Anthropic's AI legal tool triggers massive sell-off in software stocks across Europe and India

29 Sources

29 Sources

[1]

Legal Software Stocks Plunge as Anthropic Releases New AI Tool

Shares of European legal software and publishing firms dropped after US artificial intelligence firm Anthropic unveiled a tool for companies' in-house lawyers. RELX Plc and Wolters Kluwer NV both fell more than 10% after Anthropic released the tool on its GitHub page. Pearson Plc also slipped. Anthropic said its tool can automate legal work like contract reviewing, non-disclosure agreement triage, briefings and templated responses. Still, it cautioned that the plugin doesn't provide legal advice. "AI-generated analysis should be reviewed by licensed attorneys before being relied upon for legal decisions," the firm said. The share declines came amid broader losses for companies seen as exposed to AI disruption. A UBS Group AG European AI Risk basket of stocks fell as much as 4.7% on Tuesday to a record low.

[2]

Anthropic's AI push raises analyst concerns over IT services revenues

Feb 5 (Reuters) - Rapid advances in artificial intelligence, triggered in part by Anthropic's latest automation push, could structurally erode the IT sector's high-margin application services revenues, creating downside risks to earnings and valuations, analysts warn. Shares in India's software exporters (.NIFTYIT), opens new tab fell 0.7% on Thursday, a day after plunging 6% in their worst session for nearly six years, as AI-driven automation from U.S.-based Anthropic and Palantir fuelled fears of compressed project timelines and disruption to the industry's labour-intensive business model. The weakness has echoed across global IT stocks this week, extending a broader selloff in companies seen as most exposed to potential AI disruption. "There is more pain ahead for Indian IT," Jefferies said, adding that Anthropic's and Palantir's claims highlight how AI could potentially erode application service revenues for IT firms. "With application services accounting for 40-70% of revenues, firms face growth pressures, and consensus growth estimates do not fully reflect this, posing downside risks to valuations." However, some analysts said the sharp selloff may be overdone. JPMorgan said that while concerns around AI disruption were not without merit, it was illogical to extrapolate the launch of some tools to an expectation that companies will replace every layer of mission-critical enterprise software. Domestic brokerage Kotak Institutional Equities described the decline as a case of "plenty of panic over a little flutter". Reporting by Kashish Tandon and Bharath Rajeswaran in Bengaluru. Writing by Chandini Monnappa. Editing by Mark Potter Our Standards: The Thomson Reuters Trust Principles., opens new tab

[3]

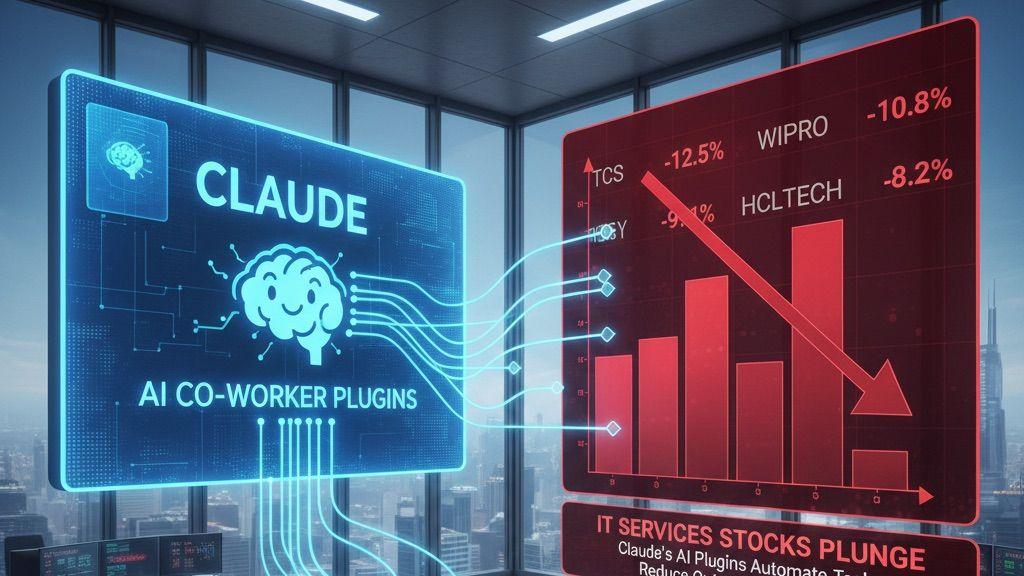

Anthropic's AI plug-ins shake India's staffing-intensive IT sector; stocks dive 6%

Feb 4 (Reuters) - Shares of Indian IT exporters (.NIFTYIT), opens new tab slumped 6.3% on Wednesday, tracking losses in global software stocks, after Anthropic launched new tools that heightened concerns over AI-driven disruption in the data and professional services industry. U.S.-based Anthropic on Friday launched plug-ins for its Claude Cowork agent to automate tasks across legal, sales, marketing and data analysis, triggering a selloff in U.S. and European data analytics and software stocks and deepening concerns in India's $283 billion IT sector, whose labour-intensive model relies on deploying large workforces for client projects. The Indian IT sub‑index was on track for its worst day since March 2020, with all 10 constituents in the red. Infosys led declines with a 7.3% drop. Other heavyweights TCS (TCS.NS), opens new tab and Wipro (WIPR.NS), opens new tab fell 5.8% and 3.9% respectively, while HCLTech (HCLT.NS), opens new tab was down 5.1%. "As Indian enterprises integrate Claude for critical coding workflows, dependency on large vendor teams may decline, squeezing billable hours and margins," said Systematix Group analyst Ambrish Shah. Anthropic's advanced AI systems also threaten entry‑level talent pool at Indian IT firms by replacing routine development and testing tasks, he added. Reporting by Kashish Tandon and Vivek Kumar M in Bengaluru; Editing by Nivedita Bhattacharjee Our Standards: The Thomson Reuters Trust Principles., opens new tab

[4]

Anthropic's launch of AI legal tool hits shares in European data services firms

Stocks in Pearson, London Stock Exchange Group and Experian plunge amid fears over impact of AI European publishing and legal software companies have suffered sharp declines in their share prices after the US artificial intelligence firm Anthropic announced a tool aimed at companies' in-house lawyers. The UK publishing group Pearson's shares fell by 4%, while the information and analytics firm Relx plunged nearly 11% on the London stock exchange, and the Dutch software company Wolters Kluwer dropped almost 9% in Amsterdam. Stocks in the London Stock Exchange Group and the credit reporting company Experian fell by more than 7%, amid fears over AI's impact on data companies. Anthropic, the company behind the popular chatbot Claude, said its tool can automate legal work such as contract reviewing, non-disclosure agreement triage, compliance workflows, legal briefings and templated responses. However, it said the plugin does not provide legal advice. "AI-generated analysis should be reviewed by licensed attorneys before being relied upon for legal decisions," the startup said. Anthropic also unveiled a number of other open-source tools to automate a range of professional activities, including sales and customer support. The news will reignite fears of job losses caused by the AI boom. The UK is losing more jobs than it is creating as companies adopt more AI tools, and is being hit harder than rival large economies, according to a study by the investment bank Morgan Stanley. More than a quarter (27%) of UK workers are worried their jobs could disappear in the next five years as a result of AI, a recent survey of thousands of employees showed. It found that British businesses reported an average 11.5% increase in productivity aided by AI. US businesses reported similar gains, but created more jobs than they cut. In his annual Mansion House speech last month, the London mayor, Sadiq Khan, said AI could destroy swathes of jobs in the capital. He said London was "at the sharpest edge of change" because of its reliance on white-collar workers in the finance and creative industries, and professional services such as law, accounting, consulting and marketing. Anthropic was founded in 2021 by Dario Amodei, its chief executive, and other former staff members from OpenAI, which developed ChatGPT.

[5]

AI concerns pummel European software stocks

LONDON, Feb 3 (Reuters) - A sell-off in European software, data analytics and advertising companies accelerated on Tuesday, as updated artificial intelligence models raised fresh doubts about whether incumbent firms can defend their business models, underscoring the technology's disruptive threat to sectors once viewed as AI winners. One of the catalysts for Tuesday's selloff was the introduction of Anthropic's legal plug-in, opens new tab for its Claude generative AI chatbot, according to traders and analysts. The move sent shares in both Britain's RELX (REL.L), opens new tab and the Netherlands' Wolters Kluwer (WLSNc.AS), opens new tab, which both provide analytics services to the legal industry, down over 10%. "The software companies were assumed to be winners from AI," said Lars Skovgaard, senior investment strategist at Danske Bank. "But all of a sudden, you start to worry about whether you can earn the money back (from your AI investments), and/or will you be outsmarted by updates coming in." Shares in RELX have now slumped over 45% from their peak last February. The dramatic reversal in RELX's share price, which had become one of the 10 largest listed companies in Britain last year, is an example of the impact AI is having on Europe's software sector. Germany's SAP (SAPG.DE), opens new tab, which less than a year ago was Europe's most valuable company, slumped over 16% last week, after its cloud revenue forecast failed to meet expectations, which wiped off $40 billion in one day. Its shares were down 1.9% on Tuesday and down 40% from last year's high. "We maintain the view that deflationary pressure on software-sector multiples could persist as long as the organic monetisation of AI is not clearly demonstrated," said Maximilien Pascaud, analyst at Baader Bank in a note where he cut his target on SAP, while keeping an add rating. Other companies that specialise in professional services were also down. Experian (EXPN.L), opens new tab, Sage Group (SGE.L), opens new tab, London Stock Exchange Group (LSEG.L), opens new tab and Pearson (PSON.L), opens new tab were down between 4.2% and 8%. ADVERTISING COMPANIES HIT Advertising companies were also under pressure. France's Publicis (PUBP.PA), opens new tab shares dived over 8.5% after the company's results. Publicis, the world's largest advertising group by market capitalisation, said it had earmarked approximately 900 million euros ($1.06 billion) for acquisitions in 2026, focusing on AI-powered technologies and data assets. According to a Barclays survey of buy-side investors published on Monday, advertising agencies are seen as the most exposed part of European media to artificial intelligence, with WPP (WPP.L), opens new tab, Omnicom (OMC.N), opens new tab and Publicis ranked the top "AI losers". Analysts at the bank said companies could most effectively shake off an "AI loser" label by launching and clearly promoting revenue‑generating AI products. ($1 = 0.8481 euros) Reporting by Samuel Indyk and Danilo Masoni; Editing by Amanda Cooper Our Standards: The Thomson Reuters Trust Principles., opens new tab

[6]

Anthropic's new Cowork plug-ins prompt sell-off in software shares

Anthropic's new plug-ins for Cowork announced on Friday are sparking jitters in the markets with software, professional services and analytics companies seeing the largest sell-offs. Last month, Anthropic launched its Cowork model, a "simpler version of Claude Code" prompting concerns among those heavily invested in software companies. Friday's (Jan 30) launch of new plug-ins seems to have accelerated the concerns. This week has seen a strong selloff in US and European software, professional services and data analytics companies, with the trend continuing yesterday and contagion in Asian markets. Commentators are blaming the release of Anthropic's plugins for Cowork which the AI player says will automate tasks across legal, sales, marketing and data analysis. The legal space is where organisations like Thompson Reuters makes much of its revenue, so it was one of the players to see an 18pc slump in its share price yesterday, according to Reuters itself, who added that its shares are now down 33pc just this year, having dropped by 22pc in 2025, as fears rise around AI disruption in the legal sector. Other providers of legal analytics also dropped with the UK's RELX falling 14pc and Dutch company Wolters Kluwer seeing a drop of 13pc. And the contagion spread to other software companies, and the broader market as AI fuels concerns among investors who are struggling to figure out who the winners and losers will be in the current AI-fuelled economy. According to Bloomberg a Goldman Sachs basket of US software stocks fell 6pc yesterday, its sharpest one-day drop since the sell-off that followed the initial US tariffs announcements in April. When Anthropic launched Cowork on January 12, it described it as a simpler version of Claude Code for non-coding related tasks. It said this new model has more agency - it can read, edit and re-organise files, taking on many of same tasks Claude Code can, but in a more "approachable" form. Cowork seems firmly targeted at the enterprise market with its promise to make using Claude "for work" easier. Now the new sector-specific plug-ins are seen as a particular threat to existing analytics players. Don't miss out on the knowledge you need to succeed. Sign up for the Daily Brief, Silicon Republic's digest of need-to-know sci-tech news.

[7]

An Indian's role in the SaaSpocalypse while Anthropic's AI shocker took away Rs 2.5 lakh cr from desi tech giants

An Indian-born tech leader, Rahul Patil, is at the heart of a market upheaval. His work on Anthropic's new Claude AI, capable of independent workflows, has erased billions from global tech firms. This 'Patil effect' challenges traditional software and IT service models, prompting a significant market reaction. An Indian-born executive is now at the centre of a market shock that wiped out billions of dollars from global software and IT services firms. Rahul Patil, the chief technology officer of AI startup Anthropic since October 2025, is being credited with driving the shift behind the company's latest Claude release, which jolted investors and triggered sharp sell-offs across technology stocks in early February 2026, The Times of India has reported. Also Read: Rs 2.5 lakh crore wiped out in 3 days as IT stocks crash. Is India's tech story at risk? Anthropic's newest version of Claude did more than improve chatbot performance. It introduced industry-specific tools that can run full workflows on their own-- from reviewing legal contracts to managing code and documents without human supervision. Indian markets reacted fast. The Nifty IT index lost nearly 8% in sell-off and erased roughly ₹2.5 lakh crore in market value over the last three trading sessions. The sell-off came from two fronts. Anthropic launched new automation tools for its Claude Cowork agent designed to automate tasks across legal, sales, marketing and data analysis -- professional services long seen as major beneficiaries of the AI era. At the same time, Palantir claimed its AI platform can now complete SAP migrations in weeks instead of years. That second claim hit markets hard because ERP implementation had been considered relatively safe from AI disruption until now. Also Read: 100% of Claude's code effectively AI-written, says Anthropic CPO At the centre of this change is Rahul Patil. Appointed CTO in October 2025, Patil was brought in to make Claude enterprise-ready at massive scale, with a focus on infrastructure, speed and cost, TOI reported. Patil pushed teams to optimise how Claude runs on costly chips, getting more output from the same hardware. Techniques such as better memory use and faster decoding cut the cost of running the AI. He also reorganised teams so product, infrastructure and AI engineers work closely together. The payoff is that Anthropic can now afford to offer always-on AI agents directly to companies rather than just selling access to its models. On Wall Street, this shift is being called the "Patil effect," TOI noted. What rattled investors was not just a smarter chatbot. Anthropic's newest version of Claude did more than improve performance. It launched plugins that allow AI to complete full workflows end-to-end without constant human input. The move sparked what traders are calling the "SaaSpocalypse." "We call it the 'SaaSpocalypse,' an apocalypse for software-as-a-service stocks," Jeffrey Favuzza of Jefferies told Bloomberg. "Trading is very much 'get me out' style selling." Patil's rise to the top role follows a long global career. He studied engineering at PES University in Bengaluru before moving to the US for higher studies. He earned his MS from Arizona State University and later completed an MBA from the University of Washington. He spent nearly nine years at Microsoft, then moved to Amazon Kinesis at AWS, and later joined Oracle Cloud Infrastructure as senior vice president overseeing more than 30 products across compute, storage, security and monitoring services. Before joining Anthropic, he spent five years at Stripe, where he led engineering and global operations. Announcing his move, Patil wrote on LinkedIn: "I am grateful to join the humble, brilliant, hardworking, and conscientious crew at Anthropic that has ignited much of the imagination and excitement around the world!" Anthropic is set to open a major office in Bengaluru, only its second global hub after Tokyo. The move aims to tap Indian talent and build local AI infrastructure. Anthropic is valued at about $183 billion after a $13 billion funding round led by ICONIQ, with investors such as Amazon, Fidelity and Lightspeed. Its revenue run-rate crossed $5 billion by mid-2025, the company has said.

[8]

Claude Cowork's debut signals start of enterprise automation

Claude Cowork, an agentic AI from Anthropic, may change how enterprises use software and cloud services. Some executives believe it won't disrupt Indian IT or SaaS immediately, while others warn it could challenge firms relying on low-end outsourcing. Companies must innovate and keep pace with AI developments to stay relevant, they said. The impact of Claude Cowork, an agentic artificial intelligence (AI) tool launched by Anthropic which can automate enterprise processes across functions, has triggered a debate about its possible fallout on the Indian IT and the software as a service (SaaS) industry. Some executives and investors said that such tools are unlikely to have a huge impact on software businesses in the short-term, and that there is an opportunity to accelerate AI development. Others said that Indian IT companies have failed to innovate beyond the low-end outsourcing model and this will sound their death knell. They cautioned that companies and startups need to innovate and keep up with the momentum to stay in business. This follows global tech and software companies losing close to $300 billion in market value when Anthropic announced Claude Cowork, an agentic AI tool, over fear that it will replace the human workforce. "What Anthropic is saying is that there is no need for expensive SaaS and cloud, you can replace it with cloud native software and Agentic AI. But that is not going to happen on its own, you need people to do it," R Srikrishna, chief executive of Hexaware Technologies, told ET. Samir Arora, founder of Helios Capital Management, wrote on the microblogging site X that "Indian IT companies cannot see beyond their nose--they only worry about next quarter's orders and guidance and if there is visibility for that they feel confident." Others said that IT companies have been conserving cash and giving back only through buybacks instead of making bold futuristic bets in IP creation, which could have made them futureproof. The comments received a strong rebuttal from former Infosys CFO Mohandas Pai, who responded to the online debate and said there is a difference between service and product companies. "These are service cos like Accenture is--very successful. They will get AI for global enterprises soon," he wrote on X, arguing that the local market for Indian product companies is still very small. "For product cos you need large local markets, huge capital, large economy... all of which India lacks even today." Meanwhile, Sridhar Vembu, cofounder and chief scientist of SaaS firm Zoho, echoed the sentiment on the site, saying "an industry that spends vastly more on sales and marketing than on engineering and product development was always vulnerable". "Can Zoho survive the AI wave? It depends on our ability to adapt. I always ask our employees to calmly contemplate our death," he said. Dev Khare, partner, LightSpeed India, told ET that in terms of IT services, what is different is that large enterprises around the world will require companies that can assure quality and maintain it over time.

[9]

Why AI agents signal a structural threat to traditional software products

Anthropic's recent launch of 11 plugins for its Claude Cowork agent, automating tasks across legal, sales, marketing and data work, spooked global tech investors, wiping about $285 billion off market capitalisation in a single day. The steepest losses hit BFSI-linked technology and large IT firms, especially those that have spent years building branded, licensed SaaS products alongside services. Infosys and TCS, for instance, now sell platforms deeply embedded in enterprise workflows. That said, nothing fundamental broke overnight. No contracts were cancelled. No revenue lines collapsed. So, was this an overreaction from investors or a future assessment of what agentic AI can do to traditional software products and services? Let's understand the concerns, first. Until now, tools such as Replit, Bolt and Claude were framed as assistants. Humans still wrote the script; AI helped you clean it up. Agentic systems, on the other hand, can now write the scripts, analyse them, test them, iterate, and even deploy them. This means that if a bank can deploy a pre-trained agent to reconcile data, generate compliance reports, monitor transactions, and flag risks, the case for paying recurring licence fees gradually weakens. Hence, the sell-off was less about coding shops and more about product moats. Revenue impact risks: * If AI can automate routine tasks cheaper and faster, this could compress billable hours, a big part of Indian IT revenue. * Customers might demand lower prices or shift to AI-centric workflows that bypass existing SaaS platforms. * Even if revenue stays stable, profit margins can shrink as businesses invest in AI or cut payroll. Ironically, mid-cap IT firms may be better prepared in the short term. Many already use AI-assisted coding and specialised platforms such as Kiro, which translate syntax and generate code for specific domains. This is not "vibe coding" but structured, production-grade automation. Replit itself already runs agents internally. Indian IT firms are quietly using Claude, Replit and domain-specific AI tools to build their own agents for clients. The market largely ignored this nuance in its rush to sell. Moreover, today's agents excel at executing preset tasks quickly. But they are far less capable of designing complex, organization-specific workflows across fragmented legacy systems. Further, agents automate but do not yet architect. Custom development won't go away in a hurry: Companies like Salesforce and Zoho that deploy software across the enterprise and customize workflow, are not likely to be as impacted anytime soon. Application development and maintenance, or ADM, too will not vanish overnight because enterprises still run decades-old stacks, undocumented processes, and regulatory landmines. Agents can assist, but humans remain essential to interpret context, validate outcomes, and take responsibility. Hence, for now, humans will stay in the loop, not because AI is weak, but because enterprises are cautious. AI agent Vs Human developer: The cost of building AI agents is another issue that the market is ignoring. Agentic AI is compute-hungry. Training and running agents require data centres packed with GPUs, TPUs, and increasingly NPUs; massive cloud bills; high-bandwidth storage; and constant inference at scale. Simply put, today's agent pricing is heavily subsidised. Those "sweetheart deals" will not last, and as we have seen often, Big Tech increases prices once they garner a sizeable number of users. They are burning investor cash, and price increases are one way to stem their losses. This implies that replacing humans is not free. A skilled developer or analyst costs a salary. An agent costs compute, cloud, power, cooling, redundancy, and uptime guarantees. At scale, those costs compound fast. Hidden layers: Security, Compliance, and Liability: Enterprises do not deploy intelligence lightly. Agents operating across finance, healthcare, or government systems raise hard questions: * Who audits the agent's decisions? * Where does sensitive data flow? * How are hallucinations detected and contained? * Who is liable when an autonomous system gets it wrong? Security, compliance, and governance will slow adoption and raise costs. Human oversight is not optional; it is mandatory. That reality tempers the more extreme replacement narratives. Counterbalances exist: * Most large firms are already integrating AI into their services and products, which could mitigate disruption. * AI might create new revenue streams, especially in analytics, automation consulting, and hybrid human-AI workflows. * AI can augment software rather than instantly replacing it. Bigger shift: Intelligence as a companion The real disruption lies elsewhere. A finance professional can now train an agent on domain data and internal rules and use it as a constant analytical companion. Instead of 10 junior analysts, one professional consults one agent endlessly. Anthropic's earlier models allowed this only through manual instruction. The new wave offers pre-trained agents, closer to plug-and-play expertise, which explains the market anxiety. So, what can we conclude? Revenue impacts will not show up immediately. Contracts are sticky. Enterprises move slowly. Agents are still expensive and operationally risky. On the other hand, SaaS pricing power is already under pressure. Clients will bargain harder. Margins will compress. Headcount will shrink persistently. Indian IT firms without proprietary IP or reusable platforms will struggle. If you can build an agent but cannot deploy it across multiple projects, you are simply labour with better tools. In short, investor perception shapes capital, and capital shapes strategy. Agents will not wipe out tech companies overnight. They will, however, permanently reset expectations about cost, productivity, pricing, and people. And markets, once they see that future, do not unsee it.

[10]

SaaSpocalypse hits when plumbers are outearning Indian techies

India's entry-level tech jobs face a stark reality as home service workers reportedly now earn more. A recent AI release has intensified fears of widespread job displacement, with experts predicting significant disruption to white-collar roles within months. While some industry leaders foresee a transformation of work, others warn of unprecedented automation impacting numerous sectors. The fear that artificial intelligence (AI) could hollow out technology jobs is arriving at a moment of deep irony in India's labour market. Entry-level tech professionals, once symbols of upward mobility, are now being out-earned by home service workers on gig platforms such as plumbers and electricians, a reversal that would have seemed unimaginable a decade ago. Against this backdrop, a dramatic global selloff triggered by Anthropic's latest AI release yesterday has sharpened anxieties about whether the tech sector itself is heading toward a reckoning, and whether entry-level white-collar jobs will bear the brunt of it. Also Read: Fear factor: Claude Cowork, techies no work? On Wednesday, the launch of Claude Cowork by AI giant Anthropic set off what brokerage firm Jefferies described as a "SaaSpocalypse." Global software stocks lost an estimated $285 billion in market capitalisation as investors reacted to the implications of the new tool. Cowork allows multiple humans and AI agents to collaborate in a shared digital workspace, automating workflows across legal, sales, marketing and data analysis. Market fears stemmed from the belief that such agentic coworkers could replace human employees, and potentially the software companies that sell tools to them. These global anxieties intersect sharply with India's domestic realities. Entry-level tech salaries in India are already low, and evidence is emerging that technology professionals are being outpaced by skilled manual and service workers. Home services platform Urban Company (UC) has said its partners earned an average net income of Rs 28,322 per month during the first nine months of FY26, according to its Partner Earnings Index released on Wednesday. In a post on X, Abhiraj Singh Bhal, cofounder and CEO of Urban Company, said the data points to a "quiet but important shift toward dignified, skill-based work." He added that these earnings are well above statutory minimum wages and on par with or better than entry-level IT salaries. Urban Company said entry-level IT and ITeS salaries are assumed at Rs 4 lakh per annum, based on publicly available industry data including Glassdoor estimates. The earnings gap widens at the top end of UC's workforce. The top 20% of service professionals earned an average Rs 42,418 per month, the top 10% earned Rs 47,471, and the top 5% earned Rs 51,673. In this context, AI-driven disruption threatens not just job security but the economic rationale of pursuing entry-level tech roles at all, particularly if automation suppresses wages further or eliminates junior positions altogether. The tech stock selloff amplified attention on statements made by Anthropic founder and CEO Dario Amodei, who has been unusually blunt about AI's labour implications. Speaking recently at the World Economic Forum, Amodei said, "We're 6 to 12 months from AI doing everything software engineers do." His remarks reflect a broader view that AI is no longer just augmenting technical work but rapidly approaching full substitution across many white-collar roles. Amodei has repeatedly warned that significant job cuts could occur within five years, particularly affecting entry-level roles in technology, finance, law and consulting. He has urged consumers and US lawmakers to prepare for this shift, while criticising governments and AI companies for "sugar-coating" what he sees as an unavoidable reality. "Most of them are unaware that this is about to happen. It sounds crazy, people just don't believe it," he said. In a recent article, Amodei sharpened the forecast further. "My prediction for 50% of entry level white collar jobs being disrupted is 1-5 years, even though I suspect we'll have powerful AI (which would be, technologically speaking, enough to do most or all jobs, not just entry level) in much less than 5 years," he wrote. Industry observers echo this concern, warning that as agentic systems mature, they could move beyond junior roles and begin displacing mid-level jobs in consulting, IT services, legal process outsourcing and corporate services. Amodei argues in his recent article that AI differs fundamentally from previous waves of automation. While mechanised farming and industrial machinery displaced workers in specific sectors, they also created new industries that absorbed labour elsewhere. AI, he suggests, may not follow this pattern. Amodei identifies three defining features. The first is speed: AI progress is unfolding far faster than past technological disruptions, giving workers and labour markets little time to adapt. The second is cognitive breadth. Unlike tools that automated narrow tasks, AI systems are increasingly matching humans across a wide spectrum of mental work, from coding and legal analysis to strategic reasoning. The third is general labour substitution. If AI can perform many cognitive tasks, it may also take on the new jobs that traditionally emerge after automation, compressing the labour market rather than reshaping it. These features undermine the traditional promise of retraining. If AI systems can quickly learn new skills at scale, displaced workers may find that the expected new jobs of the future are automated almost as soon as they appear. Despite the alarm, leaders in India's IT services sector argue that AI will reshape work rather than erase it. Cognizant chief executive Ravi Kumar S struck a more measured tone at the company's earnings briefing. "Any disruption will 'take away jobs of the past and create jobs of the future'," he said. "Old software will get modernised, and technical debt on enterprise landscapes will be rejigged. But tech service companies have yet to capture the 'drift value' from AI-infrastructure companies, leaving room for system integrators to grow and evolve towards an 'AI builder' strategy." Happiest Minds Technologies chairman Ashok Soota echoed this view, as quoted in a recent ET report. He said all platforms and plugins will expand, not diminish, the role of services companies. Innovations such as Cowork lower barriers to building software but increase the need for firms that can guide enterprises through large-scale transformation, integration, governance and orchestration, said Soota, a Wipro veteran who cofounded Mindtree. In the counter perspective, tools like Claude Cowork are not job killers but catalysts, shifting demand toward higher-order skills in AI architecture, compliance, and organisational change management. The tension between these two narratives - mass displacement versus structural evolution - defines the current moment for the global tech workforce. What makes the debate especially urgent in India is the new reality of entry-level employment, where salaries are already under pressure and alternative forms of skilled work - such as plumbers and electricians - are becoming more remunerative.

[11]

Will Anthropic's New AI Tool Disrupt India's IT Services Business Model

Stock pricing strategy might shift from billing by the hour to paying for outcomes and faster delivery. Anthropic has launched a new AI tool with advanced 'agent' features that can complete business tasks on its own, such as writing code, analysing data, preparing sales emails, and reviewing contracts. This announcement created a strong reaction in financial markets. After the news, Indian IT stocks saw a sharp fall, and the NIFTY IT index recorded one of its steepest single-day drops in recent years. Shares of Infosys, Tata Consultancy Services, Wipro, and HCLTech declined strongly. Investors fear that AI tools like this could reduce demand for large human teams that power India's IT services business model.

[12]

Anthropic's AI push raises analyst concerns over Indian IT services revenues

Rapid advances in artificial intelligence, triggered in part by Anthropic's latest automation push, could structurally erode the IT sector's high-margin application services revenues, creating downside risks to earnings and valuations, analysts warn. Shares in India's software exporters settled 0.6 per cent lower on Thursday, a day after plunging 6 per cent in their worst session for nearly six years, as AI-driven automation from U.S.-based Anthropic and Palantir fueled fears of compressed project timelines and disruption to the industry's labor-intensive business model. The weakness has echoed across global IT stocks this week, extending a broader selloff in companies seen as most exposed to potential AI disruption. "There is more pain ahead for Indian IT," Jefferies said, adding that Anthropic's and Palantir's claims highlight how AI could potentially erode application service revenues for IT firms. "With application services accounting for 40-70 per cent of revenues, firms face growth pressures, and consensus growth estimates do not fully reflect this, posing downside risks to valuations." Indian IT firms have been ramping up AI investments and re-skilling efforts, even as weak global tech spending, delayed client decision-making and pricing pressure have weighed on the sector. Foreign investors offloaded a record $8.5 billion worth of Indian IT stocks in 2025. However, some analysts said the sharp selloff may be overdone. JPMorgan said that while concerns around AI disruption were not without merit, it was illogical to extrapolate the launch of some tools to an expectation that companies will replace every layer of mission-critical enterprise software. Domestic brokerage Kotak Institutional Equities described the decline as a case of "plenty of panic over a little flutter." Among large IT firms, Tata Consultancy Services, Tech Mahindra and LTIMindtree have higher exposure to application services, which account for about 55 per cent-60 per cent of revenues, while HCL Tech has the lowest exposure at around 40 per cent. Their stocks fell between 4 per cent and 7 per cent per cent on Wednesday, and extended losses on Thursday. Brokerage Motilal Oswal estimates that 9 per cent-12 per cent of industry revenues could be eliminated over the next four years due to AI-led disruption. Jefferies expects AI to weigh on IT-sector revenue growth over the next one to two years, arguing that deflation in legacy service-line revenues will more than offset gains from AI-related opportunities. The IT sub-index has lost 17 per cent since the start of 2025, including Wednesday's selloff, and is on track for its worst week in over four months.

[13]

Why Did Anthropic's Legal Plugin lead to a Stock Market Rout?

Market analysts see a sharp shift in investor sentiment from viewing AI as an aid to software companies to seeing it as a replacement for them For context, the new Anthropic legal solution is a legal plugin released for its AI assistant, Claude Cowork. This plugin automates various legal workflows, which triggered a significant stock market selloff in software, legal tech, and professional services industries (you can read our previous report here). Anthropic released 11 open-source plugins for its agentic AI assistant, Claude Cowork, which is designed for non-technical professionals. The legal plugin automates routine tasks such as contract review, compliance checks, NDA triage, and legal briefings. Analysts noted that the tool is essentially a set of prompts and structured workflow instructions for the Claude model, rather than a proprietary, fine-tuned legal reasoning engine. The release of this tool has been dubbed a 'SaaSpocalypse' by some analysts, as it sparked a sharp shift in investor sentiment from viewing AI as an aid to software companies to seeing it as a replacement for them. Thomson Reuters, the company, which owns the Westlaw legal database, saw its shares drop sharply because the Claude tool directly targets its core legal and data services business. Investors are concerned that Anthropic is moving from just selling its underlying AI model to owning the entire workflow with ready-made vertical solutions, turning the AI platform into a direct competitor. The market panic was not limited to legal tech, with the selloff impacting the broader professional services and software sectors. The Nasdaq fell 1.4%, and the ripple effects extended to Indian IT giants, with Infosys ADRs slipping 5.5% and Wipro falling nearly 5%. The fear is rooted in the anticipation of an AI-fuelled disruption of the professional services industry. As the legal plugin and others automate multi-step tasks across functions like sales, marketing, and data analysis, investors fear that Indian IT services companies (including Infosys, Wipro, and TCS) will lose business as many of the tasks they perform for clients can be automated by these new AI tools. The Claude tool is designed to automate routine legal tasks such as contract reviews, compliance checks, NDA triage, and legal briefings. This directly encroaches on the core business of legal software/data providers whose business models are built around providing legal data services and workflow automation platforms. For Indian IT services companies like Infosys, Wipro, and TCS, the primary fear is that agentic AI solutions from Anthropic (and other developers) will automate the multi-step, routine professional services and software tasks that form the basis of their client contracts. The rapid emergence of generative AI is seen as commoditising traditional IT services -- making tasks like code and maintenance easily replicable or automated -- which could lead to a significant loss of business for the outsourcing giants. In essence, the market fears that AI will replace many of the human-led tasks performed by these firms, accelerating the industry's shift away from traditional services. The fear is that AI agents like Anthropic's Claude Cowork and its plugins can automate complex, multi-step tasks across various business functions (legal, sales, marketing, back-office operations). This disruption threatens the traditional Full-Time Equivalent (FTE) model where clients pay the Indian IT firms based on the number of people assigned to a project. As AI automates human-led tasks, the industry is forced to rapidly transition from billing for time and people to billing for outcomes and efficiency, which could significantly impact near-term revenues and profitability. This broader risk explains the stock selloff, rather than a specific dependence on a small slice of legal automation work.

[14]

AI disrupts Indian IT: Why TCS & Infosys face pain while niche players surge

India's top IT companies are not leading the AI revolution. Market expert Sudip Bandyopadhyay warns of restructuring and margin pressure for giants like TCS and Infosys. Newer, specialized IT firms are succeeding by focusing on high-growth areas like travel and electric vehicles. Investors should look to these niche players for future growth opportunities. India's technology giants may have missed the artificial intelligence revolution, warns market expert Sudip Bandyopadhyay, but a new generation of specialized IT firms is thriving by targeting booming sectors like travel and electric vehicles. As TCS and Infosys brace for painful restructuring and margin pressure, investors are discovering hidden winners in the midcap and smallcap space that built AI capabilities early -- and are now reaping the rewards. In a candid assessment that few market observers have been willing to make publicly, Bandyopadhyay acknowledged what many in the industry have quietly recognized: India's frontline IT companies are not leading the AI revolution. They're scrambling to catch up. "Unfortunately we have to admit that Indian frontline IT companies have been a little taken aback and we are not in the forefront of the AI revolution," Bandyopadhyay stated in an interview with ET Now. "It is unfortunate and they have missed the bus undoubtedly there, but they are trying to adopt and they are trying to adopt very soon." This isn't just an embarrassing oversight -- it's a strategic failure with profound financial implications. Without proprietary AI tools, Indian IT giants must rely on third-party solutions, directly squeezing the margins that have sustained their business models for decades. The cost arbitrage advantage that built the industry is evaporating as AI enables zero-marginal-cost labor. Despite his criticism, Bandyopadhyay expresses confidence that major players like TCS and Infosys possess the capacity to navigate the transition. But confidence doesn't mean painless. The companies face simultaneous pressures across multiple dimensions: people, margins, and topline growth. Job roles are already transforming. TCS recently let go between 20,000 and 30,000 employees -- a massive workforce reduction that signals the magnitude of change underway. Yet paradoxically, the same company is investing billions in data center infrastructure that will require thousands of new workers with entirely different skill sets focused on cloud computing and AI-related services. This pattern mirrors global trends. Amazon isn't necessarily reducing headcount but rather reallocating responsibilities and shifting workers between business units. The jobs aren't disappearing -- they're evolving. Menial tasks dependent on cost arbitrage are becoming obsolete, while roles supporting AI infrastructure, cloud services, and advanced technology implementation are expanding. "The nature of the jobs will change to an extent. They have to restructure. They have to redefine roles and they have to do this on a continuous basis for the foreseeable future," Bandyopadhyay explained. "The sooner they adopt, the better it is." Investors hoping the recent IT sector selloff has run its course should prepare for disappointment. Bandyopadhyay warns that further corrections lie ahead as restructuring pressures flow through to financial performance and valuations realign with diminished growth prospects. "Unfortunately there is more to come," he stated bluntly. "Their margins will be under pressure. Their service delivery models will come under pressure and they have to do a whole lot of restructuring. All these will lead to pressure on performance which will get reflected one way or the other in the valuation and the price of the stocks in the market." The timing of this correction remains uncertain -- it could unfold tomorrow or gradually over months. But the direction is clear. Current valuations for large-cap IT stocks appear bloated relative to the challenging restructuring journey ahead. That said, shareholders won't necessarily suffer catastrophic losses. These companies continue delivering 4 to 5 percent dividend yields and executing buyback programs. The total return picture may remain acceptable even as stock prices compress. Bandyopadhyay expects decent performance from the large IT players in the foreseeable future given their steady order books, but superlative returns appear unlikely. While generalist IT conglomerates navigate painful transitions, specialized players targeting high-growth verticals are thriving. Bandyopadhyay identifies two sectors where focused IT companies are not just surviving but excelling: travel and tourism, and the automotive transition from internal combustion engines to electric vehicles. Travel and tourism is experiencing a global boom, creating sustained demand for technology services. IT companies exclusively or predominantly serving this sector have adapted quickly to AI-driven changes while maintaining strong growth trajectories. These firms developed cutting-edge technologies using AI capabilities, positioning them ahead of larger competitors still figuring out their AI strategies. RateGain Technologies emerges as Bandyopadhyay's prime example in the travel tech space. The company has built specialized expertise in hospitality and travel technology, leveraging AI to deliver services that generic IT providers struggle to match. Its focused approach creates competitive moats that protect margins even as broader industry pricing pressures intensify. The global automotive industry is undergoing its most significant transformation in a century, shifting from internal combustion engines to electric vehicles. This transition requires massive technology infrastructure -- software for battery management systems, charging networks, autonomous driving capabilities, and integrated digital experiences. Indian IT companies positioned at the forefront of this transition are capturing disproportionate value. Tata Technologies stands out in Bandyopadhyay's analysis as a company providing cutting-edge engineering and technology services to automotive manufacturers navigating the EV shift. These specialized players possess critical advantages over generalists. They understand the specific technical challenges of their target industries. They've built deep relationships with key decision-makers in their verticals. And crucially, many have proactively acquired or developed AI capabilities tailored to their sectors' unique requirements. Coforge and Persistent Systems also feature in Bandyopadhyay's list of niche IT companies performing exceptionally well. Both have carved out specialized positions in specific verticals and technologies, insulating them from the broad-based margin compression affecting larger competitors. For investors trying to navigate this rapidly evolving landscape, Bandyopadhyay offers clear guidance that diverges sharply from traditional IT sector strategies. The old approach of loading up on large-cap stalwarts and riding steady growth no longer works in an AI-disrupted environment. Instead, focus on midcap and smallcap IT companies serving high-growth verticals. Identify firms that have already developed or acquired AI capabilities rather than those still in the exploration phase. Look for companies with concentrated business models rather than diversified geographic and product portfolios. "Focus on IT companies who are helping the transition of ICE engine to EV and providing cutting edge services," Bandyopadhyay advised. "Some of these companies have built AI capabilities, acquired AI capabilities, so look at these kind of niche midcap, smallcap IT companies in Indian market." The broader implication is that sector indices and ETFs tracking IT may underperform concentrated bets on specialized winners. When an industry undergoes fundamental disruption, diversification across all players means owning both winners and losers. Selectivity matters more than ever. For investors with existing positions in TCS, Infosys, and other IT giants, Bandyopadhyay suggests a nuanced approach rather than wholesale liquidation. These companies will continue delivering decent performance supported by steady order books and established client relationships. Their dividend yields and buyback programs provide downside protection. However, expectations must adjust. The era of consistent outperformance and expanding multiples has likely ended for generalist IT conglomerates. Some large players are adapting faster than others -- careful monitoring is essential to distinguish between companies handling AI challenges well and those struggling to keep pace. Recent quarterly results have been respectable, suggesting these companies can maintain acceptable performance levels even amid transformation pressures. But the bar for new investments should be high. Unless valuations become truly compelling or a specific large-cap demonstrates exceptional AI adaptation, fresh capital is better deployed in the specialized players driving innovation rather than playing catch-up. Concerns about AI eliminating IT jobs entirely miss important historical context. When computerization swept across industries 30 to 50 years ago, similar fears dominated public discourse. Would automation destroy employment? Would entire professions disappear? What actually happened was transformation rather than elimination. Jobs changed fundamentally, but employment levels remained robust as technology created new roles nobody had imagined. Bank tellers didn't disappear when ATMs arrived -- their responsibilities evolved toward customer service and complex transactions that machines couldn't handle. The current AI transition follows a similar pattern. Yes, menial coding tasks and routine maintenance work may become automated. But managing AI systems, training models, integrating AI solutions with legacy infrastructure, and ensuring ethical AI deployment all require human expertise. The skill requirements are shifting upward, not disappearing. Companies that successfully redeploy and retrain workers will emerge stronger. Those that simply shed headcount without rebuilding capabilities will struggle. This creates yet another selection criterion for investors: which IT companies are investing in workforce transformation versus merely cutting costs? Perhaps the most fundamental challenge facing Indian IT giants is the structural margin compression built into their new reality. Having missed the opportunity to develop proprietary AI tools, these companies must license technology from third parties. Every AI-powered solution they deliver to clients requires paying royalties or subscription fees to the actual AI innovators. This dependency fundamentally alters the economics of IT services. The old model captured nearly all value created for clients. The new model involves sharing significant portions of that value with AI platform providers. Even if revenue growth continues, profitability faces permanent headwinds. Companies that recognized this threat early and invested in developing their own AI capabilities -- even at smaller scale -- now enjoy competitive advantages that will compound over time. Each project they complete using proprietary tools strengthens their position. Each project large IT firms complete using licensed technology deepens their dependency. Bandyopadhyay's assessment delivers a sobering message: the Indian IT sector investors knew is gone. The industry that generated wealth through cost arbitrage, steady execution, and predictable growth faces an existential transformation driven by AI disruption. Large-cap IT stocks may continue delivering acceptable returns through dividends and modest growth, but the days of outperformance have ended. These companies missed the AI revolution and are now paying the price through margin pressure, restructuring costs, and valuation compression. The opportunity has shifted to specialized players that built AI capabilities early and focused on high-growth verticals like travel technology and electric vehicle systems. Companies like RateGain Technologies, Tata Technologies, Coforge, and Persistent Systems represent the new template for IT success -- deep vertical expertise combined with cutting-edge technology rather than geographic diversification and scale. For investors, this means abandoning the comfort of large-cap names and embracing the midcap and smallcap space where innovation and specialization create competitive moats that generalists cannot match. It means accepting that sector indices will underperform concentrated positions in the right companies. Most importantly, it means recognizing that the AI revolution hasn't destroyed the Indian IT industry -- it's simply revealed which companies were building sustainable advantages and which were riding a wave that has now crested. The winners and losers are becoming increasingly clear, and investor portfolios must adjust accordingly. Disclaimer: This article is for informational purposes only and should not be considered investment advice. Stock recommendations mentioned are the personal views of the market expert cited and do not constitute endorsements by this publication. Investors should conduct thorough research and consult with qualified financial advisors before making investment decisions. (You can now subscribe to our ETMarkets WhatsApp channel)

[15]

AI job fears trigger IT selloff; Unmesh Sharma sees opportunity for Indian IT, not doom

Indian technology stocks experienced a sharp decline following AI breakthroughs. However, an expert highlights that India's strength lies in AI implementation rather than core innovation. Electronics manufacturing services are identified as a multi-year growth sector. Investors are advised to navigate volatility with a focus on structural themes and disciplined positioning for future gains. The latest advancement in agentic AI sent Indian technology stocks tumbling, but one of the country's leading institutional equity strategists says the knee-jerk reaction misses the bigger picture. Unmesh Sharma, Senior Executive Vice President and Head of Institutional Equities at HDFC Securities, argues that while AI will indeed replace mundane jobs -- that's precisely the point -- Indian IT companies remain indispensable for implementing these very solutions across global enterprises. Following recent announcements from Anthropic regarding advanced AI capabilities, market participants reacted swiftly, hammering Indian IT stocks on fears that artificial intelligence would displace the sector's traditional service delivery model. The concern isn't new -- Sharma noted that during his firm's US marketing trips in October and November of last year, this question dominated investor conversations. The persistent worry: given IT's substantial weight in Indian indices, AI-driven disruption could drag down the broader market. However, Sharma sees a more nuanced reality emerging beneath the surface volatility. "Is there any lack of expectation that a lot of mundane jobs are going to be replaced by AI? Well, I thought that was the point of AI," Sharma observed in a recent interview with ET Now. "While there is a knee-jerk reaction to these stocks, would we really go short on them incrementally from here? The answer is no." The perception that India lacks positioning at the cutting edge of AI innovation is accurate, Sharma acknowledges. Indian companies aren't developing the breakthrough models or foundational technologies that make headlines. But that misses where the real business opportunity lies. As global corporations rush to adopt AI solutions, they face a massive implementation challenge. Rolling out AI across existing enterprise systems, integrating new capabilities with legacy infrastructure, training workforces, and managing change -- this is where Indian IT companies have built decades of expertise and client relationships. The growing market view, according to Sharma, is that Indian IT firms will serve as essential guides helping global majors navigate AI deployment. This implementation work may not be as glamorous as developing the next ChatGPT competitor, but it represents substantial, sustainable revenue streams. HDFC Securities maintains a neutral position on Indian IT companies in its model portfolio -- neither aggressively buying the dip nor joining the selloff. For investors currently underweight the sector, Sharma recommends using corrections to bring positions up to equal weight rather than remaining completely absent from what remains a significant component of the Indian equity story. While recent tariff-related relief has markets breathing easier, Sharma warns against mistaking this temporary calm for a return to normal conditions. The current environment -- characterized by valuations more than one standard deviation above historical means -- suggests volatility will remain elevated. "We continue to remain in an extremely uncertain world in a market where valuations continue to remain more than a standard deviation above mean," Sharma noted. "While the worst of the volatility may be over, this is not a normalization as far as volatility. We continue to remain fairly cautious." AI-related news flow will continue generating sharp market reactions, particularly in the technology sector. Investors should expect ongoing whipsaw movements as each new development in artificial intelligence gets digested and repriced. The key is maintaining disciplined positioning rather than attempting to trade these violent swings. Markets surged on news of progress toward an India-US trade agreement, but Sharma cautions against overestimating the direct earnings impact. At the aggregate Nifty level, the India-US trade relationship wasn't a significant mover on the way down during tariff tensions, and it won't be on the way up either. The real value of the trade deal lies in two less tangible but equally important factors. First, currency stabilization -- the rupee had been depreciating aggressively amid trade uncertainty, raising hurdle rates for foreign investors. With trade tensions easing, speculative pressure on the currency should diminish, making Indian equity returns more attractive to international capital. Second, geopolitical positioning. Combined with recent EU and UK trade agreements, the US deal signals India's successful navigation of an increasingly fractured global order. For investors concerned about India finding itself isolated or caught between competing power blocs, this multi-lateral trade engagement provides meaningful reassurance. "Is it a game changer? Answer is no," Sharma stated plainly. "This reaction in the last two days has been a collective sigh of relief that has gone through the market." As the initial euphoria fades, Sharma expects markets to refocus on fundamental earnings delivery -- which remains uneven relative to current valuations. The trade deal removes a major overhang and improves sentiment, but it doesn't fundamentally alter near-term profit trajectories for most companies. The retail sector presents what Sharma describes as a tricky valuation picture. Across the board, valuations had run far ahead of fundamentals, creating a disconnect that recent corrections have only partially addressed. The pullback has restored some sanity, but selectivity remains crucial. Within retail, Sharma identifies value-focused formats as particularly attractive. The reasoning centers on same-store sales growth potential in a low-inflation environment. When prices aren't rising dramatically, retailers must drive volume growth to deliver comparable store sales gains -- a challenge that favors value-oriented operators. Rural recovery adds another dimension to the retail thesis. After years of subdued performance, rural markets are showing signs of stabilization and modest growth. Additionally, operational efficiency improvements are creating margin expansion opportunities for well-managed retailers even without aggressive top-line growth. While compliance restrictions prevent Sharma from naming specific stocks, his directional tilt toward value retail is clear. In an environment where consumers remain price-sensitive and inflation pressures have moderated, retailers competing on value proposition rather than premium positioning appear better positioned for sustainable same-store sales growth. If there's one sector generating unqualified enthusiasm from Sharma, it's electronics manufacturing services. The recent steep correction in EMS stocks has created what he views as compelling value, but the real story is the confluence of multiple powerful tailwinds supporting sustained growth. The foundation remains government policy. Make in India and Atmanirbhar Bharat initiatives have driven EMS growth for years, but recent developments have added new dimensions to this support. The post-budget policy framework makes clear that domestic demand should increasingly be met through domestic production -- creating guaranteed volume growth for local manufacturers. Layered on top of government support is the geopolitical imperative. As India signs free trade agreements with major economies, there's an implicit understanding that expanding market access should translate into expanding domestic production capabilities. This isn't just industrial policy -- it's strategic autonomy. Perhaps most importantly, Indian EMS companies are moving up the value chain. What began as basic assembly operations has evolved into genuine manufacturing with increasing percentages of components produced in-house. This indigenization trend improves margins while reducing dependence on imported inputs. "Not only are they doing very basic assembly, a lot of parts are being manufactured in-house and then moving up the value chain," Sharma explained. "The indigenisation percentage will continue to go up. In that sense it is a long-term theme. The correction has helped and we are definitely quite excited with this." Sharma sees this as a multi-year theme with double-digit growth potential extending well into the future. The correction in EMS stocks hasn't changed the fundamental trajectory -- it's simply created better entry points for investors who understand the structural story. Sharma's sector-by-sector analysis reveals a consistent philosophy: distinguish between noise and signal, between temporary reactions and fundamental shifts. The AI-driven IT selloff represents noise -- emotional reaction to inevitable automation that doesn't negate India's implementation advantage. The trade deal rally similarly represents relief rather than transformation. Conversely, the EMS buildout and retail evolution toward value formats represent genuine structural changes playing out over years rather than quarters. These trends deserve patient capital committed to riding through volatility rather than attempting to trade it. The current market environment -- elevated valuations, ongoing geopolitical uncertainty, rapid technological change -- demands this kind of discernment. Panic selling into AI fears or euphoric buying on trade news are both likely to prove suboptimal strategies. For investors wondering how to position portfolios amid these crosscurrents, Sharma offers pragmatic guidance: maintain neutral IT exposure despite near-term volatility, recognize trade deal benefits as sentiment-positive rather than earnings-transformative, favor value retail over premium formats, and embrace the EMS theme as a multi-year structural winner. Above all, expect continued volatility without normalization. Markets trading more than one standard deviation above historical means while navigating AI disruption, geopolitical realignment, and uneven earnings delivery won't suddenly become placid. The volatility itself may be the new normal. Those who succeed in this environment will be investors who resist overreacting to each new development while remaining positioned in sectors where structural tailwinds outweigh cyclical headwinds. As Sharma's analysis makes clear, that balance currently favors electronics manufacturing and selective retail over wholesale IT exposure or indiscriminate trade-deal enthusiasm. The correction in EMS stocks may prove one of those rare moments where short-term pain creates long-term opportunity. For investors willing to look past the noise, the signal is clear: structural themes matter more than ever when volatility makes trading increasingly difficult and valuations leave little room for error.

[16]

Anthropic's AI push raises analyst concerns over IT services revenues

Feb 5 (Reuters) - Rapid advances in artificial intelligence, triggered in part by Anthropic's latest automation push, could structurally erode the IT sector's high-margin application services revenues, creating downside risks to earnings and valuations, analysts warn. Shares in India's software exporters fell 0.7% on Thursday, a day after plunging 6% in their worst session for nearly six years, as AI-driven automation from U.S.-based Anthropic and Palantir fuelled fears of compressed project timelines and disruption to the industry's labour-intensive business model. The weakness has echoed across global IT stocks this week, extending a broader selloff in companies seen as most exposed to potential AI disruption. "There is more pain ahead for Indian IT," Jefferies said, adding that Anthropic's and Palantir's claims highlight how AI could potentially erode application service revenues for IT firms. "With application services accounting for 40-70% of revenues, firms face growth pressures, and consensus growth estimates do not fully reflect this, posing downside risks to valuations." However, some analysts said the sharp selloff may be overdone. JPMorgan said that while concerns around AI disruption were not without merit, it was illogical to extrapolate the launch of some tools to an expectation that companies will replace every layer of mission-critical enterprise software. Domestic brokerage Kotak Institutional Equities described the decline as a case of "plenty of panic over a little flutter". (Reporting by Kashish Tandon and Bharath Rajeswaran in Bengaluru. Writing by Chandini Monnappa. Editing by Mark Potter)

[17]

Thomson Reuters Shares Slide After Anthropic Unveils AI Tool Targeting Legal-Workflow Business

Shares of Thomson Reuters fell sharply Tuesday after artificial intelligence company Anthropic revealed a new legal automation tool that threatens to encroach on the company's core contract-review and workflow-software business. Shares trading in Toronto were down more than 17% to 123.21 Canadian dollars ($90.06). Anthropic, the maker of Claude, released a new legal tool aimed at helping companies speed up routine legal work, such as review contracts, sort nondisclosure agreements, handle compliance workflows, prepare legal briefings and draft standard responses. The new tool touches a sensitive area for Thromson Reuters, whose legal software platforms such as Westlaw, Practical Law and CoCounsel, offer similar capabilities and have been a major focus of the company's push to integrate generative AI across its products. Legal Professionals is one of Thomson Reuters' "Big 3" business segments. It generated roughly half of the company's $1.46 billion revenue in the most-recent quarter. While Thomson Reuters offers a large legal database and stores of archives for the industry, the threat is more to the company's workflow automation layer that has become a major growth focus for the company. Chief Executive John Hasker told investors in November that Thomson Reuters expects to continue investing heavily in generative AI, with spending expected to exceed $200 million in 2025 and in 2026. Two of Europe's largest professional information companies, RELX and Wolters Kluwer, began the stock cascade Tuesday following the Anthropic news. The two companies both have large businesses built around legal research, compliance tools and workflow software. Earlier in the week, National Bank of Canada downgraded the stocks target price to C$190 from a previous C$300. The stock has seen a nearly 50% decline over the past 52 weeks. Analyst Adam Shine said the decline comes as investors shift more of their attention toward AI-driven demand for computing power, such as the chips and processing units that run massive data centers. At the same time, he adds that markets are growing more cautious that AI could eventually reduce the need for traditional software licenses and workflow tools. Write to Adriano Marchese at [email protected]

[18]

IT companies tumble on Anthropic shock; some feel its a short alarm

Indian IT stocks saw a significant fall on Wednesday. This decline followed a sell-off in US counterparts after Anthropic launched new AI tools. Market watchers fear these automation tools could replace outsourced IT services, potentially pressuring margins for Indian IT firms. Experts suggest long-term investors monitor deal trends for AI's impact. Shares of Information Technology companies tumbled on Wednesday, as the ripple effects of a heavy overnight sell-off in their US counterparts, sparked by the launch of Anthropic's legal AI tool, reverberated across traditional software services stocks. The Nifty IT index fell 5.9% on Wednesday, in its worst performance since the peak of the Covid selloff in March 2020, leading to a market cap erosion of ₹1.9 lakh crore in the Indian IT pack. "The sell-off has been triggered by market concerns that Anthropic's new automation tools could replace currently outsourced IT services, leading to margin pressure for Indian IT companies," said Vinod Nair, head of Research, Geojit Investments. The San Francisco-based AI company's new tool -- Claude Cowork, an open-source plugin, is designed to automate tasks across legal, sales, marketing and data analysis. Nair said automation tools from companies like Anthropic are viewed as a challenge to traditional IT service models. After the launch announcement, US-based stocks Accenture, Microsoft, Cognizant and Salesforce fell 310% while American Depository Receipts (ADRs) of Infosys and Wipro fell 5.6% and 4.8%, respectively, in the US on Tuesday. At home, Infosys fell the most, down 7.4%, followed by TCS, which declined 7%. The rest of all stocks on the Nifty IT index were down 3.8-6%. The benchmark Nifty ended 0.2% higher at 25,776. Sagar Shetty, research analyst at StoxBox said Wednesday's sell-off was largely a knee-jerk reaction. "At this stage, unless we see a clear and material impact on revenues, we don't see any immediate reason to worry about large-scale disruption to the industry," he said. Nifty IT index advanced 1.4% in Tuesday's trading after the finalisation of the India-US trade deal. Though Indian IT companies were not directly impacted by the tariffs, caution over business demand in the US had weighed on sentiment. SHORT-TERM WORRIES, LONG-TERM STABILITY Nair said Indian IT stocks are experiencing sentiment-driven volatility amid concerns about AI disruption, though underlying fundamentals remain stable. "At this stage, long-term investors may selectively accumulate high-quality IT names with strong client stickiness and solid balance sheets. It is important, however, to monitor deal win trends over the next few quarters to assess any impact from AI adoption," he said. Shetty also said while near-term volatility may persist, deal momentum remains healthy, and the longer-term outlook for software services remains constructive. "We remain positive on the adaptation capabilities of Indian IT players, as the revenue model shifts from headcount-led, timeand-material billing to an AI-driven, outcome-based model," he said. Shetty remains bullish on Infosys, HCL Tech, Coforge and Persistent, and sees dips as good buying opportunities.

[19]

Fear factor: Claude Cowork, techies no work?

Anthropic's launch of Claude Cowork, an AI tool for collaborative work, sparked a global software stock sell-off worth $285 billion. Indian IT stocks also fell sharply, with the Nifty IT index dropping 8% and Rs 2 lakh crore wiped out. The platform automates tasks across multiple functions, threatening traditional software service models. The launch of Claude Cowork by AI giant Anthropic triggered a shock selloff tsunami on Wednesday that rippled rapidly across the world, with global software stocks losing $285 billion in market cap. Cowork is an AI tool that allows multiple people and AI agents to collaborate in a shared workspace. Indian tech stocks also got battered, with the Nifty IT index plunging as much as 8% and Rs 2 lakh crore in market value being wiped out in the sector's worst selloff since the March 2020, Covid-19 crash. India's biggest software company, Tata Consultancy Services (TCS), fell to its lowest in five years. An open-source plugin, Cowork is designed to automate tasks across different functions such as legal, sales, marketing and data analysis, threatening the human, seat-based billing model of software services firms. Anthropic founder Dario Amodei had said at the World Economic Forum recently that "we're six-twelve months from AI doing everything software engineers do." Also Read: Explained: What is Anthropic's AI tool that's sparking job loss fears While IT companies are making the pivot to building services on top of AI models, Anthropic's latest release makes it an end-to-end product owner--a direct competitor to software companies. Brokerage firm Jefferies coined the term "SaaSpocalypse," as the impact will also be felt on software-as-a-service (SaaS) platforms such as Salesforce, SAP and ServiceNow, which have traditionally relied on subscription models. Any disruption will "take away jobs of the past and create jobs of the future," said Cognizant CEO Ravi Kumar S at the company's earnings briefing. "Old software will get modernised, and technical debt on enterprise landscapes will be rejigged. But tech service companies have yet to capture the 'drift value' from AI-infrastructure companies, leaving room for system integrators to grow and evolve towards an 'AI builder' strategy." Happiest Minds Technologies chairman Ashok Soota said aII platforms and plugins will expand, not diminish, the role of services companies. Innovations such as Cowork lower barriers to building software but increase the need for firms that can guide enterprises through large-scale transformation, integration, governance and orchestration, said Soota, a Wipro veteran who cofounded IT Mindtree as well. Market participants were also reacting to the latest earnings report of Palantir Technologies. The enterprise software company had said it's upending per-seat software companies such as SAP and Oracle as well as third-party software firms with its own AI offerings. Its AI platform is powering complex SAP migration work, compressing the implementation timeline from years to weeks, the company said. "Generalist money flows responding to the rapid AI product rate-of-change dynamic" are overwhelming the software enterprise industry that's still grounded in its legacy business, JP Morgan analysts said in a February 3 note. "These generalist money flows are invoking more knee-jerk selling." Experts said the development is a stark reminder that pivots by IT companies are insufficient with AI research labs moving up the value chain into the application layer. The "biggest application, the biggest impact of generative AI" will be on software development and routine knowledge work, Vishal Sikka, founder of Vianai Systems and former Infosys CEO, said in a blog. This shift is already delivering "real-time, conversational, accurate analysis" and promises to transform the entire enterprise IT landscape and create trillions in new value, he said. "What Claude Cowork signals is a move from single-seat interfaces to shared, agent-driven workspaces," said Natasha Malpani, founder, Boundless Ventures. "That's a genuine architectural change. But it's not an overnight disruption. Enterprises don't rip out systems of record overnight; they layer new interfaces on top of them." She said the market reaction was an overcorrection in the short term, even though the direction of travel is real. Although investor confidence in the broader software sector is low, fear is now outrunning fundamentals and producing "illogical" conclusions, according to JP Morgan. It's "an illogical leap" to assume that the emergence of Claude Cowork plug-ins means "every company is about to build and maintain homegrown systems to replace every layer of mission-critical software," the JP Morgan analysts wrote. Analysts at Motilal Oswal said that tech service companies have historically not been competitors, but system integrators or implementation partners for every new technology, be it ERP (enterprise resource planning), cloud, or in this case, GenAI. "We are already seeing enterprise partnerships being formed between AI native firms and traditional vendors. Accenture, HCL, Infosys etc. are already forming partnerships with Palantir, Cognition (AI software agent), Cursor (AI native coding platform) etc.," the note said. Companies need to see that AI is not just a productivity lever, said Ramkumar Ramamoorthy, partner at Catalincs and former CMD, Cognizant India. It's "a force that drives organisations to completely reimagine all three aspects: the business model, the operating model and the financial model," he said. "What happened last evening is only a reinforcement that a lot more can potentially be done with AI."

[20]

AI is the pin-popping SaaS' inflated balloon: Zoho founder Sridhar Vembu on Anthropic shock