Nvidia's AI Servers from Mexico Likely to Dodge U.S. Tariffs, Analysts Say

3 Sources

3 Sources

[1]

Nvidia may avoid recent tariffs on its AI servers -- 60% of Nvidia servers pass through Mexico, may be exempt from Trump tariff flurry

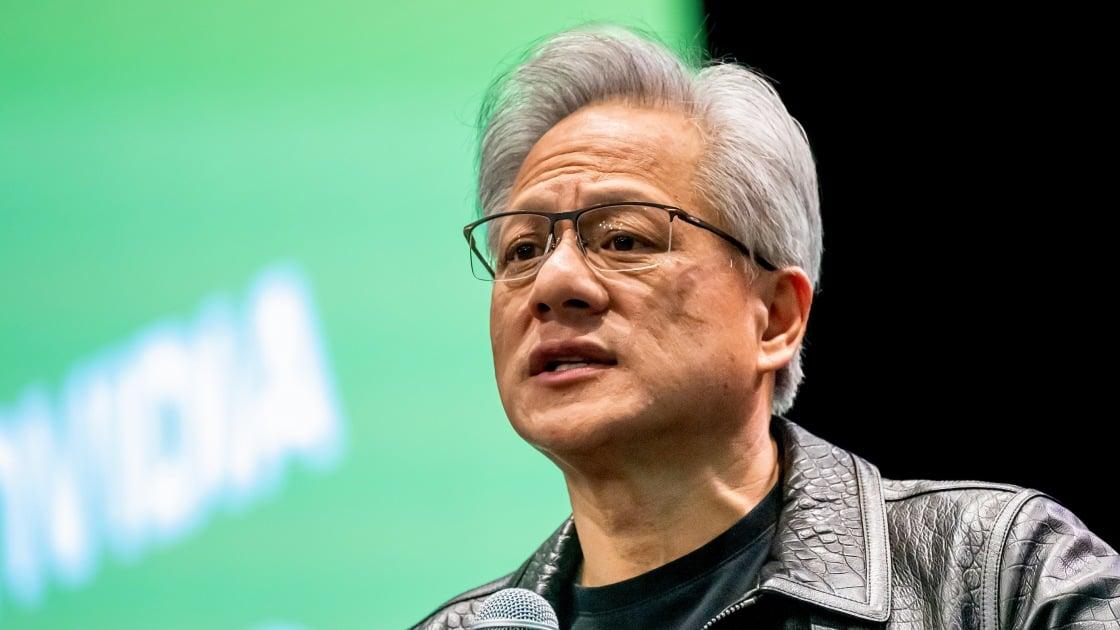

Around 60% of Nvidia's DGX and HGX AI datacenter servers may completely avoid recent U.S. tariffs, thanks to their production in Mexico. Stacy Rasgon, writing for Bernstein Private Wealth Management and one of the market's top chip analysts, found that the majority of Nvidia's datacenters going to U.S. hyperscalers might just arrive tariff-free. In a memo sent to Bernstein clients, Rasgon highlighted fears from investors over the oncoming fate of Nvidia, as while semiconductors have been largely exempted from the "Liberation Day" tariff sweep, server hardware has not. "Analysis suggests the majority of [Nvidia's] US AI server shipments likely come from Mexico," writes Rasgon. Nvidia's own export regulations website highlights that Nvidia's DGX and HGX servers are sorted under the U.S.'s Harmonized Tariff Schedule (HTS) codes within categories that are exempt from U.S.-Mexico tariffs (8471.50 and 8471.80). This is thanks to the USMCA trade agreement between the U.S., Canada, and Mexico signed in Trump's first term, which lists digital and automatic data processing units as compliant product tags exempt from new tariffs. It should be noted that the 60% estimate is not an exact percentage. The United States' import data for server-related categories 8471.50 and 8471.80 shows $73 billion of imports in 2024, with around 60% coming from Mexico, and around 30% from Taiwan. This is the data for all server imports entering the United States in 2024, not just Nvidia, though Nvidia's market dominance suggests that this general ratio represents the GPU maker appropriately. While Nvidia consumer-grade GPUs also fall under protection from tariffs within USMCA, it is unlikely that Nvidia's consumer supply chain flows through Mexico as much as its server hardware does, though the USMCA agreement may see use as a loophole for companies like Nvidia if tariffs continue to increase. Jensen Huang, longtime Nvidia CEO, has been optimistic about Nvidia's standing in the face of the threat of tariffs. During GTC 2025, Huang claimed, "In the near term, the impact of tariffs will not be meaningful." This bold confidence seemed laughable after Nvidia stock took a terrible stock tumble, but it seems prescient now. Nvidia's server footprint in Mexico is large, and is set to grow even larger as Foxconn completes production this year on its Chihuahua plant dedicated to manufacturing more Nvidia server hardware. While Nvidia's outlook for AI server imports looks rosy, the average gamer and tech enthusiast will suffer in the wake of new tariffs issued from the United States government. U.S. PC system integrators, especially boutique brands, are set to increase prices by at least 20% in response to tariffs, as price increases come for virtually all consumer PC components. Time will tell whether the new wave of tariffs will last long, but as long as they do, hyperscalers can breathe easy while PC consumers may begin to sweat.

[2]

Nvidia AI servers coming from Mexico could be partially exempt from Trump's tariffs

Silver Lining: Nvidia has been significantly impacted by the tariffs introduced by Donald Trump on April 2. The company sources nearly all of its GPU products from TSMC and is likely to face price increases in the near future. However, according to market analysts, data center servers for AI workloads could partially avoid the new tariffs. The technology industry is still grappling with the aftermath of the new economic policy imposed by the US administration on its traditional partners and competitors. Meanwhile, analysts are trying to determine whether some of the most popular tech stocks could show resilience in the face of the resulting financial shock. According to Stacy Rasgon, senior analyst at Bernstein Research, a majority of Nvidia's AI data center servers may, in fact, avoid the recently introduced Trump tariffs. The potential impact of tariffs on Nvidia's AI data center products has been one of the most frequently asked questions since Trump's announcement, Rasgon noted. So far, semiconductor products have been exempt from reciprocal tariffs, the analyst explained. However, Nvidia primarily sells "core hardware," which could fall under the scope of the new tariff measures. One possible loophole may lie in the United States-Mexico-Canada Agreement (USMCA), the free trade deal signed by Donald Trump and enacted on March 13, 2020. Products manufactured in Mexico that meet USMCA requirements remain exempt from the latest tariffs. Rasgon pointed out that Nvidia builds its AI data center systems in Mexico, which could help shield them from tariff-related price hikes. Thanks to Nvidia's own data on export regulation compliance, we can trace where its manufactured parts originate. According to Rasgon, the majority of Nvidia's server shipments - including DGX and HGX systems - come from Mexico, with approximately 60 percent manufactured on-site and another 30 percent produced in Taiwan. Given the AI industry's heavy reliance on Nvidia hardware, it's safe to assume that a significant majority of AI servers are currently routed through Mexico. The USMCA indicates that these product categories are compliant with the agreement and should therefore be exempt from the latest tariffs imposed by US authorities. Nvidia and its manufacturing partners are ramping up production in Mexico, meaning the proportion of tariff-exempt products is expected to grow over time. At the company's annual GTC conference, Nvidia CEO Jensen Huang stated that the impact of tariffs would not be "meaningful" in the near term. Huang was likely alluding to the expanded Mexico operations, where Foxconn is scaling up manufacturing to better support Nvidia's growing hardware demands.

[3]

Nvidia's Mexico-Made AI Servers Likely Exempt From US Tariffs: Analyst

While Nvidia's AI server products assembled in Mexico are likely exempt from U.S. tariffs, such products that are made in Taiwan will be subject to the imminent 32 percent import tax the White House announced on Taiwanese goods last week, according to Bernstein Research. While U.S. tariffs are expected to impact Nvidia's AI server products that are sourced from Taiwan, such products coming from Mexico -- which represent most of its U.S. shipments -- are believed to be exempt from import taxes, according to a Wall Street analyst firm. In a Monday research note, Bernstein Research said that Nvidia's Mexico-sourced AI server products such as the DGX servers and HGX server boards "should be exempt" from U.S. tariffs because they're covered under the U.S.-Mexico-Canada trade agreement. [Related: 'Confusion,' 'Uncertainty,' 'Pain': Solution Providers Grapple With Trump's Tariff Regime] However, the 32 percent tariff that is set to hit Taiwanese goods on Wednesday is expected to impact Nvidia's AI server products built in the island nation, Stacy Rasgon, Bernstein's managing director and senior analyst for U.S. semiconductors, told CRN in an email. An Nvidia spokesperson declined to comment. Bernstein said most of the AI servers Nvidia ships to the U.S. "likely come from Mexico." This is based on U.S. import data showing that roughly 60 percent of AI servers come from Mexico and the other approximately 30 percent arrive from Taiwan, which covers more than just Nvidia but is "probably representative" of its activity, according to Bernstein. Nvidia's level of AI server production in Mexico is "likely" to rise as the company's suppliers build more plants in the country, the analyst firm said. Foxconn, for example, is building a $900 million assembly plant for servers using Nvidia's Grace Blackwell GB200 Superchips, and it's expected to open by early 2026, Bloomberg reported last month. Bernstein called the exemption for Mexico-sourced AI servers "one (small) silver lining amid the recent chaos" caused by Trump's ever-changing posture on tariffs. "Among the many questions we fielded last week, one of the most frequent involved whether or not [Nvidia's] AI data center products would be subject to tariffs," it said. The president's tariff regime expanded last Wednesday with so-called "reciprocal tariffs" targeting roughly 60 countries and regions, including Taiwan, in a move Trump said is meant to boost the U.S. economy and "protect American workers." The across-the-board tariffs have prompted at least some targeted countries and regions to seek new trade deals with the U.S. This includes Taiwan, whose president vowed on Sunday to lower tariffs on U.S. goods to zero and boost its investments in the country. Trump's escalation on tariffs came a little more than two weeks after Nvidia CEO Jensen Huang pitched the next stage of growth for the company, which more than doubled revenue to $130.5 billion last year due to ramping AI development across the tech industry. "The amount of computation we need at this point as a result of agentic AI, as a result of reasoning, is easily 100 times more than we thought we needed this time last year," Huang said last month at Nvidia's GTC 2025 event, where the AI computing giant revealed an expanded road map of AI server products through 2028. An executive at a top U.S. Nvidia channel partner told CRN on Monday that he wished he had a "decoder ring" to figure out how tariffs will impact pricing for the Nvidia-based products his company sells, as he has been "asking about this almost every day." "There hasn't been any impact stated to us yet, especially around DGX, which is most of my interest," said Andy Lin, CTO and vice president of strategy and innovation of Houston-based Mark III Systems, which won in the 2025 Americas Nvidia Partner Network awards. Nvidia's OEMs, on the other hand, have told Lin's company that "things are really dynamic and that they're going to change," he said. Without any immediate answers, Lin said Mark III has already seen a couple orders for Nvidia-based products from customers since Friday out of fear that prices could go up. "The rationale was, 'We don't want to gamble. We want to buy right now,'" he said. Lin said he's been telling customers that "nobody really knows what's about to happen as far as pricing, and any of the proposals that we're putting in front of them are subject to change." "We're obviously going to do our part to make sure it's stable, because many of these expenditures are significant for them," he said. "But obviously we're just an amplification of the current state of the economy in the space." Lin said he hopes the U.S. government exempts AI servers from tariffs because of how strategic AI infrastructure is to "where the United States wants to go." "It would be completely self-defeating to also apply tariffs to those, especially when you're trying to compete," he said.

Share

Share

Copy Link

Nvidia's AI servers manufactured in Mexico may be exempt from recent U.S. tariffs due to the USMCA trade agreement, potentially shielding a significant portion of the company's AI hardware from import taxes.

Nvidia's AI Servers May Avoid Recent U.S. Tariffs

In a surprising turn of events, Nvidia, the leading AI chip manufacturer, may find itself partially shielded from the recent wave of U.S. tariffs. According to market analysts, a significant portion of Nvidia's AI datacenter servers could avoid these import taxes due to their production in Mexico

1

.The Mexico Connection

Stacy Rasgon, a top chip analyst from Bernstein Private Wealth Management, has revealed that approximately 60% of Nvidia's DGX and HGX AI datacenter servers destined for U.S. hyperscalers may arrive tariff-free

1

. This exemption is possible thanks to the United States-Mexico-Canada Agreement (USMCA), a free trade deal signed during the Trump administration2

.USMCA and Tariff Exemptions

The USMCA trade agreement lists digital and automatic data processing units as compliant products exempt from new tariffs. Nvidia's export regulations website confirms that their DGX and HGX servers fall under the U.S. Harmonized Tariff Schedule (HTS) codes within categories exempt from U.S.-Mexico tariffs

1

.Production Distribution

While the exact percentages may vary, U.S. import data for server-related categories shows that around 60% of imports come from Mexico, with approximately 30% originating from Taiwan

1

2

. This distribution is believed to be representative of Nvidia's production patterns, given the company's market dominance in AI hardware.Expanding Mexican Operations

Nvidia and its partners are ramping up production in Mexico, which could further increase the proportion of tariff-exempt products. Foxconn, for instance, is constructing a $900 million assembly plant in Chihuahua, Mexico, dedicated to manufacturing Nvidia server hardware

3

.Impact on Consumer Products

While Nvidia's AI servers may dodge the tariff bullet, the same cannot be said for consumer-grade GPUs and other PC components. U.S. PC system integrators, especially boutique brands, are expected to increase prices by at least 20% in response to the new tariffs

1

.Related Stories

Industry Reactions and Concerns

The tech industry is still grappling with the aftermath of the new economic policy. Andy Lin, CTO of Mark III Systems, a top U.S. Nvidia channel partner, expressed uncertainty about how tariffs will impact pricing for Nvidia-based products. Some customers have already placed orders out of fear that prices could increase

3

.Nvidia's Optimism

Jensen Huang, Nvidia's CEO, has maintained an optimistic outlook. During the company's annual GTC conference, Huang stated that the impact of tariffs would not be "meaningful" in the near term

2

. This confidence, initially met with skepticism, now appears to have been well-founded given the revelations about Nvidia's Mexican operations.Future Implications

As the situation continues to evolve, the tech industry watches closely. The exemption of AI servers from tariffs could be crucial for maintaining the United States' competitive edge in AI development. However, the full impact of these tariffs on the broader tech ecosystem remains to be seen, with potential ripple effects across the industry and for consumers.

References

Summarized by

Navi

[1]

Related Stories

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology