Nvidia vs. Broadcom: Complementary Strategies in the AI Chip Market

2 Sources

2 Sources

[1]

Nvidia vs. Broadcom: The debate is back on, but it often misses the mark

Broadcom's blockbuster earnings report has rekindled a long-running debate among investors: Just how firm is Nvidia's grasp on the AI chip market? The problem, though, is that might not be the best question for investors to ask. Instead, investors are better served asking just how large the AI computing market itself can grow to be. As investors in Nvidia and Broadcom, we clearly see a role for both chipmakers to play in the AI race. Nvidia is the dominant provider of "merchant" silicon, selling the same advanced chips to various data-center operators, along with a rich software presence. Broadcom is the leading purveyor of "custom" chip-design services, utilized right now by a small subset of deep-pocketed tech companies like Google that, generally speaking, are trying to get more out of their own software stacks. Undoubtedly, some sales that could've gone to Nvidia will flow to Broadcom's coffers in the years ahead as internet giants like Meta Platforms , a fellow Club name widely assumed to be one of Broadcom's existing custom-chip clients, look to run certain internal workloads at lower costs using specialized chips. Some cloud-computing providers may also look to diversify the kind of computing power they can offer customers. The tension is that, if this dynamic indeed plays out, will it mean that Nvidia is no longer be able to meet Nvidia investors' growth expectations? Or, is the demand for AI infrastructure large enough over the coming decade that Nvidia can keep growing sales and earnings, even as its own market share comes down? Our bet is on the second scenario. A pair of notes out Monday morning go to the heart of this debate -- one comes from the analysts at Citigroup, the other from Melius Research. Citi cut its 2026 sales estimate for Nvidia by $12 billion and, in turn, its price target on the stock, directly citing Broadcom's comments last week about rising demand for its custom AI chip services. The firm went to $200 a share from $210, a move certainly counter to what we have seen in recent years when it comes to Nvidia price targets, which have tended only to go up. On the other hand, Melius reiterated its price targets on both stocks and argued that even with Broadcom seeing an incredible amount of interest in its custom silicon solutions, the overall demand is large enough that both companies stand to grow immensely in coming years and likely outpace investor expectations. To be sure, while the Citi analysts cut their price target, they are still positive on the name. They maintained their buy rating and noted that even their reduced 2026 estimates are above the Wall Street consensus. Nevertheless, a bullish firm getting somewhat less bullish is notable and it underscores the current debate on the Street. Do you reduce your Nvidia exposure to increase your Broadcom stake? We think the real answer is simply to own both, planting our flag in the Melius camp. While Broadcom is certainly cementing itself as a top AI stock to own, our belief is the demand is simply so great that both will win. Do the homework on both. Adjust their individual weightings based on your standard portfolio management disciplines -- i.e., if one has gone on a parabolic move, consider booking some profits; the same goes for it a stock exceeds your threshold for weighting, which for the Club is about 5% on any given position. But analyzing the situation by only playing one against the other is short-sighted. What it really comes down to is the size of the total addressable market, often abbreviated to TAM. Sometimes, there will be a company that has so much market share of a new, rapidly growing industry that it is a given they will lose share as others see how much the company is making and look to compete. However, as the pie gets bigger, they can lose some of that share and still continue to grow. In other words, you get a smaller share or percentage of a larger pie, but that smaller share ends up being larger than the entirety of the initial, smaller pie. NVDA AVGO 1Y mountain Nvidia and Broadcom's stock performance over the past 12 months. Consider the case of Amazon and the online shopping market. Back in June 2018, the research firm eMarketer said Amazon ended 2017 with about 44% of the U.S. e-commerce market, but was on its way to capturing just under 50% in the following year. As of 2023, eMarketer pegged Amazon's share of US ecommerce at about 40%. Nonetheless, Amazon's sales in North America went from $141.4 billion in 2018 to $352.8 billion in 2023. They're on track to be $424 billion this year, according to estimates compiled by FactSet. The point is that while market share is important and the size of the market is an important metric to consider when seeking to determine the size of the opportunity, you do not want to get caught up thinking that you are strictly investing in market-share growth. Instead, what you're investing in is growth in the company's sales and earnings. Since the end of 2017, Amazon has returned around 304% versus 175% for the S & P 500, including reinvested dividends. When we apply this to Nvidia and Broadcom, we think a similar argument makes sense. Nvidia, as a first mover in the AI semiconductor space, has enjoyed the benefits of being the dominant player in the market. However, as more companies started to see the potential magnitude of AI demand, it is only natural that they would move into the space -- which, in this case, means looking to companies like Broadcom to help them design their own AI chips. We've also seen AMD ramp up its efforts to compete with Nvidia on the "merchant" silicon side of AI. This doesn't mean Nvidia will stop growing. After all, the company can barely keep up with the demand it has now, and all signs point to the need for AI infrastructure only increasing from here. "We think there are signs that the AI compute/networking TAM is entering a hugeness that is hard to fathom," Melius Research wrote in its Monday note. By their estimation, the serviceable addressable market (SAM) stands at about $2 trillion toward the end of the decade -- that's about half of the total $3 trillion to $4 trillion in data center capital expenditures that Nvidia CEO Jensen Huang recently predicted would occur by 2030. Against that backdrop, Melius argued that both Nvidia and Broadcom "are much more likely to beat our 2027 estimates than not. In fact, if Broadcom can get just 20% of our $2T SAM estimate for 2030 and Nvidia keeps just 40% then both stocks are going a heck of a lot higher." And that's really all that matters at the end of the day - the totality of AI demand. Indeed, Stacy Rasgon of Bernstein Research made a similar case Friday when he appeared on CNBC's "Closing Bell." At that time, Broadcom shares were soaring in response to its earnings report the prior night, and Nvidia was down a few percentage points. "I don't think the right question right now is necessarily who is winning or losing," Rasgon said, while noting this isn't the first time Nvidia shareholders fretted custom competition. "I actually think, personally, the question is better off to be put: Is the opportunity in front of us still large, or is it not? I think [custom chips] will take share. They're coming from a smaller base. I don't think they dominate. And I think if the opportunity in front of us is still big, if we're still early in this, as I think we are, I think they can both thrive. Think about it this way: If the opportunity in front of us is not still big, like, they're both screwed. That's the right question right now, I think, not as much who is winning or losing." Bottom line While the market makes a lot of noise about which AI chip stock to be in based on which CEO spoke most recently -- or reminded the world that AI demand has plenty of room to run -- we think investors will be better served keeping their eye on just how large the entire market will grow to be in coming years and targeting the names with best-in-class offerings. In the case of merchant AI chips, that's Nvidia thanks in large part to a massive software ecosystem that serves as a competitive moat against other competitors like AMD. And in the case of custom silicon, it is Broadcom. (Jim Cramer's Charitable Trust is long NVDA, AVGO, META and AMZN. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust's portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

[2]

Broadcom vs. Nvidia: Not a zero-sum game - SiliconANGLE

We believe the prevailing narrative that Broadcom Inc. and Nvidia Corp. are locked in a zero-sum battle for artificial intelligence data center dominance is misleading. The reality is these companies are playing very different games. Nvidia has built a vertically integrated compute and software platform that has become the engine of the AI factory era. Broadcom, by contrast, has constructed a durable business model around connectivity, custom silicon, and high-margin software. The strategies overlap but are not mutually exclusive. We believe the real story is how these firms are carving out complementary positions in the most important technology cycle since the dawn of the internet. In this Breaking Analysis, we examine the different strategies of Broadcom and Nvidia and explain why the success of one doesn't necessarily mean dilution to the others' prospects. Nvidia's strategy is straightforward in concept but extraordinarily difficult to replicate. The company builds a full-stack platform that starts with GPUs and extends across the system. Jensen Huang has repeatedly emphasized that the unit of competition is no longer the chip, but the system or what Nvidia coined as the AI factory. Nvidia has positioned itself as the indispensable supplier for anyone looking to stand up these factories. At the core of Nvidia's stack are GPUs such as Hopper and Blackwell, paired with NVLink/NVSwitch interconnects to form tightly coupled compute domains. These "pods" scale to 72 GPUs, creating high-bandwidth, low-latency islands optimized for extreme parallel processing workloads such as AI training. Nvidia extends these pods outward using InfiniBand, a proprietary network technology it captured from its Mellanox acquisition. In addition, Nvidia leverages its Spectrum-X Ethernet, a purpose-built Ethernet fabric designed to handle AI traffic deterministically. On top of the hardware sits its CUDA software stack and hundreds of libraries that represent the software glue that makes these systems programmable and highly tuned. Nvidia's software moat is deep, with tens of thousands of developers locked into its ecosystem and wide supporting a virtually infinite number of use cases. In addition, the company offers systems and services such as DGX, NIMS inference microservices, and Omniverse for simulation and digital twins, further solidifying its position as a platform, not just a chip supplier. The cadence of innovation is relentless. Each year, Nvidia launches new architectures that deliver better performance per watt and higher utilization of the cluster. This annual rhythm turns capital spending into a recurring monetization cycle. The result, when power is a constraint and systems are under-utilized, is customers spend more, generate more tokens per watt, and reduce unit cost at scale. Broadcom's approach is significantly different from that of Nvidia. Hock Tan and Charlie Kawwas are not chasing GPUs or building giant AI systems. Instead, Broadcom's playbook is to identify durable franchises - markets with a decade or more of runway - establish technology leadership, and run them with intense operating discipline. Some investors have shied away from Broadcom citing it as a "commodity player." In our view this narrative is misguided and lacks an understanding of the engineering investments required to deliver the products Broadcom produces, including in its wireless portfolio. In semiconductors, Broadcom has staked its claim in connectivity. Its Tomahawk and Jericho families dominate merchant Ethernet switching. It has also secured custom silicon design wins with Google, Meta, and likely ByteDance, embedding Broadcom deep into the hyperscale AI buildout. These are multi-billion dollar, long duration deals that are highly strategic. The company just announced it closed another $10B custom chip deal, widely known to be with OpenAI, which, like the hyperscalers, is designing its own chips to reduce its reliance on NVIDIA. On the last earnings call, Hock Tan had what appeared to be an inadvertent and ironic "tell" saying the following: Today's AI rack scales up a mere 72 GPUs at 28.8 terabit per second bandwidth using proprietary NVLink. On the other hand, earlier this year, we have launched Tomahawk 5 with Open AI -- with open Ethernet, sorry, which can scale up 512 compute nodes for customers using XPUs. This slip of the tongue came right after he announced the most recent $10B custom chip deal, leading many observers, including us, to conclude that OpenAI was clearly embedded (in a good way) in Hock's head space. Charlie Kawwas' mantra is "OSP." It stands for Open, Scalable, Power Efficient and frames Broadcom's philosophy. The company bets that open standards like Ethernet and PCIe will ultimately win out over proprietary approaches such as InfiniBand and NVLink. History suggests this is a good bet, which is why Nvidia has also embraced Ethernet. In software, Broadcom has reshaped VMware around VMware Cloud Foundation, announcing VCF 9.0 claiming the integration of all those disparate VMware software modules was achieved with thousands of engineers creating the bundle. Broadcom's strategy to force customers into higher-value contracts, while controversial, has driven operating margins above 70% and gross margins over 90%, substantially better than other SaaS gross margins. Moreover, VMware has become the most robust on-prem alternative to public cloud and represents the most mature private cloud offering on the market in our view. The quirk of Broadcom's VMware strategy is that alternatives such as Hyper-V, Nutanix, Red Hat, etc. have gained momentum, where previously they were shut out as virtualization plays. Broadcom doesn't want the customers unwilling to pay up for the full VCF stack but alternative players that don't have nearly the profitability profile of Broadcom are happy to take the business. The graphic below shows ETR's Net Score methodology for the virtualization market. The vertical axis (Net Score) represents the Net percent of customers spending more on each platform and the horizontal axis shows penetration into the data set. The data would lead one to believe that VMware is struggling, noting its precipitous drop from January 2023. But the methodology doesn't capture amount of spend. As such it misses the fact that Broadcom's strategy has been to more narrowly focus its efforts on those high value customers willing to spend on the whole VCF bundle to lower TCO. This is a classic Broadcom move. It only competes in markets where it can dominate. In the case of VMware, it's not the number of logos that matters, rather its the number of customers that willing to absorb price increases and buy the full bundle. Contrary to many misguided narratives, Broadcom invests heavily in engineering and surrounds its platform with critical technologies that drive clear ROI. This is why (for example) even Nvidia buys networking technologies from Broadcom. The bottom line is Broadcom doesn't need to win in GPUs head-to-head with Nvidia to thrive. Instead, it supplies the glue -- SerDes, NICs, optics, and switches -- that make large AI systems possible. In Kawwas' words, Broadcom doesn't make GPUs, it makes the stuff that makes XPUs and HBMs work. In addition, it has secured multi-billion dollar, long duration contracts to build custom AI chips for some of the top companies in the world, including Google, Meta, ByteDance and now OpenAI. A major flashpoint between the two companies is the question of scale. On Broadcom's most recent earnings call, Hock Tan de-positioned Nvidia's NVLink 72 as "scaling up a mere 72 GPUs at 28.8 terabits per second," contrasting it with Broadcom's Ethernet fabrics that can connect 512 nodes using Tomahawk 5. At face value, this makes NVIDIA's approach sound limited. But the comparison is misleading in our view. The way we interpret Nvidia's use of the "scale up, out across" terminology is as follows: Broadcom, in Tan's remark, appears to have used "scale up" more loosely to mean "supporting larger clusters than 72 GPUs." But technically, connecting 512 compute nodes with Ethernet is a scale-out fabric, not scale-up. In particular, scale-up is generally thought of as making a single logical system bigger by tightly coupling components. Think symmetric multiprocessing in a single box. In our view, Tan was de-positioning NVLink's rack-level island (72 GPUs) as small, contrasting it with Broadcom's Ethernet-based ability to connect hundreds of nodes. In doing so, he takes liberty with the terminology, calling Ethernet's cluster expansion "scale up," when in fact in classic parlance it's scale-out. In contrast, Nvidia's 72 GPUs refers to a tightly coupled NVLink domain where HBM pools are shared across GPUs, enabling highly efficient parallel operations. Broadcom's 512 nodes really refers to the scale-out capability of Ethernet fabrics. It is not an apples-to-apples comparison. The two approaches solve different problems. NVLink maximizes performance within a rack, while Ethernet extends clusters across racks and rows. The trade-off is NVLink delivers peak performance per GPU, Ethernet delivers estate-level scalability and economics. In practice, operators use both - NVLink for high performance compute islands, Ethernet for stitching those islands together. The financial models of Nvidia and Broadcom underscore their different strategies. On the surface, both companies post extraordinary results, but the way they get there is different. Nvidia today is running at a revenue pace of roughly $187 billion annually, up an impressive 56% year-over-year. Despite moderating from the triple-digit growth rates of prior quarters, this remains one of the fastest growth profiles of any mega-cap. Margins are equally impressive: 73% gross, 65% operating, and 33% operating cash flow. With a market capitalization north of $4 trillion and a 22x run rate revenue multiple, Nvidia is being valued as a once-in-a-generation growth company, not a traditional semiconductor provider. In our view, this reflects investor conviction that Nvidia's full-stack AI factory strategy has years of runway left, with annual cadence upgrades, CUDA software lock-in, and hyperscaler demand elasticity sustaining momentum. And an economic value proposition that is compelling when power is the limiting factor and utilization / efficiency improvements can be achieved with rapid tech refreshes. In its recent earnings call, Nvidia stressed the ramp of Blackwell, with NVLink 72 deployents showing 10× efficiency gains on reasoning workloads compared to Hopper. Management highlighted that inference is now a meaningful revenue stream, alongside training. In terms of ROI, elasticity (Jevons Parodox) is allowing Nvidia to cut price per token while still growing revenue. Broadcom, by contrast, is delivering exceptional results with a different playbook. The company is operating at an annualized revenue run rate of about $64 billion, growing a solid but more measured 22% year-over-year. This past quarter its non-AI semiconductor offerings were a headwind but they're expected to grow sequentially. Broadcom's gross margin of 67% is lower than NVIDIA's, but Broadcom shines in cash generation, with 45% operating cash flow margin - a remarkable figure given the scale of the business. Operating margin sits at 37%, well below Nvidia's, but consistent with Broadcom's blend of semiconductors and infrastructure software. Its valuation, at roughly $1.6 trillion market cap and a 25x revenue multiple, is notable. Investors are waking up to Broadcom, not for its hyper-growth, but for its durability, discipline, and strategic positioning as the connective tissue for AI infrastructure, the go-to firm for custom AI chips and the value creator of its VMware asset. Broadcom's recent earnings highlighted Tomahawk 5's ability to scale clusters well beyond the NVLink pod size. We note the caveats to Tan's statements as cited earlier. Tan reiterated that VMware Cloud Foundation adoption is ahead of schedule, with software margins approaching 70%. AI silicon revenue run-rate hit ~$16B, anchored by custom hyperscaler wins and an exciting $10B deal widely reported to be with OpenAI. In our opinion, these financial metrics underscore Nvidia as a hyper-growth platform company trading at a premium for its velocity, while Broadcom is a durable compounder valued for its consistency, cash flows, and long-term franchises. Both models are exceptional, both companies are fundamental to the AI movement, but they reflect entirely different philosophies of how to capture value in the AI era. We believe the implications of these strategies are meaningful in the sense that: In our opinion, the market should stop framing Broadcom and Nvidia as rivals in a zero-sum contest. Moreover, the idea that Broadcom is a commodity play, as posited by some pundits, is absurd in our view. Nvidia and Broadcom are playing different games, both of which are essential to the AI era. Nvidia builds the compute engines and software platforms that drive new workloads. Broadcom ensures those engines can scale, interconnect, and operate profitably over a decade-long horizon. Our research suggests that as AI moves from cloud to enterprise to real-world systems, both Nvidia and Broadcom will expand their moats in very different, but highly synergistic ways. The real battle is not between them, but between this new architecture and the legacy compute stack it is replacing.

Share

Share

Copy Link

An analysis of the ongoing debate about Nvidia and Broadcom's positions in the AI chip market, highlighting their different strategies and the potential for both companies to thrive in an expanding AI infrastructure landscape.

The Ongoing Debate: Nvidia vs. Broadcom

The recent stellar earnings report from Broadcom has reignited a long-standing debate among investors regarding Nvidia's dominance in the AI chip market. However, this debate often misses a crucial point: the potential for both companies to thrive in an expanding AI infrastructure landscape

1

.

Source: SiliconANGLE

Divergent Strategies in AI

Nvidia and Broadcom are pursuing distinctly different strategies in the AI chip market:

-

Nvidia's Approach: Nvidia has established itself as the dominant provider of "merchant" silicon, offering advanced chips to various data center operators. The company has built a vertically integrated compute and software platform, becoming the engine of the AI factory era

2

. -

Broadcom's Strategy: Broadcom focuses on custom chip-design services, catering to a select group of deep-pocketed tech companies like Google. The company has positioned itself as a leader in connectivity, custom silicon, and high-margin software

2

.

Market Share vs. Market Growth

While some investors worry about Nvidia losing market share to Broadcom, the more pertinent question is how large the AI computing market can grow. Analysts from Melius Research argue that the overall demand is substantial enough for both companies to grow significantly in the coming years, potentially outpacing investor expectations

1

.Nvidia's Technological Edge

Nvidia's strategy revolves around its full-stack platform:

- GPU Technology: At the core are GPUs like Hopper and Blackwell, coupled with NVLink/NVSwitch interconnects to form tightly coupled compute domains.

- Networking: The company leverages InfiniBand and Spectrum-X Ethernet for AI-optimized networking.

- Software Ecosystem: Nvidia's CUDA software stack and extensive libraries create a deep moat, with thousands of developers locked into its ecosystem

2

.

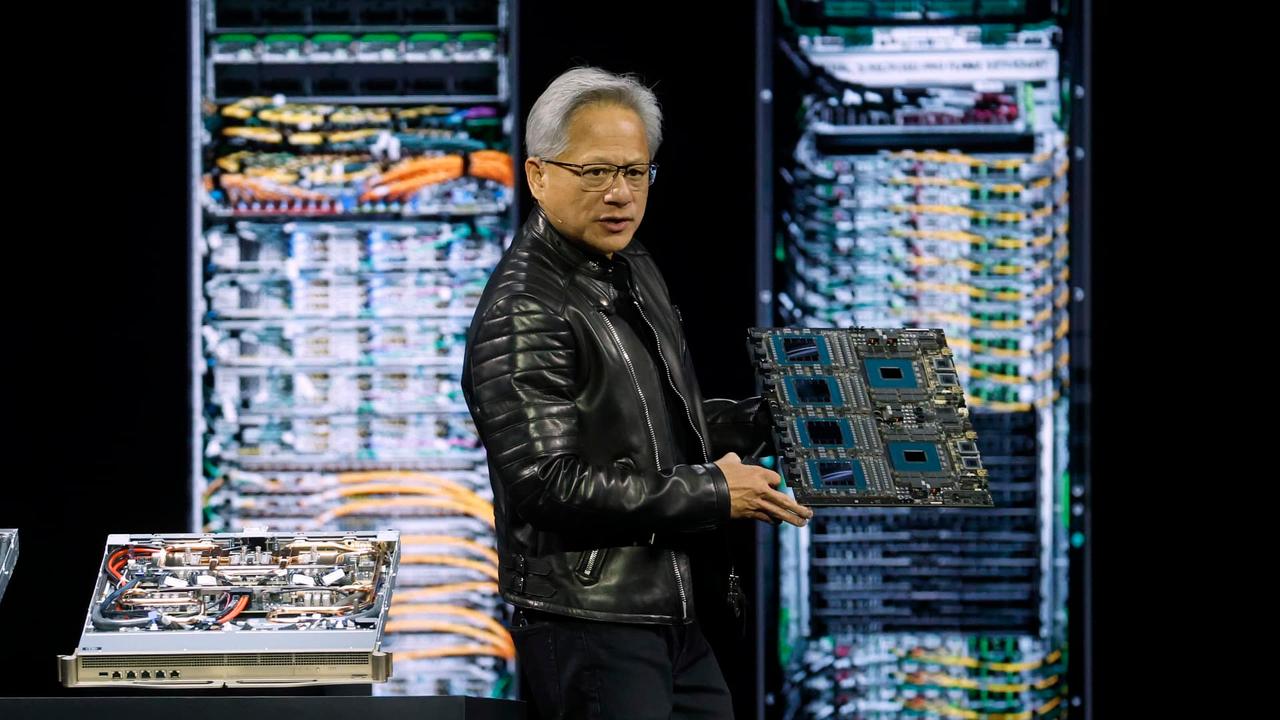

Source: CNBC

Broadcom's Unique Positioning

Broadcom's approach differs significantly from Nvidia's:

- Connectivity Focus: The company dominates merchant Ethernet switching with its Tomahawk and Jericho families.

- Custom Silicon: Broadcom has secured major custom silicon design wins with tech giants like Google, Meta, and potentially ByteDance and OpenAI.

- Software Strategy: The company has reshaped VMware around VMware Cloud Foundation, driving high operating and gross margins

2

.

Related Stories

The Expanding AI Infrastructure Market

The debate over Nvidia vs. Broadcom often overlooks the rapidly growing total addressable market (TAM) for AI infrastructure. As the market expands, both companies can potentially increase their sales and earnings, even if individual market shares fluctuate

1

.Investment Implications

Investors are advised to consider owning both Nvidia and Broadcom, rather than viewing them as mutually exclusive investments. The key is to focus on the growth potential of each company within the expanding AI market, rather than solely on market share dynamics

1

.As the AI infrastructure market continues to grow, both Nvidia and Broadcom are well-positioned to capitalize on their respective strengths and strategies, potentially offering significant returns for investors who recognize the complementary nature of their approaches in the evolving AI landscape.

References

Summarized by

Navi

[2]

Related Stories

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy