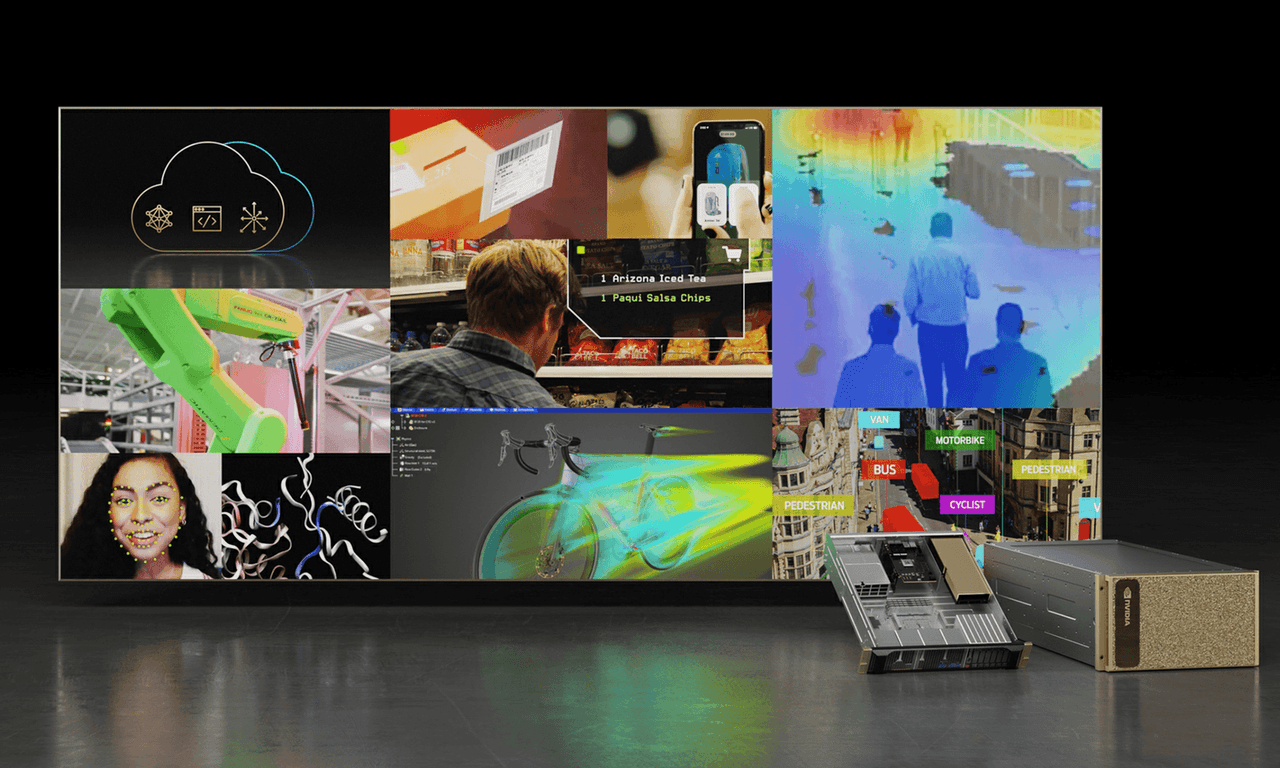

Nvidia CEO Jensen Huang described the investment as a "historic collaboration" that couples Nvidia's AI and accelerated computing stack with Intel's CPUs and the vast x86 ecosystem . This partnership aims to produce data center and PC products with the computing power necessary for the AI era.

Huang envisions a future where the entire cloud computing industry must transform to support the rigorous computational needs of AI systems. He describes this transformation as a shift from traditional data centers to "AI factories" .

Source: Motley Fool

Global Impact and Future Prospects

The implications of this partnership extend beyond the two companies. Governments and organizations worldwide are investing heavily in AI infrastructure. For instance, the British government aims to increase AI computing capacity by 20 times over the next five years, while the Stargate project in the U.S. plans to invest $500 billion in AI infrastructure by 2029 .

Market Reactions and Valuations

Following the announcement of the deal, both Nvidia and Intel stocks saw increases. However, their valuations differ significantly. Intel's price-to-sales (P/S) ratio remains a fraction of Nvidia's, suggesting that Intel stock may be undervalued compared to Nvidia's premium pricing .

Related Stories

Jensen Huang's Vision

In a candid interview with Jim Cramer, Huang reflected on the historical rivalry between Nvidia and Intel, stating, "Intel dedicated 33 years of our lives trying to kill us." However, he quickly pivoted to a more collaborative tone, emphasizing, "We're lovers, not fighters" .

Huang's vision extends far beyond the immediate future. Jim Cramer described Huang as having "a view 20 years ahead, not two quarters ahead," highlighting the CEO's long-term strategic thinking .

Broader Implications for the AI Industry

The partnership between Nvidia and Intel is not just about chip manufacturing. It represents a strategic move to control and advance the entire AI supply chain. Huang also revealed that Nvidia might take a stake in OpenAI and potentially sell GPUs directly to the ChatGPT creator, further tightening Nvidia's grip on the AI ecosystem .

As the AI industry continues to evolve rapidly, this collaboration between Nvidia and Intel could reshape the competitive landscape and accelerate the development of AI technologies across various sectors.

References

Summarized by

Navi

[1]

[2]

Related Stories

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research