Pay-i Raises $4.9M to Quantify ROI on Generative AI Investments

2 Sources

2 Sources

[1]

ROI on generative AI: Microsoft vets raise $4.9M to quantify business value of AI investments

Pay-i, a Seattle startup founded by Microsoft veterans, raised a $4.9 million seed round to help businesses figure out whether AI initiatives actually deliver business value. It's a pressing question as companies try to keep up with the flurry of new AI tools hitting the market and assess potential impact on their businesses. Founded last year, Pay-i has developed software that takes usage data from generative AI tools and combines it with key performance indicators (KPIs) to provide real-time insights on ROI for different models and design choices. The idea is to bring together usage and outcomes in an automated way. "Pay-i pinpoints which GenAI use cases create net-new value today, quantifies that value in dollars or hours, and predicts how it will compound tomorrow," Pay-i CEO David Tepper said in a statement. Tepper said the company's main competition is organizations trying to build similar solutions inside their own infrastructure. Tepper spent 19 years at Microsoft and helped lead internal generative AI consumption within Azure. Doron Holan, co-founder and CTO, spent 27 years at Microsoft, most recently as a principal architect. "With traditional software, we could track exactly how features were used," Holan said in a statement. "But with GenAI, that visibility gets lost. Pay-i closes that gap and shows exactly where value is being created, in real time." Pay-i COO and co-founder Erik Winters was previously vice president of corporate development at Advanced Vapor Devices. The company has nine employees. It has not generated revenue but projects more than $2 million in ARR by the end of 2026 based on existing partnerships. Seattle-area venture firms FUSE and Tola Capital co-led the seed round. Other backers include Firestreak, Pear VC, Gaia Capital, and angel investors.

[2]

Pay-i launches with $4.9M to ease AI application cost tracking - SiliconANGLE

Pay-i Inc., a startup that helps companies track the financial footprint of their artificial intelligence workloads, launched today with $4.9 million in funding. Fuse Partners and Tola Capital co-led the seed investment. They were joined by Firestreak, Pear VC, Gaia Capital and multiple angel investors. Pear-i is led by Chief Executive Officer David Tepper, a former principal project management architect at Microsoft Corp.'s Azure business. He launched the company last year with long-time startup executive Erik Winters and former Windows architect Doron Holan. Winters and Holan serve as Pay-i's Chief Operating Officer and Chief Technology Officer, respectively. The company provides a platform that enables enterprises to collect financial information about their AI applications. Pay-i can track the amount of revenue that a service generates, the cost of operating it and related metrics. The software is also capable of forecasting future financial performance. Many AI applications are powered by cloud-hosted large language models that are billed based on usage. OpenAI, for example, charges customers based on the amount of input and output data generated by their workloads. Other major AI providers such as Anthropic PBC have adopted a similar business model. Pay-i visualizes the expenses associated with AI model usage in a bar chart. Each bar describes the AI costs incurred during a single day. According to Pay-i, its platform tracks how daily spending changes over time and breaks down the bill by application. The software is also capable of monitoring an AI workload's profit margins. To boost financial performance, a company can use a built-in A/B testing tool to pilot several different versions of the workload side-by-side. The information collected by the testing tool makes it possible to identify the version with the biggest revenue contribution. Developers building a new AI application can use Pay-i to forecast the workload's inference costs before it launches. That makes it easier to avoid budget overruns. If Pay-i determines that the AI model used by an application may make it difficult to meet profit margin targets, developers can switch to a lower-cost model before launch. The company says that its platform also lends itself to tracking non-financial metrics. Pay-i collects usage statistics such as an application's daily active users, the number of requests that it processes per hour and the amount of data in those requests. The platform doubles as a troubleshooting tool. When an application experiences technical issues, Pay-i can highlight the prompt or AI agent step that caused the malfunction. It also provides higher-level metrics such as the percentage of user prompts that lead to errors. "The C-suite doesn't need another usage chart - they need proof and a forecast," Tepper said. "Pay-i pinpoints which GenAI use cases create net-new value today, quantifies that value in dollars or hours, and predicts how it will compound tomorrow."

Share

Share

Copy Link

Seattle-based startup Pay-i, founded by Microsoft veterans, secures $4.9 million in seed funding to help businesses measure the value of their AI investments through innovative software solutions.

Microsoft Veterans Launch AI ROI Quantification Startup

In a significant development for the AI industry, Pay-i, a Seattle-based startup founded by Microsoft veterans, has successfully raised $4.9 million in seed funding. The company aims to address a critical need in the rapidly evolving AI landscape: quantifying the business value of AI investments

1

2

.

Source: GeekWire

Innovative Solution for AI ROI Measurement

Pay-i has developed a sophisticated software platform that combines usage data from generative AI tools with key performance indicators (KPIs) to provide real-time insights on return on investment (ROI) for different AI models and design choices. This innovative approach brings together usage and outcomes in an automated way, offering businesses a clear picture of their AI investments' value

1

.Key Features of Pay-i's Platform

Source: SiliconANGLE

The Pay-i platform offers a range of features designed to help businesses optimize their AI investments:

- Financial Tracking: The software tracks revenue generation, operating costs, and related metrics for AI applications

2

. - Cost Visualization: AI model usage expenses are visualized in bar charts, showing daily spending trends and breakdowns by application

2

. - Profit Margin Monitoring: The platform monitors AI workload profit margins and offers A/B testing capabilities to identify the most profitable versions

2

. - Cost Forecasting: Developers can forecast inference costs before launching new AI applications, helping to avoid budget overruns

2

. - Usage Statistics: The platform collects non-financial metrics such as daily active users, request processing rates, and data volumes

2

. - Troubleshooting Tools: Pay-i can highlight specific prompts or AI agent steps that cause malfunctions, aiding in technical issue resolution

2

.

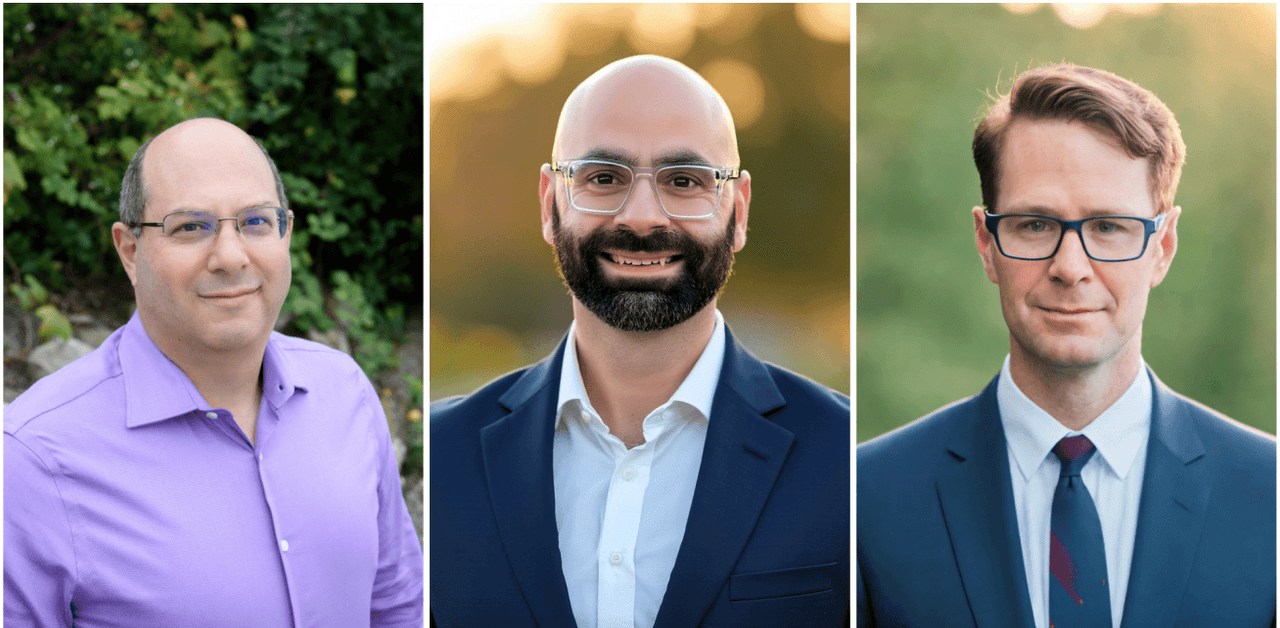

Leadership Team with Strong Microsoft Background

Pay-i boasts a leadership team with extensive experience at Microsoft:

- David Tepper, CEO: 19 years at Microsoft, led internal generative AI consumption within Azure

1

. - Doron Holan, Co-founder and CTO: 27 years at Microsoft, most recently as a principal architect

1

. - Erik Winters, COO and Co-founder: Previously vice president of corporate development at Advanced Vapor Devices

1

.

Related Stories

Market Position and Future Projections

While Pay-i has not yet generated revenue, the company projects more than $2 million in Annual Recurring Revenue (ARR) by the end of 2026, based on existing partnerships. The startup currently employs nine people and sees its main competition coming from organizations attempting to build similar solutions in-house

1

.Investor Backing

The $4.9 million seed round was co-led by Seattle-area venture firms FUSE and Tola Capital. Other backers include Firestreak, Pear VC, Gaia Capital, and angel investors, demonstrating strong confidence in Pay-i's potential to address a critical need in the AI industry

1

2

.As businesses continue to grapple with the rapid advancement of AI technologies, Pay-i's solution offers a promising approach to quantifying the value of AI investments and optimizing their impact on business performance.

References

Summarized by

Navi

[1]

Related Stories

Paid Raises $21M to Revolutionize AI Agent Billing for SaaS Companies

29 Sept 2025•Startups

Payabli Secures $28M Series B Funding to Accelerate AI Integration in Payment Solutions

18 Jun 2025•Business and Economy

Datarails raises $70M to bring AI Finance Agents to CFOs struggling with fragmented data

21 Jan 2026•Technology

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Meta strikes up to $100 billion AI chips deal with AMD, could acquire 10% stake in chipmaker

Technology

3

Pentagon threatens Anthropic with supply chain risk label over AI safeguards for military use

Policy and Regulation