Trump Administration Considers Allowing Nvidia H200 AI Chip Sales to China Amid Trade Détente

16 Sources

16 Sources

[1]

US considering letting Nvidia sell H200 chips to China, sources say

Nov 21 (Reuters) - The Trump administration is considering greenlighting sales of Nvidia's H200 artificial intelligence chips to China, people familiar with the matter said, as a bilateral detente boosts prospects for exports of advanced U.S. technology to China. The Commerce Department, which oversees U.S. export controls, is reviewing the policy of barring sales of such chips to China, the sources said, stressing that plans could change. Sign up here. The White House and the Commerce Department did not immediately respond to requests for comment. The possibility signals a friendlier approach to China, after U.S. President Donald Trump and Chinese leader Xi Jinping brokered a trade and tech war truce in Busan last month. China hawks in Washington are concerned that shipments of more advanced AI chips to China could help Beijing supercharge its military, fears that prompted the Biden administration to set limits on such exports. Reporting by Alexandra Alper in Washington, Karen Freifeld in New York and Juby Babu in Mexico City; Editing by Arun Koyyur and Richard Chang Our Standards: The Thomson Reuters Trust Principles., opens new tab

[2]

Trump might allow Nvidia to sell powerful chips to China: Lutnick

President Donald Trump speaks to reporters after stepping off Air Force One on September 7, 2025 at Joint Base Andrews, Maryland. (Kevin Dietsch/Getty Images) President Donald Trump is deciding whether to allow the AI chipmaker Nvidia to sell advanced computer chips to Beijing, Commerce Secretary Howard Lutnick said Monday. Nvidia CEO Jensen Huang has been lobbying the Trump administration to green-light those chip sales, Lutnick said. At the moment, the firm has ceded its market share in China due to persistent tensions between the U.S. and China that haven't been settled due to the lack of a trade agreement. "He's got Jensen from Nvidia, who really wants to sell those chips, and he's got a good reasons for it," Lutnick said in a CNBC interview. "There's an enormous number of other people who think that that's something that should be deeply considered." The chipmaker Nvidia has been caught in the middle of the U.S.-China trade war. The tech giant is best known for manufacturing the computer chips powering the fleet of AI data centers springing up in the U.S. and other parts of the world. If Trump authorizes the sales, it would represent a significant boost for a major tech company already worth $5 trillion after a robust third quarter earnings season. Nvidia once sold the H20 chip that was specially designed for the Chinese market until the trade war flared up this year. It's an inferior version compared to its series of Blackwell chips, among the most advanced in production today. Bloomberg News reported on Friday that U.S. officials were discussing the possibility of allowing Nvidia to sell another chip to China, the H200. Lutnick said Trump is weighing the trade-offs between safeguarding national security or boosting the U.S. economy. "That is the question, it's in front of the president," he said. The Biden administration was first in restricting U.S. companies from selling semiconductors to prevent China from gaining an edge in the global race for AI supremacy. Trump kept those policies at the start of his second term, a move supported by nationals security hawks in both the Republican and Democratic parties. The president, though, unwinded part of those restrictions in July when he signed off on an extraordinary agreement with Nvidia and AMD, another chipmaker, to hand over 15% of the revenue of H20 chip sales in China to the federal government. The Chinese government responded by discouraging state-owned companies from purchasing or otherwise relying on Nvidia's chips. Huang, who has been closely aligned with Trump, has since said the company hasn't sold any of its products or equipment in China.

[3]

Trump weighing advanced Nvidia chip sales to China: Report - The Economic Times

US President Donald Trump is weighing whether to allow Nvidia to sell advanced artificial intelligence chips to China, Commerce Secretary Howard Lutnick said in an interview to Bloomberg News on Monday. The president is consulting "lots of different advisers" in deciding on the potential exports, the report said quoting Lutnick as saying. This follows media reports on Friday detailing early discussions among US officials regarding the sale of Nvidia's H200 AI chips to China. The White House and Nvidia did not immediately respond to Reuters' requests for comment.

[4]

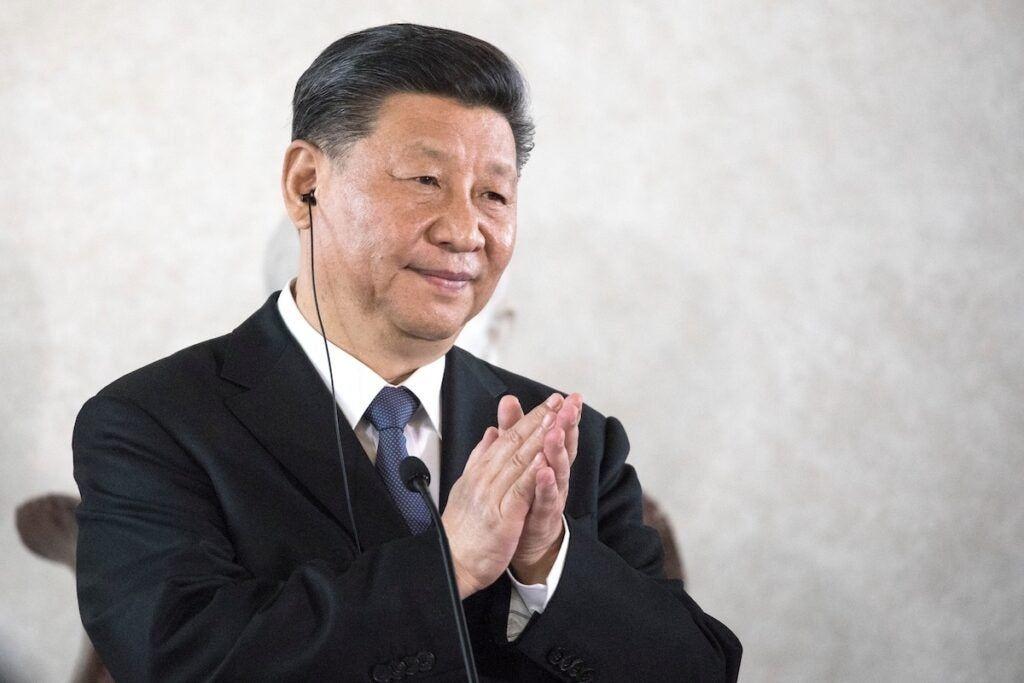

Xi Jinping Says US-China Trade Relations Maintain Positive Momentum As Trump Considers Allowing Nvidia AI Chip Sales To Beijing - NVIDIA (NASDAQ:NVDA)

On Monday, Chinese President Xi Jinping highlighted the ongoing progress in U.S.-China trade ties after a phone call with President Donald Trump. This comes after it was reported that Washington is considering allowing Nvidia Corp (NASDAQ:NVDA) to resume AI chip sales to China. Xi Jinping Highlights Positive Trade Momentum During Monday's call, Xi told Trump that US-China trade relations have maintained a positive momentum and stressed that both nations should expand their list of cooperation, according to China's Ministry of Foreign Affairs. The phone call, not previously disclosed, follows a framework agreement reached by the two leaders in South Korea in October, aiming to ease lingering trade tensions. See Also: Kevin O'Leary Says America Could Lose The AI Race To China Over One Crucial Factor -- Highlights Canada's $70B AI Megaproject As World's Largest Trump Praises Relationship And Trade Progress Taking to Truth Social, Trump described the call as "very good" and said it covered a wide range of topics, including Ukraine/Russia, fentanyl and U.S. farm products such as soybeans. He highlighted that the conversation was a follow-up to the South Korea meeting, adding, "Our relationship with China is extremely strong! ... We agreed that it is important that we communicate often, which I look forward to doing." Trump also said that he would visit Beijing in April at Xi's invitation and had extended an invitation to Xi for a U.S. state visit later this year. The South Korea framework, agreed on Oct. 30, included Washington's commitment to avoid imposing 100% tariffs on Chinese imports and Beijing's promise to hold off on export licensing restrictions for crucial rare earth minerals. Nvidia Could Reenter The Chinese Market This came after it was reported that the Trump administration is considering allowing Nvidia to resume sales of its high-end H200 AI chips to China. The Commerce Department is reviewing previous restrictions that blocked these exports due to national security concerns. Nvidia CEO Jensen Huang previously said the company's China business had collapsed, with its market share plunging from 95% to zero under the export bans, calling the situation not ideal for anyone. According to Benzinga's Edge Stock Rankings, Nvidia continues to post strong Momentum, Growth and Quality scores, maintaining a solid long-term uptrend despite recent short and mid-term dips. Click here to see how it stacks up against peers and rivals. Read Next: After Google's $2.7B Acquisition Of Founders And Staff, This AI Startup Abandons Large Language Model Plans And Shifts Focus Away From Chatbots Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors. Photo Courtesy: Alessia Pierdomenico on Shutterstock.com NVDANVIDIA Corp$179.81-1.50%OverviewMarket News and Data brought to you by Benzinga APIs

[5]

U.S. mulls letting Nvidia sell H200 chips to China, sources say

U.S. President Donald Trump's administration is considering greenlighting sales of Nvidia's H200 artificial intelligence chips to China, people familiar with the matter said, as a bilateral detente boosts prospects for exports of advanced U.S. technology to China. The Commerce Department, which oversees U.S. export controls, is reviewing a change to its policy of barring sales of such chips to China, the sources said, stressing that plans could change. A White House official declined to comment but said, "The administration is committed to securing America's global technology leadership and safeguarding our national security."

[6]

Good News for Nvidia Investors

Media reports suggest the White House is urging lawmakers to kill a pending bill in Congress that would increase export curbs on U.S.-made semiconductors. The artificial intelligence (AI) chip giant Nvidia (NVDA 5.53%) just reported a strong quarter of earnings and guided for higher revenue in the current quarter than Wall Street analysts had been modeling. That's with management excluding any potential revenue from China, which has previously been a significant market for Nvidia. Geopolitical tensions between the U.S. and China, including tariffs and chip export curbs imposed by the U.S. government, have stalled the business in the country, which could be a material contributor to overall revenue if it gets back on track. While U.S.-China trade relations are far from settled, Nvidia investors recently got some good news on this front. White House potentially softening on Nvidia export curbs Recently, Bloomberg, along with other major outlets such as Axios, reported that the White House is urging Congress to vote against a bill that would further restrict Nvidia's chip exports to China. The Guaranteeing Access and Innovation for National Artificial Intelligence Act (GAIN AI Act) would require U.S. chip companies, such as Nvidia, to prioritize U.S. sales for graphics processing units (GPUs) before being able to sell them abroad to businesses in China. According to Bloomberg, the law is written in a way that would make it difficult for Nvidia to sell its most innovative chips to China. Nvidia has publicly called the law unnecessary. "We never deprive American customers in order to serve the rest of the world ... In trying to solve a problem that does not exist, the proposed bill would restrict competition worldwide in any industry that uses mainstream computing chips," a Nvidia spokesperson said back in September. Restricting China's access to Nvidia's most advanced chips has garnered somewhat bipartisan support, and President Joe Biden's administration also took steps in this direction. Nvidia's CEO Jensen Huang has previously argued that doing so will only hurt U.S. chipmakers' competitive advantage and open the door for China to catch up. President Donald Trump and the White House have been back and forth on Nvidia and China. Earlier this year, the administration required Nvidia to obtain an export license to sell certain chips to China, forcing the company to take a $5.5 billion charge. However, since then, Huang has become more active in Washington and has lobbied Trump to roll back some of the restrictions. Several months ago, it looked as though Nvidia would be able to sell a range of its chips to China if it gave the government a portion of the proceeds. The recent media reports are good news for Nvidia, as they suggest the administration is continuing to soften its stance regarding Nvidia's chip sales to China. The bill was initially part of the National Defense Authorization Act (NDAA) as an amendment, but now a group of senators has introduced it as a separate bill, so there will be a reconciliation process at some point. Opening China would be huge for Nvidia As I mentioned earlier, Nvidia is not incorporating China sales into its revenue outlook for the current quarter. Meanwhile, Nvidia's CFO Colette Kress noted on the company's recent earnings call that "sizable purchase orders never materialized in the quarter due to geopolitical issues and the increasingly competitive market in China." Yet the company still beat earnings estimates and guided for higher revenue in the current quarter than analysts modeled. At this point, I don't think Wall Street will factor in any China sales until there is more clarity on the geopolitical front. But if this market opens up, Nvidia is going to generate significantly higher revenue. Last quarter, Huang said he thinks the opportunity in China this year would have been $50 billion, a number he expects to grow by 50% next year. In Nvidia's fiscal year 2026, which ends in late January, Wall Street analysts are projecting $208 billion in revenue, so China's contribution could significantly boost those estimates. Now, it's unclear if and when Nvidia will be able to fully capitalize on the China opportunity, as there are other export restrictions beyond the GAIN AI Act. However, Trump carries considerable influence in Congress, so if Nvidia can persuade him to soften his stance on export curbs, the company will be off to a promising start in eventually reigniting sales in China.

[7]

Could Trump greenlight Nvidia to sell H200 AI chips in China? Here's what it means for the global tech race

Nvidia H200 AI chips China: The Trump administration is weighing whether to let Nvidia resume sales of its powerful H200 artificial intelligence chips to China, which could be a potential policy shift that comes as Washington and Beijing navigate a fragile tech truce, as per a report. The Commerce Department, which is responsible for US export controls, is reviewing a possible change to its current rules that bar Nvidia from selling the advanced chips to China, and they also emphasized that no final decision has been made and plans could still shift, as per a Reuters report. Meanwhile, Nvidia did not address the review directly to Reuters, but the company noted that under existing regulations, it cannot offer a competitive AI data center chip in China, effectively leaving one of its largest markets to fast-growing foreign rivals. ALSO READ: Japan drops $135 billion stimulus as inflation spirals, experts warn of a true Minsky Moment - what is it? The potential reopening of high-end chip sales marks a notable shift in tone after US president Donald Trump and Chinese President Xi Jinping agreed to a trade and technology truce last month during talks in Busan, easing tensions after years of escalating restrictions, as per the Reuters report. Still, not everyone in Washington is comfortable with the idea. China hawks warn that giving Beijing access to more advanced AI chips could strengthen its military capabilities, the same concern that drove the Biden administration to impose strict limits on such exports, as per the report. ALSO READ: Think you know Social Security? These 3 hidden facts could change your benefits Trump, for his part, has oscillated on China tech policy this year. Despite warning that Beijing's increasing use of export controls on rare earth minerals could disrupt global technology supply chains, he ultimately rolled back many of the additional restrictions he had floated. The H200, unveiled two years ago, features significantly more high-bandwidth memory than the H100, allowing it to process data faster. It is believed to be roughly twice as powerful as Nvidia's H20, currently the most advanced chip the US allows companies to sell to China after the Trump administration reversed its brief ban on those exports earlier this year. The potential policy shift comes as Nvidia's leadership maintains a close relationship with the White House. Earlier this week, CEO Jensen Huang, whom Trump has publicly praised as a "great guy", attended a White House event during Saudi Crown Prince Mohammed bin Salman's visit. Meanwhile, the Commerce Department confirmed this week that it had approved shipments of up to 70,000 Nvidia Blackwell chips, the company's next-generation AI processors, to Saudi Arabia's Humain and the UAE's G42, reported Reuters. Why can't Nvidia sell H200 chips in China right now? Current US export rules prevent selling top AI data center chips to China. Has Nvidia's CEO been involved in White House events? Yes, Jensen Huang attended a White House event during Saudi Crown Prince Mohammed bin Salman's visit.

[8]

Nvidia Stock Dips In November, But Gene Munster Says Potential H200 Approval In China Could Supercharge Growth - Intel (NASDAQ:INTC), Advanced Micro Devices (NASDAQ:AMD)

Despite a sharp pullback in Nvidia Corp's (NASDAQ:NVDA) shares this month, a potential policy reversal on U.S. chip exports to China could dramatically boost the company's outlook, according to Deepwater Asset Management's Gene Munster. Trump Reportedly Administration Weighs H200 Exports To China On Friday, Reuters reported that the Donald Trump administration is considering allowing Nvidia to restart sales of its high-end H200 AI chips to China. The Commerce Department is reportedly reviewing restrictions that previously blocked the chip over national security concerns. The move would mark a significant shift for Nvidia, whose China business collapsed after export bans tightened. Previously, Nvidia CEO Jensen Huang said the company's market share in the region plunged from 95% to zero, adding that he couldn't imagine "any policymaker thinking that's a good idea." See Also: December Rate Cut Back On The Radar After Fed Officials Signal Dovish Tilt Munster: Reopening China Could Turn 49% Growth Into 72% In a video posted on social media, Munster said the potential policy change represents a "material win" for Nvidia and investors, estimating that turning H200 shipments back on could lift Wall Street's expected revenue growth from 49% to roughly 72%. He said former Trump administration officials told him that Nvidia chips have been a central point in U.S.-China trade discussions, and China's continued pursuit of Nvidia's hardware underscores its technical advantage. Munster referenced earlier comments from Huang that Nvidia could generate as much as $50 billion in China revenue in 2025 using compliant chips. Adding that figure to the Street's current revenue expectations -- about $330 billion -- explains the jump to a low-70% growth rate, he said. Even Without China, Analysts May Be Undervaluing Nvidia's Core Momentum Munster argued that consensus estimates are "mis-modeling" the back half of next year. He said tough comparisons in early 2026 mask true momentum -- noting that adjusting for last year's China revenue would show Nvidia's January quarter growing nearly 100%. As comparisons ease later in the year, he said analysts still assume an unnecessary slowdown. In his view, Nvidia is positioned to grow "60% plus" even if China remains restricted, and "75% plus" if H200 exports resume. Stock Slides Despite Record Earnings Nvidia shares fell 0.97% Friday and are down more than 13% in November, their worst month since March, despite reporting $57 billion in third-quarter revenue -- a 70% jump from last year. Meanwhile, market commentator The Kobeissi Letter highlighted the extraordinary scale of Nvidia's performance. It noted that the chipmaker's record third-quarter revenue is more than 2.5 times the combined $22.9 billion reported by Intel Corp (NASDAQ:INTC) and Advanced Micro Devices, Inc. (NASDAQ:AMD). Nvidia also delivered $31.8 billion in net income, surpassing Intel's and AMD's combined quarterly revenue by nearly $9 billion. Since the first quarter of 2023, Nvidia's profit has surged 2,170%, while revenue has climbed 700%, compared with far more modest gains at competitors: Intel's sales rose just 7%, and AMD's increased 70% over the same period. Kobeissi said the scale and speed of Nvidia's growth remain "unprecedented" in the semiconductor industry. Nvidia ranks in the 98th percentile for Growth and the 92nd percentile for Quality in Benzinga's Edge Stock Rankings. Click here to see how it stacks up against its peers. Read Next: David Tepper's Hedge Funds Bets On AMD, Nvidia In Q3, Takes Profits On Intel Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Image via Shutterstock AMDAdvanced Micro Devices Inc$204.500.35%OverviewINTCIntel Corp$34.680.51%NVDANVIDIA Corp$180.050.65%Market News and Data brought to you by Benzinga APIs

[9]

A Trump Policy Pivot Could Hand Nvidia Billions in AI Chip Sales -- If It Happens | The Motley Fool

Nvidia (NVDA 1.06%) is currently barred from selling its vaunted graphics processing chips (GPUs) in China, but there may be some movement on that front. Bloomberg is reporting that the Trump administration is considering allowing Nvidia to sell its H200 chips to China -- and if so, it could be worth potentially billions to Nvidia's bottom line. Nvidia would love to sell chips to China -- in fact, Chinese sales made up 13% of Nvidia's revenue in 2024, accounting for $17.1 billion in sales, according to Motley Fool research. Nvidia was previously able to sell its H20 chip in China -- a version of its popular Hopper H100 chip that was downgraded to meet U.S. export regulations imposed by the Biden administration. But in April 2025, the Trump administration imposed new export rules that blocked the chip sales. Sales never resumed -- CEO Jensen Huang at one point said the Trump administration agreed to allow Nvidia to resume sales in exchange for 15% of China sales revenue, but Beijing discouraged Chinese companies from buying the chip, citing national security reasons, and instead encouraged them to use domestic alternatives. The H200, however, is more powerful than the H100 or the downgraded H20. It has more memory capacity and bandwidth -- both of which are important for chips that train and run AI programs and large language models. Reopening the Chinese market would be great for Nvidia, but keep in mind the company is doing well without Beijing's support. Nvidia posted $57 billion in revenue in its fiscal 2026 third quarter (ending Oct. 26, 2025), with data center sales making up $51.2 billion of that. Overall sales increased by 62% from the previous year, with data center sales rising by 66%. And it issued guidance for $67 billion in sales for the fourth quarter. Nvidia is seeing massive demand for its new Blackwell chips, which are more powerful than the Hopper line, and it plans to roll out the next-generation Rubin chips next year. Trump has already stated that he wouldn't approve Nvidia selling its powerful Blackwell chips, but the H200 chips could potentially be a massive upgrade from the H20 line. However, there's a long way to go before any of this comes to fruition. First, it's unknown whether Nvidia will be able to sell the H200 chips as they are, or if it will be required to downgrade them, as with the H20 chip. Also, Beijing would have to be convinced that the chips do not constitute a security threat -- and that's a mountain that Nvidia, thus far, has been unable to scale. Undoubtedly, Chinese firms will want Nvidia's H200 chips, which by any measure are more powerful than domestic alternatives. But there are many steps to complete before investors can start banking on those potential profits.

[10]

US considering letting Nvidia sell H200 chips to China, sources say - The Korea Times

The Trump administration is considering greenlighting sales of Nvidia's H200 artificial intelligence chips to China, people familiar with the matter said, as a bilateral detente boosts prospects for exports of advanced U.S. technology to China. The Commerce Department, which oversees U.S. export controls, is reviewing the policy of barring sales of such chips to China, the sources said, stressing that plans could change. The White House and the Commerce Department did not immediately respond to requests for comment. The possibility signals a friendlier approach to China, after U.S. President Donald Trump and Chinese leader Xi Jinping brokered a trade and tech war truce in Busan last month. China hawks in Washington are concerned that shipments of more advanced AI chips to China could help Beijing supercharge its military, fears that prompted the Biden administration to set limits on such exports.

[11]

US Reviews NVIDIA H200 Export Rules as China Relations Show New Easing

The Trump administration is weighing whether to allow NVIDIA to sell its H200 artificial intelligence chips to China, according to people familiar with the internal discussions. The review comes as Washington and Beijing try to stabilize ties after a prolonged trade and technology conflict. Officials see the decision as a key test of how far the United States will go in reopening advanced technology exports to China. Businesses on both sides watch the talks closely because chip access shapes AI development. The U.S. Commerce Department oversees export controls and now studies a possible change to its current policy, which bars to Chinese buyers. Sources say officials have not reached a final decision and could still keep existing restrictions. A White House official declined to discuss the review but said the administration wants to protect U.S. technology leadership while guarding national security interests.

[12]

U.S. mulls letting Nvidia sell H200 chips to China, sources say

The Trump administration is considering greenlighting sales of Nvidia's H200 artificial intelligence chips to China, people familiar with the matter said, as a bilateral detente boosts prospects for exports of advanced U.S. technology to China. The U.S. Commerce Department, which oversees U.S. export controls, is reviewing a change to its policy of barring sales of such chips to China, the sources said, stressing that plans could change. The White House and the U.S. Commerce Department did not immediately respond to requests for comment. Nvidia did not comment directly on the review but said current regulation does not allow the company to offer a competitive AI data center chip in China, leaving that massive market to its rapidly growing foreign competitors. The possibility signals a friendlier approach to China, after U.S. President Donald Trump and Chinese leader Xi Jinping brokered a trade and tech war truce in Busan last month. China hawks in Washington are concerned that shipments of more advanced AI chips to China could help Beijing supercharge its military, fears that prompted the Biden administration to set limits on such exports. Faced with Beijing's muscular use of export controls on rare earth minerals, critical for producing a raft of tech goods, Trump this year has threatened new restrictions on tech exports to China, but ultimately rolled them back in most cases. The H200 chip, unveiled two years ago, has more high-bandwidth memory than its predecessor the H100, allowing it to process data more quickly. It is estimated to be twice as powerful as Nvidia's H20 chip, the most advanced AI semiconductor that can legally be exported to China, after the Trump administration reversed its short-lived ban on such sales earlier this year. Earlier this week, Nvidia CEO Jensen Huang, whom Trump has described as a "great guy," was among the guests at the White House during Saudi Crown Prince Mohammed bin Salman's visit. The U.S. Commerce Department announced this week it had approved shipments of the equivalent of up to 70,000 Nvidia Blackwell chips, Nvidia's next-generation AI chip, to Saudi Arabia's Humain and G42 of the United Arab Emirates.

[13]

National security or technological dominance: the dilemma over exporting Nvidia chips to China

Commerce Secretary Howard Lutnick yesterday confirmed that the Trump administration is considering allowing the export of Nvidia's H200 chips to China. The final decision will rest with President Trump and the strategy he wants to pursue towards China. On Friday, Bloomberg reported that discussions were underway within the Trump administration. That information was therefore confirmed yesterday by the Commerce Secretary, during an interview... with Bloomberg. While Howard Lutnick deferred the final decision to President Trump, he nonetheless framed the stakes around this choice: "Do you want to sell chips to China and push them to use our technology and our technological infrastructure, or tell them: Listen, we're not going to sell you our best chips. We're going to wait a little and we are ourselves going to join the AI race?" There are in fact two opposing camps in the United States. The first, led by the "China hawks", argues that this is a matter of national security. Such technologies should not be exported to China, the United States' main rival, which could also use them to strengthen its military. Meanwhile, others believe that the best way to win the AI race against China is to allow the export of Nvidia chips, so that AI infrastructure develops according to American standards. The aim here is to play the card of technological dominance. Over the months, tensions have clearly mounted, and Donald Trump has often seemed tempted to lean toward the second line, without so far fully taking the plunge. Authorizing exports of such chips would in any case mark a strategic shift by Washington, which has imposed export restrictions on semiconductors since 2022. These measures were notably taken to prevent Beijing and its military from gaining access to the most advanced technologies. It was the so-called "small yard, high fence" strategy, the idea being to erect strong barriers around a limited set of sectors. In Washington, the most forceful advocate of allowing exports to China is Nvidia CEO Jensen Huang. Beyond the broader policy debate, the current restrictions are shutting him out of a vast market. China is investing heavily in AI, yet Nvidia's projected revenue in China is currently... zero. For months, he has therefore been trying to push the Trump administration to give him the green light. When he tells the Financial Times that "China is going to win the AI race", it is essentially a way of putting pressure on everyone. In substance, his message is this: if you want the US to lead in AI, everyone needs to build their models using our chips. The H200 chip is less powerful than the Blackwell chip, the most advanced produced by Nvidia. At the end of October, just before his meeting with Xi Jinping in South Korea, Donald Trump said that he might raise the issue of exporting Blackwell chips with his Chinese counterpart. In the end, the subject was not discussed at the summit. The H200 chip would nonetheless represent a significant advance over the H20, whose export the United States approved earlier this year (in return for a 15% royalty). However, China has asked its companies not to buy it, citing supposed security concerns. Some have interpreted that decision as a Chinese negotiating tactic aimed at securing access to a better chip. A strategy that could well pay off...

[14]

Trump weighing advanced Nvidia chip sales to China, Bloomberg News reports

(Reuters) -U.S. President Donald Trump is weighing whether to allow Nvidia to sell advanced artificial intelligence chips to China, Commerce Secretary Howard Lutnick said in an interview to Bloomberg News on Monday. The president is consulting "lots of different advisers" in deciding on the potential exports, the report said quoting Lutnick as saying. This follows media reports on Friday detailing early discussions among U.S. officials regarding the sale of Nvidia's H200 AI chips to China. The White House and Nvidia did not immediately respond to Reuters' requests for comment. (Reporting by Jaspreet Singh in Bengaluru; Editing by Shilpi Majumdar)

[15]

Chinese Chip Stocks Fall After U.S. Weighs Sending Nvidia H200 Chips to China

Chinese semiconductor stocks fell sharply after news that the Trump administration is considering easing some restrictions on chip exports to China, which could undermine the appeal of domestically made chips. Shares of Semiconductor Manufacturing International Corp., China's largest contract chip maker and the only one capable of making advanced chips, dropped as much as 7.4% early Monday before paring some losses. China's No.2 foundry, Hua Hong Semiconductor, declined 6.2%, while ASMPT was down 2.1%. The Trump administration is having preliminary conversations about potentially allowing Nvidia to send its H200 AI chip to China, The Wall Street Journal reported Friday, citing people familiar with the discussions. The H200 chips would be a significant step up from the H20, which the U.S. approved earlier this year but China said it didn't want due to alleged security concerns. Chinese semiconductor stocks tend to "trade in reverse to the tenacity of proposed U.S. rules," Morningstar analyst Phelix Lee said. Easing U.S. export rules may diminish the appeal of domestically made AI chips and disrupt China's tech self-reliance thesis. However, analysts think China may not be interested in the H200 chips or could mandate that state-owned enterprises buy locally made chips in support of self-sufficiency efforts. China is more interested in buying more advanced chip-making equipment so it can expand its advanced-chip capacity and produce enough AI chips, Jefferies analysts said in a research note. Jefferies analysts said they weren't surprised by the latest twist to the Trump administration's stance as China's rare-earth export controls, which have been suspended as part of the trade truce, gives China significant leverage in trade negotiations. "The U.S. will need to consider easing export control in some areas against China to reach a trade deal with China," the Jefferies analysts added.

