Nvidia to Replace Intel in Dow Jones Industrial Average, Marking AI's Growing Influence

40 Sources

40 Sources

[1]

Nvidia to replace Intel in the Dow Jones Industrial Average

Nvidia, the chipmaker at the heart of the artificial intelligence boom, is joining the oldest of Wall Street's three main equity benchmarks. The company will replace rival Intel in the 128-year-old Dow Jones Industrial Average prior to the start of trading on Nov. 8, S&P Dow Jones Indices said in a statement late Friday. Sherwin-Williams Co. is also joining, replacing Dow. The addition of Nvidia to the blue-chip index is a testament to the power of the AI-driven rally that's pushed the chipmaker up 900% in the past 24 months. The Dow Jones Industrial Average was the only major U.S. equity benchmark that didn't hold Nvidia -- until now. "Nvidia is a well-run company and joining the Dow demonstrates just how powerful its rally has been in recent years after it was at the right place at the right time when no one else was," said Scott Colyer, chief executive at Advisors Asset Management. The Santa Clara, California-based company has been the poster child of the euphoria surrounding AI and the biggest driver of stock market gains. The chipmaker ended the week with a market value of $3.32 trillion, about $50 billion shy of Apple. Shares were up 3.2% in post-market trading, putting Nvidia in a position to dethrone Apple as the world's most valuable company as soon as Monday if the gains hold. Intel joined the gauge in November 1999 when it was added along with Microsoft., SBC Communications and Home Depot. Once the industry leader in computer processors, Intel has been recently struggling under a turnaround plan. The company has slashed spending in 2024, cut jobs and suspended investor payouts. Shares have lost 54% this year, and sank another 2% after the bell. "Intel has lagged in a huge way," said Adam Sarhan, founder of 50 Park Investments. "Now, the Dow is evolving. You don't want to see stocks that were there 30 years ago. You want to see what's the strongest that survive today." Midland, Michigan-based Dow Inc. has been in the blue-chip index since 2019, when it was spun off by former parent DowDuPont. The Dow Jones Industrial Average, which first started as an index of 12 industrial stocks that included General Electric, has faced criticism for being a much narrower equities gauge than the S&P 500 Index or the Nasdaq 100 and lacking technology stocks that have dominated markets in recent years. The switch is the second this year after Amazon replaced Walgreens Boots Alliance in February. Before that the Dow's components had held steady since August 2020 when Amgen, Honeywell International and Salesforce replaced Exxon Mobil, Pfizer and Raytheon. The benchmark has evolved over more than a century into 30 stocks that include a mix of shares from technology, financial, health care and consumer sectors. A committee selects the 30 components and weights them by price rather than market capitalization, as the S&P 500 does. The Dow's price-weighted methodology has occasionally been an impediment to technology companies that eschewed splits and whose shares often traded above $1,000. Those included Nvidia until recently. The company has split its stock two times in the past four years, the most recent of which was a 10-for-1 swap that took effect in June. Nvidia shares closed on Friday at $135.40. While the Dow's influence has faded over the years as passive managers linked to benchmarks based on market value, the index remains an exclusive club and still serves as one of the highest profile showcases of American industrial heft.

[2]

Dow Set to Install Nvidia; Intel No Longer Inside

Nvidia Corp., the chipmaker at the heart of the artificial intelligence boom, is joining the oldest of Wall Street's three main equity benchmarks.Nvidia Corp., the chipmaker at the heart of the artificial intelligence boom, is joining the oldest of Wall Street's three main equity benchmarks. The company will replace rival Intel Corp. in the 128-year-old Dow Jones Industrial Average prior to the start of trading on Nov. 8, S&P Dow Jones Indices said in a statement late Friday. Sherwin-Williams Co. is also joining, replacing Dow Inc. The addition of Nvidia to the blue-chip index is a testament to the power of the AI-driven rally that's pushed the chipmaker up 900% in the past 24 months. The Dow Jones Industrial Average was the only major US equity benchmark that didn't hold Nvidia -- until now. "Nvidia is a well-run company and joining the Dow demonstrates just how powerful its rally has been in recent years after it was at the right place at the right time when no one else was," said Scott Colyer, chief executive at Advisors Asset Management. The Santa Clara, California-based company has been the poster child of the euphoria surrounding AI and the biggest driver of stock market gains. The chipmaker ended the week with a market value of $3.32 trillion, about $50 billion shy of Apple Inc. Shares rose 3.2% in post-market trading, placing Nvidia in a position to pip Apple as the world's most valuable company as soon as Monday if the gains hold. Intel joined the gauge in November 1999 when it was added along with Microsoft Corp, SBC Communications and Home Depot Inc. Once the industry leader in computer processors, Intel has been recently struggling under a turnaround plan. It has slashed spending in 2024, cut jobs and suspended investor payouts. Shares have lost 54% this year, and sank another 2% after the bell. "Intel has lagged in a huge way," said Adam Sarhan, founder of 50 Park Investments. "Now, the Dow is evolving. You don't want to see stocks that were there 30 years ago. You want to see what's the strongest that survive today." Midland, Michigan-based Dow Inc has been in the blue-chip index since 2019, when former parent DowDuPont spun it off. The Dow Jones Industrial Average, which first started as an index of 12 industrial stocks that included General Electric Co, has faced criticism for being a much narrower equities gauge than the S&P 500 Index or the Nasdaq 100 and lacking technology stocks that have dominated markets in recent years. The switch is the second this year after Amazon.com Inc replaced Walgreens Boots Alliance Inc in February. Before that, the Dow's components had held steady since August 2020 when Amgen Inc, Honeywell International Inc and Salesforce.com replaced Exxon Mobil Corp, Pfizer Inc and Raytheon Co. The benchmark has evolved over more than a century into 30 stocks that include a mix of shares from technology, financial, health care and consumer sectors. A committee selects the 30 components and weights them by price rather than market capitalization, as the S&P 500 does. The Dow's price-weighted methodology has occasionally been an impediment to technology companies that eschewed splits and whose shares often traded above $1,000. Those included Nvidia until recently. The company has split its stock two times in the past four years. Its stock ended Friday at $135.4. While the Dow's influence has faded over the years as passive managers linked to benchmarks based on market value, it still serves as one of the highest profile showcases of American industrial heft.

[3]

Nvidia to join Dow Jones, replacing rival Intel

The addition of Nvidia to the Dow Jones Industrial Average is a notable milestone, suggesting a more stable outlook for the AI chipmaker in its continued rise and increasing prominence in the tech sector. The artificial intelligence leader Nvidia is set to replace Intel in the Dow Jones Industrial Average (DJIA), as announced in a press release by S&P Global on 1 November. This adjustment, taking effect before trading opens on 8 November, will also see Dow Inc. replaced by The Sherwin-Williams Co. in the index. The DJIA, the oldest stock index in the world and one of Wall Street's three major benchmarks, stated that the update aims to ensure "a more representative exposure to the semiconductors industry and the materials sector, respectively". The Dow Jones Industrial Average tracks 30 large publicly traded companies across various sectors. Unlike indices weighted by market capitalisation, such as the S&P 500, the DJIA is price-weighted, meaning companies with higher stock prices have a greater influence, regardless of their overall market value. Nvidia's recent 10-for-1 stock split, aimed at increasing accessibility for investors, has also facilitated its inclusion by reducing its influence on the index's movements. The addition of Nvidia to the Dow is a notable milestone, suggesting a more stable outlook for the company in its continued rise. The DJIA often includes blue-chip firms that are well-established, financially stable, and significant players within their industries, which aligns with Nvidia's profile. Nevertheless, the inclusion may not lead to a substantial buying surge, as most passive investment funds focus on broader indices, like the S&P 500. Meanwhile, Intel, one of the world's most renowned technology companies, providing central processing units (CPUs) for personal computers, has been facing growth challenges. Lagging behind competitors such as Nvidia, Broadcom, and Taiwan Semiconductor Manufacturing Co. Ltd. in the AI chip sector, Intel has seen a drastic fall in valuation, losing over half of its market capitalisation this year as its share price dropped to a 10-year low. The company has announced cost-cutting measures, including staff reductions and facility closures, and has drawn interest from rivals who may consider acquiring parts or all of its operations. Nvidia's inclusion in the Dow further underscores its meteoric rise in market valuation amid the AI boom. In June, Nvidia briefly overtook Apple as the world's most valuable company after securing a 20% weighting in the Technology Select Sector SPDR Fund (XLK) within the S&P 500. Nvidia's market capitalisation currently stands at $3.34tn (€3.07tn), trailing Apple by a modest $20bn, or about 6%. Nvidia has benefitted from surging demand in AI technology, with its shares soaring 174% year-to-date and 910% over the past two years. Nvidia's exceptional stock performance is supported by robust revenue growth, which surged by 270% over the first two quarters of its 2025 fiscal year. Its new Blackwell AI chips have been so highly sought after that production capacity is reportedly booked out for a full year, according to analysts from Morgan Stanley. Nvidia's CEO, Jensen Huang, recently confirmed that Blackwell production is at full capacity, describing demand as "insane". The forthcoming fiscal third-quarter earnings report for 2025, scheduled for next month, will likely attract close investor scrutiny. Conversely, Apple's momentum slowed following its September-quarter earnings results last week. Sales in China have continued to decline amid intensified competition from Chinese rivals, and its AI capabilities, branded "Apple Intelligence", failed to excite investors. Apple appears to be lagging behind other tech giants in the race to capitalise on AI innovation, especially compared with Nvidia's rapid ascent.

[4]

Nvidia to join Dow Jones Industrial Average, replacing rival chipmaker Intel

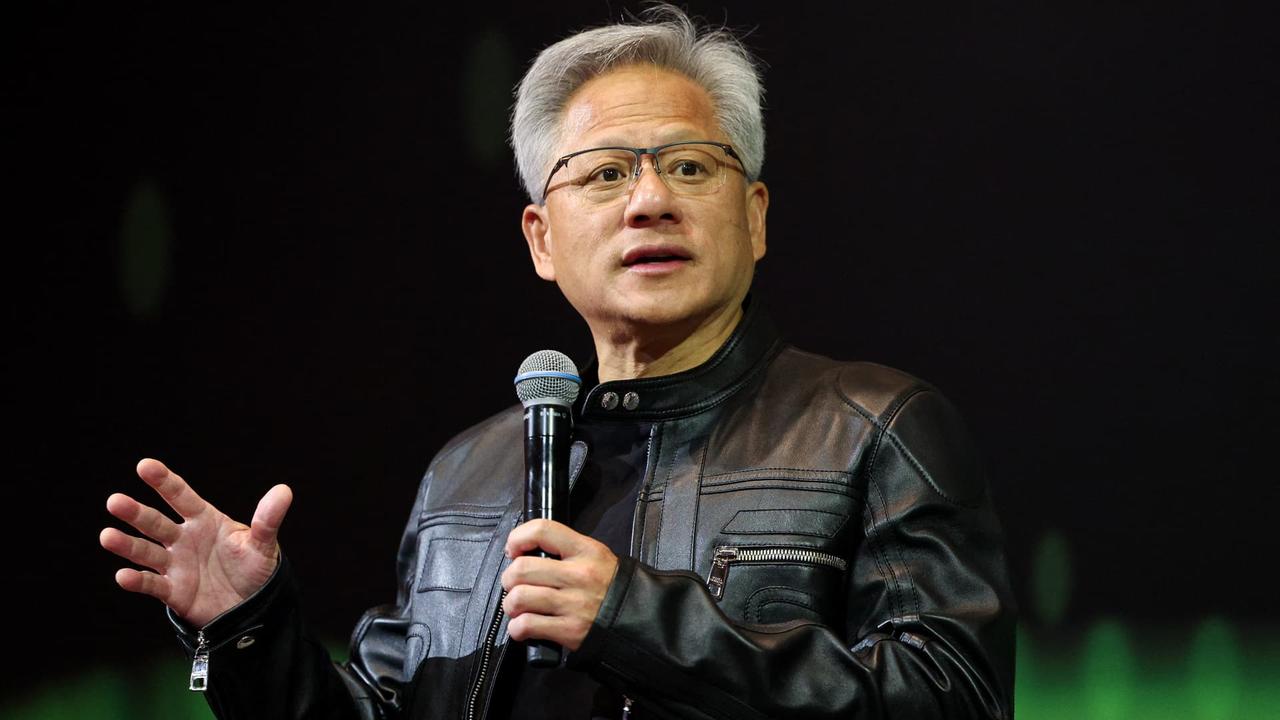

NVIDIA founder, President and CEO Jensen Huang on Sept. 27 in Washington, D.C.Chip Somodevilla / Getty Images file Nvidia is replacing rival chipmaker Intel in the Dow Jones Industrial Average, a shakeup to the blue-chip index that reflects the boom in artificial intelligence and a major shift in the semiconductor industry. The switch will take place on Nov. 8. Also, Sherwin Williams will replace Dow Inc. in the index, S&P Dow Jones said in a statement. Nvidia shares have climbed over 170% so far in 2024 after jumping roughly 240% last year, as investors have rushed to get a piece of the AI chipmaker. Nvidia's market cap has swelled to $3.3 trillion, second only to Apple among publicly traded companies. On Friday, Nvidia shares rose 1%. Intel shares were down 1% in extended trading. Companies including Microsoft, Meta, Google and Amazon are purchasing Nvidia's graphics processing units (GPUs), such as the H100, in massive quantities to build clusters of computers for their AI work. Nvidia's revenue has more than doubled in each of the past five quarters, and has at least tripled in three of them. The company has sginaled that demand for its next-generation AI GPU called Blackwell is "insane." With the addition of Nvidia, four of the six trillion-dollar tech companies are now in the index. The two not in the Dow are Alphabet and Meta. While Nvidia has been soaring, Intel has been slumping. Long the dominant maker of PC chips, Intel has lost market share to Advanced Micro Devices and has made very little headway in AI. Intel shares have fallen by more than half this year as the company struggles with manufacturing challenges and new competition for its central processors. Intel said in a filing this week that the board's audit and finance committee approved cost and capital reduction activities, including lowering head count by 16,500 employees and reducing its real estate footprint. The job cuts were originally announced in August. The Dow contains 30 components and is weighted by the share price of the individual stocks instead of total market value. Nvidia put itself in better position to join the index in May, when the company announced a 10-for-1 stock split. While doing nothing to its market cap, the move slashed the price of each share by 90%, allowing the company to become a part of the Dow without having too heavy a weighting. The switch is the first change to the index since February, when Amazon replaced Walgreens Boots Alliance. Over the years, the Dow has been playing catchup in gaining exposure to the largest technology companies. The stocks in the index are chosen by a committee from S&P Dow Jones Indices.

[5]

Nvidia will replace Intel on the Dow Jones Industrial Average in historic changing of the guard in chip sector

Chip giant Nvidia will join the Dow Jones Industrial Average, the iconic Wall Street index announced Friday, underscoring the importance of artificial intelligence in the US economy. The addition of Nvidia, which will take effect on November 8, also marks a historic moment for the semiconductor industry, as the AI chip leader replaces struggling rival Intel, which has been on the Dow index since 1999. S&P Dow Jones Indices, the company that runs the index, also said it would add paint manufacturer Sherwin-Williams, replacing chemical giant Dow. Shares of Nvidia have climbed over 180% this year as tech giants clamor for its powerful and high cost processors that power generative AI, the technology that is widely seen as the next phase of innovation. Intel, one of Silicon Valley's most iconic companies, has seen its shares fall 50% so far this year as the company struggles to meet the AI boom. The Dow Jones Industrial Average, created by Charles Dow in 1896, is often used as a bellwether for the state of the US stock market, the biggest in the world. Unlike the S&P 500 that weighs companies by market capitalization, the 30-stock Dow is price-weighted, meaning higher-priced stocks have more influence on its movements. Tech companies Apple, Microsoft, IBM, Salesforce and Cisco Systems are currently in the index, while Google, Amazon and Meta are not. The components of the DJIA are selected by a committee, and they tend to favor companies that represent a wide swathe of industries and are well-established. This has historically excluded many tech giants, despite their size and influence. With their high values, including too many tech companies would also drown out the influence of the other sectors represented in the index.

[6]

Dow average gains Nvidia, loses Intel as one chipmaker replaces another

By adding AI darling Nvidia, the Dow Jones Industrial Average will better represent the modern semiconductor industry, S&P Dow Jones Indices said. Nvidia will replace fellow chipmaker Intel in the Dow Jones Industrial Average, a swap that reflects the growing interest in artificial intelligence and its reshaping of the technology landscape. Shares of Nvidia were up nearly 3 percent in after hours trading. The AI darling's stock has risen more than 180 percent this year and climbed about 240 percent in 2023 as it emerged as the primary source of the graphics processing units, or GPUs, used in the computers that power artificial intelligence operations. Nvidia earlier this year became just the third company to reach a $3 trillion market capitalization and will join the other two, Apple and Microsoft, in the index before the market opens on Nov. 8, S&P Dow Jones Indices said Friday. Once a dominant tech industry force during the rise of personal computers, Intel joined the Dow average 25 years ago, when it became one of the first two technology companies in the index. But it failed to capitalize on the emergency of smartphones and mobile devices in the early 2000s and now trails badly in the race to meet red-hot demand for chips for AI. The company's annual revenue fell by $24 billion from 2020 through 2023 and, most recently, it announced it will lay off 15,000 workers by the end of the year. Intel's shares have dropped more than 50 percent this year as it has struggled with manufacturing challenges and increased competition for its processors, making it the worst performer in the price-weighted Dow. Intel shares edged 2 percent lower in evening trading Friday. Nvidia's addition will ensure "more representative exposure to the semiconductors industry" within the average, S&P Dow Jones Indices said. The chipmaker swap is the first change to the index since Amazon replaced Walgreens Boots Alliance in February -- another move aligning the Dow more closely with the technology companies that dominate other indices, such as the Nasdaq. Also, paint company Sherwin-Williams will replace materials science company Dow Inc., the smallest company in the average by market capitalization, starting Nov. 8. The Dow includes 30 large companies traded on U.S. stock exchanges, including Apple, Boeing, Nike and Walmart. It remains a popular benchmark for the stock market, although it is not as broad as other indexes such as the S&P 500. Its stocks are chosen by a committee from S&P Dow Jones Indices.

[7]

Nvidia to join Dow Jones Industrial Average, replacing Intel

New York (AFP) - Chip giant Nvidia will join the Dow Jones Industrial Average, the iconic Wall Street index announced Friday, underscoring the importance of artificial intelligence in the US economy. The addition of Nvidia, which will take effect on November 8, also marks a historic moment for the semiconductor industry, as the AI chip leader replaces struggling rival Intel, which has been on the Dow index since 1999. S&P Dow Jones Indices, the company that runs the index, also said it would add paint manufacturer Sherwin-Williams, replacing chemical giant Dow. Shares of Nvidia have climbed over 180 percent this year as tech giants clamor for its powerful and high cost processors that power generative AI, the technology that is widely seen as the next phase of innovation. Intel, one of Silicon Valley's most iconic companies, has seen its shares fall 50 percent so far this year as the company struggles to meet the AI boom. The Dow Jones Industrial Average, created by Charles Dow in 1896, is often used as a bellwether for the state of the US stock market, the biggest in the world. Unlike the S&P500 that weighs companies by market capitalization, the 30-stock Dow is price-weighted, meaning higher-priced stocks have more influence on its movements. Tech companies Apple, Microsoft, IBM, Salesforce and Cisco Systems are currently in the index, while Google, Amazon and Meta are not. The components of the DJIA are selected by a committee, and they tend to favor companies that represent a wide swathe of industries and are well-established. This has historically excluded many tech giants, despite their size and influence. With their high values, including too many tech companies would also drown out the influence of the other sectors represented in the index.

[8]

Nvidia replaces Intel in Dow Jones index, marking shift in tech landscape

Editor's take: This reshuffling of the Dow Jones Industrial Average is a stark reminder of the rapid pace of change in the tech industry. As AI continues to reshape various sectors of the economy, companies that can innovate and adapt to these new technologies will thrive, while those that lag may face significant challenges. Nvidia will replace Intel in the Dow Jones Industrial Average. This change, scheduled to take effect on November 8, 2024, highlights the growing importance of artificial intelligence in the US economy and the evolving dynamics of the tech sector. Nvidia's meteoric rise in the AI era has propelled it to become one of the most valuable companies globally, with a market capitalization of approximately $3.32 trillion. While it briefly held the top position, it currently ranks among the top three most valuable companies, alongside Apple and Microsoft, with the exact ranking fluctuating based on market conditions. The company's stock has surged by over 170 percent in 2024 alone, following a 240 percent increase in the previous year. This remarkable growth is largely attributed to the soaring demand for Nvidia's graphics processing units. Major tech giants such as Microsoft, Meta, Google, and Amazon have been purchasing Nvidia's GPUs in large quantities to power their AI initiatives. As a result, Nvidia has seen its revenue more than double in the past five quarters, with some quarters experiencing a tripling of revenue. In stark contrast, Intel, a long-standing titan in the semiconductor industry, has faced significant challenges. The company, which has been part of the Dow since 1999, has struggled to maintain its market position in the face of increasing competition and manufacturing difficulties. Intel's shares have plummeted by more than 50 percent this year, partly reflecting its struggles to adapt to the AI-driven landscape. A pivotal point came when the company reported a $1.6 billion loss in the second quarter of 2024. This poor showing led to a dramatic 30 percent overnight drop in Intel's stock price in August. In response to these challenges, Intel has announced significant cost-cutting measures, including a reduction of 16,500 employees. With Nvidia set to join the Dow Jones Industrial Average, there will be four trillion-dollar tech companies in the index: Apple, Microsoft, Amazon, and Nvidia. For their part, Alphabet and Meta remain outside the index. A strategic 10-for-1 stock split in May was instrumental in Nvidia's journey to the Dow. This split reduced the company's share price without affecting its market capitalization, positioning it more favorably for inclusion in the price-weighted index. The Dow Jones Industrial Average, a price-weighted index of 30 prominent companies, is often viewed as a barometer of the US stock market and the broader economy. As Nvidia steps into its new role in the Dow, it not only signals a changing of the guard in the semiconductor sector but also a broader shift towards AI-driven technologies in the global economy.

[9]

Nvidia to join Dow Jones Industrial Average, replacing Intel

Nvidia is replacing Intel on the Dow Jones Industrial Average, a shakeup to the blue-chip index that replaces a flagging semiconductor company with the primary vendor of GPUs for AI. The switch will take place on Nov. 8. In a separate move, Sherwin Williams will replace Dow Inc in the average as well, S&P Global said in a statement. Shares of Nvidia have climbed over 180% so far in 2024 as investors have seen the company as the primary beneficiary of the AI boom. On the other hand, Intel shares have fallen 51% so far this year as the company struggles with manufacturing, new competition for its central processors, and the impression that it has missed out on the AI trend.

[10]

Nvidia to replace Intel in Dow Jones Industrial Average

Nov 1 (Reuters) - Intel (INTC.O), opens new tab will lose its spot in the Dow Jones Industrial Average after a 25-year run to Nvidia (NVDA.O), opens new tab, S&P Dow Jones Indices said on Friday, the latest blow to the struggling chipmaker that was among the first two technology firms to be included in the blue-chip index. Once the dominant force in chipmaking, Intel has in recent years ceded its manufacturing edge to rival TSMC (2330.TW), opens new tab and missed out on the generative artificial intelligence boom after missteps including passing on an investment in ChatGPT-owner OpenAI. Intel's shares have declined 54% this year, making it the worst performer on the index and leaving it with the lowest stock price on the price-weighted Dow. The stock fell about 1% in extended trading on Friday, while Nvidia was up 1.5%. Launched in 1968, the Silicon Valley pioneer sold memory chips before switching to processors that helped launch the personal computer industry. In the 1990s, "Intel Inside" stickers turned commodity electronic components into premium products, and eventually became ubiquitous on laptops. Nvidia has emerged as a cornerstone of the global semiconductor industry, thanks to the essential role its chips play in powering generative AI technologies which has driven a seven-fold surge in its shares over the past two years. The company's shares have risen more than two-fold this year alone. Once popular only among gamers who hunted for PCs with Nvidia's graphics processors, the company is now the second-most valuable in the world and is seen as a barometer for the AI market. The company's 10-for-one stock split that took effect in June also helped pave the way for its addition to the index, making its soaring shares more accessible to retail traders. Reporting by Akash Sriram and Arsheeya Bajwa in Bengaluru; Editing by Maju Samuel Our Standards: The Thomson Reuters Trust Principles., opens new tab

[11]

A New Era Begins Today for the Iconic Dow Jones Industrial Average | The Motley Fool

For well over a century, the Dow Jones Industrial Average (^DJI -0.00%) has served as a barometer that gauges the health of the U.S. stock market. When the Dow Jones was officially incepted on May 26, 1896, it was comprised of a dozen companies, most of which were tied to the industrial sector. Today, it contains an assortment of 30 historically profitable, time-tested, industry-leading businesses. Over the last 128 years, this iconic index has undergone 52 meaningful changes, excluding components altering their name or existing Dow constituents merging. The most recent change had been Amazon entering the index and pharmacy chain Walgreens Boots Alliance getting the heave-ho in February -- that is, until today. Before trading begins on Friday, Nov. 8, a new era will begin for the Dow Jones Industrial Average. The 53rd change to the components of the Dow Jones will see artificial intelligence (AI) leader Nvidia (NVDA 2.25%) enter the Dow and legacy semiconductor company Intel (INTC 4.71%) head for the exit. Aside from being late to the AI party, Intel has the lowest share price within the Dow. Unlike the market cap-weighted S&P 500 and Nasdaq Composite, where larger companies exert more influence on these respective indexes, the Dow is a share price-weighted index. Market cap is irrelevant in the context of affecting the Dow's point value. Significant losses tied to Intel's Foundry division, which it's building from the ground up, as well as central processing unit market share losses to Advanced Micro Devices, made Intel a virtual non-factor for this 128-year-old index. Meanwhile, Nvidia's largest-ever stock split (10-for-1) in June paved the way for it to become one of the 30 components in the Dow. Without this split, Nvidia would be pushing close to $1,400 per share, which wouldn't have worked with the Dow's share price-weighted formula. The addition of Nvidia gives the mature stock-focused Dow a new growth component, as well as positions the index to take advantage of the rise of AI. According to the analysts at PwC, the combination of productivity gains and consumption-side effects tied to the AI revolution can add $15.7 trillion to the global economy by 2030. Nvidia's hardware is at the center of the hype surrounding artificial intelligence. Its H100 graphics processing unit (GPU) and next-generation Blackwell GPU are the brains behind the split-second decision-making needed to run generative AI solutions and build/train large language models. Over a three-year stretch, Nvidia's full-year sales are expected to climb from a reported $27 billion to an estimated $179 billion -- and AI accounts for pretty much the entirety of this projected increase. Although demand for Nvidia's solutions remains robust, as does the company's pricing power for its hardware, the addition of this AI leader may expose Wall Street's widely followed stock index to an eventual bubble-bursting event. For three decades, investors have consistently overestimated how long it would take for a game-changing technology to be adopted and/or gain widespread utility. In every instance, it's resulted in a new technology or innovation failing to live up to lofty expectations. Nothing suggests AI is going to avoid the fate of prior next-big-thing trends, which includes the advent of the internet. If the AI bubble were to burst, the Dow would be exposed to added downside, compared to if Intel were to remain in the index. On top of the flagship addition of Nvidia, S&P Dow Jones Indices -- the committee that votes on the stocks that enter and leave the Dow -- has chosen to boot materials science solutions company Dow Inc. (DOW 1.14%) and replace it with painting and coating giant Sherwin-Williams (SHW 0.86%). The writing had been on the wall for some time that Dow Inc. would be shown the door. Following the 2017 merger between Dow Chemical and DuPont, the newly formed company (DowDuPont) had stated its intent to, eventually, split into three separate business. This split occurred in 2019, resulting in DuPont, Corteva, and Dow Inc. all going their separate ways. Dow Inc. remained in the Dow Jones Industrial Average, which technically gave DuPont (via the split) a continuous presence in the index since 1935. This officially comes to an end today. Similar to Intel, Dow Inc.'s low share price made it a relative non-factor for the Dow Jones Industrial Average. Plus, with the loss of DuPont's and Corteva's operating divisions, it was no longer the diversified company it once was. With Sherwin-Williams entering the Dow today, it immediately becomes one of the most-relevant components. Its $378 share price ranks sixth among the 30 constituents of this iconic index. Because of the wide gap in share price between Sherwin-Williams and Dow Inc., as well as Nvidia and Intel, S&P Dow Jones Indices will be adjusting the Divisor used to turn share price into Dow points. Being cyclical is arguably the biggest investment draw for Sherwin-Williams. Even though downturns in the U.S. economy are normal and inevitable, they tend to be short-lived. Three-quarters of the 12 U.S. recessions since the end of World War II were resolved in less than 12 months. By comparison, most periods of growth extend for multiple years. This leads to growing consumer, commercial, an industrial demand for the company's products over time, as well as lifts its pricing power. To add, Sherwin-Williams has done an excellent job of leaning on inorganic growth to expand. Though most of these acquisitions are of the bolt-on variety, management hasn't been afraid to grab a marquee name from time to time, just as Sherwin-Williams did when it acquired Valspar for $11.3 billion in an all-cash deal in 2017. The Dow Jones Industrial Average can go years without changes being made. Today begins a new era for this iconic index.

[12]

Nvidia to replace Intel on Dow Jones Industrial Average

Nov. 2 (UPI) -- Chipmaker Nvidia will replace Intel on the Dow Jones Industrial Average on Friday as the recent emergence of artificial intelligence continues driving Nvidia's value higher. S&P Dow Jones made the announcement Friday. Nvidia shares are up by 170% in 2024 and grew by 240% in 2023 as continued development of AI drives up demand for Nvidia chips, CNBC reported Friday. Nvidia currently is valued at $3.3 trillion, making it the second-most valuable publicly traded company behind Apple, which is valued at $3.39 trillion. Nvidia briefly overtook Apple to become the world's most valuable company in late October Microsoft, Google, Meta and Amazon are among the large tech firms buying graphics processing units from Nvidia to build more computer clusters to drive their respective AI pursuits. Nvidia's GPU chips power AI applications and enabled Nvidia's value to grow by $3.1 trillion over the past two years. Demand for Nvidia products have caused the company to double its valuation each of the past five quarters and triple its during three of those quarters. Nvidia recently announced its Blackwell chip, which the tech firms says will quadruple AI training performance compared to its current Hopper chip. Nvidia officials anticipate demand for the Blackwell chips to exceed the supply in 2025 as major tech firms transition to the new chips. Nvidia's shares price has grown by 740% since OpenAI launched its ChatGPT generative AI program in November 2022. In another Industrial Average change, Sherwin Williams will replace Dow Inc., also on Friday. In April, Amazon replaced Walgreens Boots Alliance.

[13]

Nvidia is Now a Dow Member, as is Paint-Maker Sherwin-Williams

The change took effect prior to the start of trading, according to S&P Dow Jones Indices, which manages the blue-chip index, in an announcement at the start of the month. Nvidia shares, which are little changed in premarket trading, have risen nearly three-fold since the start of the year, driven by insatiable demand for the company's family of AI chips -- including its next generation Blackwell graphics processing units (GPUs). The AI boom has helped the chip designer to leapfrog Microsoft (MSFT) and Apple (AAPL) to become the most valuable publicly listed company in the world. Nvidia stock has hit record highs since the announcement of its inclusion in the blue-chip index at the start of the month. In contrast, Intel shares are down almost 50% this year, as it struggles with a costly turnaround under Chief Executive Officer (CEO) Pat Gelsinger. Paint maker Sherwin-Williams (SHW) also became a member of the blue-chip index Friday, supplanting chemical giant Dow (DOW). Sherwin-Williams shares are unchanged in premarket trading, but are up 23% this year. Intel is down 1%.

[14]

Nvidia replaces Intel on the Dow index

NEW YORK (AP) -- Nvidia is replacing Intel on the Dow Jones Industrial Average, ending a 25-year-run for a pioneering semiconductor company that has fallen behind as Nvidia cornered the market for chips that run artificial intelligence systems. Paint-maker Sherwin-Williams will also replace chemical company Dow Inc among the companies that make up the 30-stock average. S&P Dow Jones Indices said Friday that the changes that take effect Nov 7 "were initiated to ensure a more representative exposure to the semiconductors industry and the materials sector respectively." It added that because the Dow is price-weighted, "persistently lower priced stocks have a minimal impact." Dow Inc., a major producer of chemicals and plastics and unrelated to the similarly named company behind the index, has also been the smallest company on the Dow in terms of market capitalization. Intel's share price has dropped more than 50 per cent so far this year to USD23.20. On Thursday, the California chipmaker reported third-quarter revenue of USD13.3 billion, down 6 per cent from the same period last year. Intel CEO Pat Gelsinger said at the time that the company is "acting with urgency" on a plan to reduce costs and simplify its portfolio. By contrast, Nvidia's shares have risen more than 173 per cent this year to a price of USD135.40. Unlike Intel, Nvidia designs but doesn't manufacture its own chips, relying heavily on Taiwan Semiconductor Manufacturing Company, an Intel rival.

[15]

Nvidia to replace Intel in Dow Jones Industrial Average -- Intel's 25-year reign has come to an end

Nvidia's AI leadership and Intel's bungling of its finances leads to this shakeup in the financial world. Nvidia will replace Intel on the Dow Jones Industrial Average, indicating the massive impact of the AI boom on the semiconductor and tech industries and the entire market. According to CNBC, this change will happen on November 8, about three months after news of Intel's financial woes broke out. The move was sparked by Intel's massive stock price drop -- over 30% overnight -- following the disastrous financial results released last August. The company has been bleeding cash through its data center and foundry divisions, resulting in a $1.6 billion loss for the second quarter of 2024. This was soon followed by news of massive layoffs, with over 15,000 employees affected. On the other hand, Nvidia's stock price has been growing by leaps and bounds owing to the AI boom. For a short time, it has become the most valuable company in the world, with a market capitalization of $3.34 trillion. Even though the company has dropped down to second place next to Apple, it's still a remarkable rise in such a short amount of time. Nvidia's share price was $14.16 in November 2022, rising by 218% to $45.01 a year later. Today, the company's stock price is $135.37, another 201% jump over the past 12 months. This means that the company's value jumped by over 850% in just two years. Intel entered the Dow Jones Industrial Average in 1999, but its 25-year run was cut short by its failure to take the lead in artificial intelligence. On the other hand, Nvidia's replacement would be the fourth tech company worth over a trillion dollars to make it into the Dow, after Microsoft, Apple, and Amazon. Interestingly, Amazon entered the list just this year after replacing the retail company Walgreens in February. A five-person committee, including editors from the Wall Street Journal, selects the companies to be included in the list. Although there are no specific rules for a company to be considered for the Dow, the committee members consider the following factors when determining which organizations will be added: large market capitalization, industry leadership, sustained financial growth, and investor interest. Nvidia's entry into the list ticks all these boxes, showing the financial market's positive outlook on the future of artificial intelligence.

[16]

Nvidia Is Joining the Dow Jones Industrial Average. Will This "Magnificent Seven" Stock Be Next? | The Motley Fool

On Friday after the close of trading, S&P Global announced that Nvidia (NVDA 2.84%) would finally join the Dow Jones Industrial Average (^DJI 1.02%). The AI chip juggernaut has been the most valuable company that's not included in the blue-chip index for most of this year, and with its valuation hovering north of $3 trillion, it's now challenging Apple for the title of most valuable company in the world. As seemed likely after Nvidia's stock split, Nvidia will be replacing Intel (INTC 3.55%) in the Dow. S&P Global, which manages the Dow Jones, also said that Sherwin-Williams will replace chemical giant Dow on the vaunted index. S&P Global said the changes were "initiated to ensure a more representative exposure to the semiconductors industry and the materials sector respectively." The Dow Jones manager also noted that the index is price-weighted, so lower-priced stocks have less of an impact on the index, and it observed that Dow is the smallest company on the index by market cap. Both Nvidia and Sherwin-Williams have share prices that are significantly higher than Intel and Dow, respectively, so the move will increase the index's exposure to both semiconductors and materials sectors. The changes will be implemented before the opening of trading on Nov. 8. Nvidia's replacing Intel on the Dow has been a long time coming. Intel has been the only pure-play semiconductor stock on the Dow, but the industry has taken on increasing importance in the AI era, and nearly every chip stock has soared -- with the notable exception of Intel. Nvidia, which is the leading maker of the powerful data center GPUs that are used to run generative AI applications, is now worth more than 30 times as much as Intel. Nvidia has been more valuable than Intel since 2020, and their market caps have gone in opposite directions since then. Nvidia's profits have skyrocketed thanks to the AI boom kicked off by ChatGPT, while Intel has missed several opportunities and announced a massive restructuring in August. Nvidia rose 2.9% in after-hours trading on the news of its pending DJIA inclusion, while Intel fell 1.8%. Of those companies, Alphabet is the largest, with a market cap of $2.1 trillion, and probably the most diversified, with businesses that extend from Google Search to YouTube to cloud infrastructure to its Waymo autonomous vehicle subsidiary. In order for Alphabet to join the Dow, it would have to replace another company, but there's no clear parallel swap for Alphabet the way there was with Nvidia and Intel. There is another legacy tech company in the Dow that arguably deserves to be replaced by a current leader, and that's Cisco, which is best known for its networking equipment. It's one of the lowest-priced Dow Jones stocks with a share price of $55, and it has a market cap of $221.2 billion. A second option would be IBM, another legacy tech company that has slimmed down over the years after spinning off its IT services unit (now called Kyndryl) to focus on the cloud and AI services. IBM currently trades at a share price of $208 and has a market cap of $193 billion. There is no set schedule when it comes to making changes to the Dow Jones Industrial Average's makeup, but those removals and inclusions don't happen frequently. Changes are made at the discretion of the index's managers, whose goal is to keep it populated with economically important companies that have excellent reputations. Cisco and IBM both still have larger market caps than Intel, so there may not be the same urgency to remove either of them from the index in favor of Alphabet. However, Alphabet is now a well-established market leader, and it has been one of the most valuable stocks on the market for at least a decade. The Google parent should eventually gain admission to the Dow Jones Industrial Average, though it could take years for that to happen.

[17]

Nvidia Stock Is Joining the Dow Jones Industrial Average Stock Index and Intel Is Being Booted | The Motley Fool

Not surprisingly, Nvidia stock was up and Intel stock was down in Friday's after-hours trading session. Nvidia stock gained 2.9% while Intel stock lost 1.9%. Nvidia is replacing Intel in the Dow Jones Industrial Average (commonly called "the Dow") before the market open on Friday, Nov. 8. Intel has been a member of the Dow since 1999, as it was added in its glory days in the dot-com era. Nvidia is replacing Intel in the Dow index to "ensure a more representative exposure to the semiconductors industry," the S&P Dow Jones Indices said in its press release. This makes good sense as Nvidia's whopping $3.39 trillion market cap makes it the second largest stock trading on a U.S. exchange, trailing leader Apple by a slim margin. Meanwhile, Intel's market cap is $99 billion -- just 1/34th the size of Nvidia's. More to the point, Nvidia is much more representative than Intel of the current U.S. tech environment because it is the biggest player in supplying chips and related technology to enable AI capabilities. As background, the Dow Jones Industrial Average is a 30-large stock index that aims to be representative of the U.S. stock market, which in turn is generally a reflection of the U.S. economy. So, in the early decades of its history -- it was launched in 1896 -- it was primarily composed of heavy industrial and energy stocks. In recent decades, technology stocks have been being added to the Dow, as they have become increasingly dominant in the U.S. stock market. Three of the so-called "Big Techs" -- the largest technology companies trading on U.S. stock exchanges -- Amazon, Apple, and Microsoft -- are current components of the Dow. The Dow stock index is price-weighted, which means that each of its 30 components receives a weighting based on its price. So, stock components that are trading at higher prices affect the Dow's performance more than those that are trading at lower prices. What this means is that extremely high-priced stocks have little chance of being included in the Dow because they would exert too much effect on the index price. So, Nvidia's 10-for-1 stock split in June made it possible for it to be considered to be added to the Dow. Nvidia stock closed at $135.37 in Friday's regular trading session. Had it not conducted its stock split, it would be trading at about $1,353 per share. (I say "about" because the stock likely slightly benefited from the stock split.) At this price, there is no way that it would have been added to the Dow. A Dow index membership means that mutual funds and exchange-traded funds (ETFs) designed to track the Dow will have to buy shares of Nvidia. This increased demand should exert upward pressure on the stock price. The good news keeps rolling in for Nvidia stock investors. Hopefully, Wednesday, Nov. 20 will bring more positive news. This is when Nvidia reports its quarterly results for the period ended Oct. 27.

[18]

Nvidia is about to replace Intel in the Dow

Nvidia (NVDA+1.54%) shares rose 1% in Monday morning trading as the AI chipmaker is set to join the Dow Jones Industrial Average, which comprises the 30 leading U.S. stocks. This inclusion marks a significant milestone for Nvidia and reflects its growing influence in the tech and AI sectors. To make room for Nvidia, longtime Dow member Intel (INTC-2.89%) will be removed from the index, signaling a shift in focus toward AI-driven growth. In response to the news, Intel shares fell by 4%. The reshuffling is set to take effect at the end of the week. Nvidia, often hailed as an "AI darling," has seen substantial gains throughout the year, driven by its advancements in AI chip technology. The company's growth trajectory is expected to continue in the coming year, bolstered by expanding interest and investment in artificial intelligence -- a field where Nvidia remains a clear leader. Nvidia's in-demand Hopper chips, which power some of the world's most advanced generative AI models, have propelled the company to record-high quarterly results and a $3 trillion valuation. The chipmaker's next-generation Blackwell AI chip platform was launched in March and has seen a large surge in demand. The stock split Nvidia announced earlier this year also boosted popularity and growth. The company's share price has surged by 173% so far this year -- and by 193% in the past year. In the past five years, the stock has seen an astronomical 2,498% rise. In contrast, Intel has lagged in the AI boom and missed key opportunities. For example, Intel decided to pass on investing in OpenAI, the company behind ChatGPT, which has since revolutionized AI applications and reached a valuation of around $80 billion. Intel's stock has suffered, dropping over 53% this year alone, highlighting the challenges the company faces as it tries to catch up with more agile competitors such as Nvidia.

[19]

Nvidia replaces Intel on the Dow index in AI-driven shift for semiconductor industry

Nvidia is replacing Intel on the Dow Jones Industrial Average, ending a 25-year-run for a pioneering semiconductor company that has fallen behind as Nvidia cornered the market for chips that run artificial intelligence systems NEW YORK -- Nvidia is replacing Intel on the Dow Jones Industrial Average, ending a 25-year-run for a pioneering semiconductor company that has fallen behind as Nvidia cornered the market for chips that run artificial intelligence systems. Paint-maker Sherwin-Williams will also replace chemical company Dow Inc. among the companies that make up the 30-stock average. S&P Dow Jones Indices said Friday that the changes that take effect Nov. 7 "were initiated to ensure a more representative exposure to the semiconductors industry and the materials sector respectively." It added that because the Dow is price-weighted, "persistently lower priced stocks have a minimal impact." Dow Inc., a major producer of chemicals and plastics and unrelated to the similarly named company behind the index, has also been the smallest company on the Dow in terms of market capitalization. In another index, the Dow Jones Utility Average, Texas-based energy company Vistra will replace Virginia-based AES Corp.

[20]

Nvidia Replaces Intel in Dow Jones: AI Revolution Reshapes Wall Street | Investing.com UK

In a seismic shift reflecting the artificial intelligence revolution, Nvidia (NASDAQ:NVDA) - this year's poster child for the AI boom - will replace semiconductor pioneer Intel (NASDAQ:INTC) in the prestigious Dow Jones Industrial Average on November 8. The changing of the guard couldn't be more symbolic: while Nvidia's shares have skyrocketed over 180% this year on explosive AI chip demand, Intel's stock has plunged 50%, highlighting the dramatic transformation in technology leadership. The move represents more than just a routine index adjustment. As the first-ever semiconductor company to join the Dow in 1999, Intel's departure marks the end of an era in traditional computing. Its replacement by Nvidia - a company that transformed itself from a gaming hardware maker into an AI powerhouse - signals Wall Street's emphatic bet on artificial intelligence as the next major driver of economic growth. Understanding the Dow's Structure Unlike its broader cousin, the S&P 500, which weighs companies by market capitalization, the Dow's unique price-weighted structure means that higher-priced stocks have more influence on its movements. With Nvidia's stock trading at record highs, its inclusion will give it significant sway in the 30-stock index that has served as Wall Street's benchmark since 1896. Tech companies Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), IBM (NYSE:IBM), Salesforce, and Cisco Systems (NASDAQ:CSCO) are currently in the index, while tech giants Google (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and Meta remain notably absent. This selective inclusion reflects the Dow's commitment to maintaining a balanced representation of the broader U.S. economy rather than merely tracking the largest companies. Intel's Exit: End of an Era Intel's removal from the Dow reflects its struggling position in today's rapidly evolving tech landscape. Once the undisputed leader in semiconductor manufacturing, the company has faced mounting challenges in recent years. Falling behind in manufacturing advancements, particularly compared to rivals like TSMC and AMD (NASDAQ:AMD), Intel has struggled to maintain its competitive edge in the industry it once dominated. The company's difficulties in adapting to the AI boom have been particularly costly. While competitors raced to develop specialized chips for artificial intelligence applications, Intel's traditional focus on CPUs left it playing catch-up in this crucial growth market. Despite its rich history and ongoing turnaround efforts, the company's declining market position made its removal from the Dow increasingly inevitable. Nvidia: The New Face of Tech Leadership Nvidia's ascension to the Dow represents more than just its individual success - it symbolizes the broader shift toward AI-centric computing. The company's GPUs, originally designed for gaming, have become the backbone of AI and machine learning applications, powering everything from chatbots to autonomous vehicles. The company's remarkable growth trajectory speaks for itself. Nvidia has emerged as a market leader in high-performance computing, with its chips becoming essential components in data centers worldwide. Its focus on AI-specific hardware has proven prescient, as tech giants scramble to secure its powerful processors for their AI initiatives. Market Impact and Investment Implications The index change has immediate implications for investors. Approximately $15 billion in index-linked investments directly track the Dow, meaning fund managers will need to adjust their portfolios accordingly. This rebalancing could create additional buying pressure for Nvidia shares while potentially adding to selling pressure on Intel. For retail investors, the shift underscores a broader trend: the growing divide between legacy tech companies and those at the forefront of AI innovation. While Intel focuses on regaining its manufacturing edge through a multi-year turnaround plan, Nvidia's chips have become the de facto standard for training AI models, commanding premium prices and overwhelming demand. By the Numbers - Nvidia Year-to-Date Stock Performance: +180% - Intel Year-to-Date Stock Performance: -50% - Date of Change: November 8, 2024 - Number of Years Intel Was in Dow: 25 (1999-2024) The Dow Difference - Only 30 companies - Price-weighted index - Started in 1896 - Current tech members: Apple, Microsoft, IBM, Salesforce, Cisco Systems - Notable tech exclusions: Google, Amazon, Meta Looking at the monthly chart for NVDA below, there are a couple of worthwhile technical observations: Looking Ahead The replacement of Intel with Nvidia in the Dow Jones marks more than just an index reshuffling - it represents a fundamental shift in how Wall Street values technology companies. As artificial intelligence continues to reshape industries from healthcare to autonomous vehicles, this change suggests that the next decade of market leaders may look very different from the last. For investors, the message is clear: the future belongs to those who can successfully harness the AI revolution. For Nvidia, joining the Dow represents both a milestone achievement and a new challenge. As one of the most influential companies in the index, it will face increased scrutiny and expectations. However, given its central role in the AI transformation sweeping through global industries, Nvidia appears well-positioned to carry the torch that Intel held for the past quarter-century.

[21]

Nvidia Takes Intel's Spot on Dow Index as AI Thrives

Nvidia is replacing Intel on the Dow Jones Industrial Average, ending a 25-year-run for a pioneering semiconductor company that has fallen behind as Nvidia cornered the market for chips that run artificial intelligence systems. Paint-maker Sherwin-Williams will also replace chemical company Dow Inc. among the companies that make up the 30-stock average. S&P Dow Jones Indices said Friday that the changes that take effect Nov. 7 "were initiated to ensure a more representative exposure to the semiconductors industry and the materials sector respectively." It added that because the Dow is price-weighted, "persistently lower priced stocks have a minimal impact."

[22]

Nvidia to take Intel's spot on Dow Jones Industrial Average

Once the dominant force in chipmaking, Intel has in recent years ceded its manufacturing edge to rival TSMC and missed out on the generative artificial intelligence boom after missteps including passing on an investment in ChatGPT-owner OpenAI.Intel will be replaced by Nvidia on the blue-chip Dow Jones Industrial Average index after a 25-year run, underscoring the shift in the chipmaking market and marking another setback for the struggling semiconductor firm. Nvidia will join the index next week along with paint-maker Sherwin-Williams, which will replace Dow, S&P Dow Jones Indices said on Friday. Once the dominant force in chipmaking, Intel has in recent years ceded its manufacturing edge to rival TSMC and missed out on the generative artificial intelligence boom after missteps including passing on an investment in ChatGPT-owner OpenAI. Intel's shares have declined 54 per cent this year, making the company the worst performer on the index and leaving it with the lowest stock price on the price-weighted Dow. Shares of Intel fell 1.6 per cent in extended trading on Friday, while those of Nvidia were up 2.2 per cent . This development comes a day after Intel expressed optimism about the future of its PC and server businesses, projecting current-quarter revenue above estimates but warning that it had "a lot of work to do." "Losing the status of Dow Jones inclusion would be another reputational blow for Intel, as it grapples with a painful transformation and loss of confidence," said Susannah Streeter, head of money and markets at Hargreaves Lansdown. "It would also mean that Intel is not included in exchange-traded funds (ETFs) which track the index, which could impact the share price further." Launched in 1968, the Silicon Valley pioneer sold memory chips before switching to processors that helped launch the personal computer industry. In the 1990s, "Intel Inside" stickers turned commodity electronic components into premium products, and eventually became ubiquitous on laptops. Intel's revenue was $54 billion in 2023, down nearly one-third from 2021, when Pat Gelsinger took over as CEO. Analysts expect Intel to report its first annual net loss this year since 1986. The company is worth less than $100 billion for the first time in 30 years. That pales in comparison to Nvidia, which is sitting at a $3.32 trillion valuation, making it the world's second-most valuable company. Nvidia has emerged as a cornerstone of the global semiconductor industry, thanks to the essential role its chips play in powering generative AI technologies which has driven a seven-fold surge in its shares over the past two years. The company's shares have risen more than two-fold this year alone. Once popular only among gamers who hunted for PCs with Nvidia's graphics processors, it is now seen as a barometer for the AI market. The company's 10-for-one stock split that took effect in June also helped pave the way for its addition to the index, making its soaring shares more accessible to retail traders. Intel, on the other hand, has struggled to gain share in the AI chip market dominated by Nvidia, with the front-runner's chips hard to get and even harder to replace in AI datacenters, owing to the processors' technological edge and the high costs of replacing them.

[23]

Nvidia Replaces Intel on the Dow Index in AI-Driven Shift for Semiconductor Industry

NEW YORK (AP) -- Nvidia is replacing Intel on the Dow Jones Industrial Average, ending a 25-year-run for a pioneering semiconductor company that has fallen behind as Nvidia cornered the market for chips that run artificial intelligence systems. Paint-maker Sherwin-Williams will also replace chemical company Dow Inc. among the companies that make up the 30-stock average. S&P Dow Jones Indices said Friday that the changes that take effect Nov. 7 "were initiated to ensure a more representative exposure to the semiconductors industry and the materials sector respectively." It added that because the Dow is price-weighted, "persistently lower priced stocks have a minimal impact." Dow Inc., a major producer of chemicals and plastics and unrelated to the similarly named company behind the index, has also been the smallest company on the Dow in terms of market capitalization. In another index, the Dow Jones Utility Average, Texas-based energy company Vistra will replace Virginia-based AES Corp. Copyright 2024 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

[24]

Nvidia replaces Intel on the Dow index in AI-driven shift for semiconductor industry

NEW YORK (AP) -- Nvidia is replacing Intel on the Dow Jones Industrial Average, ending a 25-year-run for a pioneering semiconductor company that has fallen behind as Nvidia cornered the market for chips that run artificial intelligence systems. Paint-maker Sherwin-Williams will also replace chemical company Dow Inc. among the companies that make up the 30-stock average. S&P Dow Jones Indices said Friday that the changes that take effect Nov. 7 "were initiated to ensure a more representative exposure to the semiconductors industry and the materials sector respectively." It added that because the Dow is price-weighted, "persistently lower priced stocks have a minimal impact." Dow Inc., a major producer of chemicals and plastics and unrelated to the similarly named company behind the index, has also been the smallest company on the Dow in terms of market capitalization. In another index, the Dow Jones Utility Average, Texas-based energy company Vistra will replace Virginia-based AES Corp.

[25]

Nvidia replaces Intel on the Dow index in AI-driven shift for semiconductor industry

NEW YORK (AP) -- Nvidia is replacing Intel on the Dow Jones Industrial Average, ending a 25-year-run for a pioneering semiconductor company that has fallen behind as Nvidia cornered the market for chips that run artificial intelligence systems. Paint-maker Sherwin-Williams will also replace chemical company Dow Inc. among the companies that make up the 30-stock average. S&P Dow Jones Indices said Friday that the changes that take effect Nov. 7 "were initiated to ensure a more representative exposure to the semiconductors industry and the materials sector respectively." It added that because the Dow is price-weighted, "persistently lower priced stocks have a minimal impact." Dow Inc., a major producer of chemicals and plastics and unrelated to the similarly named company behind the index, has also been the smallest company on the Dow in terms of market capitalization. In another index, the Dow Jones Utility Average, Texas-based energy company Vistra will replace Virginia-based AES Corp.

[26]

Nvidia Will Replace Intel in the Dow Jones Stock Index

The change, starting next Friday, lifts a dominant player in artificial intelligence over its chip-making rival, which has struggled to keep up. The chip-maker Nvidia will soon replace its rival Intel in the Dow Jones industrial average, S&P Dow Jones Indices said on Friday, reflecting Nvidia's dominance in the world of artificial intelligence. S&P Dow Jones Indices, which maintains the stock index, said in a statement that the change would take place before the opening of trading next Friday "to ensure a more representative exposure to the semiconductors industry." Nvidia established an early foothold in the A.I. revolution, tailor-making its chips for machine learning tasks and building a community of A.I. programmers who were eager to develop their technology on the company's hardware. The bet paid off. Nvidia now accounts for the majority of A.I. chip sales and has become the second-most-valuable company in the world, slightly trailing Apple at $3.32 trillion after trading hours on Friday. Intel, which makes the chips that serve as the brains of most computers, once considered buying Nvidia. But its board resisted the acquisition, and Nvidia went on to become a dominant player in the A.I. boom while Intel struggled to keep up. Intel's market capitalization has fallen below $1 trillion. "The thing that we understood is that this is a reinvention of how computing is done," Jensen Huang, Nvidia's chief executive and one of its founders, told The New York Times last year. "And we built everything from the ground up, from the processor all the way up to the end." A recent stock split at Nvidia prompted speculation that it would replace Intel on the Dow Jones. In June, Nvidia unveiled a 10-for-one stock split that would make it easier for a retail investor to buy into the company without diluting its valuation. Spokeswomen for Nvidia and Intel declined to comment.

[27]

Nvidia Rides AI Wave To Replace Intel On Dow Jones Industrial Average, Ending Its 25-Year Run - Intel (NASDAQ:INTC), Dow (NYSE:DOW)

Nvidia Corp. NVDA is poised to replace Intel Corp. INTC on the Dow Jones Industrial Average index. What Happened: On Friday, S&P Dow Jones Indices announced that Nvidia, along with paint-maker Sherwin-Williams Co. SHW, will join the index next week. Intel will be replaced by Nvidia on the Dow Jones Industrial Average index after a 25-year run, while Sherwin-Williams will replace Dow Inc. DOW. This change highlights the shift in the chipmaking market and is another blow for Intel, which has seen a decline in its market position. Intel's shares have dropped 54% this year, making it the worst performer on the index and leaving it with the lowest stock price on the price-weighted Dow. See Also: Intel Says It Won't Even Make $500M From Gaudi AI Chips In 2024 Despite Nvidia Minting Billions: CEO Gelsinger Says Uptake 'Slower Than We Anticipated' "Losing the status of Dow Jones inclusion would be another reputational blow for Intel, as it grapples with a painful transformation and loss of confidence," said Susannah Streeter, head of money and markets at Hargreaves Lansdown, reported Reuters. Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox. Why It Matters: Intel, once a dominant player in the chipmaking industry, has lost its manufacturing edge to rival Taiwan Semiconductor Manufacturing Co. TSM and missed out on the lucrative artificial intelligence boom. This development comes after Intel expressed optimism about its future, despite warning that it had "a lot of work to do." Intel's struggles were evident in its third-quarter earnings report, where it reported a loss of 46 cents per share, missing analyst estimates. Intel's struggles with market share and profitability have led to a cautious outlook from analysts. The company also fell short of its revenue targets for its Gaudi AI accelerator program in 2024. On the other hand, Nvidia has emerged as a cornerstone of the global semiconductor industry, thanks to the essential role its chips play in powering generative AI technologies. The company's shares have risen more than two-fold this year alone. Read Next: The Guy Who Tracked Elon Musk, Taylor Swift's Private Jet Wants To Know 'Who's Behind' His Suspended Social Media Accounts: '...Until Someone Threatens You Or Tells You To Do This' Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Photo courtesy: Shutterstock Market News and Data brought to you by Benzinga APIs

[28]

Nvidia To Replace Intel In Dow Index Amid AI Chips Rivalry

The change is meant 'to ensure a more representative exposure to the semiconductors industry,' according to S&P. A changing of the guard will happen before trading opens Nov. 8 among publicly traded chipmakers, with graphics processing unit and artificial intelligence heavyweight Nvidia taking Intel's spot in the Dow Jones Industrial Average. S&P Dow Jones Indices, the organization behind the DJIA, said in a statement Friday that the change is meant "to ensure a more representative exposure to the semiconductors industry." "The DJIA is a price weighted index, and thus persistently lower priced stocks have a minimal impact on the index," according to S&P. [RELATED: Intel CEO Gelsinger: AI, Foundry Advances Will Foster Future Growth] CRN has reached out to Nvidia and Intel for comment. Both chipmakers are based in Santa Clara, Calif. The news comes a day after Intel reported a net loss of $15.64 billion in its latest quarterly earnings report using Generally Accepted Accounting Principles. Non-GAAP net loss was $1.98 billion. The vendor said it expects fourth fiscal quarter 2024 revenue of $13.3 billion to $14.3 billion, down from the $15.4 billion the company reported for its fourth fiscal quarter 2023. Nvidia will deliver its next quarterly earnings report on Nov. 20. In August, the vendor reportednet income for the latest quarter of $16.6 billion, up more than 168 percent from one year earlier. Nvidia's stock was up about 3 percent after market close Friday, trading at about $139 a share. Intel's stock was down about 2 percent, trading at about $23 a share.

[29]

Nvidia to take Intel's place on the Dow after 25 years

Won't make a difference for institutional investors, but retail traders be warned, analyst tells El Reg On Friday, Nvidia will supplant Intel after 25 years as the semiconductor sector's representative on the Dow Jones Industrial Average. The decision, announced late last week by S&P Global, which oversees the DOW, was made to "ensure a more representative exposure to the semiconductors industry" and will go into effect before the market opens on Nov. 8. Intel's removal has been anticipated for some time. The Dow is a price-weighted index and Chipzilla's stock has dropped by more than half since the start of the year. It has grappled with enormous losses, which totaled $16.6 billion in the third quarter alone. At the time of writing, Intel's share price sits at $23.33. Of all the chip companies that could fill Intel's shoes, Nvidia was the obvious choice, despite the fact it doesn't actually produce any of its own chips. The GPU giant has become a kingmaker amid the rise of generative AI with its accelerators and systems powering some of the largest and power hungry compute clusters in the world. xAI's Colossus, which we looked at last month, houses 100,000 of Nvidia's venerable H100 GPUs. The extreme demand for its accelerators drove meteoric growth at the company, which has seen its market cap surge to more than $3 trillion dollars and its share price rise about 985 percent over the past two years. According to Patrick Moorhead, chief analyst at Moor Insights and Strategy, the decision reflects a shift in value from general-purpose CPUs to GPUs and a preference for complete system designs. "You need CPUs to light up the GPUs but from a metric value, GPUs are a larger portion of the growth," he said. "Second, is the higher value of a solution (CPU+GPU+networking+even cables) from the individual piece parts. Total solutions are looked at as better for time-to-market and even reliability." Nvidia's rapid rise from PC graphics peddler to datacenter Goliath has, however, put the firm at the mercy of the market. We've seen Nvidia's market cap vacillated wildly over the past few months, sometimes rising and falling by hundreds of millions of dollars. While it's true its market cap has experienced some of the largest swings in the tech sector, Nvidia's share price has also experienced relatively steady growth, albeit over a far shorter period of time than is typical of most companies listed on the Dow. But, as if reflecting the market volatility of late itself, a company whose market cap swings up and down by nearly a billion dollars is at odds with an index often looked to for its relative stability and more practical view of the "real world" market. "A decade or two ago it would have mattered as the Dow represented stability while the NASDAQ was looked at as riskier, but today no," Moorhead explained, adding that he doesn't expect Nvidia's addition to result in major swings for the Dow. In fact, Moorhead expects Nvidia's inclusion on the Dow will mean very little for institutional investors, but will have a meaningful impact on retail investors ruled by emotion. ®

[30]

What Nvidia's Dow inclusion means for the chipmaker, according to history

Investors are expecting the Dow Jones Industrial Average to get a boost from the inclusion of the biggest artificial intelligence beneficiary of the last year. But history shows they may have to wait. The 30-stock Dow has underperformed this year and last after failing to capitalize on the artificial intelligence boom that helped bolster the comparatively tech-heavy S & P 500 and Nasdaq Composite. The Dow has advanced just 11% this year, after rising 13.7% in 2023. By comparison, the S & P 500 has surged 20% in 2024, after climbing 24% last year. So it's natural that calls for the Dow to modernize a bit grew louder and the S & P Dow Jones index committee finally took action last week, with Nvidia's recent stock split giving them the opportunity to do so by making it a more palatable for the price-weighted average. NVDA 1D mountain Nvidia "When we kind of think about where the world is headed to over the next decade or so, it's one where semiconductors are going to play a much bigger theme out there, across different vectors of the market," said CFRA Research's Angelo Zino. Investors' enthusiasm around the addition boosted Nvidia Monday, even as the Dow struggled . Nvidia doesn't actually join the average until Friday before the bell so it couldn't help. New additions underperform History shows that stocks that leave the Dow have historically outperformed incoming members, according to past data from Ned Davis Research , as the new addition typically comes after a long run of outperformance and the exiled stock becomes a kind-of contrarian value buy. Since 1972, outgoing members have averaged a 12-month gain of nearly 17.5%, while new members have averaged a 10% gain in their first year. However, CFRA's Zino is skeptical the same pattern will hold true as the Dow exchanges one of the market's worst-performing chipmakers for one of its best. The analyst cited Nvidia's strong fundamentals, as well as "absolutely enormous" growth cycle tied to its Blackwell GPUs that has the analyst bullish on the company's future prospects. Meanwhile, Intel will have to contend with losing further share in its core markets, he said. And the pattern didn't hold when Amazon joined earlier in the year. For example, Amazon, which replaced Walgreens Boots Alliance in February, gained 13% since the change, as of Friday's close. On the other hand, shares of Walgreens Boots Alliance have plummeted 56%. Nvidia shares have gained 179% this year, and last advanced 1.8% in midday trading. Meanwhile, Intel shares have tumbled more than 55% in 2024; on Monday, it was last off by another 3.5%. "It makes all the sense in the world to kind of replace a name like Intel, which kind of really missed a number of major themes here, and trends across the tech space over the last two decades for that matter, and kind of replacing it with a name that has had that AI inflection that should be a big winner here over the next couple of years," Zino said. "[The Dow] couldn't yield better performance," he added. Nvidia will be the fourth of the Magnificent Seven companies to join the benchmark.

[31]

Nvidia replacing fallen icon in Dow stock index after 25-year run

Intel will lose its spot in the Dow Jones Industrial Average after a 25-year run to Nvidia, S&P Dow Jones Indices said Friday, the latest blow to the struggling chipmaker that was among the first two technology firms to be included in the blue-chip index. Once the dominant force in chipmaking, Intel has in recent years ceded its manufacturing edge to rival TSMC and missed out on the generative artificial intelligence boom after missteps including passing on an investment in ChatGPT-owner OpenAI. Intel's shares have declined 54% this year, making it the worst performer on the index and leaving it with the lowest stock price on the price-weighted Dow. The stock fell about 1% to $22.79 in extended trading on Friday, while Nvidia was up more than 2% to $139.17. This development comes a day after Intel expressed optimism about the future of its PC and server businesses, projecting current-quarter revenue above estimates but warning that it had "a lot of work to do." "Losing the status of Dow Jones inclusion would be another reputational blow for Intel, as it grapples with a painful transformation and loss of confidence," said Susannah Streeter, head of money and markets at Hargreaves Lansdown. "It would also mean that Intel is not included in exchange-traded funds (ETFs) which track the index, which could impact the share price further." Launched in 1968, the Silicon Valley pioneer sold memory chips before switching to processors that helped launch the personal computer industry. In the 1990s, "Intel Inside" stickers turned commodity electronic components into premium products, and eventually became ubiquitous on laptops. Intel's revenue was $54 billion in 2023, down nearly one-third from 2021, when Pat Gelsinger took over as CEO. Analysts expect Intel to report its first annual net loss this year since 1986. The company is worth less than $100 billion for the first time in 30 years. That pales in comparison to Nvidia, which is sitting at a $3.32 trillion valuation, making it the world's second-most valuable company. Nvidia has emerged as a cornerstone of the global semiconductor industry, thanks to the essential role its chips play in powering generative AI technologies which has driven a seven-fold surge in its shares over the past two years. The company's shares have risen more than two-fold this year alone. Once popular only among gamers who hunted for PCs with Nvidia's graphics processors, the company is now the second-most valuable in the world and is seen as a barometer for the AI market. The company's 10-for-one stock split that took effect in June also helped pave the way for its addition to the index, making its soaring shares more accessible to retail traders. Intel, on the other hand, has struggled to gain share in the AI chip market dominated by Nvidia, with the front-runner's chips hard to get and even harder to replace in AI datacenters, owing to the processors' technological edge and the high costs of replacing them.

[32]

End Of An Era - AI Propels Nvidia To Replace Struggling Intel In Dow Index - NVIDIA (NASDAQ:NVDA), Intel (NASDAQ:INTC)