Nvidia's CES 2025 Showcase Sparks Market Volatility Despite AI Advancements

34 Sources

34 Sources

[1]

Nvidia's CES Setback Mirrors 2007 iPhone Launch, Says Dan Ives: 'Jensen Plays Chess While Others Are Playing Checkers' - NVIDIA (NASDAQ:NVDA), IonQ (NYSE:IONQ)

NVIDIA Corp. NVDA shares fell 6.22% on Tuesday following CEO Jensen Huang's CES 2025 keynote, prompting Wedbush Securities Managing Director Dan Ives to draw parallels with another transformative tech moment - Apple Inc.'s iPhone launch in 2007, which initially saw minimal market reaction before driving a 15.9% surge in the following month. What Happened: "The only thing that could compare would maybe be the iPhone launch in 2007. I'm trying to give you an example of how different the energy was -- there was something new, something transformational," Ives told Yahoo Finance on Wednesday, suggesting the market response might similarly underestimate Nvidia's long-term impact. "None of this happens without Jensen and Nvidia. The bears who've missed every major tech transformation in the last 20 years are now hyper-focused on things like geopolitical risks and the 10-year at 5%." Huang's comments about quantum computing's practical implementation being 15-30 years away triggered a broader sector selloff, with IonQ Inc. IONQ dropping 10.75% and Rigetti Computing Inc. RGTI falling 13% on Wednesday. Bank of America analyst Vivek Arya maintained a Buy rating with a $190 price target, describing Nvidia as an "end-to-end AI shop," while Benchmark analyst Cody Acree noted the presentation may have been "too technical" for investors seeking near-term guidance. See Also: Palantir CTO Shyam Sankar Challenges Automation's Potential As Selling Pressure Mounts: 'What Have We Been Doing For 20 Years?' What Happened: Ives dismissed concerns about the stock decline, pointing to similar patterns in other tech leaders. "Look at Apple -- it sold off to $190 after WWDC, and then it shot back up to $250-260," he explained. "The reality is, coming out of CES, we should actually be more bullish, given the market opportunities in robotics and autonomy." The analyst emphasized the growing enterprise demand for AI solutions, citing his observations across Asia and Europe. "We're going to see a tidal wave of activity in terms of AI use cases," Ives predicted, noting that IT buyers are ramping up investments not just in consumer applications but across the enterprise sector. Nvidia's stock has surged over 160% in the past year, pushing its market capitalization above $3.5 trillion. Despite near-term volatility driven by macroeconomic concerns including interest rates and inflation, Ives maintains his bullish stance on the company's position in what he describes as a "once-in-40-year revolution with AI." "They're so far ahead of the game, it's pretty insane," Ives added, referencing skepticism in 2022 about Jensen's heavy AI investments over gaming. "Jensen plays chess while others are playing checkers. Blackwell demand is insane." Read Next: SoftBank-Owned Arm Eyes Acquisition Of Oracle-Backed Chip Designer Ampere Computing Amid Nvidia's Dominance: Report Image Via Shutterstock Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. IONQIonQ Inc$32.05-35.4%WatchlistOverviewNVDANVIDIA Corp$138.54-1.14%RGTIRigetti Computing Inc$10.33-43.8%Market News and Data brought to you by Benzinga APIs

[2]

Why Nvidia's record high was followed by a $220B sell-off

Nvidia stock closed at a record high on Monday, its first since November, as investors anticipated CEO Jensen Huang's keynote at CES, igniting excitement around artificial intelligence advancements. During his presentation to an audience of more than 6,000 in Las Vegas, Huang articulated a vision he described as the "era of physical AI." He stated, "The ChatGPT moment for general robotics is just around the corner," emphasizing the untapped potential of AI in physical applications like Nvidia's Cosmos platform. He also highlighted partnerships with major automotive companies, including Toyota and Volvo, utilizing Nvidia's DRIVE Hyperion platform for next-generation autonomous vehicles. According to Huang, building autonomous vehicles, akin to all robots, necessitates three computers: one for training, one for simulation, and one in the vehicle, all powered by Nvidia. Investor enthusiasm helped drive Nvidia's stock to new highs following Huang's bold claims about the future of humanoid robots and self-driving cars. However, a "sell the news" response emerged when Wall Street opened the following day, resulting in a $220 billion decline in market capitalization, marking Nvidia's worst drop in four months. This pattern of reaching record highs followed by sharp corrections is familiar to Nvidia investors. This pattern previously occurred after Nvidia's earnings release on November 20, when the stock climbed above $150 for the first time, only to suffer a subsequent 13% decline. Similarly, a surge to $140 on June 20, 2024, resulted in a 27% sell-off, allowing Microsoft to reclaim the title of the world's largest stock. A disappointing jobs report in February 2024 led to another situation where Nvidia opened at a new record, only to experience its worst return in 10 months and a later pullback of 20%. Following an earnings announcement on August 23, 2023, that lifted Nvidia's stock to a split-adjusted $50, the stock frustrated investors, trading sideways for four months. Despite these fluctuations, Nvidia remains a dominant player in the current bull market, a fact not lost on investors. Paul Meeks, chief investment officer at Harvest Portfolio Management, discussed the company on Yahoo Finance's Morning Brief, suggesting that a future slowdown in Nvidia's growth rate would prompt him to sell. "If you wait for the year-to-year growth slowdown, you're going to [be selling] late. So I'll be looking for that sequential drop in the growth rate," Meeks remarked. When asked about the possibility of Nvidia becoming a $4 trillion company this year, Meeks stated, "I don't think I'm bold enough to say that's definitely going to happen," but acknowledged that it seems inevitable over the next couple of years. In a reflection of investor expectations, Nvidia's significant price drop after Huang's keynote on January 7 marked its worst day since September 3. Despite Huang's compelling discourse on advances in robotics and AI, many investors left wanting more, leading to the sharp decline. This sentiment was discussed in a Yahoo Finance interview with tech analyst Dan Ives, who provided insights on Nvidia's performance and the tech landscape more broadly. Disclaimer: The content of this article is for informational purposes only and should not be construed as investment advice. We do not endorse any specific investment strategies or make recommendations regarding the purchase or sale of any securities.

[3]

Nvidia Stock Drops After Huang's CES Keynote: Analysts Dub It 'End-To-End AI Shop' - NVIDIA (NASDAQ:NVDA)

While Nvidia unveiled new products and shared updates, one analyst said the event may have been too technical and not given enough color. NVIDIA Corporation NVDA analysts are highlighting the company's upcoming product line and growth in segments like robotics and artificial intelligence after CEO Jensen Huang's keynote at the 2025 CES conference. The NVDA Analysts: Benchmark analyst Cody Acree reiterated a Buy rating on Nvidia with a $190 price target. Bank of America analyst Vivek Arya maintained a Buy rating with a $190 price target. Read Also: Nvidia 5000 Series, Product Updates Make It Top Semiconductor Pick Ahead Of Jensen Huang's CES Keynote: Analyst Benchmark on NVDA: Nvidia had a "solid, but somewhat muted CES keynote," Acree said in a new investor note. Acree described Huang's keynote as a "master-class on the current state and direction of the AI industry." However, the announcements might have leaned too heavily on technical details, offering limited clarity for shareholders seeking a near-term outlook on the ramp of Blackwell and its next-generation GPU platform. "We believe many investors were hoping for more concrete progress updates," Acree said. The analyst highlighted the unveiling of the Nvidia 5000 series, focusing on AI agents and the Cosmos platform announcement for autonomous vehicles and robots. Several automotive companies working with Nvidia were named during the keynote. "With platforms spanning training in the cloud to simulation to compute in the car, NVIDIA's automotive vertical business is expected to grow to approximately $5 billion in fiscal year 2026." Are you buying when the CEOs of the Magnificent 7 are selling? Stay in the know with our Insider Trades page -- see when leaders like Mark Zuckerberg, Elon Musk, and Jensen Huang are offloading their own shares. Bank of America on NVDA: Huang's CES keynote showed Nvidia's AI dominance in the cloud, enterprise and consumer segments, Arya said in a new investor note. Arya said highlights in the keynote were the Blackwell accelerators being in full production, expansion of AI reach with the Cosmos platform, automotive market growth, Nvidia-optimized open-source LLMs and a desk-sized personal AI supercomputer called Nvidia DIGITS. "Nvidia continues to expand its well-optimized and targeted lineup of AI services for enterprise customers," Arya said. The analyst said Nvidia is an "end-to-end AI shop," expanding its reach from cloud to enterprise and consumer segments. The unveiling of the RTX 5000 series comes as competitor AMD did not announce its next-gen GPUs during its Monday keynote, despite many expecting a similar announcement, the analyst added. NVDA Price Action: Nvidia stock is down 5.3% to $141.48 on Tuesday versus a 52-week trading range of $49.48 and $153.13. Nvidia stock is up 172% over the last year. Read Next: Jensen Huang Unveils $3000 'Personal AI Supercomputer' The Size Of A Small Book: 'It Runs The Entire Nvidia AI Stack' Image created using photos from Shutterstock. NVDANVIDIA Corp$141.21-5.50%Overview Rating:Good75%Technicals Analysis1000100Financials Analysis600100WatchlistOverviewMarket News and Data brought to you by Benzinga APIs

[4]

Nvidia slides after unveiling leaves investors wanting more

The stock fell 6.2% to $140.14 in New York, marking the biggest single-day decline in four months. Though the Nvidia's latest announcements gave an upbeat view of the company's long-range prospects, there wasn't as much near-term upside as some investors had sought. "Nvidia's announcements today are significant, but long-tailed," Stifel Financial Corp. said in a report.Nvidia Corp. shares slid on Tuesday after a wide-ranging product presentation by Chief Executive Officer Jensen Huang failed to propel the artificial intelligence chipmaker to new heights. The stock fell 6.2% to $140.14 in New York, marking the biggest single-day decline in four months. Though the Nvidia's latest announcements gave an upbeat view of the company's long-range prospects, there wasn't as much near-term upside as some investors had sought. "Nvidia's announcements today are significant, but long-tailed," Stifel Financial Corp. said in a report. Huang took the stage at a packed arena in Las Vegas to kick off the CES trade show on Monday and present the new lineup, offering a vision for how AI will spread throughout the economy. The company wants its products to be the heart of a future tech world with a billion humanoid robots, 10 million automated factories, and 1.5 billion self-driving cars and trucks. Interest in Nvidia's products -- and Huang's forecasts -- has exploded as companies rush to deploy new AI computing gear. The CEO outlined Nvidia's products and strategy to his audience of hundreds for more than 90 minutes, including tie-ups with Toyota Motor Corp. and MediaTek Inc. that sent their shares more than 3% higher. Before the retreat Tuesday, Nvidia's stock had more than tripled in the past 12 months. Asian suppliers, including Taiwan Semiconductor Manufacturing Co. and Hon Hai Precision Industry Co., also surged on optimism about Nvidia's prospects. Chief Financial Officer Colette Kress said during a separate event that the AI transition will continue to drive growth for the next 10 years. "It is going to be with us over the next decade and past that," she said Tuesday during a JPMorgan Chase & Co. chat that coincided with CES. "We still have a lot of growth opportunity in the future for us." During Huang's presentation Monday, he also delivered news to his traditional audience: gamers. Nvidia is launching an update to its GeForce GPUs -- short for graphics processing units -- which were created with the same Blackwell design that the company uses in its AI accelerators, Huang said. New GeForce 50 series cards will take advantage of Blackwell's capabilities to create even more realistic experiences for computer gamers, the company said. While traditional graphics chips build an image by calculating the shade of each pixel in the picture, the new technology will lean more heavily on AI to anticipate what the next frame should look like. "GeForce allowed AI to reach the masses, and now AI is coming home to GeForce," Huang said during the presentation. The flagship RTX 5090 model will be available later this month for $1,999, with less powerful cards following later. The RTX 5070, costing $549, will debut in February with better performance than the prior range's top model, the RTX 4090, Nvidia said. As recently as 2022, gaming was Nvidia's biggest source of sales. Now the chipmaker's data center operation is far larger. It's on course to contribute more than $100 billion this year, as the company's accelerator chips are prized by the world's largest tech companies. The next step is rolling out hardware and software to a larger swath of business and government agencies, helping diversify Nvidia's revenue. Huang announced that Toyota, the world's biggest vehicle maker, is now a customer for Nvidia's autonomous driving AI products and will use its Drive chips and software. Toyota shares in Tokyo extended gains after the announcement. Extending AI into more of the physical world will transform industries worth $50 trillion, Nvidia said. But the move will also bring challenges. Robots and cars will require software that can handle real-life complexities in a safe way. The company has created Nvidia Cosmos to help make robots smarter and produce fully autonomous vehicles, Huang said. Cosmos technology is able to create video from inputs such as text. That video then becomes the basis of virtual training, helping reduce dependence on expensive and time-consuming real-world experimentation. The generated video can be searched and honed so that important but infrequent events -- such as a car's encounter with an emergency vehicle -- can be tested repeatedly. Nvidia also is working with Uber Technologies Inc. to develop self-driving technology. The millions of trips that Uber handles daily will provide a trove of data for training AI models. Mass-market carmakers are going to shift toward using one computer and operating system for their entire model lineup, rather that segmenting systems by the class of vehicle, Nvidia said. That transition will set the table for a wider use of the chip designer's comprehensive offerings, the company believes. To speed that up, Nvidia has had its products certified by government transportation safety organizations. Nvidia is now also offering a desktop PC called Project Digits. The company is equipping the small $3,000 device with a single Grace Blackwell Superchip - a combination of central processor and graphics semiconductor - working with a large chunk of memory and fast connectivity. The idea is to provide developers with hardware capable of running very large AI models, ones that current laptops will struggle to handle. The new machines, developed in partnership with Taiwan's MediaTek, will run a version of the Linux operating system and aren't designed for everyday use. Instead, they're meant to help AI developers work locally when either connecting to the cloud or using conventional computers isn't practical or possible. Nvidia chose MediaTek to help it create the main chip for Digits because of that company's skills at making low-power semiconductors. The Taiwanese company also will offer products containing the technology to other customers, Huang said. When asked whether Project Digits signals that Nvidia wants to get into the PC market more broadly, Huang said that the machine is intended for AI developers and students. But he also hinted that Nvidia has a larger interest in the sector. "Obviously, we have plans," he said during a briefing with financial analysts. "I'm going to have to wait to tell you about that."

[5]

Nvidia stock falls over 6%: What went wrong?

Nvidia stock experienced a sharp decline on Tuesday, falling over 6% to $140.14, marking its worst day since September 3, despite an initial surge following CEO Jensen Huang's keynote at the CES 2025 conference. After briefly touching a record high of $153 shortly after market open, Nvidia's shares reversed direction amid a broader selloff in technology stocks, which saw the S&P 500 decline by 1.1% and the Nasdaq fall by 1.9% due to mounting investor concerns about U.S. fiscal and monetary policies. The drop in Nvidia's stock wiped out more than $220 billion in market value. Other technology firms also faced significant losses, including government contractor Palantir and electric vehicle company Tesla, whose stocks fell by 8% and 4%, respectively. This selloff occurred despite a positive reception from Wall Street regarding Huang's presentation, which emphasized Nvidia's advancements in robotics and its ongoing development of AI hardware and software. Analysts like Hans Mosesmann from Rosenblatt noted Nvidia's capability to enhance its AI leading position, stating that the company continues to innovate in both hardware and software. Huang's keynote highlighted new partnerships, including naming Micron as Nvidia's memory partner for gaming GPUs. He also announced deals to supply semiconductor chips for Toyota's driver assistance programs and technology for autonomous vehicles, including self-driving trucks for Aurora and Uber's autonomous driving initiative using Nvidia's Cosmos platform. CES 2025: Nvidia RTX 5090 brings 2X the power of 4090 After closing at a record high of $149.43 on Monday, Nvidia's stock addition of over 190% from the previous year had analysts such as William Stein from Truist Securities reiterating their Buy ratings, projecting an average price target of $172.80 for the stock over the next 12 months. Nvidia unveiled notable updates during the CES event, including the introduction of a new superchip called GB10, designed for use in a compact new supercomputer, intended to be available for developers and researchers at a price of $3,000 in May. The company also debuted its Cosmos platform, which creates AI models for developing humanoid robots and enhancing autonomous vehicle technology. Huang indicated that the autonomous driving market alone could grow into the first multitrillion-dollar robotics industry. Analysts from Wedbush expect robotics and autonomous technology to represent a potential $1 trillion market for Nvidia. Underwhelming market reactions to Nvidia's CES showcase highlight a tough reality: even AI and robotics leadership can't shield a stock from broader market jitters. The drop to $140, after hitting a record $153 earlier, reflects tech sector vulnerability more than Nvidia's fundamentals. Wall Street loved the GB10 superchip and autonomous vehicle announcements, but fiscal fears had the final say. Nvidia's $220 billion market value wipeout stings, but it doesn't change the company's trajectory in AI or robotics. Jensen Huang laid out a compelling vision for a trillion-dollar robotics market, yet macro concerns over fiscal policies crushed momentum. This wasn't a rejection of Nvidia's story -- it was a market resetting its appetite for risk. Disclaimer: The content of this article is for informational purposes only and should not be construed as investment advice. We do not endorse any specific investment strategies or make recommendations regarding the purchase or sale of any securities.

[6]

Wall Street Bullish on Nvidia Following Advanced AI Development Announcement at CES 2025 - NVIDIA (NASDAQ:NVDA)

Analysts highlight Nvidia's data center growth, AI demand, and $1 trillion infrastructure opportunity as key long-term drivers. Wall Street analysts rerated Nvidia Corp NVDA after it showcased its Blackwell Geforce RTX 50 series product lineup, AI supercomputer Project Digits, and more at the CES 2025. Rosenblatt analyst Hans Mosesmann maintained Nvidia with a Buy and a $220 price target. CEO Jensen Huang and CFO Colette Kress held court with Wall Street yesterday at CES, as investors were still digesting Jensen's keynote in Las Vegas. Mosesmann provided his key takeaways from the Financial Analyst Q&A. The AI movement is moving quickly to Agentic AI (use of iterative planning and reasoning to solve massively complex multi-tasks) from simplistic Gen AI solving a simple query. Also Read: Nvidia Teams Up With MediaTek to Challenge Intel and AMD in Desktop CPU Market The benefits include significant operational efficiencies and outcomes, but the issue is that it requires massive data. The massive data requirements of Agentic AI and the need for better outcomes require three AI compute subsystems that are constantly in iterative mode: Training at scale, Digital tuning (simulation Omniverse and physical AI real-world interaction called Cosmos), and AI deployment or inference. Agentic AI requires not just chip acceleration and CPU know-how but also systems, software, algorithms, and massive engineering resources. Hence, Jensen quipped that not many AI chip startups are doing well. Jensen's vision is that the next wave of AI will require AI co-pilots, assistants, and at-scale complete AI factories (token generators). So, for every manufacturing automobile factory, there needs to be a complete AI factory in constant support. Jensen sees a rough rule of thumb: for every 1 million vehicles, there needs to be at least $1 billion in AI data center support in a brand-new market, and significant investment is required. The $1 trillion existing general-purpose data center footprint needs to accelerate in the next ~4 years. The urgency comes from the current CPU-centered footprint, which is economically unviable in AI workloads. Accelerated computing is margin accretive. The price target reflects ~44 times the P/E multiple to Mosesmann's fiscal 2027 EPS. JP Morgan analyst Harlan Sur reiterated an Overweight rating on Nvidia with a price target of $170. Nvidia continues to execute across all segments, the analyst said. While the first half is typically seasonally weaker than the second, Sur expects solid demand in PC gaming to be a strong revenue driver for the company, offsetting PC OEM, which is in secular decline. The analyst expects the data center segment to grow strongly as hyperscale customers continue to embrace GPU-accelerated deep learning for processing large data sets. Sur remains encouraged by strength in the automotive and enterprise segments. Sur flagged key takeaways from a fireside chat with CFO Colette Kress. Nvidia expects strong spending momentum in the data center sector to continue into calendar 2025, driven by the Blackwell ramp and broad-based demand strength. In the longer term, it expects significant revenue growth opportunities as it captures a larger percentage of the $1 trillion in data center infrastructure installed base. This growth will be driven by the shift to accelerated computing and more demand for AI solutions. Training model complexity, new scaling laws, and test-time computing continue to drive long-term demand sustainability for Nvidia GPUs. Nvidia highlighted a strong competitive advantage over ASIC solutions. Enterprise AI demand remains strong, and adopting agentic AI will likely drive increased inferencing adoption. Price Action: NVDA stock is up 0.18% at $140.45 at the last check on Wednesday. Also Read: Samsung's Outlook Dims Amid HBM Supply Struggles for Nvidia and Sluggish Consumer Chip Sales Image via Shutterstock NVDANVIDIA Corp$140.210.05%Overview Rating:Good75%Technicals Analysis1000100Financials Analysis600100WatchlistOverviewMarket News and Data brought to you by Benzinga APIs

[7]

Nvidia stock tumbles more than 4% after reaching all-time high

The chipmaker's shares were down by more than 4% during late morning trading -- a reverse after climbing 2.5% at the market open and setting a new intraday all-time high of $153.13. The previous day, Nvidia's shares climbed more than 3% to reach a record close of $149.43 per share -- cents higher than its previous record close of $148.88 in early November. The chipmaker's shares rallied Monday ahead of chief executive Jensen Huang's keynote at the Consumer Electronics Show. Huang announced a suite of artificial intelligence tools for AI agents and updates to the chipmaker's robotics efforts at the annual Las Vegas trade show Monday night. The chip leader also unveiled its next generation RTX Blackwell GPUs for gaming ranging between $549 and $1,999. To end the keynote, Huang announced Project DIGITS, a personal AI supercomputer that can run AI models with up to 200 billion parameters -- more than OpenAI's GPT-3. The device, which is aimed toward AI researchers and developers, will be available from Nvidia and its partners in May, and starts at $3,000. The chipmaker designed the AI supercomputer with Taiwanese semiconductor company MediaTek. The chip company's Taiwan-listed shares were up by 4.5% at the market close. Ahead of Huang's keynote, Bank of America (BAC+1.86%) reiterated its "buy" rating on Nvidia in a note, with research analyst Vivek Arya describing CES as "a positive catalyst" for the chipmaker. "[W]hile we don't doubt NVDA's capabilities, we are unsure as to when and how fast they can influence NVDA's financials," Arya said about the chipmaker's robotics strategy. In a note on Tuesday, Bank of America maintained its buy rating on its top pick, and Arya said Huang's keynote highlighted the chipmaker's "continued dominance in genAI compute and ecosystem."

[8]

Nvidia shares slide after hitting a record following new AI chip debut

Nvidia's shares dropped more than 6% on Tuesday amid a broad-based selloff in technology stocks, following a record high reached the previous day after the unveiling of its new AI chips. Nvidia's shares slumped 6.2% on Tuesday after reaching a record high a day ago when the company unveiled a series of new AI chips to power its growth prospects. The decline was partially due to a broad-based selloff in technology stocks amid surging US government bond yields. Despite the drop, the AI powerhouse remained the top performer in the Magnificent Seven stocks, surging 185% year on year and more than 900% in the past two years. The chipmaker is the largest beneficiary of the artificial intelligence boom, with its revenue nearly five-folded in the past five quarters. Nvidia's Data Centre sales, contributing nearly 90% of its total revenue, have repeatedly reached a record over the past eight quarters. At the Consumer Electronics Show (CES) in Las Vegas on Monday, CEO Jessen Huang unveiled the latest generation of graphics processors, the GeForce RTX 50 series, powered by Blackwell. Blackwell is the core product expected to accelerate Nvidia's future growth, which started shipment in the last quarter of 2024. However, the RTX 50 chips are particularly designed to improve gaming performance by boosting gaming frame rates. The RTX 50 series will be available preinstalled in computers priced between $550 (€531.10)and $2,000 (€1931.3). This may be a little less impressive for investors. Gaming revenue only contributes 9% of its total revenue, according to its latest quarterly report. Before 2022, the gaming segment was the primary revenue source for Nvidia, especially driven by the pandemic's stay-at-home effect. Meanwhile, the chipmaker also announced Project Digits - "a personal AI supercomputer that provides AI researchers, data scientists and students worldwide with access to the power of the NVIDIA Grace Blackwell platform". This marks a potential strategic move to expand Nvidia's presence in the PC market. The Project Digits featured the new GB10 Grace Blackwell Superchip, a compact AI chip capable of running 200 billion parameter models. Traditionally, such high-performance chips require large-scale hardware, but Nvidia's innovation delivers a desktop-sized solution system will be a pro option for developers to complete their jobs wherever they want. This portability is expected to appeal to developers seeking flexibility in their work environments. The system will be available in May, with prices starting at $3,000 (€2896.9). MediaTek, a Taiwanese tech company that specialises in making power-efficient semiconductors, partners with Nvidia in the project. "AI will be mainstream in every application for every industry. With Project DIGITS, the Grace Blackwell Superchip comes to millions of developers", said Huang. "Placing an AI supercomputer on the desks of every data scientist, AI researcher and student empowers them to engage and shape the age of AI." Nvidia's revenue surge over the past two years has been heavily reliant on hyperscaler customers, such as Amazon, Microsoft, and Alphabet, which together account for 50% of its revenue. At the October quarter earnings call, CEO Jensen Huang highlighted that the AI industry is "large and diverse". He previously mentioned Nvidia's strategy to diversify its product offerings across a range of industries, including consumer internet, automotive, and healthcare, rather than focusing exclusively on cloud businesses. At CES 2025, the company also emphasised its ambition to make its products broadly adopted in the future tech world, including robots and self-driving cars, and AI development tools. It has launched Nivida Cosmos, a computing platform that aids physical AI development in autonomous vehicles and robots. Josh Gibert, an analyst at eToro believes that Nvidia remains on the course of a robust growth trajectory. "He (Jensen Huang) laid out a very clear roadmap of what's ahead, detailing new products and the AI vision ahead', he said, adding that the company's growth "doesn't look to be slowing down and February's results are likely to reflect that".

[9]

What Nvidia CEO's Latest AI Technology Unveiling Means for Investors

Bank of America analysts called the stock a "top pick," citing the chipmaker's AI dominance, anticipating further gains this year after shares nearly tripled in value in 2024. Nvidia (NVDA) CEO Jensen Huang kicked off this year's consumer electronics trade show with a slew of artificial intelligence (AI) announcements Monday, in a blockbuster address that had analysts calling the chipmaker's stock a "top pick" on its AI leadership. Shares hit an all-time high of $153.13 shortly after the open, before reversing course as part of a broader market decline. The stock was down 5.3% to $141.50 in recent trading, after closing at a record high Monday ahead of the event. "There was a lot here I think for people to get excited about. I don't think the price action today really has much to do with anything that Jensen said or didn't say yesterday," said Bernstein analyst Stacy Rasgon in an interview with CNBC Tuesday morning. Rasgon cited the broader issues affecting the market and said there was likely some profit-taking after the stock hit new highs. During Monday's event, Nvidia revealed new chips in its GeForce RTX 50 series for AI PCs that run on Nvidia's Blackwell architecture, among a flurry of other announcements. The GeForce RTX 50 lineup, which includes the RTX 5070, RTX 5070 Ti, RTX 5080, and RTX 5090, range from about $550 to $2,000, with some desktop models holding the chips slated to launch later this month, and laptops expected in March. Nvidia also introduced AI foundational models for its RTX AI PCs, and unveiled its Cosmos platform meant to support processing pipelines for robots, autonomous vehicles, and vision AI. Huang called Cosmos a "game-changer for robotics and industrial AI," and said he expects "the ChatGPT moment for general robotics is just around the corner," with a shoutout to ridesharing giant Uber (UBER) and Chinese electric vehicle maker XPeng (XPEV) as early adopters of Cosmos. "The autonomous vehicle revolution is here," Huang said, highlighting partnerships with Toyota (TM) and Aurora Innovation (AUR) on autonomous driving as well. In a note to clients after the event, Bank of America analysts called Nvidia a "top pick," citing its "continued AI dominance" and growing reach across different enterprise and consumer segments. The analysts maintained a "buy" rating and $190 price target, a roughly 35% premium from the stock's intraday price, after nearly tripling in value in 2024. They're not the only ones bullish on Nvidia's trajectory. All but one of the 21 analysts covering the stock tracked by Visible Alpha maintain a "buy" or equivalent rating as of Tuesday, with a consensus price target of $177, implying 25% upside. Wedbush analysts, who wrote Monday's event "felt more like a rock concert vibe than a tech CEO speech," said the robotics and autonomous tech market could present another $1 trillion opportunity for Nvidia over the next few years. They projected Nvidia's market value to exceed $4 trillion, and could even hit $5 trillion in the next year and half -- levels no company has reached yet. The company currently has a market capitalization of about $3.5 trillion.

[10]

Nvidia Stock Closed Tuesday Down 6% After Hitting All-Time Highs: What Happened? - NVIDIA (NASDAQ:NVDA)

Despite hitting new highs, Nvidia shares close Tuesday down more than 6%. Nvidia Corporation NVDA shares traded lower on Tuesday following product announcements made during CES 2025. Broader weakness across markets following economic data Tuesday morning also appears to have weighed on shares. Here's what you need to know. What To Know: Nvidia shares briefly hit new all-time highs in pre-market trading Tuesday as investors cheered CEO Jensen Huang's keynote address, which included several new product announcements. Product Announcements: Cosmos Foundation Models: At CES 2025, Nvidia introduced Cosmos, a synthetic AI model designed to generate photorealistic video for training robots and self-driving cars. This technology aims to lower costs by reducing the need for traditional data-gathering methods like physical road testing or manual training. RTX 50 Series Gaming Chips: The company unveiled the RTX 50 series, powered by Blackwell AI technology, designed to enhance gaming graphics with more realistic textures and human facial detail generation. The new chips are priced between $549 and $1,999, with high-tier models arriving Jan. 30 and lower-tier models coming in February. Project DIGITS Desktop: Nvidia also revealed its first desktop computer, Project DIGITS, tailored for AI developers. Priced at $3,000, the desktop model runs Nvidia's data center hardware and will be available in March 2025. Nvidia also announced a partnership with Toyota to integrate its Orin chips and software into advanced driver-assistance systems for several vehicle models. The company expects automotive hardware and software revenue to grow from $4 billion in 2025 to $5 billion in fiscal 2026. Huang discussed the potential of the Cosmos foundation models, likening their impact on robotics to the transformation large language models have brought to enterprise AI. Huang expressed confidence in these advancements, especially the cost-saving benefits for training robots and cars. Despite the launch of innovative products, including gaming chips, AI tools and automotive technologies, the stock's decline reflects broader investor skepticism. Broader market indices sold off on Tuesday after the Institute for Supply Management released data showing a surprise surge in prices. The ISM's Services PMI climbed to 54.1% in December, versus estimates of 53.5%, and the ISM Prices index jumped to 64.4%, well above estimates of 57.5%, suggesting inflation continues to be sticky. The SPDR S&P 500 SPY closed Tuesday down 1.12%, while Nvidia shares traded down from around $153 to around $140 by the end of the day. Analyst Take: Bank of America's Vivek Arya highlighted the challenge of scaling robotics into a reliable and cost-effective business, comparing it to niche markets like the metaverse. He noted that while these technologies are promising, it's not clear if they will lead to substantial revenue growth. Arya maintained a Buy rating and price target of $190. Benchmark analyst Cody Acree also reiterated a Buy rating and price target of $190 Tuesday morning. NVDA Price Action: Nvidia shares closed Tuesday down 6.22% at $140.84, according to Benzinga Pro. Read Next: Why PepsiCo Is An Opportunity For Investors With A Long-Term Time Horizon Photo: courtesy of Nvidia. Market News and Data brought to you by Benzinga APIs

[11]

What Analysts Think of Nvidia Stock Ahead of CEO Jensen Huang's CES Keynote

The event is seen as a potential growth catalyst for Nvidia, even after the company's shares surged about 170% in 2024. Nvidia (NVDA) Chief Executive Officer (CEO) Jensen Huang will deliver the opening keynote at a major consumer electronics show on Monday, with many analysts viewing the event as a potential growth catalyst for the chipmaking giant. All but one of the 21 analysts covering the company who are tracked by Visible Alpha maintain a "buy" or equivalent rating, with analysts at Morgan Stanley, Bank of America, and Bernstein recently naming it a "top pick." The consensus price target is about $177, a roughly 28% premium over the chipmaker's intraday Thursday level. When Huang delivers the keynote address on Monday, the spotlight will be on Nvidia's Blackwell GPUs, which are used to power generative artificial intelligence (AI) processes like large language models (LLMs). Citi Analysts Point to High Demand for Blackwell Analysts at Citi said in late November that they expect Nvidia to raise sales expectations for Blackwell as the company works to meet what Huang has called "insane" demand. On Nvidia's earnings call in November, Huang said Nvidia expects to deliver more Blackwell platforms in the current quarter than previously estimated. Citi also expects Huang to discuss a demand inflection in artificial intelligence (AI) robotics "around warehouses, manufacturing, and humanoid AI robots." The company may also discuss Rubin, a successor to Blackwell chips that Huang unveiled in June and said would release in 2026. CES comes after Nvidia's stock wrapped up a stellar 2024. Despite shares entering correction territory last month, Nvidia stock surged about 170% in 2024 as Big Tech customers -- including Microsoft (MSFT), Meta Platforms (META), and Alphabet's (GOOGL) Google -- beefed up their AI data-center and cloud computing infrastructure. Last year's big gain for Nvidia came on the heels of a 240% stock-price increase in 2023.

[12]

Jensen Huang's CES 2025 Vision Sparks Mixed Reactions: Ross Gerber Says Nvidia Has 'Changed The World,' While Analysts Debate AI And Autonomous Driving Ambitions - Meta Platforms (NASDAQ:META), NVIDIA (NASDAQ:NVDA)

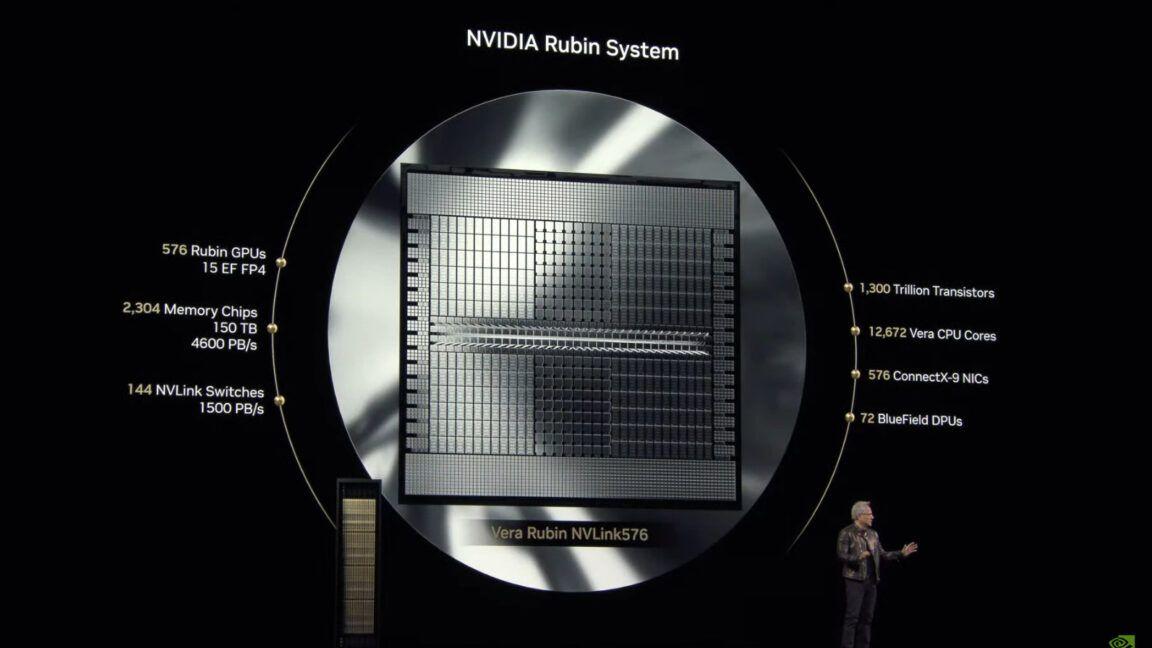

Wall Street analysts and industry experts offered mixed reactions to NVIDIA Corp.'s NVDA ambitious technological roadmap unveiled at CES 2025 on Monday, particularly regarding its artificial intelligence and autonomous driving initiatives. What Happened: During his keynote address at Las Vegas's Mandalay Bay Arena, Nvidia CEO Jensen Huang sparked debate with his prediction that self-driving vehicles would become "the first multi-trillion dollar robotics industry." Ross Gerber, CEO of Gerber Kawasaki Wealth and Investment Management, praised the presentation, declaring "Nvidia has changed the world" and anticipating "incredible things to come." GLJ Research analyst Gordon Johnson strongly contested this view, warning that widespread autonomous vehicles could trigger "depressions globally" by displacing transport workers. The presentation also highlighted Nvidia's collaboration with Meta Platforms Inc. META on refining open-source Llama models. Daniel Newman, CEO of The Futurum Group, suggested this partnership could potentially outperform OpenAI, noting that "open source wins out here." The chipmaker unveiled its next-generation GeForce RTX 5000 series graphics cards, headlined by the flagship RTX 5090 priced at $1,999. Nvidia claims the new GPU delivers twice the performance of its predecessor, featuring 32GB of GDDR7 memory and 21,760 CUDA cores. The company plans to release the RTX 5090 and 5080 on Jan. 30, with more affordable models following later. Huang also introduced the Grace Blackwell NVLink 72 system, incorporating 72 Blackwell GPUs and 2,592 Grace CPU cores, designed to power advanced AI applications. TECHnalysis Research's Bob O'Donnell highlighted the significance of Nvidia's refined Llama models, suggesting they "could have a big impact." Price Action: Nvidia's stock ended Monday's trading session at $149.43, up 3.43%, and added another 0.57% in after-hours trading to reach $150.28. However, it dipped 0.54% in Robinhood Markets' overnight trading service. Over the past year, Nvidia has gained an impressive 185.99%, according to data from Benzinga Pro. Nvidia's consensus price target is $170.56, ranging from $220 to $120. Recent ratings average $154.67, implying a 2.92% upside. Read Next: Cathie Wood's Monday Moves: Dumps $15M Worth Of Hot Stock Palantir, Loads Up Amazon.com Image Via Shutterstock Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Market News and Data brought to you by Benzinga APIs

[13]

Nvidia Stock Surges In Monday Pre-Market Ahead Of Jensen Huang's CES Keynote - NVIDIA (NASDAQ:NVDA), Cerence (NASDAQ:CRNC)

Nvidia Corp. NVDA shares climbed 2.58% in pre-market trading on Monday, as per Benzinga Pro. This surge is driven by investor anticipation surrounding CEO Jensen Huang's keynote at the CES trade show in Las Vegas. What Happened: Huang's presentation is expected to spotlight the eagerly awaited Blackwell chip. Despite robust demand, the chip has encountered supply chain issues due to manufacturing challenges. Investors are eager for any updates that might revitalize interest in Nvidia's stock, which has stagnated since November, Bloomberg reported on Monday. Portfolio manager Matt Cioppa from Franklin Templeton Equity Group commented, "The expectation is that Blackwell demand remains very strong." This sentiment previously boosted Nvidia's stock, with Huang describing demand as "insane" in October. Despite a downturn in December, Nvidia's shares have surged 171% in 2024, significantly aiding the S&P 500 Index's overall growth. However, the stock faced a setback after a disappointing earnings report in November, resulting in a dip in market value. As the tech earnings season looms, Nvidia's valuation remains a concern. Analysts from Morgan Stanley and Mizuho Securities are closely monitoring Huang's keynote, viewing it as a crucial moment for investor sentiment and the company's market trajectory. Why It Matters: Nvidia's recent rise is not just about the CES keynote. The company's collaboration with Cerence Inc. CRNC to enhance automotive AI has also played a significant role. This partnership, which integrates Nvidia's AI Enterprise software and DRIVE AGX Orin hardware, has bolstered Nvidia's market position, driving widespread adoption of its AI chips. Moreover, Nvidia's presence at CES 2025 is significant. The company is expected to unveil its latest RTX 50-series products, potentially setting the stage for a strong start to 2025. Nvidia has historically used CES to showcase upcoming innovations, and this year's event could further solidify its standing as a top-performing S&P 500 stock, following a stellar 2024 performance. Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors. Image via Shutterstock Market News and Data brought to you by Benzinga APIs

[14]

Nvidia CES keynote: Analysts highlight key takeaways By Investing.com

Investing.com -- At the much-anticipated CES 2025 event, Nvidia (NASDAQ:NVDA) unveiled a range of new products aimed at expanding its business into consumer markets, demonstrating advancements in AI gaming, and desktop computing. CEO Jensen Huang laid out how Nvidia is leveraging technology from its high-performing data center AI chips to improve PCs and laptops. Among the significant announcements was the introduction of Cosmos foundation models, designed to generate realistic videos for training robots and self-driving cars at a lower cost than traditional data collection methods. By producing "synthetic" training data, Cosmos allows machines to understand the physical world, much like language models enable chatbots to converse naturally. Users can input text descriptions to generate a video that adheres to the laws of physics, reducing the need for expensive real-world data collection. Huang noted that Cosmos will be available under an "open license," similar to Meta (NASDAQ:META)'s Llama 3 models. Nvidia also launched its RTX 50 series gaming chips, incorporating the company's Blackwell AI technology, which has driven growth in the data center sector. These chips aim to elevate gaming graphics to cinematic levels by improving shaders, enhancing surface details, and generating lifelike human faces -- key areas where even small imperfections are noticeable. Moreover, Nvidia introduced its first desktop computer, designed primarily for computer programmers rather than regular consumers. Regarding its Blackwell platform, Huang said the AI chips were now in "full production." Bank of America (NYSE:BAC): "We highlight NVDA's continued dominance in genAI compute and ecosystem, quickly expanding from the cloud all the way to enterprise and consumers. Maintain Buy on our top sector pick." Stifel: "Nvidia's announcements today are significant, but long-tailed. We view these developments as further deepening the company's competitive moat and positioning around potentially multi-billion dollar advancements tied to AI agents, robotics, autonomous vehicles, graphics and PC and edge-device inferences in the coming years." Meanwhile, for Wells Fargo (NYSE:WFC) analysts, key takeaways from the keynote were the introduction of the new RTX 50-series GPUs, the announcement that Blackwell is now in full production, AI scaling expansion, and expectations that the company's automotive business could grow to around $5 billion by fiscal 2026. Lastly, Wedbush analysts said Huang's CES speech "felt more like a rock concert vibe than a tech CEO speech." "The overriding message from Jensen was a slew of new AI technology is coming out of Nvidia around robotics, autonomous technology, PCs that will further stretch their enormous technology lead vs. the rest of the semi and Big Tech landscape," analysts noted. "This was a major "flex the muscles" moment for Nvidia and Jensen in this AI arms race playing out across the tech ecosystem globally."

[15]

Nvidia Stock Is Sinking Today -- Is This a Buying Opportunity for 2025? | The Motley Fool

Nvidia stock is losing ground today due to a "buy the rumor, sell the news" dynamic. The company's share price had climbed higher yesterday in anticipation of CEO Jensen Huang's keynote address at the start of the CES conference last night. While the tech leader actually had some exciting news to share with investors and show attendees, the news hasn't been enough to sustain gains for the stock today. On the hardware side, Nvidia mostly focused on its new graphics processing units (GPUs) for gaming and consumer PC applications. Given that the company's advanced GPUs for AI data center applications have been the driving force behind its incredible stock gains, it's not shocking that investors have been a bit let down by what's been spotlighted so far. But today's stock move suggests investors may be overlooking some huge opportunities for the company. While Nvidia's upcoming GB300 processor for data center AI applications hasn't been getting the CES spotlighting some investors have been hoping for, the company has continued to show why it's one of the most important and exciting players in the tech sector. The GPU leader's hardware initiatives have naturally received most of the focus from industry watchers and investors, but it's the AI pioneer's software initiatives that have emerged as its most exciting projects at CES. Nvidia is positioning itself as a leader in software services for robotics, industrial automation, and category-specific AI worker agents. The company's CUDA platform for leveraging GPUs for AI already gives the tech giant strong software foundations and a formidable competitive moat, but its software initiatives in other categories still appear to be broadly underappreciated. Nvidia is using its dominant position in AI hardware and interfacing tools to establish forefront positions in some of today's most exciting software categories. Given that the stock hit a record high in yesterday's trading, today's pullback isn't a dramatic development -- and some strong performance is already priced into the company's valuation. On the other hand, the AI leader has actually served up some very exciting news at CES, and its competitive positioning and growth opportunities have never looked stronger. For long-term investors, today's pullback could be a worthwhile buying opportunity in part of a larger dollar-cost-averaging strategy.

[16]

Nvidia stock surges on GeForce RTX 50 Series udebut at CES

Nvidia stock on Tuesday, a day after of founder Jensen Huang's speech at CES 2025, has soared 24% to top its record set in November. Sparking the surge is the chipmaker's unveiling of its GeForce RTX 50 Series desktop and laptop GPUs -- its most advanced consumer graphics processor units for gamers, creators and developers. In a packed Las Vegas arena, Nvidia founder Huang on Monday stood on stage and marveled over the crisp real-time computer graphics displayed on the screen behind him. He watched as a dark-haired woman walked through ornate gilded double doors and took in the rays of light that poured in through stained glass windows. "The amount of geometry that you saw was absolutely insane," Huang told an audience of thousands at CES 2025 Monday night. "It would have been impossible without artificial intelligence." Huang said the GPUs, which use the company's next-generation artificial intelligence chip Blackwell, can deliver breakthroughs in AI-driven rendering. "Blackwell, the engine of AI, has arrived for PC gamers, developers and creatives," Huang said, adding that Blackwell "is the most significant computer graphics innovation since we introduced programmable shading 25 years ago." Blackwell technology is now in full production, he said. The GeForce RTX 5090 and GeForce RTX 5080 graphics cards will arrive on store shelves on Jan. 30, according to the Nvidia site. The GeForce RTX 5070 Ti and GeForce RTX 5070 will be available starting in February. Building on the tech Nvidia released 25 years ago, the company announced that it would also introduce "RTX Neural Shaders," which use AI to help render game characters in deep detail -- a task that's notoriously tricky because people can easily spot a small error on digital humans. Huang said Nvidia is also introducing a new suite of technologies that enable "autonomous characters" to perceive, plan and act like human players. Those characters can help players plan strategies or adapt tactics to challenge players and create more dynamic battles. In addition to Nvidia, tech giants such as AMD, Google and Samsung were at CES 2025 to unveil artificial intelligence tools aimed at helping both content creators and consumers alike in their quest for entertainment. Nvidia and other AI stocks keep climbing even as criticism rises that their stock prices have already shot too high, too fast. Despite worries about a potential bubble, the industry continues to talk up its potential.

[17]

Nvidia stock jumps 4% before CEO Jensen Huang's CES keynote

XRP, Cardano, Stellar, Avalanche, and more: Cryptocurrencies to watch this week The chipmaker is expected to make major artificial intelligence-focused product announcements at the annual Las Vegas trade show. Bank of America (BAC+2.28%) reiterated its "buy" rating on Nvidia in a note on Monday outlining its expectations for CES. "[W]e still see CES as a positive catalyst, re-asserting NVDA's platform dominance/opportunity in high-growth markets," Vivek Arya, a research analyst at Bank of America Global Research, said in the note. Arya said the bank is expecting updates on Nvidia's robotics strategy, such as its Jetson Thor robot computer, which would leverage its silicon and software capabilities for physical AI. "The challenge in our view is however making the products reliable enough, cheap enough and pervasive enough to spawn credible business models," Arya said, adding that robotics could be seen as "cool but niche," similar to the metaverse and autonomous cars. "[W]hile we don't doubt NVDA's capabilities, we are unsure as to when and how fast they can influence NVDA's financials," Arya said. Bank of America is also looking for Nvidia to announce the launch of its RTX 50-series GPUs, "[p]otential entry into" the AI PC market through a partnership or on its own, and updates to its data center business, including on its current-generation Blackwell platform. The chipmaker's shares stalled toward the end of last year after reaching record highs driven by the AI boom. Production and shipping of the highly anticipated Blackwell chips were delayed due to a now-fixed design flaw that sent its shares falling. The company also saw its shares tumble after the Chinese government announced an investigation into the chipmaker for possibly violating anti-monopoly laws. In June, Huang announced the Blackwell Ultra chip for this year and a next-generation AI chip platform called Rubin coming in 2026. Arya said announcements on "timeline acceleration" for Rubin could help the chipmaker "regain control of the (overstated) narrative around custom-chips from cloud vendors overtaking/reducing need to buy NVDA's merchant silicon."

[18]

Nvidia shares jump after CEO Jensen Huang unveils new chips in Las...

Nvidia shares jumped 1.7% on Tuesday to a new all-time high after CEO Jensen Huang unveiled the company's next family of gaming chips and hinted that robotics technology is about to ramp up. Huang unveiled the latest chips for desktop and laptop PCs during his keynote speech Monday night at CES in Las Vegas, the massive tech trade show with the latest gadgets, promising to deliver better-quality images. The stock, which already had risen to a new high on Monday ahead of the chief executive's address, was trading at $151.94 as of Tuesday around 9:30 a.m. The GeForce RTX 50-series chips use the same Blackwell architecture as the firm's artificial intelligence processors - and are twice as speedy as their predecessors, Huang said. The chips will come preinstalled in computers costing $550 to $2,000 that will start shipping in March, the company said. "Can you imagine, you have this incredible graphics card, Blackwell - I'm going to shrink it and put it in there," Huang said as he held up a laptop. CES 2025 featured more robots and artificial intelligence features than ever before - and the longtime Nvidia CEO hinted that advanced robot infrastructure is coming soon. The "ChatGPT moment for general robotics is just around the corner," he said Monday night. He introduced an AI model called Cosmos which could generate training videos for robots and self-driving cars - and drastically reduce the costs of current training methods, he said. "All of the enabling technologies that I've been talking about is going to make it possible for us in the next several years to see very rapid breakthroughs, surprising breakthroughs in general robotics," he added. Nvidia has skyrocketed past $3.5 trillion in market cap over the past few years - surpassing Apple to grow into the world's most valuable company in November 2024. For most of its existence, since its launch in the early 1990s, Nvidia has been known for selling graphics processing units, or GPUs, used to make video games. Its first chip in 1999 was made to draw triangles and polygons for 3D games. But Nvidia has shot to new heights by selling artificial intelligence chips to cloud vendors and tech giants including Microsoft, Meta and Google - outpacing rivals like Advanced Micro Devices and Intel. Its dominance in the AI market has led to some increased regulatory scrutiny from watchdog groups in the US, Europe, South Korea and China. Now, gaming sales represent just a drop in the bucket of Nvidia's business. In the quarter that ended in October, gaming sales accounted for less than 10% of Nvidia's total revenue - compared to 88% from data center chips. But the newly-announced RTX 50-series chips are meant for gaming, with higher frame rates, the ability to show more details on character faces, improved graphics and higher resolution images. The new generation of gaming chips will include a variety of configurations. The RTX 5090 - the most powerful, and thus most expensive of the bunch - will sell for $1,999 each. It is twice as fast as its predecessor, the RTX 4090, with 92 billion transistors, Nvidia said. The chips will be optimized to run AI models, so creators can fold generative AI into their video games. Nvidia said the chips can also run large language models and image generation models from companies like Meta. Nvidia's gaming business has increased 15% from a year ago, though it has been overshadowed by tremendous growth in its AI chip sales. The company's data center sales have doubled for six straight quarters to more than $30 billion in its most recent quarter. "While we are now an AI company as well as a gaming company, our gaming side still benefits tremendously from the fact that we are an AI company," Justin Walker, senior director of product at Nvidia, said on a press call.

[19]

Nvidia Hits Record Highs On CES AI Breakthroughs: Goldman Stays Bullish - Meta Platforms (NASDAQ:META), NVIDIA (NASDAQ:NVDA)

Goldman Sachs' Toshiya Hari reaffirmed a "Buy" rating, citing Nvidia's "industry-leading speed" in hardware, software, and partnerships. Nvidia Corporation NVDA saw its stock price climb to fresh all-time highs in Tuesday's premarket trading following its show-stopping presentation at CES 2025 in Las Vegas, where the company unveiled a bold vision for the future of artificial intelligence (AI) and robotics. Founder and CEO Jensen Huang delivered a keynote Monday that emphasized Physical AI as the next frontier for the robotics industry, likening the moment to what ChatGPT represented for natural language processing. In a note shared Tuesday, Goldman Sachs analyst Toshiya Hari reiterated his Buy rating on Nvidia stock, which is also on the firm's Conviction List. "We believe today's string of announcements, at a minimum, highlights the company's ability to innovate at industry-leading speed across hardware and software as well as its robust partner and customer ecosystem," Hari said. A New Standard In Gaming And Computing Power Central to Nvidia's CES announcements was the launch of its RTX Blackwell family of GPUs, which includes the GeForce RTX 5090 and RTX 5070. These next-generation GPUs are poised to redefine gaming and creative computing, offering unprecedented performance gains. The RTX 5090, which features 92 billion transistors and 3,352 AI TOPS of computing power, is designed to deliver 2x the performance of the RTX 4090, thanks to AI-driven rendering technology. This advancement allows the GPU to generate three frames for every one rendered, dramatically boosting frame rates. For budget-conscious gamers, Nvidia introduced the RTX 5070 at $549, which promises performance equivalent to the current RTX 4090, a GPU priced at $1,599. According to Huang, this family of GPUs demonstrates Nvidia's focus on driving down the cost of compute as models, including OpenAI's o1 and o3 and Google's Gemini Pro, continue to increase in complexity. Physical AI: The "Largest Technology Industry the World's Ever Seen" Huang's keynote went beyond GPUs, focusing heavily on Physical AI -- a domain encompassing robotics, autonomous systems, and real-world AI applications. According to Hari, Nvidia is positioning itself to lead what Huang described as "the largest technology industry the world's ever seen." Nvidia's strategy is grounded in three key scaling laws: Pre-training scaling, which improves AI models by applying more computational power to larger datasets. Post-training scaling, which enhances models through reinforcement learning. Test-time scaling, where models gain reasoning and problem-solving capabilities. Nvidia Unveils 'Cosmos' Nvidia introduced Cosmos, an open platform designed to democratize physical AI development for applications like autonomous vehicles and humanoid robots. Hari said, "Cosmos (which NVDA has made available under an open model license) democratizes the development process through synthetic data for training and evaluation." The platform also integrates with Nvidia's Omniverse, enabling developers to simulate AI scenarios -- such as snowy roads or crowded warehouses -- without relying on real-world data collection. Llama Nemotron And The Future Of Robotics In collaboration with Meta Platforms Inc. META, Nvidia unveiled the Llama Nemotron Language Foundation Models, designed for enterprise AI applications such as fraud detection and customer support. Hari highlighted, "These models are optimized for Agentic AI for enterprises and provide options for different scale deployments." Hari indicated that the development of humanoid robots hinges on processing imitation information, which Nvidia aims to accelerate using its Omniverse platform. Market Reactions And Goldman Sachs' Nvidia Outlook Shares of Nvidia were up 2.3% to $152 during Tuesday's premarket trading , poised to open the session at record highs. Goldman Sachs holds a 12-month price target of $165 on Nvidia, based on a 50x multiple of its normalized EPS estimate of $3.30. Read now: AMD Unveils 'Next Generation' AI Processors, Gaming Gear Ahead Of CES 2025 Photo: Shutterstock Market News and Data brought to you by Benzinga APIs

[20]

Nvidia Highlights AI Chips Powering PUBG, Robotics 'ChatGPT Moment,' Automotive Expansion And More At CES Event - NVIDIA (NASDAQ:NVDA)

Nvidia partners with Toyota on driver-assistance tech, boosting its automotive business. Nvidia Corp NVDA maintains an upward stock trajectory this week after a power-packed start with the Consumer Electronics Show (CES), Microsoft Corp MSFT eying an $80 billion investment in developing AI data centers for 2025, and Foxconn's robust quarterly results. Chief Jensen Huang announced the company's $3,000 desktop-sized personal AI supercomputer, Project DIGITS, powered by the GB10 Grace Blackwell super chip, during his CES 2025 keynote. Huang also presented the new RTX 5000 GPU series, laptops featuring the RTX 50-series, and the Grace Blackwell NVLink 72 system. Also Read: AMD and Nvidia Overtake Intel in Key Markets, Challenging Its Leadership Nvidia told CNBC that the high-end RTX 5090 chips will be able to run AI models and do computer graphics, including helping game makers integrate generative AI into their characters in games like PUBG: Battlegrounds. The new processors will also be able to run large language models and image generation models from companies including Meta, Mistral, and Stability AI. He also announced that Toyota Motor Corp TM will use Nvidia Drive AGX Orin to enhance its automated driving capabilities. Nvidia forged a deal to provide driver-assistance chips and software for Toyota vehicles. Nvidia expects its automotive vertical business to grow to ~$5 billion in fiscal 2026 from ~$4 billion in fiscal 2025. Some of Nvidia Drive AGX clients include BYD Co BYDDF BYDDY, Li Auto Inc LI, Lucid Group Inc LCID, Rivian Automotive, Inc RIVN, Xiaomi Corp XIACF XIACY, ZEEKR Intelligent Technology Holding ZK. At the event, Nvidia also flagged its alliance with Meta Platforms Inc META on innovating open-source Llama models, which Daniel Newman of The Futurum Group expects to outperform OpenAI potentially. Huang showcased physical AI tools to train robots, leveraging simulated environments that closely mimic the real world. These tools enabled higher automation in warehouses and factories and boosted a humanoid-robot market that the company said could be worth $38 billion in decades, the Wall Street Journal reports. Huang told the WSJ that the ChatGPT moment for general robotics is just around the corner. Nvidia product director Justin Walker told CNBC that despite being an AI company and a gaming company, the gaming side still benefits tremendously from being an AI company. Nvidia also announced its Cosmos foundation models, which generate photorealistic video to train robots and self-driving cars at a more affordable cost. Cosmos will be available on an "open license," similar to Meta's Llama 3 language models. Huang expects Cosmos to do the same for robotics and industrial AI as Llama 3 has done for enterprise AI, Reuters reports. Bank of America's Vivek Arya told Reuters that he will await possible upside from Nvidia's robotics by drawing [parallels with the metaverse and autonomous cars. Price Action: NVDA stock is up 2.20% at $152.87 premarket at the last check Tuesday. Also Read: Nvidia Targets Robotics as Next Big Opportunity Amid Rising AI Rivalry Image via Shutterstock NVDANVIDIA Corp$152.562.09%Overview Rating:Good75%Technicals Analysis1000100Financials Analysis600100WatchlistOverviewBYDDFBYD Co Ltd$33.08-%BYDDYBYD Co Ltd$66.14-0.02%LCIDLucid Group Inc$3.381.50%LILi Auto Inc$23.75-0.63%METAMeta Platforms Inc$627.68-0.40%MSFTMicrosoft Corp$429.430.37%RIVNRivian Automotive Inc$15.810.60%TMToyota Motor Corp$194.402.11%XIACFXiaomi Corp$4.68-%XIACYXiaomi Corp$22.95-1.69%ZKZEEKR Intelligent Technology Holding Ltd$28.001.16%Market News and Data brought to you by Benzinga APIs

[21]

NVIDIA's Huang CES keynote stirs anticipation among global investors By Investing.com

Investing.com -- NVIDIA (NASDAQ:NVDA)'s CEO, Jensen Huang, is set to deliver a keynote speech at the 2025 Consumer Electronics Show (CES) on Monday, drawing a global audience of investors. The CEO's presentation is expected to underscore the role of NVIDIA's innovative technology in powering artificial intelligence (AI), which is predicted to fuel broader market growth this year, according to Nigel Green, CEO of deVere Group. Huang's speech, scheduled for 6:20 p.m. PT in the packed Mandalay Bay Arena in Las Vegas, will highlight NVIDIA's pivotal role in driving transformative technologies that are redefining industries and stimulating economic growth. Investors and tech enthusiasts are eagerly awaiting news about the Blackwell family of graphics processing units (GPUs). These GPUs are expected to redefine the capabilities of AI-driven applications. Huang is also expected to reveal a new ultra-fast graphics card designed for gamers, developers, and enterprises requiring high-performance solutions. Nigel Green, who leads one of the world's largest independent financial advisory and asset management organizations, sees Huang's CES keynote as a defining moment for investors. He believes that NVIDIA's innovations are not only transforming industries but also contributing to broader economic growth and market highs. Green is confident that AI, with NVIDIA at the forefront, will continue to outperform the market in 2025. NVIDIA's performance has already demonstrated market enthusiasm. The company's stock soared by 239% in 2023, driven by a surge in demand for AI applications. Despite a mid-year dip of 27.5% in 2024, NVIDIA rebounded to end the year with a remarkable annual gain of 171.2%. NVIDIA's momentum has continued into 2025, with the stock climbing an additional 7.6% in the first two trading days of the year. Green attributes much of this excitement to the upcoming CES announcements, particularly about the Blackwell GPUs. These processors are crucial for developers working on large language models, such as OpenAI's ChatGPT and Google (NASDAQ:GOOGL)'s Gemini, as well as applications in autonomous vehicles, healthcare, and enterprise solutions. Under Huang's leadership, NVIDIA has become a key player in the AI revolution, enabling industries to fully utilize machine learning, data processing, and advanced computing. Green views AI as the present, not the future. He believes that NVIDIA's innovations are driving the fourth industrial revolution and creating unprecedented opportunities for forward-thinking investors. As the global economy continues to adopt AI-driven advancements, Green expects NVIDIA to remain at the helm, delivering outsized returns and influencing broader market trends. CES 2025, running from Tuesday to Friday, serves as a testament to the pervasiveness of AI in today's tech landscape. With more than 3,500 exhibitors and 130,000 attendees, the conference is centered around the latest breakthroughs. As AI continues to permeate every aspect of life, from healthcare and transportation to gaming and enterprise efficiency, NVIDIA, with its dominant position in the AI ecosystem, stands to benefit significantly from this economic shift. In conclusion, Green believes that Huang's CES keynote will set the tone for investors globally. As Huang steps onto the stage, the message is clear: NVIDIA's vision and execution are not only driving the AI revolution but are also likely to influence financial markets in 2025.

[22]

Goldman, other analysts reiterate Nvidia as top pick following Jensen Huang's keynote

Wall Street liked what it heard from Nvidia CEO Jensen Huang's keynote at the Consumer Electronics Show in Las Vegas. During the Monday night event, Huang revealed new gaming chips for PCs utilizing the company's Blackwell architecture known as the GeForce RTX 50 series. He also touted Nvidia's Cosmos foundation platform for creating physical artificial intelligence use cases such as autonomous vehicles and robots. The news led Nvidia shares to a record high Tuesday before they moved lower for the day. "We highlight NVDA's continued dominance in genAI compute and ecosystem, quickly expanding from the cloud all the way to enterprise and consumers," wrote Bank of America's Vivek Arya, reiterating his buy rating and the stock as a top sector pick. Wells Fargo analyst Aaron Rakers highlighted commentary from Huang related to the company's Blackwell chip being in "full production" as a positive for investors following recent concerns of production delays resulting from some design issues. Rakers has an overweight rating on shares and a $185 price target, which implies more than 23% upside. Goldman Sachs analyst Toshiya Hari also offered up a bullish view on the stock post-CES, highlighting Huang's remarks on Physical AI and a "ChatGPT moment" for robotics. He believes that strides in this industry could expand the buildout for AI infrastructure and help ease any Blackwell-related concerns. "With Blackwell in full production, scaling laws alive and well ... and the major hyperscalers still in a competitive arms race, we remain bullish on the near- to medium-term earnings growth outlook for Nvidia," he wrote. Hari maintained his buy rating on the conviction list stock, with his $165 price target implying 10% upside from Monday's close. The stock is already up 11% less than a week into 2025. NVDA YTD mountain Shares in 2025 Elsewhere, Stifel's Ruben Roy called the updates from Nvidia "significant," but unlikely to largely impact the firm's financial modeling. "We view these developments as further deepening the company's competitive moat and positioning around potentially multi-billion dollar advancements tied to AI agents, robotics, autonomous vehicles, graphics and PC and edge-device inferences in the coming years," he said. Roy has a buy rating on the stock.

[23]

Nvidia 5000 Series, Product Updates Make It Top Semiconductor Pick Ahead Of Jensen Huang's CES Keynote: Analyst - NVIDIA (NASDAQ:NVDA)

Themes such as the Nvidia 5000 Series GPU and a push into robotics are top areas the analyst is watching. NVIDIA Corporation NVDA stock hit new all-time highs Monday as investors and analysts size up the company's new products and growth opportunities that will be key storylines at this year's CES conference. The NVDA Analyst: Bank of America analyst Vivek Arya reiterated a Buy rating on Nvidia with a $190 price target. The NVDATakeaways: Nvidia updates on its AI and robotics growth and the unveiling of the new Nvidia 5000 series graphics cards are among the key catalysts for the stock after CES, Arya said in a new investor note. The analyst named Nvidia the top sector pick ahead of a keynote presentation by CEO Jensen Huang on Monday night. The keynote and other presentations could highlight Nvidia's presence in many of the CES trending topic areas including robotics, gaming, PC and artificial intelligence, the analyst said. Arya said the key question is how quickly the new products will help shareholders. "The challenge in our view is however making the products reliable enough, cheap enough and pervasive enough to spawn credible business models," Arya said. The analyst said robotics could be a "cool but niche opportunity" similar to the metaverse and autonomous cars that could take time to reward shareholders. "While we don't doubt NVDA's capabilities, we are unsure as to when and how fast they can influence NVDA's financials." The analyst said CES remains a "positive catalyst" for Nvidia that can show the company's dominance and opportunity in growth markets. Arya said Nvidia's new products could help the company continue its strong pace of year-over-year sales growth. "NVDA's 50%+ YoY sales growth in CY25E YoY could be the fastest in the S&P 500 index, based on current consensus." The analyst said Nvidia trades at around 30 times its forward price-to-earnings ratio, compared to a historical trading range of 25x to 35x, making the stock attractive while trading in the middle of the range. NVDA Price Action: Nvidia stock is up 4.49% to $150.96 on Monday versus a 52-week trading range of $49.48 to $152.89. Nvidia shares hit new all-time highs earlier Monday morning and are up over 190% over the last year. Read Next: Nvidia CEO Jensen Huang Calls AI A 'Miracle,' Say It 'Can't Do 100% Of Our Jobs' Photo: Shutterstock Market News and Data brought to you by Benzinga APIs

[24]

Why Nvidia Stock Slumped Tuesday Morning | The Motley Fool

Nvidia stock appeared to be caught up in overall market weakness, and taking a breather after closing at a new record high on Monday. Furthermore, investors seem to be digesting the myriad product announcements from the artificial intelligence (AI) chipmaker in conjunction with the kickoff of CES yesterday in Las Vegas. CEO Jensen Huang was the keynote speaker to open CES on Monday, and his address came with a long list of product announcements, including: There were other, less groundbreaking announcements, but you get the picture. Nvidia stock had reached a new all-time high in early November, only to lose more than 13% of its value on no news. After this all-too-brief correction, however, Nvidia has enjoyed a stellar rebound, notching a new record close on Monday. Wedbush analyst Dan Ives noted that Huang's speech at the event "felt more like a rock concert vibe than a tech CEO speech." He went on to suggest that despite Nvidia's meteoric rise of more than 900% over the past two years, the stock still has room to run. Nvidia's market cap -- which currently sits at roughly $3.5 trillion -- will ultimately clear $4 trillion and could run as high as $5 trillion over the coming 12 to 18 months, which suggests potential upside of as much as 44%. Yet for all that opportunity, Nvidia stock is remarkably affordable, selling for roughly 32 times its estimated earnings for fiscal 2026, which begins in late January.

[25]

Monitor These Nvidia Stock Price Levels After Two Years of Massive Gains

Shares in artificial intelligence (AI) chipmaker Nvidia (NVDA) will be in the spotlight ahead of a presentation by CEO Jensen Huang scheduled for next Monday at the Consumer Electronics Show in Las Vegas. Investors will be watching for updates from Huang on sales projections for the company's Blackwell chips and details about Rubin, Blackwell's successor, which Nvidia plans to release in 2026. Several leading Wall Street firms have named the AI behemoth as their 2025 "top pick," pointing out that strong demand for its Blackwell platform positions the company for another year of explosive growth. After setting their record high in late November, Nvidia shares have traded within a descending channel, with the price tagging the pattern's upper and lower trendlines on several occasions since that time. More recently, the stock ran into selling pressure near the channel's top trendline and 50-day moving average (MA), though the move occurred on light end-of-year share turnover. The relative strength index (RSI) signals slightly bearish price momentum in the stock to kick off 2025 with the indicator falling below 50. Let's look at key support and resistance levels on Nvidia's chart that investors may be eyeing as the first quarter gets underway. The first level to watch sits around $130, a location on the chart where the shares may encounter support near a trendline that connects the prominent August swing high with the December swing low. A decisive close below this important technical level could see the shares break down beneath the descending channel's lower trendline and revisit lower support around $115. This location, currently just below the rising 200-day MA, would likely attract buying interest near a horizontal line that links a range of comparable price points between May and October last year. Upon a move higher from current levels, investors should initially monitor the $140 area. The shares may run into resistance in this region near the descending channel's upper trendline, which also closely aligns with the stock's June 2024 peak. Buying above this level could see the shares rally up to around $150. Investors who have bought the recent retracement may seek to lock in profits in this area near a series of price action situated just below the stock's record high. The comments, opinions, and analyses expressed on Investopedia are for informational purposes only. Read our warranty and liability disclaimer for more info.

[26]

Nvidia: CES, JP Morgan Healthcare Conference Participation, Feb Earnings in Focus | Investing.com UK