Nvidia's Stock Soars as Citi Raises Price Target, Citing Expanding AI and Sovereign AI Opportunities

5 Sources

5 Sources

[1]

Citi raises price target on Nvidia, citing expanding AI opportunity

Citi see an expanding market for Nvidia's AI business as the company leads global sovereign AI build-outs and continues to scale Blackwell. Analyst Atif Malik raised his price target on Nvidia to $190 from $180, which suggests shares can jump 19.2% from their latest close. Malik's bullish thesis is partly driven by the uptick in sovereign AI demand , which refers to nations' efforts to produce and control their own AI infrastructure and data. "We believe sovereign demand is already contributing up to billions of dollars in 2025 and expect the mix of sovereign AI sales to step up in 2026," Malik wrote in a Monday note to clients. "Nvidia has line of sight to 10s of GW over the next couple of years for enterprise and sovereign AI factory buildouts and the company is involved in essentially every sovereign deal (1GW ~ $50B of Nvidia sales)." He modeled his 2028 total addressable market for Nvidia's data center, semis and AI businesses to reach $563 billion, 13% higher than his prior estimate. He also lifted his expectations on Nvidia's networking segment to $119 billion from $90 billion, citing larger AI training clusters and emerging scale-up intra-networking opportunities. Nvidia's Blackwell ramp is another bright spot for the stock story, according to Malik. "Regarding the pace of rack buildouts of GB200, we believe the concerns of potential bottlenecks in terms of supply are no longer justified as deployments are happening at a rapid pace," he said. "On GB300, we expect smooth transition as Nvidia likely learned from Hopper to B200 transition." CoreWeave last week became the first cloud provider to deploy systems that include Nvidia's next-generation GB300 NVL72 AI systems, also known as its Blackwell Ultra chips. Nvidia has said that Blackwell Ultra can produce 50 times more AI content compared to its predecessor, Blackwell.

[2]

Nvidia Stock Gets Price Target Bump From Citi on 'Sovereign AI' Demand Surge

Last month, Nvidia CEO Jensen Huang announced multiple sovereign AI partnerships during a European tour. Nvidia (NVDA) is poised to take advantage of growing demand for sovereign artificial intelligence, Citi analysts wrote Monday, as governments and other organizations invest heavily in AI. The bank raised its price target for Nvidia stock to $190 from $180, lifting it further above the Visible Alpha analyst consensus of $174. Citi expects the AI data center market to reach $563 billion in 2028, up from a prior estimate of $500 billion, based on higher-than-expected sovereign AI demand. That benefits Nvidia, which is "involved in essentially every sovereign deal," Citi said. Sovereign AI refers to artificial intelligence capabilities developed for a single entity, often a national government, run on systems under that entity's control. Nvidia CEO Jensen Huang last month announced multiple sovereign AI partnerships during a European tour that included stops in the United Kingdom, France and Germany. The semiconductor titan also recently partnered with Humain, an AI subsidiary of Saudi Arabia's sovereign wealth fund. Bank of America analysts have said they expect "every major country" to invest in sovereign AI, "generating high-tech employment, and serving critical healthcare, defense, industrial, financial and cyber needs." Oppenheimer said the global sovereign AI market could be $1.5 trillion, including $120 billion in Europe. Shares of Nvidia were less than 1% lower in recent trading Monday. They ended last week at a record high.

[3]

AI boom sends Nvidia soaring -- Citi hikes price target to $190 as governments rush to buy Jensen Huang's tech

Nvidia is already the crown jewel of the AI revolution, but now, it's becoming a key player in something even bigger, in the race among world governments to build their own national AI systems, and Wall Street is taking notice, as per a report. On Monday, Citi analysts boosted their price target for Nvidia to $190, up from $180, because of a higher-than-expected surge in "sovereign AI" demand, as reported by Investopedia. That's well above the Visible Alpha analyst consensus estimate of $174 and signals growing confidence that Nvidia's dominance is far from over, according to the report. Analyst Atif Malik's new target price is a 19% increase from the current trading levels and comes as the company approaches a $4 trillion market capitalisation, as reported by Perplexity. ALSO READ: Wolfspeed stock soars over 100% after shock CFO appointment -- who is Gregor van Issum? The bank's analysts have pointed out that the AI chipmaker will be taking advantage of growing demand for sovereign artificial intelligence because governments and other organisations will invest heavily in AI, as reported by Investopedia. Citi has now projected that the AI data center market will potentially hit $563 billion in 2028, which it raised from a previous estimate of $500 billion because of the higher-than-expected sovereign AI demand, according to the report. The bank highlighted that it will benefit Nvidia, which is "involved in essentially every sovereign deal," as quoted by Investopedia. Investopedia defined sovereign AI as being used to refer to artificial intelligence capabilities developed for a single entity, often a national government, run on systems under that entity's control, as per the report. Malik wrote in a research note, "We model total 2028 data center semis AI TAM to now reach $563B," and emphasized that sovereign AI investments are already contributing "billions of dollars in 2025" and are expected to increase further, according to the Perplexity report. ALSO READ: Xi Jinping losing his grip? Signs emerge of chaos in China's military and political circles Nvidia also revised its networking market projection to $119 billion from $90 billion, because of demand for larger AI training clusters, as reported by Perplexity. The bank's upgrade comes after Nvidia CEO Jensen Huang last month shared about multiple sovereign AI partnerships during a European tour that included stops in the United Kingdom, France, and Germany, according to the Investopedia report. The AI chip giant also recently partnered with Humain, which is an AI subsidiary of Saudi Arabia's sovereign wealth fund, as per the report. While even Bank of America analysts have pointed out that they expect "every major country" to invest in sovereign AI, "generating high-tech employment, and serving critical healthcare, defense, industrial, financial and cyber needs," as reported by Investopedia. Even Oppenheimer has highlighted that the global sovereign AI market could hit $1.5 trillion, including $120 billion in Europe, according to the report. What is sovereign AI? Sovereign AI refers to artificial intelligence systems developed and controlled by a specific government, often used for national defense, healthcare, finance, and cybersecurity, as per the Investopedia report. Why is Nvidia benefiting from sovereign AI? Because Nvidia provides the chips and systems powering these projects, and it's involved in nearly every major government AI initiative globally.

[4]

Wall Street veterans and analysts set bold new price for Nvidia -- is it headed for another record run?

Nvidia's stock is surging, prompting analysts to raise price targets, with Citi setting the bar at $190. Fueling this growth is the booming AI chip market, projected to reach $563 billion by 2028, driven by government investments. CEO Jensen Huang is visiting China amidst trade tensions, advocating for continued AI sales to maintain US leadership. Nvidia recently hit a $4 trillion market cap, and one of Wall Street's veteran analysts highlighted that the company's rise might be far from over and even set a bold new price for Nvidia's stock, as per a report. The AI chipmaker has already watched its stock surge almost 22% in 2025, and now the price targets keep going up as an experienced trader and contributor to TheStreet Pro, Stephen Guilfoyle, recently increased his Nvidia price target to $175, following his previous $165 estimate that was rapidly achieved, according to The Street report. Guilfoyle wrote in The Street Pro's column, saying that his $165 target price has essentially been met and will likely be surpassed this week, as per the report. ALSO READ: What is the Voting Rights Act, the 1965 law that changed America -- and why it's back in the spotlight now He's not alone in doubling down on Nvidia's strength. On July 10, Goldman Sachs' James Schneider initiated coverage of Nvidia with a buy rating and price target of $185 for Nvidia stock, according to The Street report. He said that the AI investment cycle is in transition but can sustain growth from current levels, as per the report Only a few days before that, on July 7, Citi analyst Atif Malik increased the price target for Nvidia to $190, from an earlier $180, according to The Street report. Malik attributed the growth to Nvidia's overall addressable market for AI chips, now projected to be $563 billion by 2028, as per the report. That's a 13% increase from Citi's earlier projection, driven partly by increasing demand by governments building national AI infrastructure, as reported by The Street. ALSO READ: Are you 65 or older? You could get a $6,000 bonus tax deduction under Trump's new law Meanwhile, CEO Jensen Huang is set to visit Beijing, where he will be meeting with high-ranking Chinese officials, including the nation's commerce minister, according to a Bloomberg report. He will be attending the International Supply Chain Expo, a key event organized by the Chinese government from July 16 through July 20, as per the report. Huang's visit is at a sensitive moment, as the United States and China have set an August 12 deadline to agree on settling trade frictions that would add new tariffs, some of which were initially imposed at over 100%, as reported by The Street. Without an agreement, US president Donald Trump might restore more import restrictions that were initially imposed during the April and May tariff talks, as per a Reuters report. Guilfoyle wrote in his recent column, "How Huang comes out of this meeting will be key," as quoted in The Street report. He added, "So will be what comes of the continued negotiations between Washington and Beijing that come with their August 12 deadline of their own," as quoted by The Street. The Nvidia CEO has long resisted US limits on chip sales to China and has accused the controls of being a "failure," claiming they're damaging American business more than they're hurting China, as per the report. He's also cautioned lawmakers that China is rapidly advancing in AI and may soon narrow the gap with the United States, according to The Street report. In earlier remarks, Huang had highlighted that selling AI technology to China is necessary if the US is to maintain its status as a world leader in AI, as per the report. He noted that Nvidia has been in China for 30 years and has extensive experience with computing as well as the Chinese market, according to The Street report. Why are analysts raising Nvidia's price target? Because of stronger-than-expected demand in AI, especially from governments investing in their own AI infrastructure, as per The Street report. What's the new price target for Nvidia stock? Estimates are rising -- $175 from Stephen Guilfoyle, $185 from Goldman Sachs, and $190 from Citi.

[5]

Nvidia Stock May Double in the Next 3 Years. Here's Why. | The Motley Fool

Shares of Nvidia (NVDA 0.75%) are flying once again following a difficult start to the year. The semiconductor giant's stock jumped 42% in the past three months, easily crushing the 15% gains clocked by the S&P 500 index during this period. So, anyone who bought Nvidia stock while it was sliding earlier in 2025 must be sitting on nice gains right now. However, if you are one of those who missed out on Nvidia's impressive rally, you can still consider buying it right now, as there is a good chance that it could double in the next three years. Let's look at the reasons why. Investment bank Citi has just raised its price target on Nvidia to $190 per share, citing Nvidia's terrific opportunity in sovereign artificial intelligence (AI) infrastructure (i.e., government-related AI). Citi analysts said that the demand for sovereign AI infrastructure is already contributing "billions of dollars" in revenue for Nvidia in 2025. Importantly, Citi analysts say this business segment is expected to ramp up further as the chip giant is involved in nearly every deal for building sovereign AI infrastructure. Nvidia struck agreements with several European nations, including the U.K., France, Italy, and Germany, to deploy its Blackwell AI graphics processing units (GPUs) to help them create an AI ecosystem so that they can "strengthen digital sovereignty, support economic growth and position the continent as a leader in the AI industrial revolution," according to a release from Nvidia. On the other hand, Nvidia's sovereign business is also gaining traction in the Middle East. From Saudi Arabia to Qatar to the U.A.E., the demand for Nvidia's AI accelerators is booming in these markets. In fact, Nvidia points out that it is helping in the rollout of sovereign AI infrastructure across five continents, including South America, Asia, and Africa. Not surprisingly, Bank of America estimates that the sovereign AI infrastructure market could generate annual revenue of $50 billion in the long run. Nvidia's relationships with countries across the globe suggest that it is well placed to corner a nice chunk of this sizable opportunity. As such, it is easy to see why Citi is forecasting Nvidia's data center revenue to increase by 5% in fiscal 2027, followed by an 11% jump in fiscal 2028. Sales of data center networking chips, on the other hand, are forecast to increase by 12% in the next fiscal year and 27% in the one after. However, don't be surprised to see this business growing at a faster pace. After all, Citi estimates a total addressable market (TAM) worth $563 billion for AI compute chips by 2028, with another $119 billion coming from AI networking chips. Nvidia's data center revenue stood at $115 billion in fiscal 2025 (which ended in February this year), growing by an impressive 142% from the prior year. Given that Nvidia is the dominant player in the data center compute market and is gaining traction in networking chips as well, it won't be surprising to see its data center revenue exceeding analysts' expectations going forward. Nvidia controlled an estimated 92% of the AI data center GPU market last year. Even if its market share drops to 50% in the next three years, the company's revenue from sales of AI chips could hit $280 billion (based on the $563 billion end-market opportunity pointed out above). That would be more than double the company's data center revenue in fiscal 2025. Nvidia's revenue from the non-data center business stood at $15 billion last year. The good part is that the company sees healthy growth in markets such as gaming, which opens the possibility of an uptick in the company's non-data center business as well. But even if we assume that Nvidia's revenue from the non-data center business grows to $20 billion after three years and hits $280 billion in revenue from selling data center chips, its top line could jump to $300 billion. Nvidia stock trades at just over 26 times sales. It can maintain this premium multiple after three years, considering that its top line could more than double from last year's reading of $130.5 billion, growing at an annual rate of 32%. Another reason why Nvidia can continue to sport a premium valuation is that it is unlikely to lose a lot of share in the AI chip market because of its control over the supply chain. A sales multiple of 26 and a projected top line of $300 billion could take Nvidia's market cap to $7.8 trillion, which is just about double its current market cap. Investors, therefore, can still consider buying this AI stock hand over fist as it seems capable of soaring higher.

Share

Share

Copy Link

Citi raises Nvidia's price target to $190, driven by expanding AI opportunities and sovereign AI demand. Analysts project significant growth in Nvidia's data center and AI businesses, with a potential market of $563 billion by 2028.

Citi Raises Nvidia's Price Target on Expanding AI Opportunities

Citi has raised its price target for Nvidia (NVDA) to $190 from $180, citing an expanding market for the company's AI business

1

. Analyst Atif Malik's bullish thesis is driven by the uptick in sovereign AI demand and Nvidia's leadership in global sovereign AI build-outs1

.

Source: ET

Sovereign AI Demand Surge

Sovereign AI refers to artificial intelligence capabilities developed for a single entity, often a national government, run on systems under that entity's control

2

. Nvidia CEO Jensen Huang recently announced multiple sovereign AI partnerships during a European tour, including stops in the United Kingdom, France, and Germany2

.Citi believes sovereign demand is already contributing billions of dollars in 2025 and expects the mix of sovereign AI sales to increase in 2026

1

. Bank of America analysts expect "every major country" to invest in sovereign AI, serving critical needs in healthcare, defense, industry, finance, and cybersecurity [2](https://www.investopedia.com/nvidia-stock-gets-price-target-bump-from-citi-on-sovereign-ai-demand-surge-11767497].Expanding Market Projections

Citi has revised its 2028 total addressable market for Nvidia's data center, semiconductors, and AI businesses to reach $563 billion, a 13% increase from its prior estimate

1

. The bank also lifted its expectations for Nvidia's networking segment to $119 billion from $90 billion, citing larger AI training clusters and emerging scale-up intra-networking opportunities1

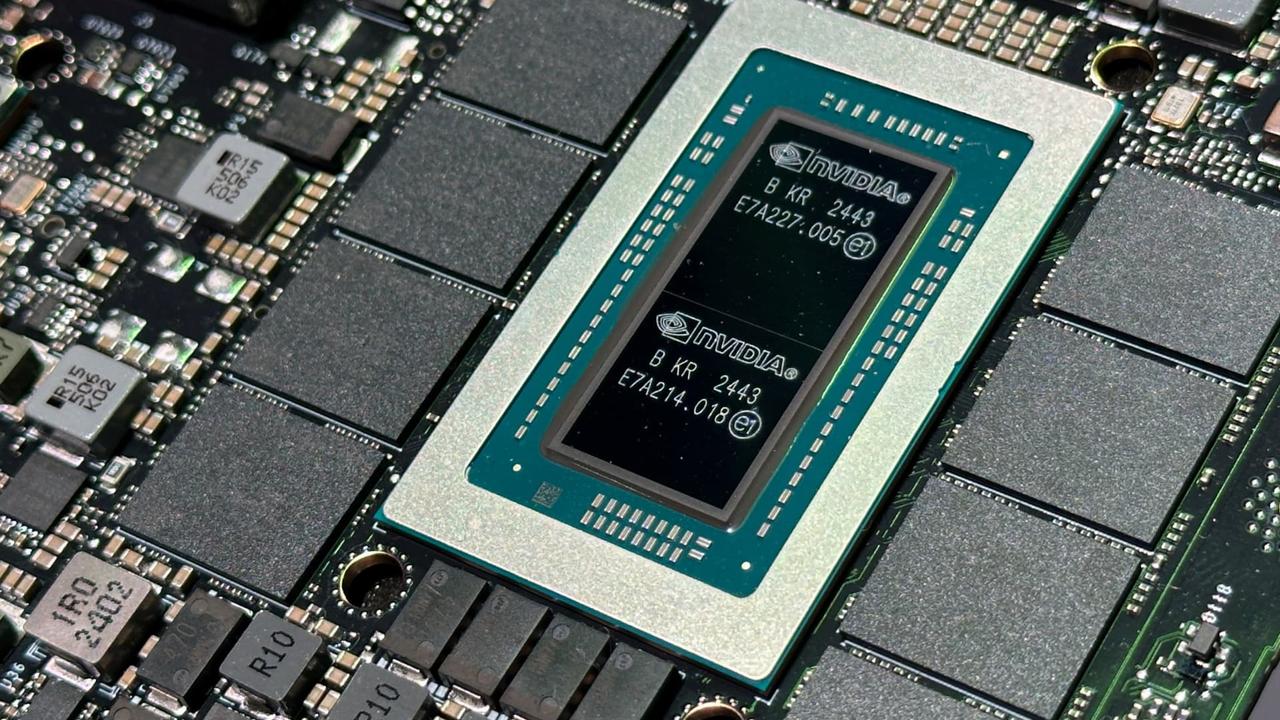

.Nvidia's Technological Advancements

Source: CNBC

Nvidia's Blackwell ramp is another bright spot for the stock, according to Malik

1

. The company recently introduced its next-generation GB300 NVL72 AI systems, also known as Blackwell Ultra chips, which can produce 50 times more AI content compared to its predecessor1

.Related Stories

Market Position and Future Outlook

Nvidia controlled an estimated 92% of the AI data center GPU market last year

5

. Even if its market share drops to 50% in the next three years, the company's revenue from sales of AI chips could hit $280 billion5

.Some analysts believe Nvidia's stock could double in the next three years, driven by the booming AI chip market and the company's dominant position in the industry

5

.International Developments

Source: Motley Fool

Jensen Huang is set to visit Beijing, where he will meet with high-ranking Chinese officials and attend the International Supply Chain Expo

4

. This visit comes at a sensitive time, as the United States and China have set an August 12 deadline to agree on settling trade frictions4

.Huang has long resisted US limits on chip sales to China, arguing that selling AI technology to China is necessary for the US to maintain its status as a world leader in AI

4

.References

Summarized by

Navi

Related Stories

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Meta strikes up to $100 billion AI chips deal with AMD, could acquire 10% stake in chipmaker

Technology

3

Pentagon threatens Anthropic with supply chain risk label over AI safeguards for military use

Policy and Regulation