[16]

US Officials in Early Talks on Letting Nvidia Sell H200 AI Chips to China

NVIDIA Corporation is the world leader in the design, development, and marketing of programmable graphics processors. The group also develops associated software. Net sales break down by family of products as follows: - computing and networking solutions (89%): data center platforms and infrastructure, Ethernet interconnect solutions, high-performance computing solutions, platforms and solutions for autonomous and intelligent vehicles, solutions for enterprise artificial intelligence infrastructure, crypto-currency mining processors, embedded computer boards for robotics, teaching, learning and artificial intelligence development, etc.; - graphics processors (11%): for PCs, game consoles, video game streaming platforms, workstations, etc. (GeForce, NVIDIA RTX, Quadro brands, etc.). The group also offers laptops, desktops, gaming computers, computer peripherals (monitors, mice, joysticks, remote controls, etc.), software for visual and virtual computing, platforms for automotive infotainment systems and cloud collaboration platforms. Net sales break down by industry between data storage (88.3%), gaming (8.7%), professional visualization (1.4%), automotive (1.3%) and other (0.3%). Net sales are distributed geographically as follows: the United States (46.9%), Singapore (18.2%), Taiwan (15.8%), China and Hong Kong (13.1%) and other (6%).

Share

Share

Copy Link

The Trump administration is reviewing export restrictions on Nvidia's advanced H200 AI chips to China, signaling a potential shift in U.S.-China tech policy. This comes as bilateral relations show positive momentum following recent diplomatic agreements.

Trump Administration Reviews Nvidia Chip Export Policy

The Trump administration is actively considering allowing Nvidia Corporation to resume sales of its advanced H200 artificial intelligence chips to China, marking a potential significant shift in U.S. export control policies

1

. The Commerce Department, which oversees U.S. export controls, is reviewing its current policy of barring sales of such advanced semiconductors to China, according to sources familiar with the matter5

.Commerce Secretary Howard Lutnick confirmed in a CNBC interview that President Trump is weighing the decision, consulting with "lots of different advisers" on the potential exports

2

. Lutnick emphasized that Trump is considering the trade-offs between safeguarding national security and boosting the U.S. economy, stating "That is the question, it's in front of the president"2

.

Source: ET

Nvidia's Lobbying Efforts and Market Impact

Nvidia CEO Jensen Huang has been actively lobbying the Trump administration to greenlight these chip sales, according to Lutnick

2

. The chipmaker has been significantly impacted by the ongoing U.S.-China trade tensions, with Huang previously stating that the company's China business had collapsed, seeing its market share plunge from 95% to zero under the export bans4

.The potential authorization would represent a significant boost for Nvidia, already valued at $5 trillion following a robust third-quarter earnings season

2

. The company previously sold the H20 chip, specially designed for the Chinese market, until trade tensions escalated. The H200 represents a more advanced offering compared to the H20, though still less capable than Nvidia's cutting-edge Blackwell series chips2

.

Source: Benzinga

Diplomatic Context and Bilateral Relations

This policy review comes amid improving U.S.-China relations following recent diplomatic engagements. Chinese President Xi Jinping highlighted the ongoing progress in bilateral trade ties during a Monday phone call with President Trump, emphasizing that both nations should expand their cooperation

4

.

Source: Benzinga

The phone conversation followed a framework agreement reached by the two leaders in South Korea in October, aimed at easing lingering trade tensions

4

. Trump described the call as "very good" on Truth Social, covering topics including Ukraine/Russia, fentanyl, and U.S. farm products such as soybeans. He also announced plans to visit Beijing in April at Xi's invitation and extended an invitation to Xi for a U.S. state visit later this year4

.Related Stories

National Security Concerns and Policy Evolution

The Biden administration initially implemented restrictions on U.S. companies selling semiconductors to prevent China from gaining an advantage in the global AI race

2

. These policies were supported by national security hawks in both Republican and Democratic parties, who expressed concerns that shipments of advanced AI chips to China could help Beijing enhance its military capabilities1

.Trump initially maintained these restrictive policies at the start of his second term but later modified them in July with an extraordinary agreement involving Nvidia and AMD. Under this arrangement, the companies would hand over 15% of H20 chip sales revenue in China to the federal government

2

. However, the Chinese government responded by discouraging state-owned companies from purchasing or relying on Nvidia's chips, effectively limiting the impact of this compromise2

.References

Summarized by

Navi

Related Stories

U.S. Imposes 15% Revenue Share on Nvidia and AMD's AI Chip Sales to China Amid Escalating Tech Rivalry

05 Aug 2025•Policy and Regulation

Nvidia Set to Resume AI Chip Sales to China Amid Regulatory Shifts

10 Jul 2025•Technology

Nvidia Navigates US-China Tensions with Potential New AI Chip for Chinese Market

22 Aug 2025•Technology

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy