Terry Smith's Skepticism on Nvidia: Questioning AI's Financial Future

2 Sources

2 Sources

[1]

Terry Smith Shuns Nvidia Shares on Fears AI Hype Is Overblown

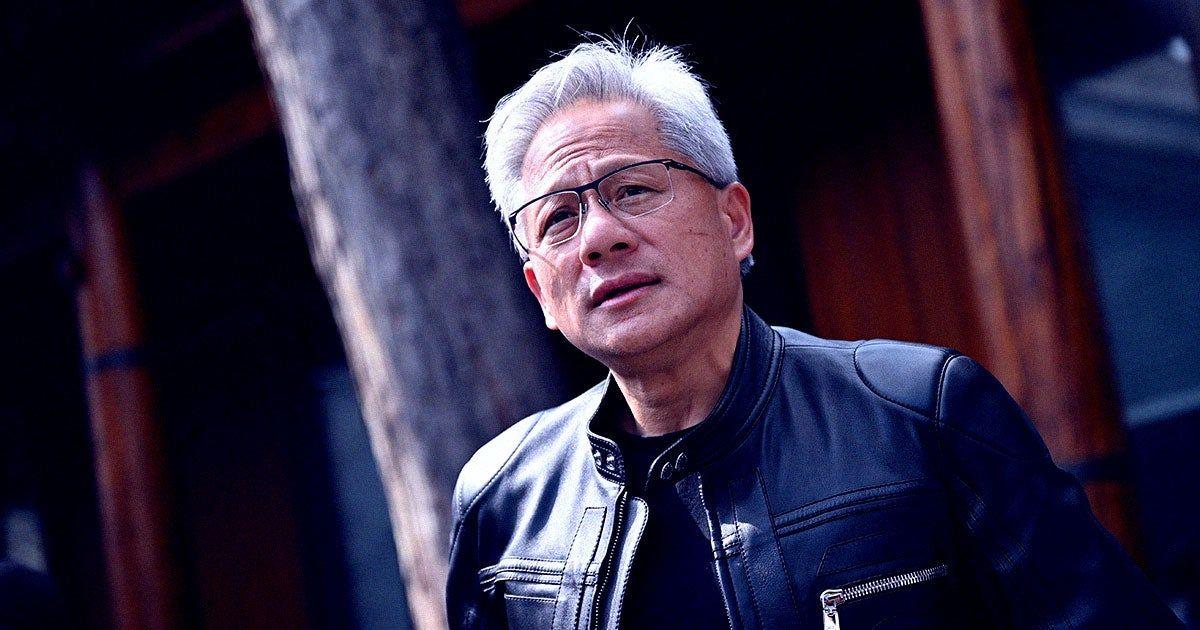

(Bloomberg) -- Nvidia Corp.'s stock has almost tripled this year, and Wall Street analysts are overwhelmingly positive on the chipmaker. But, Terry Smith isn't impressed. The money manager, who's been dubbed by the UK press as Britain's Warren Buffett, is skeptical as he says the world's largest stock lacks a predictable earnings stream and a strong track record of high return on capital. Smith is avoiding the shares even as he acknowledges that such a move undercuts his portfolio's performance. "I'm not confident that we know what the future of AI is because there are almost no applications people are paying for," Smith said in a Nov. 5 interview in Tokyo. "Will they be willing to pay on a sufficient scale and a sufficient price to justify this? Because if not, the suppliers of the chips are going to have a problem." Smith's caution strikes at one of the biggest concerns about the future of the artificial intelligence industry: will the revenue generated by the technology ultimately justify the billions of dollars of investments the firms have plowed in? The doubts contributed to a selloff which erased about $900 billion from Nvidia's market value from a June peak to an August low, although the shares have since rebounded. AI enthusiasts note that Nvidia's biggest customers, including Microsoft Corp. and Alphabet Inc., have pledged to pump more into capital spending after splashing a record $59 billion into data center gear and other fixed assets in the third quarter. Strategists expect the company to record a net profit margin of 56% in the 2025 fiscal year as tech firms continue to boost AI spending to keep up with rivals. But, Smith thinks such hefty margins may not last. "Even if AI is the next big thing and we're going to be paying enough money to justify it, is there just going to be one manufacturer of these chips?" he said. "If you are making fantastic returns, it attracts competition." "In fact, if you look at the people who are the big users of the microprocessors that Nvidia is supplying, such as Microsoft, Amazon and Oracle, they have a history of developing their own," he added. Smith's Fundsmith Equity Fund returned 9% this year in dollar terms, trailing the MSCI World Index of developing-market stocks which has gained almost 20%. The underperformance is due to "concentration of performance amongst a handful of stocks," Smith said, adding that the rising popularity of index funds is fueling this trend. "The popularity of index funds is worrying," he said. "A lot of people call them passive. But they are not passive. They are momentum strategy. And the momentum will last until it doesn't."

[2]

Why One Prominent Investor, 'Britain's Warren Buffett,' Is Staying Away From Nvidia Stock

84% of over 22,000 PC users surveyed in May said they wouldn't pay more for AI hardware. While some strategists say to "buy high, sell higher" on Nvidia stock, Terry Smith is staying away from Nvidia altogether. Smith has been called Britain's Warren Buffett; he manages the £22.8 billion ($29.33 billion) Fundsmith Equity Fund. He has chosen not to invest in Nvidia, the world's largest company with a market cap of over $3.5 trillion at the time of writing because he says consumers haven't shown that they're willing to pay for AI. "I'm not confident that we know what the future of AI is because there are almost no applications people are paying for," Smith told Bloomberg last week. "Will they be willing to pay on a sufficient scale and a sufficient price to justify this? Because if not, the suppliers of the chips are going to have a problem." Related: Nvidia's Immense Market Power Is Worrying Investors -- Here's Why A recent survey shows that people are unwilling to pay extra for AI processors and other hardware: 84% of over 22,000 PC users surveyed in May by TechPowerUp said that they would not pay more for hardware with AI features. Yet another data point shows that users are willing to pay for AI products in some cases. Over 11 million people are opting to pay for ChatGPT; an August report estimates that OpenAI makes an estimated $3.4 billion in annual revenue from ChatGPT subscriptions. Nvidia CEO Jensen Huang has stated that he personally pays for ChatGPT and uses it as a personal tutor. Smith's decision to not invest in Nvidia has caused his fund to miss out on Nvidia's high returns. The Fundsmith Equity Fund saw a 9.3% return between January 1 and June 30; it underperformed compared to the MSCI World Index, which made 12.7% over the same six-month period. Smith said that it was "difficult" to reach the MSCI World Index return without owning Nvidia, but defended his stance to stay away from the stock: "We do not own any Nvidia as we have yet to convince ourselves that its outlook is as predictable as we seek," he wrote at the time. Fundsmith Equity has a stake in other tech stocks, including Apple, Meta, and Microsoft. Related: Nvidia Was Once 30 Days Away From Going Out of Business. Here's Why It Just Overtook Apple to Become the World's Biggest Company. While Smith may have his reasons for not investing in Nvidia, the company remains one of the world's most sought-after AI chip suppliers, with anywhere from 70% to 95% of the AI chip market. Huang spoke recently about the "insane demand" the company faced when it came to its latest Blackwell AI chip. "Everybody wants to have the most, and everybody wants to be first," he stated last month. Nvidia is one of the "Magnificent Seven," a group of tech stocks that also includes, Amazon, Apple, Meta, Microsoft, Google, and Tesla. Nvidia is not only a part of the Magnificent Seven, but many members of the group are also clients: Amazon, Meta, Microsoft, and Google are responsible for more than 40% of Nvidia's revenue.

Share

Share

Copy Link

Terry Smith, a prominent UK investor, expresses doubts about Nvidia's stock value and the future profitability of AI, despite the company's market dominance and Wall Street's optimism.

Terry Smith's Skepticism on Nvidia and AI Hype

Terry Smith, a prominent UK investor dubbed "Britain's Warren Buffett," has taken a contrarian stance on Nvidia, the world's largest chipmaker and a key player in the AI industry. Despite Nvidia's stock nearly tripling in value this year and overwhelming positive sentiment from Wall Street analysts, Smith remains skeptical about the company's long-term prospects

1

.Concerns Over AI's Financial Viability

Smith's primary concern revolves around the uncertain future of AI applications and their ability to generate sufficient revenue. He argues, "I'm not confident that we know what the future of AI is because there are almost no applications people are paying for"

2

. This skepticism is partially supported by a recent survey where 84% of over 22,000 PC users stated they wouldn't pay more for AI hardware2

.Market Dominance and Competition

Nvidia currently holds a dominant position in the AI chip market, with estimates ranging from 70% to 95% market share. The company's CEO, Jensen Huang, has spoken about the "insane demand" for their latest Blackwell AI chip

2

. However, Smith questions the sustainability of Nvidia's hefty profit margins, suggesting that such high returns might attract competition, potentially from their own customers like Microsoft, Amazon, and Oracle1

.Impact on Investment Strategy

Smith's decision to avoid Nvidia stock has affected his Fundsmith Equity Fund's performance. The fund returned 9% this year in dollar terms, trailing behind the MSCI World Index's nearly 20% gain

1

. Smith attributes this underperformance to the concentration of returns among a handful of stocks, including Nvidia.Broader AI Industry Concerns

Smith's skepticism extends beyond Nvidia to the broader AI industry. He questions whether consumers and businesses will be willing to pay sufficiently for AI applications to justify the massive investments being made. This concern is particularly relevant given that tech giants like Microsoft, Alphabet, and others have pledged to increase their capital spending on AI infrastructure

1

.Related Stories

Contrasting Views and Market Realities

While Smith remains cautious, it's worth noting that some AI applications are generating revenue. For instance, over 11 million people are paying for ChatGPT subscriptions, contributing to an estimated $3.4 billion in annual revenue for OpenAI

2

. Additionally, Nvidia's biggest customers, including members of the "Magnificent Seven" tech stocks, are responsible for more than 40% of the company's revenue2

.The Future of AI Investment

As the AI industry continues to evolve, the debate over its long-term financial viability and the valuation of key players like Nvidia is likely to persist. Smith's perspective serves as a counterpoint to the prevailing optimism, highlighting the need for careful consideration of AI's practical applications and revenue potential in investment decisions.

References

Summarized by

Navi

Related Stories

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy