Trump Media announces $6 billion fusion energy merger to power AI data centers

5 Sources

5 Sources

[1]

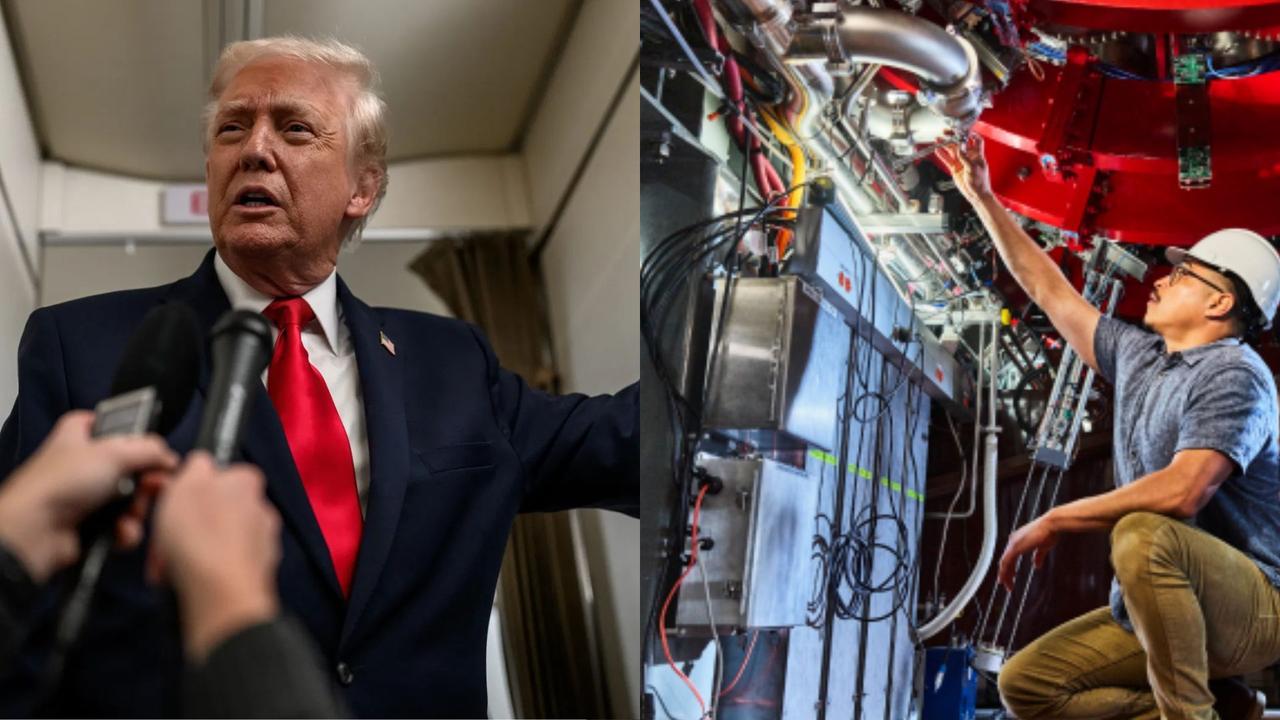

Trump Media pivots to fusion energy with $6B AI-focused merger

The all-stock deal would turn Trump Media into the holding company for both Truth Social and TAE. Executives say the combined firm plans to select a site and begin building a utility-scale fusion plant next year. The goal is to supply electricity for large AI data centers. Fusion combines light atomic nuclei to release massive energy. The process powers the sun but remains difficult to replicate on Earth. Experts say commercial fusion remains years away and requires sustained funding and regulatory support. Trump Media has struggled to find profitability since launching Truth Social in 2021. The company went public through a blank-check merger in March 2024. It has since explored cryptocurrency ventures, prediction markets, and a Roku streaming app. The company reported a $54.8 million quarterly loss at the end of September. Its stock had fallen about 70% this year before rebounding sharply on Thursday. Shares jumped more than 34% following the fusion announcement.

[2]

Trump Media announces $6bn merger plan with fusion power firm

TMTG, which owns president's Truth Social platform, unveils link-up TAE Technologies to respond to AI boom Donald Trump's loss-making social media business has announced plans to merge with a fusion power company. Trump Media and Technology Group, owner of the US president's minnow Truth Social platform, unveiled an extraordinary merger worth more than $6bn with TAE Technologies, combining its social media operation with a vast bet on the AI boom driving a surge in energy demand. TMTG intends to start building "the world's first utility-scale fusion power plant" next year, it said, in an effort to use the experimental technology to power the huge datacenters behind the development of AI. Shares in TMTG surged 22% during early trading in New York on Thursday. Shareholders of TMTG and TAE Technologies will each own about 50% of the combined entity after the deal is completed. The companies expect this to take place in mid-2026. TAE, backed by Alphabet's Google and Chevron, the oil giant, is aiming to develop and sell next-generation neutral beam systems for fusion and related applications in a more cost-effective manner. Nuclear fusion refers to a nascent technology that aims to generate electricity by harnessing the process that powers the sun. It offers the vision of abundant energy without pollution, radioactive waste or greenhouse gases. TMTG, meanwhile, has struggled to capitalize on its ownership of Trump's Truth Social platform, which the president regularly updates with musings, announcements and attacks. The firm reported sales of $927,900 for the three months to 30 September, down from just over $1.01m the previous year. Its losses also widened to $54.8m, from $19.2m in the same quarter of 2024. Devin Nunes, chairman and CEO of TMTG, made the case for its planned combination of social media and fusion power. "Trump Media & Technology Group built uncancellable infrastructure to secure free expression online for Americans, and now we're taking a big step forward toward a revolutionary technology that will cement America's global energy dominance for generations," Nunes said in a statement. "Fusion power will be the most dramatic energy breakthrough since the onset of commercial nuclear energy in the 1950s - an innovation that will lower energy prices, boost supply, ensure America's A.I.-supremacy, revive our manufacturing base and bolster national defense." TMTG "brings the capital and public market access to quickly move TAE's proven technology to commercial viability", he added. The tech industry's insatiable demand for electricity needed to run datacenters that power artificial intelligence technologies has renewed interest in nuclear power supply, including restarting fully shut reactors, expanding capacity and contracting for power from future small modular reactors. The rising demand is also propelling the development of nuclear power plants, which is widely deemed to be a cleaner source of energy. Nunes will serve as co-CEO of the new company, along with TAE's CEO and director, Michl Binderbauer, the companies said, adding the deal was approved by the boards.

[3]

Trump media to merge with fusion energy company in $6 billion AI power deal

Trump Media is merging with fusion energy company TAE Technologies in a multi-billion-dollar deal. The move links social media, clean energy, and artificial intelligence. The new company aims to build large-scale fusion power in the future. Supporters see energy potential, while critics raise concerns about politics, regulation, and funding for this emerging technology. The parent company of U.S. President Donald Trump's social media platform, Truth Social, is merging with a nuclear fusion power company in an unusual deal, according to an announcement made Thursday. The deal brings together Trump Media & Technology Group and TAE Technologies, a private company focused on fusion energy, the companies said. The merger is an all-stock deal and is valued at more than $6 billion, the companies announced, as reported by AP News. The combined company says it plans to find a site and begin construction next year on what it calls the "world's first utility-scale fusion power plant." The goal of the fusion plant is to produce massive amounts of electricity needed to power artificial intelligence systems, the companies said. Nuclear fusion is seen by scientists as a clean energy solution that could reduce climate change caused by burning fossil fuels. Fusion technology is still far away compared to current clean energy sources like wind and solar power. Fusion development requires huge investment and heavy government regulation, making political ties a major concern, said Richard Painter, former White House ethics lawyer. Painter said Trump's involvement creates a clear conflict of interest because the government is expected to play a big role in regulating fusion energy, as cited in the report by AP News. "He's jumping into this industry just like he jumped into cryptocurrency," Painter said, warning about government influence. Devin Nunes, a Republican former congressman, will serve as co-CEO of the new company after resigning from Congress in 2021 to lead Trump Media. Nunes will share the CEO role with TAE Technologies CEO Michl Binderbauer, the companies said. Shares of Trump Media & Technology have fallen about 70% so far this year, reflecting weak performance. Despite the drop, Trump Media shares jumped 34% in afternoon trading on Thursday after the merger news. TAE Technologies is backed by Google and other investors and is currently a private company, according to AP News. The merger would make one of the first publicly traded nuclear fusion companies in the world, the companies said. Nunes said the deal would help secure America's energy leadership for generations in a prepared statement. TAE's technology focuses on nuclear fusion, which combines two light atomic nuclei into a heavier one to release massive energy. This fusion process happens naturally in the sun and other stars, according to the United Nations' nuclear watchdog. Under the deal, TAE shareholders and Trump Media shareholders will each own about 50% of the combined company. Trump is the largest shareholder in Trump Media, owning 41% of the company's outstanding shares, as stated in the report by AP News. In October, the U.S. Department of Energy released a fusion "road map" to speed up development of the technology. The roadmap aims to build a strong private fusion industry in the U.S. as quickly as possible. Tech companies like Google and Microsoft are interested in fusion as a way to power energy-hungry AI data centers. OpenAI CEO Sam Altman has also shown interest in fusion technology. Andrew Holland, CEO of the Fusion Industry Association, said new funding and a public fusion company are positive steps. Holland said technology breakthroughs depend on time and resources, and this deal adds both. He said the merger allows TAE to move forward faster with building its pilot fusion plant. The location of the pilot plant has not yet been announced, Holland said. Holland called the deal exciting because it helps move closer to a fusion-powered future. Fusion energy can meet AI's huge power needs because it is clean, safe, and scalable once commercialized, Holland said. Before this deal, private fusion companies worldwide raised about $10 billion to make fusion commercially viable. Most fusion investment and development is happening in the United States, Holland said, as reported by AP News. Holland said the Trump administration has voiced strong support for fusion energy. However, he said no new government funding has yet been announced. Industry surveys show companies expect fusion energy to reach the electric grid in the 2030s.Most companies believe fusion power will arrive in the first half of the 2030s, Holland said. The companies said the deal values each share of TAE common stock at $53.89. (After the merger closes, Trump Media & Technology Group will become the holding company for Truth Social and TAE. The combined company will also include TAE Power Solutions and TAE Life Sciences as subsidiaries, as noted in the report by AP News. Q1. What is the Trump Media and TAE Technologies merger about? It is a $6 billion all-stock deal where Trump Media is merging with fusion company TAE to build clean fusion power for future AI energy needs. Q2. Why is nuclear fusion important for AI and clean energy? Fusion can produce huge amounts of clean, safe power, which could support energy-hungry AI data centers in the future.

[4]

Trump Media's Nuclear Bet Is Riding The 'Manhattan Project' Trade - Trump Media & Tech Gr (NASDAQ:DJT)

Investors piling into Trump Media & Technology Group Corp (NASDAQ:DJT) stock aren't reacting to a social media story. They're reacting to a much bigger macro theme: power. As artificial intelligence scales, electricity -- not chips -- is emerging as the next hard constraint. That's the trade DJT's fusion tie-up is suddenly plugged into. * Track DJT stock here. Donald Trump-owned Trump Media, the parent of Truth Social, recently announced plans to merge with fusion startup TAE Technologies in a deal that could be valued at up to $6 billion. TAE aims to begin construction of its fusion power plant in 2026 -- an aggressive timeline that has drawn skepticism. But markets aren't pricing certainty. They're pricing optionality. Read Also: Trump Media Makes $6 Billion Fusion Power Play To Fuel AI Future AI Is Driving The Power Narrative Daniel Newman, CEO of The Futurum Group, speaking to Yahoo Finance, explained why energy has become central to the AI investment debate. AI demand alone, he said, could drive "something like 130 gigawatts, maybe as much as 150 gigawatts of demand just by the end of the decade," roughly 10% to 15% of total electricity load. More importantly, "peak load on AI is going to be pulling from the grid all the time," Newman said -- a structural challenge for aging power infrastructure. Why Fusion Is Back In The Conversation Fusion's appeal isn't just theoretical. Newman noted that fusion faces a very different regulatory path than traditional nuclear. "This is clean nuclear with no risk of a meltdown," he said, adding that approvals may involve "a lot less red tape, more like heavy industrial manufacturing builds, as opposed to traditional nuclear approvals." That regulatory framing helps explain why speculation is moving early. "Once this happens, it's going to have run away from you," Newman said, calling fusion a potential "10, 100 plus X opportunity" if milestones are met. The Manhattan Project Framing Newman summed up the stakes bluntly: "This is the United States Manhattan Project." While Asia races ahead in advanced manufacturing, he argued, "where we've fallen behind is power." For DJT traders, that's the signal. This isn't about fusion timelines yet -- it's about exposure to one of the most urgent unsolved problems of the AI era. DJTTrump Media & Technology Group Corp $13.91-3.47% Overview Market News and Data brought to you by Benzinga APIs

[5]

Trump Bets on an Unproven Technology To Win Superintelligence Race

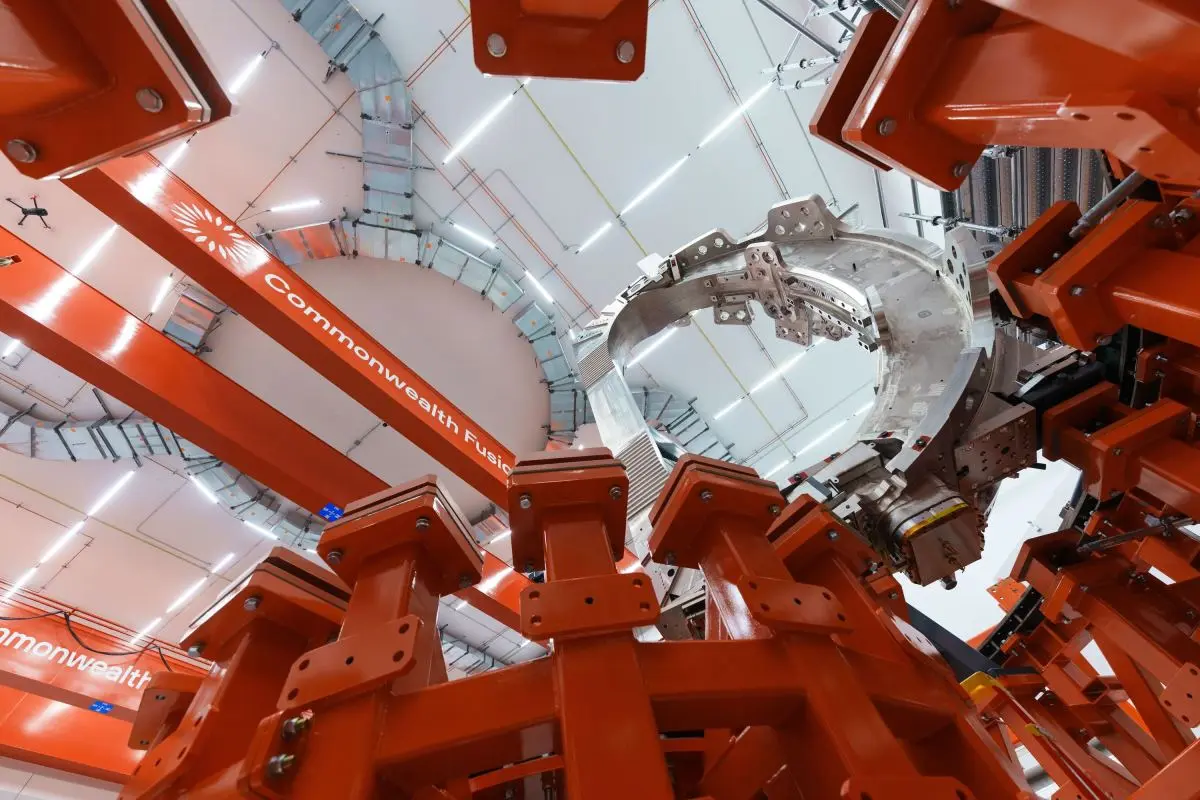

Industrial Revolution-sized energy demand from AI data centers is fueling competition to find a transformational power source, with the president having his dollars invested and his thumb on the scale. As AI data centers present major competition to consumers for energy from the existing electrical grid, the Federal Energy Regulatory Commission's decision to allow data centers to connect directly to power plants presents a new opportunity for fuel producers to cash in on adding to the supply. President Trump is betting on one of them in particular to prove transformational -- for America and himself. TAE Technologies and President Trump's social media venture, Trump Media and Technologies Group, announced Thursday a 50-50 stake worth $6 billion. The deal would create the first publicly traded fusion company and comes as the company prepares to begin construction on the world's first utility-scale fusion power plant in 2026. "Fusion power will be the most dramatic energy breakthrough since the onset of commercial nuclear energy in the 1950s -- an innovation that will lower energy prices, boost supply, ensure America's A.I.-supremacy, revive our manufacturing base and bolster national defense," said Trump Media's CEO Devin Nunes. Whether the mythology of fusion becomes a reality remains to be seen. As dramatized in "The Saint," the 1997 film starring Val Kilmer and Elizabeth Banks about corporate espionage in the effort to make fusion energy abundant and free to all, fusion has been the unfulfilled promise of clean energy for decades. "Maybe there is a tip now in the technology such that it is now getting demonstrated. I mean, I've heard that, but you know you always hear that. That's the thing. It's like who do you believe this time?" an attorney for a large energy company who asked not to be named tells the New York Sun. If fusion is close to reality, it's no doubt in part due to massive investment from government-sponsored laboratories as well as private technology, energy, and financial firms like Google, Chevron, Italy's global energy firm Eni, and Goldman Sachs, among many others. But it has yet to be proven. The longest fusion reactions only last for about a minute at a time, says the president of energy and emerging tech at the AI infrastructure company Maykr, John Cook. That is not long enough to reliably source AI data center needs, much less anything else. "Humanity has not yet invented the necessary materials via material manufacturing at the subatomic level" to contain a fusion reaction, Mr. Cook tells the New York Sun. "What we've done is build massive magnets, like the size of one magnet being the size of your house's first floor, maybe a little bigger than that, and then stacking multiple magnets -- five or six -- on top of one another. That is what is currently containing a fusion reaction. That is inadequate to contain a fusion reaction for any length of time, which is, of course, the trick of the trade." That trick is what TAE Technologies and its chief competitor, Commonwealth Fusion Systems, have been trying to solve for decades. The key to fusion relies on stabilizing bonded high-temperature atoms in a plasma soup whose carbon-free heat can be captured and transformed to power a turbine. It's akin to trying to bottle the sun. While the technologies of competitors in the field are radically different, Commonwealth Fusion Systems -- whose top expert, MIT scientist and professor Nuno Loureiro, was murdered just days ago -- says it achieved the ultimate breakthrough of reducing the size and cost of tokamak reactors and external magnets. Ironically, Commonwealth's research leap was enhanced by the energy-sucking AI data centers its technology will feed. MIT's Plasma Science and Fusion Research program, which Mr. Loureiro headed, announced in November that its data science center was set to accelerate "massive experimental and simulation data into predictive insight" to move its fusion program from experiment to pilot-plant transition. TAE's method was believed to be further away from commercialization; however, it claims its process of converting the plasma into a steam to power turbines is ready to go, a bet which if true, could be transformational, not only for energy demands but for the owners of the power source. "What's the coin of the realm? The coin of the realm is electricity. Whoever has the electricity wins," says Mr. Cook. Assuming TAE gets regulatory approval -- a not outlandish bet given its newest partner is the head of the federal government -- TAE's first plant is expected to produce 50 megawatts of electricity, enough to power up to 10,000 homes -- or one data center. That's shy of the 1.5-2 gigawatts necessary to backstop a grid failure should AI data centers need to draw on the power company for its load. But it's enough to participate in the race for superintelligence. "Because of the astonishing speed with which AI builds itself, whoever's there first leaves everybody else behind. There's no catching up. That's the race," said Mr. Cook. While many data centers are relying on traditional and abundant fuels like natural gas and coal, alternatives like fusion or small model nuclear reactors are quickly coming online. And with all the moving parts required to get an energy source up and running, the president's ability to put his thumb on the regulatory scale could prove favorable to his business partners. "That great need is literally on the front doorstep, some of it's already into the house," the energy attorney said of AI's power demands. "If you don't already have a fusion plant built that's giving you at least two gigawatts of energy, you're behind." As for the high prices and lower reliability consumers are experiencing as a result of the pull on electricity from AI, Mr. Cook said the pain-now, payoff-later will eventually subside as data centers contribute back to the grid. "The objective is to be behind the meter," he said. "If you get in the back of the grid, you are in a better position to conduct the data activity that you want to be conducting."

Share

Share

Copy Link

Trump Media & Technology Group is merging with fusion energy company TAE Technologies in a $6 billion all-stock deal aimed at building the world's first utility-scale fusion power plant. The combined entity plans to begin construction in 2026 to supply electricity for large AI data centers as surging energy demand from artificial intelligence threatens existing power infrastructure.

Trump Media Pivots to Fusion Energy With Unprecedented $6 Billion Merger

Trump Media & Technology Group, owner of Truth Social, announced Thursday an extraordinary $6 billion merger with TAE Technologies, a private fusion energy company backed by Google and Chevron

1

2

. The all-stock deal combines a struggling social media platform with an ambitious bet on nuclear fusion technology designed to address surging energy demand from artificial intelligence. Shareholders of both companies will each own approximately 50% of the combined entity once the deal closes in mid-20262

3

.

Source: Benzinga

The announcement sent Trump Media stock price surging more than 34% in afternoon trading, a dramatic reversal for shares that had fallen approximately 70% earlier this year

1

3

. The combined company plans to select a site and begin construction on what it calls the "world's first utility-scale fusion power plant" in 2026, specifically targeting electricity production for AI data centers1

5

.

Source: Interesting Engineering

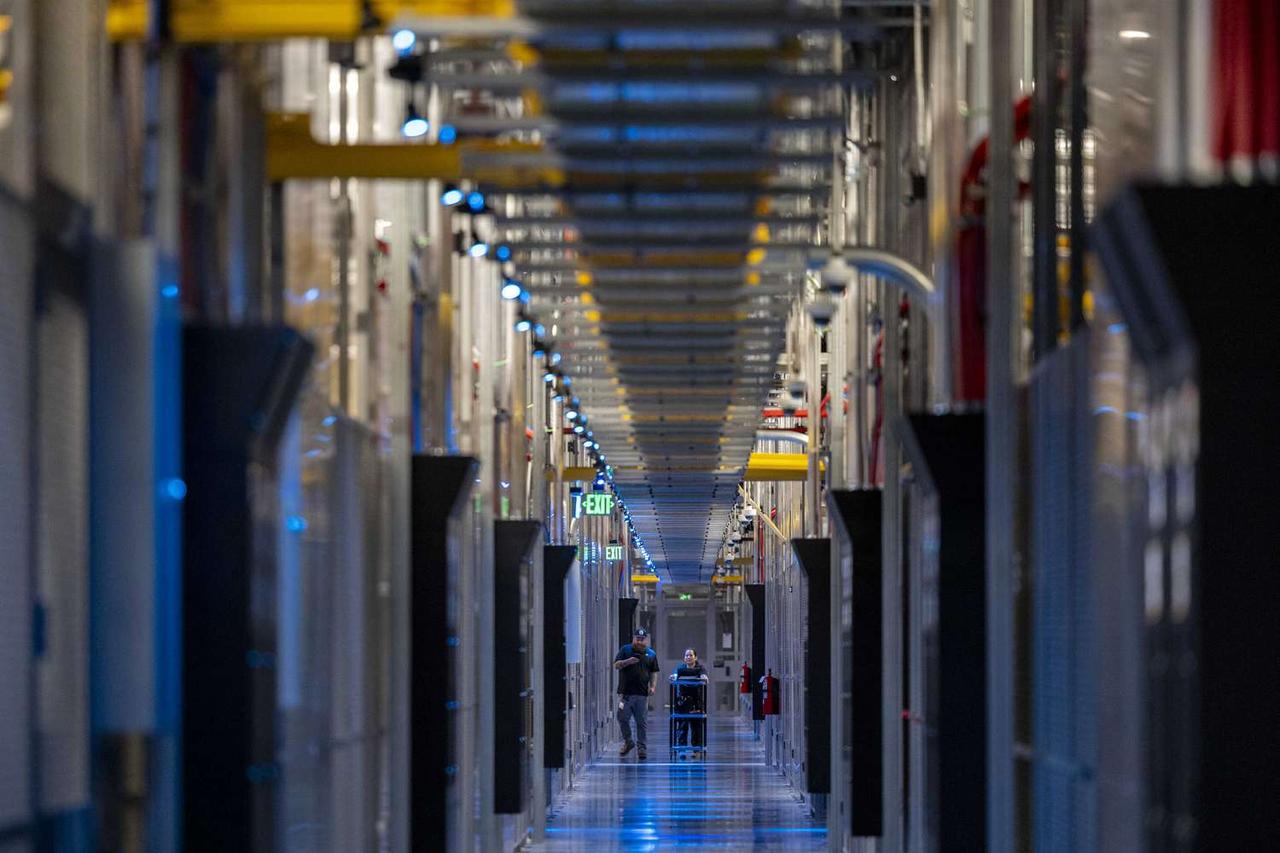

Powering Artificial Intelligence Becomes the Critical Bottleneck

The merger addresses a fundamental constraint facing the tech industry: electricity. Daniel Newman, CEO of The Futurum Group, explained that AI demand alone could drive "something like 130 gigawatts, maybe as much as 150 gigawatts of demand just by the end of the decade," representing roughly 10% to 15% of total electricity load

4

. More critically, "peak load on AI is going to be pulling from the power grid all the time," creating structural challenges for aging power infrastructure4

.TAE's first plant is expected to produce 50 megawatts of electricity, enough to power approximately 10,000 homes or one data center

5

. The company focuses on developing next-generation neutral beam systems for fusion applications in a more cost-effective manner2

. Nuclear fusion combines light atomic nuclei to release massive energy without pollution, radioactive waste, or greenhouse gases, offering a vision of abundant clean energy1

2

.America's A.I.-Supremacy and National Energy Dominance at Stake

Devin Nunes, Trump Media's chairman and CEO who will serve as co-CEO of the merged company alongside TAE's Michl Binderbauer, framed the deal in sweeping terms. "Trump Media & Technology Group built uncancellable infrastructure to secure free expression online for Americans, and now we're taking a big step forward toward a revolutionary technology that will cement America's global energy dominance for generations," Nunes stated

2

. He described fusion power as "the most dramatic energy breakthrough since the onset of commercial nuclear energy in the 1950s" that would "ensure America's A.I.-supremacy, revive our manufacturing base and bolster national defense"2

5

.Newman characterized the investment as part of the "Manhattan Project trade," stating: "This is the United States Manhattan Project. Where we've fallen behind is power"

4

. For investors, the appeal lies not in fusion timelines but in exposure to one of the most urgent unsolved problems of the AI era. "Once this happens, it's going to have run away from you," Newman said, calling fusion a potential "10, 100 plus X opportunity" if milestones are met4

.Regulatory Challenges and Political Influence Loom Large

The deal raises significant questions about regulatory challenges and political influence. Fusion development requires substantial investment and heavy government regulation, making political ties a major concern. Richard Painter, former White House ethics lawyer, said Trump's involvement creates a clear conflict of interest because the government is expected to play a major role in regulating fusion energy. "He's jumping into this industry just like he jumped into cryptocurrency," Painter warned about government influence

3

.However, Newman noted that fusion faces a different regulatory path than traditional nuclear power. "This is clean nuclear with no risk of a meltdown," he said, adding that approvals may involve "a lot less red tape, more like heavy industrial manufacturing builds, as opposed to traditional nuclear approvals"

4

. President Trump is the largest shareholder in Trump Media, owning 41% of the company's outstanding shares3

.Related Stories

The Profitability Question and Technical Reality Check

Trump Media has struggled with profitability since launching Truth Social in 2021, exploring ventures in cryptocurrency, prediction markets, and streaming apps

1

. The company reported sales of just $927,900 for the three months ending September 30, down from $1.01 million the previous year, with losses widening to $54.8 million from $19.2 million in the same quarter of 20241

2

.Despite TAE's aggressive 2026 construction timeline, technical hurdles remain substantial. John Cook, president of energy and emerging tech at AI infrastructure company Maykr, noted that the longest fusion reactions only last about a minute, insufficient to reliably source AI data center needs. "Humanity has not yet invented the necessary materials via material manufacturing at the subatomic level" to contain a fusion reaction for extended periods

5

. Commercial fusion remains years away according to experts, requiring sustained funding and regulatory support1

.The Superintelligence Race and Industry Momentum

The merger creates one of the first publicly traded nuclear fusion companies globally and adds to approximately $10 billion in private fusion investment raised worldwide

3

. Andrew Holland, CEO of the Fusion Industry Association, called the deal exciting because "it helps move closer to a fusion-powered future." He emphasized that "technology breakthroughs depend on time and resources, and this deal adds both"3

.Industry surveys indicate companies expect fusion energy to reach the power grid in the 2030s, with most believing it will arrive in the first half of the decade

3

. In October, the U.S. Department of Energy released a fusion "road map" to accelerate development and build a strong private fusion industry as quickly as possible3

. Tech companies including Google and Microsoft are actively interested in fusion as a way to power energy-hungry AI data centers, while OpenAI CEO Sam Altman has also shown interest in the technology3

. As one expert noted about the superintelligence race: "What's the coin of the realm? The coin of the realm is electricity. Whoever has the electricity wins"5

.References

Summarized by

Navi

[1]

[2]

[4]

Related Stories

Commonwealth Fusion Systems installs first reactor magnet, partners with Nvidia on digital twin

06 Jan 2026•Technology

Trump Administration Prepares Executive Orders to Boost AI Infrastructure and Energy Supply

27 Jun 2025•Technology

AI's Energy Appetite: Big Tech Turns to Nuclear and Alternative Power Sources

05 Jun 2025•Business and Economy

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research