TCS Announces $6.5-7 Billion Data Centre Investment to Combat 'Tech Colonisation' and Build AI Infrastructure

2 Sources

2 Sources

[1]

TCS's $7 Billion Data Centre Plan Centres on Enduring Partnerships | AIM

The company said the data centre investment is central to its AI aspirations and will generate committed annuity revenues. In a strategic shift that could secure steady, recurring income rather than one-off project fees, Tata Consultancy Services (TCS) said it expects the contracts linked to its data-centre expansion to be long-term agreements with hyperscalers and AI companies. These will focus on "long-term committed and annuity revenues", even as negotiations remain underway. During an investor interaction titled 'TCS' AI Data Centre Investment and Opportunity' on Friday, chief financial officer Samir Seksaria and chief strategy officer Mangesh Sathe said the initiative reflects the company's plan to build a foundational layer for its broader AI ambitions. The IT services major said this phase is "not a stand-alone investment but a very core part of our overall aspiration". "If we do

[2]

TCS' $6.5 bn bet marks India's push against tech colonisation

Tata Consultancy Services is investing $6.5 billion to bolster its digital capabilities and guard against "tech colonization" as India's digital infrastructure demand surges. The company aims to become the world's largest AI-led services firm, funding this expansion through a mix of equity and debt. Tata Consultancy Services (TCS) has drawn up a $6.5 billion capital expenditure plan that goes beyond simply setting aside risk capital, Times of India reported. The move marks a deeper push to build long-term digital capabilities and potentially guard against what experts call "tech colonisation". As India's digital infrastructure demand surges, companies are turning to private capital to fund new capacity and build resilience in their technology networks. In an interview with ToI, TCS CEO K Krithivasan said the company aims to become "the world's largest AI-led services company." He said the initiative carries "a strong India angle, alongside global opportunities with our existing clients." On funding, Krithivasan said it would be "a mix of equity and debt." He added, "On the equity side, we've partnered with a financial investor, giving us the flexibility and control to shape our growth path and decide who we work with -- resulting in a stronger and more strategic business model." Prateek Jhawar, managing director and head of infrastructure and real assets investment banking at Avendus Capital, said global investment institutions such as Apollo, Blackstone, and CPP Investments are structuring long-tenor debt backed by contracted hyperscaler cash flows. "Recent deals (Digital Realty's $7 billion JV with Blackstone, Aligned's $1.7 billion private credit raise, and EdgeCore's $1.9 billion financing) highlight how bespoke capital stacks are reshaping the ecosystem," he said. "The demand tailwinds are so strong that data centres are now being underwritten more like core infrastructure assets, not just technology real estate." Jhawar said India's total data centre capacity is expected to exceed 2,000 MW in the next two years, which would require an estimated $3.5 billion in additional investment. He added that operators such as AdaniConneX, Yotta Data, and CapitaLand have already raised a cumulative $2 billion to fund hyperscale campuses in Mumbai, Chennai, and Hyderabad. "What's changing is not just the volume of capital, but the nature of it," Jhawar said. "Flexible private credit structures and long-dated infrastructure funds are now competing to anchor Indian digital infrastructure. For investors, this convergence of AI-led demand, predictable cash flows, and hard-asset characteristics is transforming data centres into the defining infrastructure story of the next decade." A report by Barclays projected that India could attract about $19 billion in data centre investments by 2030, up from $12 billion last year. Sanjeev Dasgupta, CEO of CapitaLand Investment India, said India's demand is being fuelled by two key segments -- hyperscalers and large enterprise customers such as banks, financial institutions, and stock exchanges. "Both are growing fast, but hyperscalers are expanding faster due to AI plans in India and other markets," he said. Dasgupta said, "We are building roughly about 245-250 MW of gross load. Our planned capex is about $1 billion, which is being incurred as projects get built." He added that many US and other foreign companies establishing large data centre projects in India are taking two approaches. "Some have bought large land parcels and are going for self-builds, while others are leasing space from existing operators," he said. Ramkumar Ramamoorthy, partner at tech growth advisory firm Catalincs, said this period represents a rare inflection point for Indian technology firms. "With hundreds of billions of dollars tied to opportunities created by structural shifts in technology, this is the moment for companies to reinvest their margin dollars back into their businesses and leap into the future instead of playing by yesterday's rules," he said. Ramamoorthy added, "Following TCS' footsteps, I hope a consortium of cash-rich companies will invest in building India's much-needed compute, AI, cloud, and cyber infrastructure -- and benefit from it -- rather than leaving this critical task largely to the government. If we don't act now and scale rapidly, we risk missing a generational opportunity and enabling digital colonization -- a future where we remain dependent on others for our technology needs and opportunities."

Share

Share

Copy Link

Tata Consultancy Services unveils a massive $6.5-7 billion data centre expansion plan aimed at establishing India as a global AI hub while preventing technological dependence on foreign entities. The investment focuses on long-term partnerships with hyperscalers and building foundational AI infrastructure.

TCS Unveils Ambitious Data Centre Investment Strategy

Tata Consultancy Services (TCS) has announced a substantial $6.5-7 billion capital expenditure plan focused on data centre expansion, marking one of the largest infrastructure investments by an Indian IT services company

1

2

. The investment represents a strategic shift toward building foundational AI infrastructure capabilities while securing long-term recurring revenue streams.

Source: AIM

During an investor interaction titled 'TCS' AI Data Centre Investment and Opportunity', Chief Financial Officer Samir Seksaria and Chief Strategy Officer Mangesh Sathe emphasized that this initiative is "not a stand-alone investment but a very core part of our overall aspiration"

1

. The company expects contracts linked to its data-centre expansion to be long-term agreements with hyperscalers and AI companies, focusing on "long-term committed and annuity revenues" rather than traditional one-off project fees.Combating Tech Colonisation Through Indigenous Infrastructure

TCS CEO K Krithivasan positioned the investment as part of India's broader push against "tech colonisation," aiming to establish the company as "the world's largest AI-led services company"

2

. The initiative carries "a strong India angle, alongside global opportunities with our existing clients," according to Krithivasan.Ramkumar Ramamoorthy, partner at tech growth advisory firm Catalincs, described this period as "a rare inflection point for Indian technology firms," emphasizing the critical nature of the moment

2

. He warned that without rapid scaling and investment in indigenous infrastructure, India risks "missing a generational opportunity and enabling digital colonization."Funding Structure and Market Dynamics

The massive investment will be funded through "a mix of equity and debt," with TCS partnering with financial investors to maintain flexibility and control over its growth trajectory

2

. This approach allows the company to "shape our growth path and decide who we work with," resulting in what Krithivasan describes as "a stronger and more strategic business model."Prateek Jhawar from Avendus Capital highlighted how global investment institutions like Apollo, Blackstone, and CPP Investments are structuring long-tenor debt backed by contracted hyperscaler cash flows

2

. Recent deals, including Digital Realty's $7 billion joint venture with Blackstone and Aligned's $1.7 billion private credit raise, demonstrate how "bespoke capital stacks are reshaping the ecosystem."Related Stories

India's Data Centre Market Expansion

India's data centre landscape is experiencing unprecedented growth, with total capacity expected to exceed 2,000 MW within the next two years, requiring an estimated $3.5 billion in additional investment . Major operators including AdaniConneX, Yotta Data, and CapitaLand have already raised a cumulative $2 billion to fund hyperscale campuses across Mumbai, Chennai, and Hyderabad.

A Barclays report projects that India could attract approximately $19 billion in data centre investments by 2030, up from $12 billion in the previous year

2

. Sanjeev Dasgupta, CEO of CapitaLand Investment India, identified two key demand segments driving this growth: hyperscalers and large enterprise customers such as banks, financial institutions, and stock exchanges, with hyperscalers expanding faster due to AI implementation plans.References

Summarized by

Navi

Related Stories

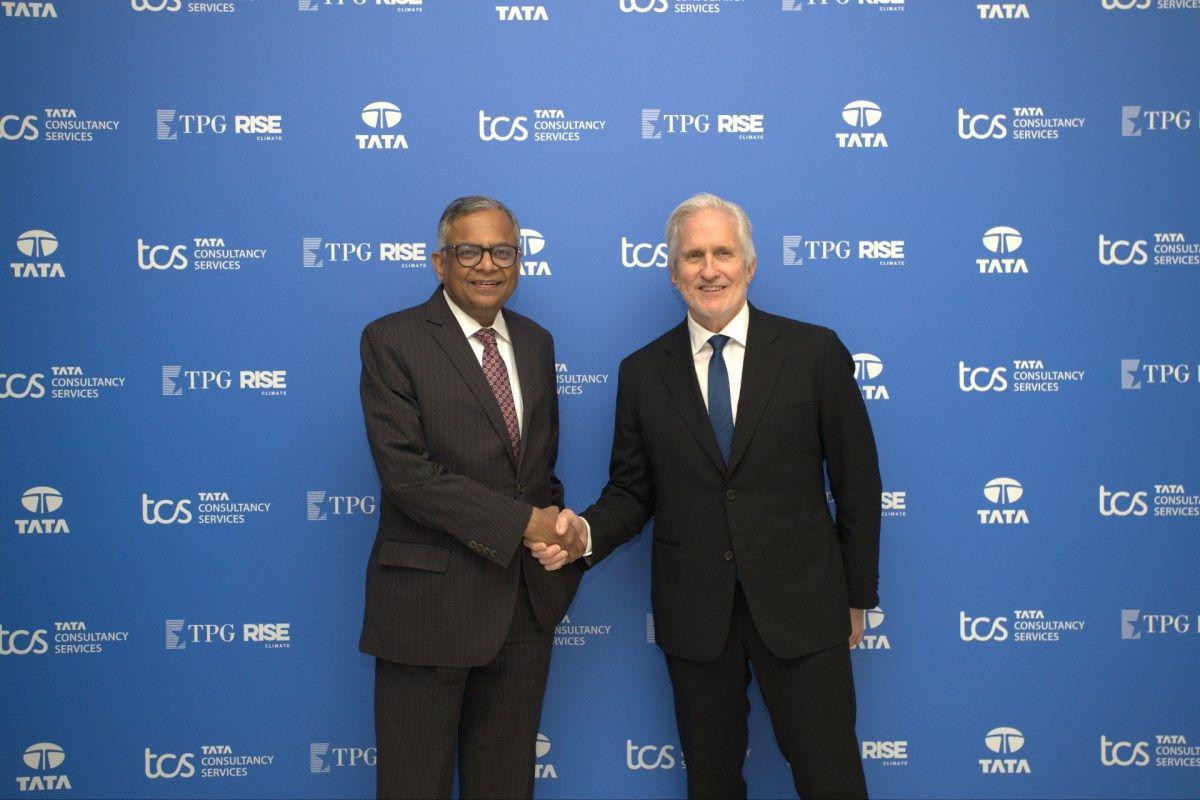

TCS Partners with TPG in $2 Billion AI Data Center Venture to Build India's Digital Infrastructure

20 Nov 2025•Business and Economy

TCS Unveils $6-7 Billion AI Data Centre Initiative, Aims to Become World's Largest AI-Led Tech Services Company

10 Oct 2025•Technology

OpenAI and TCS advance talks on HyperVault partnership to build AI compute infrastructure in India

04 Dec 2025•Business and Economy

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research