Shopify's Q2 Earnings Soar, Boosted by AI Innovations and Strong E-commerce Demand

3 Sources

3 Sources

[1]

Shopify forecasts Q3 revenue above estimates on AI-backed platform upgrades

Aug 6 (Reuters) - Shopify (SHOP.TO), opens new tab, forecast third-quarter revenue above market estimates on Wednesday, as its AI features and platform upgrades boosted demand for its e-commerce services despite tariff-related uncertainty pressuring retail businesses. U.S. listed shares of the company surged nearly 10% in premarket trading. President Donald Trump's shifting trade policies have clouded the global economic outlook, leaving retail businesses unsure about consumer demand, production and sourcing, as well as the costs of running their operations. Shopify, however, saw healthy consumer spending at least until April, with sellers signomg up for its services. E-commerce giant Amazon (AMZN.O), opens new tab last week reported strong retail results, saying it was yet to see a demand drop or a notable rise in prices. Shopify expects revenue to rise mid-to-high twenties percentage rate in the current quarter, while analysts on average estimated a rise of 21.54%, according to data compiled by LSEG. For the second quarter, Shopify reported revenue of $2.68 billion, up 31% from last year and above analysts' average estimate of $2.55 billion. Reporting by Kritika Lamba in Bengaluru; Editing by Devika Syamnath and Arun Koyyur Our Standards: The Thomson Reuters Trust Principles., opens new tab

[2]

No tariff trouble here! Shopify stock jumps 20% on blowout quarter and bullish outlook

Shopify's stock soared by 20% following impressive second-quarter results, exceeding expectations with adjusted earnings per share of 35 cents and revenue reaching $2.68 billion. The company's sales grew by 31% year-over-year, and it anticipates continued growth in Q3, projecting a "mid-to-high twenties" percent increase. Shopify also stated that Trump-era trade tariffs did not impact sales. Shopify's stock jumped 20% on Wednesday after the company announced strong second-quarter results and gave a very positive forecast for the third quarter. Shopify's Q2 earnings were much better than expected, adjusted earnings per share: 35 cents and revenue: $2.68 billion. Wall Street expected $2.55 billion. Shopify's second-quarter sales grew by 31% year-over-year, which is a faster rate compared to last year's Q2 when sales grew by about 20%. The company gave a very strong forecast for Q3, saying revenue would grow at a "mid-to-high twenties" percent rate year-over-year. This is better than analysts' prediction of 21.7% growth, as per the report by CNBC. ALSO READ: DOJ bombshell: Ghislaine Maxwell says Trump wasn't involved in Epstein drama -- here's what she said Shopify's success shows it's handling trade issues well, even with concerns about tariffs during President Donald Trump's trade war. The company said it had expected some problems but they didn't happen. CFO Jeff Hoffmeister confirmed this on a call with investors, saying, "We had factored into our guidance some potential impact from tariffs, which did not materialize." Shopify President Harley Finkelstein said the millions of stores on the platform are doing great. He added, "So far we're seeing no slowdown from the tariffs... The stores are doing really, really well", as stated by the CNBC report. Shopify's gross merchandise sales (GMS) -- which means the total value of goods sold through the platform -- rose by 29% year-over-year to $87.8 billion. Analysts had expected $81.5 billion, so this was also a beat. Shopify hasn't seen any fall in U.S. shopping activity. Hoffmeister said: "We haven't seen any drops in U.S. demand -- whether inbound, outbound, or local." Shoppers also aren't panic buying or hoarding because of tariff fears. Hoffmeister said: "They're not pulling forward demand in anticipation of tariffs." Online shopping overall is still strong. Last week, Shopify's rivals Amazon and eBay also reported solid revenue growth -- showing that consumers are still spending, even with rising prices, as per the CNBC tech news report. ALSO READ: China cracks down: Huawei ex-employees get prison for stealing chip secrets to launch rival startup Zunpai Shopify expects to lower its operating expenses slightly. In Q3, it expects operating costs to be 38%-39% of revenue, compared to 39%-40% last quarter. Shopify is investing heavily in artificial intelligence (AI) to improve its platform and attract more merchants. In May, it launched an AI store builder, which creates websites using just a few keywords. On Tuesday, it rolled out new AI tools to help shoppers interact with AI agents. Executives believe these AI upgrades are helping. Hoffmeister said, "As we expand our platform, add new tools, and build for the future of commerce, Shopify is becoming even more attractive to more businesses than ever before", as per the report by CNBC. Q1. Why did Shopify stock go up by 20%? Shopify stock rose 20% because it beat Q2 earnings expectations and gave a strong growth forecast for Q3. Q2. Is Shopify affected by Trump's trade tariffs? No, Shopify said the expected impact from Trump-era tariffs did not happen and sales stayed strong.

[3]

Shopify (SHOP) Q2 Revenue Jumps 31% | The Motley Fool

Shopify (SHOP 22.00%), a leading cloud-based commerce platform for businesses of all sizes, announced its financial results for the second quarter of fiscal 2025 on August 6, 2025. Shopify delivered GAAP revenue of $2,680 million, surpassing analyst forecasts of $2,548.76 million by 5.15% (GAAP). Gross merchandise volume (GMV) jumped 31%, with Europe leading international growth. Despite strong top-line gains and robust free cash flow, operating expenses and loan loss provisions increased at a rapid pace. Overall, the quarter reflected significant business momentum and successful execution across its platform and merchant ecosystem. Source: Analyst estimates provided by FactSet. Management expectations based on management's guidance, as provided in Q1 2025 earnings report. Shopify provides a platform that allows businesses to create and manage their own online and offline stores. Its software runs in the cloud, which means merchants can access their storefronts and back-end tools from anywhere. The company supports millions of merchants across more than 175 countries, from individual entrepreneurs to large brands. Recent business focus areas include enhancing platform scalability, expanding its commercial ecosystem, and embedding artificial intelligence (AI) into both merchant-facing and internal services. Key success factors for Shopify are platform reliability, ecosystem growth, merchant solutions like payment processing, and continuous product innovation. The company also pushes into international markets, offering features tailored for cross-border commerce and local regulatory needs. Revenue (GAAP) reached $2,680 million, surpassing analyst expectations by a solid margin, as GAAP revenue of $2,680 million exceeded the analyst consensus estimate of $2,548.76 million by $131.24 million, or 5.15%. This figure represented a 31% increase over the same period a year ago (GAAP). Growth was fueled by both merchant solutions and subscription solutions, with merchant solutions revenue rising 37% year over year to $2,024 million (GAAP). The company principally generates merchant solutions revenue from payment processing fees and lending products. Subscription solutions, which comprise platform fees from merchants, grew 17% to $656 million. Gross merchandise volume, or GMV -- which tracks the total value of sales made by merchants on the platform -- climbed 31% year over year to $87,837 million. International momentum stood out, with GMV in Europe rising 42% on a constant currency basis. The company highlighted wins with major brands and enterprise merchants, as well as a steady flow of new small and mid-sized business sign-ups. Shopify maintained free cash flow (non-GAAP) at $422 million, representing a free cash flow margin of 16%, unchanged from a year earlier. Operating income reached $291 million, up from $241 million in Q2 2024. Gross profit margin for the quarter ended June 30, 2025, was 48.6%, down from 51.1% in the same period last year. This was due to a larger mix of payment processing revenue, which carries lower profit margins than software subscriptions, and to partnership accounting changes. Operating expenses (GAAP) rose 26% year over year to $1,011 million. Provision for transaction and loan losses increased from $42 million in the quarter ended June 30, 2024, to $80 million in the quarter ended June 30, 2025. Provision for transaction and loan losses (GAAP) rose to $80 million from $42 million in Q2 2024. Shopify continued product innovation during the quarter, especially with AI tools. Merchant-facing features such as Shopify Magic and Sidekick aim to help merchants run their businesses more efficiently with AI-driven support and automation. Shopify completed the acquisition of Vantage Discovery, a technology company focused on improving product search. The company's platform scalability was tested by bringing on large enterprise merchants during the quarter, including well-known names from apparel and education. New features supporting international commerce, such as advanced tax and language tools, contributed to broader adoption in Europe and other emerging regions. One-time items affected headline results. Net income (GAAP) jumped sharply to $906 million, but this was mainly due to a $568 million gain on equity investments. Management highlighted that these investment gains are not relevant to the fundamentals of its operations and should not be considered as underlying profit drivers. Management provided guidance for the third quarter of fiscal 2025. Expectations are for GAAP revenue growth in the mid-to-high twenties percent range year-over-year. Gross profit dollars are set to increase at a low-twenties percent rate. Operating expenses are projected at 38-39% of revenue, and free cash flow margin (non-GAAP) is expected to land in the mid-to-high teens. These calls suggest continued top-line growth, but signal that expense discipline and margin headwinds should remain under close observation. Investors and analysts should continue to watch for updates on merchant acquisition rates, international growth (particularly in Europe), expense trends, and the performance of the loan portfolio. Notably, the jump in transaction and loan losses stands out as a key area for risk monitoring. Meanwhile, expansion of AI features and ecosystem partnerships, such as those already signed with major footwear and technology brands, could support longer-term momentum for Shopify's platform and its growing merchant base.

Share

Share

Copy Link

Shopify reports impressive Q2 2025 results with revenue up 31%, beating analyst expectations. The company's success is attributed to AI-driven platform upgrades and robust e-commerce growth, despite concerns over trade tariffs.

Shopify's Q2 Performance Exceeds Expectations

Shopify, a leading cloud-based commerce platform, has reported exceptional financial results for the second quarter of fiscal 2025. The company's revenue soared to $2.68 billion, marking a 31% increase from the previous year and surpassing analyst estimates of $2.55 billion

1

3

. This impressive growth has been attributed to the company's successful implementation of AI-driven features and platform upgrades, which have boosted demand for its e-commerce services.

Source: ET

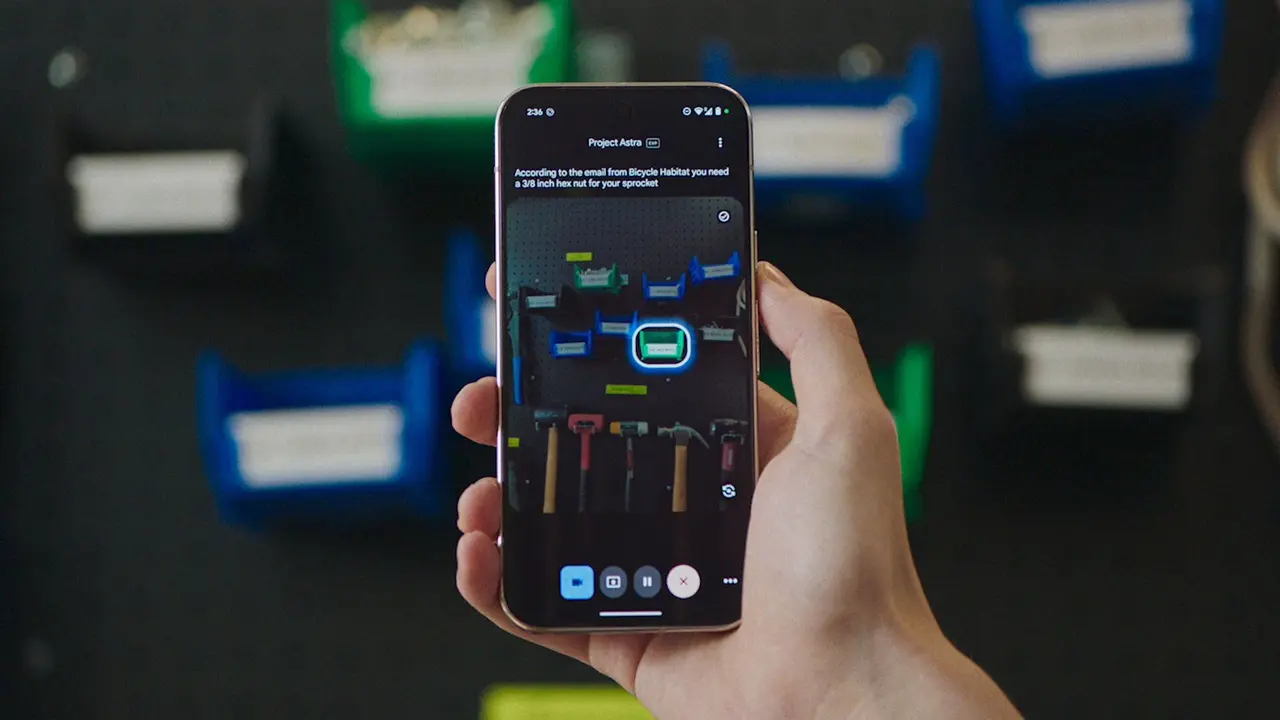

AI Innovations Drive Growth

Shopify's recent focus on artificial intelligence has played a crucial role in its success. The company has been investing heavily in AI to enhance its platform and attract more merchants. In May, Shopify launched an AI store builder that can create websites using just a few keywords. More recently, the company rolled out new AI tools to help shoppers interact with AI agents

2

. These innovations have made Shopify's platform more attractive to businesses of all sizes, contributing to its strong performance.Robust E-commerce Demand

Despite concerns over trade tariffs and economic uncertainty, Shopify has experienced healthy consumer spending and continued growth in its merchant base. The company's Gross Merchandise Volume (GMV), which represents the total value of goods sold through the platform, increased by 31% year-over-year to $87.8 billion, exceeding analyst expectations of $81.5 billion

2

3

.

Source: Reuters

International Expansion and Enterprise Wins

Shopify's growth has been particularly strong in international markets, with Europe leading the way. GMV in Europe rose by 42% on a constant currency basis

3

. The company has also seen success in attracting major brands and enterprise merchants, while maintaining a steady flow of new small and mid-sized business sign-ups.Financial Highlights

- Merchant solutions revenue increased by 37% to $2,024 million

3

- Subscription solutions revenue grew by 17% to $656 million

3

- Free cash flow remained strong at $422 million, representing a 16% margin

3

- Operating income reached $291 million, up from $241 million in Q2 2024

3

Related Stories

Outlook and Challenges

Shopify has provided an optimistic forecast for the third quarter of fiscal 2025, projecting revenue growth in the "mid-to-high twenties" percentage range year-over-year

1

2

. This outlook is more bullish than analysts' predictions of 21.7% growth.However, the company faces some challenges. Operating expenses rose by 26% year-over-year to $1,011 million, and the provision for transaction and loan losses increased from $42 million to $80 million

3

. These factors, along with a shift in revenue mix towards lower-margin payment processing, have put some pressure on profit margins.Resilience Amidst Trade Uncertainties

Contrary to initial concerns, Shopify has reported that the expected impact from Trump-era tariffs did not materialize. The company's CFO, Jeff Hoffmeister, confirmed that they had factored potential tariff impacts into their guidance, but these did not affect their performance

2

. This resilience in the face of trade uncertainties has further bolstered investor confidence in Shopify's business model and growth prospects.As Shopify continues to innovate and expand its global presence, the company appears well-positioned to capitalize on the growing e-commerce market and maintain its strong growth trajectory.

References

Summarized by

Navi

[3]

Related Stories

Shopify Exceeds Q4 Revenue Expectations, But Profit Outlook Raises Concerns

12 Feb 2025•Business and Economy

Shopify Doubles Down on AI Commerce Revolution with 7x Traffic Surge

05 Nov 2025•Business and Economy

Shopify's AI Capabilities Drive Upgrade and Optimistic Growth Forecast

07 Dec 2024•Business and Economy

Recent Highlights

1

Elon Musk merges SpaceX with xAI, plans 1 million satellites to power orbital data centers

Business and Economy

2

SpaceX files to launch 1 million satellites as orbital data centers for AI computing power

Technology

3

Google Chrome AI launches Auto Browse agent to handle tedious web tasks autonomously

Technology