Alibaba's $50 Billion AI and Cloud Computing Investment Signals China's Tech Resurgence

15 Sources

15 Sources

[1]

China's Alibaba to invest $50 bil. in AI, cloud computing

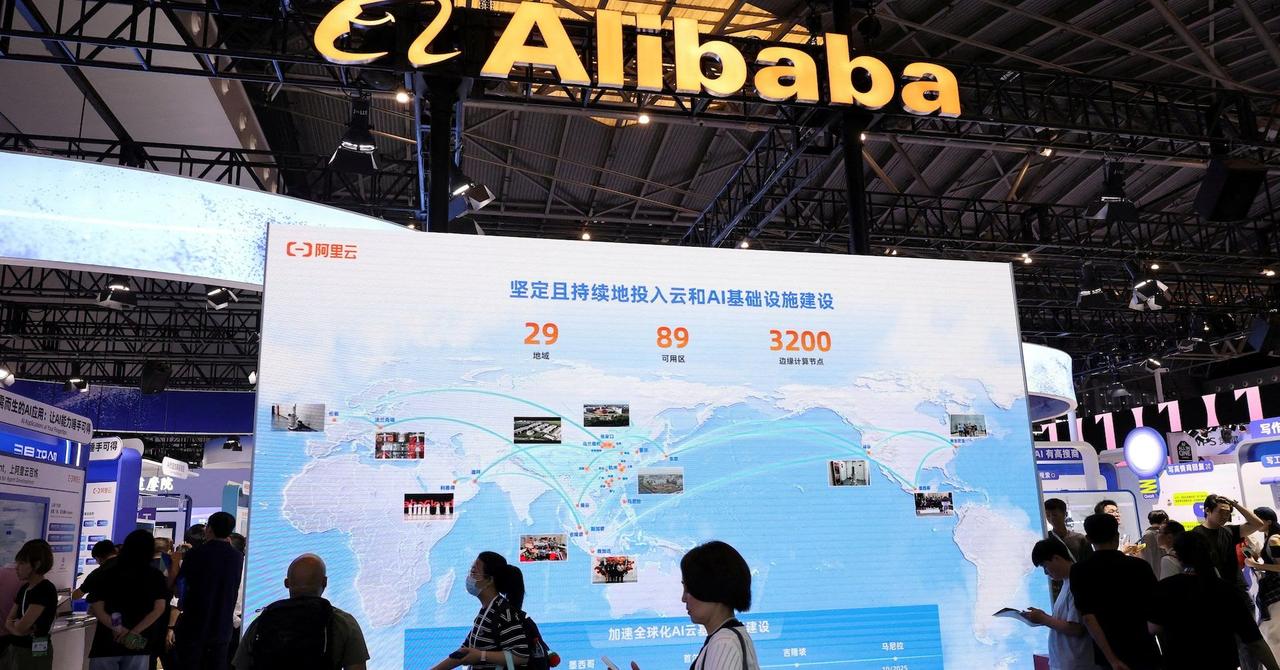

The logo of Alibaba is seen at the World Artificial Intelligence Conference (WAIC) in Shanghai, China, July 6, 2023. AFP-Yonhap Chinese tech giant Alibaba said Monday it will spend more than $50 billion on artificial intelligence and cloud computing over the next three years, a week after co-founder Jack Ma was seen meeting President Xi Jinping. Investors have piled into Chinese technology stocks since the start of the year, with Alibaba -- which runs some of the country's biggest online shopping platforms -- seeing its shares soar to three-year highs. The gains have been boosted since the Hangzhou-based firm announced robust sales growth last week, adding to signs that the sector is staging a comeback from years of gloom sparked by a government crackdown. Alibaba plans to "invest at least 380 billion yuan ($53 billion) over the next three years to advance its cloud computing and AI infrastructure," a company statement said. The firm said its strategy was aimed at "reinforcing (Alibaba's) commitment to long-term technological innovation... (and) underscores the company's focus on AI-driven growth." The statement did not detail how the company would allocate the funds or what specific projects would be supported. It did add that the investment would exceed its total AI and cloud spending over the past decade. Alibaba last week reported an eight percent bump in revenue for the three months through December, beating estimates to reach 280 billion yuan -- and triggering a 14 percent surge in its Hong Kong shares on Friday. CEO Eddie Wu said last week that the quarterly results "demonstrated substantial progress in (Alibaba's) 'user-first, AI-driven' strategies and the re-accelerated growth of our core businesses." The company and its industry peers endured years of dampened investor confidence after Beijing launched an aggressive regulatory crackdown on the tech sector in 2020. But they have been riding higher in recent months, buoyed by the launch of a chatbot by Chinese startup DeepSeek that has upended the AI industry. The turnaround comes as the world's second-largest economy continues to battle sluggish consumption and persistent woes in the property sector. At a rare meeting with business luminaries last week, Xi hailed the private sector and said the current economic problems were "surmountable" -- a move widely interpreted as a show of support for big tech. Ma remains an influential figure despite no longer being an Alibaba executive and shunning the limelight since authorities brought down affiliate Ant Group's high-stakes IPO in 2020. His inclusion in the meeting hinted at the billionaire magnate's potential public rehabilitation following the tangle with regulators. (AFP)

[2]

China's Alibaba to invest $50 bil. in AI, cloud computing

The logo of Alibaba is seen at the World Artificial Intelligence Conference (WAIC) in Shanghai, China, July 6, 2023. AFP-Yonhap Chinese tech giant Alibaba said Monday it will spend more than $50 billion on artificial intelligence and cloud computing over the next three years, a week after co-founder Jack Ma was seen meeting President Xi Jinping. Investors have piled into Chinese technology stocks since the start of the year, with Alibaba -- which runs some of the country's biggest online shopping platforms -- seeing its shares soar to three-year highs. The gains have been boosted since the Hangzhou-based firm announced robust sales growth last week, adding to signs that the sector is staging a comeback from years of gloom sparked by a government crackdown. Alibaba plans to "invest at least 380 billion yuan ($53 billion) over the next three years to advance its cloud computing and AI infrastructure," a company statement said. The firm said its strategy was aimed at "reinforcing (Alibaba's) commitment to long-term technological innovation... (and) underscores the company's focus on AI-driven growth." The statement did not detail how the company would allocate the funds or what specific projects would be supported. It did add that the investment would exceed its total AI and cloud spending over the past decade. Alibaba last week reported an eight percent bump in revenue for the three months through December, beating estimates to reach 280 billion yuan -- and triggering a 14 percent surge in its Hong Kong shares on Friday. CEO Eddie Wu said last week that the quarterly results "demonstrated substantial progress in (Alibaba's) 'user-first, AI-driven' strategies and the re-accelerated growth of our core businesses." The company and its industry peers endured years of dampened investor confidence after Beijing launched an aggressive regulatory crackdown on the tech sector in 2020. But they have been riding higher in recent months, buoyed by the launch of a chatbot by Chinese startup DeepSeek that has upended the AI industry. The turnaround comes as the world's second-largest economy continues to battle sluggish consumption and persistent woes in the property sector. At a rare meeting with business luminaries last week, Xi hailed the private sector and said the current economic problems were "surmountable" -- a move widely interpreted as a show of support for big tech. Ma remains an influential figure despite no longer being an Alibaba executive and shunning the limelight since authorities brought down affiliate Ant Group's high-stakes IPO in 2020. His inclusion in the meeting hinted at the billionaire magnate's potential public rehabilitation following the tangle with regulators. (AFP)

[3]

China's Alibaba to invest $50 bn in AI, cloud computing

Chinese tech giant Alibaba said Monday it will spend more than $50 billion on artificial intelligence and cloud computing over the next three years, a week after co-founder Jack Ma was seen meeting President Xi Jinping. Investors have piled into Chinese technology stocks since the start of the year, with Alibaba -- which runs some of the country's biggest online shopping platforms -- seeing its shares soar to three-year highs. The gains have been boosted since the Hangzhou-based firm announced robust sales growth last week, adding to signs that the sector is staging a comeback from years of gloom sparked by a government crackdown. Alibaba plans to "invest at least 380 billion yuan ($53 billion) over the next three years to advance its cloud computing and AI infrastructure", a company statement said. The firm said its strategy was aimed at "reinforcing (Alibaba's) commitment to long-term technological innovation... (and) underscores the company's focus on AI-driven growth". The statement did not detail how the company would allocate the funds or what specific projects would be supported. It did add that the investment would exceed its total AI and cloud spending over the past decade. Alibaba last week reported an eight percent bump in revenue for the three months through December, beating estimates to reach 280 billion yuan -- and triggering a 14 percent surge in its Hong Kong shares on Friday. CEO Eddie Wu said last week that the quarterly results "demonstrated substantial progress in (Alibaba's) 'user-first, AI-driven' strategies and the re-accelerated growth of our core businesses". The company and its industry peers endured years of dampened investor confidence after Beijing launched an aggressive regulatory crackdown on the tech sector in 2020. But they have been riding higher in recent months, buoyed by the launch of a chatbot by Chinese startup DeepSeek that has upended the AI industry. The turnaround comes as the world's second-largest economy continues to battle sluggish consumption and persistent woes in the property sector. At a rare meeting with business luminaries last week, Xi hailed the private sector and said the current economic problems were "surmountable" -- a move widely interpreted as a show of support for big tech. Ma remains an influential figure despite no longer being an Alibaba executive and shunning the limelight since authorities brought down affiliate Ant Group's high-stakes IPO in 2020. His inclusion in the meeting hinted at the billionaire magnate's potential public rehabilitation following the tangle with regulators.

[4]

China's Alibaba to invest USD50B in AI, cloud computing

BEIJING (AFP) - Chinese tech giant Alibaba said yesterday it will spend more than USD50 billion on artificial intelligence (AI) and cloud computing over the next three years, a week after co-founder Jack Ma was seen meeting Chinese President Xi Jinping. Investors have piled into Chinese technology stocks since the start of the year, with Alibaba - which runs some of the country's biggest online shopping platforms - seeing its shares soar to three-year highs. The gains have been boosted since the Hangzhou-based firm announced robust sales growth last week, adding to signs that the sector is staging a comeback from years of gloom sparked by a government crackdown. Alibaba plans to "invest at least CNY380 billion (USD53 billion) over the next three years to advance its cloud computing and AI infrastructure", a company statement said. The firm said its strategy was aimed at "reinforcing (Alibaba's) commitment to long-term technological innovation... (and) underscores the company's focus on AI-driven growth". The statement did not detail how the company would allocate the funds or what specific projects would be supported. It did add that the investment would exceed its total AI and cloud spending over the past decade. Alibaba last week reported an eight per cent bump in revenue for the three months through December, beating estimates to reach CNY280 billion - and triggering a 14 per cent surge in its Hong Kong shares on Friday. Chief Executive Officer Eddie Wu said last week that the quarterly results "demonstrated substantial progress in (Alibaba's) 'user-first, AI-driven' strategies and the re-accelerated growth of our core businesses". The company and its industry peers endured years of dampened investor confidence after Beijing launched an aggressive regulatory crackdown on the tech sector in 2020. But they have been riding higher in recent months, buoyed by the launch of a chatbot by Chinese startup DeepSeek that has upended the AI industry. The turnaround comes as the world's second-largest economy continues to battle sluggish consumption and persistent woes in the property sector. At a rare meeting with business luminaries last week, Xi hailed the private sector and said the current economic problems were "surmountable" - a move widely interpreted as a show of support for big tech. Ma remains an influential figure despite no longer being an Alibaba executive and shunning the limelight since authorities brought down affiliate Ant Group's high-stakes IPO in 2020. His inclusion in the meeting hinted at the billionaire magnate's potential public rehabilitation following the tangle with regulators.

[5]

Alibaba Commits Over $50B to AI and Cloud After Jack Ma's Xi Jinping Meeting

Alibaba has pledged to invest "at least" 380 billion yuan ($52 billion) in new cloud and AI infrastructure over the next three years. The move comes the week after company founder Jack Ma joined Chinese President Xi Jinping and other Big Tech bosses to discuss China's AI economy. A report from the firm's newsroom stated that the investment will "[reinforce] its commitment to long-term technological innovation," and "[underscore] the company's focus on AI-driven growth and its role as a leading global cloud provider." With a 36% share of the Chinese cloud market, Alibaba is set to benefit from rising AI adoption, boosted by DeepSeek and a foreign investment boom. "As AI models evolve, a growing share of AI-generated data will be processed and distributed via cloud networks," the company stated. This trend, "positions Alibaba Cloud as a key infrastructure provider." However, Alibaba isn't the only Chinese Big Tech firm riding the AI wave. In the week since, Alibaba's share price has climbed more than 11%, catalyzed by the show of support from Xi and better-than-expected earnings results. Facing a trade war with the U.S., the meeting sent a clear signal about how the government views private corporations. After a period of sluggish growth, Beijing is hoping to kickstart the economy by doubling down on innovation and creating a more favorable business climate. China's AI Ambitions While Alibaba's $52 billion commitment is dwarfed by the $500 billion Stargate project in the U.S., it still exceeds the firm's total AI and cloud spending over the past decade. Delivering the company's quarterly results, CEO Eddie Wu said Alibaba "will continue to execute our strategy and make significant investments to seize opportunities presented by the AI era. Meanwhile, "the pursuit of [Artificial General Intelligence] is our primary objective," he added. Other Big Tech players are also doubling down on AI investment. Baidu CEO Robin Li recently called for greater infrastructure spending to support China's continued competitiveness in the space. "The investment in cloud infrastructure is still very much required," he said. "In order to come up with models that are smarter than everyone else, you have to use more compute."

[6]

Alibaba to Spend More Than $52 Billion in AI, Cloud Over Next Three Years

Alibaba Group plans to invest more than $52 billion on AI and cloud infrastructure over the next three years, in a bid to seize more opportunities in the artificial-intelligence era. The spending of at least 380 billion yuan, equivalent to $52.41 billion, will surpass the company's AI and cloud computing investment over the past decade, Alibaba said in a post Monday on its news site. Alibaba first mentioned the plan last week when the company reported its results but didn't provide a specific figure. The technology giant co-founded by Jack Ma delivered better-than-expected results for three months ended December, with revenue growth accelerating to its fastest pace since late 2023, supported by improvements in its e-commerce and cloud businesses. Major Chinese tech companies, from Alibaba to Baidu, have been ramping up efforts to spur AI business growth as advancements by homegrown upstart DeepSeek have gained global attention. Alibaba co-founder Joe Tsai earlier this month said its AI technology would be integrated into Apple's iPhones for the Chinese market, a move that analysts expect to burnish the Hangzhou-based company's brand image and benefit its long-term growth. Last month, Alibaba introduced the Qwen2.5 Max, the latest version of its AI model, which it said was competitive with global leaders, including DeepSeek-V3. Alibaba's pledged AI and cloud investment exceeded the forecast of Citi analysts, who projected spending of 350 billion yuan from the fiscal fourth quarter of 2025 through the end of fiscal 2028. "We believe Alibaba is well-positioned to capture the influx demand of cloud computing services in the coming years," they said in a commentary.

[7]

Alibaba Group announces multi-billion dollar AI and cloud investment

Chinese e-commerce giant Alibaba Group has revealed it is investing $53 billion (€50.6bn) into cloud computing and artificial intelligence over the next three years. This would be one of the company's biggest tech investments so far, surpassing its investments in these sectors in the past 10 years. The move comes as Alibaba, along with several Chinese technology companies, have been seeing increased gains following robust earnings and a rebound in investor confidence. Alibaba's share price was down 2% on Monday morning. The decision comes after a meeting between the Chinese president Xi Jinping and Alibaba's co-founder Jack Ma, which has renewed investor hopes of the Chinese government providing more support to the tech sector. Eddie Wu, the company's chief executive officer (CEO), also emphasised that Alibaba has been focusing more on artificial intelligence lately, which has also propelled its current growth. He has also highlighted AI's potential to mimic human physical and intellectual labour, which could go a long way towards reinvigorating industries across the world. Significant cloud infrastructure is also expected to be needed to distribute and process large amounts of AI-generated data. The company has also shared its intention to integrate AI across its various divisions, such as enterprise and consumer applications, as well as e-commerce, in an attempt to improve customer experience, boost growth and make operations more efficient. Other major Chinese companies, such as ByteDance, which owns TikTok, have also been investing more in artificial intelligence lately, through increasing their capital expenditure budgets. This comes as China increases efforts to strengthen its position in the global artificial intelligence race. This is often done by sidestepping potential Western regulations and restrictions, through the use of open-source technologies. The method also supports Chinese companies in coming up with AI solutions much more quickly and cheaply than many of their Western counterparts. Companies such as Apple will also be able to use Alibaba's cloud infrastructure to provide advanced AI options to its Chinese consumer base, while still being in line with local regulations. This could go towards helping foreign tech giants navigate the complicated Chinese AI market, which could also further solidify Alibaba's position in the sector. Euronews has contacted Alibaba for comment. Alibaba released its fourth quarter 2024 results, with the company seeing a revenue of RMB 280,154 million (€36,907.4m), which was a rise of 8% on an annual basis. Net income attributable to ordinary shareholders came up to RMB 48,945m (€6,448m). Wu said in a press release on the company's website: "This quarter's results demonstrated substantial progress in our 'user first, AI-driven' strategies and the reaccelerated growth of our core businesses. During this quarter, customer management revenue at Taobao and Tmall Group grew 9% as a result of initiatives to enhance user experience and effective monetization. "Our Cloud revenue growth reignited to double digits at 13%, with AI-related product revenue achieving triple-digit growth for the sixth consecutive quarter. Looking ahead, revenue growth at Cloud Intelligence Group driven by AI will continue to accelerate. We will continue to execute against our strategic priorities in e-commerce and cloud computing, including further investment to drive long-term growth."

[8]

Alibaba to invest more than $52 billion in AI over next 3 years

Feb 24 (Reuters) - Alibaba said on Monday it plans to invest at least 380 billion yuan ($52.44 billion) in its cloud computing and artificial intelligence infrastructure over the next three years. The Chinese e-commerce giant had said it had plans to invest in the sector while announcing its results on Friday, but did not provide an exact figure at the time. The company had reported revenue of 280.15 billion yuan for the three months ended December 31, marginally ahead of analysts' estimates. Alibaba said the total investment amount exceeds the company's spending in AI and cloud computing over the past decade. The company has kicked off 2025 as a winner in China's AI race, drawing in investors with strategic business deals. Its stock has risen more than 68% this year, as of last close. Other Chinese firms have also been investing into the sector, with ByteDance, the Chinese owner of TikTok, earmarking over 150 billion yuan in capital expenditure for this year, much of which will be centred on AI according to sources familiar with the matter, Reuters reported in late January. ($1 = 7.2470 Chinese yuan renminbi) (Reporting by Shivangi Lahiri in Bengaluru; Editing by Varun H K)

[9]

Chinese Giant Alibaba to Invest Over $52 Billion in AI Over the Next Three Years

"Alibaba Cloud will become the most important AI infrastructure and one of the largest cloud computing networks for outputting AI intelligence, which is Alibaba Cloud's goal," said Eddie Wu, CEO. Chinese giant Alibaba on Monday announced that it plans to invest over $52 billion in the cloud computing and artificial intelligence sector over the next three years. The investment exceeds the company's total AI and cloud spending in the past decade, the company said. A few days ago, Alibaba Group also announced financial results for the quarter ending December 31, 2024, and revenue increased by 8% year-on-year. During the earnings call, Eddie Wu, CEO of Alibaba Group, said, "We see AI as a once-in-a-generation industry transformation opportunity, and the primary goal of our AI strategy is to pursue the realisation of AGI (Artificial General Intelligence) and continuously push the boundaries of model intelligence capabilities." It was also reported by The Information that Alibaba plans to release a new reasoning model. "Alibaba Cloud will become the most important AI infrastructure and one of the largest cloud computing networks for outputting AI intelligence, which is Alibaba Cloud's goal," added Wu. Recently, it was reported that Alibaba plans to introduce AI features in China. Apple initially considered working with Baidu, Tencent, ByteDance, and DeepSeek but ultimately chose Alibaba. Apple Intelligence's delay in China was due to its reliance on ChatGPT, which is unavailable in the country. Alibaba introduced its Qwen series of AI models in April 2023. Most recently, it unveiled the Qwen2.5 Max, which outperforms DeepSeek's V3 model. The model can also control mobile and computer screens, similar to Anthropic's Computer Use and OpenAI's Operator. Qwen's models can be accessed for free on the web chatbot application. With the exception of their latest Qwen2.5 Max, most of Qwen's models are available for open-source use via Hugging Face. Alibaba's investment is yet another landmark event, signifying that China is investing heavily in building an AI ecosystem that will outperform the United States.

[10]

Alibaba to Spend $53 Billion on AI Infrastructure in Big Pivot

Alibaba Group Holding Ltd. has pledged to invest more than 380 billion yuan ($53 billion) on AI infrastructure such as data centers over the next three years, a major commitment that underscores the e-commerce pioneer's ambitions of becoming a leader in artificial intelligence. The internet company co-founded by Jack Ma plans to spend more on its AI and cloud computing network than it has over the past decade. Alibaba envisions becoming a key partner to companies developing and applying AI to the real world as models evolve and need increasing amounts of computing power, the company said on its official blog.

[11]

Alibaba Plans to Invest $52B in AI, Cloud Over Next Three Years

Alibaba shares have gained almost 90% in the past 12 months through Friday. U.S.-listed shares of Alibaba Group (BABA) are falling 3% in premarket trading Monday after the Chinese tech giant announced plans to invest more than $52 billion in artificial intelligence and cloud infrastructure over the next three years. In a post on its news site, the company said over the next three years it would spend at least 380 billion yuan ($52.4 billion) -- an amount that would exceed the company's AI and cloud computing investment over the past decade. Alibaba said the investment "underscores the company's focus on AI-driven growth and its role as a leading global cloud provider." Alibaba CEO Eddie Wu had announced plans last week to "aggressively invest" in cloud and AI spending over the next three years but didn't give a specific amount. Jefferies analysts, who have a "buy" rating and $160 price target on Alibaba stock, noted that the investment "aligns with the earnings call last week and in line with street expectations." They said Alibaba Cloud "is a key player and outpaces peers in terms of capex spend, helping to foster sector development in the pursuit of AGI, intelligence enhancement and open strategy." Alibaba shares soared to a three-year high after the firm reported better-than-estimated quarterly results Thursday. They are up almost 90% to $143.75 over the past 12 months entering Monday trading.

[12]

Alibaba to invest more than $52 billion in AI over next 3 years

Feb 24 (Reuters) - Alibaba (9988.HK), opens new tab said on Monday it plans to invest at least 380 billion yuan ($52.44 billion) in its cloud computing and artificial intelligence infrastructure over the next three years. ($1 = 7.2470 Chinese yuan renminbi) Reporting by Shivangi Lahiri in Bengaluru; Editing by Varun H K Our Standards: The Thomson Reuters Trust Principles., opens new tab Suggested Topics:Artificial Intelligence

[13]

Cloud Giant Alibaba Invests $53B In AI Infrastructure As Stock Surges

Alibaba, the fourth largest cloud company in the world, unveils plans to invest $53 billion in AI infrastructure as China's largest cloud provider seeks to become a more dominant global AI player. Here's what you need to know. The world's fourth largest cloud computing company, Alibaba Group, unveiled plans Monday to invest $53 billion in its AI infrastructure and data centers as the company's stock hits a three-year high. The Chinese cloud giant is pouring $53 billion into AI over the next three years in Alibaba's pursuit to become a global powerhouse in providing AI infrastructure, AI models and innovation with CEO Eddie Wu declaring that AI is now the company's primary objective. "AI [is] the kind of opportunity for industry transformation that comes around only once every few decades," Wu said during the company's financial quarterly earnings call last week. "When it comes to Alibaba's AI strategy, [we] aim to continue to develop models that extend the boundaries of intelligence." Alibaba has gained over $100 billion in market value in 2025 alone. The company's market capitalization is currently $342 billion. [Related: AWS, Microsoft, Google Fight For $90B Q4 2024 Cloud Market Share] Alibaba Group Holding stock (ADR) is trading up 61 percent Monday morning at around $144 per share compared with one month ago. The company's U.S.-listed stock hasn't been trading this high since late 2021. Alibaba stock was trading at around $85 per share at the start of 2025. Looking at the financial earnings results of Alibaba's calendar year fourth-quarter 2024, the company generated total revenue of $38.4 billion, up 8 percent year over year. Alibaba's Cloud Intelligence Group generated $4.3 billion in total revenue during the quarter, representing an increase of 13 percent year over year. "Our Cloud revenue growth reignited to double digits at 13 percent, with AI-related product revenue achieving triple-digit growth for the sixth consecutive quarter," Alibaba's CEO said. "Looking ahead, revenue growth at Cloud Intelligence Group driven by AI will continue to accelerate." Alibaba has over 194,000 employees worldwide. Alibaba currently ranks No. 4 in terms of global cloud market share when it comes to cloud infrastructure services, winning 4 percent share during fourth-quarter 2024. Amazon Web Services is in first place with 30 percent share of the global cloud market, followed by Microsoft at 21 percent share then Google at 12 percent share. Alibaba's global cloud market share has been hovering at around 4 percent share over the past two years. It is key to note that Alibaba's $53 billion commitment to AI infrastructure comes years after its global competitors have already invested large sums of money in the same area. Cloud competitors like Google Cloud, Microsoft and AWS invested billions in growing their AI infrastructure and AI innovation in 2023 and 2024, while each is pledging to invest billions more in 2025. Looking at Alibaba's AI strategy, the company builds its own open-source AI large language models (LLMs), dubbed Qwen, while owning billions worth of cloud infrastructure inside its data centers. Alibaba unveiled an upgraded version of its newest Qwen 2.5 AI model just a few weeks ago, saying it outperforms Chinese AI rival DeepSeek's V3 model. As of Jan. 31, more than 90,000 derivative models had been developed on Hugging Face based on Alibaba's Qwen family of models, making it one of the largest global AI model families. Alibaba also has invested in Chinese AI startups like Zhipu and Moonshot. Alibaba Cloud recently introduced the Alibaba Cloud GenAI Empowerment Program, a dedicated support program for global developers and startups leveraging its Qwen models to build generative AI applications. Alibaba said its new $53 billion AI investment exceeds the company's spending in AI and cloud computing over the past decade.

[14]

Alibaba Places $52 Billion Price Tag on AI Plans | PYMNTS.com

Last week, Chinese tech conglomerate Alibaba announced a major uptick in AI spending. Now, the company has put a price tag on the effort, according to a Monday (Feb. 24) report by Reuters: at least 380 billion yuan, or $52.44 billion, over a three-year period. During an earnings call last week, the company said it would spend more on artificial intelligence (AI) in the next three years than it has in the last 10, without providing an exact figure. The goal, management said, is to help Alibaba pursue artificial general intelligence (AGI), or a version of AI that can think and reason at or above the level of humans. "We aim to continue to develop models that extend the boundaries of intelligence. Why is that the primary aim?" Eddie Wu, the company's CEO, said during the earnings call. "Well, it's because all of the visible AI application scenarios today that we see around content creation, search and so on and so forth have arisen precisely as a result of the ongoing extension of those boundaries, and we want to keep pushing out those boundaries to create more and more opportunities." As PYMNTS wrote earlier this year, developing AGI has become a goal for most of the world's biggest tech players such as OpenAI, Google and Meta. OpenAI CEO Sam Altman "fanned the flames" -- as that report put it -- at the beginning of the year when he wrote on his blog that the company is "now confident we know how to build AGI" as the technology has been traditionally recognized. "Achieving AGI would have big implications for business. For example, one AI system can analyze market trends while simultaneously redesigning the supply chain to adapt to those changes," PYMNTS wrote. "It can handle customer service while using those interactions to inform product development. It can manage operations while developing innovative solutions to efficiency problems. It can make strategic decisions by synthesizing information across multiple industries and domains, which requires high-level general reasoning." The Reuters report notes that Alibaba has begun 2025 as "a winner in China's AI race," attracting investors with its business deals, and seeing its stock climb more than 68% this year. Perhaps the company's most high-profile deal is the one it recently inked with Apple, to help that company develop an AI-powered iPhone for sale in China. Restrictions by the Chinese government require companies to have a local partner before launching AI products.

[15]

Alibaba Commits Unprecedented $53 Billion To AI Infrastructure. Competes With Trump's Stargate AI Plan - Alibaba Gr Hldgs (NYSE:BABA), Apple (NASDAQ:AAPL)

Alibaba Group Holding Ltd. BABA has announced an investment of 380 billion yuan (nearly $53 billion) for its cloud computing and AI infrastructure, making it the largest private computing project to date. What Happened: on Monday, Alibaba announced its plans to invest an amount that surpasses its total AI infrastructure spending over the past decade, reported South China Morning Post. This investment is on par with half of the initial $100 billion earmarked for the Stargate AI plan by the U.S. Alibaba stated that this commitment underscores its "focus on AI-driven growth and its role as a leading global cloud provider". CEO Eddie Wu Yongming, in the conference call last week, revealed that the intends to make significant investments in AI and cloud computing infrastructure over the next three years. However, he did not mention the amount of investment during the call. SEE ALSO: Economist Warns Junk Bond Spreads Are Flashing 2007 Crisis Warning Signs: '...Just Waiting To Catch Fire' Why It Matters: Alibaba's latest earnings report revealed higher-than-anticipated profit and revenue for the December quarter, fueling investor enthusiasm. The Chinese tech giant's AI endeavors garnered worldwide attention following reports that Apple AAPL had selected Alibaba as one of its AI partners in mainland China for the Apple Intelligence feature on iPhones. Alibaba also stated that its upgraded Qwen 2.5 Max edition was a strong alternative for DeepSeek's R1 model. In a research note on Monday, Morgan Stanley stated that Alibaba "appears poised to capture the AI cloud opportunity" with its latest investment strategy. The analyst also expects Alibaba Cloud revenue to double in the next three years, to reach 240 billion yuan (nearly $33.10 billion) in 2028. Meanwhile, equity strategists at UBS said on Thursday that they have replaced PDD Holdings PDD with Alibaba in a model portfolio due to its exposure to AI and quantitative factors. Besides Alibaba, other Chinese companies have also been investing in AI in a big way. ByteDance, the Chinese parent company of TikTok, allocated over 150 billion yuan ($20.69 billion) in capital expenditure for this year, with a significant portion expected to focus on AI, according to a previous Reuters report. The ADR of Alibaba Group surged more than 87% over the past year. READ MORE: Elon Musk-Led Tesla's Supercharger Vandalized With Nazi Symbols, EV Giant Says It 'Will Press Charges' Image via Shutterstock Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. AAPLApple Inc$245.00-0.22%OverviewBABAAlibaba Group Holding Ltd$143.70-0.03%BIDUBaidu Inc$91.23-0.05%PDDPDD Holdings Inc$131.00-0.26%Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Alibaba announces a massive $50 billion investment in AI and cloud computing over the next three years, following a meeting between Jack Ma and President Xi Jinping, indicating a potential shift in China's tech landscape and AI ambitions.

Alibaba's Massive AI and Cloud Computing Investment

Chinese tech giant Alibaba has announced a significant investment of at least 380 billion yuan ($53 billion) in artificial intelligence (AI) and cloud computing infrastructure over the next three years

1

. This move comes just a week after Alibaba's co-founder Jack Ma was seen meeting with Chinese President Xi Jinping, signaling a potential shift in the relationship between China's tech sector and the government2

.Strategic Focus on AI-Driven Growth

Alibaba's investment strategy aims to reinforce its commitment to long-term technological innovation and underscores the company's focus on AI-driven growth

3

. The investment will exceed Alibaba's total AI and cloud spending over the past decade, highlighting the company's ambitious plans for the future. CEO Eddie Wu emphasized that this move aligns with Alibaba's 'user-first, AI-driven' strategies and the re-accelerated growth of its core businesses4

.Market Response and Industry Impact

The announcement has been well-received by investors, with Alibaba's shares soaring to three-year highs. The company reported an 8% increase in revenue for the three months through December, reaching 280 billion yuan and triggering a 14% surge in its Hong Kong shares

1

. This positive performance, coupled with the massive investment plan, suggests a potential comeback for China's tech sector after years of regulatory challenges.China's AI Ambitions and Competition

Alibaba's investment is part of a broader trend in China's tech industry, with other major players also increasing their focus on AI. Baidu CEO Robin Li has called for greater infrastructure spending to support China's continued competitiveness in the AI space

5

. While Alibaba's $52 billion commitment is significant, it is still smaller than some international projects, such as the $500 billion Stargate project in the U.S.5

.Related Stories

Government Support and Economic Implications

The recent meeting between Jack Ma and President Xi Jinping, along with other business luminaries, has been interpreted as a show of support for the private sector and big tech companies

2

. This gesture comes as China's economy faces challenges, including sluggish consumption and issues in the property sector. The government appears to be looking to innovation and creating a more favorable business climate to kickstart economic growth5

.Future Prospects and Challenges

As AI models continue to evolve, Alibaba Cloud is positioning itself as a key infrastructure provider, with the company stating that a growing share of AI-generated data will be processed and distributed via cloud networks

5

. However, the specific allocation of funds and details of supported projects remain undisclosed1

. The tech giant's ambitious investment plan, coupled with the apparent thawing of relations between the tech sector and the government, suggests a potentially transformative period for China's AI and cloud computing landscape.References

Summarized by

Navi

[1]

[2]

[3]

[4]

Related Stories

Recent Highlights

1

Samsung unveils Galaxy S26 lineup with Privacy Display tech and expanded AI capabilities

Technology

2

Anthropic refuses Pentagon's ultimatum over AI use in mass surveillance and autonomous weapons

Policy and Regulation

3

AI models deploy nuclear weapons in 95% of war games, raising alarm over military use

Science and Research