AMD Reports Record Q3 Revenue of $9.25 Billion Driven by AI Chip Demand, But Faces Growing Competition

18 Sources

18 Sources

[1]

AMD's record quarter shows strength in client and AI, as Ryzen leads the charge -- but data center dominance could be out of reach

Ryzen 7 9800 and MI300X sales drive growth, while new risks to AMD's EPYC foothold emerge from Nvidia-Intel partnership. AMD has posted its highest quarterly revenue to date, booking $9.2 billion for Q3 2025. The company broke records in both its client and data center segments, with the Ryzen 7 9800X3D powering a rebound in consumer sales, and the Instinct MI300 series finally achieving meaningful volume. But while the company's margins are up and guidance looks stable, AMD also flagged major risks in its data center business -- from export constraints and packaging bottlenecks, to a potentially seismic shift in how Nvidia builds its next-generation platforms. The biggest surprise in AMD's earnings print wasn't just its record-breaking topline, but the fact that $2.8 billion of it came from client processors. That figure includes strong sell-through of the Ryzen 7 9800 and 9800X3D, two chips that have outperformed expectations in gaming laptops and compact desktops. The Zen 5-based 9800X3D in particular has been noted for its aggressive efficiency profile and broad adoption by OEMs. More telling is what this bounce tells us about AMD's design focus. While Intel's Meteor Lake platform continues to find traction with its integrated NPU push, AMD has leaned into gaming-first, performance-per-watt silicon. As a result, AMD has clawed back meaningful share in premium laptop designs. On the data center side, AMD reported $4.3 billion in revenue (a 22% year-over-year increase), driven by stronger EPYC adoption and meaningful Instinct MI300X shipments. This is the first quarter in which AMD has made a serious dent in the accelerator business, which it has long trailed Nvidia in. That growth came without any revenue from China-bound MI308 shipments, which were blocked under ongoing U.S. export restrictions and domestic bans in China. AMD confirmed Q3 and Q4 guidance excludes those entirely. The company's focus isn't just on GPUs; it's also building a vertically aware, modular, open platform. Announced back in June and dubbed Helios, AMD's cabinet reference design combines MI400-class accelerators, EPYC "Venice" CPUs, and Pensando "Vulcano" AI NICs, all connected via Ultra Ethernet. The goal is to win over hyperscalers and HPC customers looking for a coherent, Ethernet-native alternative to Nvidia's NVLink- and InfiniBand-centric products. AMD's Helios pitch is part of a long-term strategy to offer a full-stack, open alternative to Nvidia's vertically integrated systems. While Helios is built around the upcoming MI400-series GPUs, AMD's current MI355X -- its top-end CDNA 4 part for 2025 -- already reflects the shift toward inference-first workloads. With 288GB of HBM3E, support for FP4 and INT4, and aggressive focus on cost-per-token rather than peak FLOPs, MI355X is optimized for large-scale inference where memory bandwidth and low-precision throughput matter most. AMD is explicitly targeting the economics of production AI, not just training benchmarks. Oracle, one of AMD's largest cloud customers, is already rolling out MI300- and MI350-based infrastructure, and plans to adopt MI400-series platforms starting in 2026. The most significant long-term threat to AMD's data center business may not be in GPUs at all. In September, Nvidia and Intel announced an unexpected partnership that includes a custom x86 CPU built on Intel 18A, designed specifically for future Nvidia platforms. If it becomes the default attach CPU for Nvidia's Rubin or GB300-class AI systems, AMD's share of the server CPU footprint inside Nvidia-designed racks could shrink. This matters because EPYC currently benefits from Nvidia's lack of an x86 license. If that dependency disappears, AMD risks losing high-margin CPU slots inside third-party AI deployments, even if Instinct wins elsewhere. AMD also faces growing competition from in-house silicon at hyperscalers. Broadcom is currently working on a custom chip project with OpenAI that could scale to 10 gigawatts of compute by 2029. Amazon already uses its Trainium chips in production, and Microsoft's Maia program, though delayed, is still expected to launch. Each of these efforts eats into the total accessible market that AMD and Nvidia compete over. Further challenges for AMD's outlook include pending litigation. Hybrid bonding, the foundational tech behind its 3D V-Cache stack, is now the subject of two patent suits filed by Adeia. While neither is likely to impact short-term shipments, both could introduce licensing costs or design constraints if successful. AMD's Q3 was both strong and coherent. Ryzen's momentum validated Zen 5's efficiency push and helped balance a market tilted toward AI. Instinct MI300X found traction. Data center revenue reached new highs. And yet, it was also a map of AMD's next challenges. Nvidia's vertical integration and its new x86 CPU partnership with Intel could erode EPYC's share in high-value racks. In addition, supply chain bottlenecks will slow Instinct ramps, no matter how strong the architecture, and hyperscaler custom silicon at OpenAI et al is beginning to absorb budget that once went to merchant GPUs. On top of all that, real, unresolved geopolitical risks between the U.S. and China add even more uncertainty. AMD is executing well, given all these factors, but it's operating against a backdrop where the rules and alliances are changing constantly.

[2]

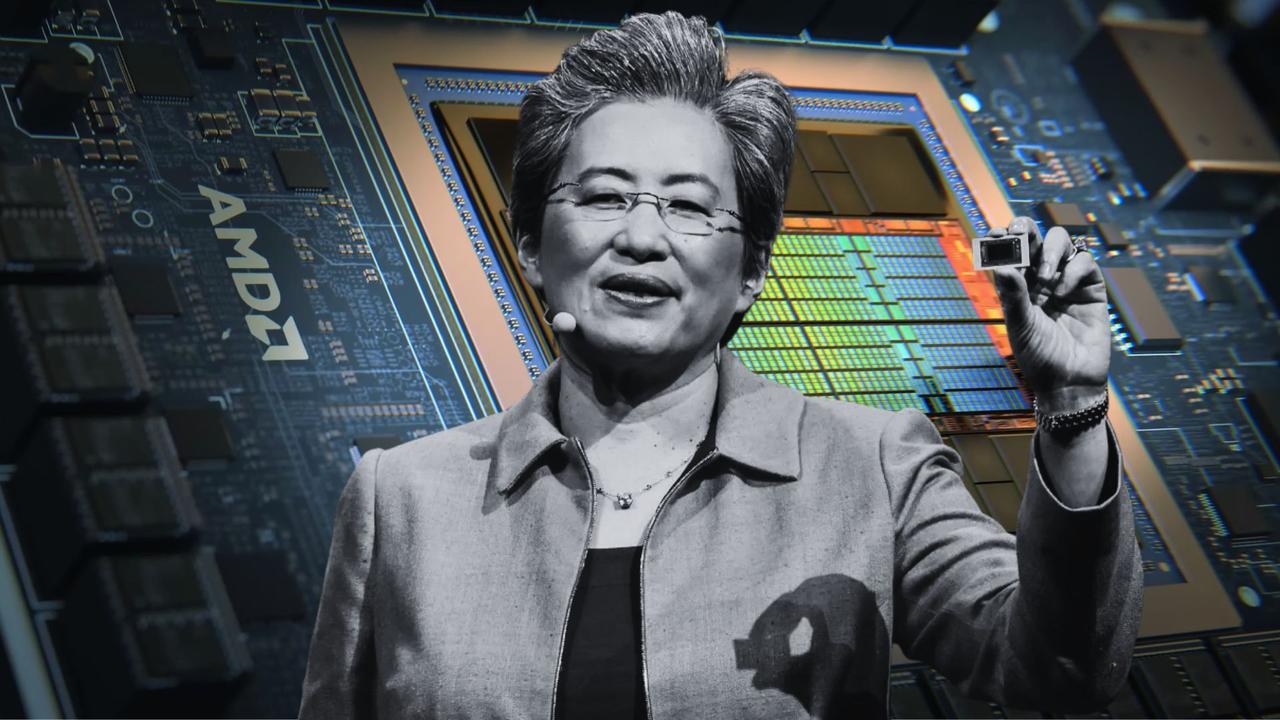

AMD's Lisa Su sees 35% annual sales growth driven by 'insatiable' AI demand

Lisa Su, chair and chief executive officer of Advanced Micro Devices Inc. (AMD), during a Bloomberg Television interview in San Francisco, California, US, on Monday, Oct. 6, 2025. AMD shares swung on Tuesday after CEO Lisa Su said the company's overall revenue growth would expand to about 35% per year over the next three to five years, driven by "insatiable" demand for artificial intelligence chips. Su said that much of that would be captured by the company's AI data center business, which it expects to grow at about 80% per year over the same time period, on track to hit tens of billions of dollars of sales by 2027. "This is what we see as our potential given the customer traction, both with the announced customers, as well as customers that are currently working very closely with us," Su told analysts. Ultimately, Su said that AMD could be able to achieve "double-digit" share in the data center AI chip market over the next three to five years. The AI chip market is currently dominated by Nvidia, which has over 90% of the market share, according to some estimates, and which has given the company a market cap of over $4.6 trillion, versus AMD's roughly $387 billion valuation. AMD is holding its first financial analyst day since 2022, as the company has found itself at the center of a boom in data center spending for AI. While companies are spending hundreds of billions of dollars in total on graphics processing unit (GPU) chips to build and power artificial intelligence applications like OpenAI's ChatGPT, they are also looking for alternatives to increase capacity and control costs. AMD is the only other major developer of GPUs aside from Nvidia. In October, AMD announced a partnership with OpenAI in which it would sell the AI startup billions of dollars in its Instinct AI chips over multiple years, starting with enough chips in 2026 to use 1 gigawatt of power.

[3]

AMD's revenue and profit jumps again, but stock falls as margins disappoint - SiliconANGLE

AMD's revenue and profit jumps again, but stock falls as margins disappoint Advanced Micro Devices Inc. delivered sharp increases in both profit and revenue today as it pushed deeper into the artificial intelligence data center market. However, its stock was headed lower in late-trading after disappointing investors with its margin guidance. The chipmaker reported third-quarter earnings before certain costs such as stock compensation of $1.20 per share, edging past the $1.16 analyst target. Revenue for the period jumped 36% to $9.25 billion, surging past the Street's consensus estimate of $8.74 billion. All told, the company posted a net profit of $1.24 billion in the quarter, up from a profit of just $771 million one year ago. In terms of guidance, AMD said it's looking for fourth quarter revenue of around $9.6 billion at the midpoint of its forecast range, implying growth of approximately 25%. That's quite a bit higher than the Street's target of $9.15 billion. However, investors were disappointed to see AMD's forecast for adjusted gross margin, which came to just 54.5%, in-line with Wall Street's consensus. AMD Chair and Chief Executive Lisa Su (pictured) hailed the company's latest results as "outstanding", noting it delivered record-breaking revenue and profitability. She said the numbers reflect broad-based demand for the company's high-performance EPYC and Ryzen processors and growing interest in its Instinct AI accelerators. She added that the results mark "a clear step in our growth trajectory as our expanding compute franchise and rapidly scaling data center AI business drive significant revenue and earnings growth." Notably, AMD said its guidance for the current quarter does not include anticipated revenue from shipments of its Instinct MI308 processors to China, similar to the previous quarter when they were also excluded. The reason is that, although the U.S. government has approved waivers that allow it to ship MI308 to Chinese customers, it's currently waiting on the Department of Commerce to review its license applications, and can't be sure when they'll be accepted. If AMD is able to clear its shipments to China, that could boost its revenue substantially and perhaps also move the needle on its margins, but it seems investors don't like uncertainty, and so the company's stock fell 3% in extended trading today. That followed a decline of nearly 4% in the regular trading session. Despite this, the company's stock is still up 107% in the year to date, compared to a gain of just 21% for the broader Nasdaq index. AMD's stock has surged this year because the company is striving to keep pace with Nvidia Corp. in the market for graphics processing units that power AI workloads. For years, the biggest players in AI, such as OpenAI Group PBC, were almost exclusively reliant on Nvidia's GPUs, but that has changed with the arrival of AMD's Instinct processors. The company has made some significant announcements regarding the growing adoption of its chips. Last month, Oracle Corp. announced plans to deploy 50,000 new AMD Instinct MI450 AI processors in its cloud, starting next year. The MI450 is AMD's most advanced GPU, set to launch early next year. Also last month, AMD said OpenAI is planning to deploy six gigawatts of its Instinct processors over multiple years, and across multiple generations of hardware, starting with an initial deployment of around one gigawatt. As part of that deal, OpenAI is also considering taking a 10% stake in the chipmaker, having been given the option to purchase 160 million shares. AMD's growing traction was noted by D.A. Davidson analyst Gil Luria, who told the Wall Street Journal that he sees a potential inflection point for the chipmaker. "It depends on them executing on the operations side going forward and releasing a chip that performs at scale with high yields and high performance," he said. "If it does that, the sales are there waiting. There's significant demand out there for an Nvidia alternative." AMD's data center unit, which includes its AI accelerators and also standard EPYC central processing units, delivered $4.34 billion in revenue during the quarter, up 22% from a year earlier and above the Street's $4.13 billion forecast. Still, investors had been looking for greater profitability, and although the unit delivered record revenue, its operating income of $1.07 billion trailed the Street's forecast by approximately 14%. That's because data center margins dropped to 25%, from 29% one year ago. The client computing business, which accounts for chips used in personal computers, came to $2.75 billion, up 46% and well ahead of the Street's forecast of $2.61 billion. Gaming revenue totaled $1.3 billion, up 181% from a year earlier and above the consensus estimate of $1.05 billion.

[4]

AMD's Earnings Blow Past Estimates on Strong Demand for Data Center Chips

The chipmaker's fourth-quarter outlook was also well above the analyst consensus. Advanced Micro Devices (AMD) on Tuesday reported record quarterly results above analysts' projections as booming demand for AI helped boost sales of its data center chips. AMD posted adjusted earnings per share of $1.20 on revenue that jumped 36% year-over-year to a record $9.25 billion in the third quarter, well above analysts' estimates compiled by Visible Alpha. Sales in AMD's data center segment -- by far its largest -- rose 22% year-over-year to $4.3 billion, slightly above expectations. The results did not include any revenue from shipments of AMD's MI308 AI chip line to China, which AMD has said it would resume after ironing out a revenue-sharing agreement with the Trump administration. CEO Lisa Su said the strong results mark "a clear step up in our growth trajectory as our expanding compute franchise and rapidly scaling data center AI business drive significant revenue and earnings growth." For the current quarter, AMD said it sees revenue between $9.3 billion and $9.9 billion, above the analyst consensus of $9.17 billion. That range doesn't include any revenue from AMD MI308 shipments to China either, AMD said. Shares of AMD slipped about 1% in extended trading following the release, after dropping close to 4% in Tuesday's session amid broader declines as worries about an AI bubble weighed on tech stocks. The chipmaker's stock has more than doubled in value this year.

[5]

AMD expected to outline plans for AI chip business at analyst day

The chip designer has been attempting to expand its AI business as rival Nvidia gobbles up market share for data center chips as the market explodes. AMD has been successful in the central processor (CPU) business, steadily taking share against Intel. Advanced Micro Devices is expected on Tuesday to outline the company's plans for its artificial intelligence chip and systems businesses at a financial analyst day at the Nasdaq in New York. The chip designer has been attempting to expand its AI business as rival Nvidia gobbles up market share for data center chips as the market explodes. AMD has been successful in the central processor (CPU) business, steadily taking share against Intel. The company's next-generation MI400 series of AI chips is set to launch in 2026 and include several variants designed for scientific applications and for generative AI. Along with the MI400 chips, AMD is also planning to launch a complete server rack, similar to a product Nvidia sells called the GB200 NVL72. At AMD analyst days, business unit heads typically present a series of projections and financial forecasts for the next several years. Beyond its AI chips, AMD likely will discuss its PC and video game chip businesses and its programmable chip unit. Last week, the Santa Clara, California-based company forecast fourth-quarter revenue that topped Wall Street estimates. Demand for AI chips gave AMD executives a reason for optimism about the remainder of the year. The company's data center CPU business has also benefitted from the surge in AI-related spending. The company last held an analyst day in 2022. Tuesday's event will start at 1 p.m. EST (1800 GMT). AMD signed a multiyear deal with ChatGPT creator OpenAI in October that will bring the company more than $100 billion in new revenue over four years from OpenAI and other customers. As part of the arrangement, OpenAI will receive warrants that allow it to purchase a stake of up to 10% in the chipmaker. The OpenAI arrangement was a much-needed large customer for AMD, which has not yet captured the outsized returns from the boom in AI spending as Nvidia has.

[6]

AMD Sees 'Very Clear Path' To Double-Digit Share In Nvidia-Dominated Data Center AI Market

AMD CEO Lisa Su explains how she expects the chip designer's business to grow over the next three to five years, with its Instinct GPUs estimated to drive an average of 80 percent growth in revenue and sales of other products also expected to increase over that period. AMD Chair and CEO Lisa Su said Tuesday that the chip designer sees a "very clear path" to gaining double-digit share in the Nvidia-dominated data center AI market that could drive an average of 80 percent in revenue growth over the next three to five years for the segment. Speaking at the AMD Financial Analyst Day 2025 event, Su (pictured) said the estimated revenue growth rate for data center AI products, anchored by its Instinct GPU lineup, could allow the company's broader data center business to grow at a compound annual growth rate of more than 60 percent over the next three to five years. [Related: Analysis: AMD Puts Channel Pressure On Intel As Both Firms Revamp Partner Programs] The Santa Clara, Calif.-based company expects the total addressable market for AMD's products in data centers to reach more than $1 trillion by 2030. This is double the $500 billion market figure Su gave in June, but that market-size estimate was only for AI accelerator chips in data centers and not a broader portfolio of products, including CPUs and networking components that the company is considering for its new figure. Nvidia, by contrast, said back in August that it expects the AI infrastructure market to reach between $3 trillion and $4 trillion by the end of the decade. Addressing the previous $500 billion estimate AMD gave for the data center accelerator chip market, Su said, "Many of you said, 'Well, that seems too high, Lisa, why would you think that those numbers should be so high?' It turns out that we were probably closer to right than wrong in terms of just the acceleration of AI spend." AMD's expected data center momentum, combined with an estimated 10 percent growth in revenue on average for the rest of AMD's business, would result in the compound annual growth rate for overall revenue reaching more than 35 percent over the next three to five years, according to Su. "It's an exciting growth trajectory that we have," she said. Across the other parts of AMD's business, Su set revenue share targets the company expects to hit in the next three to five years: more than 50 percent for server CPU products, more than 40 percent for client products and over 70 percent for adaptive chip products. "Now, as exciting as the data center AI revenue opportunity is for us, the other message that we want to leave you with today is every other part of our business is firing on all cylinders, and that's actually a very nice place to be," Su said. The disclosures were made a week after AMD reported a "sharp" jump in sales for its CPUs across the PC and server segments as well as its Instinct data center GPUs, which allowed the company to deliver record revenue of $9.2 billion for the third quarter. The company has spent significant resources over the past few years on building out competitive GPU, system and software capabilities that is helping it chip away at Nvidia's dominance of the AI infrastructure market. During the presentation, Su said AMD has invested more than $40 billion into research and development as well as more than $60 billion in acquisitions over the past five years, with many of these efforts meant to boost the company's AI strategy. The largest acquisitions during this period consisted of AMD's $49 billion Xilinx deal in 2022 and its $4.9 billion ZT Systems deal that was completed in March. (The company sold the server manufacturing unit of ZT Systems to Sanmina for $3 billion in October). Su said last week that AMD is "on a clear trajectory" to make tens of billions of dollars in annual revenue in 2027 from the company's Instinct data center GPU business, thanks in large part to its recently announced deal for OpenAI to deploy 6 megawatts of Instinct-based infrastructure. When the OpenAI deal was announced in early October, Su said the win could spur additional revenue of more than $100 million from other customers in the coming years.

[7]

AMD's Earnings Set To Rocket By 2030, Bank of America Says - Broadcom (NASDAQ:AVGO), Advanced Micro Devices (NASDAQ:AMD)

Advanced Micro Devices, Inc. (NASDAQ:AMD) may be gearing up for its most explosive growth yet, with artificial intelligence poised to drive a multi-year earnings boom. That's based on a new forecast from Bank of America, which sees AMD's earnings per share (EPS) climbing to as high as $18 by 2030 -- more than five times its current annual EPS -- driven by its growing footprint in the artificial intelligence graphics chip market. Ahead of AMD's Analyst Day event scheduled for Tuesday, Nov. 11, in New York City, Bank of America analyst Vivek Arya maintained a Buy rating and a $300 price target on the stock. That suggests a nearly 30% upside from AMD's current share price. AI GPU Share, Sales Targets In Focus Arya expects AMD to raise its estimate for the total addressable market in AI accelerators -- chips that power machine learning models -- from more than $500 billion to a range of $750 billion to $850 billion. Bank of America believes AMD will aim to capture a double-digit percentage of this market, particularly in merchant graphics chips, which could mean $55 billion to $65 billion in annual sales by the end of the decade. The estimate assumes AMD ships about 2 gigawatts of AI compute capacity to OpenAI by 2030, as part of a broader 6 gigawatt buildout, and includes the effect of any stock dilution related to that deal. "We see potential $15-18 EPS Power by calendar year 2030, assuming a full 6GW AI deployment by OpenAI and related dilution," Arya said. Profitability to Improve As Scale Kicks In While AMD's gross margin -- the percentage of revenue left after manufacturing costs -- may come in slightly lower than past targets, around 53% to 55%, Arya sees efficiency improving as the company scales its AI business. He expects AMD's operating expenses to decline as a percentage of revenue, from 30% to around 21% to 22%, allowing operating margins to recover into the low- to mid-30% range. Back in 2022, AMD's Analyst Day targeted 20% annual revenue growth, over 57% gross margin, and mid-30% operating margins. Still, those projections were knocked off course by weak demand across personal computers, game consoles, and server chips in 2023 and 2024. Execution Still A Key Risk For AMD Bank of America warned that execution will be critical, particularly as AMD prepares to launch its MI400 "Helios" rack-scale AI system in the second half of 2026. This will be the company's first attempt to ship a fully integrated AI system at scale -- something Nvidia Corporation (NASDAQ:NVDA) has already done, now moving into its third generation of rack systems. Arya highlighted Nvidia's earlier delays and profit issues with its Blackwell rack systems in 2024, suggesting AMD must avoid similar missteps. Another area of concern is AMD's dependence on a few large customers, especially OpenAI and Oracle. The OpenAI agreement includes equity and warrant structures, raising questions about the long-term value of the deal. Arya said that broadening the customer base will be essential to support sustained growth. He also flagged AMD's lack of a clear networking strategy. Unlike Nvidia, which has built strong in-house systems using InfiniBand and NVLink, AMD is still lagging in interconnect technologies and has yet to fully define its role in initiatives like the UALink consortium. "We flag AMD's lack of an effective networking strategy (switching, UALink ecosystem, etc.)," Arya wrote. Valuation Still Attractive, But Under-Owned Despite its AI push, AMD's stock is still trading at what Arya considers a discount to competitors. The company trades at 25 times estimated 2027 earnings, with a price-to-earnings-to-growth (PEG) ratio of just 0.6, based on expected annual earnings growth of 41% from 2025 to 2028. That compares to Nvidia's PEG of 0.9 and Broadcom Inc. (NASDAQ:AVGO) at 1.1. Arya also highlighted that AMD remains under-owned by institutional investors, with only 24% of S&P 500 funds holding the stock as of October, and just 0.19 times portfolio weighting, compared to 1.13x for Nvidia and 1.60x for Broadcom. Bottom Line: A Critical Analyst Day For AMD Bank of America views AMD's upcoming Analyst Day as a potential turning point. With a multi-billion-dollar AI chip business in sight and earnings possibly rising to $18 per share by the end of the decade, Arya sees a chance for AMD to reframe the narrative after a difficult two years. But execution will be key. Investors will be watching for signs that AMD can scale AI infrastructure, diversify its customer base, and close the gap with Nvidia's tightly integrated hardware and software stack. Read Next: Trump's 50-Year Mortgage Plan Sounds Great Until You See The Interest Bill Photo: Piotr Swat / Shutterstock AMDAdvanced Micro Devices Inc$243.824.40%OverviewAVGOBroadcom Inc$358.392.56%NVDANVIDIA Corp$199.175.86%Market News and Data brought to you by Benzinga APIs

[8]

AMD Has Multiple "OpenAI-Scale" Customers Lined Up for Its AI Chips, Reflecting Massive Interest in the Next-Gen Instinct Lineup

AMD's CEO, Lisa Su, revealed in the company's recent Q3 earnings call that the firm has multiple customers hoping to strike a deal of a similar magnitude to the OpenAI partnership. It appears that Team Red is garnering significant attention from the mainstream AI industry, particularly following the firm's recent collaboration with OpenAI, a deal that is expected to generate $100 billion in revenue. It appears that AMD is in talks with multiple customers to establish an agreement on a similar framework, according to what CEO Lisa Su disclosed; however, the specifics of how the partnership would unfold are uncertain for now. Here's what AMD's CEO said on this matter: Q: How is the OpenAI partnership influencing your market position, and what is the risk of customer concentration with OpenAI? A: Lisa Su, CEO: The OpenAI partnership is significant and has increased interest and engagement from other customers. We are planning for multiple customers at similar scales to OpenAI, ensuring a broad customer base to mitigate concentration risk. This is indeed an optimistic development regarding AMD's future, especially when it comes to the Instinct AI lineup, as Team Red is 'doubling down' on AI chips like the Instinct MI450, not just in terms of architectural advancements, but also in power efficiency and rack-scale configurations being offered. Based on comments from AMD's executives over time, it appears that the Instinct MI450 series will be a pivotal moment in the company's AI journey, as it is claimed that the lineup will bridge the gap with NVIDIA offerings, leaving competitors no excuse for non-adoption. AMD's CEO also gave an insight into what we should expect next-gen AI chips to drop in the markets, and it is disclosed that the Instinct MI355 series has started to see production ramp-up, continuing with "strong momentum" moving into 2026, and similarly, the Instinct MI450 series will drop in the markets by H2 of next year. There are significant advancements expected with the MI450 lineup, which will bring AMD's DC and AI business into the mainstream segment. Considering the prospects for extensive collaborations with partners beyond OpenAI, industry competition is expected to increase substantially.

[9]

How AMD Stock Surged 58% Last Month | The Motley Fool

Shares of Advanced Micro Devices (AMD 3.53%) rose 58.3% in October 2025, according to data from S&P Global Market Intelligence. The semiconductor designer had a lot going on last month, divesting a hardware manufacturing operation and winning a big supercomputing contract at Oak Ridge National Laboratory. But most of the news only inspired small blips on AMD's stock chart. The real rocket fuel came from an unexpected OpenAI deal. On Oct. 6, ChatGPT maker OpenAI and AMD announced a multiyear processor supply deal, sending a total of 6 gigawatts of AMD processors to OpenAI's data centers. Revenue-generating shipments for the first gigawatt of AMD Instinct MI450 chips will start in the second half of 2026. AMD will also supply other parts of the artificial intelligence (AI) infrastructure, from rack platforms and cooling to central controllers with the EPYC server-class processors. The announcement also clarified AMD's place in OpenAI's existing setup. According to press materials, OpenAI is already working with AMD's older Instinct MI300X and MI350X AI accelerators. That simple fact may have been an eye-opener for some investors, who expected to find nothing but Nvidia (NVDA 3.85%) accelerators in OpenAI's number-crunching systems. The OpenAI deal is a sophisticated one, giving OpenAI the right to purchase up to 10% of AMD's stock as the AI system installations continue. At the same time, OpenAI didn't commit to a pure AMD partnership. In September, Nvidia signed an even larger AI accelerator deal with OpenAI, adding up to 10 gigawatts of annual power consumption over several years. And this week, OpenAI inked a $38 billion deal with Amazon (AMZN 1.91%) that puts even more Nvidia chips to work for the ChatGPT developer. So AMD didn't win the AI accelerator wars last month, but it did score a few much-needed points with investors and other AI software giants. If OpenAI is using a lot of AMD chips, that business relationship should open the door for other tech giants to try the Instinct hardware. Nvidia's latest and greatest accelerators typically win pure performance comparisons, but AMD may offer lower power draws, more affordable up-front costs, and other advantages. In other words, the AI hardware market is still in its early innings, and Nvidia doesn't own the whole thing. Investors are catching on to this dynamic situation, and AMD's stock has outperformed Nvidia's in 2025.

[10]

AMD CEO says AI market is 'faster than anything we've seen before,' sees $1T by 2030 (AMD:NASDAQ)

AMD (AMD) made several updates at its financial analyst day on Tuesday, including reiterating the theme that artificial intelligence spending is not likely to slow down anytime soon. AMD CEO and Chairman Dr. Lisa Su updated the size of the total AMD projects tens of billions in revenue by 2027 from the AI data center segment, driven by its MI450 and Helios solutions and expanding custom design wins. AMD aims for double-digit data center AI market share within three to five years, versus Nvidia's current dominant position. AMD sees ongoing strong AI infrastructure demand due to rapid industry change, expanding key customer engagement, and increased belief in AI compute's importance.

[11]

AMD stock crashes despite strong Q3 results: why is AMD stock down today, and could AMD's rack-scale AI breakthrough spark a massive 2026 comeback?

AMD stock crashed 3.7% to $250.05 despite posting record Q3 2025 earnings. The chipmaker reported $9.25 billion in revenue, up 36% year-over-year, and $1.20 EPS, beating forecasts. Strong AI chip demand and new deals with OpenAI and Oracle pushed data center revenue to $4.3 billion. Yet, investors booked profits after massive gains this year. AMD's $406 billion market cap and high 150.63 P/E ratio reflect steep valuation worries. Analysts still see rack-scale AI systems as AMD's 2026 growth catalyst. AMD Q3 2025 earnings results just shattered Wall Street forecasts. The chipmaker reported record revenue of $9.25 billion, up 36% year-over-year, and non-GAAP EPS of $1.20, beating analyst expectations of $1.17. Analysts had projected $8.74 billion in sales, but AMD surged past that with strong performance in data centers, gaming, and AI chips. CEO Lisa Su said it was an "outstanding quarter," fueled by "broad-based demand" for its EPYC processors, Ryzen CPUs, and Instinct AI accelerators. The company guided for Q4 2025 revenue between $9.3 billion and $9.9 billion, above Wall Street's $9.21 billion forecast, signaling continued growth momentum. Data center revenue jumped to $4.3 billion from $3.5 billion a year ago. Client segment sales climbed to $2.9 billion, ahead of expectations at $2.6 billion. Gaming revenue rose to $1.3 billion, surpassing estimates of $1.1 billion. AMD's AI segment remains its biggest growth driver, supported by fresh deals with OpenAI and Oracle. Under the OpenAI deal, AMD will supply up to 6 gigawatts of GPUs to power AI data centers, while OpenAI will purchase roughly 160 million AMD shares, equal to about 10% ownership. Oracle will deploy 50,000 AMD GPUs across global cloud data centers. Both partners will use AMD's next-generation MI450 AI chips and rack-scale platforms launching in 2026. AMD is also providing chips for two Department of Energy supercomputers, representing a $1 billion investment. Despite the strong earnings, AMD stock (NASDAQ: AMD) slipped 3.7% to $250.05 at close, and 3.72% after hours to $240.76. The stock's 52-week range is $76.48 to $267.08, with a market cap of $406 billion and a high P/E ratio of 150.63. Still, shares have jumped 108% year to date and 79% in the last 12 months, reflecting strong investor confidence in its AI expansion. Analysts, including Morgan Stanley's Joseph Moore, said AMD's rack-scale systems will be key for future growth, though execution risks remain compared to Nvidia, whose market cap now exceeds $5 trillion. AMD's partnerships and Q4 guidance mark a major inflection point in its AI trajectory. Lisa Su said the company's "record quarter and strong outlook show the next phase of AMD's compute and AI growth is accelerating." Advanced Micro Devices (NASDAQ: AMD) crushed Wall Street expectations in its third quarter of 2025, reporting record revenue of $9.25 billion, a 36% year-over-year increase. The company posted non-GAAP earnings per share (EPS) of $1.20, above analyst forecasts of $1.17, according to Bloomberg consensus. CEO Lisa Su called it an "outstanding quarter," highlighting broad-based demand across EPYC data center processors, Ryzen CPUs, and Instinct AI accelerators. AMD expects its Q4 2025 revenue to reach between $9.3 billion and $9.9 billion, topping Wall Street's $9.21 billion estimate. The data center segment led AMD's results, bringing in $4.3 billion in revenue versus analyst expectations of $4.1 billion. That's up sharply from $3.5 billion a year earlier. AMD's client division, which includes desktop and laptop chips, delivered $2.9 billion, beating forecasts of $2.6 billion. The gaming unit also performed well, hitting $1.3 billion in revenue compared with projections of $1.1 billion. The results underscore AMD's momentum in the AI and high-performance computing market, where it's rapidly expanding against Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO). AMD recently signed two landmark deals with OpenAI and Oracle that could redefine its AI strategy. Under the OpenAI agreement, AMD will supply up to 6 gigawatts of GPUs for OpenAI's AI data centers, while OpenAI will acquire about 160 million AMD shares, roughly 10% of the company. A separate deal with Oracle includes deploying 50,000 AMD GPUs across Oracle's global data centers. Both partnerships will integrate AMD's next-generation MI450 GPUs and rack-scale systems, expected to ship in the second half of 2026. These deals strengthen AMD's role in powering large-scale AI infrastructure, a space currently dominated by Nvidia. Despite stellar results, AMD stock (NASDAQ: AMD) closed down 3.7% at $250.05, slipping $9.60 in the last session. After-hours trading showed a further 3.7% dip to $240.76. The stock's 52-week range spans from $76.48 to $267.08, and its market capitalization stands at roughly $406 billion. AMD trades at a P/E ratio of 150.63, signaling high growth expectations from investors. Even with the pullback, shares are up 108% year to date and 79% over the past 12 months. The stock has gained 53% in the last month following its AI announcements. Morgan Stanley analyst Joseph Moore praised AMD's rack-scale AI architecture as "key to the company's next growth phase." He noted the OpenAI deal as a "clear accelerant" but cautioned that execution and return-on-investment (ROI) versus Nvidia remain important watchpoints. "AMD's rack-scale solution shipping next year is the key, and we are excited to see what the company can do," Moore said. However, he added that "cloud ramp-up and ecosystem readiness" will be vital to maintaining momentum. AMD projects its Q4 2025 revenue at up to $9.9 billion, driven by strong AI demand, robust data center growth, and expanding enterprise adoption. With partnerships spanning OpenAI, Oracle, and U.S. government supercomputing initiatives, AMD is positioning itself as the most credible challenger to Nvidia's dominance in AI chips. As Lisa Su put it: "Our record third-quarter performance and strong fourth-quarter guidance mark a clear step up in our growth trajectory as our compute franchise and AI business continue to scale." (You can now subscribe to our Economic Times WhatsApp channel)

[12]

AMD Notes 'Sharp' Sales Jump For CPUs And Instinct GPUs As OpenAI Ties Deepen

'Our data center AI, server, and PC businesses are each entering periods of strong growth, led by an expanding [total addressable market], accelerating adoption of our Instinct platforms and EPYC and Ryzen CPU share gains,' AMD CEO Lisa Su says. AMD said Tuesday that a "sharp" jump in sales for the company's CPUs across the PC and server segments as well as its Instinct data center GPUs allowed it to deliver record revenue of $9.2 billion for the third quarter as it teased deeper ties with OpenAI. With quarterly revenue representing a 36 percent increase year over year and a 20 percent sequential increase, AMD CEO Lisa Su called the "record" third-quarter results and "strong" fourth-quarter outlook a reflection of the chip designer's "significant momentum building across our business" in its earnings call. [Related: Analysis: AMD Puts Channel Pressure On Intel As Both Firms Revamp Partner Programs] "Our data center AI, server, and PC businesses are each entering periods of strong growth, led by an expanding [total addressable market], accelerating adoption of our Instinct platforms and EPYC and Ryzen CPU share gains," she said. For the three-month period, which ended in late September, AMD reported a GAAP gross profit of $4.8 billion, up 40 percent year over year and up 56 percent sequentially, as well as a GAAP gross margin of 52 percent, up 2 points year over year and up 12 points year over year. The company's GAAP net income for the quarter was $1.2 billion, up 61 percent year over year and up 43 percent sequentially. Its GAAP earnings per share was 75 cents. AMD beat Wall Street's expectations on revenue by $500 million and on non-GAAP earnings per share by 3 cents with a reported $1.20 earnings per share. The chip designer expects fourth-quarter revenue to reach roughly $9.6 billion, plus or minus $300 million. This would represent a 25 percent year-over-year increase and 4 percent growth sequentially at the midpoint of its guidance. The quarterly revenue forecast came within the average estimate by Wall Street analysts but was below the high-end estimate of $9.8 billion, according to Yahoo Finance. AMD's stock price was down more than 3.5 percent in after-hours trading. The company's data center business grew 22 percent year over year to a record $4.3 billion, driven by "strong demand" for its fifth-generation EPYC processors as well as a "sharp" sales ramp of its Instinct MI350 GPUs and "broader" MI300 GPU deployments. On the Instinct side, Su said the company has "multiple" MI350 series deployments "underway with large cloud and AI providers, with additional large-scale rollouts on track to ramp over the coming quarters." The cloud companies buying MI350 GPUs include Oracle as well as several smaller providers such as Crusoe, Digital Ocean, Tensorwave and Vultr. Su also cited IBM, Zyphra, Cohere, Character AI and Luma AI as companies that are using the MI300 series for training or inference workloads. As for AMD's next-generation MI400 series, Su said development of the GPUs as well as the Helios rack-scale platform they will power "is progressing rapidly." She added that the products are supported by "deep technical engagements across a growing set of hyperscalers, AI companies and OEM and ODM partners to enable large-scale deployments next year." Among those companies is OpenAI, which announced last month a multi-year agreement with AMD to deploy six gigawatts of Instinct GPUs starting in the second half of next year. Echoing comments Su made when the deal was disclosed, she said the partnership will "significantly accelerate" AMD's data center AI business, adding that it could allow the company to bring in "over $100 billion in revenue over the next few years." "Moving forward, AMD and OpenAI will work even more closely on future hardware, software, networking and system-level roadmaps and technologies," Su said. She also reaffirmed her recent outlook that the company is "on a clear trajectory" to make tens of billions in annual revenue in 2027 from rack-scale solutions like Helios. As for the other major driver of AMD's data center business, Su said server CPU revenue "reached an all-time high" thanks to rapid adoption of its fifth-gen EPYC processors, which made up nearly half of all EPYC revenue for the quarter. "Sales of our prior generation EPYC processors were also very robust in the quarter, reflecting their strong competitive positioning across a wide range of workloads," she said. The company saw "record sales" in the cloud infrastructure market from hyperscalers deploying EPYC for both first-party services and public cloud offerings, with more than 160 EPYC-powered instances launched in the quarter, according to Su. This brought the total number of public EPYC cloud instances to more than 1,350, nearly 50 percent higher than it was a year ago, she added. Further reinforcing AMD's strength in the cloud, Su said large businesses increased their adoption of EPYC cloud instances by more than three-fold year over year, with on-premises usages "driving increased demand from enterprise customers." AMD expects server CPU demand to "remain very strong as hyperscalers are significantly increasing their general-purpose compute capacity as they scale their AI workloads," Su said. "Many customers are now planning substantially larger CPU buildouts over the coming quarters to support increased demands from AI, serving as a powerful new catalyst for our server business," she added. As for on-premises customers, the company has seen a sharp increase in EPYC server sell-through compared to a year ago thanks to "accelerating enterprise adoption," supported by more than 150 fifth-gen EPYC platforms on the market from a variety of OEMs, Su said. AMD notched "large" new EPYC customer deals with "leading" Fortune 500 companies across several verticals, including telecom, financial services, retail and automotive, she added. Su said the company's next-generation, 2-nanometer EPYC "Venice" processors remain on track to launch next year, calling customer pull and engagement for the product line "the strongest we have seen." This, according to her, reflects AMD's "competitive positioning and the growing demand for more data center compute." "Multiple cloud and OEM partners have already brought their first Venice platforms online, setting the stage for broad solution availability and cloud deployments at launch," she said. AMD's client PC and gaming segment grew 73 percent year over year to $4 billion, with client revenue alone generating a record $2.8 billion, up 46 percent from the same period last year thanks to "record sales of Ryzen processors and a richer product mix." Gaming revenue, on the other hand, grew 181 percent year over year to $1.3 billion, thanks to "higher semi-custom revenue" driven by Microsoft's and Sony's video game consoles as well as "strong demand" for the company's Radeon gaming GPUs. Desktop CPU sales alone "reached an all-time high, with record channel sell-in and sell-out led by robust demand" for the company's Ryzen 9000 processors," Su said. The CEO also cited a sharp increase in OEM sell-through of Ryzen-powered laptops, saying that it reflected "sustained end customer pull for premium gaming and commercial AMD PCs." In the commercial segment alone, AMD saw Ryzen PC sell-through grow more than 30 percent year over year, with enterprise adoption growing "sharply" thanks to "large wins with Fortune 500 companies across healthcare, financial services, manufacturing, automotive, and pharmaceuticals," according to Su. "Looking ahead, we see significant opportunity to continue growing our client business faster than the overall PC market based on the strength of our Ryzen portfolio, broader platform coverage, and expanded go-to-market investments," she said. The comment about expanded go-to-market investments was a reference to the more than 40 percent boost the company made to partner funding this year as part of its restructured commercial partner program, AMD Partner Network, which launched last month. AMD's only weak spot was the embedded segment, which declined 8 percent year over year to $857 million. However, Su indicated that the market is improving. "Design momentum remains very strong across our embedded portfolio," she said. "We are on track for a second straight year of record design wins, already totaling more than $14 billion year-to-date, reflecting the growing adoption of our leadership products across a broad range of markets and expanding set of applications."

[13]

AMD CEO Says AI Chip Market Is 'Larger Opportunity' Than $500B - Advanced Micro Devices (NASDAQ:AMD)

Lisa Su thinks the AI boom is just getting started -- and the numbers back her up. On Advanced Micro Devices Inc's (NASDAQ:AMD) third quarter earnings call, the CEO said the total addressable market for AI silicon has grown beyond earlier projections, calling it "a larger opportunity" than the $500 billion estimate she floated just months ago. Track AMD stock here. From Trillions Of Tokens To Billions In Silicon Su told investors that, "from everything that we see, we see the AI compute TAM just going up," hinting at a faster expansion than even AMD's bullish forecasts. The new outlook reflects surging demand for data center AI chips, which helped AMD post record Q3 revenue of $9.2 billion, up sharply on the strength of its MI300 series and next-gen MI400 roadmap. "Whereas $500 billion sounded like a lot when we first talked about it, we think there is a larger opportunity for us over the next few years," she said. Read Also: Who Needs Nvidia? AMD, Intel Crash The Magnificent 7 Party Betting On OpenAI -- And Everything Beyond AMD's optimism comes on the heels of its multi-gigawatt, multi-year partnership with OpenAI, which Su described as "significant scale." She confirmed the first gigawatt of deployments will begin in the second half of 2026, powered by the new MI450 series and Helios rack systems. With similar conversations underway across cloud providers and sovereign AI projects, AMD appears to be spreading its bets well beyond a single marquee customer. Read More: Nvidia Vs. AMD: Who Gets Hit Harder By The 15% China Revenue Tax? Why It Matters While Nvidia Corp (NASDAQ:NVDA) still commands the lion's share of AI GPU sales, AMD's pitch is scale and sustainability -- serving multiple hyperscalers at once while addressing power and supply bottlenecks. If the AI silicon market truly is bigger than $500 billion, as Su now insists, AMD's runway may be longer -- and hotter -- than Wall Street had priced in. Read Next: AMD, Nvidia, Broadcom's Combined Value Surges 1000% In Just Three Years -- And Bulls Want More. Image: Shutterstock AMDAdvanced Micro Devices Inc$237.44-7.37%OverviewNVDANVIDIA Corp$190.36-2.48%Market News and Data brought to you by Benzinga APIs

[14]

AMD CEO Lisa Su Expects OpenAI Partnership To Generate Over $100 Billion In Revenue And 'Significantly Accelerate' AI Business - Advanced Micro Devices (NASDAQ:AMD)

Chipmaker Advanced Micro Devices Inc.'s (NASDAQ:AMD) CEO, Lisa Su, highlighted the significance of the company's multi-billion-dollar, multi-year partnership with OpenAI, saying that it could help the company's AI business gain traction. AMD is among today's weakest performers. View the charts here. $100 Billion In Revenue From OpenAI Deal During the company's third-quarter earnings call on Tuesday, Su said that the deal with "significantly accelerate" AMD's data center AI business, while potentially generating "over $100 billion in revenue over the next few years." The partnership includes a massive deployment of AMD's Instinct GPUs, totaling 6 gigawatts of compute power. According to Su, "The first gigawatt of MI450 series accelerators [is] scheduled to start coming online in the second half of 2026," helping position it as a key player in the AI compute arms race. See Also: Market Wants More AMD Datacenter Growth Despite OpenAI Win, Must Answer Nvidia's $500 Trillion Orders, Says Daniel Newman "The partnership establishes AMD as a core compute provider for OpenAI and underscores the strength of our hardware, software, and full-stack solutions strategy," she said. AMD and OpenAI are set to collaborate across multiple fronts, including future hardware, software, and system-level roadmaps, as this partnership moves forward. Stock Dips Despite Beat-And-Raise Quarter AMD released its third-quarter results on Tuesday, reporting $9.25 billion in revenue, up 36% year-over-year, and ahead of consensus estimates at $8.74 billion. The company reported a profit of $1.20 per share, which was again ahead of analyst consensus at $1.16, according to Benzinga Pro. The chipmaker also raised its fourth-quarter guidance, now expecting $9.6 billion in revenue, compared with analyst estimates of $9.16 billion. Despite posting a beat-and-raise quarter, AMD's shares were down 3.7% on Tuesday, closing at $250.05, and are down another 3.19% overnight. The stock scores high on Momentum, Growth and Quality in Benzinga's Edge Stock Rankings, with a favorable price trend in the short, medium and long-term. Click here for deeper insights. Read More: AMD Hit With Two Lawsuits From Adeia Alleging Massive Patent Violations Ahead Of Q3 Earnings Photo Courtesy: jamesonwu1972 On Shutterstock.com AMDAdvanced Micro Devices Inc$238.20-8.26%OverviewMarket News and Data brought to you by Benzinga APIs

[15]

AMD aims to expand data center, AI leadership with 35% revenue CAGR By Investing.com

NEW YORK - AMD (NASDAQ:AMD) outlined its long-term growth strategy at its Financial Analyst Day on Tuesday, targeting more than 35% revenue compound annual growth rate and non-GAAP earnings per share exceeding $20 over the next three to five years. The chipmaker, currently valued at $387.5 billion, has already demonstrated strong growth with revenue increasing 31.8% in the last twelve months. According to InvestingPro data, AMD appears overvalued at its current trading price of $237.52, despite analysts setting price targets as high as $350. The chipmaker expects its data center business to grow at more than 60% CAGR, driven by its AMD Instinct MI350 Series GPUs, which the company described as its fastest ramping product in company history. AMD plans to launch Helios systems with Instinct MI450 Series GPUs in the third quarter of 2026, followed by the MI500 Series in 2027. "AMD is entering a new era of growth fueled by our leadership technology roadmaps and accelerating AI momentum," said Dr. Lisa Su, AMD chair and CEO, according to the press release. The company aims to achieve more than 50% server CPU revenue market share with its EPYC processor portfolio and drive data center AI revenue at more than 80% CAGR. For its client and gaming segment, AMD expects to exceed 40% client revenue market share while building on what it says is a base of more than one billion AMD-based gaming devices. The company projects more than 10% revenue CAGR across its embedded and client and gaming businesses. AMD also detailed its 5th Gen null Fabric technology and shared extended roadmaps across x86 CPUs, data center and gaming GPUs, and NPUs. The company stated that its ROCm open software downloads have increased tenfold year-over-year, and its AI PC portfolio has expanded 2.5 times since 2024, with AMD Ryzen now powering more than 250 platforms across notebooks and desktops. In other recent news, OpenAI CEO Sam Altman announced that the company does not seek government guarantees for its data centers. OpenAI is expanding its data center operations and anticipates ending 2025 with an annualized revenue run rate exceeding $20 billion. In related developments, Advanced Micro Devices (AMD) has seen several analysts adjust their stock price targets. TD Cowen increased its price target for AMD to $290, citing progress in the company's data center GPU sector. Benchmark also raised its price target to $325, highlighting AMD's growing influence in the AI data center market. Truist Securities set a new price target of $279, noting minor imperfections in AMD's third-quarter results but maintaining a positive outlook. Additionally, Cantor Fitzgerald reiterated its Overweight rating and a $350 price target, following AMD's recent quarterly results. AMD reported a modest beat for the September quarter, with mixed guidance for the December quarter, indicating slightly better revenue but lower earnings per share expectations. This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

[16]

AMD reports upbeat guidance as Q3 results beat on AI-fueled data center boom By Investing.com

Investing.com-- AMD reported Tuesday upbeat guidance and better-than-expected Q3 results, as its "rapidly scaling" data center business continued to ride the artificial intelligence wave despite regulatory headwinds on chip sales to China. Advanced Micro Devices Inc (NASDAQ:AMD) (AMD) shares fell more than 2% in afterhours trade following the report. AMD reported adjusted EPS $1.2 on revenue of $9.25 billion. Analysts polled by Investing.com anticipated EPS of $1.17 on revenue of $8.74B. Data center revenue jumped 22% to $4.3B year-over-year, primarily driven by "strong demand for 5th Gen AMD EPYC processors and AMD Instinct MI350 Series GPUs," the company said. The jump revenue didn't include any revenue from shipments of AMD Instinct MI308 GPU products to China following the U.S. ban on chipmaking equipment to China. Client and gaming business revenue jumped 73% in Q3 to $4B year-over-year. Looking ahead, the company guided fiscal fourth-quarter revenue of $9.6B, give or take $300 million, an increase of about 25% year-on-year. That beat estimates for $8.75B. Q4 guidance marks a "clear step up in our growth trajectory as our expanding compute franchise and rapidly scaling data center AI business drive significant revenue and earnings growth," the company said.

[17]

AMD expects data center chip market to grow to $1 trillion by 2030

NEW YORK (Reuters) -Advanced Micro Devices expects the market for the company's data center chips will grow to $1 trillion by 2030, CEO Lisa Su said at the company's analyst day on Tuesday. Artificial intelligence will drive much of the growth to the trillion-dollar figure, a market that includes AMD's central processing units (CPUs) and networking chips, along with its specialized AI chips, Su said at the Nasdaq in New York. "It's an exciting market," Su said. "There's no question, data center is the largest growth opportunity out there, and one that AMD is very, very well positioned for." The chip designer has been attempting to expand its AI business as rival Nvidia gobbles up market share for data center chips as the market explodes. AMD has been successful in the CPU business, steadily taking share against Intel. In the next three to five years, AMD expects 35% growth across its entire business each year and 60% in its data center business, finance chief Jean Hu said at the analyst day. The company also expects earnings to rise to $20 a share in the same three-to-five-year period. AMD shares jumped nearly 4% in extended trading after the CFO's forecast. The shares ended the regular session down 2.7% at $237.52. Nvidia CEO Jensen Huang has said the broader AI infrastructure market will grow to $3 trillion to $4 trillion by 2030. AMD's next-generation MI400 series of AI chips is set to launch in 2026 and include several variants designed for scientific applications and for generative AI. Along with the MI400 chips, AMD is also planning to launch a complete server rack, similar to a product Nvidia sells called the GB200 NVL72. In her opening remarks Su highlighted the company's recent AI-related acquisitions, including the server builder ZT Systems and a slew of smaller software companies. AMD has built "an M&A machine," Su said. In recent months, AMD has acquired a batch of startups that focus on building software needed to run AI applications. On Monday, AMD said it bought MK1. The plan is to ensure AMD has access to the appropriate software and the people it needs to build its AI capabilities, Chief Strategy Officer Mat Hein told Reuters in an interview. "We'll continue to do AI software tuck-ins," said Hein. Last week, the Santa Clara, California-based company forecast fourth-quarter revenue that topped Wall Street estimates. Demand for AI chips gave AMD executives a reason for optimism about the remainder of the year. The company's data center CPU business has also benefitted from the surge in AI-related spending. The company last held an analyst day in 2022. AMD signed a multiyear deal with ChatGPT creator OpenAI in October that will bring the company more than $100 billion in new revenue over four years from OpenAI and other customers. As part of the arrangement, OpenAI will receive warrants that allow it to purchase a stake of up to 10% in the chipmaker. The OpenAI deal was an arrangement with a much-needed large customer for AMD, which has not yet captured the outsized returns from the boom in AI spending as Nvidia has. (Reporting by Max A. Cherney in New York, Stephen Nellis in San Francisco and Juby Babu in Mexico City; Editing by Peter Henderson and Matthew Lewis)

[18]

AMD forecasts fourth-quarter revenue above estimates

(Reuters) -Advanced Micro Devices forecast fourth-quarter revenue above market estimates on Tuesday, betting on the multibillion-dollar expansions of data center infrastructure to boost demand for its artificial intelligence chips. The company expects revenue of about $9.6 billion for the quarter, plus or minus $300 million, compared with analysts' average estimate of $9.15 billion, according to data compiled by LSEG. AMD has been the recipient of many significant investments in AI hardware alongside partners ranging from ChatGPT parent OpenAI to the U.S. Department of Energy, with Wall Street betting heavily on the potential of relentless spending on advanced processors. The company's shares rose 1.5% in choppy extended trading. AMD reported third-quarter sales of $9.25 billion, compared with analysts' average estimate of $8.74 billion. Its shares have more than doubled in value in this year, with AMD's stock gains outpacing those of market leader Nvidia, even as the larger rival's market valuation scaled the $5 trillion mark. Fears of an AI bubble have lately rippled through Wall Street and AMD's results are being closely watched. AMD last month said it would supply AI chips to OpenAI in a multi-year deal that would bring in tens of billions of dollars in annual revenue and give the startup the option to buy up to roughly 10% of the chipmaker. The deal covers the deployment of hundreds of thousands of AMD's graphics processing units (GPUs), roughly equivalent to the energy needs of 5 million U.S. households, or about thrice the amount of power produced by the Hoover Dam. This has raised optimism around AMD's position in the unrelenting race to build the fastest, most widely adopted AI chips. However, Nvidia's dominance of the lucrative GPU industry and its dominant share of this market are still largely secure, analysts say, even as AMD competes for a bigger piece of the AI chip pie. (Reporting by Max A. Cherney in San Francisco and Arsheeya Bajwa in New Delhi; Editing by Sriraj Kalluvila and Matthew Lewis)

Share

Share

Copy Link

AMD achieved record quarterly revenue of $9.25 billion in Q3 2025, driven by strong performance in both client processors and AI data center chips. Despite the success, the company faces mounting challenges from Nvidia-Intel partnership and margin concerns.

Record-Breaking Financial Performance

Advanced Micro Devices (AMD) delivered its strongest quarterly performance to date, reporting record revenue of $9.25 billion for Q3 2025, representing a 36% year-over-year increase that significantly exceeded analyst expectations of $8.74 billion

1

3

. The company posted adjusted earnings per share of $1.20, surpassing the analyst target of $1.16, while net profit surged to $1.24 billion from $771 million in the previous year3

.

Source: Market Screener

Client Computing Drives Unexpected Growth

AMD's client computing segment emerged as a major surprise, generating $2.75 billion in revenue—a 46% increase that well exceeded Wall Street forecasts of $2.61 billion

3

. The standout performer was the Ryzen 7 9800X3D processor, which demonstrated exceptional efficiency and broad adoption by original equipment manufacturers in gaming laptops and compact desktops1

. This success reflects AMD's strategic focus on gaming-first, performance-per-watt silicon, helping the company regain meaningful market share in premium laptop designs while Intel continues its integrated NPU push with Meteor Lake platforms.Data Center AI Business Gains Momentum

The data center segment, AMD's largest revenue driver, contributed $4.34 billion in Q3, marking a 22% year-over-year increase

3

. This growth was powered by stronger EPYC processor adoption and meaningful shipments of Instinct MI300X AI accelerators, marking the first quarter where AMD made a serious impact in the AI accelerator market traditionally dominated by Nvidia1

. Notably, these results excluded any revenue from China-bound MI308 shipments due to ongoing U.S. export restrictions1

3

.

Source: Wccftech

Ambitious Growth Projections and Strategic Partnerships

During AMD's first financial analyst day since 2022, CEO Lisa Su outlined ambitious growth targets, projecting 35% annual revenue growth over the next three to five years driven by "insatiable" AI demand

2

. The AI data center business is expected to grow at approximately 80% annually, potentially reaching tens of billions in sales by 20272

. Su expressed confidence that AMD could achieve "double-digit" market share in the data center AI chip market, challenging Nvidia's current dominance of over 90% market share2

.

Source: Benzinga

A significant milestone came through AMD's partnership with OpenAI, announced in October, which includes a multi-year deal worth over $100 billion in revenue over four years

5

. As part of this arrangement, OpenAI received warrants allowing it to purchase up to a 10% stake in AMD, representing a major validation of AMD's AI chip capabilities5

.Related Stories

Emerging Competitive Threats and Market Challenges

Despite strong performance, AMD faces significant long-term challenges that could impact its data center growth trajectory. The most concerning development is the unexpected partnership between Nvidia and Intel, announced in September, which includes a custom x86 CPU built on Intel's 18A process specifically for future Nvidia platforms

1

. This partnership could potentially erode AMD's EPYC processor share in high-value AI system deployments, as EPYC currently benefits from Nvidia's lack of an x86 license1

.Additionally, AMD confronts growing competition from hyperscaler companies developing in-house silicon solutions. Broadcom is collaborating with OpenAI on a custom chip project that could scale to 10 gigawatts of compute by 2029, while Amazon's Trainium chips are already in production and Microsoft's Maia program remains in development

1

.Investor Concerns and Market Response

Despite record revenue and strong guidance for Q4 revenue of approximately $9.6 billion (well above the Street's $9.15 billion estimate), AMD's stock declined in after-hours trading due to margin concerns

3

4

. The company's forecast for adjusted gross margin came in at 54.5%, meeting but not exceeding Wall Street consensus, while data center margins dropped to 25% from 29% a year earlier3

. This margin compression reflects the competitive pressures and investment requirements in the rapidly evolving AI chip market, where AMD continues to challenge Nvidia's dominance while building its own comprehensive AI platform ecosystem.References

Summarized by

Navi

[1]

[3]

Related Stories

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Pentagon Summons Anthropic CEO as $200M Contract Faces Supply Chain Risk Over AI Restrictions

Policy and Regulation

3

Canada Summons OpenAI Executives After ChatGPT User Became Mass Shooting Suspect

Policy and Regulation