SoftBank Sells Entire $5.8 Billion Nvidia Stake to Fund AI Ambitions, Sparking Market Concerns

40 Sources

40 Sources

[1]

SoftBank's Nvidia sale rattles market, raises questions | TechCrunch

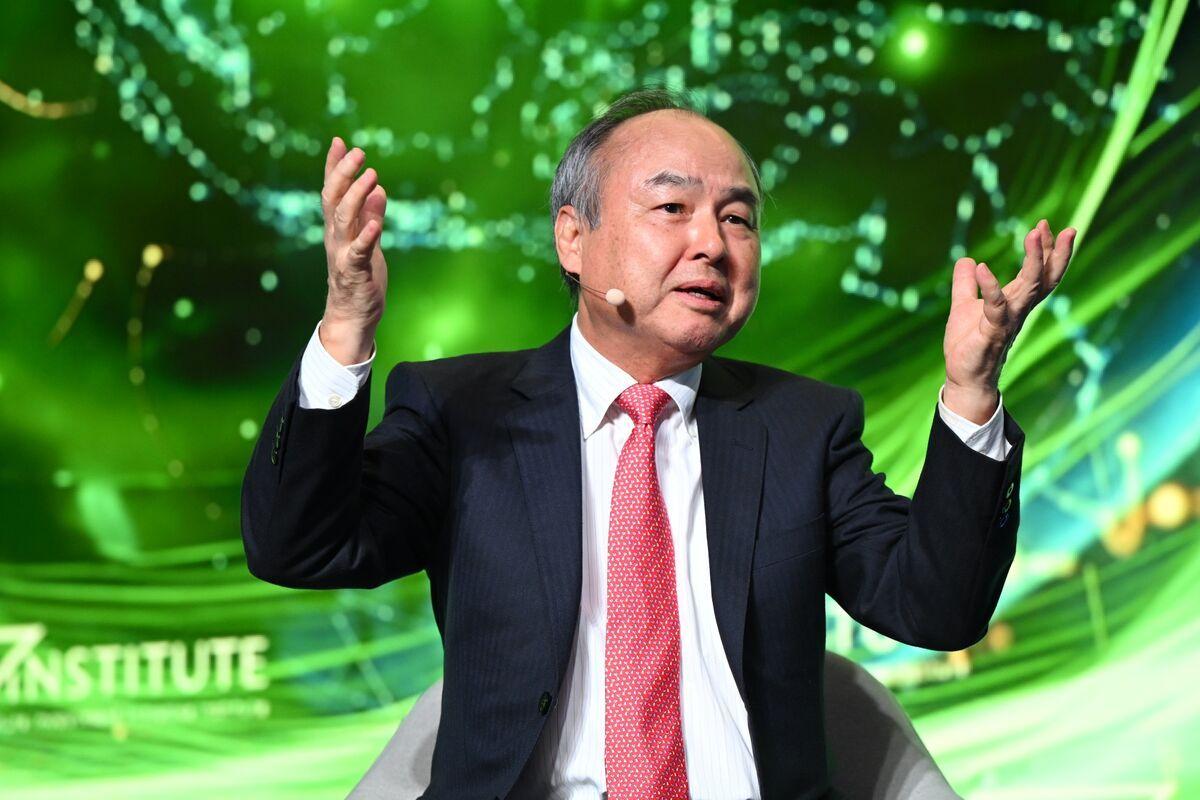

Masayoshi Son isn't known for half measures. The SoftBank founder's career has been studded with brow-raising bets, each one seemingly more outrageous than the last. His latest move is to cash out his entire $5.8 billion NVIDIA stake to go all-in on AI, and while it surprised the business world on Tuesday, it maybe should not. At this point, it's almost more surprising when the 68-year-old Son doesn't push his chips to the center of the table. Consider that during the late 1990s dot-com bubble, Son's net worth soared to approximately $78 billion by February 2000, briefly making him the richest person in the world. Then came the ugly dot-com implosion months later. He lost $70 billion personally - which, at the time, was the largest financial loss by any individual in history -- as SoftBank's market cap plummeted 98% from $180 billion to just $2.5 billion. But amid that terribleness, Son made what would become his most legendary bet: a $20 million investment in Alibaba in 2000, one decided (the story goes) after just a six-minute meeting with Jack Ma. That stake would eventually grow to be worth $150 billion by 2020, transforming him into one of the venture industry's most celebrated figures and funding his comeback. That Alibaba success has often made it harder to see when Son has stayed too long at the table. When Son needed capital to launch his first Vision Fund in 2017, he didn't hesitate to seek $45 billion from Saudi Arabia's Public Investment Fund - long before taking Saudi money became acceptable in Silicon Valley. After journalist Jamal Khashoggi was murdered in October 2018, Son condemned the killing as "horrific and deeply regrettable" but insisted SoftBank couldn't "turn our backs on the Saudi people," maintaining the firm's commitment to managing the kingdom's capital. In fact, the Vision Fund actually ramped up dealmaking soon after. That didn't turn out so well. A big bet on Uber generated paper losses for years. Then came WeWork. Son overrode his lieutenants' objections, fell "in love" with founder Adam Neumann, and assigned the co-working company a dizzying valuation of $47 billion in early 2019 after making several previous investments in the company. But WeWork's IPO plans collapsed after it published a famously troubling S-1 filing. The company never quite recovered - even after pushing out Neumann and instituting a series of belt-tightening measures - ultimately costing SoftBank $11.5 billion in equity losses and another $2.2 billion in debt. (Son reportedly later called it "a stain on my life.") But Son has been mounting another comeback for years, and Tuesday will undoubtedly be remembered as an important moment in his turnaround tale. Indeed, it will likely be recalled as the day SoftBank sold all 32.1 million of its NVIDIA shares - not to diversify its bets but instead to double down elsewhere, including on a planned $30 billion commitment to OpenAI and to participate (it reportedly hopes) in a $1 trillion AI manufacturing hub in Arizona. If selling that position still gives Son some heartburn, that's understandable. At approximately $181.58 per share, SoftBank exited just 14% below NVIDIA's all-time high of $212.19, which is a strong look. That's remarkably close to peak valuation for such a huge position. Still, the move marks SoftBank's second complete exit from NVIDIA, and the first one was exceedingly costly. (In 2019, SoftBank sold a $4 billion stake in the company for $3.6 billion, shares that would now be worth more than $150 billion.) The move also rattled the market. As of this writing, NVIDIA shares are down nearly 3% following the disclosure, even as analysts emphasize that the sale "should not be seen as a cautious or negative stance on Nvidia," but rather reflects SoftBank needing capital for its AI ambitions. Wall Street can't help but wonder: does Son see something right now that others do not? Judging by his track record, maybe -- and that ambiguity is all investors have to go on.

[2]

SoftBank offloads entire $5.83 billion stake in Nvidia -- firm sells off stock, cash will fund major investment in OpenAI, also in talks over Stargate

SoftBank has confirmed it sold its entire stake in Nvidia in October, offloading 32.1 million shares for $5.83 billion. The disclosure came Tuesday alongside the Japanese conglomerate's latest earnings report, which also revealed a $9.17 billion sale of T-Mobile US shares. Both moves form part of a broader strategy to reallocate capital into artificial intelligence ventures, among which is most notably a deepening alignment with OpenAI. The stake sale severs a direct investment link between SoftBank and the world's most valuable chipmaker at a time when Nvidia's position in the AI boom is virtually unchallenged. Nvidia's data center GPU business is currently driving quarterly revenues in the tens of billions, with hyperscale buyers like Microsoft and Meta securing multi-quarter supply commitments. Even so, SoftBank is shifting focus from component suppliers to the companies consuming that compute and the infrastructure required to deliver it at scale. According to reporting by Reuters, proceeds from the Nvidia divestment will support SoftBank's expanding AI portfolio, including a major investment in OpenAI and its ecosystem. The company is also in talks to fund Stargate, a next-generation AI data center initiative co-developed by OpenAI and Oracle that could cost tens of billions of dollars and require thousands of Nvidia accelerators. SoftBank reported a net profit of approximately $16.6 billion for the quarter. While its Vision Fund segment remains volatile, the firm has increasingly positioned itself as a key capital allocator in AI, betting on end-to-end dominance from model development to deployment infrastructure. Despite the Nvidia sale, SoftBank retains a strategic foothold in the silicon stack. It continues to own approximately 90 percent of Arm, whose CPU cores power everything from smartphones to Nvidia's Grace Blackwell CPU and future AI-focused Windows laptops. That keeps SoftBank embedded in AI hardware even as it steps away from Nvidia's equity entirely. The sale has had no visible impact on trading so far in terms of Nvidia's stock value. The company's shares remain near all-time highs, supported by record earnings and strong forward guidance, and in spite of a high-profile bet against the firm by Michael Burry, famed for predicting the 2008 global financial crisis. But SoftBank's sale signals how large investors are beginning to re-evaluate where the next wave of AI value might accrue. Speaking to Reuters, SoftBank CFO Yoshimitsu Goto said that its investment in OpenAI was "very large" and the company had to use its "existing assets to finance new investments."

[3]

SoftBank's $5.8 billion Nvidia stake sale stirs fresh AI bubble fears

Nov 11 (Reuters) - SoftBank Group's $5.8 billion sale of its Nvidia stake jolted stock markets on Tuesday, stoking fears that the frenzy around artificial intelligence may have peaked, especially after recent warnings from Wall Street bank chiefs and a famed short seller. In its quarterly results, the Japanese tech investor (9984.T), opens new tab said it had sold all the 32.1 million Nvidia shares it held in October to bankroll CEO Masayoshi Son's sweeping AI push, built around his "all in" bet on ChatGPT-creator OpenAI. SoftBank needs the proceeds for initiatives including the $500 billion Stargate project to expand U.S. data-center capacity and as much as $40 billion funding pledged to OpenAI, whose financing details were not given with the announcements. But the timing of its sale deepened some investor doubts that valuations in the AI industry might have gotten ahead of fundamentals. Nvidia (NVDA.O), opens new tab shares were down more than 2% in early trading, weighing on the benchmark S&P 500 index (.SPX), opens new tab. Adding to the jitters was a revenue forecast cut from AI cloud provider CoreWeave over a contract delay that sent its stock down 9%. Drumbeats of an AI bubble grew louder in recent weeks after Morgan Stanley (MS.N), opens new tab and Goldman Sachs (GS.N), opens new tab CEOs warned equities could be heading to a drawdown, while hedge fund manager Michael Burry, known for shorts on the U.S. housing market ahead of the 2008 crash, bet against Nvidia and Palantir. Several analysts said the sale suggested Son - one of tech's most audacious investors - sees the blistering rally that turned Nvidia into the first $5 trillion company last month cooling after a more than 1,200% surge in the past three years. But a few of them pointed to SoftBank's patchy record managing its Nvidia holdings. The company, by some estimates, missed out on a more than $100 billion rally in Nvidia shares by selling it off in 2019 before the AI boom took off, only to later buy the chipmaker's shares again. "As for timing, cannot say Masayoshi Son has been great with his trading of Nvidia shares," said C J Muse, senior managing director at Cantor Fitzgerald. "It appears simply resource allocation - finding funds to make bets elsewhere." OPENAI FOCUS, SON'S GROWING WARCHEST Along with the Nvidia share sale, SoftBank sold around $9.2 billion worth of shares in T-Mobile (TMUS.O), opens new tab, providing Son with a larger money chest to stamp his influence on an industry hungry for the capital and chips needed to fund the pursuit of AI technology that can match or surpass human intelligence. "By cashing in now, he's securing the capital needed to double down on his conviction in AI applications and the super-scaled infrastructure behind them, OpenAI, Oracle and the Stargate project," said Michael Ashley Schulman, chief investment officer at Running Point Capital Advisors. But the rising bet on OpenAI also ties SoftBank, which has taken massive losses, opens new tab on its Vision Fund investments, closer to the startup at the center of a series of circular deals that have fueled worries about the bubble. The Japanese company's stock, which has surged more than twofold this year, is getting priced more and more based on its exposure to OpenAI. The stock jumped last month on news of a sweeping OpenAI restructuring that frees the startup from its non-profit roots. The startup is considering a $1 trillion public listing as soon as next year, which could be a big windfall for investors such as Microsoft and SoftBank, Reuters has reported. The rising valuation of OpenAI also boosted SoftBank's second-quarter net profit, which more than doubled. But OpenAI has not given any clear details on how it plans to fund its AI infrastructure deals that total around $1.4 trillion. It expects to finish the year with $20 billion in annual recurring revenue and recently walked back comments on need for government-backed loans. "The Vision Fund's checkered past certainly lends an air of high-stakes poker to this divestment," Schulman said. Reporting by Aditya Soni in Bengaluru, additional reporting by Anhata Rooprai and Arnav Mishra; Editing by Ken Li and Arun Koyyur Our Standards: The Thomson Reuters Trust Principles., opens new tab

[4]

SoftBank profits more than double as AI valuations soar

Masayoshi Son's SoftBank Group said net profit more than doubled in its second quarter and announced a four-to-one stock split on Tuesday as valuations of artificial intelligence companies soar alongside growing fears of a bubble. Net profit at the AI-invested company was ¥2.5tn ($16.2bn) in the quarter to the end of September, far above analysts' expectations of ¥207bn, according to LSEG data and the ¥1.2tn recorded in the same period last year. The profits were driven by the group's tech-heavy Vision Fund, which recorded an investment gain of ¥2.8tn in the quarter from stakes in OpenAI and PayPay. Son has bet his reputation on a series of huge investments aimed at turning SoftBank into a critical player in AI, a technology he believes will shape "humanity's future". Alongside his ownership of UK chip designer Arm, Son has invested in OpenAI, Nvidia and Oracle. He most recently bought ABB's robotics arm in a deal valuing the business at $5.4bn. SoftBank's shares have more than doubled this year to over ¥22,000, driven by its investment in OpenAI, making Son Japan's richest man. The company on Tuesday said the stock split, which will take effect on January 1, will make the shares "more accessible to investors and further expand its investor base". Last month the ChatGPT maker completed a long-awaited restructuring, unlocking a second tranche of investment from SoftBank and the possibility of an eventual public listing.

[5]

SoftBank rides the AI wave as OpenAI lifts Vision Fund to $19 billion gain

The logo of Japanese company SoftBank Group is seen outside the company's headquarters in Tokyo on January 22, 2025. Japanese giant SoftBank on Tuesday posted a $19 billion gain on its Vision Fund in its fiscal second quarter ended Sept. 30. The broader Vision Fund segment factors in non-investment performance such as administrative expenses and gains and losses attributable to third-party investors. The value of the fund had risen $4.8 billion in the company's fiscal first quarter. Here's how SoftBank fared in the fiscal second quarter: Softbank is ploughing ahead with its push into artificial intelligence, investing and acquiring firms that will bolster its presence in robots and Artificial Super Intelligence (ASI). The Japanese conglomerate's stock has slumped in the past week as concerns of an AI bubble sent jitters through global markets. Nearly $50 billion in market cap was wiped out from the stock last week, marking its worst weekly loss since March 2020. However, shares are up over 140% this year as its tech investment arm has showed signs of recovery. Last month Softbank reportedly approved its final tranche of funding to complete its $30 billion investment in OpenAI. The Japanese firm's investment in the ChatGPT maker came with a caveat -- that its total investment could be slashed to as low as $20 billion if OpenAI didn't restructure into a for-profit entity by Dec. 31. The AI startup recently completed its recapitalization, cementing its structure as a nonprofit with a controlling stake in its for-profit business, which is now a public benefit corporation called OpenAI Group PBC.

[6]

SoftBank Sells $5.8 Billion Stake in Nvidia to Pay for OpenAI Deals

SoftBank, the Japanese technology giant, has staked its future on artificial intelligence. But to help pay for those expensive investments, the company last month sold its entire $5.8 billion holdings in Nvidia, the chipmaker behind the A.I. boom, SoftBank said in its quarterly earnings report on Tuesday. SoftBank's enormous spending plans, including some $30 billion alone on OpenAI, come amid a flood of planned investments in artificial intelligence across the technology industry -- including circular deals among the same companies. (Nvidia, for example, is committed to investing up to $100 billion in OpenAI, which in turn plans to buy an enormous slug of the chipmaker's processors.) News that SoftBank, an influential technology investor, was getting out of one of the biggest names in artificial intelligence stoked concern among some investors that the rally in A.I. stocks was overdone. A new skeptic of the boom appeared on Monday: Michael Burry, the hedge fund manager made famous by the book and the movie "The Big Short," questioned on social media the accounting for tech giants' huge purchases of computer chips. But SoftBank's reason for the sale was purely pragmatic, according to its chief financial officer, Yoshimitsu Goto. "We do need to divest our existing portfolio so that, that can be utilized for our financing," he told analysts. "It's nothing to do with Nvidia itself." Late last month, OpenAI completed a corporate reorganization to become a for-profit company. As part of that move, SoftBank agreed to make its full $30 billion investment in the ChatGPT maker. The move underscored the steep financial requirements of SoftBank's continuing focus on artificial intelligence. "I want SoftBank to lead the A.I. revolution," Masayoshi Son, the company's founder and chief executive, said in 2023. That has meant making big pledges, including the OpenAI investment, and joining a venture called Stargate, with OpenAI and Oracle, that intends to build an array of data centers. More broadly, SoftBank has announced that it plans to invest $100 billion in projects in the United States. Doing so has forced the company to find the money for its pledges, including by selling off existing investments and borrowing heavily. In some cases, however, those investments have paid off already. Despite the price tag of the OpenAI commitment, the start-up's soaring valuation -- on paper, at least -- helped SoftBank more than double its profit in the most recent quarter, to 2.5 trillion yen, or $16.2 billion. But SoftBank's sale of its Nvidia stake resurrected memories of its last investment in the chipmaker, which it sold off in 2019. That was a few years before its stock began to climb on the back of demand for A.I. services like ChatGPT.

[7]

SoftBank sold its Nvidia shares while betting big on OpenAI

Stake sales were part of SoftBank's broader "asset monetization" strategy SoftBank's decision to sell all its Nvidia shares has drawn sharp attention from investors already wary of overheated AI valuations. The Japanese conglomerate sold its entire 32.1 million-share holding for about $5.83 billion, ending a position that dates back to Nvidia's early rise as the chip industry's leading AI supplier. Nvidia shares slipped roughly 2% after the sale, though analysts say the move may have less to do with doubts about Nvidia and more with SoftBank's urgent need for liquidity. New Street Research analyst Rolf Bulk noted the sale "should not be seen" as a lack of confidence in Nvidia but rather a practical decision. SoftBank reportedly needs at least $30.5 billion for new investments in the last quarter of the year, with $22.5 billion allocated to OpenAI and another $6.5 billion to Ampere. The total represents more investment in one quarter than in the previous two years combined. "We want to provide a lot of investment opportunities for investors, while we can still maintain financial strength," said SoftBank's chief financial officer, Yoshimitsu Goto, during an investor presentation. "So through those options and tools we make sure that we are ready for funding in a very safe manner" The company added that the stake sales were part of its broader strategy for "asset monetization." This suggests a strategic shift toward broader artificial intelligence ventures rather than an exit from the AI space itself. Former Intel CEO Pat Gelsinger has warned that the AI sector sits in bubble territory, though he expects any correction to unfold gradually. Also, recent financial disclosures show Michael Burry's Scion Asset Management has opened large option positions tied to Nvidia and Palantir. The notional value of these positions exceeds $1 billion, signaling an apparent bet on downside risk in the ongoing AI rally. But SoftBank also sold part of its stake in T-Mobile for $9.17 billion and raised funds through a margin loan on its ARM Holdings shares. Insiders claim that these asset sales are simply "sources of cash" for new acquisitions, including ABB's robotics business. These sales and SoftBank's $19 billion gain this quarter from the Vision Fund bolstered its growing portfolio of AI-focused holdings. "The reason we were able to have this result is because of September last year, which was the first time we invested in OpenAI," said SoftBank's Goto. SoftBank remains deeply linked to Nvidia through projects like the $500 billion Stargate data center initiative, which still depends on Nvidia's GPUs and AI tools. Via CNBC

[8]

Softbank dumps its entire Nvidia portfolio worth $5.8 billion as its CEO goes all-in on OpenAI to the tune of $30 billion | Fortune

SoftBank sold 32.1 million Nvidia shares in October, the company disclosed Tuesday alongside fiscal second-quarter earnings showing net profit more than doubling to 2.5 trillion yen, or approximately $16.6 billion. The windfall represented SoftBank's best quarterly performance since July-September 2022, driven primarily by valuation gains in its OpenAI holdings, which totaled 2.16 trillion yen for the quarter. This marks SoftBank's second complete exit from the chipmaker. The firm previously sold its entire $3.6 billion Nvidia stake in 2019, only to re-enter the position in 2020 before this latest departure. That earlier sale has become something of a cautionary tale in investment circles: Had SoftBank retained those original shares, they would now be worth more than $150 billion. Asked during an earnings call about the timing of the Nvidia sale, SoftBank's CFO Yoshimitsu Goto suggested the company needed liquidity to fund its OpenAI commitments. "This year our investment in OpenAI is large, more than $30 billion needs to be made," he said. "For that, we do need to divest our existing assets." Goto declined to specify whether the October timing held particular significance, but described the sale as part of SoftBank's ongoing cycle of "divesting and reinvesting," calling it the company's "fate" to continually reallocate capital. Notably, he added the decision had "nothing to do with Nvidia itself." As SoftBank turns away from Nvidia, its involvement with OpenAI has grown much deeper, especially over this past year. In March, the company agreed to lead a funding round of up to $40 billion at a valuation of $300 billion. Under the arrangement, SoftBank committed to an initial closing of $10 billion in April, with a second tranche of up to $30 billion scheduled for December. The company plans to syndicate $10 billion to co-investors, bringing its effective investment to $30 billion. In October, SoftBank's board approved the second installment of $22.5 billion, contingent on OpenAI completing a corporate restructuring that would enable a future public listing. If the restructuring fails to materialize by year-end, SoftBank's total investment would drop to $20 billion. By the end of December, SoftBank's total investment in OpenAI is expected to reach $34.7 billion. OpenAI's valuation has rapidly climbed over the past year, rising from $157 billion last October to $300 billion in March and then to $500 billion following an employee share sale last month. The dramatic appreciation has positioned OpenAI as the world's most valuable private company, surpassing Elon Musk's SpaceX. SoftBank's aggressive financing of its OpenAI stake has included selling down equity holdings -- including T-Mobile shares worth $9.17 billion between June and September -- as well as issuing bonds and securing bridge loans. The company also recently expanded the terms of a margin loan backed by shares of Arm Holdings from $13.5 billion to $20 billion. The investment is central to several sprawling AI initiatives. In January, Son joined President Donald Trump, OpenAI CEO Sam Altman, and Oracle's Larry Ellison in announcing the Stargate Project, a $500 billion initiative to develop AI infrastructure across the United States. SoftBank assumed financial responsibility for the project, with Son serving as chairman, while OpenAI took operational control. Despite the scale of the commitment, the Stargate rollout has encountered delays. During a September briefing, Goto acknowledged that progress was taking longer than anticipated, citing the need to build consensus among partners including Oracle and Abu Dhabi's MGX. "We need to take our time to prepare a model case for Stargate," Goto told analysts and reporters. "A lot of parties are involved. Time is needed to form a consensus." In September, OpenAI announced the first Stargate data center in Abilene, Texas, had begun operations, with five additional facilities planned across Texas, New Mexico, Ohio, and the Midwest. The buildout is projected to create 7 gigawatts of data center capacity and more than $400 billion in investments over three years, aiming for a total of 10 gigawatts. The Nvidia sale has freed SoftBank to pursue additional AI-related acquisitions. The company is finalizing a $6.5 billion acquisition of chip designer Ampere Computing and recently acquired ABB's robotics division for about $5.4 billion. It also took a $2 billion stake in Intel to support development of AI chips based on Arm's architecture. Yet, concerns persist about the sustainability of AI valuations and whether the enormous capital commitments will generate commensurate returns. "There are various opinions, but SoftBank's position is that the risk of not investing is far greater than the risk of investing," Goto said during Tuesday's presentation. SoftBank's stock has nearly tripled in 2025 as investors have treated the company as a proxy for OpenAI's success. The company also announced a four-for-one stock split effective Jan. 1, 2026, to improve accessibility for retail investors. But questions remain about financing. David Gibson at MST Financial told The Financial Times SoftBank has committed approximately $113 billion in investments but possesses funding capacity of only $58.5 billion. The shortfall has prompted the company to leverage existing assets aggressively, including raising a $5 billion margin loan backed by Arm shares and securing $8.5 billion in bridging loans for OpenAI. Son's investment philosophy has always centered on long-term, transformative technologies. His early bet on Alibaba in 2000 yielded $58 billion when the Chinese e-commerce giant went public in 2014. But the track record is mixed -- SoftBank's backing of WeWork ended in a high-profile collapse, and the premature exit from Nvidia has become a painful reminder of opportunities lost. For now, Son appears willing to stake SoftBank's future on AI.

[9]

SoftBank cashes out $5.8bn Nvidia stake to fund OpenAI bet

Masayoshi Son's SoftBank surprised investors when it said it had sold its entire Nvidia stake for about $5.83 billion to help fund more bets on AI. The Tokyo-based conglomerate said it offloaded roughly 32 million shares in the U.S. chipmaker last month as it builds up capital for its expanding investment in OpenAI. Nvidia shares slipped 1.5% in early U.S. trading Tuesday. Chief financial officer Yoshimitsu Goto said in translated comments that the decision was "nothing to do with Nvidia itself." He said: "This year our investment in OpenAI is large, more than $30 billion needs to be made. For that we do need to divest our existing portfolios." He added: "We want to provide a lot of investment opportunities for investors, while we can still maintain financial strength." SoftBank's results for the six months to September showed profits almost tripled from a year earlier, climbing to about 2.5 trillion yen ($13 billion). Revenue grew 7.7% to 3.7 trillion yen ($24 billion). A $19 billion profit from the group's Vision Fund partly fuelled those gains, reflecting higher valuations in tech and AI stocks in general. The fund has been expanding across AI including in semiconductors, robotics, and large language models. "The reason we were able to have this result is because of September last year, that was the first time we invested in OpenAI," Goto said. SoftBank's founder Masayoshi Son has been positioning the group as a central player in global AI development. In February, he appeared with President Donald Trump, OpenAI's Sam Altman, and Oracle co-founder Larry Ellison to unveil a planned $500 billion AI infrastructure project called Stargate. But it also comes as concerns grow about an overheated AI market, as tech firms pour billions into new projects. Some investors have warned that valuations have raced ahead of real-world profits. When asked about those fears, Goto said: "I can't say if we're in an AI bubble or not."

[10]

SoftBank Dumps Entire $5.8B Nvidia Stake to Double Down on OpenAI Bet - Decrypt

"As SoftBank's investment in OpenAI was very large the company had to use its existing assets to finance new investments," CFO Yoshimitsu Goto told reporters. SoftBank Group sold all its shares in Nvidia in October, severing ties with the AI chipmaker that powered the sector's historic rally. The Japanese conglomerate is redirecting capital toward OpenAI, even as the ChatGPT maker faces mounting losses and its CEO's credibility comes under fire. The Tokyo-based firm disclosed the complete exit from Nvidia in its financial filing Tuesday, revealing that it and an asset management subsidiary "sold all of Nvidia Corporation shares that they had owned, for $5.83 billion." The move came alongside a $9.17 billion partial sale of its T-Mobile stake, part of an "asset monetization" to fund a $40 billion investment in OpenAI by year-end. The sale comes as Wall Street questions whether AI infrastructure spending will pay off and as OpenAI CEO Sam Altman faces scrutiny for publicly denying he sought federal loan guarantees just days after his company explicitly requested them in a letter to the White House. SoftBank's Vision Fund posted a blowout investment gain of $23.4 billion (¥3.54 trillion) for the quarter, $14.3 billion (¥2.16 trillion) of which came from marking up its OpenAI holdings to a pre-money valuation of $260 billion. The gains helped the company more than double net income to $19.3 billion (¥2.924 trillion), up 190.9% from the previous year. The Nvidia sale marks SoftBank's second exit from the chipmaker, after an initial $4 billion stake bought in 2017 and sold in early 2019. The group later re-entered before offloading its position again in October. To finance its OpenAI investment, SoftBank issued $4.1 billion (¥620 billion) in yen bonds, $4.2 billion in foreign debt, and arranged bridge loans of $8.5 billion for OpenAI and $6.5 billion for ABB Robotics. "As SoftBank's investment in OpenAI was very large the company had to use its existing assets to finance new investments," the firm's Chief Financial Officer Yoshimitsu Goto said in a press briefing, as cited in a CNBC report. SoftBank agreed on March 31 to invest up to $40 billion in OpenAI, with $30 billion of its own capital, with $10 billion funded in April and $22.5 billion set for December, according to the filing. The robotics acquisition aligns with SoftBank's stated mission to "realize artificial super intelligence (ASI) for the advancement of humanity," focusing on AI chips, robots, data centers, and energy, and investing in leading generative AI firms, according to the filing. SoftBank's sale of its Nvidia stake is a "strong, but hugely unexpected, move away from hardware and toward AI projects and the data that fuels them," Jiahao Sun, CEO of decentralized AI platform FLock.io, told Decrypt. Taiwan Semiconductor Manufacturing Co, Nvidia's main supplier, posted 16.9% revenue growth for October, its slowest pace since February 2024. Short-seller Michael Burry's Scion Asset Management disclosed bearish wagers on Nvidia last week, even as Meta, Alphabet, Amazon and Microsoft plan to collectively spend over $400 billion on AI infrastructure in 2025. Nvidia (NVDA) shares dipped 1.46% in pre-market trading after closing at $199.05, while SoftBank Group (SFTBY), which ended the prior session at $72.40 up 2.74%, was little changed before market open, according to Yahoo Finance data.

[11]

SoftBank just sold its entire $5.83 billion stake in Nvidia but I'm sure it'll all feed back into Team Green's pockets before long

SoftBank is the world's biggest technology investment management group, and it's just pulled its entire $5.83 billion stake out of Nvidia, according to Bloomberg. It has reportedly sold all these shares to help bankroll its continued investments into AI. This was followed by its own share price sliding, but that's only by a few dollars so far, putting the company back to where it was just a few days ago, before a climb after reporting its stellar profits of over $16 billion [PDF warning] yesterday. In other words, SoftBank reported high profits and its share price climbed, then almost immediately dumped its Nvidia stocks, and its price dipped again. Nvidia's share price also dipped a little, too, after SoftBank shed stocks. SoftBank has already said it's attempting to position itself as "the organiser of the industry in the artificial superintelligence era", investing heavily into AI companies, for instance pledging a $40 billion investment into OpenAI earlier in the year. It looks like the company is continuing this push by selling off as much as it can to keep pumping money into AI superscalers and providers. One might initially consider that SoftBank is, in some way, betting against Nvidia. And this, not long after the guy who correctly predicted the World Financial Crisis, placed a $1 billion bet against the chipmaker. The thing is, though, all these companies seem to feed back into each other, so I'm not sure it will ultimately make much difference to Nvidia -- which is still the richest company in the world, by the way, with a market cap of over $4.6 trillion at the time of writing. Any AI provider that SoftBank ends up investing in will almost certainly use Nvidia Blackwell GPUs, so in some ways, this is just an indirect reinvestment into Nvidia. It is, of course, not that straightforward, as purchasing a company's products isn't the same as buying its stocks, but the money is still flowing in Team Green's direction. Many believe that the AI industry is a bubble, and that this bubble may, indeed, burst. And a big part of what contributes to the idea that it's a bubble is this interrelated nature of investment within the industry. That Nvidia might indirectly benefit from SoftBank's diverted investments isn't quite the same as this, though, because that relationship isn't circular in the same way that Nvidia investing in OpenAI and OpenAI buying Nvidia's GPUs is. Whatever the case, I don't think we need to worry about Nvidia. The 'small indie company' joke is overused but very apt, here: the company will be just fine.

[12]

SoftBank ditches Nvidia in favour of deeper drive into AI

SoftBank has exited Nvidia for about €5.4bn and, after reporting a €14bn quarterly profit, said it will redirect capital into AI investments. Japanese multinational investment company SoftBank said it had sold its remaining stake in Nvidia for $5.83 billion (€5bn) as it pivots towards AI investments. SoftBank also reported stronger-than-expected earnings for the three months to 30 September, posting a net profit of ¥2.5 trillion (€14bn), more than double the ¥1.18 trillion (€6.6bn) recorded a year earlier. The jump was fuelled by gains in its Vision Fund portfolio, which benefited from soaring valuations of AI-related firms, suggesting that its renewed focus on artificial intelligence is beginning to pay off after years of uneven returns. Revenue at the Japanese company also grew, helped by improving performance across SoftBank's technology holdings and its telecom unit. It sold off its stake in Nvidia in October bringing an end to its long exposure to the American tech giant, which recently hit a market capitalisation of $5tr (€4.3tr). "We want to provide a lot of investment opportunities for investors, while we can still maintain financial strength," SoftBank's Chief Financial Officer and Senior Managing Director Yoshimitsu Goto said at an investor presentation. "So through those options and tools we make sure that we are ready for funding in a very safe manner," Goto added. This marks the second time SoftBank has offloaded Nvidia shares, a move that comes as a surprise given the chipmaker's status as one of the best-performing US stocks, particularly amid President Trump's drive to ramp up investment in AI-related industries. SoftBank's renewed focus on artificial intelligence may also strike some observers as counterintuitive, coming amid investor concerns of an impending AI bubble burst. By deepening its AI bets just as talk of a potential bubble intensifies, SoftBank is signalling confidence that the current boom still has room to run, even as others brace for a possible correction. "There are various opinions but SoftBank's position is that the risk of not investing is far greater than the risk of investing," Yoshimitsu Goto said at a briefing in Tokyo. It caps a significant year for SoftBank's investment in AI. In March, SoftBank agreed to spearhead a funding round worth up to US$40bn (€34.55bn) for OpenAI with its total investment expected to hit $34.7bn (€30bn) by December, while in February it joined with Open AI and Oracle in announcing an investment of $500bn (€431.9bn) in the Stargate AI infrastructure project. SoftBank's unabashed focus on AI will likely increase investor speculation that it will take a direct stake in OpenAI.

[13]

AI stock boom delivers bumper quarter for Japan's SoftBank

Tokyo (AFP) - Japan's SoftBank Group reported Tuesday that net profit more than doubled in the second quarter thanks to a boom in AI-related share prices that has fuelled fears of a market bubble. The tech investment giant -- a major backer of ChatGPT-maker OpenAI -- logged a net profit of 2.5 trillion yen ($16.2 billion) in July-September, up from 1.2 trillion yen in the same period last year. SoftBank also announced it sold $5.8 billion worth of shares in US chip giant Nvidia last month, after the quarter had ended. The group's earnings often swing dramatically because it invests heavily in tech start-ups and semiconductor firms, whose stocks are volatile. In recent months optimism over the promise of AI technology has sparked a rush of multi-billion-dollar deals -- sending tech shares soaring worldwide. Wall Street's tech-rich Nasdaq index has surged 25 percent since May. But that has fed concerns of a market bubble that could eventually burst, like the dot-com boom that imploded at the turn of the millennium. Fears that AI stock valuations are too high sparked a market sell-off last week. Nvidia, whose chips are used to train and power generative AI systems, recently became the world's first company valued above $5 trillion, though its market cap has since receded to around $4.8 trillion. SoftBank did not give a reason for the Nvidia stock sale in its earnings statement. But Bloomberg News said it could reflect plans by the Japanese company's flamboyant founder Masayoshi Son to boost his own influence in the AI field. Son, 68, believes "artificial superintelligence" is on the horizon, which will herald a technological revolution with new inventions and medicine. He appeared alongside US President Donald Trump at the White House in January when SoftBank teamed up with OpenAI and cloud giant Oracle to lead the $500 billion Stargate project to build AI infrastructure in the United States. By some estimates, OpenAI has signed approximately $1 trillion worth of infrastructure deals in 2025, including a $300 billion Oracle agreement. SoftBank stock has "had a strong run" itself, said a Jefferies equity research published last month. "The recent surge appears to be driven by excitement around its exposure to OpenAI," it said. The firm has soared more than 140 percent so far in 2025. But Jefferies also listed some reasons for caution. "While OpenAI has strong consumer visibility, its share in (the) enterprise market is tiny. Its transition from non-profit to for-profit remains unresolved, and its relationship with Microsoft is still evolving," the note said. And "the competitive landscape is intense, with Google, Anthropic, Grok, and others investing heavily". SoftBank said last month it would buy Swiss-Swedish firm ABB Robotics for nearly $5.4 billion as part of its plans to develop so-called physical AI.

[14]

SoftBank offloads $5.8B stake in Nvidia to free up cash for OpenAI investment - SiliconANGLE

SoftBank offloads $5.8B stake in Nvidia to free up cash for OpenAI investment SoftBank Group Corp. has sold its entire remaining stake in Nvidia Corp. in order to raise funds for its promised $22.5 billion investment in ChatGPT maker OpenAI Group PBC. The Japanese company said in its latest financial earnings report that it sold all 32.1 million shares it held in Nvidia last month, raising $5.83 billion. It also offloaded part of its stake in the wireless carrier T-Mobile USA Inc. for $9.17 billion. The sale, along with money raised from a recent margin loan on SoftBank's holding in the British chip designer Arm Holdings Plc, will help provide much needed cash for the company's commitment to OpenAI, which was made earlier this year. SoftBank Chief Financial Officer Yoshimitsu Goto told investors during a presentation that the company wants to provide lots of investment opportunities while still maintaining financial strength. "So through those options and tools we make sure that we are ready for funding in a very safe manner," he said, adding that the sales were part of the company's "asset monetization" strategy. Contrary to some reports that the sale means SoftBank is going "all-in" on OpenAI, that's not really the case, for SoftBank still has plenty of other investments besides the artificial intelligence company, including its stakes in Arm and Ampere Computing LLC, which it acquired for $6.5 billion earlier this year. It's also said to be negotiating an investment in ABB Group's robotics unit. Rolf Bulk, a research analyst at New Street Research, told CNBC that the sale doesn't necessarily mean SoftBank has taken a negative stance on Nvidia or the broader artificial intelligence industry. "It should be seen in the context of SoftBank needing at least $30.5 billion in capital for investments in the Oct-Dec quarter, including OpenAI and Ampere," he said. "That amounts to more in a single quarter than it has invested in aggregate than over the two prior years combined." In any case, SoftBank's fortunes are entwined with those of the AI industry for the foreseeable future, for it's tied up in a number of ventures focused on building the infrastructure required by companies like OpenAI. For instance, it's one of the biggest backers of OpenAI's $500 billion Stargate initiative, which aims to build multiple data centers in the U.S. over the next few years. It has also invested in a number of startups across the AI supply chain through its technology focused Vision Fund. "The reason we were able to have this result is because of September last year, that was the first time we invested in OpenAI," Goto said. SoftBank's stake in OpenAI is significant. In the wake of that last month's recapitalization and OpenAI's latest valuation of $500 billion, the additional $22.5 billion investment will see its ownership of the company rise from 4% to 11%. The company could yet increase its stake in OpenAI further, depending on its future performance and the valuation of future investment rounds, according to an anonymous source familiar with its dealings told CNBC. However, the source said SoftBank probably wouldn't go beyond a 40% equity ownership, as that would amount to a controlling stake in the company, which is something it tends to avoid, the person said. The decision by SoftBank to sell off its stake in Nvidia may have surprised some investors, but it's not without precedent. In fact, it's the second time the Japanese company has opted to do this. SoftBank first invested in Nvidia back in May 2017 via its Vision Fund, and reportedly amassed a $4 billion stake in the chipmaker before offloading everything in January 2019. However, it later reinvested in the company prior to the beginning of the current AI boom, benefitting from substantial gains as a result of Nvidia's rampant growth in the last three years. The chipmaker's market capitalization currently stands at $5.03 trillion, making it the world's most valuable publicly traded company.

[15]

Why did SoftBank sell off its Nvidia stake?

The bad vibes were muted somewhat by news of what SoftBank says it will do with the proceeds of the sell off, along with those from the sale of some of its $9.17 billion T-Mobile stake: The firm will double down on another big bet in the AI space-OpenAI. SoftBank expects to directly invest $30 billion in OpenAI this year, according to its second-quarter financial statement in September. And it had already committed $19 billion to the $500 billion Project Stargate infrastructure initiative (with OpenAI and Oracle). To bankroll these commitments, Masayoshi Son, SoftBank's CEO, likely needed to free up funds. Hence the Nvidia sell-off.

[16]

Softbank sells off entire Nvidia stake for 'all in' OpenAI bet

This is not the first time Softbank has cashed out on Nvidia shares. Japanese investment giant Softbank has sold all of its 31.2m Nvidia shares for around $5.8bn as the company makes an "all in" bet on OpenAI. The company also sold 40.2m T-mobile shares for $9.17bn between June and September, in addition to partially selling the shares of T-mobile's parent company Deutsche Telekom, generating $2.37bn in proceeds. This is not the first time the company has cashed out on Nvidia. In 2017, reports emerged that Softbank had "quietly" amassed a $4bn stake in the chipmaker, before selling off all of its holdings for $3.6bn in 2019. Nvidia, at the time, was seeing its share prices nearly halving in the months leading up to the sale. Although this time Nvidia is at its strongest position ever, playing a key role as the premier AI chip provider for major businesses worldwide, including OpenAI. The US company quickly jumped a $1trn valuation in 2023, becoming the first company in history to reach a market value of $5trn last month, a little more than two years later. Softbank, however, is placing its bets on OpenAI and Arm for its growth. Since the start of this fiscal year, the investment group's market cap has increased by about three times, reaching a record high in October. "OpenAI is one of our key growth drivers," said company chief financial officer Yoshimitsu Goto in the earnings call today (11 November). Softbank is also a part of a $500bn joint venture with OpenAI called Stargate. The AI giant switched up its corporate structure recently, a key requirement if it were to tap additional funding from Softbank. Softbank's Vision Fund 2 is now gearing to make an additional $22.5bn investment into OpenAI at a $260bn pre-money valuation, the company's financial reports revealed. "Together, Arm and OpenAI are powering SoftBank Group toward our goal of becoming the number one platform provider for the artificial superintelligence era," Goto added. In a comment to CNBC, Rolf Bulk, an equity research analyst at New Street Research said, "This [the share sell-off] should not be seen, in our view, as a cautious or negative stance on Nvidia, but rather in the context of SoftBank needing at least $30.5bn of capital for investments in the October-December quarter, including $22.5bn for OpenAI". Don't miss out on the knowledge you need to succeed. Sign up for the Daily Brief, Silicon Republic's digest of need-to-know sci-tech news.

[17]

Masayoshi Son trades Nvidia profits for a $30B AI spending spree

SoftBank founder Masayoshi Son divested the company's entire $5.8 billion Nvidia stake on Tuesday to focus on artificial intelligence investments. Son's career includes significant market events, such as his net worth reaching approximately $78 billion by February 2000 during the dot-com bubble. He subsequently experienced a $70 billion personal loss as SoftBank's market capitalization fell 98% from $180 billion to $2.5 billion. In 2000, Son made a $20 million investment in Alibaba, a stake that grew to $150 billion by 2020. In 2017, to establish his first Vision Fund, Son secured $45 billion from Saudi Arabia's Public Investment Fund. Following the murder of journalist Jamal Khashoggi in October 2018, Son condemned the act but maintained SoftBank's commitment to managing the kingdom's capital, subsequently increasing deal-making. Subsequent investments faced challenges. A bet on Uber resulted in paper losses for years. SoftBank also invested in WeWork, valuing it at $47 billion in early 2019. WeWork's IPO plans collapsed after a filed S-1 document, leading to $11.5 billion in equity losses and $2.2 billion in debt for SoftBank. Son reportedly referred to this as "a stain on my life." SoftBank's latest move involves selling all 32.1 million Nvidia shares. The capital will support a planned $30 billion commitment to OpenAI and potential participation in a $1 trillion AI manufacturing hub in Arizona. The shares were sold at approximately $181.58 per share, which is 14% below Nvidia's all-time high of $212.19. This marks SoftBank's second complete exit from Nvidia. A previous sale in 2019 involved a $4 billion stake for $3.6 billion; those shares would now be valued at over $150 billion. Nvidia shares decreased by nearly 3% after the disclosure. Analysts note the sale reflects SoftBank's capital needs for AI initiatives rather than a negative outlook on Nvidia.

[18]

SoftBank Just Sold Its Entire Nvidia Stake to Bet Big on OpenAI

"OpenAI is one of our key growth drivers. The fair value of our OpenAI investment rose sharply, reflecting the latest transaction valuation," said SoftBank's CFO Yoshimitsu Goto in a video to investors. SoftBank invested $10 billion in OpenAI earlier this year, as a part of a $40 billion commitment. Out of that, $7.5 billion was invested through SoftBank's Vision Fund 2 and $2.5 billion through co-investors. Goto said that after OpenAI addressed its "long term structure," by the end of 2025 SoftBank will invest an additional $22.5 billion in the company. Goto is referring to OpenAI's long-awaited restructuring, which was approved at the end of October. The restructuring splits OpenAI into two separate organizations, the OpenAI Foundation, which is the nonprofit entity, and OpenAI Group, the company's for-profit entity which has been restructured as a public benefit corporation. OpenAI's previous for-profit corporate structure capped investors' potential returns at 100 times their investment, with any additional revenue owned by the nonprofit. This is no longer the case, though the nonprofit currently owns a controlling share in OpenAI Group. OpenAI's nonprofit and for-profit entities have long had tensions. The company was initially founded as a nonprofit with the mission of producing artificial intelligence that will benefit all of humanity. But in order to attract outside investors, it spun out a for-profit arm in 2019. That tension came to a head in 2023 when the nonprofit board ousted Sam Altman with the explanation that he was no longer accountable to the board. But after investor pressure, Altman was reinstated and the process of restructuring OpenAI as a for-profit entity ensued. The new restructuring gave the OpenAI Foundation a 26 percent equity stake in OpenAI.

[19]

SoftBank announces it has sold its Nvidia shares for $5.8 billion

Japan's SoftBank Group Corp. sold the shares in October, reflecting a shift in focus to OpenAI. Japanese technology giant SoftBank said Tuesday it has sold its stake in Nvidia, raising $5.8 billion to pour into other investments. It also reported its profit nearly tripled in the first half of this fiscal year from a year earlier. Tokyo-based SoftBank Group Corp. said it sold the stake in Silicon Vally-based Nvidia in October, a move that reflects its shift in focus to OpenAI, owner of the artificial intelligence chatbot ChatGPT. SoftBank reported its profit in April-September soared to about 2.5 trillion yen (about $13 billion). Its sales for the six month period rose 7.7% year-on-year to 3.7 trillion yen ($24 billion), it said. The company's fortunes tend to fluctuate because it invests in a range of ventures, including through its tech-focused Vision Funds. Those recently have paid off. In February, SoftBank's chairman Masayoshi Son joined Trump, Sam Altman of OpenAI and Larry Ellison of Oracle in announcing a major investment of up to $500 billion in a project to develop artificial intelligence called Stargate. SoftBank has invested tens of billions of dollars in OpenAI. The two companies also plan to provide AI services in Japan. Selling SoftBank's stake in Nvidia reflects Son's shift in strategy and also nets his company a healthy profit thanks to the recent runup in Nvidia's market value. Nvidia recently become the first $5 trillion company, just three months after it broke through the $4 trillion barrier. It plans a $100 billion investment in OpenAI as part of a partnership that will add at least 10 gigawatts of Nvidia AI data centers to ramp up OpenAI's computing power. The chip maker and other winners in the frenzy around artificial-intelligence technology have been driving much of this year's rally in share prices. Critics say stock prices of the tech giants have soared too high and too fast in the mania around AI, drawing comparisons to the 2000 dot-com bubble that ultimately burst. SoftBank and Nvidia still have strong relations since various ventures that SoftBank invests in use Nvidia technology. SoftBank also has investments in Arm Holdings and Taiwan Semiconductor Manufacturing Co., computer chip makers that like Nvidia are benefitting greatly from the growth of AI. SoftBank stocks have nearly doubled in value in the past year. They gained nearly 2% Tuesday. Nvidia's shares fell 1.3% in premarket trading early Tuesday. They jumped 5.8% on Monday.

[20]

The why behind SoftBank's Nvidia stake sale

The acquisition aligns with SoftBank's ownership of Arm, creating a vertically integrated chip ecosystem. SoftBank has sold its entire $5.83 billion Nvidia stake, a move that isn't a retreat from AI but a massive strategic move. The cash is being used to fund a $6.5 billion all-cash acquisition of a smaller, private AI chip designer: Ampere Computing. The Japanese conglomerate confirmed the sale of 32.1 million Nvidia shares in its Tuesday earnings statement. While the sale helped SoftBank post a blowout $19 billion gain for its Vision Fund, the move is less about profit-taking and more about funding a massive, $30.5 billion spending spree planned for this quarter alone. The $5.83 billion from the chipmaker, combined with a separate $9.17 billion T-Mobile stake sale, provides the capital for a new, aggressive phase in CEO Masayoshi Son's AI ambitions. "We want to provide a lot of investment opportunities for investors, while we can still maintain financial strength," said SoftBank's Chief Financial Officer Yoshimitsu Goto during an investor presentation, reports CNBC. This move is a direct "swap" in strategy. The company is cashing out its passive investment in the current market leader, Nvidia, to acquire a direct competitor. The $6.5 billion Ampere acquisition, which is closing this quarter, signals a massive strategic shift. Instead of just holding stock in an AI company, SoftBank is moving to own the AI infrastructure itself. Ampere is a U.S.-based semiconductor firm that designs high-performance, energy-efficient processors specifically for data centers and AI workloads. The key connection: Ampere's chips are built on the Arm architecture. SoftBank, which owns a majority stake in Arm, is now doubling down on its own ecosystem. By acquiring Ampere, Masayoshi Son is betting that he can build a powerful, vertically integrated alternative to Nvidia's dominant platform. While selling Nvidia -- a stock SoftBank has sold out of twice now -- may look like a mistake to some, Son is playing a different game. He's no longer content to be a passenger in the AI boom; he's using the cash from his former Nvidia stake to try and build the engine.

[21]

SoftBank sinks 10% -- did selling Nvidia to fund a cash furnace just backfire big?

SoftBank Group Corp.'s shares dropped as much as 10% in Tokyo on Wednesday, making investors nervous about its heavy spending on artificial intelligence. On X, ZeroHedge posted: "SOFTBANK SHARES FALL AS MUCH AS 10% Maybe liquidating NVDA to invest in its biggest cash-incinerating client wasn't the best idea." The company sold its entire stake in Nvidia Corp. for $5.83 billion, using the money to fund new AI projects. Many investors, however, are questioning if the massive AI spending will give good returns, as per the report by Bloomberg. SoftBank founder Masayoshi Son is selling old investments to pay for new AI plans, including Stargate data centers with OpenAI and Oracle, and robot manufacturing sites in the US. The sale comes as people debate whether big tech's AI investments -- by firms like Meta and Alphabet, which could top $1 trillion -- will actually pay off in the long run. Nvidia's stock fell 3.9% in US trading, even after climbing 48% earlier this year, showing how investor mood is shifting. SoftBank executives said the sale of Nvidia was just a "necessary financing measure," not because they think Nvidia is overvalued. "I can't say if we're in an AI bubble or not," Chief Financial Officer Yoshimitsu Goto said during the earnings call. He added, SoftBank sold Nvidia "so that the capital can be utilized for our financing", as per the report by Bloomberg. This isn't the first time SoftBank sold Nvidia. It first exited in 2019, bought small stakes again in 2020, and had raised its stake to $3 billion by March this year. Since then, Nvidia's market value jumped by $2 trillion. SoftBank reported a net income of ¥2.5 trillion ($16.2 billion) in its fiscal second quarter, way higher than the analyst estimate of ¥418.2 billion, helped by gains from OpenAI and Nvidia's rally. OpenAI's value rose $14.6 billion since SoftBank invested, according to CFO Goto. This helped lift SoftBank's total profit. Analyst Kirk Boodry from Bloomberg Intelligence said the Nvidia sale shows SoftBank's "access to liquidity as it continues its AI investment program," and predicted its best profit since 2020. Son's AI dream includes a $1 trillion AI manufacturing hub in Arizona and Stargate data centers in collaboration with US tech giants. He has also met Donald Trump and leaders of TSMC and South Korean companies to push his plans. SoftBank even explored buying Marvell Technology Inc. earlier this year and now owns stakes in OpenAI, ByteDance, and Perplexity AI, which boosted its shares by 78% between July and September, its best performance since 2005. The company announced a 4-for-1 stock split effective January 1, to make its shares cheaper and more appealing to Japanese retail investors. SoftBank plans to fully invest $22.5 billion in OpenAI through its Vision Fund 2, removing earlier conditions. It's also buying Ampere Computing for $6.5 billion and ABB's robotics arm for $5.4 billion. The company expanded a margin loan using Arm Holdings shares to $20 billion (from $13.5B), with $11.5B still available. It also secured two bridge loans worth $8.5B each to fund its OpenAI and Ampere deals, as per the Bloomberg report. Finimize Research, in a Smartkarma note, said, "The simple trade was to buy SoftBank for cheap exposure to Arm shares and a broader AI and tech mix. That idea has more than delivered - the stock's more than doubled." But it warned, "Now the discount's mostly closed, so SoftBank isn't a 'cheap' way in anymore. So on that basis, it's likely a good time to sell and take your profits." Q1. Why did SoftBank sell all its Nvidia shares? SoftBank sold its entire Nvidia stake for $5.83 billion to raise money for new artificial intelligence projects, including data centers and robotics. Q2. Why did SoftBank's stock fall 10%? SoftBank's stock dropped 10% as investors worried its huge spending on AI might not bring strong returns soon.

[22]

SoftBank Swaps Nvidia For OpenAI -- Is The Hardware Play Done? - NVIDIA (NASDAQ:NVDA)

SoftBank (OTCPK:SFTBY) just made one of the boldest trades in the AI era -- selling $5.8 billion worth of Nvidia Corp (NASDAQ:NVDA) shares to fund a $22.5 billion commitment to OpenAI. On paper, it looks like Masayoshi Son is ditching the shovel-maker in the middle of a gold rush. But this may be less a call on Nvidia's ceiling and more a bet that the next big AI boom won't be in GPUs -- it'll be in the software that runs on them. Nvidia, The Hardware King Isn't Falling -- It's Evolving Nvidia remains the undisputed backbone of the AI economy. Its chips still power nearly every large model training run, from OpenAI's GPT series to Anthropic's Claude. Yet even Nvidia seems to sense the plateau coming. The company recently struck a high-profile partnership with Palantir Technologies Inc (NASDAQ:PLTR) to co-develop AI-driven software infrastructure -- a move designed to capture value beyond silicon. The Nvidia-Palantir alliance could be the fastest route to a $500 billion AI software business. And, Nvidia isn't waiting for hardware demand to cool; it's already laying claim to the layer above. Related: Palantir Could Be Nvidia's Fastest Route To $500 Billion In AI Software -- Cathie Wood Saw It Coming SoftBank's Bet: From Builders To Thinkers By contrast, SoftBank's pivot from Nvidia to OpenAI signals a sharper swing -- away from those who build AI tools toward those who teach them to think. Son's move comes at a time when AI hardware rivals are mushrooming, each claiming to be "the next Nvidia." But none have matched its moat of CUDA software, ecosystem lock-in, and developer dominance. Selling Nvidia, in that context, isn't a statement of doubt -- it's desperation to fund Son's new obsession: OpenAI. Read Also: OpenAI's Tesla Playbook: Big Revenue, Zero Profit, All Vision From Chips To Chatbots: The Great AI Rotation Nvidia still makes the picks and shovels of the AI age. OpenAI makes the gold -- if it ever strikes it profitably. For investors, the choice between the two boils down to timing: Nvidia is the cash engine of AI today, OpenAI the optionality of AI tomorrow. Son has made his pick. The market will decide whether he just sold stability for speculation, or hardware for the future of intelligence. Read Next: Nvidia Stock Is Sailing Into A Sweet Spot -- And The Street's Just Taking Notice Photo: Shutterstock NVDANVIDIA Corp$195.621.27%OverviewPLTRPalantir Technologies Inc$191.800.44%SFTBYSoftBank Group CorpNot Available-%Market News and Data brought to you by Benzinga APIs

[23]

SoftBank sells Nvidia stake for $5.8 billion to fund AI bets

SoftBank Group sold its entire stake in Nvidia for $5.83 billion to help bankroll artificial intelligence investments, even as investors question the amount of capital pouring into a technology with uncertain returns. Founder Masayoshi Son has been unwinding positions to pay for a plethora of AI projects, from Stargate data centers with OpenAI and Oracle to robot manufacturing sites in the United States. The Nvidia exit coincides with a growing debate about whether spending by big tech firms like Meta Platforms and Alphabet -- expected to surpass $1 trillion in coming years -- will produce commensurate returns. SoftBank's stock slid more than 10% in Tokyo on Wednesday, highlighting how investors remain nervous about lofty tech valuations. Nvidia's shares slid as much as 3.9% in U.S. trading, after climbing 48% this year through Monday's close.

[24]

Why Did SoftBank Just Sell Its Entire Nvidia Stake?

SoftBank divested entirely from Nvidia to make room for other AI investments. SoftBank Group (SFTBF +1.06%) this week revealed it sold its entire Nvidia (NVDA +1.77%) stake in October, some 32.1 million shares for a total of $5.83 billion. SoftBank is a Japanese holding company that focuses on investment management. It invests in public and private businesses through its venture capital funds. The company's Vision Fund is the world's largest venture capital fund focused on technology. And as of the end of September, Nvidia accounted for 19.3% of SoftBank's portfolio. SoftBank CFO Yoshimitsu Goto said the October sale had nothing to do with Nvidia itself. Instead, the company made several large divestments in the quarter, including the sale of $9.2 billion in shares of T-Mobile US, to raise money for other artificial intelligence (AI)-related investments. SoftBank has new AI investment needs SoftBank began acquiring its stake in Nvidia back in 2020, before the rollout of OpenAI's ChatGPT started the price rally in shares of Nvidia and other AI-related companies. Share prices of Nvidia are up 1,339% over the past five years. And now SoftBank is apparently moving on. SoftBank's financial filing said the company entered an agreement with OpenAI in March to invest an additional $30 billion in the company. "This year our investment in OpenAI is large -- more than $30 billion needs to be made -- so for that we do need to divest our existing portfolios," said Goto. OpenAI is looking to develop human-level AI, also known as artificial general intelligence. The company owns ChatGPT, which has over 800 million weekly active users. SoftBank is all in on AI SoftBank founder, chairman, and CEO Masayoshi Son is going all in on AI. He says in a message on the company website that SoftBank's ultimate mission is "the evolution of humanity," and that the mission "will be accomplished through the realization of artificial super intelligence (ASI) -- AI that is ten thousand times more intelligent than human wisdom." To that end, the holding company is heavily invested in AI companies. In addition to OpenAI, it owns stakes in China's ByteDance, another leader in AI technologies, and Perplexity AI, a rival to OpenAI, plus many other AI-related investments. Son's investments in AI have paid off in a big way. His net worth soared more than 240% this year, to $55 billion, which makes him Japan's wealthiest person. Despite Goto's reassurance that the large divestment had nothing to do with Nvidia itself, shares of the AI chipmaker fell 3% during the day of the SoftBank announcement. SoftBank's share price climbed about 3.6% the day of the announcement regarding its Nvidia shares. The stock price is up 129% so far in 2025.

[25]

SoftBank tanks 10% after $5.8-bn Nvidia stock sale

SoftBank has sold its entire stake in chip giant Nvidia for $5.8 billion. This move aims to generate cash for significant artificial intelligence investments. These include the ambitious US megaproject Stargate. SoftBank is a key investor in OpenAI, the creator of ChatGPT. The company reported a substantial profit increase in its latest quarter. Shares in SoftBank Group plunged as much as 10 percent on Wednesday after the Japanese tech investor said it had sold all its stock in US chip titan Nvidia for $5.8 billion. Analysts said the move was to free up cash to pay for massive investments in AI promised by SoftBank's charismatic founder Masayoshi Son, including in US megaproject Stargate. Shares in Nvidia, whose cutting-edge processors are used to train and run artificial intelligence models, fell three percent in New York. Optimism over the promise of AI technology has sparked a rush of multi-billion-dollar deals, sending tech shares soaring. Wall Street's tech-rich Nasdaq index has surged 25 percent since May -- leading to concerns of a market bubble that could burst. "The sale is a sign of Son's desperation to finance his commitment to OpenAI CEO Sam Altman," wrote Martin Peers, at specialist tech news site The Information. SoftBank is a major investor in ChatGPT creator OpenAI. "He is scouring the proverbial cushions on SoftBank's couch for spare change," he said, noting that "the Nvidia stake was, indeed, the equivalent of pennies." SoftBank, OpenAI and cloud giant Oracle are jointly leading the $500 billion Stargate project to build AI infrastructure in the United States announced by President Donald Trump in January. SoftBank's shares were trading down 5.4 percent in mid-morning trade Wednesday, having lost as much as 10 percent soon after the open. The company had reported on Tuesday that net profit more than doubled in the second quarter to a colossal 2.5 trillion yen ($16.2 billion) thanks to booming AI shares. Chief financial officer Yoshimitsu Goto said the decision to sell Nvidia shares was taken "so that the capital can be utilised for our financing", without elaborating, Bloomberg News reported. "I can't say if we're in an AI bubble or not," he said. Mary Pollock of CreditSights noted the "strong business case" for generative AI technology and "OpenAI's unique position in the industry today". But "while the picture today is rosy, the risk that AI valuations are frothy cannot be disregarded", she warned after SoftBank's earnings release. "It is far from certain that confidence in AI's value proposition, the timeline by which revenues are achieved, and investors' expectations for growth all continue to evolve in-step."

[26]

SoftBank Offloads $15 Billion Nvidia And T-Mobile Stakes To Fund AI Push - NVIDIA (NASDAQ:NVDA), SoftBank Group (OTC:SFTBY)

SoftBank Group Corp. (OTCPK: SFTBY) has raised over $15 billion by offloading its high-profile stakes in T-Mobile US Inc. (NASDAQ:TMUS) and Nvidia Corp. (NASDAQ:NVDA), as detailed in its fiscal second-quarter earnings report. SoftBank Sells NVDA, TMUS To Fund AI Push These sales are part of a continued financing initiative for large-scale investments, most notably its massive follow-on commitment to ChatGPT maker OpenAI. The Japanese conglomerate sold its entire stake in U.S. chip designer Nvidia in October. This complete sale of 32.1 million shares, held by both SBG and its asset management subsidiary, fetched about $5.83 billion. During the six months ending Sept. 30, 2025, it also completed a partial sale of its T-Mobile stake. This involved 40.2 million shares and fetched $9.17 billion in proceeds. The earnings report highlights that the company obtained an $8.5 billion bridge loan for the first closing of its OpenAI investment in April 2025. With a second closing for an additional $22.5 billion investment in OpenAI planned for December 2025 and a $6.5 billion bridge loan arranged for the acquisition of Ampere, these multibillion-dollar sales provide critical capital for SoftBank's deepening pivot into artificial intelligence. See also: Japan's SoftBank Shares Dive Nearly 20% This Week As AI Bubble Jitters Rattle Global Tech Stocks Nvidia Soars Over 43% In 2025 NVDA closed 5.79% higher at $199.05 apiece on Monday. However, it fell by 1.58% in premarket on Tuesday. The stock has advanced 43.92% year-to-date, and it has fallen 37.03% over the year. It maintains a stronger price trend over the short, medium, and long terms, with a poor value ranking. Additional performance details, as per Benzinga's Edge Stock Rankings, are available here. TMUS, on the other hand, was 0.79% higher in premarket on Tuesday. The stock has declined 6.22% YTD and 13.62% over the year. T-Mobile maintains a weaker price trend over the short, medium, and long terms, with a solid quality ranking. Additional performance details, as per Benzinga's Edge Stock Rankings, are available here. Read Next: Nvidia Now Larger Than 6 Out Of 11 US Sectors -- Tom Lee Says It's 'Cheaper Than Costco:' AI Stocks Still In 'Really Good Shape' Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Image via Shutterstock NVDANVIDIA Corp$195.72-1.67%OverviewSFTBYSoftBank Group Corp$72.40-%TMUST-Mobile US Inc$208.001.03%Market News and Data brought to you by Benzinga APIs

[27]

SoftBank sells $5.8 billion Nvidia stake, sparking fears of AI market bubble - what investors must know

SoftBank Nvidia stake sale: SoftBank has divested its entire $5.8 billion stake in Nvidia. This move aims to finance Chief Executive Masayoshi Son's ambitious artificial intelligence projects. These include significant investments in OpenAI and the large-scale Stargate initiative. The sale has sparked discussions about the current state of the AI market. Investors are watching these developments closely. SoftBank Nvidia stake sale: SoftBank Group shook stock markets on Tuesday after selling its entire $5.8 billion stake in Nvidia, raising questions about whether the recent AI-fueled frenzy may be cooling, as per a report. The Japanese tech giant offloaded all 32.1 million Nvidia shares it held in October, a move intended to fund CEO Masayoshi Son's ambitious AI initiatives, including his "all-in" bet on OpenAI, the creator of ChatGPT, as reported by Reuters. The sale comes as SoftBank looks to finance major projects, including the $500 billion Stargate initiative aimed at expanding US data-center capacity and up to $40 billion pledged to OpenAI, although financing details were not disclosed, as per the report. ALSO READ: Verizon layoffs: Another major US company planning to sack staff? Here's what reports say Nvidia shares fell more than 2% in early trading, adding pressure to the S&P 500 index. Market jitters were compounded by a revenue forecast cut from AI cloud provider CoreWeave due to a contract delay, sending its stock down 9%, as per the Reuters report. Concerns over a potential AI bubble have been growing in recent weeks. Morgan Stanley and Goldman Sachs CEOs have warned that equities could face a drawdown, while famed short-seller Michael Burry, known for betting against the US housing market before the 2008 crash, has taken short positions in Nvidia and Palantir, according to the report. Some analysts suggested the sale reflects Son's view that the blistering rally that made Nvidia the first $5 trillion company last month may be slowing, despite its 1,200% surge over the past three years, as per the report. However, others noted SoftBank's uneven history with Nvidia. The company famously sold Nvidia shares in 2019 before the AI boom, missing out on a rally worth more than $100 billion, only to repurchase them later, as per the Reuters report. ALSO READ: Italian pasta poised to disappear from American grocery shelves, and here's the big reason for it C.J. Muse, senior managing director at Cantor Fitzgerald, said that, "As for timing, cannot say Masayoshi Son has been great with his trading of Nvidia shares," adding, "It appears simply resource allocation - finding funds to make bets elsewhere," as quoted by Reuters. Alongside Nvidia, SoftBank also sold about $9.2 billion in T-Mobile shares, increasing its war chest to fund AI infrastructure and applications connected to OpenAI, Oracle, and the Stargate project, as per the report. Michael Ashley Schulman, chief investment officer at Running Point Capital Advisors, said that, "By cashing in now, he's securing the capital needed to double down on his conviction in AI applications and the super-scaled infrastructure behind them, OpenAI, Oracle and the Stargate project," as quoted in the report. The heavy focus on OpenAI has drawn SoftBank closer to the startup, which recently restructured to move away from its non-profit roots and is considering a potential $1 trillion public listing next year, as per Reuters. Such a move could be a major windfall for investors, including Microsoft and SoftBank, according to the report. SoftBank's stock has more than doubled this year, increasingly valued based on its exposure to OpenAI. The company's second-quarter net profit also more than doubled, buoyed by the rising valuation of the startup, as per the Reuters report. Despite the optimism, OpenAI has not provided detailed plans on how it intends to fund AI infrastructure deals totaling approximately $1.4 trillion, as per Reuters. It expects to finish the year with $20 billion in annual recurring revenue and has recently revised comments regarding the need for government-backed loans, according to the report. Why did SoftBank sell its Nvidia shares? SoftBank sold all 32.1 million Nvidia shares to fund CEO Masayoshi Son's AI projects, including investments in OpenAI and the Stargate initiative. Why are investors worried about an AI bubble? Concerns have grown after warnings from Wall Street CEOs and short positions by investors like Michael Burry, suggesting AI stocks might be overvalued. (You can now subscribe to our Economic Times WhatsApp channel)

[28]

SoftBank Sells $5.8B NVIDIA Stake to Invest in OpenAI and AI Infrastructure

NVIDIA Shares Fall 1.1% After SoftBank Sells its $5.8B Stake, but Market Cap Stays at $4.8T SoftBank Group Corp. disclosed in early November that it had sold its entire holding in NVIDIA, shedding around 32.1 million shares for approximately $5.83 billion. The Tokyo‑based conglomerate had built a stake of about $3 billion in NVIDIA by March 2025 and previously exited a similar investment in January 2019 before re‑entering. SoftBank said the latest exit supports a portfolio shift toward large-scale , including a planned $30 billion investment in OpenAI and participation in a $1 trillion AI manufacturing hub in Arizona. The divestment contributed to SoftBank's fiscal second‑quarter net income of ¥2.5 trillion ($16.2 billion), significantly above analyst expectations. Masayoshi Son, SoftBank's founder, is redirecting capital into infrastructure projects such as the Stargate data center rollout and exploring partnerships with chipmakers like Taiwan Semiconductor Manufacturing Co. to expand AI production. The company has also considered acquisitions of chip designers, including Marvell Technology and Ampere Computing, as part of a broader plan to control more of the AI hardware stack. SoftBank's Vision Fund was an early NVIDIA investor, purchasing about $4 billion of shares in 2017, but it sold that stake in 2019 before rebuilding and then exiting again.

[29]

Japan's SoftBank says it has sold its shares in Nvidia for US$5.8 billion, turning its focus to OpenAI