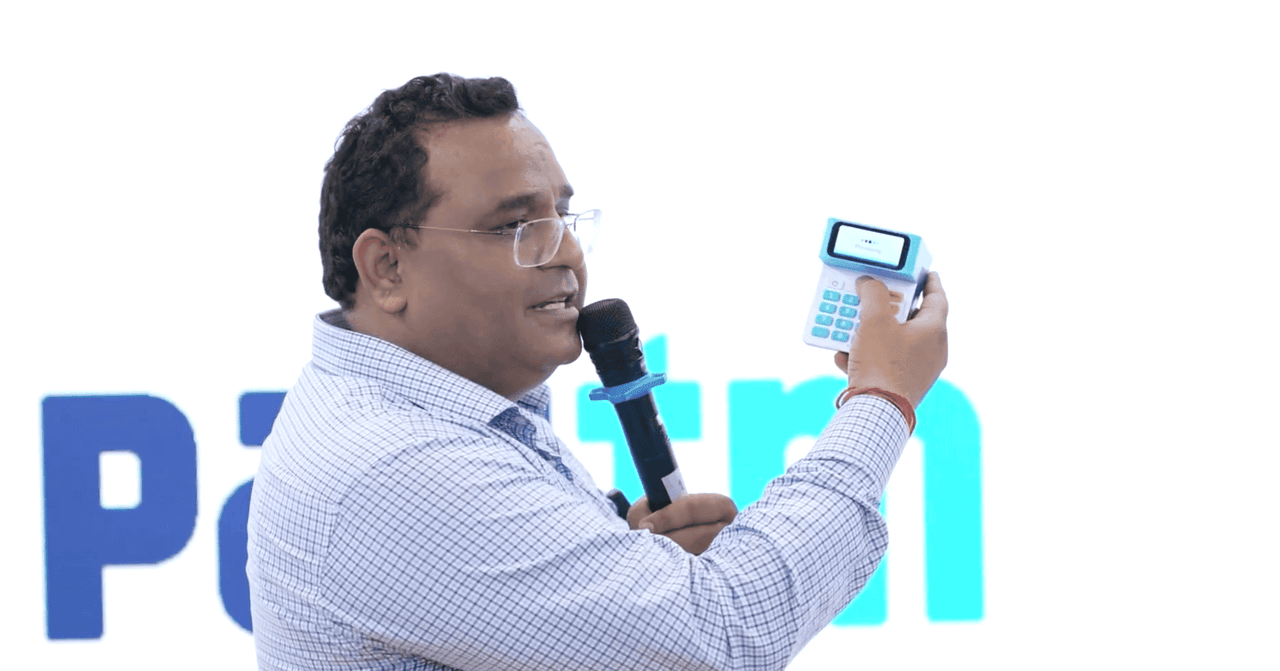

Paytm's Vijay Shekhar Sharma Outlines Future Plans for Sustainable Profitability

2 Sources

2 Sources

[1]

Paytm's Vijay Shekhar Sharma on firm's future plans: 'Resolved challenges, now...'

Read more: Zomato to buy Paytm's movie, event ticketing business for ₹2,048 crore Highlighting that the last financial year was one of the most important learning experiences for the company, he said that the fintech company will focus on generating free cash flow for the rest of the year. This comes after the Reserve Bank of India (RBI) placed crippling restrictions on Paytm Payments Bank citing 'persistent non-compliance' and 'material supervisory concerns' in January this year. He noted, "In the last quarter, we encountered regulatory action on our associate entity Paytm Payments Bank Limited (PPBL), which presented significant challenges and provided us with many valuable lessons." The Paytm boss said that the company would focus on artificial intelligence (AI)-led cost savings and build AI-first products to help small merchants and micro-businesses. The company has also identified significant savings through the use of AI and expanded in areas where "we see the future of technology heading".

[2]

'After resolving many...': Paytm to focus on long-term profits, says CEO Sharma | Mint

Paytm founder Vijay Shekhar said that the company aims to generate free cash flow despite while overcoming challenges. Paytm founder Vijay Shekhar Sharma has outlined the company's focus on delivering a long-term, sustainable and profitable business model to shareholders in a letter. "After resolving many of the challenges that we faced, we are now refocused on our path to deliver a long-term, sustainable and profitable business mode," he wrote in the letter. The Paytm head said the fintech company plans to focus on artificial intelligence (AI)-based cost savings measures and build AI-first products to cater to small merchants and micro-businesses. Paytm also claims that the company has identified significant savings through AI and expanded in areas where the future of technology is heading. Vijay Shekhar Sharma acknowledged that the last financial year was a learning experience for the fintech company and said that the company will focus on free cash flow generation for the rest of the year. "In the last quarter, we encountered regulatory action on our associate entity Paytm Payments Bank Limited (PPBL), which presented significant challenges and provided us with many valuable lessons," he said. Paytm reported a net loss of ₹840 crore in Q1 FY 25, up from ₹550 crore in the previous quarter and ₹338 Crore in the same quarter last year. RBI banned transactions such as deposit and credit facilities, no top-up on prepaid and post-paid accounts, fast tag recharge, and UPI transactions. The customers could, however, withdraw funds from their accounts. The RBI issued the directive on allegations of non-compliance with KYC norms and money laundering concerns. The payments bank came under the central bank's scrutiny for the first time in 2018 when the RBI halted the opening of new accounts due to licensing violations and non-compliance with KYC norms. In 2021, the payments bank was fined ₹1 crore for submitting false information. In 2022, Paytm was banned from acquiring new customers. Paytm Payments Bank is the banking arm under One97 Communications founded in 2017 by Vijay Shekhar Sharma.

Share

Share

Copy Link

Paytm's founder and CEO, Vijay Shekhar Sharma, discusses the company's future strategy after overcoming recent challenges. He emphasizes focus on sustainable profitability and expansion of financial services.

Paytm's Resilience Amid Regulatory Challenges

Vijay Shekhar Sharma, the founder and CEO of Paytm, has recently shared insights into the company's future direction following a period of significant challenges. In a letter to shareholders, Sharma expressed confidence in Paytm's ability to navigate through recent regulatory hurdles and emerge stronger

1

.Focus on Sustainable Profitability

The fintech giant is now setting its sights on long-term, sustainable profitability. Sharma emphasized that the company has successfully addressed many of the challenges it faced and is now poised for growth. He stated, "We have resolved many challenges and are now working towards long-term value creation for all stakeholders"

2

.Expansion of Financial Services

Paytm's strategy moving forward includes a strong focus on expanding its financial services offerings. The company plans to leverage its technology and vast user base to introduce innovative products and services. Sharma highlighted the potential for growth in areas such as lending, insurance, and wealth management

1

.Regulatory Compliance and Trust Building

In light of recent regulatory scrutiny, Paytm has reaffirmed its commitment to compliance and building trust with authorities and customers alike. Sharma assured stakeholders that the company is working closely with regulators to ensure all operations are in line with industry standards and legal requirements

2

.Technology-Driven Innovation

The CEO emphasized Paytm's continued focus on technology-driven innovation as a key driver for future growth. He mentioned ongoing investments in artificial intelligence and machine learning to enhance user experience and operational efficiency

1

.Related Stories

Market Position and Competition

Despite recent challenges, Sharma remains optimistic about Paytm's market position. He highlighted the company's strong brand recognition and loyal customer base as key advantages in the competitive fintech landscape. The CEO expressed confidence in Paytm's ability to maintain its leadership position while adapting to evolving market dynamics

2

.Shareholder Value and Future Outlook

In his communication with shareholders, Sharma reiterated Paytm's commitment to creating long-term value. He outlined plans for sustainable growth, improved profitability metrics, and continued innovation in financial services. The CEO's message aimed to reassure investors and stakeholders of the company's resilience and potential for future success

1

.References

Summarized by

Navi

[1]

Related Stories

Paytm Shifts Focus to Core Payment Business and Profitability Amid Regulatory Challenges

12 Sept 2024

Paytm's AI-First Transformation: Vijay Shekhar Sharma's Vision for India's AI Future

12 Jul 2025•Business and Economy

Paytm Partners with Groq to Power AI-Driven Financial Services Revolution

05 Nov 2025•Business and Economy

Recent Highlights

1

Samsung unveils Galaxy S26 lineup with Privacy Display tech and expanded AI capabilities

Technology

2

Anthropic refuses Pentagon's ultimatum over AI use in mass surveillance and autonomous weapons

Policy and Regulation

3

AI models deploy nuclear weapons in 95% of war games, raising alarm over military use

Science and Research