TSMC's Confident Stance in AI Chip Market: "They Will All Come to Us in the End"

2 Sources

2 Sources

[1]

TSMC boss claims the chipmaker doesn't need to pick winners to work with, just wait patiently 'because they will all come to us in the end'

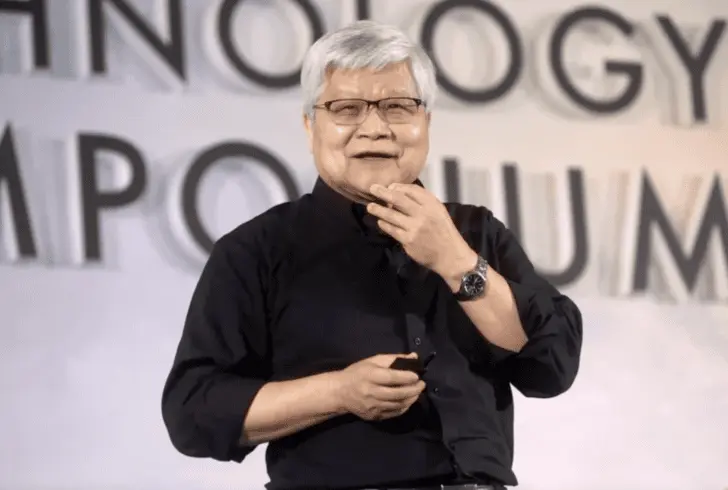

Yesterday, TSMC held a shareholder meeting, and in an interview following this the company showed every sign of confidence in its future, regardless of the ebbing and flowing of different AI companies that are some of its biggest customers. The world's biggest semiconductor company even went as far as to say about AI companies: "We don't need to judge who will win, because they will all come to us in the end." That eerily ominous machine translated quote, brought to you by Taiwan Economic Daily (via Wccftech), comes from Wei Zhejia (C. C. Wei), CEO and chairman of TSMC. It comes off the back of of Wei pointing out that both GPUs and ASICs are made at TSMC, implying that whatever kind of AI data centre compute you need, TSMC has you covered. And it's true, TSMC does produce most of the compute for AI data centres, with Nvidia's various Hopper and Blackwell chips being the most obvious ones and the ones that AI companies seem to be lining up for. Yesterday we covered how TSMC said at this TSMC shareholder meeting that "AI demand has always been very strong and it's consistently outpacing supply" despite US tariffs. The company did say that tariffs have an impact, though. With a new $100 billion planned investment in the US and an Arizona fab capacity that's already apparently sold out through 2027, it doesn't look like TSMC has much to worry about on the international trade war front, either. I suppose that with production based both in Taiwan and in the US, it's not too ridiculous to assume that "they will all come to us in the end." Wei reportedly admits that the company did face overcapacity in the recent past, but "this time we are more careful and thorough than before." This seems to be in part because TSMC is getting forecasts and info from chip-scale packaging manufacturers (CSPs) as "they are also worried that we are not prepared enough." It must be difficult to predict demand in such a new and booming market as AI, but if any company can be sure to do well -- other than Nvidia, of course -- it does seem to be TSMC. Let's just hope we see some of that sweet chip revenue trickle down into the laps of we humble gamers in the form of some derivative gaming chips and GPUs. Hey, I'm not above scooping up the scraps, are you?

[2]

TSMC's CEO Says It Will Always Win In The AI Chip Race, Claiming That Big Tech Has No Option Other Than The Taiwan Giant

TSMC has acknowledged its dominance in the chip industry, claiming that despite all firms competing in the AI race, TSMC will be the ultimate winner. The Taiwan giant has made massive contributions to where AI has reached when it comes to computational capabilities, given that the foundry is the primary source of chips and advanced packaging for firms like NVIDIA. Right now, there are no competitors close to the firm regarding process technology, production scalability, and popularity, which is why it is safe to say that TSMC is the undisputed king. At the company's annual shareholders' meeting (via Taiwan Economic Daily), TSMC CEO C.C. Wei claimed that orders will always flow towards the firm in the AI segment, despite any Big Tech organization pursuing a project in conflict with the company's interests. Elaborating on it, he said that TSMC isn't concerned about which AI design company wins in the end, but delivering on customer requirements is a priority. TSMC supplies GPUs, ASICs, chip nodes, and many services to its partners, so all competition would likely end up sourcing from the same foundry, which is a win-win situation for the Taiwan giant. He also claimed that the ongoing tariff situation will have "little effect" on TSMC's opportunities, given that the demand for AI is likely going to offset all losses. TSMC specifically focused on upscaling production to meet future demands, revealing that the firm has managed to catch up with the production bottleneck existing since 2023, and is now operating to meet the needs of its partners to the fullest. The firm is now on track to capitalize on new market avenues, mainly humanoid robots and AI factories. C.C. Wei claimed that the hype of such technologies will only increase the company's revenue over time. TSMC has revealed complete dominance over the chip markets, and, given the company's trajectory, it won't be wrong to say that the monopoly is here to stay.

Share

Share

Copy Link

TSMC's CEO C.C. Wei expresses unwavering confidence in the company's dominance of the AI chip market, citing their diverse product offerings and strategic positioning in both Taiwan and the US.

TSMC's Confident Stance in AI Chip Market

Taiwan Semiconductor Manufacturing Company (TSMC), the world's largest semiconductor foundry, has expressed unwavering confidence in its position as the dominant player in the AI chip market. During a recent shareholder meeting, TSMC's CEO and Chairman C.C. Wei made a bold statement, saying, "We don't need to judge who will win, because they will all come to us in the end"

1

.

Source: PC Gamer

Diverse Product Offerings

TSMC's confidence stems from its comprehensive range of products catering to the AI industry. The company produces both GPUs and ASICs, effectively covering all bases for AI data center compute needs

1

. This diversification ensures that regardless of which AI companies emerge as leaders, TSMC remains the go-to manufacturer for their chip requirements.Market Dominance and Customer Relations

Wei emphasized that TSMC's priority is delivering on customer requirements rather than picking winners in the AI race

2

. The company's unparalleled process technology, production scalability, and popularity have solidified its position as the primary source of chips and advanced packaging for major players like NVIDIA.

Source: Wccftech

Strong Demand and Supply Challenges

Despite facing overcapacity issues in the recent past, TSMC reports that AI demand consistently outpaces supply

1

. The company has taken a more cautious approach to capacity planning, collaborating closely with chip-scale packaging manufacturers to better predict and meet market demands.Strategic Expansion and Trade War Mitigation

TSMC is actively expanding its global footprint to mitigate potential impacts from international trade tensions. The company has announced a $100 billion investment plan in the United States, with its Arizona fab capacity reportedly sold out through 2027

1

. This strategic move allows TSMC to maintain its dominant position regardless of geopolitical challenges.Related Stories

Future Outlook and Emerging Technologies

Looking ahead, TSMC is positioning itself to capitalize on emerging technologies such as humanoid robots and AI factories

2

. The company believes that the growing hype around these technologies will further boost its revenue streams in the coming years.Impact on Gaming Industry

While TSMC's focus remains on high-end AI chips, there's potential for this technology to trickle down to the gaming industry. Gamers may eventually benefit from derivative chips and GPUs resulting from advancements in AI computing

1

.As the AI chip race intensifies, TSMC's confident stance and strategic positioning suggest that it is well-prepared to maintain its leadership in the semiconductor industry, regardless of which AI companies emerge as frontrunners in the coming years.

References

Summarized by

Navi

Related Stories

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology