US Energy Infrastructure Firms Poised for Record Gains Amid Surging AI Power Demand

2 Sources

2 Sources

[1]

US energy infra firms set for record gains as AI power demand soars

Nov 22 (Reuters) - U.S. energy infrastructure providers are on pace to post their best year in many, as investors hedge against volatility in the commodity markets and wager on long-term demand fueled by the rise of power-guzzling technologies such as generative AI. The Alerian Midstream Energy Index (.AMNA), opens new tab, which tracks major North American pipeline and storage companies, is up about 46% this year after hitting a record high in March. This compares with the nearly 25% gains in the broader S&P 500 index (.SPX), opens new tab during the same period. Alerian index constituents Kinder Morgan (KMI.N), opens new tab and Targa Resources (TRGP.N), opens new tab are set for their best yearly gains, while Williams Co (WMB.N), opens new tab is on track for its best year in nearly two decades. "We've seen fairly substantial flows from a lot of institutional investors over the past six months," said Kenny Zhu, research analyst at Global X ETFs, a New York-based provider of exchange-traded funds. Energy infrastructure firms' fixed-fee model shields them from the volatility in oil and gas prices, while the sector also benefits from surging U.S. production. Payouts in the form of dividends and buybacks due to stable cash flows are also pulling in small investors, experts said. The explosive growth in artificial intelligence and the related insatiable demand from data centers to run the power-hungry applications have reinforced the segment's appeal. "There's no artificial intelligence without energy infrastructure, because AI needs the power 24 hours a day, seven days a week," said Rob Thummel, senior portfolio manager at asset management firm Tortoise. Additionally, several liquefied natural gas export projects are expected to come online in the latter half of the decade, further boosting demand for pipelines. However, building new large-scale pipelines is not an easy task in the U.S., as they often run into regulatory hurdles, making existing infrastructure even more valuable. "If you have pipelines in the ground right now, you're in a really good spot because those are going to become more and more valuable as demand continues to grow," said Zack Van Everen, director of research at TPH&Co. Reporting by Sourasis Bose in Bengaluru; Editing by Sriraj Kalluvila Our Standards: The Thomson Reuters Trust Principles., opens new tab Suggested Topics:EnergyGrid & InfrastructurePipelines & TransportGas

[2]

US Energy Infra Firms Set for Record Gains as AI Power Demand Soars

(Reuters) - U.S. energy infrastructure providers are on pace to post their best year in many, as investors hedge against volatility in the commodity markets and wager on long-term demand fueled by the rise of power-guzzling technologies such as generative AI. The Alerian Midstream Energy Index, which tracks major North American pipeline and storage companies, is up about 46% this year after hitting a record high in March. This compares with the nearly 25% gains in the broader S&P 500 index during the same period. Alerian index constituents Kinder Morgan and Targa Resources are set for their best yearly gains, while Williams Co is on track for its best year in nearly two decades. "We've seen fairly substantial flows from a lot of institutional investors over the past six months," said Kenny Zhu, research analyst at Global X ETFs, a New York-based provider of exchange-traded funds. Energy infrastructure firms' fixed-fee model shields them from the volatility in oil and gas prices, while the sector also benefits from surging U.S. production. Payouts in the form of dividends and buybacks due to stable cash flows are also pulling in small investors, experts said. The explosive growth in artificial intelligence and the related insatiable demand from data centers to run the power-hungry applications have reinforced the segment's appeal. "There's no artificial intelligence without energy infrastructure, because AI needs the power 24 hours a day, seven days a week," said Rob Thummel, senior portfolio manager at asset management firm Tortoise. Additionally, several liquefied natural gas export projects are expected to come online in the latter half of the decade, further boosting demand for pipelines. However, building new large-scale pipelines is not an easy task in the U.S., as they often run into regulatory hurdles, making existing infrastructure even more valuable. "If you have pipelines in the ground right now, you're in a really good spot because those are going to become more and more valuable as demand continues to grow," said Zack Van Everen, director of research at TPH&Co. (Reporting by Sourasis Bose in Bengaluru; Editing by Sriraj Kalluvila)

Share

Share

Copy Link

U.S. energy infrastructure companies are experiencing unprecedented growth, driven by investor interest in stable returns and increasing power demand from AI technologies. The sector's fixed-fee model and strategic position in meeting future energy needs are attracting both institutional and retail investors.

Energy Infrastructure Sector Experiences Unprecedented Growth

U.S. energy infrastructure providers are on track to achieve their best performance in years, with the Alerian Midstream Energy Index surging approximately 46% in 2024

1

2

. This remarkable growth significantly outpaces the broader S&P 500 index, which has seen gains of nearly 25% during the same period. Industry leaders such as Kinder Morgan, Targa Resources, and Williams Co are poised to record their most substantial yearly gains in recent history1

2

.Investors Flock to Energy Infrastructure

The sector's appeal has grown considerably among both institutional and retail investors. Kenny Zhu, a research analyst at Global X ETFs, notes, "We've seen fairly substantial flows from a lot of institutional investors over the past six months"

1

. This influx of investment is attributed to several key factors:- Fixed-fee model: Energy infrastructure firms operate on a fixed-fee basis, which insulates them from the volatility typically associated with oil and gas prices

1

2

. - Stable cash flows: The sector's ability to generate consistent cash flows has led to attractive payouts in the form of dividends and share buybacks, drawing in smaller investors

1

2

. - Surging U.S. production: The ongoing increase in U.S. energy production has provided additional tailwinds for the sector

1

2

.

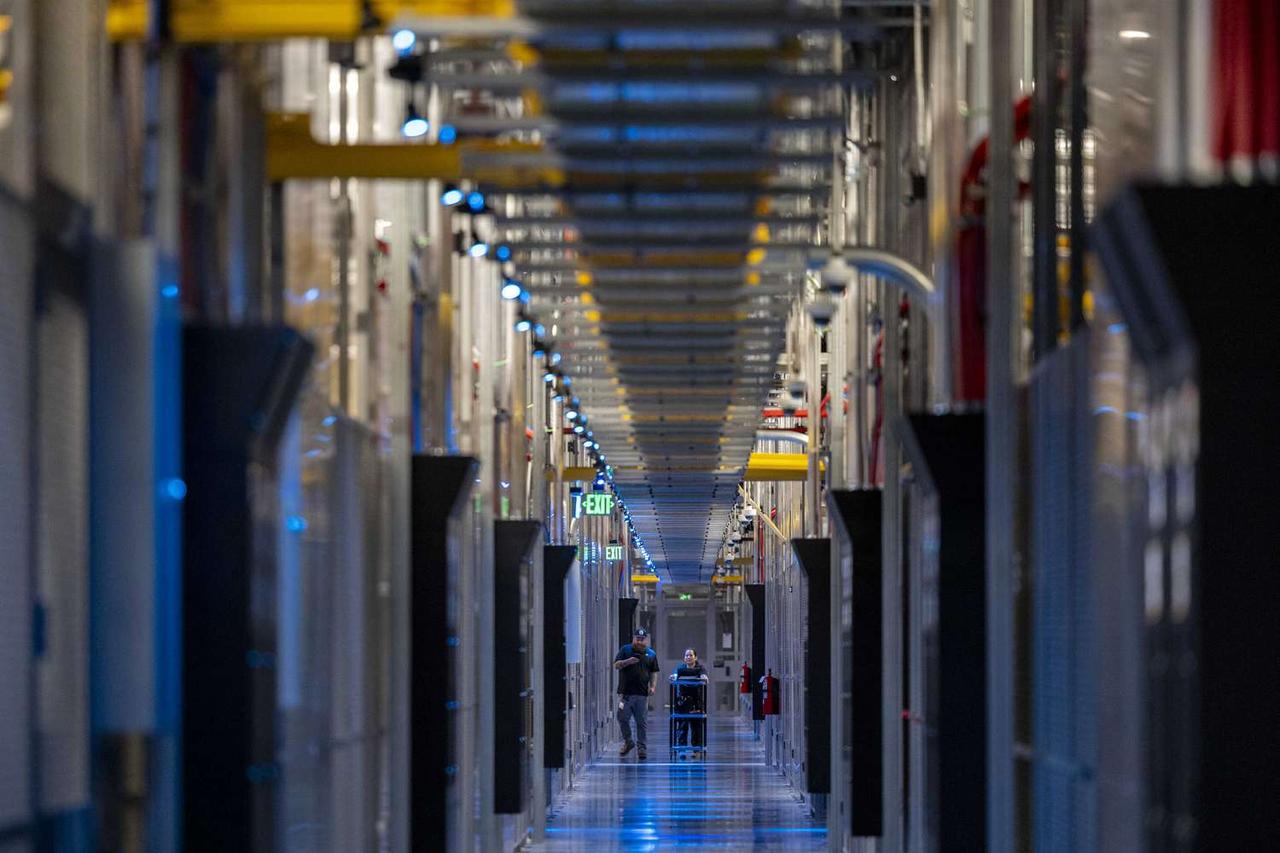

AI's Role in Driving Energy Demand

The explosive growth of artificial intelligence (AI) technologies has emerged as a significant factor in the sector's success. Power-hungry AI applications and data centers require substantial and consistent energy supply. Rob Thummel, senior portfolio manager at Tortoise, emphasizes this connection: "There's no artificial intelligence without energy infrastructure, because AI needs the power 24 hours a day, seven days a week"

1

2

.Related Stories

Future Growth Prospects

Several factors point to continued growth in the energy infrastructure sector:

- LNG export projects: Multiple liquefied natural gas (LNG) export facilities are expected to come online in the latter half of the decade, further increasing demand for pipeline infrastructure

1

2

. - Regulatory hurdles: The challenges associated with building new large-scale pipelines in the U.S. have made existing infrastructure even more valuable

1

2

. - Growing demand: Zack Van Everen, director of research at TPH&Co, highlights the advantageous position of companies with existing pipelines: "If you have pipelines in the ground right now, you're in a really good spot because those are going to become more and more valuable as demand continues to grow"

1

2

.

As the energy landscape continues to evolve, driven by technological advancements and changing consumption patterns, the U.S. energy infrastructure sector appears well-positioned to capitalize on these trends and maintain its growth trajectory.

References

Summarized by

Navi

Related Stories

AI-Driven Power Demand Fuels Record M&A Activity in US Energy Sector

13 Mar 2025•Business and Economy

Utility Stocks Surge on AI-Driven Energy Demand: Vistra and Constellation Energy Lead the Charge

10 Oct 2024•Business and Economy

AI's Energy Appetite: Big Tech Turns to Nuclear and Alternative Power Sources

05 Jun 2025•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy