SanDisk forecasts massive profit surge as AI storage demand drives flash storage boom

3 Sources

3 Sources

[1]

Sandisk forecasts profit surge, secures supply deal as AI fuels storage demand

The data storage firm forecast fiscal third-quarter revenue with a midpoint of $4.6 billion and adjusted profit with a midpoint of $14 per share. Both were above estimates of $2.77 billion and $4.37 apiece, respectively, according to LSEG-compiled data. Sandisk on Thursday predicted profits and sales well above Wall Street estimates and extended a major supply agreement, riding a surge in artificial-intelligence-driven demand for data storage. The data storage firm forecast fiscal third-quarter revenue with a midpoint of $4.6 billion and adjusted profit with a midpoint of $14 per share. Both were above estimates of $2.77 billion and $4.37 apiece, respectively, according to LSEG-compiled data. Silicon Valley-based Sandisk supplies flash storage memory, the basis for solid-state drives that hold massive amounts of data inside AI data centers. While most of a burgeoning global shortage of memory chips has focused on DRAM, the faster type of memory chip that sits closer to a computer's processor, AI is also increasing demand for flash storage, Sandisk CEO David Goeckeler told Reuters. Large AI firms are building data centers for what is known as "inference," when AI models answer questions from users, a process that requires feeding stored data into computing chips. Sandisk's forecast reflects the fact that those firms are willing to spend money amid tight flash storage supplies to keep their plans on track. "Customers prefer supply over price," Goeckeler said. Sandisk reported sales and adjusted profits of $3.3 billion and $6.20 per share for the just-ended fiscal second quarter, above estimates of $2.64 billion and $3.33 per share, respectively, according to LSEG-compiled data. Sandisk secures its flash chip supply through a joint venture with Kioxia Corp in Japan. "We have incredible capacity in Japan that we've been investing in, and we continue to invest in. Now we're signed up together for another nine years," Goeckeler said. "So that's our capacity plan going forward." The companies said that they have extended their supply agreement through the end of 2034, from its previous expiration at the end of 2029.

[2]

SanDisk Breaks Out as AI Storage Demand Drives Margin Expansion | Investing.com UK

SanDisk Corporation (NASDAQ:SNDK) shares rocketed over 19% in premarket trading on Friday, January 30, 2026, following exceptional fiscal second quarter 2026 earnings that dramatically exceeded Wall Street expectations. The storage solutions provider reported adjusted earnings per share of $6.20, nearly doubling the analyst estimate of $3.49, while revenue reached $3.03 billion versus expectations of $2.67 billion. The company's third-quarter guidance proved equally stunning, with projected revenue of $4.4-$4.8 billion and adjusted EPS of $12.00-$14.00, far surpassing consensus estimates of $2.92 billion and $4.21 respectively. Sandisk's fiscal second quarter 2026 performance showcased the company's dominant position in AI-driven storage solutions. Revenue climbed 31% sequentially to $3.03 billion, with datacenter revenue jumping 64% quarter-over-quarter, fueled by strong adoption among AI infrastructure builders and technology companies deploying AI at scale. The company reported GAAP net income of $803 million ($5.15 diluted EPS) and Non-GAAP net income of $967 million ($6.20 diluted EPS), reflecting gross margins that expanded dramatically to over 50%. CEO David Goeckeler emphasized the company's strategic positioning, stating that the quarter's performance underscores their agility in capitalizing on improved product mix, accelerating enterprise SSD deployments, and strengthening market demand dynamics. The company's structural reset to align supply with sustained demand has positioned Sandisk to deliver industry-leading financial performance. Year-over-year comparisons proved equally impressive, with revenue up 61% and operating income surging 446% compared to Q2 FY2025. In premarket trading at 5:50 AM EST on January 30, 2026, SNDK shares jumped to $644.00, up $104.70 or 19.41% from the previous close of $527.63. The stock has experienced extraordinary momentum, surging 559% in 2025 and climbing an additional 127% year-to-date based on Thursday's close. The dramatic rally reflects investor enthusiasm for the company's exposure to booming AI-driven storage demand, with the stock's 52-week range expanding from $27.89 to $546.75. Analysts have responded enthusiastically to the results, with multiple firms raising price targets significantly. Morgan Stanley analyst Joseph Moore raised his target to $690 from $483, noting that despite the persistent march higher in share price, earnings power continues to keep pace, and at a sub-10x PE ratio on forward estimates, he sees sustained upside. Raymond James analyst Melissa Fairbanks highlighted that even after rallying more than 16x since the spin-off from Western Digital a year ago, further upside remains driven by an unprecedented datacenter/AI cycle. Mizuho set a new street-high price target of $600, citing massive NAND pricing tailwinds and robust AI demand. *** Looking to start your trading day ahead of the curve?

[3]

Sandisk forecasts profit surge, secures supply deal as AI fuels storage demand

SAN FRANCISCO, Jan 29 (Reuters) - Sandisk on Thursday predicted profits and sales well above Wall Street estimates and extended a major supply agreement, riding a surge in artificial-intelligence-driven demand for data storage. The data storage firm forecast fiscal third-quarter revenue with a midpoint of $4.6 billion and adjusted profit with a midpoint of $14 per share. Both were above estimates of $2.77 billion and $4.37 apiece, respectively, according to LSEG-compiled data. Silicon Valley-based Sandisk supplies flash storage memory, the basis for solid-state drives that hold massive amounts of data inside AI data centers. While most of a burgeoning global shortage of memory chips has focused on DRAM, the faster type of memory chip that sits closer to a computer's processor, AI is also increasing demand for flash storage, Sandisk CEO David Goeckeler told Reuters. Large AI firms are building data centers for what is known as "inference," when AI models answer questions from users, a process that requires feeding stored data into computing chips. Sandisk's forecast reflects the fact that those firms are willing to spend money amid tight flash storage supplies to keep their plans on track. "Customers prefer supply over price," Goeckeler said. Sandisk reported sales and adjusted profits of $3.3 billion and $6.20 per share for the just-ended fiscal second quarter, above estimates of $2.64 billion and $3.33 per share, respectively, according to LSEG-compiled data. Sandisk secures its flash chip supply through a joint venture with Kioxia Corp in Japan. "We have incredible capacity in Japan that we've been investing in, and we continue to invest in. Now we're signed up together for another nine years," Goeckeler said. "So that's our capacity plan going forward." The companies said that they have extended their supply agreement through the end of 2034, from its previous expiration at the end of 2029. (Reporting by Stephen Nellis in San Francisco; Editing by Sherry Jacob-Phillips)

Share

Share

Copy Link

SanDisk predicted fiscal third-quarter revenue of $4.6 billion and adjusted profit of $14 per share, dramatically exceeding Wall Street estimates of $2.77 billion and $4.37 respectively. The data storage firm extended its supply agreement with Kioxia Corp through 2034 as AI fuels storage demand across data centers, with shares surging 19% in premarket trading.

SanDisk Forecasts Profit Surge Amid Booming AI Storage Demand

SanDisk delivered a stunning financial performance that sent shockwaves through Wall Street, with the data storage firm predicting fiscal third-quarter revenue with a midpoint of $4.6 billion and adjusted profit of $14 per share

1

. These projections crushed Wall Street estimates of $2.77 billion in revenue and $4.37 per share, signaling the company's dominant position as AI fuels storage demand across the technology sector3

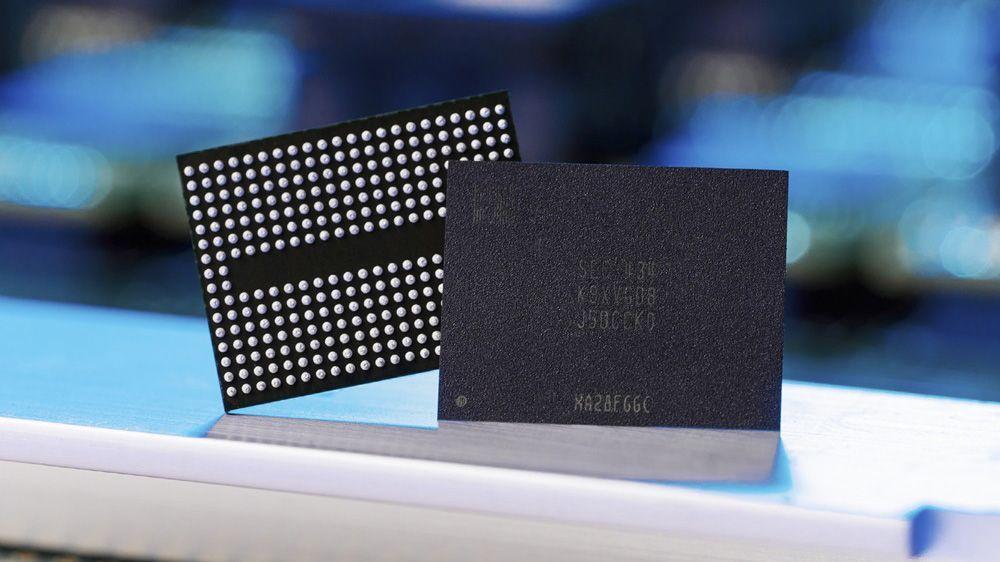

. The Silicon Valley-based company supplies flash storage memory that forms the foundation for solid-state drives holding massive amounts of data inside AI data centers1

. Shares of NASDAQ:SNDK rocketed over 19% in premarket trading to $644.00, reflecting investor enthusiasm for the company's exposure to the datacenter/AI cycle2

.

Source: ET

Flash Storage Becomes Critical Bottleneck in AI Infrastructure

The surge in AI-driven storage solutions stems from large AI firms building data centers for inference processes, when AI models answer questions from users by feeding stored data into computing chips

3

. CEO David Goeckeler told Reuters that while global attention has focused on DRAM memory chips, AI is also increasing demand for flash storage in unprecedented ways1

. The company's forecast reflects that AI firms are willing to spend money amid tight flash storage supplies to keep their expansion plans on track. "Customers prefer supply over price," Goeckeler emphasized, highlighting how critical memory chips have become to AI infrastructure deployment3

.Margin Expansion Drives Exceptional Q2 Performance

SanDisk's fiscal second quarter 2026 results showcased impressive margin expansion, with revenue climbing 31% sequentially to $3.03 billion against expectations of $2.67 billion

2

. The company reported adjusted earnings per share of $6.20, nearly doubling analyst estimates of $3.49, while datacenter revenue jumped 64% quarter-over-quarter2

. GAAP net income reached $803 million with gross margins expanding dramatically to over 50%, demonstrating the company's ability to capitalize on improved product mix and accelerating enterprise SSD deployments2

. Year-over-year comparisons proved equally striking, with revenue up 61% and operating income surging 446% compared to Q2 FY20252

.Related Stories

Supply Agreement With Kioxia Corp Secures Long-Term Capacity

SanDisk extended its supply agreement with Kioxia Corp through the end of 2034, adding nine years to the previous expiration date of 2029

1

. The company secures its flash chip supply through a joint venture with the Japanese firm, providing critical capacity to meet surging demand. "We have incredible capacity in Japan that we've been investing in, and we continue to invest in. Now we're signed up together for another nine years," Goeckeler said, outlining the company's capacity plan going forward3

. This extended partnership positions SanDisk to maintain its supply chain advantage as AI infrastructure builders compete for limited flash storage capacity.Analysts Raise Price Targets on NAND Pricing Tailwinds

Morgan Stanley analyst Joseph Moore raised his price target to $690 from $483, noting that despite the persistent march higher in share price, earnings power continues to keep pace

2

. At a sub-10x PE ratio on forward estimates, Moore sees sustained upside for the stock, which has surged 559% in 2025 and climbed an additional 127% year-to-date2

. Raymond James analyst Melissa Fairbanks highlighted that even after rallying more than 16x since the spin-off from Western Digital a year ago, further upside remains driven by an unprecedented datacenter/AI cycle2

. Mizuho set a new street-high price target of $600, citing massive NAND pricing tailwinds and robust AI demand that show no signs of slowing2

. The stock's 52-week range expanded from $27.89 to $546.75, reflecting extraordinary stock price appreciation driven by the company's strategic positioning in AI infrastructure2

.References

Summarized by

Navi

Related Stories

Sandisk Stock Rockets 22% as AI Memory Boom Fuels 830% Rally and Price Surge

06 Jan 2026•Business and Economy

Western Digital's 970% surge reveals AI's hidden storage crisis as hyperscalers lock in supply

12 Feb 2026•Technology

AI Boom Triggers Storage Crisis: HDD and SSD Prices Surge Amid Supply Shortages

16 Sept 2025•Technology

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation