Nvidia's Strong Earnings Overshadowed by Potential Trump Trade Policies

2 Sources

2 Sources

[1]

Nvidia sinks after strong earnings but questions about Trump tariffs

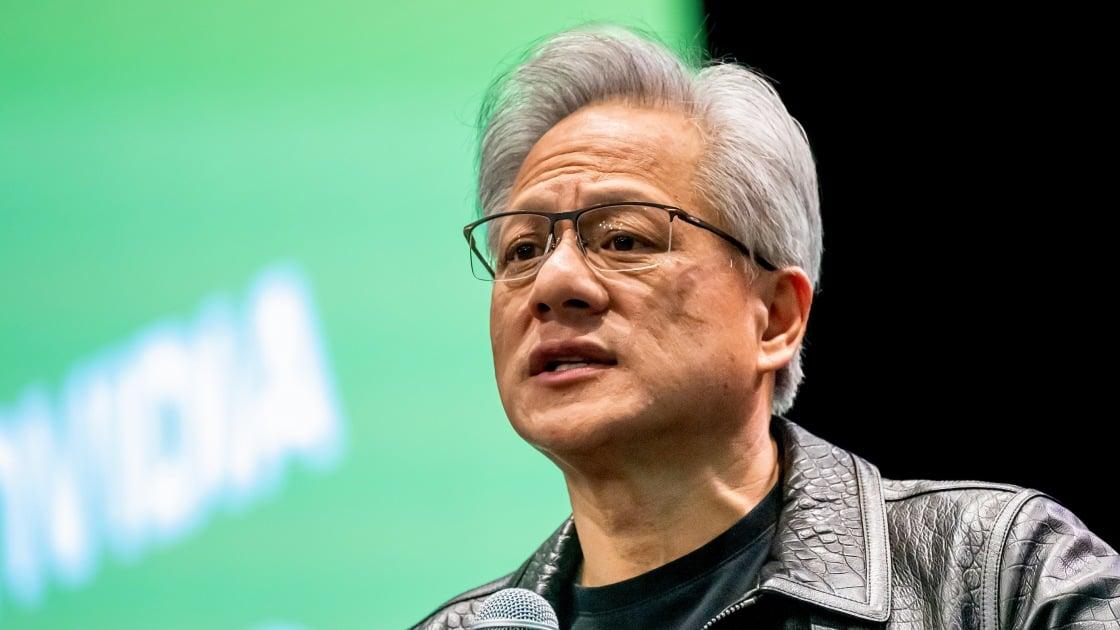

The AI chip maker reported a 94 percent increase in revenue but depends on manufacturing plants in Taiwan, which Trump claims "stole our chip business." Nvidia's shares sank about 2 percent in after-hours trading Wednesday after the artificial intelligence chip maker posted quarterly earnings that beat estimates but apparently failed to convince investors it could maintain the huge recent growth that has made it one of the world's most valuable companies. Nvidia's business, which draws significant revenue from China and depends on Taiwan Semiconductor Manufacturing Co. to build its GPU chips, faces potential uncertainty under president-elect Donald Trump's future trade policies. He has proposed a blanket tariff on all imported goods and said Taiwan "stole our chip business." Nvidia reported $35.1 billion in revenue for its third quarter ending Oct. 27, up 94 percent from the same period last year. The company anticipates about $37.5 billion in revenue next quarter. Nvidia is the top supplier of chips that power generative AI tools like OpenAI's ChatGPT and stock energy-hungry data centers. The company could benefit from president-elect Trump's promises to enable AI development in the United States. He is expected to repeal a Biden-era executive-order he has said "hinders" AI innovation, and said his energy policies will help meet the huge energy demands of data centers. Nvidia founder and CEO Jensen Huang was asked on an investor call Wednesday about the potential impacts on his company of future tariffs imposed by Trump, a question that has also been raised by some analysts. "Whatever the new administration decides, we will, of course, support the administration," Huang said. Nvidia originally created its GPU chips, or graphics processing units, to render video game graphics. It still leads in that market but pivoted to also focus on AI after its products emerged as crucial to the machine learning technology that powers capabilities such as image recognition and chatbots. The company now dominates the AI chip market with a market capitalization above $3 trillion. Its earnings reports are highly anticipated as a barometer for the tech industry, the prospects for AI development and broader market sentiment. Nvidia stock is one of the few ways amateur investors have found to directly cash in on the hype around AI, with many AI companies being private start-ups.

[2]

Nvidia's Jensen Huang pledges to 'comply fully' with Trump trade policies as uncertainty looms over chip industry

Trump's calls for worldwide tariffs would presumably affect Nvidia. Despite his general tough-on-China rhetoric, previous comments casting doubt on America's commitment to help Taiwan defend itself against a potential Chinese invasion have weighed on chip stocks. Taiwan is the home of Nvidia's preeminent supplier, TSMC. "The unpredictability of the president elect is now an overhang on basically all of tech," said Ted Mortonson, a managing director and tech desk sector strategist at Baird. Whatever a second Trump administration decides to do, Huang said, Nvidia will be on board. "That's our highest mandate," he said. "We will comply fully with any regulation that comes along." Nvidia, as well as other chip makers, has struggled to make chips for the Chinese market to meet export controls from the Biden administration, which is also reportedly weighing additional measures on sales to wealthy nations in the Persian Gulf. Sales to China, once making up a quarter of the company's revenue, accounted for just 12% of business last quarter, per Bloomberg. Angelo Zino of CFRA Research said there's a possibility a more transactional approach from the Trump administration regarding China, compared to the current's administration blanket bans, could potentially benefit the world's largest company. China, he said in a recent note, is currently a generation or two behind when it comes to AI chip development. "According to our Washington Analysis team, Trump may be willing to offer more advanced AI chips to other nations, even China, if the price is right while maintaining a certain technology lead," he wrote. Still, Trump's proposed universal tariff could pose challenges, given that 57% of Nvidia's business is done abroad, according to Bloomberg. Nvidia CFO Colette Kress touted momentum in demand for so-called "sovereign AI," or nations investing in their own GenAI infrastructure, saying deployment of GPUs in India have grown 10 times. CFRA believes sovereign AI could account for $11-12 billion in revenue this year. Nonetheless, no matter who's in the White House, Nvidia's importance to the U.S. as a national security asset looms large. "There is a worry that now this is a national defense company," Mortonson said. Amid many unknowns, it's obvious Huang and his company must navigate much more than meeting ravenous demand.

Share

Share

Copy Link

Nvidia reports impressive Q3 earnings but faces uncertainty due to potential Trump trade policies. CEO Jensen Huang pledges compliance with future regulations as the company navigates geopolitical challenges.

Nvidia Reports Strong Q3 Earnings Amid Geopolitical Uncertainty

Nvidia, the leading AI chip manufacturer, has reported impressive third-quarter earnings for the period ending October 27, with revenue soaring 94% year-over-year to $35.1 billion

1

. Despite this strong performance, the company's shares dipped approximately 2% in after-hours trading, reflecting investor concerns about sustaining such rapid growth in the face of potential geopolitical challenges1

.Trump's Trade Policies Cast Shadow on Nvidia's Future

The election of Donald Trump as the next U.S. president has introduced new uncertainties for Nvidia and the broader chip industry. Trump's proposed blanket tariff on all imported goods and his statements about Taiwan "stealing" America's chip business have raised concerns about the company's future operations

1

. Nvidia heavily relies on Taiwan Semiconductor Manufacturing Co. (TSMC) for manufacturing its GPU chips, making it vulnerable to potential trade restrictions2

.CEO Jensen Huang Pledges Compliance with Future Regulations

In response to questions about the potential impact of Trump's policies, Nvidia's founder and CEO Jensen Huang stated, "Whatever the new administration decides, we will, of course, support the administration"

1

. He further emphasized the company's commitment to compliance, saying, "That's our highest mandate. We will comply fully with any regulation that comes along"2

.Navigating Geopolitical Challenges

Nvidia's business has already been affected by existing export controls imposed by the Biden administration. Sales to China, which once accounted for a quarter of the company's revenue, have dropped to just 12% in the last quarter

2

. The company has been working on developing chips for the Chinese market that meet current export control requirements.Potential Opportunities and Risks

While Trump's policies pose potential challenges, some analysts suggest they could also present opportunities. Angelo Zino of CFRA Research noted that a more transactional approach from the Trump administration regarding China, compared to the current administration's blanket bans, could potentially benefit Nvidia

2

.Related Stories

Sovereign AI: A Growing Market

Nvidia CFO Colette Kress highlighted the company's growing momentum in "sovereign AI," where nations invest in their own generative AI infrastructure. She noted that GPU deployments in India have grown tenfold, indicating a significant expansion in this market segment

2

.Nvidia's Strategic Importance

As Nvidia continues to dominate the AI chip market with a market capitalization exceeding $3 trillion, its strategic importance to the United States as a national security asset is becoming increasingly apparent

1

2

. This status adds another layer of complexity to the company's operations and future prospects.Looking Ahead

Despite the uncertainties, Nvidia remains optimistic about its near-term prospects, projecting revenue of approximately $37.5 billion for the next quarter

1

. However, as Ted Mortonson, a managing director at Baird, points out, "The unpredictability of the president-elect is now an overhang on basically all of tech"2

. This sentiment underscores the challenges Nvidia and other tech companies face in navigating the evolving geopolitical landscape.References

Summarized by

Navi

[1]

Related Stories

Nvidia CEO Jensen Huang Redefines Company as 'AI Factory,' Addresses Market Concerns

20 Mar 2025•Business and Economy

Nvidia Navigates US-China Tensions with Potential New AI Chip for Chinese Market

22 Aug 2025•Technology

Nvidia Set to Resume AI Chip Sales to China Amid Regulatory Shifts

10 Jul 2025•Technology

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy