Nvidia's AI Dominance Grows as CoreWeave Emerges as a Rising Star in Cloud Computing

16 Sources

16 Sources

[1]

Jensen Huang bets big: This AI stock now makes up a whopping 78% of Nvidia's entire investment portfolio

After a bumpy beginning to the year, Nvidia's stock has now increased almost 40% since April and one of the hidden reasons is its own investment in a firm that may be driving the momentum, as per a report. One of Nvidia's biggest holdings is CoreWeave, a fast-emerging AI startup that's come to the spotlight since its well-publicized IPO on March 28, 2025, as per The Street. CoreWeave's stock has surged over 100%, and Nvidia has benefitted from it as it owns over 24 million shares of the firm, valued at an estimated $896 million, as shown in 13F filings monitored by WhaleWisdom. That investment now constitutes 78% of Nvidia's entire equity holdings, according to the report. ALSO READ: Kevin O'Leary, one of Donald Trump's biggest allies, says top retailers will not listen to the president and will hike prices following tariffs Other assets in Nvidia's portfolio are British semiconductor company Arm Holdings and digital infrastructure company Applied Digital Corp, as per The Street. Both have done well over the past few weeks, but their increases are modest versus the latest run by CoreWeave, according to the report. CoreWeave was founded in 2017 as a crypto mining company, but now the company provides cloud-based graphics processing unit (GPU) infrastructure for clients with AI and machine learning projects, as per The Street. According to the company's webpage, it helps manage "the complexities of AI growth to make supercomputing accessible," as per the report. While, Nvidia remains fully behind the hyperscaler startup and has invested in CoreWeave since April 2023, as per The Street. The chipmaker, in its annual report, gave more context on its investments, "We acquire and invest in businesses that offer products, services, and technologies that we believe will help expand or enhance our strategic objectives... Further, our investments in publicly traded companies could create volatility in our results and may generate losses up to the value of the investment," reported The Street. How much of Nvidia's portfolio is invested in CoreWeave? Nvidia owns over 24 million shares of CoreWeave, which now represents 78% of its entire equity portfolio. What has been the performance of CoreWeave's stock? CoreWeave's stock has skyrocketed by more than 100% since its IPO on March 28, 2025, which has led to Nvidia's stock gains, as per The Street.

[2]

Prediction: This Artificial Intelligence (AI) Stock Will Skyrocket After May 28 (Hint: It's Not Nvidia) | The Motley Fool

Artificial intelligence (AI) pioneer Nvidia is set to release its fiscal 2026 first-quarter results after the market closes on May 28, and analysts and investors will be waiting to see how the chip giant fares considering the central role it plays in the AI space. Nvidia's chips power AI data centers from the world's leading cloud computing companies. The company's graphics processing units (GPUs) are also in solid demand from governments looking to shore up their AI infrastructure. So, a closer look at Nvidia's results and outlook will help us understand the direction in which the AI market is headed. However, there's another company that's benefiting from the fast-improving adoption of AI and will release its fiscal 2025 fourth-quarter results on May 28 -- C3.ai (AI 2.24%). The company provides enterprise AI solutions to both government and enterprise customers, but it has endured a difficult 2025 so far. C3.ai stock is down 33% this year. However, its upcoming quarterly report could help turn its fortunes around and send the stock soaring. The generative AI software market was worth an estimated $10 billion in 2023, but it is expected to jump to a whopping $176 billion in 2030, according to ABI Research. The company points out that the integration of generative AI software in enterprise use cases is likely to generate $434 billion in value annually by the end of the decade. That's not surprising as this technology is helping companies boost productivity and improve the efficiency of their operations. C3.ai is benefiting from the growing adoption of generative AI software. The company expects to report $389 million in revenue for the recently concluded fiscal year, which would be a 25% increase over the prior year. It is worth noting that C3.ai's annual top-line growth is projected to accelerate by 9 percentage points in the latest fiscal year. This can be attributed to the improving demand for C3.ai's AI software solutions. The company provides more than 130 turnkey applications that could be deployed across a wide range of industries, while also offering an AI development platform to customers, using which they can build and deploy AI agents and applications. Importantly, customer interest in C3.ai's AI software offerings has been picking up, which explains the improvement in its growth rate in the recent fiscal year. For instance, C3.ai closed 66 agreements in the third quarter of fiscal 2025 (which ended on Jan. 31), an increase of 72% from the year-ago period. These included 50 pilot projects. If C3.ai manages to convert a significant chunk of those pilot projects into actual contracts, it could end up delivering better-than-expected growth when it releases its results later this month. What's worth noting is that C3.ai has exceeded Wall Street's bottom-line estimates by big margins in each of the last four quarters. The company isn't profitable yet, but its losses have been much lower than analysts' expectations of late. C3.ai is projected to end fiscal 2025 with an estimated loss of $0.44 per share. The good part is that its loss is expected to shrink in the future. The potential growth in C3.ai's customer base, along with an increase in spending by the company's existing customers, could allow it to reduce its losses at a faster pace. All this indicates that C3.ai may be able to top expectations when it releases its quarterly results later this month. Moreover, the fast-improving demand for generative AI software and the big jump in the number of agreements that it struck in the last reported quarter could be enough for it to deliver stronger-than-expected guidance. It is worth noting that C3.ai has already jumped 19% in the past month, and more upside cannot be ruled out as a combination of strong results along with impressive guidance could give it a shot in the arm. Additionally, analysts have increased their expectations for the current and the next fiscal year, indicating that they are expecting its momentum to continue. All this makes C3.ai a solid buy going into its quarterly report. It is currently trading at 8 times sales, which is lower than its price-to-sales ratio of 12 at the end of 2024. So, investors can buy this AI stock at a relatively cheaper valuation right now, and doing so could turn out to be a smart move considering that it could zoom higher after May 28.

[3]

Billionaire Dan Loeb Sold His Fund's Entire Stake in Tesla and Is Piling Into Wall Street's Preeminent Artificial Intelligence (AI) Stock | The Motley Fool

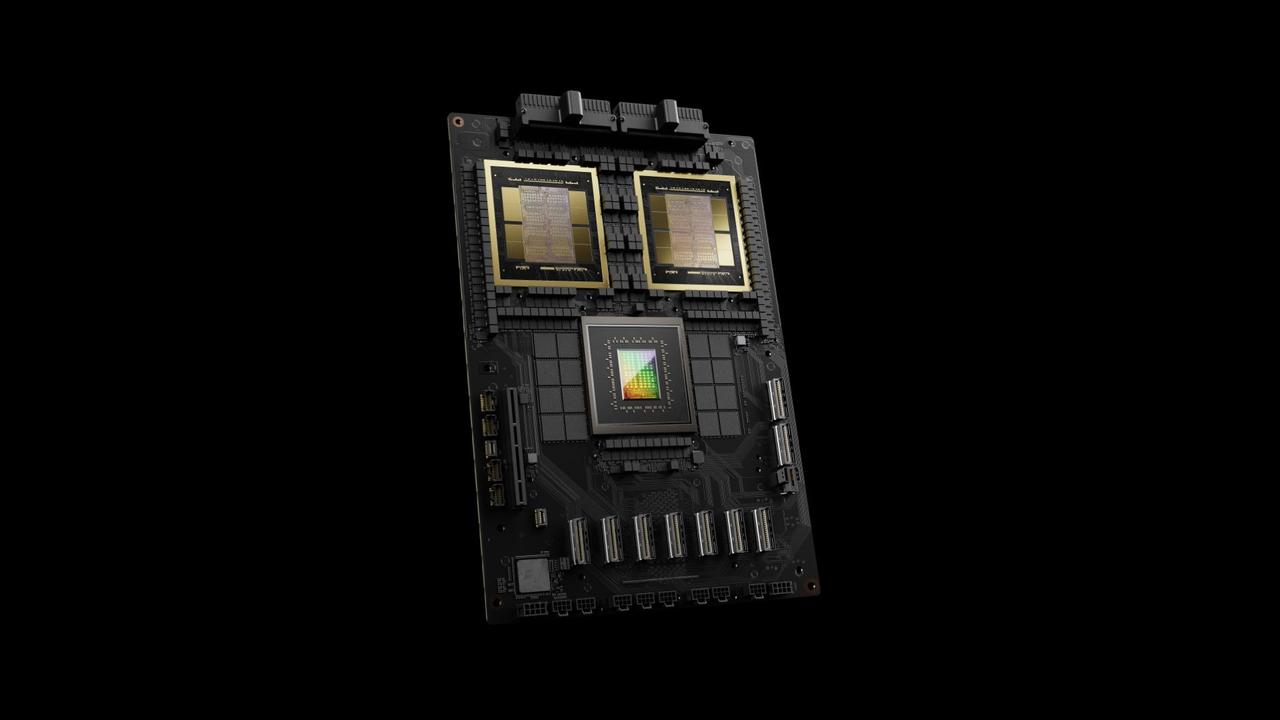

Third Point's Dan Loeb is swapping out one of Wall Street's most influential businesses for another innovative leader. The month of May has been packed with pivotal data releases. We've had no shortage of earnings reports from influential businesses, a Federal Reserve Open Market Committee meeting, and countless updates on tariff and trade policy from President Donald Trump and his administration. But amid this sea of data, perhaps nothing has been more telling than the filing of Form 13Fs with the Securities and Exchange Commission (SEC). No later than 45 calendar days following the end to a quarter, institutional investors overseeing at least $100 million in assets under management (AUM) are required to file a 13F with the SEC. This filing allows professional and everyday investors to see which stocks and exchange-traded funds (ETFs) Wall Street's leading asset managers bought and sold in the most recent quarter. May 15 marked the filing deadline for 13Fs detailing trading activity for the March-ended quarter. Though Warren Buffett is the most-popular of all money managers, he's far from the only billionaire fund manager known for outsized investment returns. Third Point's billionaire chief Dan Loeb also has quite the following on Wall Street. Loeb closed out the first frame of 2025 with $6.55 billion in AUM which was spread across 45 stocks. But what's particularly noteworthy about Loeb's investing style is his penchant for buying and selling high-growth and widely owned companies. Based on Third Point's latest 13F, Dan Loeb completely kicked North America's electric-vehicle (EV) kingpin Tesla (TSLA 2.08%) to the curb and chose to pile into Wall Street's preeminent artificial intelligence (AI) stock. Although Dan Loeb completely exited nine positions at Third Point during the first quarter, including social media colossus Meta Platforms, the sale of 500,000 shares of Tesla is what stands out most. The reason? Loeb initially purchased 400,000 shares of Tesla during the third quarter of 2024 and tacked on an additional 100,000 shares in the December-ended quarter. Between Jan. 1 and March 31, something changed. This "something" could very well be Tesla's soaring share price. In the wake of President Donald Trump's victory in November and CEO Elon Musk being designated as a "special government employee" for the Department of Government Efficiency (DOGE), Tesla stock very briefly doubled. The average stock in Loeb's portfolio has an average hold time of a little over 13 months, so he's not shy about locking in profits. But there may be more to this selling activity than meets the eye. To begin with, there's growing concern that Musk's involvement with DOGE and his numerous other companies and projects are detracting from Tesla's growth potential. Despite continued sales growth from Tesla's energy generation and storage operations, EV revenue plunged 20% in the first quarter from the prior-year period. Moreover, Tesla's vehicle margin has been trending lower for the last two years. Musk noted during his company's 2023 annual meeting that EV demand dictates pricing. A slew of sweeping price cuts for Tesla's fleet (Model's 3, S, X, and Y) confirms that competition is picking up and/or demand for EVs has waned. Even with steep price cuts, Tesla has struggled to keep its EV inventory levels from rising. Another concern is that Tesla's earnings quality is poor. Companies with first-mover advantages should be generating their profits from their products and services. More than half of Tesla's pre-tax income can be traced to automotive regulatory credits, which are given to it for free by governments, and interest income earned on its cash. Without automotive regulatory credits, Tesla would have reported a pre-tax loss in the March-ended quarter. Lastly, Dan Loeb might be out due to Elon Musk's numerous unfulfilled promises. For instance, Tesla's chief has claimed that Level 5 full self-driving is "one year away" for the last 11 years. He also expected 1 million robotaxis on American roadways "next year" in 2019. The cherry on top is that demand for Cybertruck has been well below the initial hype. If these unfulfilled promises are backed out of Tesla's valuation, its stock could have a long way to fall. On the other end of the spectrum, Third Point's 13F shows that Loeb opened 10 new positions during the first quarter. Though he did add a handful of high-yield dividend stocks, such as telecom titan AT&T and consumer health products company Kenvue, which isn't unexpected given the volatility we began witnessing in the stock market late in the first quarter, Loeb's eyebrow-raising purchase is premier AI stock Nvidia (NVDA 0.83%). The last time Third Point's billionaire investor held shares of Nvidia for his fund was the second quarter of 2023. He then sold what's now the equivalent of 5,000,000 shares of Nvidia during the third quarter of 2023, which takes into account Nvidia's 10-for-1 stock split in June 2024. During the first quarter of 2025, Loeb scooped up 1,450,000 shares, which are currently valued at almost $196 million. No company has been a more direct beneficiary of the AI revolution than Nvidia. Its Hopper graphics processing units (GPUs) and Blackwell GPU architecture are the undisputed preferred choice by businesses operating AI-accelerated data centers. Essentially, Nvidia's hardware is the brains behind generative AI solutions and the training of many large language models (LLMs). Nvidia has also been able to take full advantage of AI-GPU scarcity. Even with world-leading chip fabrication company Taiwan Semiconductor Manufacturing ramping up its chip-on-wafer-on-substrate capacity, Nvidia can't come close to meeting the full demand for its hardware. When demand for a good overwhelms supply, it's perfectly normal the price of that good to climb. Both Nvidia's Hopper and Blackwell GPUs are commanding a premium to competing chips, which has been a benefit to the company's gross margin. Even the CUDA software platform is doing its part to make Nvidia one of Wall Street's most-influential businesses. CUDA is the toolkit developers use to maximize the compute potential of their Nvidia GPUs, as well as build LLMs. More importantly, it's an anchoring tool that's helping to keep clients loyal to Nvidia's ecosystem of products and services. The final piece of the puzzle for Loeb looks to be Nvidia's valuation, which has become considerably more palatable. During the tail-end of March, Nvidia's forward price-to-earnings (P/E) ratio dipped to around 19, which appears quite inexpensive given the growth rate it's been able to sustain. But Nvidia stock isn't guaranteed to head higher. Every next-big-thing trend for more than three decades has worked its way through a bubble-bursting event early in its expansion. The simple fact that most businesses lack a well-defined AI game plan and aren't generating a profit on their AI investments signals that investors have, once again, overestimated the adoption rate and utility of another game-changing technology. Competition is a genuine concern, as well. As both external and internal competition ramps up, AI-GPU scarcity will diminish. Ultimately, this is bad news for Nvidia's AI-GPU pricing power and its margins.

[4]

Where Will Nvidia Be in 3 Years? | The Motley Fool

Nvidia (NVDA -0.99%) stock has seen some volatile trading lately. After sinking in response to concerns about the demand outlook for advanced artificial intelligence (AI) hardware and new import taxes that threatened to destabilize global trade, the company's share price benefited from explosive rebound momentum after the Trump administration announced a softening of its tariff policies. With Nvidia stock surging following the Trump administration's shift on tariff policies, investors may be wondering whether it's now too late to buy into the stock. Read on for a look at what two Motley Fool contributors think Nvidia's prospects are over the next three years. Keith Noonan: Nvidia has been at the forefront of advanced graphics processing units (GPUs) and accelerators since the AI revolution started rapidly gaining steam a couple of years ago. Thus far, there's little indication that competitors, including Advanced Micro Devices and Intel, are catching up to the company. Meaningful advances for Chinese designers, including Huawei, could emerge at some point, but it looks like demand for those processors will be largely concentrated in China and its allies. With AI potentially providing major competitive advantages for both companies and governments, there will continue to be massive incentives to invest heavily in the kind of high-powered hardware that Nvidia has a big edge in. Even better, the company has strengthened its competitive moat through its CUDA software platform, which helps developers get the most out of AI processors. This will likely make it very difficult for AMD, Intel, and other players to beat Nvidia in the space. With Nvidia posting great sales and margins, it's also got more flexibility to experiment in other potentially explosive categories, including agentic AI software and robotics. Rivals, including AMD and Intel, are having a hard enough time competing in the AI processor space, and that hypothetically leaves them with less flexibility when it comes to spending big to branch outside their core competencies. With significant macroeconomic and geopolitical uncertainty on the horizon, there's a good chance that Nvidia stock will continue to see significant volatility this year. On the other hand, the company's strength in the AI processor space should continue to help Nvidia score strong sales and earnings and also facilitate pushes into other business categories. Nvidia still faces some substantial risks over the next three years, but I think the most pressing risk factors for the stock are potential macroeconomic and geopolitical dynamics that extend to the market at large. Jennifer Saibil: Nvidia had been a winning stock for years before it became a household name in the age of generative AI. Some uncertainties about the future, however, make it harder to determine where it could be in three years and whether it's worth buying today. It was a success in the past for its gaming products, but it became a household name thanks to its dominant position in the quickly expanding generative AI sector. Explosive demand for its GPUs continues, with sales jumping 78% year over year in fiscal 2025's fourth quarter (ended Jan. 26) to $39 billion. Looking ahead, management guidance called for sales to increase 65% in fiscal 2026's first quarter. CEO Jensen Huang said the continuing incredible demand can be attributed to the company's newest generation of AI products under the Blackwell name. Management noted how far-reaching and multilayered its opportunity is. Its products now serve multiple industries beyond internet and technology, and they are put to use in many more ways than before. Of particular relevance is the growing demand for GPU-driven data centers, or what Nvidia management calls AI factories. The entire paradigm of how a data center works is changing, with more emphasis on machine learning and generative AI, ramping up the data center market opportunity from $1 trillion to $2 trillion. This is of particular relevance because data centers now account for 88% of Nvidia's revenue. As with any new technology, new competition will try to copy a good thing and try to do it for a cheaper price. Top tech companies like Amazon and Apple are working to design specialized GPUs at a lower cost to drive at least some part of their operations, even if they still rely on Nvidia for the moment. That means even if the opportunity is growing, Nvidia's share of it might not increase proportionally, and more options for clients could also erode its pricing power. Finally, it's interesting to add Nvidia's valuation to the analysis. It trades at a forward one-year P/E ratio of only 24. That could be an indication that the market thinks the company is slowing down. The drop in share price could be because the market is pricing in the effects of competition and saturation. On the other hand, it could just be that the company is growing fast enough to keep pace with the market's expectations, implying that this growth stock is a bargain. That could mean it's undervalued, and the lag between the market's perception and the reality of what's coming could create a windfall for patient investors over the next three years.

[5]

Better Artificial Intelligence (AI) Stock: Nvidia vs. CoreWeave | The Motley Fool

Nvidia has a long history of success stretching back to the creation of its famed graphics processing unit (GPU) in 1999. CoreWeave offers cloud computing infrastructure tailored for AI, and when it went public, Nvidia bought shares. Does the up-and-coming CoreWeave have what it takes to make a good AI investment for the long haul? Or is tried-and-true Nvidia a safer choice in the competitive AI market? Nvidia became an AI juggernaut thanks to its popular GPUs. This hardware enables computers to process data faster and more efficiently than a traditional CPU, and was initially developed for video game graphics. Jensen Huang, Nvidia's prescient founder and CEO, recognized years ago that GPUs could be applied to AI. Now, he believes cloud computing will become akin to factories in the Industrial Revolution to deliver economies of scale for AI. As part of this vision, he explained in a press release, "AI, like electricity and internet, is essential infrastructure for every nation." That's why Nvidia is helping countries, such as Saudi Arabia, construct AI factories. On top of that, the company introduced its powerful Blackwell Ultra platform this year. Blackwell Ultra shifts AI systems toward mimicking human thinking, such as drawing conclusions from data. This marks the AI sector's move into what's referred to as the age of AI reasoning. These developments set Nvidia up for growth over the long run. Its AI success has already translated into a record $39.3 billion in sales in its fiscal fourth quarter, ended Jan. 26, representing 78% year-over-year growth. Moreover, fiscal Q4 net income rose 80% year over year to $22.1 billion. Nvidia forecasts sales will accelerate to $43 billion in Q1, a 65% increase over the prior year's $26 billion. CoreWeave's cloud computing services employ Nvidia's GPUs, and it contracts with companies hungry to utilize that computing power. As a newly public business, CoreWeave has only its first-quarter earnings report under its belt, but those Q1 results were outstanding. Revenue rose 420% year over year to $981.6 million. Its performance was thanks to CoreWeave's success in acquiring customers. Clients include AI luminaries such as Microsoft, IBM, and OpenAI. At the end of Q1, the company's contracts represented an impressive revenue backlog of $25.9 billion. CoreWeave already added to this haul in Q2 thanks to a $4 billion contract expansion with one of its customers. In addition, while President Donald Trump's tariff policies introduced economic uncertainty, CoreWeave isn't seeing an effect. About the tariffs, CFO Nitin Agrawal stated on the recent earnings call: "We haven't observed any impact on customer behavior. In fact, we are seeing an acceleration of customer demand." As a result, the company estimates Q2 sales of about $1.1 billion, up from $395 million in 2024. For the full year, CoreWeave projects 2025 revenue of at least 4.9 billion compared to last year's $1.9 billion. Despite the massive sales growth, CoreWeave is not profitable. The company exited Q1 with a net loss of $314.6 million. This is more than a 100% increase from the prior year's net loss of $129.2 million as the company invested in expanding its AI infrastructure to keep up with customer demand. When it comes to picking an AI stock, plenty of reasons exist to choose Nvidia over CoreWeave. After all, Nvidia has years of business growth behind it, and possesses industry-leading AI tech that even CoreWeave is buying. But one factor to consider is valuation. Here's a look at the forward price-to-sales (P/S) ratio for both companies. This metric measures how much investors are willing to pay for every dollar of revenue based on estimates for the next 12 months. Nvidia's forward P/S ratio dropped this year as the aforementioned economic uncertainty, and the appearance of Chinese AI start-up DeepSeek on Jan. 27, rattled Wall Street's perception of high-flying AI companies such as Nvidia. Even so, CoreWeave's forward P/S multiple is substantially lower than Nvidia's, suggesting CoreWeave stock is a better value. The company's shares have about doubled from its IPO price of $40 at the time of this writing. Its strong trend of sales growth could lead to further stock appreciation. However, Nvidia shares warrant a higher valuation. The tech giant is profitable, a leader in the AI field, and its diluted earnings per share rose 82% year over year to $0.89 in Q4, which shows it's delivering results for shareholders. CoreWeave has little history to demonstrate whether it can do the same. Therefore, only investors with a high risk tolerance should consider buying CoreWeave stock. Nvidia is a strong company under Huang's leadership, and its P/S ratio drop makes now a good time to invest in this AI stock.

[6]

Should You Buy Nvidia Stock Before May 28? Here's What the Evidence Suggests. | The Motley Fool

The chipmaker's stock has been essentially flat so far in 2025. Could its quarterly results spark a resurgence? Advances in the field of artificial intelligence (AI) have taken the world by storm over the past few years, but much of the initial hype has since subsided. Investors are looking for evidence that the adoption of AI still has legs. Nvidia's (NVDA 0.83%) graphics processing units (GPUs) quickly became the gold standard for training and running generative AI models. The company generated five consecutive quarters of triple-digit revenue and profit growth, but as its growth rate began to decelerate, investors got nervous. The company is scheduled to release the results of its fiscal 2026 first quarter after the market closes on Wednesday, May 28, and shareholders -- and indeed Wall Street at large -- will be sitting on the edge of their seats for clues as to where AI goes from here. Let's review the company's most recent results, see what the available evidence suggests about the company's future prospects, and whether Nvidia stock is a compelling opportunity ahead of its highly anticipated financial report. For its fiscal 2025 fourth quarter (ended Jan. 26), Nvidia reported revenue of $39.3 billion, which soared 78% year over year and 12% sequentially. Strong sales drove robust earnings per share (EPS) of $0.89, which surged 82%. Lest there be any doubt, it was the continuing adoption of AI that fueled the results, as revenue in its data center segment jumped 93%. Nvidia expects its strong growth to continue. For its fiscal 2026 first quarter (ended April 28), management is guiding for revenue of $43 billion, which would represent growth of 65%. Wall Street is equally bullish, with analysts' consensus estimates calling for revenue of $43.15 billion and adjusted EPS of $0.73. While this would mark a minor deceleration compared to last quarter's robust sales performance, it would be remarkably strong nonetheless. Nvidia has a long history of issuing conservative guidance, so the actual results could well be higher. The popular narrative suggests the rapid buildout of AI-centric data centers by the major cloud and tech companies is showing cracks, but the evidence suggests otherwise. Amazon Web Services, Microsoft Azure, and Alphabet's Google Cloud, the "Big Three" in cloud computing, have announced plans to boost infrastructure spending this year. Not surprisingly, the vast majority of that spending is earmarked for additional data centers to support demand for AI. Not to be outdone, Meta Platforms has already announced plans for higher capex spending than it originally envisioned. The totals are intriguing: As the world's foremost provider of processors used for AI, Nvidia is well-positioned to capture a significant part of this data center spending from the four horsemen of tech. There's more. The Trump administration recently rescinded the so-called "AI Diffusion Rule." The strict set of export curbs initiated by the Biden Administration was designed to keep U.S. adversaries from using AI against our national interests. Critics complained the rules were too strict and threatened to stifle innovation. Rescinding this rule opened the floodgates, resulting in a host of new AI chip deals for Nvidia. For example, the company announced a partnership with Saudi Arabian company Humain. Nvidia will immediately supply more than 18,000 GB300 Grace Blackwell processors -- its most advanced AI chips -- for the country's data center buildout, with plans to eventually ship "several hundred thousand." The deal also includes Infiniband networking technology solutions, which provide ultra-fast processing combined with low latency. This helps illustrate the vast opportunity that remains for Nvidia. Make no mistake, Nvidia remains extremely volatile, but it's hard to deny the company's long-term success. Over the past three years, the stock has gained 688% (as of this writing) but has also fallen as much as 35% -- so it isn't for the faint of heart. This helps illustrate one of the surest paths to investing success: Buy stocks in the best businesses you can find and plan to hold for at least three to five years. The biggest question on the mind of investors is whether Nvidia stock will rise or fall following its highly anticipated financial report, and the truth is I have no idea. In fact, anyone who professes to know what will happen in the days or weeks to come is not being completely honest. If I were to prognosticate, I would feel comfortable making several very vague predictions: Beyond that, your guess is as good as mine, and my predictions could be dead wrong. That said, nothing about my investing thesis for Nvidia has changed. The company's state-of-the-art GPUs are the gold standard for AI processing, and it continues to dominate the market. There's always the chance someone will create a better mousetrap, so to speak, but the specter of competition is always a factor. The majority of experts believe we're still in the early stages of AI adoption. Most estimates place the AI market size at a minimum of $1 trillion, with some estimates suggesting it could eventually be 10 to 15 times higher. Nvidia stock currently sells for roughly 30 times forward earnings, with its valuation recently rebounding from a two-year low. However, the company's history of innovation, industry-leading position, and long track record of growth give me confidence the best is yet to come. For investors who believe that AI is still in the early innings and Nvidia will continue to lead the charge, buy Nvidia stock and buckle up for the bumpy -- yet potentially lucrative -- ride ahead.

[7]

These AI Stocks Soared 270% to 1,400% in 5 Years, but Billionaires Keep Buying | The Motley Fool

Artificial intelligence (AI) is a game-changing technology, where the right stocks could earn investors handsome gains. But as with any technology that comes along, investors will need to watch for companies that fail to live up to the hype. This is where following the stock picks of billionaire investors could prove very helpful. These investors have had successful investing careers, and they generally don't invest in a company until they have completed exhaustive research into its competitive position, risks, and return prospects. Fortunately, billionaire fund managers are required to report their holdings on Form 13F every quarter. The latest round of 13Fs revealed prominent billionaires still buying shares of two high-flying chip stocks in the first quarter. Taiwan Semiconductor Manufacturing (TSM 2.44%) is the leading chip manufacturer in the world. It controls more than 60% of the global foundry market, as it makes chips for leading chip companies, including Nvidia (NVDA 0.83%). Growing demand for chips used for AI workloads in data centers has helped send the stock up 279% over the past five years, and its run may not be over. Three notable billionaires were buying shares in the first quarter. David Tepper of Appaloosa Management, Stephen Mandel of Lone Pine Capital, and Chase Coleman of Tiger Global Management were adding to their firm's stakes. The company's strong first quarter amid uncertainty over the economy is pointing to tremendous momentum in the AI market. Demand for AI chips remained robust in the first quarter. Revenue and earnings grew 35% and 60% year over year, and TSMC is making significant investments in expanding capacity to support long-term demand. TSMC recently unveiled its A14 logic process technology, representing a step forward from its current 2-nanometer (N2) process. The A14 delivers a 15% increase in performance with a 30% power savings over the N2 and is scheduled to enter production in 2028. These billionaires are making a bet that TSMC is benefiting from sustainable demand in the AI market. They are obviously aware of the semiconductor industry's historical cyclicality, and some of that cyclical nature revealed itself last quarter, as not all the markets that TSMC sells into are experiencing strong demand right now. For example, seasonal softness in smartphone demand caused TSMC's revenue to fall 5% over the previous quarter. It also experienced a small setback in chip production following a recent earthquake that disrupted operations. Over the long term, the increasing use of more technologically advanced devices and data centers for AI should create opportunity for TSMC. The growing need for more advanced chips is why the stock has delivered market-beating returns over the last decade, and it could repeat that performance. TSMC forecasts AI chip sales to double in 2025 and grow at an annualized rate of 40% through 2028. Considering this forecast, the stock looks compelling, trading at a reasonable 21 times this year's earnings estimate, while analysts expect earnings to grow at an annualized rate of 21%. TSMC's long-term outlook for AI chip sales bodes well for Nvidia. Its graphics processing units (GPUs) are the gold standard in the AI chip market. The stock has rocketed 1,400% over the past five years, yet a few billionaires still see upsides. In the first quarter, Chase Coleman added to his firm's stake, while Daniel Loeb of Third Point established a new position in the stock. Nvidia is coming off an incredible year, where its revenue more than doubled to $130 billion. Based on a strong outlook for Nvidia's new chips going into production, analysts expect the company's revenue to increase by 53% to nearly $200 billion in the current fiscal year. Its new Blackwell computing platform designed for the most advanced AI workloads is already raking in billions in revenue, and the company is racing to raise supply to meet demand. Even Nvidia's automotive chips for self-driving cars are seeing strong demand, with revenue expected to triple this year to $5 billion. One risk for Nvidia is companies pursuing cheaper alternatives than buying its GPUs. Some of Nvidia's customers, including Amazon and Alphabet's Google, have invested in their own chips for AI. Custom chip solutions can perform more efficiently at specific computing tasks and save money over Nvidia's general-purpose GPUs that can cost tens of thousands of dollars per unit. Coleman and Loeb are obviously betting that data centers will continue to need Nvidia's GPUs. With Nvidia's software, companies can tailor these GPUs to work with a number of use cases. Nvidia just made a flurry of announcements at the recent Computex conference that show its GPU technology becoming more entrenched in companies' AI investment plans. For example, Nvidia and Microsoft are working together on agentic AI, an advanced form of AI that can make decisions without a human prompt. Perhaps the most important announcement from Nvidia was the introduction of NVLink Fusion, which will allow customers to integrate chips from other chipmakers alongside Nvidia's GPUs in data centers. This strategy could ultimately expand the addressable market for Nvidia's chips, while protecting its lead in the AI market. Despite these positive developments, the stock trades at a forward price-to-earnings ratio of 30, which seems on the low side for a company that analysts expect to grow earnings at a 35% annualized rate. Given Nvidia's lead in GPUs, the stock could hit new highs this year and still deliver market-beating returns over the next few years.

[8]

3 No-Brainer Artificial Intelligence (AI) Growth Stocks to Buy With $250 Right Now | The Motley Fool

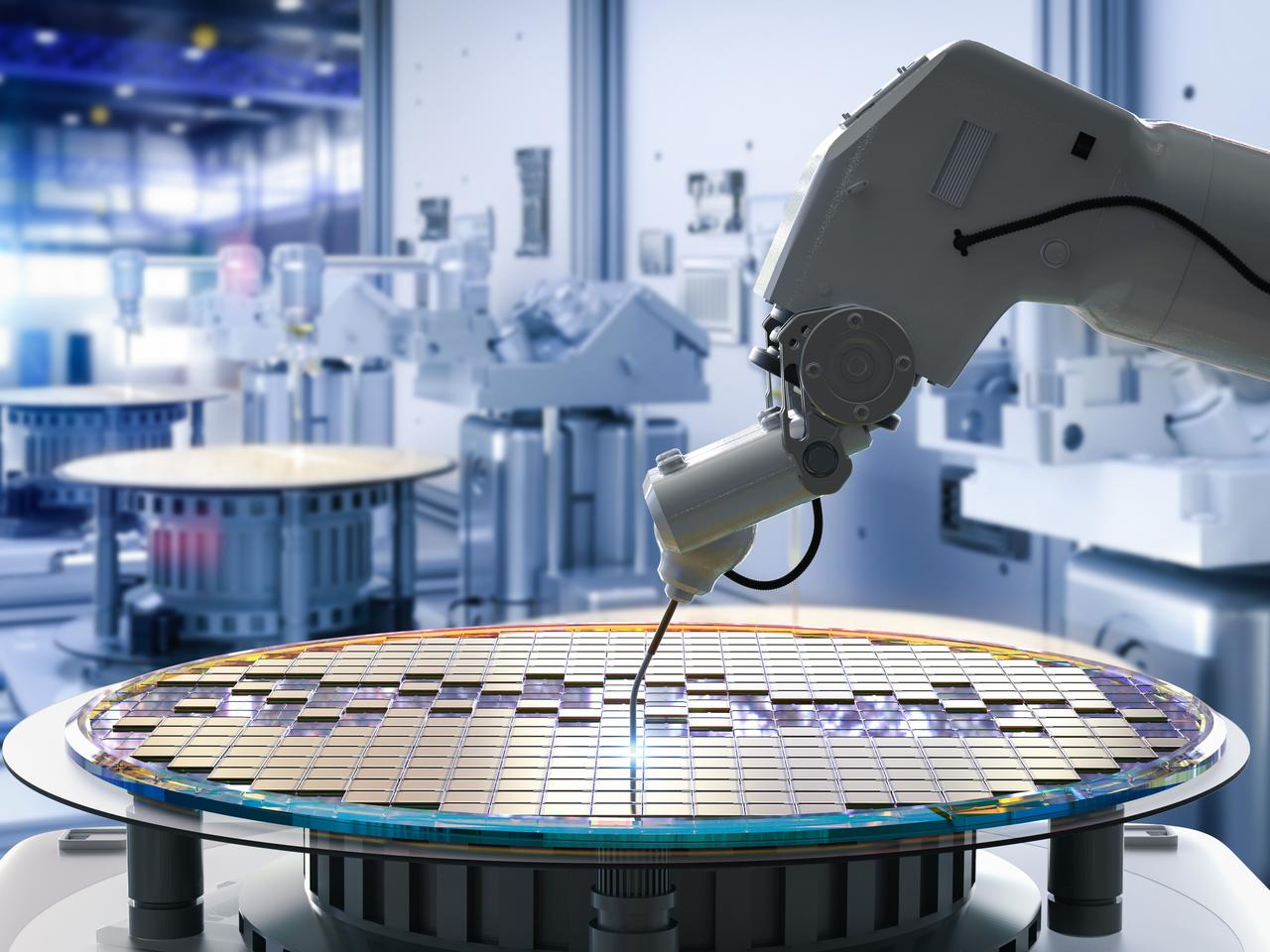

You can still find good values among AI stocks even after their strong price recovery in recent weeks. With more and more capital going into artificial intelligence (AI) development and infrastructure, and investors growing increasingly excited about the tech's potential impact on various businesses, stocks connected to the trend have been some of the market's biggest winners over the last two and a half years. Despite that rapid growth, many of those stocks could still have plenty of room to keep climbing. The world's biggest tech companies plan to spend hundreds of billions of dollars on building out data centers this year alone. And from the way their leadership teams talked on their most recent earnings calls, most of them don't expect to slow that capital spending down anytime soon. Of course, not every company will come out ahead from their investments in AI. And even if a company looks poised for financial success, the stock still needs to offer good value for investors. If you have a small amount available to invest at the moment, like $250, finding a good stock to buy could be even harder. I've identified three AI stocks you can buy now with just $250 that can help you capitalize on the next phase of growth in the industry. Amazon (AMZN 0.92%) is the largest public cloud computing infrastructure provider in the world. That said, it was caught flatfooted when the AI trend kicked off. It has worked hard to catch up with its competitors by focusing on providing a diverse range of AI services and making a strategic investment in Anthropic, a leading developer of foundational AI models. Now, when it comes to everything from raw computing power to platforms to build new large language models on top of, Amazon Web Services can meet clients' needs. Amazon is also working on its own purpose-built AI accelerator chips for both training and inference. It has seen strong demand for its custom silicon, and says customers are seeing significantly better price performance for both training and inference with its chips compared to the leading GPUs on the market. Importantly, Amazon expects to lay out more than $100 billion this year in capital expenditures, mostly focused on AI data centers. It wouldn't be spending that much if it didn't see strong demand for computing power. Management reiterated during its most recent earnings call that it remains capacity-constrained, so as more of its new data centers come online later this year, revenue growth for Amazon Web Services (AWS) should accelerate. Outside of AWS, the company continues to operate a massive online retail business. It has seen strong margin expansion over the last few years as a result of optimizing its logistics network and scaling its advertising business. While Amazon's massive spending on data centers is cutting into its free cash flow, the long-term trend remains positive. Despite its huge step up in investments over the last year, free cash flow still topped $25 billion over the trailing 12 months. With the stock trading at around $200 per share -- more than 15% below the all-time high it reached earlier this year -- it looks like a no-brainer buy. Tencent (TCEHY -1.24%) is the company behind WeChat, the massively popular Chinese super-app. If you took WhatsApp, combined it with Facebook, added Netflix and Spotify, built an app store on top of that, and extended payments from the app store to other websites and even physical stores, you'd have something that looks like the all-in-one app that is WeChat. Tencent also has a massive mobile gaming business, and it's the third-largest cloud computing provider in China. It has already seen the benefits of putting machine-learning AI algorithms to work in its advertising business. More targeted content leads to higher engagement rates and supports higher ad prices. That has been reflected in the strong gross margin expansion for its value-added services over the last two years. Tencent has also rolled out AI tools for marketers to improve their ad generation. With its strong operating leverage, it is reinvesting its excess capital into AI development to further improve ad targeting and content recommendations, and expand its cloud computing infrastructure. But it has not yet laid out timelines for monetizing newer features like its AI chatbot within WeChat, its AI-powered search engine, or its image generator. As a result, management says it expects its increased AI spending to hold back its margin expansion for the foreseeable future. Still, the long-term benefits should be worth it for investors. Tencent stock does come with some meaningful risks, not least of which is its position as a Chinese company. Management has long dealt with assertive regulators in Beijing exercising control over its industry and operations. Still, increasingly tight regulations could strangle Tencent's advancements. Even after considerable price appreciation this year, Tencent stock trades for less than 20 times trailing earnings. Given that it's trading at around $66 per share, investors with about $250 to deploy now could add three or four shares of the stock to their portfolios. Somebody has to manufacture and package all of the high-end chips that go into AI data centers, and more often than not, that somebody is Taiwan Semiconductor Manufacturing (TSM 2.44%), aka, TSMC. It commands roughly two-thirds of the third-party semiconductor fabrication market, and it's responsible for a particularly large share of those semiconductors made with the most advanced processes, which are required for high-end AI accelerator chips. As a result, the Taiwan-based company has been one of the biggest beneficiaries of the boom in AI spending, and it should continue to benefit well into the future. Management expects revenue from AI accelerators to double in 2025 and grow at an average annual rate of 40% through the end of the decade. That supports its long-term view that its total revenue will grow at a 20% compound annual rate between 2025 and 2029. Meanwhile, the company should be able to maintain its high gross margins. TSMC benefits from a virtuous cycle. Its industry-leading technology and scale make it the top foundry choice for any company that's designing cutting-edge chips for data centers or personal computing devices. As a result, TSMC collects a lot more revenue than its competitors, which gives it more money to invest in research and development. In turn, that ensures it can maintain and even extend its technological lead and continue winning more contracts. TSMC has been in the crosshairs of President Donald Trump's tariffs, and the ongoing trade policy changes he is engaging in present a major risk for the company. However, strong demand for AI chips will likely limit the impact on TSMC's non-AI business, and since AI is driving a significant portion of its growth these days, the overall impact should remain manageable. After the stock touched a 52-week low in April due to investors' tariff-related fears, it has recovered and is trading in the range it was in last fall. But it's still a relative bargain. Investors can buy shares for just 20 times forward earnings, as its price remains below $200 per share.

[9]

This Is My Top Artificial Intelligence (AI) Stock to Buy Right Now | The Motley Fool

Selecting a single artificial intelligence (AI) stock to buy right now is a difficult task. Every stock has its bear and bull cases, but the key is to find one with a far more certain bull than bear case. If I use those criteria to select my top AI stock to buy right now, I come up with Taiwan Semiconductor Manufacturing (TSM 2.44%) as my top pick. Regardless of what computing hardware a company uses for AI, the road likely leads back to Taiwan Semiconductor. Management is also incredibly bullish on the future, and it has great information that allows it to see a few years into the future. Taiwan Semiconductor is the leading chip foundry in the world, a position it obtained by staying neutral in the chip race while offering cutting-edge technology. Unlike some of the other chip foundry companies, TSMC isn't marketing its own product. This gives clients like Nvidia or Apple the confidence that Taiwan Semi isn't going to steal some of the proprietary chip designs and market them themselves. Taiwan Semiconductor also has leading technology. Its 3 nanometer chip node is the best available globally, although some other fabrication facilities also have this production ability. But it's not stopping there. By the end of 2025, TSMC's 2nm chips will be available, and its 1.6nm chips will be launched in late 2026. The focus on these chips isn't increased power; it's improved energy efficiency. When the 2nm chips are configured to run at the same speed as a 3nm chip, they consume 20% to 30% less power. And 1.6nm chips will improve the energy consumption level by 15% to 20% on top of that. With a large focus on how much energy data centers consume for AI training, these chips should prove popular. Although this is exciting technology, customers aren't waiting for next-generation chips to be launched; they're buying what's available now. This is evident at TSMC's Arizona production facility, which sold out chip production through 2027. This makes it obvious that TSMC management has an idea of what level of demand is brewing a few years out, and the commentary it's provided on this subject is incredibly bullish. Over the next five years, it expects AI-related revenue to increase at a compound annual growth rate (CAGR) of around 45%. Companywide, it expects this growth rate to approach a CAGR of 20%. That's an impressive level of growth for a company of TSMC's size, and it underscores the entire bull case for the company. However, there are some counterarguments to TSMC that investors should know. First and foremost, a large risk is Taiwan's geographical location. Although TSMC announced an additional $100 billion in U.S. chip production facilities and is working on building more production facilities elsewhere in the world, there is still the possibility of a mainland China takeover. The panic and potential ensuing war following such an event would crash the entire market, let alone TSMC. Another threat stemming from TSMC's location is President Donald Trump's tariffs. While there are currently no tariffs on semiconductors, the Trump administration has stated that it's an area it's looking to implement some tariffs after further examination. I'm not sure if there will be a semiconductor tariff based on the various trade deals that are rumored to be ongoing, but TSMC is the sole provider of chips for many of its clients. This means that TSMC can force its clients or their customers to eat the cost of tariffs, although it may provide a bit of relief. Regardless, Taiwan Semiconductor is already building more production facilities in the U.S. to sidestep the tariffs, which is exactly what Trump wants anyway. So, this gesture and plan may be enough to keep TSMC in Trump's good graces and keep semiconductors off the tariff list. The bear case for Taiwan Semiconductor's stock is far weaker than the bull case and relies only on conjecture, rather than hard evidence like the bull case does. With Taiwan Semiconductor's unique positioning as a key provider for nearly every big tech company, I'm bullish on the stock. It's a nearly sure-fire investment over the next five years, which is why it's my top AI stock to buy right now.

[10]

Looking for the Next Palantir Stock? This New Artificial Intelligence (AI) Stock Is Up 150% in 2 Months | The Motley Fool

Artificial intelligence (AI) is likely to be one of the most transformative technologies in human history. The International Data Corp. (IDC) says AI will add $19.9 trillion to the global economy by 2030, and Grand View Research estimates spending on AI hardware, software, and services will increase at 36% annually during the same period. Many investors eager to capitalize on that once-in-a-lifetime opportunity have bought stock in Palantir Technologies (PLTR 0.97%), a software vendor that specializes in analytics. Two years ago, the company introduced AIP, a large language model orchestration tool that helps customers infuse generative AI across their businesses. Palantir's revenue growth has since accelerated in seven straight quarters, and its share price has advanced 1,500% since May 2023. That means $5,000 invested in Palantir two years ago would now be worth about $80,000. Few stocks generate that much wealth so quickly, but a newly public AI company recently rocketed out of the gate. CoreWeave (CRWV 2.66%) held its initial public offering (IPO) on March 28, 2025, and the stock has since advanced 150%. That makes CoreWeave a candidate to be the "next Palantir," meaning the next AI stock to generate blockbuster returns in a relatively short period. Here's what investors should know. CoreWeave offers cloud infrastructure and software services. Hyperscalers like Amazon Web Services and Microsoft Azure provide similar products, but CoreWeave operates what is known as a GPU cloud. In other words, its data centers are purpose-built to support artificial intelligence and other high-performance computing workloads that require GPU acceleration. Research company SemiAnalysis recently ranked CoreWeave as the best GPU cloud on the market. The report highlighted a few key sources of differentiation. First, CoreWeave is usually among the first to deploy the latest Nvidia GPUs due to its close relationship with the chipmaker. For instance, it was first to make Nvidia GB200 NVL72 instances available, which feature 36 interconnected Grace Blackwell Superchips. Second, CoreWeave has generally scored very highly at the MLPerf benchmarks, unbiased tests that evaluate the performance of AI hardware, software, and services across training and inference workloads. For instance, CoreWeave achieved record-breaking inference results with Nvidia GB200 Grace Blackwell Superchips in April. CoreWeave reported impressive first-quarter financial results. Revenue increased 420% to $981 million and adjusted operating income (which excludes stock-based compensation and interest payments on debt) rose 550% to $162 million. However, the company reported a non-GAAP (adjusted) net loss of $150 million, a much larger loss than $24 million in the same quarter last year. Interest payments accounted for the discrepancy between adjusted operating income and adjusted net income. Building AI infrastructure is capital intensive and CoreWeave has $7.8 billion in long-term debt and lease obligations. The interest expense on that debt was $264 million in the first quarter. Put differently, interest payments consumed more than a quarter of revenue. In May, CoreWeave completed its acquisition of AI developer platform Weights & Biases, which extends the utility of its platform. Specifically, whereas CoreWeave provides the GPU-accelerated infrastructure required for AI workloads, Weights & Biases provides the tools developers need to train and evaluate AI models, and monitor the performance of AI applications. CoreWeave currently trades at 18 times sales, which puts the stock somewhere between expensive and reasonable. For context, cloud services company Cloudflare trades at 31 times sales, but Microsoft trades at 13 times sales. Of course, price-to-sales (P/S) ratios are usually a function of earnings power, meaning companies with higher margins tend to have higher P/S ratios. Unfortunately, it is impossible to know exactly how profitable CoreWeave will be in the future, which makes the stock relatively risky. For that reason, only investors comfortable with extreme volatility -- I'm talking about a 50% drop in the stock -- should consider buying shares today.

[11]

4 Brilliant Growth Stocks to Buy Now and Hold for the Long Term | The Motley Fool

Looking past all the talk of on-again, off-again tariffs, it's easy to forget that we are perhaps in the midst of the biggest technological shift in our lifetimes, thanks to the potential of artificial intelligence (AI). If this is true, then investors are certainly going to want to jump onto stocks of AI leaders and hold for the long term. Let's look at four AI growth stocks to buy now. Nvidia's (NVDA -1.02%) graphics processing units (GPUs) have become the backbone of AI infrastructure thanks to their fast processing speeds, making them well-suited for running processor-intensive AI workloads. Meanwhile, the company has created a wide moat against potential competitors with the help of its CUDA software platform. Nvidia originally created the software platform to allow developers to program its chips for tasks outside their original purpose of speeding up graphics rendering in video in an effort to expand the market of GPUs. However, it didn't stop there, and in the years since, it has built a collection of high-performance computing libraries and tools that help improve the performance of its chips with AI tasks. This has led it to take a dominant market share of more than 80% in the GPU space. As such, the company has become the biggest beneficiary of the AI data center build-out. Where AI spending goes, Nvidia's revenue and profits are sure to follow. This is both the biggest opportunity and risk for the company moving forward, but at this time, spending continues to rise as cloud-computing companies, AI model start-ups, large enterprises, and even countries pour money into the space so as not to be left behind. Data gathering and analytics provider Palantir Technologies (PLTR 0.97%) has become one of the best growth stories in AI. Instead of trying to create the best AI model, Palantir has instead focused its efforts on garnering the power of these AI models to help solve real-world problems. It does this by gathering data from a multitude of sources and structuring it into an "ontology," linking data to real-world objects and processes. While Nvidia's GPUs serve as the backbone of AI infrastructure, Palantir's AI Platform (AIP) serves as the backbone for how organizations actually use AI in the real world. AIP helps customers connect AI models to their data and workflows to solve practical business problems. More recently, Palantir has rolled out AI agents within AIP, which can automate processes and even take action, pushing AI from insight to execution. The stock's valuation and government budget cuts are the biggest risks Palantir faces, but with its technology now being embraced across sectors for various tasks, the opportunity in front of it is huge. Manufacturing advanced chips from companies like Nvidia isn't easy, which is why leading semiconductor contract manufacturer Taiwan Semiconductor Manufacturing (TSM -2.02%) has become an invaluable part of the semiconductor value chain. Given the upfront costs, complexity, technological expertise, high utilization, and scale needed to profitably run a fab (chip manufacturing plant), most semiconductor chip design companies today outsource their manufacturing. As its biggest competitors, Intel and Samsung have struggled with their foundry businesses, TSMC has become the go-to maker of advanced chips and a critical partner to semiconductor companies. As such, TSMC is well-positioned to continue to benefit from the growing demand for GPUs and other chips that are fueling the AI infrastructure boom. The company is working closely with its largest customers to expand capacity based on their demand projects, while its technological leadership in the space has given it strong pricing power. That's a powerful combination. Like Nvidia, its biggest risk would be an AI infrastructure spending slowdown, but right now, most signs point to continued robust chip spending. While there have been some concerns that AI could disrupt its prized Google search business, Alphabet (GOOGL -1.37%) (GOOG -1.34%) looks poised to be an AI winner. Its cloud-computing business Google Cloud has been seeing strong revenue growth and operating leverage, which have led the segment to see its profitability begin to soar. Customers are attracted to its AI cloud services due to the strength of its leading Gemini AI model and strong analytics platform. In addition, the company has developed its own custom AI chips that enhance performance and use less power, leading to improved efficiency and lower costs. Meanwhile, when it comes to search, the company has big distribution and network advantages that should not be overlooked. Google is the default search engine for most devices and browsers through its Android operating system, Chrome browser, and revenue-sharing deals with companies like Apple. In addition, the company has spent decades building out an ad network that can cater to both local companies and global brands. With the company historically only serving ads on 20% of its search queries, AI should become more of an opportunity than a challenge. At the same time, it is expensive to run AI-powered search. It was recently revealed that upstart AI search Perplexity AI is burning through a ton of cash as it spends heavily on third-party AI models and cloud-computing services, while losing money on trial users and those on its free tier. Overall, Alphabet is well positioned to benefit from AI with both Google Cloud and search, while also having another promising business with Waymo, its robotaxi business that has been growing rapidly.

[12]

Prediction: This Artificial Intelligence (AI) Stock Will Be the Biggest Winner of 2025 | The Motley Fool

It seems like everyone is trying to identify the next big AI stock. There are many to choose from, but as with any craze, picking long-term winners from long-term losers can be a difficult task. While there are many exciting names to choose from, there's one business in particular that every artificial intelligence investor needs to own in 2025 and beyond. Artificial intelligence will be one of the biggest growth opportunities this century. The United Nations believes that the AI market will zoom from $189 billion in value in 2023 to nearly $5 billion in value by 2033. But betting on AI isn't as easy as just buying any business exposed to this massive theme. Some companies are developing AI technologies, some are consuming these technologies to gain competitive advantages and operational efficiencies, and yet others are selling to the AI developers themselves, making future innovation possible. There's an old saying: When everybody is digging for gold, it's good to be in the pick-and-shovel business. This wisdom advises investors not to go straight into the rush itself, but to supply the rush with the requisite supplies. This way, no matter who finds gold, or whether or not there is gold at all, you still come away with a profit. In this regard, no AI stock shines more than Nvidia (NVDA 0.37%). Nvidia is by far the leading supplier of GPUs to the AI industry. Sometimes, these specialized GPUs are sold directly to AI developers. Most sales, however, are directed toward data center providers or cloud computing providers. These businesses own data centers around the world powered by GPUs. When an AI developer wants to train a model, a mature AI business wants to execute an AI application, or a consumer wants to use that application on their smartphone, the data required is usually processed and delivered using cloud computing infrastructure. Roughly 90% of data center GPUs are manufactured by Nvidia -- a dominant market share that shows how much more powerful and in-demand its chips are compared to the competition. Therefore, nearly any business or individual that wants to incorporate AI into their processes will be using Nvidia chips. And any developers looking to build new AI applications will also likely be using Nvidia chips. Put simply, Nvidia is sitting at the center of the AI revolution. However, over the past five years, Nvidia's stock has risen by an astounding 1,400%. Is it too late to jump in? You might be surprised by the answer. Nvidia stock looks expensive at first glance, with shares trading at roughly 46 times earnings. But this is already a very profitable business, and sales continue to grow at double-digit rates. Looking ahead based on next year's earnings, the stock trades at just 30 times forward profits. That's still a premium to the S&P 500's forward earnings multiple of around 23, but the valuation starts to seem much more reasonable once you factor in some expected growth. The most important thing to keep in mind is that the AI revolution won't unfold over the next year or two. This is truly a multidecade opportunity. Nvidia will face competitive and pricing pressures over time, but market growth will be sustained for so long that even if some market share is ceded, the company should still be able to grow significantly over the next decade. As with any growth stock, Nvidia shares will be exposed to high levels of volatility. But if you're willing to stay patient, the upfront premium isn't as steep as it seems, and this one AI stock should be a continued winner through 2025 and beyond thanks to its central position in the AI supply chain.

[13]

Billionaire Philippe Laffont Has Cumulatively Sold 83% of Coatue's Nvidia Stake and Is Piling Into Wall Street's Hottest Artificial Intelligence (AI) IPO | The Motley Fool

Coatue Management's billionaire chief is swapping out the brains of AI-powered data centers for a newly public AI stock with scorching-hot growth potential. May has been a data-packed month for investors. Between earnings season, a steady flow of economic data releases from the government, and the Federal Open Market Committee's federal funds rate decision, there's been a lot to unpack. But arguably the most important data release of the quarter occurred one week ago, on May 15. This was the deadline for institutional investors with at least $100 million in assets under management (AUM) to file Form 13F with the Securities and Exchange Commission. A 13F provides investors with a way to track which stocks and exchange-traded funds (ETFs) Wall Street's most prominent money managers have been buying and selling. Though Berkshire Hathaway's Warren Buffett is the most followed of all asset managers, he's far from the only billionaire investor known to deliver outsized returns and move markets. For instance, billionaire fund manager Philippe Laffont of Coatue Management, who's overseeing $22.7 billion in AUM, has a rich track record of outperformance. Laffont is also known for his love of high-growth stocks -- especially those in the tech sector. Based on Coatue's first-quarter 13F, its billionaire chief continued to be a seller of the world's leading artificial intelligence (AI) stock, Nvidia (NVDA -1.82%), but absolutely piled into Wall Street's hottest AI-initial public offering (IPO) of the year. Taking into account that Nvidia completed a 10-for-1 forward split in June 2024, Coatue's position in Wall Street's AI darling peaked at 49,802,020 shares in the March-ended quarter of 2023. Over the last two years, Laffont has been paring down this position with regularity. During the first quarter of 2025, Laffont's fund dumped 1,460,653 shares of Nvidia stock, which represents a sequential quarterly decline of about 15%. But over the last eight quarters, Coatue's billionaire boss has overseen the sale of 41,256,185 cumulative shares of Nvidia, representing 83% of the fund's original stake. To be objective, Nvidia has done a lot of things right to get to where it is now. Its Hopper (H100) graphics processing unit (GPU) and successor Blackwell GPU architecture have run circles around the competition, in terms of compute ability. Nvidia's hardware maintains a near-monopoly-like share in enterprise AI data centers. Overwhelming demand for Nvidia's GPUs also boosted its pricing power. With the Hopper and Blackwell commanding a premium over all other GPUs, it's no surprise that Nvidia's gross margin surpassed 70%. But not everything is perfect for Nvidia -- and Laffont's trading activity suggests it. Despite Nvidia having superior hardware, competitive pressures are beginning to weigh on its margins. In addition to direct external competitors ramping up production of their AI-GPUs, many of Nvidia's top customers by net sales are internally developing chips they'll use in their own data centers. The cost and accessibility advantage of relying on internally produced AI solutions could realistically result in Nvidia losing out on valuable future data center real estate. The presence of new external and internal competition is also working to minimize the effect of AI-GPU scarcity. This has been Nvidia's primary competitive edge for two years, and it's the core reason its gross margin surged to as high as 78.4% one year ago. With its gross margin expected to decline, yet again, in the fiscal first quarter, it's clear that Nvidia's biggest advantage is withering. The other big-time concern for Nvidia shareholders is the likelihood of an AI bubble forming and bursting. Including the proliferation of the internet in the mid-1990s, there hasn't been a game-changing innovation in more than three decades that's avoided a bubble-bursting event early in its expansion. The fact that most businesses haven't optimized their AI solutions, and in many instances aren't generating a positive return on their AI investments, strongly signals that investors have (again) overestimated the early innings utility and adoption rate of a next-big-thing trend. With more than 90% of Nvidia's net sales coming from its data center segment in the fiscal fourth quarter of 2025 (ended Jan. 26, 2025), a bursting of the AI bubble would be disastrous for its stock. Although Laffont was a seller of a lot of high-growth tech stocks during the March-ended quarter, there was one artificial intelligence company that caught his attention in a big way -- and it only debuted as a public company days before the end of the first quarter! Arguably no stock was purchased more aggressively in the opening frame of 2025 by Coatue's billionaire chief than Nvidia-backed AI-data center infrastructure company CoreWeave (CRWV 18.79%). In its two business days as a publicly traded company in the first quarter (the company's IPO was Friday, March 28), Laffont scooped up 14,402,999 shares, which vaulted it to Coatue's 16th-largest holding by market value. The allure of CoreWeave for Laffont almost certainly has to do with the insatiable enterprise demand for AI computing resources. CoreWeave has purchased 250,000 Hopper chips from Nvidia, which is no small investment. In return, the company can lease out its AI infrastructure and services to clients, with the amount it generates in sales all dependent on things like demand, the services rendered, and the GPUs needed to complete a task. Coatue's billionaire money manager is likely also impressed with CoreWeave's expected growth ramp. Keeping in mind that consensus growth estimates for relatively early stage businesses are often fluid, CoreWeave's sales are projected to catapult from a reported $1.92 billion in 2024 to an estimated $19.66 billion come 2028. The company also announced a strategic deal with OpenAI that tacks on $11.2 billion in its revenue backlog. The numbers on paper absolutely paint an exciting picture for CoreWeave. But the real world doesn't always pan out as things do on paper. To begin with, CoreWeave's net losses are accelerating at the same staggering rate as its sales. As an early stage business, the company had to rely on debt financing to fund its GPU purchases. Last year, CoreWeave had nearly $361 million in net interest expenses. Its annual run in 2025 for net interest expense, based on its recently reported first quarter, is almost $1.06 billion! Investors should expect steep losses as CoreWeave's revenue ramp-up continues. Another sizable concern for CoreWeave, which might actually trump its rapidly widening net loss, is Nvidia's accelerated innovation cycle. Nvidia plans to bring a new high-powered AI chip to market roughly once per year. This means that CoreWeave's predominantly Hopper GPU-powered data centers could quickly become obsolete -- or at the very least, it could substantially weaken the company's pricing power for its services. Lastly, CoreWeave would almost certainly be adversely affected by an AI bubble forming and bursting. Until artificial intelligence matures as a technology, the threat of businesses paring back their AI infrastructure spending remains a tangible concern.

[14]

Billionaire Investor Stanley Druckenmiller Just Slashed His Fund's Stake in Tesla by 50% and Quadrupled Its Position in Another AI Stock Up 2,800% Since Its IPO | The Motley Fool

There aren't too many investors with better track records than Stanley Druckenmiller. Over a 30-year period, which included 12 years working as a portfolio manager for George Soros at the Quant Fund, Druckenmiller generated average annual returns of 30%, according to Hedge Fund Alpha. Today, Druckenmiller is still investing his own money through his family's fund, Duquesne Capital Management. In the first quarter of the year, Druckenmiller slashed his position in the electric-car maker Tesla (TSLA 2.08%) by about 50% and more than quadrupled his stake in another artificial intelligence (AI) stock up 2,800% since its initial public offering (IPO). Filings from the Securities and Exchange Commission show that Duquesne lowered its stake in Tesla by about 50% and now holds about 18.8 million shares. Following President Donald Trump's election victory in November, shares of Tesla rocketed higher as investors believed the stock would benefit from CEO Elon Musk's close relationship to the president. However, in the first quarter of the year, most of those gains evaporated, as Tesla's core electric-vehicle (EV) business struggled and investors worried about how Musk's foray into politics might impact the brand. Druckenmiller is certainly a believer in AI but also remains disciplined on valuation, as his past investments have showed. The legendary investor didn't hesitate to sell the AI chip giant Nvidia when he thought that valuation rose to unsustainable levels. Tesla always traded at a nosebleed valuation due to Musk's larger-than-life brand and the company's promising future initiatives. These include full-self-driving (FSD) technology and the Optimus robots that will supposedly be able to complete regular household chores. All eyes are now on an upcoming FSD demonstration in Austin some time in June that could renew investor excitement for the stock. But with the core EV business still struggling, particularly in China, where competitors like BYD have taken significant market share, Tesla needs to keep future initiatives on track to maintain its high valuation. In the first quarter, Duquesne also more than quadrupled its position in Taiwan Semiconductor (TSM 2.44%), purchasing an additional 491 million of shares in the quarter. Nvidia is viewed as one of the main pick-and-shovel AI plays, given that its chips help power AI applications. But Taiwan Semiconductor goes a layer deeper and is currently one of the most advanced manufacturers of graphics processing units (GPUs). The company manufactures Nvidia's next-generation Blackwell chips. Nvidia's CEO Jensen Huang previously called Taiwan Semiconductor the premier chip manufacturer in the world by an "incredible margin." He said if something were to happen to the company or Nvidia wasn't able to partner with them, the company could still produce chips but it would be much more difficult. "Maybe the process technology is not as great. Maybe we won't be able to get the same level of outperformance or cost, but we will be able to provide the supply," Huang said. In the first quarter of the year, Taiwan Semiconductor reported solid earnings ahead of Wall Street consensus estimates, while guiding for revenue growth in the mid-20s percentile in 2025, driven by AI-associated revenue, which the company expects to double this year. This seemed to suggest that tariffs haven't impacted the company yet and that management is still seeing strong AI demand. Taiwan Semiconductor certainly faces challenges from export restrictions set by the Trump administration on Nvidia and other U.S. chip players that do business in China, but the stock trades at a fairly reasonable forward earnings multiple of 18, which isn't expensive as far as the AI space goes.

[15]

Billionaire Philippe Laffont Just Sold Shares of Nvidia and 2 Other AI Powerhouses and Bought Shares of This Nvidia-Backed Company | The Motley Fool

The artificial intelligence (AI) boom has driven stock market gains over the past couple of years, but the momentum may be far from over. Not only do analysts predict an AI market of more than $2 trillion by the early 2030s, but current activity in the space supports that. Technology companies from Meta Platforms to Alphabet (GOOG -1.34%) (GOOGL -1.37%) have announced billions of dollars in spending to support AI projects. Data center buildout continues. And there are more AI stages to come, such as the moment of AI agents, when companies will apply AI to handle complex real-world problems. All of this is right up the alley of billionaire Philippe Laffont, who as founder of Coatue Management, focuses on innovators and invests heavily in tech companies. In fact, the biggest positions in Coatue's $22.6 billion portfolio are Meta and Amazon, each with weightings of more than 9%. So, it may seem surprising that right now, with so much ahead for AI, Laffont just sold some shares of top AI chip designer Nvidia (NVDA -1.02%) and two other AI giants. But, at the same time, Laffont picked up shares of an Nvidia-backed company that could become the next AI powerhouse. Let's take a look at his moves and consider the potential of this newish player. First, as mentioned, it's important to keep in mind that Laffont isn't just dabbling in AI, but is someone who specializes in the technology sector and heavily invests in today's leaders and tomorrow's potential leaders. Laffont holds a computer science degree from MIT and went on to hone his investing skills at Tiger Management, one of the world's first hedge funds. He then became known as one of the "Tiger Cubs," Tiger employees who later launched their own funds -- and he founded Coatue in 1999. It's clear that, considering Laffont's experience and investment priorities, he has his finger on the pulse of the AI market. So, he could offer investors inspiration as they look for AI stocks to buy. In the first quarter of this year, Laffont made the following moves: And what Nvidia-backed AI stock did Laffont add to his portfolio? CoreWeave (CRWV 2.66%), a company that in late March completed its initial public offering (IPO) and has since seen its stock surge more than 160%, bringing the company's market value to more than $50 billion. Laffont made a decent-sized bet on this player, buying 14,402,999 shares. The IPO itself was considered a flop, as the stock stagnated during its first trading session, then fell before eventually gathering some positive momentum. President Donald Trump's import tariff plans weighed on stocks -- specifically growth players -- and that created a difficult environment for CoreWeave's first trading days. Since, though, optimism about trade deals that won't weigh heavily on the economy and the support of Nvidia have helped CoreWeave stock take off. Nvidia recently said it had a 7% stake in CoreWeave as of March 31. These two tech giants are closely linked because CoreWeave's business is tied to demand for Nvidia's graphics processing units (GPUs). This young company offers customers access to its fleet of 250,000 Nvidia GPUs -- in fact, users can even rent access to them by the hour. So, working with CoreWeave brings customers great flexibility along with the power of Nvidia's top AI chips. This helped CoreWeave report a 420% increase in revenue in the recent quarter to $981 million. It's important to keep in mind, though, that to build up its GPU platform, CoreWeave also built up a considerable level of debt. As of the end of the quarter, current debt totaled $3.8 billion, and non-current debt totaled $4.9 billion. Meanwhile, CoreWeave must continue spending heavily to keep growth going and serve demand -- the company forecasts capital spending of as much as $23 billion this year. And CoreWeave expects annual revenue to reach $4.9 billion to $5.1 billion. It's clear that for a big tech investor like Laffont, it makes sense to lock in some gains from AI giants that have been in the portfolio for a while -- and bet on a new player that's still in its early growth stages. But before you follow Laffont, it's key to consider your investment style. If you're uncomfortable with risk and prefer stability, you're better off sticking with well-established AI players -- such as Nvidia, AMD, or Alphabet. And Laffont, too, continues to believe in their stories as they remain in his portfolio. But, if you're an aggressive investor looking for the next big AI growth story -- and you don't mind some risk and volatility along the way -- you might consider picking up a few shares of CoreWeave. Significant upside could lie ahead as the AI boom continues.

[16]

Prediction: This Artificial Intelligence (AI) Stock Will See the Biggest Comeback in the Second Half of 2025 | The Motley Fool