Nvidia Surges Past $5 Trillion Market Cap as CEO Huang Reveals $500 Billion Order Backlog

5 Sources

5 Sources

[1]

Nvidia adds nearly $100B in market cap in a matter of days. Here is what's going right

Nvidia was once again on the move after the world's three biggest cloud companies, along with Meta Platforms , guided spending higher last week to keep pace in the artificial intelligence arms race. Some, if not much, of that spend should continue to fill the coffers of the Jensen Huang-run AI chip king. Club stock Nvidia on Monday soared another 4% to another all-time high -- around $5.12 trillion in market value. In the run-up to next week's earnings, we would expect to see more analysts raise their quarterly estimates and price targets on Nvidia. The stock closed above $5 trillion for the first time last Wednesday. Three trading days later, it added nearly $100 billion in market cap. In a Monday note to clients , Loop Capital raised its Nvidia price target to $350 per share from $250. The analysts acknowledged that the 70% upside from Friday's close built into their PT over the next four to five quarters sounds crazy. But they believe their "work suggests NVDA is about to begin a ramp of GPU that will essentially double its unit shipments in the next 12-15 months, while seeing the benefit of [average selling price] expansion and networking." Loop's note came out ahead of two major Nvidia developments before Monday's opening bell. First, Microsoft said it secured export licenses to ship Nvidia chips to the United Arab Emirates. Second, Amazon got a $38 billion commitment from OpenAI to use AWS, the largest cloud, for more compute, tapping hundreds of thousands of Nvidia graphics processing units (GPUs). Microsoft's Azure and Google Cloud at the second and third biggest, respectively. On Friday, we learned the South Korean government, along with key South Korean industrial companies including Samsung, Hyundai, and others, is working with Nvidia "to expand the nation's AI infrastructure with over a quarter-million Nvidia GPUs across its sovereign clouds and AI factories." The idea is for various South Korean entities, some government-funded, others private, to source Nvidia chips and build out various data centers with the infrastructure forming a "foundation for AI-enabled economic growth and innovation across Korea's industries, including automotive, manufacturing, and telecommunications." Remember, Nvidia made its own OpenAI deal in September, announcing a $100 billion investment into OpenAI to help the latter build out 10 gigawatts of artificial intelligence data center capacity. NVDA 5Y mountain Nvidia performance over 5 years All these updates come as it is becoming increasingly clear that access to AI infrastructure is not only important for businesses looking to compete against one another, but also fast becoming a national security issue. Governments must be proactive in securing supplies of the cutting-edge accelerated computing platforms - at this point, the latest products from Nvidia are so far beyond simply being chips - if they are to compete in a world in which data is gold and cyberattacks can cause billions of dollars worth of economic damage. Though there is no denying that the gains tied to the AI trade have already been nothing short of incredible, there is still so much more room to run. That doesn't, however, mean those gains will be made in a straight line. We must consider that while AI is real and the demand is certainly there, many companies being bid up still do not generate earnings, and in some cases may not even be generating sales yet. We wouldn't advise playing in that part of the speculative arena. While we have to consider that bubble-like froth in one part of the market can seep into other parts or that a popping of those micro bubbles in the nuclear and quantum can cause collateral damage in less speculative names, the most recent updates support the idea that investors need to maintain exposure to the highest quality AI players, and that for all the millionaires it has already minted , Nvidia's best days still lie ahead. (Jim Cramer's Charitable Trust is long NVDA, MSFT, AMZN, META. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust's portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

[2]

Nvidia Termed 'Undervalued' By Masayoshi Son Last Year, Now Worth $5 Trillion: Here Is What Japanese Billionaire Investor Said About Ongoing AI Hype - Apple (NASDAQ:AAPL), Amazon.com (NASDAQ:AMZN)

As Nvidia Corp. (NASDAQ:NVDA) races past a record-breaking $5 trillion valuation, a remark from SoftBank Group (OTC:SFTBF) (OTC:SFTBY) CEO Masayoshi Son last year that the chipmaker was "undervalued" looks remarkably prescient. Masayoshi Son's $9 Trillion AI Vision Speaking with Bloomberg at the Future Investment Initiative conference in Saudi Arabia in October 2024, Son dismissed concerns about an AI bubble, arguing that Nvidia's market potential was still vastly underestimated. Son said he thinks "Nvidia is undervalued" because the "future is much bigger" and that the chipmaker is just one example of it. He went on to frame an expansive vision for the artificial intelligence economy, estimating that the rise of artificial superintelligence could require 400 gigawatts of data center power and as many as 200 million AI chips, representing a cumulative capital expenditure of $9 trillion. "It's too much investment for many people's view. I say it's still very reasonable. CapEx, $9 trillion is not too big, maybe too small," Son stated at the time. See Also: Palantir Could Be Nvidia's Fastest Route To $500 Billion In AI Software -- Cathie Wood Saw It Coming AI Investment, Not A Bubble Son also addressed critics who warned of excessive hype surrounding generative AI and semiconductor stocks, but countered that even modest real-world productivity gains would justify massive AI investments. He also projected that four major companies -- the "new GAFA," a reference to Alphabet Inc.'s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google, Apple Inc. (NASDAQ:AAPL), Meta Platforms, Inc.'s (NASDAQ:MET) Facebook and Amazon.com, Inc. (NASDAQ:AMZN) -- could together earn $4 trillion in annual profit from the AI revolution. When asked if SoftBank aimed to be one of them, he replied immediately, saying, "Of course." Jensen Huang-Led Nvidia's Meteoric Rise Fast forward to today, Nvidia -- led by CEO Jensen Huang -- has crossed the $5 trillion market capitalization mark, cementing its position as the most valuable semiconductor company in history. The rally has been fueled by record demand for AI accelerators and data center chips powering large-scale models across tech giants like Microsoft Corporation (NASDAQ:MSFT), Meta and Google. Analysts such as Dan Ives of Wedbush call this "the fuel for the AI revolution," while others, like Kevin Gordon at Schwab, caution that Nvidia's valuation now represents 16.5% of U.S. nominal GDP -- far surpassing the dot-com era highs of Cisco. Nvidia shares have climbed 49.58% year to date. According to Benzinga's Edge Stock Rankings, the stock shows strong Momentum, Growth and Quality, maintaining a positive price trend across short-, medium-, and long-term periods. Click here for a detailed look at how it stacks up against peers and competitors. Read Next: After Google's $2.7B Acquisition Of Founders And Staff, This AI Startup Abandons Large Language Model Plans And Shifts Focus Away From Chatbots Photo courtesy: glen photo / Shutterstock.com Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors. AAPLApple Inc$268.20-0.80%OverviewAMZNAmazon.com Inc$252.183.26%GOOGAlphabet Inc$282.170.12%GOOGLAlphabet Inc$281.820.22%METMetLife Inc$79.15-0.84%MSFTMicrosoft Corp$516.11-0.33%NVDANVIDIA Corp$206.602.03%SFTBFSoftBank Group Corp$176.852.72%SFTBYSoftBank Group CorpNot Available-%Market News and Data brought to you by Benzinga APIs

[3]

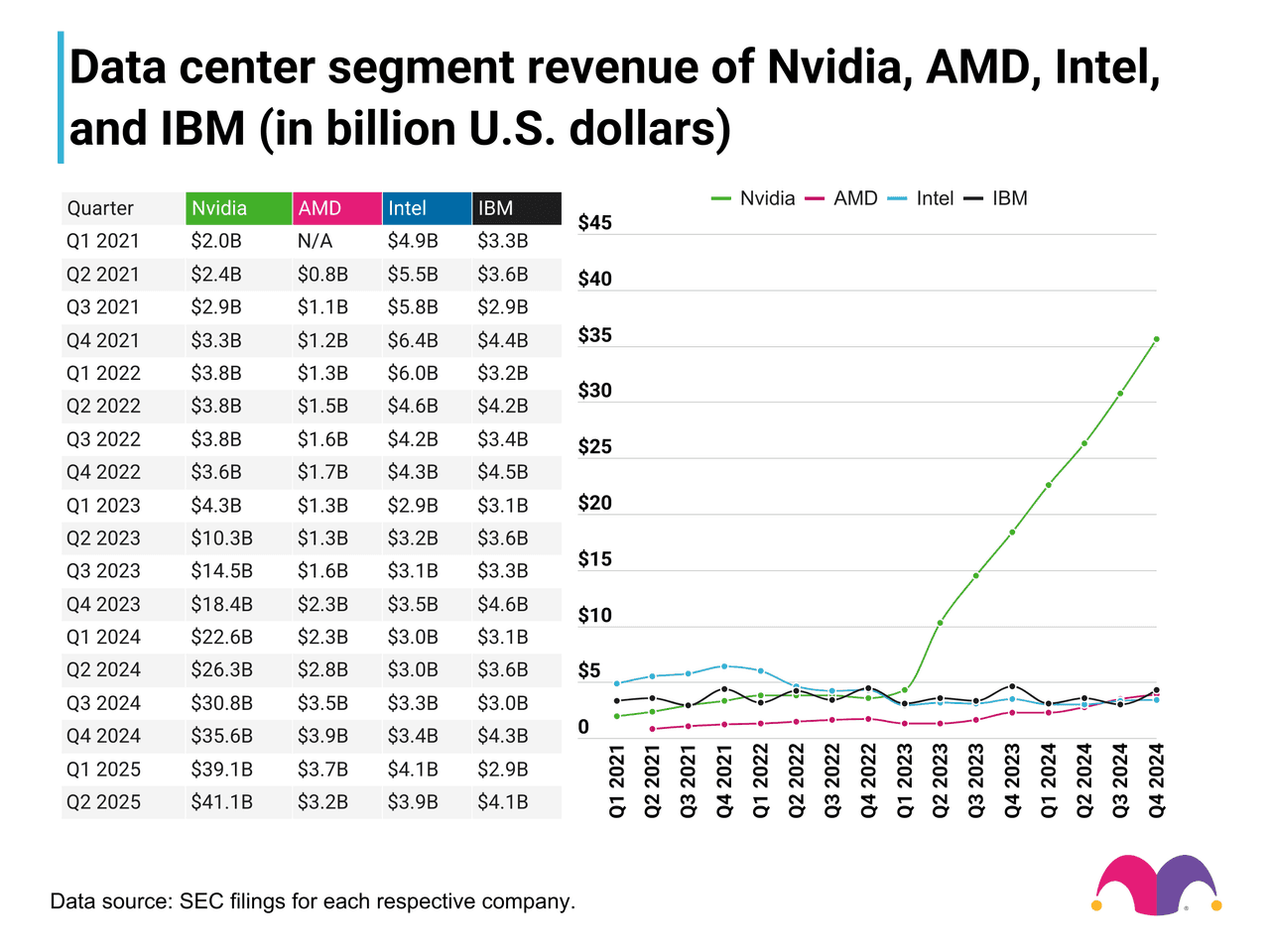

Nvidia's AI Dominance: Data Center Revenue Poised for 165% Surge by 2027

Nvidia's biggest business can keep growing at a terrific pace over the next couple of years. The data center business has been the cornerstone of Nvidia's (NVDA +0.03%) outstanding surge in the past three years. This business accounts for the majority of Nvidia's top line, and that can be attributed to its dominant presence in the market for artificial intelligence (AI) chips. According to one estimate, Nvidia commands a whopping 90% share of the AI chip market. This explains why the company's data center revenue is substantially higher than the competition. The good part is that Nvidia's data center business could soar to new heights in the next couple of years. Let's see why that's likely to be the case. Nvidia CEO Jensen Huang suggests there is a huge backlog for its AI chips Nvidia's data center business has generated just over $80 billion in revenue in the first half of the ongoing fiscal year 2026, accounting for 88% of its top line. The company is expecting $54 billion in revenue in Q3. Assuming the data center segment's share remains in line with what we have seen in the first half of the year, this business is likely to account for $47.5 billion in fiscal Q3 revenue. The quarterly revenue run rate based on Nvidia's data center revenue for the first nine months of the year suggests that it could end fiscal 2026 (which ends in January 2026) with $170 billion in data center revenue. CEO Jensen Huang pointed out at a recent developer conference in Washington, D.C., that the company has secured over $500 billion worth of orders for its current generation of Blackwell processors and the upcoming Rubin graphics processing units (GPUs), which will be launched next year. Now, Huang didn't point out if all of these orders are pending, or if they include the revenue that Nvidia has already generated from the sale of its current generation Blackwell processors. But even if we assume that the $500 billion figure is inclusive of the Blackwell orders already fulfilled, Nvidia will still have a sizable backlog. Nvidia's Blackwell GPUs went on sale in the fourth quarter of calendar 2024, which coincided with two months of its fiscal 2025 fourth quarter. Nvidia sold $11 billion worth of Blackwell processors in that quarter. Assuming the entire $170 billion data center revenue that Nvidia is projected to generate in fiscal 2026 is from sales of its Blackwell GPUs, it has sold around $180 billion worth of these processors since they were launched. That still leaves the company with a potential $320 billion in backlog for fiscal 2027 (which will begin in January next year). If Nvidia manages to convert all of that backlog into revenue during the fiscal year, its data center revenue could jump by an estimated 88% next year (from fiscal 2026's estimated sales of $170 billion). You may be wondering if Nvidia can indeed convert the entirety of its projected backlog into revenue next year. The good part is that the company's foundry partner, Taiwan Semiconductor Manufacturing Company, is expected to increase its advanced chip packaging capacity by 33% next year. With Nvidia reportedly securing 60% of that capacity for itself, there is a good chance that it could indeed turn that massive order backlog into revenue. Hefty data center spending will be a tailwind in 2027 Nvidia estimates that data center capital spending is likely to grow at an annual pace of 40% between 2025 and 2030, with annual spending estimated to land between $3 trillion and $4 trillion by the end of the decade. The company estimates that data center capital expenditures (capex) could land at $1 trillion next year before approaching $1.5 trillion in 2027. So, there is ample incremental revenue opportunity for Nvidia to sustain its data center growth beyond next year. Even if we assume that the company's data center revenue grows in line with the estimated annual growth of 40% in data center capex, its revenue from this segment could jump to almost $450 billion in 2027 (which coincides with Nvidia's fiscal 2028). That points toward a potential increase of 165% from the $170 billion data center revenue that Nvidia may deliver this year. Analysts, meanwhile, are expecting Nvidia to generate $345 billion in revenue after a couple of fiscal years, having raised their estimate notably of late. NVDA Revenue Estimates for 2 Fiscal Years Ahead data by YCharts Nvidia, therefore, has the potential to easily grow at a much stronger pace than what analysts are expecting thanks to its AI chip dominance, tremendous backlog, and further growth in AI chip spending. That could ensure more upside for this high-flying AI stock over the next three years.

[4]

Bank of America revamps Nvidia stock forecast on AI skepticism

Investors are eagerly awaiting Nvidia's Q3 earnings that will be released on November 19. The company's results will, to some degree, reflect the state of the AI industry as a whole, as Nvidia is at the center of it. This is putting a lot of pressure on the company as AI skepticism is growing. Nvidia CEO Jensen Huang doesn't think AI is a bubble like the dot-com one. Many experts believe it is a bubble, but some, such as Jeff Bezos, think it is more similar to the biotech bubble in the '90s. The company's success in the AI space can easily be measured by its secured orders, and Huang stated that the company has already secured half a trillion dollars in orders for its AI chips over the next five quarters, according to The Financial Times. While there is no doubt that Nvidia is profitable and that the hardware it produces serves its purpose, the software side of the AI (bubble) is quite different. If that side doesn't become profitable, then we certainly aren't in a "good bubble." To determine whether that's the case, we need to consider OpenAI as the largest AI player in the software space. It is currently unprofitable, and the company has committed to spending $1.4 trillion building computational resources over the next eight years, as reported by Reuters. OpenAI is a private company that does not release its earnings reports; however, it is fortunate that Microsoft has invested in it (as it must report to the SEC). A securities filing from Microsoft suggests that OpenAI lost more than $12 billion in the third quarter. OpenAI CFO Sarah Friar recently proposed that government involvement would help the company take on more debt. But David Sacks, the White House artificial intelligence and crypto czar, said there will be no federal bailout for AI. Bank of America analyst Vivek Arya and his team addressed this AI skepticism in their latest research note. Bank of America calls AI skepticism healthy but overstated in near- and medium-term Analysts said the pervasive skepticism regarding AI capital expenditures is understandable but likely a contrarian positive, helping to minimize overcrowding. "The common argument that 'AI stocks must be overvalued because OpenAI cannot justify $1.4 trillion of long-term commitments' is a lazy/cherry-picked argument in our view," they wrote. The team noted that OpenAI's spending has yet to be put in place and will be constrained by practical limitations such as access to power and data center space. Public hyperscalers upgrading their infrastructure are doing the majority of AI spending, and they are profitable. They said that Nvidia's disclosure of $500 billion in 2025-26 data-center orders indicates that the stock is capable of growing sales/EPS by 50% and 70% YoY at an undemanding price-to-earnings market multiple of 24. Analysts added that they think "the daily noise" around China's restrictions is irrelevant to the near- and medium-term financial estimates. In a research note shared with TheStreet, Arya reiterated a buy rating and the target price of $275, based on 44 multiple his estimate for price-to-earnings ratio excluding cash for calendar year 2026, which is within Nvidia's historical forward-year price-to-earnings range of 25 to 56. He concluded by saying that the multiple is "justified by [Nvidia]'s leading share in fast-growing AI compute/networking markets, offset by lumpiness in global AI projects, cyclical gaming market, and concerns around access to power." Arya's team noted downside risk factors for Nvidia: * Weakness in consumer driven gaming market * Competition with major public firms * Larger-than-expected impact from restrictions on compute shipments to China * Lumpy and unpredictable sales in new enterprise, data center, and auto markets * Potential for decelerating capital returns * Enhanced government scrutiny of Nvidia's dominant market position in AI chips Nvidia's recent activity Nvidia (NVDA) and Deutsche Telekom are building a €1 billion ($1.2 billion) data center in Germany, which is set to begin operating in early 2026, according to a Bloomberg report. The companies describe the project as the Industrial AI Cloud, a sovereign, enterprise-grade platform. The new platform combines Deutsche Telekom's infrastructure and operations with Nvidia AI and Omniverse digital twin platforms. Nvidia shared at the APEC summit that it will expand South Korea's AI infrastructure with over a quarter of a million Nvidia GPUs across its sovereign clouds and AI factories. South Korea's Ministry of Science and ICT (MSIT) plans to deploy up to 50,000 of the latest Nvidia GPUs. The initial deployment will consist of 13,000 Nvidia Blackwell GPUs and other GPUs by Nvidia Cloud Partner NAVER Cloud, in collaboration with NHN Cloud and Kakao Corp. The company also unveiled plans with Samsung Electronics to build a new AI factory. The AI factory will combine Samsung's semiconductor technologies with Nvidia's platforms to lay the groundwork for AI-driven production. More than 50,000 Nvidia GPUs will power Samsung's semiconductor AI factory. It is intended to integrate accelerated computing directly into advanced chip manufacturing. The Arena Media Brands, LLC THESTREET is a registered trademark of TheStreet, Inc. This story was originally published November 10, 2025 at 7:03 PM.

[5]

CEO Jensen Huang Just Delivered Fantastic News for Nvidia Investors | The Motley Fool

Nvidia's GTC event in Washington, D.C., will be one for the history books. Nvidia (NVDA 3.96%) made headlines at its GTC event that was held on Oct. 28. There were several bombshell announcements ranging from government contracts to quantum computing to new technology. However, I think the biggest announcement centers around the massive growth Nvidia expects to see manifest by the end of 2026. CEO Jensen Huang announced that Nvidia has $500 billion in orders through the end of 2026 for its Blackwell and Rubin graphics processing units (GPUs). That's monster growth, and far exceeds analysts' projections over the next year. This has the potential to ignite a massive rally in the stock because if this projection pans out, Nvidia's stock could more than double by the end of 2026. Up until a few weeks ago, Nvidia's dominance in the artificial intelligence (AI) space was unquestioned. However, that dominance came into question when OpenAI, the maker of ChatGPT, announced several deals with competitors, like Advanced Micro Devices (AMD 3.70%) and Broadcom (AVGO 2.93%). While Nvidia also announced its own deal with OpenAI, investors were concerned that Nvidia could be losing its touch. However, CEO and founder Jensen Huang put those worries to rest at the company's GTC event. Nvidia's $500 billion in orders for its cutting-edge chips was an absolute bombshell of an announcement. While that includes five quarters' worth of sales, Wall Street analysts were only expecting $277 billion in revenue for Nvidia during fiscal year 2027 (ending January 2027). Another huge revelation was President Donald Trump's announcement that China will soon be able to buy some of Nvidia's chips, just not its most advanced ones. Nvidia's market share in China is currently zero due to its export license being revoked earlier this year. Although Nvidia has applied for another license, it has yet to be granted. With Trump likely granting China access to some chips as a concession during trade talks, this could open up even more sales during fiscal year 2027 that aren't currently accounted for. This would be another massive catalyst for Nvidia's stock, but even if this doesn't come to fruition, Nvidia will be a fantastic investment. If Nvidia can deliver on its $500 billion in orders by the end of 2026, that would mark a massive uptick in growth. If we assume that the $500 billion in sales is distributed in five separate quarters (a bad assumption, but it bakes a bit of conservatism into the prediction), that means Nvidia would generate $400 billion in annual sales from its Blackwell and Rubin chips. If we add in $5 billion each quarter for non-data center revenue streams -- which matches what Nvidia posted in its second quarter of fiscal 2026 -- that equates to $420 billion in revenue for fiscal 2027. At Nvidia's current 52% profit margin, that comes out to $218 billion in profits. Right now, Nvidia's stock trades for 57 times trailing earnings. At a slightly more conservative 50 times earnings valuation, that would price Nvidia's stock at $10.9 trillion by the end of fiscal 2027. With Nvidia's market cap hovering around the $5 trillion level, that equates to a doubling in a little over a year's time. Remember, that's with some conservatism baked into the projection and zero in China sales. All of that could factor into further sales, making Nvidia one of the best stocks to buy in the market today. Nvidia has proven its dominance once again, and investors can be rewarded with incredible gains by buying the stock today, even after its pop following the event.

Share

Share

Copy Link

Nvidia's market capitalization has crossed the historic $5 trillion milestone, driven by massive AI chip demand and CEO Jensen Huang's announcement of $500 billion in secured orders through 2026. The surge reflects growing enterprise and government investments in AI infrastructure worldwide.

Historic Market Milestone

Nvidia has achieved a remarkable feat by crossing the $5 trillion market capitalization threshold, becoming the most valuable semiconductor company in history. The stock surged 4% on Monday to reach this unprecedented milestone, adding nearly $100 billion in market value within just three trading days since first closing above $5 trillion last Wednesday

1

. This meteoric rise has been fueled by increased AI spending commitments from major cloud providers and significant government partnerships worldwide.

Source: Motley Fool

Massive Order Backlog Revealed

At Nvidia's GTC event in Washington, D.C., CEO Jensen Huang delivered what analysts are calling "fantastic news" by announcing that the company has secured $500 billion in orders for its current-generation Blackwell processors and upcoming Rubin GPUs through the end of 2026

5

. This figure dramatically exceeds Wall Street's revenue projections of $277 billion for Nvidia's fiscal year 2027, suggesting the company could potentially double its stock value by the end of 2026.The announcement comes as Nvidia's data center business, which accounts for 88% of the company's revenue, is projected to generate $170 billion in fiscal 2026. With the massive order backlog, analysts estimate the data center segment could experience a 165% surge by 2027, potentially reaching $450 billion in annual revenue

3

.

Source: Motley Fool

Global Infrastructure Expansion

Nvidia's growth trajectory is being supported by significant international partnerships and government initiatives. The company announced plans to expand South Korea's AI infrastructure with over 250,000 Nvidia GPUs across sovereign clouds and AI factories, involving key South Korean companies including Samsung and Hyundai

1

. Additionally, Nvidia and Deutsche Telekom are building a €1 billion data center in Germany, set to begin operations in early 20264

.Related Stories

Industry Validation and Future Outlook

SoftBank CEO Masayoshi Son's prescient assessment from October 2024 that Nvidia was "undervalued" has proven remarkably accurate. Son projected that the rise of artificial superintelligence could require $9 trillion in cumulative capital expenditure, with four major tech companies potentially earning $4 trillion in annual profit from the AI revolution

2

.

Source: Benzinga

Bank of America analysts have addressed growing AI skepticism by maintaining their buy rating and $275 price target for Nvidia, arguing that the skepticism is "healthy but overstated." They noted that Nvidia's dominant 90% market share in AI chips and the disclosed $500 billion in orders indicate the stock can grow sales and earnings by 50% and 70% year-over-year respectively

4

.References

Summarized by

Navi

[4]

Related Stories

Recent Highlights

1

Samsung unveils Galaxy S26 lineup with Privacy Display tech and expanded AI capabilities

Technology

2

Anthropic refuses Pentagon's ultimatum over AI use in mass surveillance and autonomous weapons

Policy and Regulation

3

AI models deploy nuclear weapons in 95% of war games, raising alarm over military use

Science and Research