Trump Media & Technology Group Shares Rebound After Initial Plunge

3 Sources

3 Sources

[1]

Shares of Trump's media company rebound from all-time low

Shares of former U.S. President Donald Trump's media company sprang back over 6% on Wednesday, rebounding from all-time lows after restrictions on insider selling expired last week. Two straight days of gains in Trump Media & Technology Group, which is 57% owned by the Republican presidential nominee, have lifted it 12%, bringing its market capitalization to $2.7 billion. In the two sessions after restrictions on insider selling lifted at the end of Thursday, shares of Trump Media, which operates the Truth Social app, tumbled to their lowest since the company's stock-market debut in March. The stock was last at $13.64 after trading as high as $14.48 earlier on Wednesday. Trump, whose stake in Trump Media is now worth roughly $1.6 billion, said on Sept. 13 he did not plan to sell his shares, turning the focus to other major stakeholders who could cash out. Traders have exchanged an average of $275 million worth of Trump Media shares a day since the insider trading restrictions ended, higher than the average daily turnover of $188 million for the rest of September, according to LSEG data. No insiders have filed disclosures of share sales. Trump Media saw its value balloon to nearly $10 billion following its Wall Street debut, lifted by Trump retail traders who saw it as a speculative bet on his chances of securing a second four-year term as president in the November elections. Since then, Trump Media shares have steadily lost ground, with share declines accelerating after President Joe Biden ended his failing reelection bid on July 21. United Atlantic Ventures and Patrick Orlando, whose fund ARC Global Investments II sponsored the blank-check company that merged with Trump Media in March, together own about 11% of Trump Media shares, according to a company filing. Trump Media is burning cash and its revenue is equivalent to two Starbucks coffee shops. Its stock is trading at the equivalent of almost 700 times its revenue, far exceeding the valuation of even AI superstar Nvidia, which recently traded at 31 times its revenue, according to LSEG data. (Reporting by Noel Randewich; Editing by Marguerita Choy)

[2]

Shares of Trump's Media Company Rebound From All-Time Low

Shares of former U.S. President Donald Trump's media company sprang back over 6% on Wednesday, rebounding from all-time lows after restrictions on insider selling expired last week. Two straight days of gains in Trump Media & Technology Group, which is 57% owned by the Republican presidential nominee, have lifted it 12%, bringing its market capitalization to $2.7 billion. In the two sessions after restrictions on insider selling lifted at the end of Thursday, shares of Trump Media, which operates the Truth Social app, tumbled to their lowest since the company's stock-market debut in March. The stock was last at $13.64 after trading as high as $14.48 earlier on Wednesday. Trump, whose stake in Trump Media is now worth roughly $1.6 billion, said on Sept. 13 he did not plan to sell his shares, turning the focus to other major stakeholders who could cash out. Traders have exchanged an average of $275 million worth of Trump Media shares a day since the insider trading restrictions ended, higher than the average daily turnover of $188 million for the rest of September, according to LSEG data. No insiders have filed disclosures of share sales. Trump Media saw its value balloon to nearly $10 billion following its Wall Street debut, lifted by Trump retail traders who saw it as a speculative bet on his chances of securing a second four-year term as president in the November elections. Since then, Trump Media shares have steadily lost ground, with share declines accelerating after President Joe Biden ended his failing reelection bid on July 21. United Atlantic Ventures and Patrick Orlando, whose fund ARC Global Investments II sponsored the blank-check company that merged with Trump Media in March, together own about 11% of Trump Media shares, according to a company filing. Trump Media is burning cash and its revenue is equivalent to two Starbucks coffee shops. Its stock is trading at the equivalent of almost 700 times its revenue, far exceeding the valuation of even AI superstar Nvidia, which recently traded at 31 times its revenue, according to LSEG data. (Reporting by Noel Randewich; Editing by Marguerita Choy)

[3]

Shares of Donald Trump's media company bounce back

Sept 25 - Shares of former U.S. President Donald Trump's media company sprang back over 6% on Wednesday, rebounding from all-time lows after restrictions on insider selling expired last week. Two straight days of gains in Trump Media & Technology Group (DJT.O), opens new tab, which is 57% owned by the Republican presidential nominee, have lifted it 12%, bringing its market capitalization to $2.7 billion. In the two sessions after restrictions on insider selling lifted at the end of Thursday, shares of Trump Media, which operates the Truth Social app, tumbled to their lowest since the company's stock-market debut in March. Advertisement · Scroll to continue The stock was last at $13.64 after trading as high as $14.48 earlier on Wednesday. Trump, whose stake in Trump Media is now worth roughly $1.6 billion, said on Sept. 13 he did not plan to sell his shares, turning the focus to other major stakeholders who could cash out. Traders have exchanged an average of $275 million worth of Trump Media shares a day since the insider trading restrictions ended, higher than the average daily turnover of $188 million for the rest of September, according to LSEG data. No insiders have filed disclosures of share sales. Advertisement · Scroll to continue Trump Media saw its value balloon to nearly $10 billion following its Wall Street debut, lifted by Trump retail traders who saw it as a speculative bet on his chances of securing a second four-year term as president in the November elections. Since then, Trump Media shares have steadily lost ground, with share declines accelerating after President Joe Biden ended his failing reelection bid on July 21. United Atlantic Ventures and Patrick Orlando, whose fund ARC Global Investments II sponsored the blank-check company that merged with Trump Media in March, together own about 11% of Trump Media shares, according to a company filing. Trump Media is burning cash and its revenue is equivalent to two Starbucks coffee shops. Its stock is trading at the equivalent of almost 700 times its revenue, far exceeding the valuation of even AI superstar Nvidia (NVDA.O), opens new tab, which recently traded at 31 times its revenue, according to LSEG data. Reporting by Noel Randewich Editing by Marguerita Choy Our Standards: The Thomson Reuters Trust Principles., opens new tab

Share

Share

Copy Link

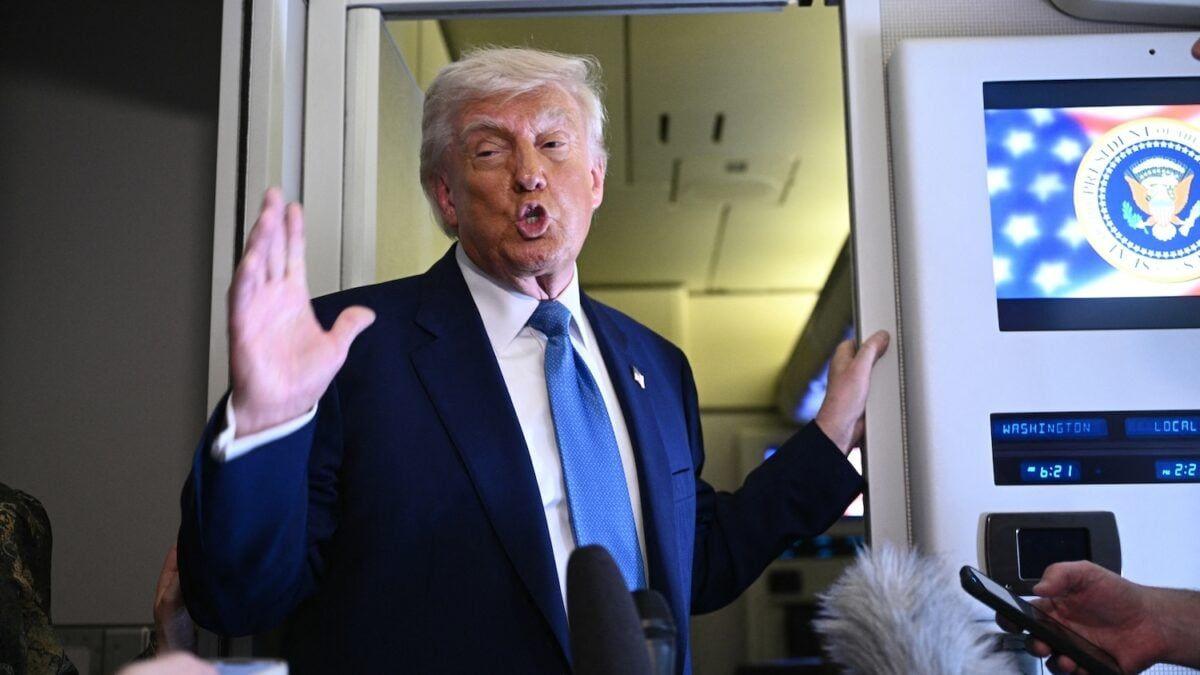

Shares of Trump Media & Technology Group (TMTG) recover from an all-time low following a significant drop. The company, which owns Truth Social, sees its stock price fluctuate amid financial disclosures and market speculation.

Trump Media & Technology Group's Stock Rollercoaster

Shares of Trump Media & Technology Group (TMTG), the company behind former U.S. President Donald Trump's social media platform Truth Social, experienced a dramatic turnaround on Monday. After plummeting to an all-time low of $16.15, the stock rebounded sharply, closing at $25.725, marking a 38.5% increase from its lowest point

1

.Initial Public Offering and Stock Performance

TMTG went public on March 26 through a merger with blank-check company Digital World Acquisition Corp. The stock, trading under the ticker DJT, initially soared to $79.38 on its debut. However, it has since faced significant volatility, losing about 70% of its value from that peak

2

.Financial Disclosures and Market Reaction

The company's stock price fluctuations come in the wake of recent financial disclosures. TMTG reported a net loss of $58.2 million in 2023, with revenue of just $4.1 million. This stark contrast between the company's financial performance and its market valuation has led to increased scrutiny from investors and analysts

3

.Truth Social's User Base and Growth Challenges

Truth Social, launched in February 2022, was created as an alternative to mainstream social media platforms. However, it has struggled to gain widespread traction. The platform reported 8.9 million sign-ups as of February 2024, a figure significantly lower than those of established social media giants

2

.Market Speculation and Future Prospects

The recent rebound in TMTG's stock price has sparked discussions about the company's future. Some analysts attribute the volatility to speculative trading, while others point to the potential impact of Donald Trump's ongoing legal challenges and his bid for re-election in 2024

1

.Related Stories

Regulatory Scrutiny and Investor Concerns

TMTG faces ongoing regulatory scrutiny, including investigations by the U.S. Securities and Exchange Commission and federal prosecutors in Manhattan. These investigations, coupled with the company's financial losses, have raised concerns among investors about the long-term viability of the business

3

.The Role of Donald Trump

As the primary shareholder, Donald Trump's involvement remains crucial to TMTG's public image and potential success. His ability to use and promote Truth Social, especially in light of his political activities, could significantly influence the platform's growth and the company's stock performance in the coming months

2

.References

Summarized by

Navi

[1]

Related Stories

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy