SK Hynix commits $13 billion to world's largest HBM plant as AI demand creates historic shortage

13 Sources

13 Sources

[1]

SK hynix to spend $13 billion on the world's largest HBM memory assembly plant amid the worst shortage on record -- South Korea facility to handle packaging and testing for AI memory campus

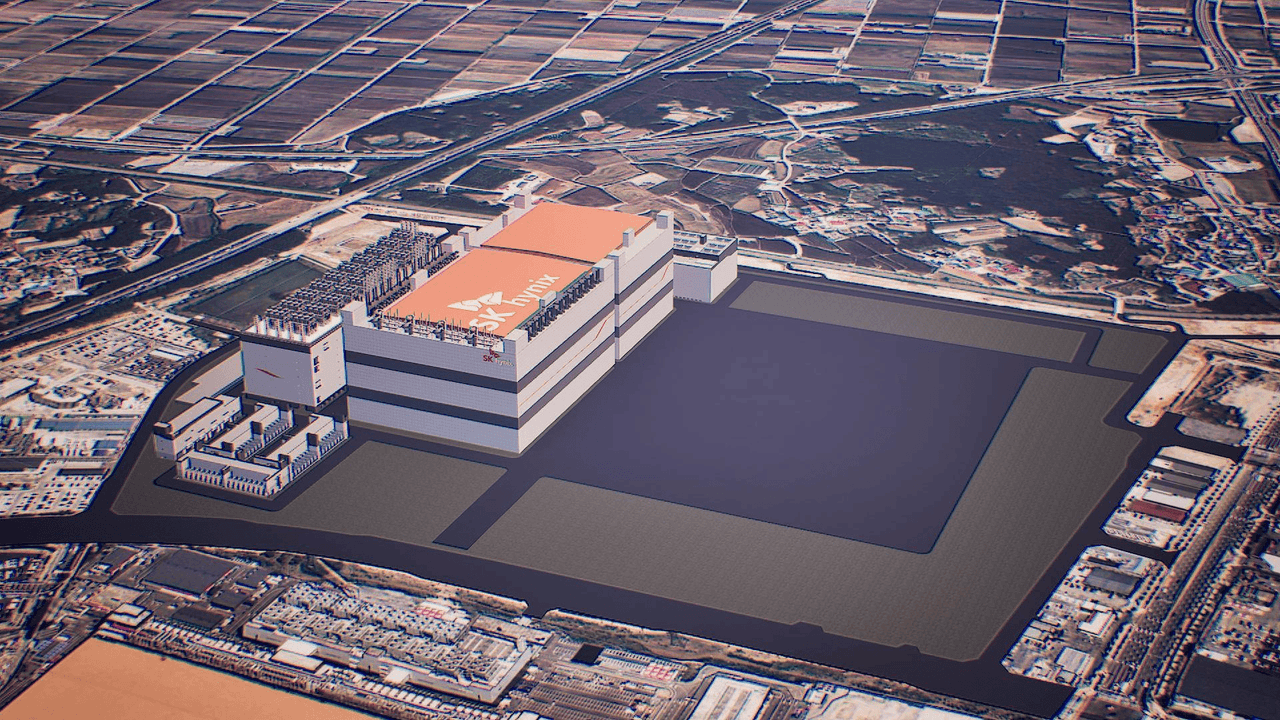

SK hynix, the world's biggest supplier of high-bandwidth memory (HBM), this week approved a ₩19 trillion ($12.896 billion) investment to build P&T7, a new advanced packaging and test facility in South Korea, dedicated solely to HBM. The plant will likely be the biggest HBM assembly and test facility in the world, but it will almost certainly not be the last HBM packaging and test facility of the same scale and cost going forward, considering the booming demand for memory, which has caused DRAM pricing to skyrocket. Being the world's largest supplier of any type of product means you need to stay ahead of the whole industry, in terms of technology and production capacity, and the devil is in the details. The company plans to construct what it calls P&T7 (Packaging & Testing 7) facility at the Cheongju Technopolis Industrial Complex, on a site measuring approximately 70,000 pyeong (approx. 231,405 square meters or 2,490,822 square feet). Construction is scheduled to begin in April 2026, and completion is targeted for the end of 2027, which is when the building will be finished, and is when SK hynix will begin installing equipment. Due to the equipping phase, expect the plant to come online toward the end of the decade on time for HBM4E, HBM5, and HBM5E types of memory. The facility's dimensions are massive, resulting in a campus-scale site, rather than a back-end factory plot. For packaging and testing, the Fab P&T7 plot is unusually large; this may reflect the importance of HBM (and other exotic types of memory) assembly for the AI industry specifically, and the memory industry as a whole. To put the scale into context, Intel's Ocotillo Campus near Chandler, Arizona, spans over 362,727 square meters, but it houses multiple front-end fab buildings, such as Fab 12, Fab 22, Fab 32, Fab 52, and Fab 62. Both Fab 52 and Fab 62 are expected to be capable of processing up to 40,000 wafer starts per month each when fully ramped, which makes them bigger than typical logic fabs run by TSMC. While HBM packaging is a back-end activity, it still requires complex techniques like etching, lithography, hybrid bonding, and many other steps and tools used in logic production. This explains why HBM testing and packaging facilities are larger than typical back-end facilities. Nonetheless, HBM packaging is inherently simpler than producing logic, so the scale of SK hynix's P&T7 plant is enormous, even by HBM standards. Its dimensions and investments dwarf SK hynix's HBM testing and assembly plant in West Lafayette, Indiana, which will cost the memory maker $4 billion and will span 39,948 square meters. Yet, keeping in mind that SK hynix expects the compound annual growth rate (CAGR) of HBM to be 33% from 2025 to 2030, it needs all the front-end DRAM and back-end packaging facilities it can build. A key element of the project is its operational linkage with Fab M15X, a major SK hynix semiconductor manufacturing facility currently located in Cheongju that is currently being equipped with fab tools. The company expects the combined operation of M15X and P&T7 to create a tightly coupled manufacturing ecosystem capable of building HBM dies (which are three to four times larger than commodity DDR5). Therefore, SK hynix can test and package HBM in close proximity, essentially creating a vertically integrated manufacturing facility for HBM or other exotic types of memory that use multi-chip packaging. The adjacency of Fab M15X and P&T7 is intended to elevate Cheongju into a new core base for SK hynix's AI memory operations, which will optimize production and packaging and can potentially enable the company to respond to market demand for HBM faster than it can today. As a bonus, the close proximity of the front-end memory fab and the advanced packaging and testing facility will shorten feedback loops between engineers at both facilities, which might positively affect yields and/or performance. In fact, as the industry transits to more sophisticated types of memory for AI accelerators -- such as HBM4 with a 2,048-bit interface -- the bigger and more sophisticated assembly and testing plants for high-bandwidth memory located close to front-end DRAM fabs make sense. From a strategic planning perspective, SK hynix says it had evaluated multiple domestic and international locations before selecting Cheongju for P&T7. The decision reflects multiple objectives. Firstly, the vast majority of SK hynix's memory is produced in South Korea, so it is reasonable to build its most advanced testing and packaging facility for AI DRAM nearby. Secondly, P&T7 working in proximity with M15X will reinforce the overall competitiveness of South Korea's semiconductor industry. Thirdly, a large project also supports regional development, a policy promoted by the government. SK hynix notes that the site selection decision was not purely cost-driven; the company evaluated proximity to existing fabs, infrastructure readiness, and long-term supply-chain resilience. Cheongju was ultimately chosen as the location that balanced industrial efficiency best. Although SK hynix never mentions it, there is one more factor that likely affected its decision to build its biggest HBM packaging facility in South Korea. Because the vast majority of AI accelerators are made in the region, not only in South Korea, but in Taiwan by TSMC. Since SK hynix and TSMC share a lot of customers, the two companies work closely with one another. However, due to geopolitical and regional competitive reasons, SK hynix isn't likely to build a major facility in Taiwan, making South Korea the next-best option. Building an extremely big HBM testing and packaging facility is important for SK hynix, not only from strategic and logistical points of view, but also from a technology development point of view. Advanced packaging is as critical to HBM as the DRAM front-end fab because of HBM's inherent characteristics -- extreme bandwidth, power efficiency, and density. These elements are enabled by the DRAM itself and packaging technology. A single DRAM die does not expose a 1,024-bit or 2,048-bit interface: it's enabled by stacking 8 - 16 dies, each featuring a 128-bit I/O, interconnected with Through Silicon Vias (TSVs), and routed through base dies and Redistribution layers (RDLs). To make everything work properly and according to specification, packaging must ensure bonding accuracy, optimal TSV resistance, and RDL integrity. Power efficiency and thermals are also largely determined by packaging, as they define things like TSV and RDL parasitics, micro-bump or hybrid-bond quality, and interposer losses. Some packaging technologies have increased I/O voltage requirements and higher switching losses, which force manufacturers to reduce data transfer rates compared to offerings from their rivals. Heat-extraction is also a big deal, and it entirely depends on packaging process technology (underfill and mold materials, as well as package-level thermal paths), as the better heat dissipation is between memory dies, the easier it is to cool the whole stack. SK hynix leads the industry with its mass reflow-molded underfill (MR-MUF). Yield economics also increase the importance of packaging technology: even if a front-end DRAM fab achieves a 99% good die yield, if yield loss during packaging is significant (due to TSV defects, bond misalignment, and/or RDL defects), it hits margins across both the expensive DRAM fab and relatively inexpensive back-end packaging facility. Reliability qualification -- burn-in, thermal cycling, and long-duration stress testing -- is also performed at the package level and cannot be handled by generic back-end lines. As HBM scales toward more dies per stack, wider interfaces, tighter pitches, and hybrid bonding, packaging complexity and costs of packaging and testing facilities will rise to logic-fab-class levels, which is probably what we are dealing with here. Eventually, advanced packaging facilities -- which already have costs similar to logic fabs from 2010 to 2015 -- will become considerably more expensive, and DRAM makers will have to be willing to spend $20 billion or more on such facilities, as this will be the only way to enhance the bandwidth, efficiency, yields, and reliability of HBM memory going forward. Although HBM packaging is a back-end process, its reliance on lithography, etching, hybrid bonding, and other steps common in front-end fabs explains the cost of modern packaging facilities like logic fabs from the previous decade. Furthermore, increasingly complex next-generation types of HBM, starting from HBM4 and onwards, will encourage memory makers to build facilities like P&T7 costing tens of billions of dollars and located adjacent to DRAM fabs.

[2]

SK Hynix plans to open $13B HBM packaging plant in 2027

Great news for AMD and Nvidia, less so for cash-strapped consumers Memory makers just can't churn out their DRAM fast enough. On the heels of an AI-driven shortage, SK Hynix on Tuesday announced a new 19 trillion Korean won (about $13 billion) advanced packaging and test facility in South Korea that could offer some relief - just not for consumer products like laptops and phones. The South Korean memory giant unveiled the new site, dubbed P&T7, which will be located at the Cheongju Technopolis Industrial Park in Chungbuk, South Korea. Work on the plant is expected to begin in April with completion targeted for the end of 2027. The site aims to address surging demand for high-bandwidth memory (HBM) modules used extensively in datacenter GPUs and AI accelerators. Between 2025 and 2030, SK expects HBM demand to grow by an average of 33 percent a year, fueled in no small part by extreme demand for AI infrastructure. HBM is manufactured by stacking multiple layers of DRAM - eight and 12 layers are most common - to achieve higher capacity and bandwidth while reducing energy consumption in the process. The process is incredibly expensive, as a single defect in any of the layers could render the final module worthless. Worse, because of HBM's prodigious data rates - as high as 2.75 TB/s per module in the latest generations - the chips usually need to be permanently co-packaged alongside the compute logic. This makes the margin incredibly tight. Defective modules could scrap a $50,000 GPU. Because of this, specialized packaging and test facilities, like SK's newly announced P&T7 site, are essential to producing HBM in volume. Development of the P&T7 facility comes as SK Hynix prepares to bring its M15X DRAM plant online. Announced in 2024, the 20 trillion won (about $13.5 billion) DRAM plant was built to address growing HBM demand. It opened its clean room in October and, according to SK, work to deploy fab equipment is progressing smoothly. While the new packaging site may be welcome news for the likes of AMD or Nvidia - two of the largest consumers of HBM memory - the packaging site will likely do little to address skyrocketing memory prices seen by consumers and businesses over the past few months. While HBM has appeared in consumer products in the past, its extreme cost and complexity usually preclude its use in modern client devices. DDR5 memory kits that, a year ago, sold for less than $100 are now going for well in excess of $300 as vendors grapple with the ongoing DRAM and NAND crunch. As we previously reported, DRAM prices are expected to remain high for the next several years, driven in part by strong demand for AI infrastructure. Analysts predict DRAM prices to peak later this year before plateauing in 2027, and rising again in 2028. While customers pay through the nose, memory vendors are raking in billions of dollars of revenue. Last week, Samsung issued a revised Q4 forecast in which it predicted its operating profits would more than triple, while Micron and SK Hynix's profits are expected to more than double. ®

[3]

Exclusive: SK Hynix speeds up new chip fab opening to meet memory demand, executive says

SEOUL/SAN FRANCISCO, Jan 15 (Reuters) - SK Hynix (000660.KS), opens new tab plans to accelerate the opening of a new factory by three months and will also begin operating another new plant in February, a senior executive said, as surging memory demand pressures global supply. The South Korean chipmaker's decision comes as a global memory chip shortage has driven up prices of consumer gadgets like phones and PCs and slowed the construction of data centers needed to power artificial intelligence. "We have to support memory consumption for AI infrastructure," said Sungsoo Ryu, CEO of SK Hynix America, in an interview with Reuters. Ryu said his company, a key Nvidia (NVDA.O), opens new tab supplier, would open the first factory at its new chip facility in Yongin, South Korea, three months early in February 2027. In addition, it plans to begin deploying silicon wafers next month into a new fab, M15X, in Cheongju, South Korea, to produce high-bandwidth memory (HBM) chips. HBM chips are used by Nvidia, Advanced Micro Devices (AMD.O), opens new tab and other firms to build the systems needed for AI applications. Reuters is reporting SK Hynix's decision to move up its timetable at the Yongin facility for the first time. A local media outlet earlier reported on the firm's HBM production plan, citing unnamed industry sources. The fab in Yongin, 40 km (25 miles) south of Seoul, is part of the company's planned 600 trillion won ($407 billion) investment in its "Semiconductor Cluster," which will eventually house four fabs. LONG-TERM AGREEMENTS Ryu declined to provide details on the production capabilities at the phase-one Yongin fab, but said the additional capacity would be "very helpful" in meeting customer demand. Analysts estimate the first fab in Yongin would be comparable in current capacity terms to the company's complex at Icheon, which is home to several factories. Ryu said customers, including hyperscalers, are increasingly seeking multi-year supply agreements - a shift from the one-year contracts that were more common in the past - as they scramble to lock in long-term supplies. The global memory chip market is experiencing an unprecedented boom, with prices of some products surging more than 300% in the fourth quarter alone from a year earlier, according to data from market tracker TrendForce, as surging demand for AI infrastructure strains production capacity. Ryu said SK Hynix is reviewing production plans for its products on a monthly basis to ensure its ability to support customers. "Structural changes are happening now (in the memory chip market)," Ryu said, adding that he has not seen signs of a slowdown in demand. "We are seeing a lot of tremendous and humongous demand," he said. Shares of SK Hynix, the world's second-largest memory chipmaker after Samsung Electronics (005930.KS), opens new tab, have jumped 280% over the past year. ($1 = 1,475.6800 won) Reporting by Heekyong Yang in Seoul and Max A. Cherney in San Francisco; Editing by Miyoung Kim and Thomas Derpinghaus Our Standards: The Thomson Reuters Trust Principles., opens new tab * Suggested Topics: * Artificial Intelligence Max A. Cherney Thomson Reuters Max A. Cherney is a correspondent for Reuters based in San Francisco, where he reports on the semiconductor industry and artificial intelligence. He joined Reuters in 2023 and has previously worked for Barron's magazine and its sister publication, MarketWatch. Cherney graduated from Trent University with a degree in history.

[4]

SK Hynix to invest $13 billion in new plant amid memory chip shortage

A visitor takes a picture of a model of SK hynix's high-bandwidth memory (HBM) technology during the 2025 World IT Show in Seoul on April 24, 2025. South Korea-based memory maker SK Hynix announced Tuesday it will invest 19 trillion Korean won ($12.9 billion) to build a new advanced packaging plant, as it expands production to meet rising demands driven by the artificial intelligence boom. The new fabrication facility will be located in the Korean city of Cheongju, building on the company's existing footprint there. Construction set to begin in April, with completion targeted for the end of 2027, the firm said in a statement. SK Hynix is among the world's largest producers of memory chips and leads the world in so-called high-bandwidth memory (HBM), which is used in artificial intelligence processors, including those designed by U.S. chipmaker Nvidia. The new fab will help SK Hynix meet growing demand for HBM as global AI competition intensifies, pushing up prices and making it very lucrative for memory giants. According to industry projections cited by SK Hynix, the HBM market is expected to expand at a compound annual growth rate of 33% between 2025 and 2030. However, the shift by producers to meet AI demand has strained supplies of conventional memory chips, raising concerns that shortages could impact the broader electronics industry. In response, memory chip makers have been expanding production capacity, as with SK Hynix's new advanced packaging and testing facility. Advanced packaging in memory is the process of combining multiple memory chips into a single, high-density unit to improve performance and energy efficiency while reducing overall size. SK Hynix rival Samsung Electronics has also announced plans to ramp up HBM production in recent months.

[5]

To meet 'tremendous and humongous demand' from AI customers, SK Hynix accelerates 2027 fab plans by three months, with an even fresher fab beginning wafer production next month

We already knew SK Hynix had multiple new memory chip fabs in the works, but completion of any of them was still too far off to know if they'd have any tangible effect on the raging memory supply crisis. Well, the major memory maker has just announced its intentions to accelerate construction plans for one fab by three months, now aiming to finish up in February 2027. Furthermore, an already-existing fab is expected to start churning out wafers as soon as next month. This follows news earlier this week that the South Korean memory manufacturer planned to invest a further 19 trillion won (or $12.90 billion) into another advanced chip packaging facility in Cheongju. The company announced in December that it planned "to invest approximately 30% of our sales in facilities in 2026 and accelerate the transition to 1c DRAM, but it will be difficult to resolve the supply shortage." Expanding production was always part of the plan -- but the AI industry's demand for memory has been scaling up faster than production can match. Sungsoo Ryu, CEO of SK Hynix America, told Reuters this week, "We have to support memory consumption for AI infrastructure." To clarify, Ryu shared that the company would open only the first of a number of factories at its new chip facility in Yongin, South Korea, in February 2027. Once complete, the company's 600 trillion won (or $407 billion) 'Semiconductor Cluster' will eventually house a total of four fabs. A key supplier to Nvidia, SK Hynix will also start deploying silicon wafers intended for high-bandwidth memory (HBM) chips (which are used for data centre GPUs) next month at another fab already established in Cheongju, called M15X. So, yes, this latest news is great for hyperscaling, data centre customers, though less immediately helpful for your typical PC gaming consumer. Saying that, though, hopefully it will go some way towards increasing overall market supply and lowering prices across the board (or at least slow their seeming perpetual climb recently). Ryu explains that many of SK Hynix's AI customers are also beginning to shift away from shorter term, one-year supply agreements in favour of multi-year contracts. "We are seeing a lot of tremendous and humongous demand," Ryu said. Fellow memory chip maker, Micron, has been keen to point out it's not its fault that demand is high and there simply isn't enough supply, though as a key memory supplier it surely bears some responsibility. As another of the big three DRAM makers, Samsung seems to be quite happy to keep that supply tight so it doesn't end up holding a ton of chips it can't sell if something happens to that demand. "Rather than rapidly expanding facilities, we will pursue a strategy of maintaining long-term profitability," a Samsung rep said during an investor relations call last year, adding, "we will minimize the risk of oversupply through a capital expenditure (CAPEX) strategy that balances customer demand and pricing." It's not necessarily so pretty for the memory module makers, however, with Patriot claiming to not be 'laughing their way to the bank' during this supply crisis. However, the actual IC manufacturers are a different matter entirely, with Reuters noting that SK Hynix's share price has increased by 280% over the last year. While that's a massive win for the company, consumers still don't have much reason to celebrate when faced with sky-high street prices.

[6]

In a bid to meet the memory supply crisis head on, SK Hynix announces it will invest nearly $13 billion into fresh AI packaging facility

SK Hynix has announced this week it will invest 19 trillion won (or $12.90 billion) into a new advanced chip packaging facility in Cheongju, South Korea -- and it isn't the only company making multi-billion dollar moves to meet the demands of the raging memory supply crisis. SK Hynix is one of Nvidia's leading suppliers of high-bandwidth memory (HBM) for its AI accelerators. The planned chip packaging facility is set to begin construction this April, but won't be able to address demand until after work is complete in late 2027 (via Bloomberg). This follows news last year of the company committing an additional $500 billion to building four new memory fabs, with the first of these aiming for a similar 2027 completion window. Chey Tae-won, the chairman of SK Hynix's parent group, SK Group, recently spoke during a keynote speech at the SK AI Summit in Seoul, saying, "We have entered an era in which supply is facing a bottleneck. We are receiving memory chip supply requests from many companies, and we are thinking hard about how to address all demands." With the limited flow of memory now actively restricting how many data centres can be built, it's not the only company announcing plans to address the situation. Memory maker Micron, too, has just announced plans for a massive megafab, this time in New York. Apparently not wanting to be outdone on AI's world stage, the planned semiconductor manufacturing facility will be the largest in the US, with Micron investing $100 billion into the project set to break ground in Onondaga County "following rigorous environmental review and necessary permit approvals." Micron shut down their consumer sub-brand Crucial in favour of focussing on supplying AI data centres, though the release of the Micron 3610 NVMe SSD has since suggested the company still wants to keep a toe in the consumer space moving forward. Still, like many memory manufacturers, it sees that economic winds remain favourable for AI acceleration (SK Hynix predicts the HBM market will, on average, grow about 30% every year between 2025 and 2030, according to Reuters). "Breaking ground at Micron's New York megafab is a pivotal moment for Micron and the United States," Micron CEO Sanjay Mehrotra said, "I want to thank President Trump, Secretary Lutnick, Administrator Zeldin, Governor Hochul, Senator Schumer, Congressman Mannion, Congresswoman Tenney, County Executive McMahon and all of our partners in the Administration and Congress for their leadership and partnership in getting to this milestone." He adds, "As the global economy enters the AI era, leadership in advanced semiconductors will be the cornerstone in innovation and economic prosperity. Our investments and progress solidify our position as the only United States manufacturer of memory." But even with all of these billions from two major memory makers, there's little use hoping the memory crisis will be alleviated before the end of this year. For one thing, all of these builds will take more than the year to complete and are not really geared towards meeting consumer demand. But for another, even with memory production scaling up, the demand coming from AI data centres is growing even faster, with some industry observers predicting the memory supply crisis could run into 2028 and beyond.

[7]

SK Hynix to invest nearly $13 billion in chip packaging plant in South Korea

SK Hynix said accelerating global competition in AI is driving a sharp rise in demand for AI-focused memory, underscoring the need to respond proactively to growing demand for high-bandwidth memory (HBM) chips. South Korea's SK Hynix said on Tuesday it has decided to invest 19 trillion won ($12.90 billion) to build an advanced chip packaging plant in South Korea to meet rising memory chip demand related to artificial intelligence. The chipmaker said in a statement that the construction of the new factory will begin in April, with completion targeted by the end of next year. SK Hynix said accelerating global competition in AI is driving a sharp rise in demand for AI-focused memory, underscoring the need to respond proactively to growing demand for high-bandwidth memory (HBM) chips. HBM - a type of dynamic random access memory or DRAM standard first produced in 2013 - involves stacking chips vertically to save space and reduce power consumption, helping to process the large volumes of data generated by complex AI applications. SK Hynix, the main HBM supplier to Nvidia, was the leading player in the HBM market last year, with a 61% share, followed by Samsung Electronics at 19% and Micron at 20%, data from Macquarie Equity Research showed.

[8]

SK Hynix Announces Mega Investments to Enter Advanced Packaging Business as AI Demand Forces It to Take Production Into Its Own Hands

SK hynix, a prominent memory manufacturer, has unveiled plans to build advanced packaging production lines in South Korea to meet the growing demand. Advanced packaging is emerging as one of the significant bottlenecks in the AI supply chain, as companies have based their chip portfolios on this technology, and current production lines are insufficient to meet demand. Technologies like CoWoS enable firms like NVIDIA/AMD to integrate HBM modules directly onto the main compute die. This is why, for memory manufacturers like SK hynix, having sufficient advanced packaging capacity is a necessity. In their latest announcement, SK hynix is now investing heavily in Cheongju, South Korea, for advanced packaging. Amidst this changing environment, SK Hynix has decided to invest in a new advanced packaging fab, P&T7 , to ensure a stable response to global AI memory demand and optimize production at its Cheongju fab. This investment is a strategic decision that resonates with the government's policy of balanced regional growth while comprehensively considering supply chain efficiency and future competitiveness. - SK hynix The advanced packaging fab, called the P&T7, will be built with a total investment of approximately $13 billion, serving as an "organic linkage" between the company's upcoming M15X DRAM facility. This means that SK hynix now plans to offer a one-stop solution for HBM customers within the Cheongju Techno Valley Industrial Complex. After DRAM modules are manufactured, they will be transferred to advanced packaging lines, where the remaining manufacturing and stacking processes will be carried out. SK hynix has previously been reported to be building a 2.5D packaging plant in the US, with an investment of almost $4 billion. However, the bigger question here is whether the Korean giant itself has an alternative similar to TSMC's CoWoS. We do know that SK hynix does utilize MR-MUF vertical stacking for its HBM solutions, but when it comes to packaging the entire chip, the company has been reliant on TSMC. The recent investments do indicate that SK hynix looks to increase its competitiveness in the HBM segment by offering its clients a turnkey solution. The company hasn't disclosed the type of technology these advanced packaging lines would focus on. Still, our best estimate is that SK hynix would likely form a partnership with companies like Amkor or possibly even TSMC by investing the necessary funds to produce advanced packaging products in its facilities. Alternatively, SK hynix could develop a proprietary technology, reducing its reliance on foundry partners.

[9]

SK Hynix Bets $13 Billion To Lock In AI Memory Dominance - Advanced Micro Devices (NASDAQ:AMD), Alphabet (NASDAQ:GOOGL)

SK Hynix, Samsung Electronics Co. Ltd. (OTC:SSNLF), and global rivals, including Taiwan Semiconductor Manufacturing Company Ltd. (NYSE:TSM) and Micron Technology Inc. (NASDAQ:MU), are accelerating investments as competition intensifies to supply high-bandwidth memory and advanced chips for the artificial intelligence boom. SK Hynix Commits $13 Billion To Expand AI Memory Capacity SK Hynix is ramping up investment to strengthen its position in the global AI chip supply chain as demand for high-bandwidth memory (HBM) continues to surge. The South Korean memory giant, the world's top supplier of HBM to Nvidia Corp. (NASDAQ:NVDA), said it will invest 19 trillion won (about $13 billion) to build a new advanced semiconductor packaging and testing facility, known as P&T7, in the Cheongju Techno Polis industrial complex. Construction will begin in April, with completion likely by 2027 and full operations expected in 2028, the Korea Economic Daily reported on Tuesday. The plant will focus on advanced packaging, the back-end process that combines multiple memory chips into high-density units that improve performance and energy efficiency for AI workloads. Rising Competition in the High-Bandwidth Memory Market The investment comes as competition heats up across the AI memory market. Samsung has also announced plans to ramp up HBM output. It has hiked prices on key memory chips by up to 60% since September. Taiwan-based rivals, including Taiwan Semiconductor and U.S. firms such as Micron, are racing to secure capacity. HBM demand is accelerating as AI and generative AI workloads require faster and more power-efficient memory to handle massive data volumes. HBM plays a critical role in training large language models and powering AI accelerators used by Nvidia, Alphabet Inc.'s (NASDAQ:GOOGL) Google and Advanced Micro Devices, Inc. (NASDAQ:AMD). SK Hynix leads the global HBM market with a 53% share in the third quarter of 2025, while Samsung followed with 35% and Micron held 11%, according to Counterpoint Research. Industry projections cited by SK Hynix forecast the global HBM market will grow at a 33% compound annual rate from 2025 to 2030. Memory Pricing Tightens Amid Supply Constraints Pricing has also tightened. TrendForce said it expects average DRAM prices, including HBM, to rise 50% to 55% this quarter compared with the fourth quarter of 2025, as AI-driven demand increases and conventional memory supply tightens, CNBC reported on Tuesday. SK Hynix said the P&T7 plant will be responsible for the final assembly and quality inspection of chips manufactured at its front-end fabrication facilities, transforming silicon dies into finished products through advanced packaging processes. The site will be located next to M15X, the company's next-generation DRAM manufacturing facility in Cheongju, which is currently being built under a separate investment of 20 trillion won. Once both facilities are operational, DRAM wafers produced at M15X will be packaged into high-bandwidth memory products on-site, enabling a more vertically integrated manufacturing workflow. Following the launch of P&T7, SK Hynix will run three major advanced packaging centers worldwide, located in Icheon near Seoul, Cheongju, and West Lafayette, Indiana. Image via Shutterstock AMDAdvanced Micro Devices Inc$210.971.58%OverviewGOOGLAlphabet Inc$334.350.75%MUMicron Technology Inc$345.01-0.25%NVDANVIDIA Corp$185.670.39%SSNLFSamsung Electronics Co Ltd$65.2154.0%TSMTaiwan Semiconductor Manufacturing Co Ltd$332.460.21%Market News and Data brought to you by Benzinga APIs

[10]

SK hynix confirms new packaging fab construction in Cheongju - The Korea Times

An artist's rendering of SK hynix's P&T7 packaging fab in Cheongju, North Chungcheong Province / Courtesy of SK hynix SK hynix on Tuesday confirmed the construction of its new semiconductor packaging fab, dubbed P&T7, in Cheongju, North Chungcheong Province, as the memory giant accelerates expansion of its production capacity for high-bandwidth memory (HBM) for artificial intelligence (AI) accelerators. On its website, SK hynix said it will invest 19 trillion won ($12.92 billion) to build the P&T7 fab on a 230,000-square-meter site in the city's industrial complex. Construction is set to begin in April with completion targeted for the end of 2027. The company said it is "a strategic decision that reflected the government's policy goal of balanced national growth while also taking into account supply chain efficiency and future competitiveness." According to the company, P&T stands for packaging and testing, and P&T7 will be an advanced packaging facility that turns chips produced at front-end fabs into finished products and conducts final quality inspections. The P&T7 plan has been rumored since June 2025, as the company demolished buildings on the site of LG's former Cheongju Plant 2 that SK hynix had previously acquired to make way for a new packaging facility. P&T7 is designed to work in tandem with the existing M15 fab and the M15X facility now being built for HBM production in Cheongju. Of the two, SK hynix invested 20 trillion won in M15X, which opened its cleanroom in October 2025 ahead of schedule and is now in the final stages of equipment installation. Along with M15 and M15X, SK hynix has M11, M12 and P&T3 fabs in Cheongju, which is about 130 kilometers south of Seoul. "The organic link between the M15X and P&T7 is expected to position the city as SK hynix's new core hub for AI memory, as well as strengthening its ability to meet rising demand for advanced memories," SK hynix said. While announcing the new investment, SK hynix stressed the decision aligns with the government's policy goal of balanced national growth. "Amid the rapid shifts in the investment environment surrounding the semiconductor industry, there are debates over the meaning and role of investments in the noncapital area," the company said. "SK hynix sees beyond short-term efficiency or immediate gains, and seeks to make contribution in strengthening the country's industrial foundation over the long term and building a structure in which the capital and noncapital regions grow together." The company referred to debates among political voices that semiconductor fabs should be located across the country for balanced growth alongside the semiconductor industry's hesitation, citing infrastructure and workforce issues. President Lee Jae Myung on Dec. 10, 2025, told Samsung Electronics' chip division head Vice Chairman Jun Young-hyun and SK hynix CEO Kwak Noh-jung that he hopes for "semiconductor companies to turn their eyes to the southern region and make contributions to the country's balanced development." Minister of Climate, Energy and Environment Kim Sung-hwan also floated the necessity of dispersing the chip cluster during a radio interview. The comments were interpreted to be targeting that semiconductor complex that the two companies are building or set to build in Yongin, Gyeonggi Province, about 50 kilometers south of Seoul. SK hynix had already begun construction, while Samsung Electronics has recently signed deals to purchase land in Yongin. Lawmakers from the southern part of the country have also raised their voices, with those from North Jeolla Province urging the industrial complex to be relocated to the province's Saemangeum area, about 250 kilometers southwest of Seoul. Though presidential spokesperson Kim Nam-joon said Thursday that any relocation decision would be up to the company, lawmakers' calls are growing. Semiconductor industry officials expressed concern that political considerations could end up dictating corporate decisions based on feasibility, because both Samsung and SK hynix considered Yongin's grid infrastructure, water resources and the advantage of the capital area in attracting workers. Samsung Electronics operates its main semiconductor complexes in Yongin, Hwaseong and Pyeongtaek, all in Gyeonggi Province, which surrounds Seoul. It also has a packaging facility in Asan, South Chungcheong Province, located about 100 kilometers south of Seoul.

[11]

SK Hynix to spend $13 billion on South Korea chip packaging plant By Investing.com

Investing.com-- Nvidia (NASDAQ:NVDA) supplier SK Hynix Inc (KS:000660) said on Tuesday it will spend 19 trillion won ($13 billion) to build an advanced chip packaging plant in South Korea, as the memory chips supplier benefits from outsized artificial intelligence demand. SK Hynix said the project will be built in the city of Cheongju, with construction set to begin in April. The company already has several production facilities in the city. Get more breaking news and top AI stock picks with InvestingPro The chipmaker said the new plant was largely aimed at bolstering its production capacity in response to rising AI-fueled demand for memory. Memory chips are a key component of AI processors, especially the advanced high-bandwidth memory chips made by SK Hynix. The company, along with rival Samsung Electronics Co Ltd (KS:005930), is among the world's largest memory chips maker, and also makes the most advanced HBM chips available in the market. This makes it a key component of the AI supply chain, with SK Hynix also acting as a major supplier for Nvidia. The company is set to report its December quarter earnings next week, and is widely expected to have logged a bumper print on outsized AI demand. Rival Samsung had last week flagged an over 200% surge in its profit for the same period. SK Hynix and Samsung are also set to benefit greatly from a sharp increase in memory chip prices, as AI demand largely outpaced supply. SK Hynix shares fell 0.5% in morning trade, but remained close to record highs.

[12]

SK Hynix to Build $13 Billion Chip Packaging Plant in South Korea

SK Hynix, a major supplier of high-bandwidth-memory products to Nvidia, plans to build a $13 billion chip packaging plant in South Korea amid surging demand for artificial-intelligence chips. The South Korean memory-chip maker said Tuesday it will spend 19 trillion won to build an advanced facility for packaging and testing AI chips in Cheongju, south of Seoul. The new plant, due to be completed by the end of 2027 with construction set to start in April, will add to SK Hynix's chip-packaging capacity in South Korea. The company is also building facilities in the U.S. SK Hynix "is proactively responding to rising HBM demand" amid surging AI memory demand, according to a statement released by the company. The HBM market is expected to grow 33% annually on average from 2025 to 2030, it said. HSBC analyst Ricky Seo said in a research note on Tuesday that SK Hynix would continue to benefit from what he calls "a memory supercycle" that could last for four to five years. The upbeat outlook is underpinned by solid HBM shipments supported by robust AI investments, as well as strong demand for conventional commodity dynamic random-access memory chips, he said. The chip maker is set to post record fourth-quarter earnings, Seo said. Its operating profit in the October-December period is expected to have surged 57% from the previous quarter to a record 18 trillion won, with its DRAM and NAND chip prices likely having risen 25% and 20%, respectively, he said. The South Korean won's weakness against the U.S. dollar also likely helped boost SK Hynix's quarterly earnings, Seo added. The company is expected to disclose its results later this month. Shares in SK Hynix were down 1.6% in Tuesday afternoon trading on profit taking following recent gains. Nonetheless, the stock is up around 13% so far this year.

[13]

SK Hynix to invest nearly $13 billion in chip packaging plant in South Korea

SEOUL, Jan 13 (Reuters) - South Korea's SK Hynix said on Tuesday it has decided to invest 19 trillion won ($12.90 billion) to build an advanced chip packaging plant in South Korea to meet rising memory chip demand related to artificial intelligence. The chipmaker said in a statement that the construction of the new factory will begin in April, with completion targeted by the end of next year. SK Hynix said accelerating global competition in AI is driving a sharp rise in demand for AI-focused memory, underscoring the need to respond proactively to growing demand for high-bandwidth memory (HBM) chips. HBM - a type of dynamic random access memory or DRAM standard first produced in 2013 - involves stacking chips vertically to save space and reduce power consumption, helping to process the large volumes of data generated by complex AI applications. SK Hynix, the main HBM supplier to Nvidia, was the leading player in the HBM market last year, with a 61% share, followed by Samsung Electronics at 19% and Micron at 20%, data from Macquarie Equity Research showed.

Share

Share

Copy Link

SK Hynix approved a $13 billion investment to build the world's largest high-bandwidth memory assembly facility in South Korea, targeting completion by late 2027. The move addresses surging AI infrastructure needs as the company accelerates production timelines across multiple fabs. Memory prices have surged over 300% in Q4 alone, with DRAM expected to remain expensive through 2028.

SK Hynix Commits $13 Billion to Massive HBM Facility

SK Hynix, the world's leading supplier of high-bandwidth memory, approved a ₩19 trillion ($12.896 billion) investment to construct P&T7, an advanced packaging plant dedicated exclusively to HBM production

1

. The South Korea facility will span approximately 231,405 square meters at the Cheongju Technopolis Industrial Complex, making it the world's largest HBM assembly and test facility4

. Construction begins in April 2026, with completion targeted for the end of 2027, though equipment installation means full operations won't start until the decade's end1

.

Source: Korea Times

The facility's scale reflects HBM's critical role in AI infrastructure. While HBM packaging is technically a back-end activity, it requires complex techniques like etching, lithography, and hybrid bonding—processes typically associated with logic production

1

. To contextualize the $13 billion investment, this dwarfs SK Hynix's West Lafayette, Indiana plant, which costs $4 billion and spans just 39,948 square meters1

.Memory Chip Shortage Drives Unprecedented Demand for HBM

The global memory chip market faces an unprecedented boom, with some DRAM prices surging more than 300% in Q4 alone compared to a year earlier, according to TrendForce data

3

. DDR5 memory kits that sold for less than $100 a year ago now exceed $300 as vendors grapple with the ongoing memory chip shortage2

. Analysts predict DRAM prices will peak later this year, plateau in 2027, then rise again in 20282

.

Source: The Register

Sungsoo Ryu, CEO of SK Hynix America, told Reuters the company expects demand for HBM to grow at a compound annual growth rate of 33% from 2025 to 2030

3

. "We are seeing a lot of tremendous and humongous demand," Ryu explained, adding that customers including hyperscalers increasingly seek multi-year supply agreements rather than the one-year contracts previously common3

.AI Accelerators Push Production Capacity to Limits

HBM modules are manufactured by stacking multiple DRAM layers—typically eight to 12—to achieve higher capacity and bandwidth while reducing energy consumption

2

. The process proves incredibly expensive, as a single defect in any layer could render the final module worthless. With data rates reaching 2.75 TB/s per module in the latest generations, HBM chips typically require permanent co-packaging alongside compute logic in datacenter GPUs, making margins extremely tight2

.The P&T7 facility will operate in close proximity to Fab M15X, SK Hynix's major semiconductor manufacturing facility in Cheongju currently being equipped with fab tools

1

. This adjacency creates a vertically integrated manufacturing ecosystem capable of building HBM dies—which are three to four times larger than commodity DDR5—then testing and packaging them nearby1

. The company plans to begin deploying wafers into M15X next month to produce HBM chips for Nvidia, AMD, and other AI accelerators manufacturers3

.

Source: PC Gamer

Related Stories

SK Hynix Accelerates Timeline Across Multiple Fabs

Beyond the Cheongju expansion, SK Hynix announced it will accelerate opening of its first factory at the new Yongin facility by three months, now targeting February 2027

3

. Located 40 km south of Seoul, the Yongin site is part of the company's planned 600 trillion won ($407 billion) "Semiconductor Cluster" that will eventually house four fabs5

."We have to support memory consumption for AI infrastructure," Ryu stated, noting the company reviews production plans monthly to ensure it can support customers

3

. The semiconductor industry benefits substantially from this demand, with SK Hynix shares jumping 280% over the past year3

. Samsung Electronics and other memory vendors have reported operating profits more than doubling or tripling2

.While the new advanced packaging plant offers relief for Nvidia and AMD—two of the largest HBM consumers—it will likely do little to address skyrocketing memory prices for consumer products like laptops and phones

2

. The shift by producers to meet AI demand has strained supplies of conventional memory chips, raising concerns about broader electronics industry impacts. Ryu noted he has not seen signs of demand slowdown, describing "structural changes" now happening in the memory market3

.References

Summarized by

Navi

[2]

Related Stories

SK Hynix Accelerates HBM4 Development to Meet Nvidia's Demand, Unveils 16-Layer HBM3E

04 Nov 2024•Technology

SK Hynix Forecasts 30% Annual Growth in AI Memory Market Through 2030

11 Aug 2025•Technology

SK Hynix Dramatically Expands Yongin Semiconductor Investment to $410 Billion Amid AI Memory Chip Surge

18 Nov 2025•Business and Economy

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation