NVIDIA's AI Dominance Drives S&P 500 Gains and Market Volatility

4 Sources

4 Sources

[1]

Nvidia's AI Surge Powers 25% of S&P 500 Gains in 2024, Makes Co-founder Huang Among Fastest Growing: Report - NVIDIA (NASDAQ:NVDA)

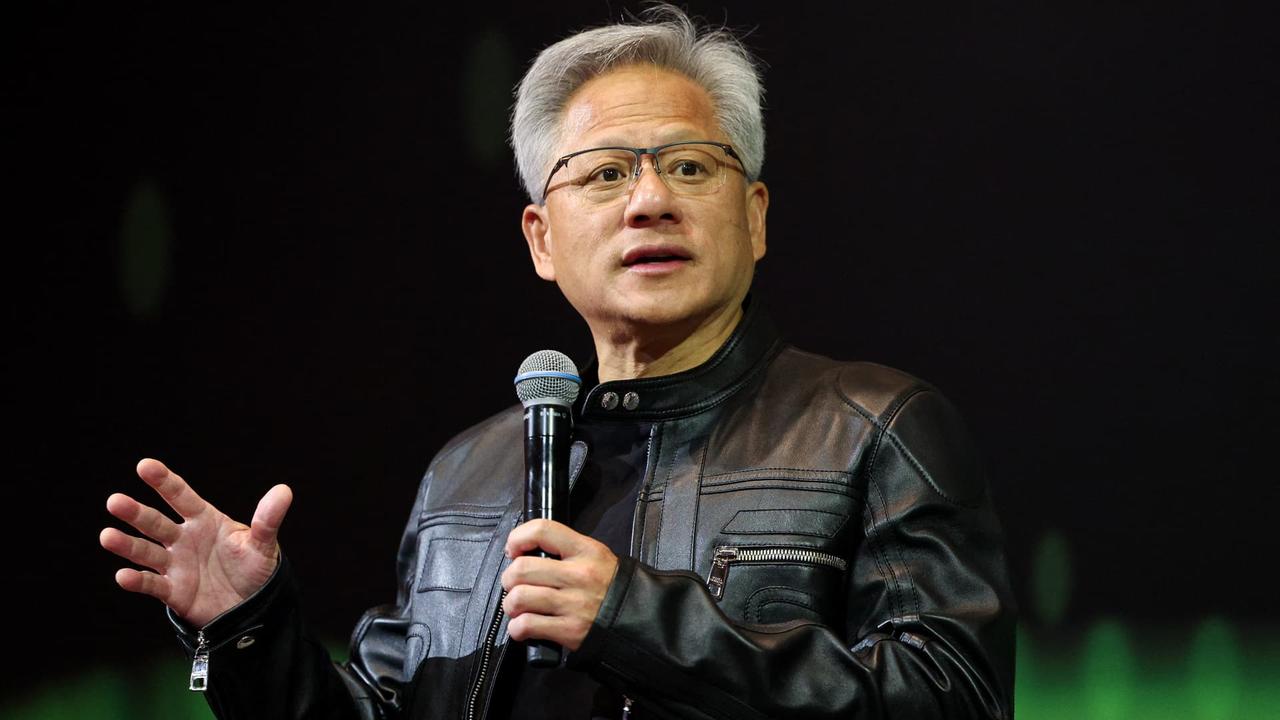

Nvidia's market value surged by $200 billion after strong chip demand, accounting for 44% of a single-day S&P 500 boost. Nvidia Corp's NVDA rally disproportionately influences the S&P 500 index, reflecting concerns over the domino effect due to the integrated semiconductor ecosystem. Nvidia accounted for 25% of the S&P 500's 17% gain in 2024, Reuters reports. The chip designer has risen by 166% in the last 12 months as Big Techs, including Microsoft Corp MSFT, Amazon.Com Inc AMZN, and Google parent Alphabet Inc GOOG GOOGL, splurge on their artificial intelligence ambitions. Also Read: AMD Gains Ground in AI Chip Market, Oracle Exec Confirms Growing Demand: Report The rising valuation of NvidiaNVIDIA in 2024 has helped boost the wealth of Jensen Huang, the co-founder and CEO of the company that was once created inside a Denny's restaurant. Huang has a wealth of $90.5 billion, ranking 18th according to Bloomberg. While Huang hasn't cracked the top 10 list yet and would currently need to hit a wealth of $130 billion, the Nvidia co-founder is one of the fastest risers among the world's richest people. Huang's wealth is up $46.4 billion year-to-date in 2024. That figure is more than the combined $41.83 billion gained by Elon Musk, Jeff Bezos and Bill Gates. Musk, Bezos and Gates currently rank first, second and fifth, respectively, with their current wealth and year-to-date gains. Elon Musk: $237 billion, +$7.73 billion year-to-date Jeff Bezos: $195 billion, +$17.9 billion year-to-date Bill Gates: $157 billion, +$16.2 billion year-to-date The gain by Huang is one of the largest year-to-date gains, trailing only Meta Platforms CEO Mark Zuckerberg, who is up $49.9 billion and listed fourth at $178 billion. It's not just personal wealth - due to the AI frenzy, Huang expects hyper-scale customers to produce $5 in rental revenue for every $1 spent on Nvidia's infrastructure. He also reiterated that Blackwell-based products will ship in the fourth fiscal quarter. This indicates that Nvidia stock losing value would impact the S&P500 and Huang's wealth. However, Huang had snubbed geopolitical tensions surrounding supplier Taiwan Semiconductor Manufacturing Co TSM, voicing the possibility of switching suppliers. Microsoft, Apple Inc AAPL, and Nvidia have a combined weighting of 20% in the S&P 500. Microsoft gained 31%, and Apple has risen 22% in the last 12 months as they remain invested in their AI goals. Investors can gain exposure to Nvidia and the S&P 500 through SPDR S&P 500 SPY and iShares Core S&P 500 ETF IVV. Price Action: NVDA stock closed lower by 1.95% to $116.78 on Monday. Also Read: Taiwan Semiconductor's Strong August Sales Hint at Big Gains Ahead, AI and iPhone Demand Fuel Optimism Image via Shutterstock Market News and Data brought to you by Benzinga APIs

[2]

Nvidia's stock market dominance fuels big swings in the S&P 500

NEW YORK - Nvidia's huge stock rally is still exerting an outsized influence over the S&P 500 index, reinforcing concerns that broader markets could be hurt if the chipmaking giant's fortunes turn. This year's 140% surge in shares of Nvidia, whose chips are seen as the gold standard in artificial intelligence applications, has accounted for about a quarter of the S&P 500's 17% gain. Nvidia showed its powerful hold over Wall Street on Wednesday, when the stock's 8.2% rally helped drive the S&P 500 to its biggest intraday upswing in nearly two years. The index reversed a 1.6% loss to end the day up 1.1%. Nvidia jumped after CEO Jensen Huang flagged strong demand for the company's chips, boosting its market value by more than $200 billion and accounting for 44% of the S&P 500's surge that day, data from Nomura showed. Nvidia's rally "got the whole market moving," said Chris Murphy, co-head of derivative strategy at Susquehanna Financial Group. The S&P 500 has struggled to make headway this year on Nvidia's down days, eking out gains only 13% of the time when the chipmaker's shares have closed weaker, a Reuters analysis showed. This year, the index has failed to rise more than 1% on any day when Nvidia's shares ended lower. In 2020, there were 13 such instances. For many investors, the recent moves revived worries over a small cohort of stocks dictating the market's direction. Microsoft, Apple and Nvidia have a combined weighting of nearly 20% in the S&P 500, though shares of the first two have gained far less this year than Nvidia's. While recent strength in non-tech sectors has stirred hopes of a broadening rally, a sustained sell-off in any of the tech megacaps could still badly hurt broader markets, analysts said. "If Nvidia is weak because demand for their product goes down then that's going to tank the whole market," said Susquehanna's Murphy. OPTIONS BOOST Traders are keeping a close eye on Nvidia's options, which have played a major role in boosting recent moves. Nvidia recently accounted for about 22% of the overall volume of individual stock options traded daily, up from around 5% at the start of the year, making it the most actively traded stock in the options market on most days, Trade Alert data showed. Nvidia's gains are amplified when traders rush into upside call options. When buying of these options surges, market makers who sell these contracts are on the hook to buy and deliver more Nvidia shares at the agreed price, leaving them "short gamma," in options parlance. The additional purchases to cover risk lift the stock even higher. "You do see the market keen to buy upside calls when it's working," said Chris Weston, head of research at online broker Pepperstone. "When it's hot, these flows absolutely make a difference." Nvidia is not the first stock to have such a powerful sway over the rest of the market. Tesla, another favorite of nonprofessional traders, displayed similar characteristics a few years ago when the options market amplified the electric vehicle maker's stock swings, Nomura strategist Charlie McElligott said. But AI seems to have stirred the imagination of investors even more than EVs. "The mania that is the actual paradigm shift which AI represents across the corporate landscape, is just making it a magnitudes-larger theme," he said. "Tesla was never close to that." "AI is just its own animal," McElligott said. (Reporting by Saqib Iqbal Ahmed; Editing by Ira Iosebashvili and Richard Chang)

[3]

Nvidia's Immense Market Power Is Worrying Investors -- Here's Why

When Nvidia stock fluctuates, it noticeably impacts the broader market -- and this link has investors wondering what would happen if demand slows or shifts away from Nvidia's AI chips. Nvidia has jumped 140% year-to-date -- and made up about one-fourth of the entire S&P 500's 17% overall gain. In June, Nvidia had an even higher impact on the index's returns, making up over a third of overall returns. Demand for the company's AI chips is so high that CEO Jensen Huang says it is his biggest worry. Related: Why Are Nvidia Earnings So Important? They Could Be a 'Market Mover,' Says Expert Though Nvidia stock could rally further this week if the Federal Reserve cuts interest rates, any boost could also reinforce concerns about the AI giant's undeniable influence on the index, and what may happen to the market if demand slows or shifts away from Nvidia's AI chips. When Nvidia stock fluctuates, it noticeably impacts the broader market; Nvidia's drops accompany declines in markets overall. For example, a low point earlier this month wiped out over $10 billion of Nvidia CEO Jensen Huang's personal wealth in one day and over $279 billion of the company's overall market capitalization. The Nasdaq also dropped by 3.3% and the S&P 500 by 2.1% that day. In contrast, when shares grew over 30% across the two weeks ending August 21, Nvidia's market capitalization grew by $750 billion and lifted the Nasdaq by over 7%. Swings in Nvidia's stock price "could influence broader indices like the Nasdaq 100 and S&P 500, given their strong correlation with Nvidia shares," Lukman Otunuga, senior market analyst at online trader FXTM, told Entrepreneur in an email before Nvidia's second-quarter earnings report in August. Related: Nvidia CEO Jensen Huang's Biggest Worry Shows that Success Has a Downside Nvidia's performance has a deeper impact: It affects investors' perceptions of AI demand as a whole. The four companies that comprise over 40% of Nvidia's profits are Amazon, Google, Meta, and Microsoft -- so if Nvidia's earnings are up, interest in AI parts among major players is too. Nvidia posted second-quarter profits of $16.6 billion last month, beating expectations of $15 billion. It had its fourth quarter in a row of triple-digit growth. The AI chipmaker had a market cap of around $2.866 trillion at the time of writing and was the third-largest company by market cap in the world.

[4]

Nvidia's stock market dominance fuels big swings in the S&P 500

Nvidia showed its powerful hold over Wall Street on Wednesday, when the stock's 8.2% rally helped drive the S&P 500 to its biggest intraday upswing in nearly two years. The index reversed a 1.6% loss to end the day up 1.1%. Nvidia jumped after CEO Jensen Huang flagged strong demand for the company's chips, boosting its market value by more than $200 billion and accounting for 44% of the S&P 500's surge that day, data from Nomura showed. Nvidia's rally "got the whole market moving," said Chris Murphy, co-head of derivative strategy at Susquehanna Financial Group. The S&P 500 has struggled to make headway this year on Nvidia's down days, eking out gains only 13% of the time when the chipmaker's shares have closed weaker, a Reuters analysis showed. This year, the index has failed to rise more than 1% on any day when Nvidia's shares ended lower. In 2020, there were 13 such instances. For many investors, the recent moves revived worries over a small cohort of stocks dictating the market's direction. Microsoft, Apple and Nvidia have a combined weighting of nearly 20% in the S&P 500, though shares of the first two have gained far less this year than Nvidia's. While recent strength in non-tech sectors has stirred hopes of a broadening rally, a sustained sell-off in any of the tech megacaps could still badly hurt broader markets, analysts said. "If Nvidia is weak because demand for their product goes down then that's going to tank the whole market," said Susquehanna's Murphy. OPTIONS BOOST Traders are keeping a close eye on Nvidia's options, which have played a major role in boosting recent moves. Nvidia recently accounted for about 22% of the overall volume of individual stock options traded daily, up from around 5% at the start of the year, making it the most actively traded stock in the options market on most days, Trade Alert data showed. Nvidia's gains are amplified when traders rush into upside call options. When buying of these options surges, market makers who sell these contracts are on the hook to buy and deliver more Nvidia shares at the agreed price, leaving them "short gamma," in options parlance. The additional purchases to cover risk lift the stock even higher. "You do see the market keen to buy upside calls when it's working," said Chris Weston, head of research at online broker Pepperstone. "When it's hot, these flows absolutely make a difference." Nvidia is not the first stock to have such a powerful sway over the rest of the market. Tesla, another favorite of nonprofessional traders, displayed similar characteristics a few years ago when the options market amplified the electric vehicle maker's stock swings, Nomura strategist Charlie McElligott said. But AI seems to have stirred the imagination of investors even more than EVs. "The mania that is the actual paradigm shift which AI represents across the corporate landscape, is just making it a magnitudes-larger theme," he said. "Tesla was never close to that." "AI is just its own animal," McElligott said. (Reporting by Saqib Iqbal Ahmed; Editing by Ira Iosebashvili and Richard Chang)

Share

Share

Copy Link

NVIDIA's remarkable growth in the AI chip market has led to significant gains in the S&P 500 and increased market volatility. The company's success has also propelled its co-founder, Jensen Huang, to become one of the fastest-growing billionaires.

NVIDIA's Unprecedented Impact on S&P 500

NVIDIA, the AI chip giant, has emerged as a powerhouse in the stock market, contributing to a staggering 25% of the S&P 500's gains in 2024

1

. This remarkable performance has not only bolstered the broader market but also highlighted the growing influence of AI-focused companies on global financial indices.Market Volatility and NVIDIA's Dominance

The company's outsized impact on the S&P 500 has led to increased market volatility. NVIDIA's stock movements have become a significant factor in the index's daily fluctuations, with the company accounting for about 15% of the S&P 500's daily moves

2

. This level of influence is unprecedented for a single stock and has raised concerns among investors about market concentration.AI Chip Demand Fuels Growth

The surge in NVIDIA's stock price is primarily attributed to the soaring demand for its AI chips. As companies worldwide rush to adopt AI technologies, NVIDIA's specialized hardware has become essential for powering these advanced systems

3

. This demand has not only driven NVIDIA's success but has also had a ripple effect on the entire tech sector.Jensen Huang's Rising Fortune

NVIDIA's co-founder and CEO, Jensen Huang, has seen his personal wealth skyrocket alongside the company's success. Huang has become one of the fastest-growing billionaires, with his net worth increasing by approximately $9.6 billion in 2024 alone

1

. This rapid accumulation of wealth underscores the lucrative nature of the AI industry and its potential for creating immense value.Related Stories

Investor Concerns and Market Dynamics

While NVIDIA's success has been celebrated, it has also raised concerns among investors about the sustainability of such growth and its impact on market dynamics. The concentration of gains in a single stock has led to discussions about the need for diversification and the potential risks associated with overreliance on AI-driven companies

4

.Global Impact and Future Outlook

NVIDIA's influence extends beyond the U.S. market, affecting global stock indices and investor sentiment worldwide. As AI continues to reshape industries, NVIDIA's position as a key player in this technological revolution suggests that its impact on financial markets may persist in the foreseeable future. However, investors and analysts remain vigilant, watching for any signs of market saturation or increased competition in the AI chip sector.

References

Summarized by

Navi

Related Stories

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology