Trump Media Shares at Risk of Sell-Off as Insider Trading Restrictions Expire

4 Sources

4 Sources

[1]

Trump Media shares face potential sell-off as insider selling restrictions lift

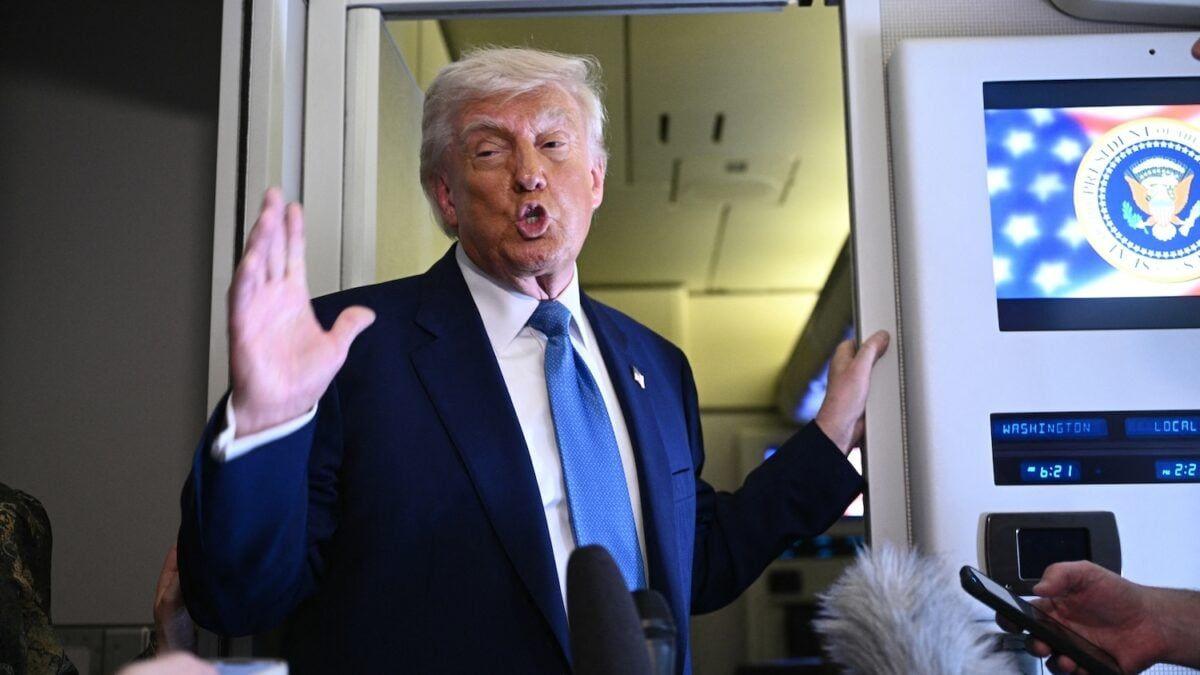

Former U.S. President Donald Trump has stated he will not sell his $1.7 billion stake in Trump Media, despite the expiration of restrictions. Other insiders, including United Atlantic Ventures and Patrick Orlando, may soon sell their shares. Trump Media's stock has seen significant losses recently, influenced by market conditions and political developments.While former U.S. President Donald Trump has said he will not sell his $1.7 billion stake in Trump Media after restrictions likely expire on Thursday, other insiders could soon cash in their gains. Trump Media & Technology Group is 57% owned by the Republican presidential candidate who told reporters last Friday that he does not plan to sell his shares. Other major stakeholders who could soon sell their shares include United Atlantic Ventures and Patrick Orlando, whose fund, ARC Global Investments II, sponsored the blank-check company that merged with Trump Media in March. The two own a combined 11% of Trump Media, according to a company filing. "Even if Trump doesn't, it would be interesting if other insiders begin selling because that would be a clue as to what they think his mindset is about selling," said Steve Sosnick, chief strategist at Interactive Brokers. Trump Media insiders could sell their shares as early as after the bell on Thursday if the stock ends the regular trading session at or above $12, according to a provision in the company's prospectus. Shares were last down 4% at $15, extending sharp losses in recent weeks fueled by worries about the end of so-called lock-up period related to its stock market debut in March. Trump and other insiders, including Chief Operating Officer Andrew Northwall, Chief Technology Officer Vladimir Novachki and director Donald Trump Jr., did not respond to Reuters' requests for comment on their plans after the lock-up expires. Trump Media did not respond to a request for a comment. The size of ARC's stake in Trump Media is in dispute. A Delaware judge this week ruled ARC Global should receive 8.19 million shares of Trump Media, more than the roughly 7 million shares that the company has said that ARC was entitled to. Separately, Truth Social cofounders Andy Litinsky and Wes Moss have also sued TMTG for damages for preventing them from selling their stock sooner. Orlando and Moss did not immediately reply to requests for comment, while Litinsky could not be reached for a comment. Newly listed companies often see pressure on their stocks ahead of the end of their lock-up period, when insiders become free to sell their often considerable stakes. Trump Media, which operates the Truth Social app, saw its value balloon to nearly $10 billion following its Wall Street debut, lifted by retail traders and traders who see it as a speculative bet on his chances of securing a second four-year term as president. However, after reaching that peak, Trump Media shares have lost most of their value, with declines accelerating in recent weeks after President Joe Biden gave up his reelection bid on July 21, and Trump lost a lead in opinion polls ahead of the Nov. 5 presidential election to Democratic candidate Vice President Kamala Harris. Betting markets now show Harris with a modest advantage over Trump in a tight race. Trump Media's revenue is equivalent to two Starbucks coffee shops, and strategists say its $3 billion stock market value is detached from its day-to-day business. Its stock is trading at the equivalent of over 1,000 times its revenue, far exceeding the valuation of even AI superstar Nvidia, which recently traded at 24 times its revenue. "The market couldn't absorb even a partial stake sale without some material damage to the stock," Sosnick said. "Ultimately a lot will hinge on whether (Trump) keeps his word on not selling while the longer term prospects of the company are completely dependent upon his electoral prospects." Insiders Stake as % of outstanding Donald Trump 56.6% United Atlantic 5.5% ARC Global 5.5% Phillip Juhan 0.2%, Devin Nunes 0.06% Scott Glabe 0.01%

[2]

Trump Media shares face potential sell-off as insider selling restrictions lift

(Reuters) - While former U.S. President Donald Trump has said he will not sell his $1.7 billion stake in Trump Media after restrictions likely expire on Thursday, other insiders could soon cash in their gains. Trump Media & Technology Group is 57% owned by the Republican presidential candidate who told reporters last Friday that he does not plan to sell his shares. Other major stakeholders who could soon sell their shares include United Atlantic Ventures and Patrick Orlando, whose fund, ARC Global Investments II, sponsored the blank-check company that merged with Trump Media in March. The two own a combined 11% of Trump Media, according to a company filing. "Even if Trump doesn't, it would be interesting if other insiders begin selling because that would be a clue as to what they think his mindset is about selling," said Steve Sosnick, chief strategist at Interactive Brokers. Trump Media insiders could sell their shares as early as after the bell on Thursday if the stock ends the regular trading session at or above $12, according to a provision in the company's prospectus. Shares were last down 4% at $15, extending sharp losses in recent weeks fueled by worries about the end of so-called lock-up period related to its stock market debut in March. Trump and other insiders, including Chief Operating Officer Andrew Northwall, Chief Technology Officer Vladimir Novachki and director Donald Trump Jr., did not respond to Reuters' requests for comment on their plans after the lock-up expires. Trump Media did not respond to a request for a comment. The size of ARC's stake in Trump Media is in dispute. A Delaware judge this week ruled ARC Global should receive 8.19 million shares of Trump Media, more than the roughly 7 million shares that the company has said that ARC was entitled to. Separately, Truth Social cofounders Andy Litinsky and Wes Moss have also sued TMTG for damages for preventing them from selling their stock sooner. Orlando and Moss did not immediately reply to requests for comment, while Litinsky could not be reached for a comment. Newly listed companies often see pressure on their stocks ahead of the end of their lock-up period, when insiders become free to sell their often considerable stakes. Trump Media, which operates the Truth Social app, saw its value balloon to nearly $10 billion following its Wall Street debut, lifted by retail traders and traders who see it as a speculative bet on his chances of securing a second four-year term as president. However, after reaching that peak, Trump Media shares have lost most of their value, with declines accelerating in recent weeks after President Joe Biden gave up his reelection bid on July 21, and Trump lost a lead in opinion polls ahead of the Nov. 5 presidential election to Democratic candidate Vice President Kamala Harris. Betting markets now show Harris with a modest advantage over Trump in a tight race. Trump Media's revenue is equivalent to two Starbucks coffee shops, and strategists say its $3 billion stock market value is detached from its day-to-day business. Its stock is trading at the equivalent of over 1,000 times its revenue, far exceeding the valuation of even AI superstar Nvidia, which recently traded at 24 times its revenue. "The market couldn't absorb even a partial stake sale without some material damage to the stock," Sosnick said. "Ultimately a lot will hinge on whether (Trump) keeps his word on not selling while the longer term prospects of the company are completely dependent upon his electoral prospects." (Reporting by Noel Randewich and Medha Singh; Additional reporting by Lance Tupper and Tom Hals; Editing by Megan Davies and Diane Craft)

[3]

Trump Media Shares Face Potential Sell-Off as Insider Selling Restrictions Lift

(Reuters) - While former U.S. President Donald Trump has said he will not sell his $1.7 billion stake in Trump Media after restrictions likely expire on Thursday, other insiders could soon cash in their gains. Trump Media & Technology Group is 57% owned by the Republican presidential candidate who told reporters last Friday that he does not plan to sell his shares. Other major stakeholders who could soon sell their shares include United Atlantic Ventures and Patrick Orlando, whose fund, ARC Global Investments II, sponsored the blank-check company that merged with Trump Media in March. The two own a combined 11% of Trump Media, according to a company filing. "Even if Trump doesn't, it would be interesting if other insiders begin selling because that would be a clue as to what they think his mindset is about selling," said Steve Sosnick, chief strategist at Interactive Brokers. Trump Media insiders could sell their shares as early as after the bell on Thursday if the stock ends the regular trading session at or above $12, according to a provision in the company's prospectus. Shares were last down 4% at $15, extending sharp losses in recent weeks fueled by worries about the end of so-called lock-up period related to its stock market debut in March. Trump and other insiders, including Chief Operating Officer Andrew Northwall, Chief Technology Officer Vladimir Novachki and director Donald Trump Jr., did not respond to Reuters' requests for comment on their plans after the lock-up expires. Trump Media did not respond to a request for a comment. The size of ARC's stake in Trump Media is in dispute. A Delaware judge this week ruled ARC Global should receive 8.19 million shares of Trump Media, more than the roughly 7 million shares that the company has said that ARC was entitled to. Separately, Truth Social cofounders Andy Litinsky and Wes Moss have also sued TMTG for damages for preventing them from selling their stock sooner. Orlando and Moss did not immediately reply to requests for comment, while Litinsky could not be reached for a comment. Newly listed companies often see pressure on their stocks ahead of the end of their lock-up period, when insiders become free to sell their often considerable stakes. Trump Media, which operates the Truth Social app, saw its value balloon to nearly $10 billion following its Wall Street debut, lifted by retail traders and traders who see it as a speculative bet on his chances of securing a second four-year term as president. However, after reaching that peak, Trump Media shares have lost most of their value, with declines accelerating in recent weeks after President Joe Biden gave up his reelection bid on July 21, and Trump lost a lead in opinion polls ahead of the Nov. 5 presidential election to Democratic candidate Vice President Kamala Harris. Betting markets now show Harris with a modest advantage over Trump in a tight race. Trump Media's revenue is equivalent to two Starbucks coffee shops, and strategists say its $3 billion stock market value is detached from its day-to-day business. Its stock is trading at the equivalent of over 1,000 times its revenue, far exceeding the valuation of even AI superstar Nvidia, which recently traded at 24 times its revenue. "The market couldn't absorb even a partial stake sale without some material damage to the stock," Sosnick said. "Ultimately a lot will hinge on whether (Trump) keeps his word on not selling while the longer term prospects of the company are completely dependent upon his electoral prospects." (Reporting by Noel Randewich and Medha Singh; Additional reporting by Lance Tupper and Tom Hals; Editing by Megan Davies and Diane Craft)

[4]

Trump Media shares face potential sell-off as insider selling restrictions lift

Other major stakeholders who could soon sell their shares include United Atlantic Ventures and Patrick Orlando, whose fund, ARC Global Investments II, sponsored the blank-check company that merged with Trump Media in March. The two own a combined 11% of Trump Media, according to a company filing. "Even if Trump doesn't, it would be interesting if other insiders begin selling because that would be a clue as to what they think his mindset is about selling," said Steve Sosnick, chief strategist at Interactive Brokers. Trump Media insiders could sell their shares as early as after the bell on Thursday if the stock ends the regular trading session at or above $12, according to a provision in the company's prospectus. Shares were last down 4% at $15, extending sharp losses in recent weeks fueled by worries about the end of so-called lock-up period related to its stock market debut in March. Trump and other insiders, including Chief Operating Officer Andrew Northwall, Chief Technology Officer Vladimir Novachki and director Donald Trump Jr., did not respond to Reuters' requests for comment on their plans after the lock-up expires. Trump Media did not respond to a request for a comment. The size of ARC's stake in Trump Media is in dispute. A Delaware judge this week ruled ARC Global should receive 8.19 million shares of Trump Media, more than the roughly 7 million shares that the company has said that ARC was entitled to. Separately, Truth Social cofounders Andy Litinsky and Wes Moss have also sued TMTG for damages for preventing them from selling their stock sooner. Orlando and Moss did not immediately reply to requests for comment, while Litinsky could not be reached for a comment. Newly listed companies often see pressure on their stocks ahead of the end of their lock-up period, when insiders become free to sell their often considerable stakes. Trump Media, which operates the Truth Social app, saw its value balloon to nearly $10 billion following its Wall Street debut, lifted by retail traders and traders who see it as a speculative bet on his chances of securing a second four-year term as president. However, after reaching that peak, Trump Media shares have lost most of their value, with declines accelerating in recent weeks after President Joe Biden gave up his reelection bid on July 21, and Trump lost a lead in opinion polls ahead of the Nov. 5 presidential election to Democratic candidate Vice President Kamala Harris. Betting markets now show Harris with a modest advantage over Trump in a tight race. Trump Media's revenue is equivalent to two Starbucks coffee shops, and strategists say its $3 billion stock market value is detached from its day-to-day business. Its stock is trading at the equivalent of over 1,000 times its revenue, far exceeding the valuation of even AI superstar Nvidia, which recently traded at 24 times its revenue. "The market couldn't absorb even a partial stake sale without some material damage to the stock," Sosnick said. "Ultimately a lot will hinge on whether (Trump) keeps his word on not selling while the longer term prospects of the company are completely dependent upon his electoral prospects." (Reporting by Noel Randewich and Medha Singh; Additional reporting by Lance Tupper and Tom Hals; Editing by Megan Davies and Diane Craft)

Share

Share

Copy Link

Trump Media & Technology Group faces potential stock volatility as insider selling restrictions are lifted. The expiration of the lock-up period could lead to significant share sales by early investors and executives.

Expiration of Lock-Up Period

Trump Media & Technology Group (TMTG), the company behind former U.S. President Donald Trump's social media platform Truth Social, is facing a crucial moment as insider selling restrictions are set to expire. This development could potentially trigger a significant sell-off of the company's shares, which have experienced substantial volatility since their market debut

1

.Stock Performance and Market Capitalization

TMTG's stock, trading under the ticker DJT, has seen remarkable fluctuations since its listing. The company's market capitalization soared to approximately $11 billion following its debut, despite Truth Social reporting less than $3.5 million in revenue for the first nine months of 2023. However, the stock has since retreated from its peak, closing at $52.95 on Monday, which still values the company at about $7.2 billion

2

.Potential Impact of Insider Sales

The expiration of the lock-up period allows early investors, executives, and other insiders to sell their shares for the first time since the company went public. This event is particularly significant given that insiders, including the former president, control nearly 89% of the stock

3

. The potential for large-scale selling by these stakeholders could exert downward pressure on the stock price.Trump's Stake and Financial Implications

Donald Trump, who serves as the chairman of TMTG, holds a stake of about 60% in the company. This translates to approximately 78.75 million shares, valued at around $4.1 billion based on Monday's closing price. The ability to sell these shares could provide Trump with a substantial financial windfall, potentially alleviating some of his legal and financial challenges

4

.Related Stories

Market Skepticism and Short Selling

Despite the high valuation, TMTG faces significant skepticism from some market participants. The company's shares are heavily shorted, with about 12% of the free float sold short, according to data from S3 Partners. This level of short interest indicates that a considerable number of investors are betting on a decline in the stock price

1

.Regulatory Scrutiny and Future Outlook

TMTG is currently under investigation by federal prosecutors and regulators, adding another layer of uncertainty to its future prospects. The company's ability to maintain its high valuation in the face of potential insider selling, regulatory challenges, and market skepticism remains a key question for investors and analysts alike

2

.References

Summarized by

Navi

Related Stories

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy