China's Ambitious AI Data Center Plans Raise Questions About Chip Acquisition

4 Sources

4 Sources

[1]

China Wants to Use 115,000 Banned Nvidia Chips to Fulfil Its AI Ambitions

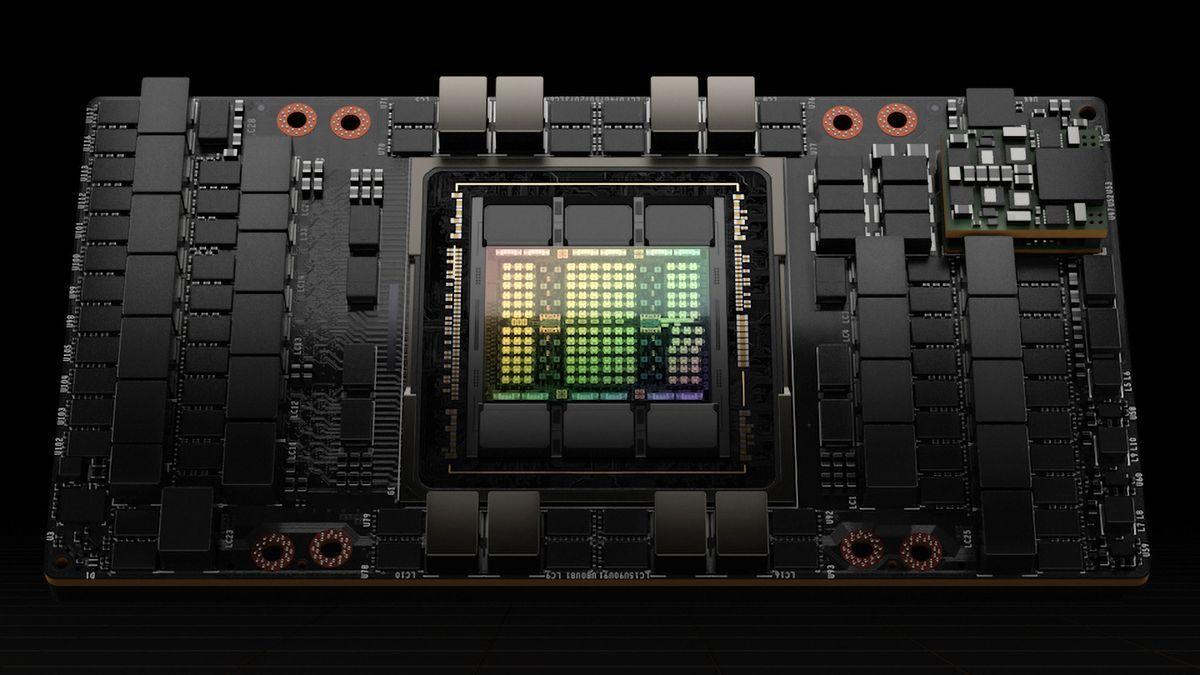

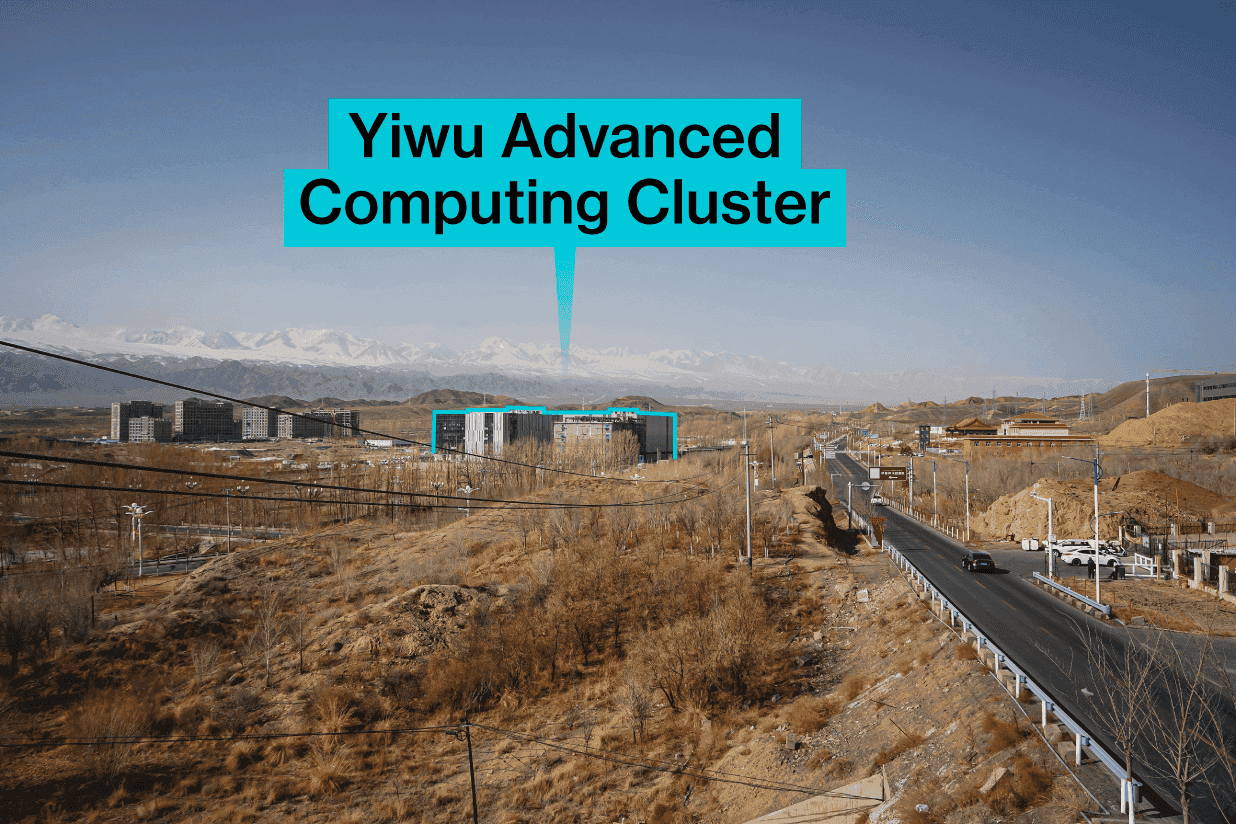

The futuristic structures are data centers that the operators seek to equip with high-end American semiconductors -- chips that the US government doesn't want its geopolitical rival to obtain. A Bloomberg News analysis of investment approvals, tender documents and company filings shows that Chinese firms aim to install more than 115,000 Nvidia Corp. AI chips in some three dozen data centers across the country's western deserts. Operators in Xinjiang intend to house the lion's share of those processors in a single compound -- which, if they can pull it off, could be used to train foundational large-language models like those of Chinese AI startup DeepSeek. The complex as envisioned would still be dwarfed by the scale of AI infrastructure in the US, but it would significantly boost China's computing prowess as President Xi Jinping pushes for technological breakthroughs. Such a project also would raise serious concerns for officials in Washington, who restricted leading-edge Nvidia chip sales to China in 2022 over worries that advanced AI could give Beijing a military edge. Yet the Chinese documents contain no explanation of how companies plan to acquire the chips, which cannot be legally purchased without licenses from the US government, permits that haven't been given. The companies listed in the filings, state officials and central government representatives in Beijing declined to comment when asked to explain. To gauge whether Chinese entities could realistically procure that quantity of restricted processors, Bloomberg News spoke with more than a dozen people who've been involved in or privy to US government investigations into the matter, as well as several people with direct knowledge of the black market in China. None of those familiar with the US probes said they previously knew of the data center buildout in Xinjiang. All said that while they believe there are indeed banned chips in China, they're not aware of an illicit trade network sophisticated enough to procure more than 100,000 such processors and direct that hardware to a centralized location. But the US government doesn't appear to have reached a consensus on the number of restricted Nvidia chips currently in the Asian country. Most of the people interviewed for this story said they were unaware of an agreed-upon estimate, while some offered rough numbers that differed by tens of thousands of processors. Two senior Biden administration officials said they believe there are around 25,000 banned Nvidia chips in China -- a number that, one of them added, would not be terribly concerning. That volume of semiconductors, assuming they are integrated into servers and designated for the same facility, could power at most one mid-sized data center. The US Commerce Department -- whose Bureau of Industry and Security, known as BIS, is tasked with implementing and enforcing chip trade restrictions -- did not answer detailed questions for this story, including how many banned Nvidia chips the Trump administration believes are in China, nor whether Trump officials were previously aware of the projects in Xinjiang. "Posting a web page asking about restricted products is not the same as successfully licensing, building, and operating a datacenter," Nvidia said in an emailed response to questions about the Chinese companies' claims. "Datacenters are massive and complex systems, making smuggling extremely difficult, and we do not provide any support or repairs for restricted products." The California-based company also said that "trying to cobble together a datacenter from smuggled, previous-generation products makes no business or engineering sense," especially since chips and servers made by Huawei Technologies Co. are widely available in China. Jensen Huang, Nvidia's chief executive officer, made his position clear at a May conference in Taipei: "There's no evidence of any AI chip diversion," he said. Yet the head of BIS pointedly contradicted that assertion just weeks later, telling US lawmakers that there is clearly a problem with AI chip smuggling. "It's happening," said Commerce Under Secretary Jeffrey Kessler. "It's a fact." Although Kessler didn't mention Nvidia by name, the company is by far the dominant provider of such semiconductors. Kessler also said that US efforts to restrict Huawei's chipmaking capabilities will keep China's output at just 200,000 AI processors this year -- a number far short of domestic demand. To be sure, Bloomberg News has not found evidence that China has amassed, or can amass, 115,000 banned Nvidia chips -- nor evidence that smaller volumes of restricted semiconductors that US officials believe are in the country have been directed to centralized locations. And yet in Yiwu, the construction goes on. Looming out of the desert, a tower the height of the Golden Gate Bridge radiates an intense light that pierces the surrounding dust clouds. Arrays of reflectors focus the sun's energy onto a receiver that allows the daytime heat of the arid plains to be stored, ensuring continuous power generation. It's one main reason for the choice of Yiwu, just to the south over a mountain pass. On the barren hill behind one new building stands a wall with a slogan picked out in red Chinese letters two meters high: "Data-electricity fusion shows great promise." Xinjiang, and especially the Hami region which includes Yiwu County, is rich in wind and solar energy, as well as abundant in coal, offering a ready source of affordable power. Local governments there are at the forefront of a state strategy to take advantage of those energy resources -- along with cheap land and cool weather at altitude, helping counter the heat generated by racks of servers -- to meet the AI computing-power demand of more economically developed regions such as Shanghai and Shenzhen. On a midweek day in March, workers loaded windmill blades onto the back of trucks traveling the road between the prefectural capital of Hami City and Yiwu, over bleak terrain past occasional camels grazing, and through a new tunnel leading out to a plain with views of snow-capped mountains. The main road into town leads past the first data center, still under construction, with a man welding from his perch on metal scaffolding. Hami is best known for its sweet melons, and Yiwu claims to be the site of the last battle on the mainland of the Chinese civil war in 1949. There's a monument downtown dedicated to a horse that played a role in the final engagement between Communist forces and nationalists loyal to Chiang Kai-shek. The authorities in Xinjiang are particularly suspicious of foreigners due to Western allegations of human-rights abuses against ethnic Uyghurs. Interview requests sent to eight data center operators in Yiwu were ignored, rejected or agreed to and then cancelled at short notice. The Xinjiang government and Ministry of Industry and Information Technology (MIIT), the central government ministry overseeing data center development, didn't reply to Bloomberg requests for comment. The most important part of a giant data center is relatively small. Nvidia dominates the market for so-called AI accelerators, highly coveted components that have propelled the chipmaker's valuation to nearly $4 trillion. The processors are connected together in giant arrays numbering tens of thousands and used to sift through mountains of data to create new computer code that can in many ways approximate human intelligence. The US barred China from importing Nvidia's best chips in October 2022, a month before OpenAI's ChatGPT debut roiled the tech industry and sparked a global race that now includes DeepSeek among its top players. Washington several times has ratcheted up those curbs, restricting sales to China of a variety of advanced semiconductors and the machines used to make them -- with additional sanctions levied on specific Chinese tech companies. That sweeping effort, which dates back to Trump's first term, has become a primary source of tension with Beijing -- one that Chinese officials repeatedly raised in recent trade talks with the US after the Trump administration imposed punitive tariffs. "All the greatest chips in the world are American, right? So of course they want them," Commerce Secretary Howard Lutnick told CNBC last month, speaking about China's position during negotiations in London. "And of course we said 'absolutely not.'" The Xinjiang effort suggests that China's AI ambitions -- which hinge in large part on locally produced chips from the likes of Huawei -- still include some hope of accessing restricted Nvidia hardware too. Project approval documents show that in the fourth quarter of 2024, local governments in Xinjiang and in neighboring Qinghai province green-lit a total of 39 data centers that intend to use more than 115,000 Nvidia processors. All of the companies stated in their investment plans that they aim to obtain H100 or H200 chips, two Nvidia GPUs, or graphics processing units, that were the industrial standard for training large language models such as OpenAI's GPT4o and Google's Gemini through last year. Nvidia this year debuted a new, more advanced model -- dubbed the Grace Blackwell -- that is banned along with the H100 and H200 from export to China without a US government license. Seven Xinjiang projects that aim to use those processors had started construction or won open tenders for AI computing service as of June 2025, according to tender documents obtained by Bloomberg. One operator says it's already using advanced hardware facilities to support cloud access to DeepSeek's R1 model, according to local news reports. Still, the provincial projects' description of their intended computing capabilities may be somewhat aspirational: Local party officials try to signal to Beijing that they are working toward national priorities, but Chinese companies frequently launch initiatives that are never completed. Nyocor declined to comment. China Bester and China Energy Investment didn't reply to requests for comment. Infinigence AI couldn't be reached for a response. Around 70% of computing power planned by the identified projects is in a single compound set up by the local government in Xinjiang. That makes the region -- the epicenter of Western charges of Chinese rights abuses including forced labor and religious persecution -- pivotal to China's efforts to seize the lead from the US in a sphere seen as key to future global technological, and geopolitical, dominance. Even if successful, the Xinjiang complex would only involve the number of Nvidia chips that one major hyperscaler -- a term for massive data center operators like Microsoft Corp. and Amazon Web Services -- deploys in a single week, according to data Nvidia provided on a recent earnings call. Still, Chinese companies like DeepSeek are beginning to show they can do more with less. "The gap between leading US and Chinese AI labs is closing," said Kevin Xu, a tech investor and founder of US-based Interconnected Capital, who put it at around three months. Players like DeepSeek, which says it trained its R1 model using less-advanced Nvidia chips, are "very serious and sincere" about pursuing artificial general intelligence, Xu said. The fact that leading Chinese models are open source means they spread faster globally, he added, while noting that diffusion is hard to track: "Beijing sees this trend as a source of technological soft power worth embracing." DeepSeek and other Chinese AI startups have already expressed interest in collaborating with the data center projects in Xinjiang, according to an employee of one of the largest investors in the Yiwu sites. That employee, whose name has been withheld to protect their identity, said in a message exchange that their company will invest more than 5 billion yuan ($700 million) in data center projects there in 2025 and 2026. China's data center industry is expected to surpass 300 billion yuan in scale this year, according to the Securities Times. Chinese entities are collectively expected to invest nearly that amount on an annual basis by 2028, according to the China Communications Industry Association -- a more than threefold increase from a half-decade prior. Xinjiang has already brought its first "intelligent computing center" online, and constructed 24,000 petaflops of computing power for demand from the logistics hub of Chongqing, Chairman of the People's Government of Xinjiang Erkin Tuniyaz said in an annual government work report in January, without specifying the type of chips installed. The cited computing power is equivalent to roughly 12,000 server-integrated Nvidia H100s. Prospective investors in such projects are attracted with the promise of free electricity worth up to 20% of total power costs. Data center operators also can access government support ranging from one-off payments for construction to operation incentives for up to five years, depending on company size, according to local government documents reviewed by Bloomberg. Experts in "green computing" areas are also eligible for favorable terms on accommodation, children's education and research funding. From a standing start, "Xinjiang's intelligent computing has achieved a historic breakthrough," Tuniyaz said in January. Policymakers in Washington for years have been aware that limiting China's access to US technology is not as simple as writing a regulation. Not two months after the chip restrictions took effect, Chinese officials caught a woman hiding forbidden hardware in a baby bump. The American AI company Anthropic recently said smugglers have packed GPUs next to live lobsters. Nvidia has dismissed both examples as "tall tales" that ignore the complexity of building data centers, which require operational support to run properly -- support that Nvidia does not provide for restricted products in China. Still, conversations with people privy to illicit semiconductor transactions, as well as media reports from a range of outlets, indicate that smuggling networks have gotten more sophisticated over time. Those stories -- which have helped inform US investigations, people familiar with the matter said -- have cited examples ranging from dozens of illicit processors to more than a thousand. Potential smuggling in Malaysia has become a big concern for the Trump administration, which plans to restrict Nvidia sales there to halt possible diversion to China, and also has asked Malaysian authorities to crack down on the issue -- a request the government has said it'll heed. Officials in Singapore, meanwhile, are prosecuting three men for alleged fraud in exports to Malaysia of AI servers that likely contained advanced Nvidia processors -- bound for an unknown final destination. In response to queries about Washington's export control plans, Malaysia's Ministry of Investment, Trade & Industry said the country will "act firmly against any company or individual should there be strong evidence" of misuse or diversion of advanced tech. The ministry added that Malaysia welcomes a dialogue with the US and other nations to "clarify any misunderstandings and to strengthen mutual trust." Trump officials are separately investigating whether DeepSeek may have accessed restricted chips through intermediaries in Singapore, and a bipartisan congressional committee focused on China recently requested Nvidia's customer data for 11 Asian countries, related to concerns that DeepSeek may have circumvented US export controls. (None of the documents viewed or interviews conducted through the course of this investigation indicated any link between the Xinjiang projects and supply chains in Singapore or Malaysia. Nvidia is not accused of any wrongdoing in Singapore's probe or in the US investigation into DeepSeek.) Read More: Lutnick Urges Tougher Enforcement of Export Curbs on China Nvidia consistently has said it abides by all US rules, but Huang has made no secret that he doesn't like Washington's strategy. Years of curbs -- including on crucial semiconductor manufacturing equipment -- have "failed" to contain Huawei's rise, he said at the May conference in Taipei. Nvidia now sees Huawei as a formidable competitor, and the company worries its Chinese rival will continue to improve and gain market share -- unless the US government allows Nvidia to compete on Huawei's home turf. Washington isn't buying it. The Trump administration has already further limited the types of chips Nvidia can sell in China, at a $5.5 billion hit to the company. White House AI Advisor Sriram Krishnan, asked about Huang's urge to lift those curbs, said that "there is still bipartisan and broad concern about what can happen to these GPUs once they're physically inside" the Asian country. Meanwhile, Chinese companies continue to build their data centers, a sign they expect to receive AI chips from somewhere. Two such construction projects were approved by the Qinghai government in December 2024, with a total investment of 13.5 billion yuan, documents from Qinghai's investment review website show. The companies applying for construction permits for both projects were founded that same month. China's company registry services show both entities can be traced by shareholding data to the same group of controlling companies: one real estate firm in Qinghai named Qinghai Borong Group and one AI tech company in Sichuan called Chengdu Qingshu Technology. They didn't respond to requests for comment.

[2]

China is building data centres to house over 115,000 high-end Nvidia AI GPUs despite Trump's ban on selling the tech

The AI race between China and the United States of America continues, as reports surface pointing at huge data centres being planned in Yiwu, China. While Trump attempts to clamp down on the nation's access to this tech by shackling Nvidia and launching investigations to potential chip smuggling, it seems that China will continue to move forward in its own plans for AI. WCCFtech spotted a Bloomberg report revealing the plans for the massive facility which is to be built by several Chinese AI firms with support from the Chinese government. The plans will see at least 36 datacentres established. Though only a single building is expected to house the majority of the over 115,000 high-end Nvidia AI GPUs detailed in the plans, which is where things get a little confusing. It's not so much that China plans to build these facilities across its western desert, but rather where those cards will come from given the U.S. current restrictions. The facility may be the biggest planned for China, but it's relatively small compared to what the U.S. has planned. Still, I wouldn't expect the United States to lift the controls any time soon. This means China is going to have to figure out some other way to access these new cards. It won't be as easy as calling Dell to haul over some racks of new Blackwell Ultra cards like what was recently installed at CoreWeave. It's also unlikely other countries are going to be super keen to help. Singapore is already under investigations for potentially helping to smuggle restricted chips into China, and with hefty fines most are probably trying to keep their noses as clean as possible. China as a country does have access to a hefty supply of H20 AI accelerators that it might choose to allocate to this new data centre, but the goal would almost certainly have to be to have higher powered Nvidia chips installed instead. Maybe they'll be able to use these old ones as collateral for a big loan to help with new fangled chips. Assuming the report is correct and China is going ahead with the facility, that does imply a fair amount of confidence in the project. If the country is targeting those new Nvidia chips then it certainly expects to get them one way or another. That's a helluva lot of infrastructure to build if you never intend on filling it with working servers. If China isn't able to import these chips, it could be that China is ready to make its own. Given Nvidia boss Jen-Hsun Huang has commented on the country's growing capabilities, China might be getting ready to fill its data centres with its own AI chips in the near future.

[3]

Chinese AI companies plan new facility in China with 115,000 NVIDIA AI GPUs, even with chip ban

As an Amazon Associate, we earn from qualifying purchases. TweakTown may also earn commissions from other affiliate partners at no extra cost to you. Chinese AI companies want to secure 115,000 NVIDIA AI GPUs to power new data centers in the desert, in the middle of US export restrictions stopping high-end AI chips from entering China. In a new report from Bloomberg, we're hearing that futuristic structures are data centers that Chinese AI companies want to equip with high-end American semiconductors, chips that the US government doesn't want China to obtain. Bloomberg News has analyzed investment approvals, tender documents, and company filings that show Chinese AI companies aim to install over 115,000 of NVIDIA's high-end AI GPUs. The companies want to install the AI chips in over 36 data centers across China's western deserts, with operators in Xinjiang planning to house most of the AI chips in a single compound, which, if achieved, could be used to train foundational LLMs (large language models) like those of Chinese AI startup DeepSeek. Even with this huge installation of AI chips, the US would still lead the world with AI computing power, but Chinese President Xi Jinping is continuing to push for technological breakthroughs for China. The project would raise serious concerns for Washington, which has been restricting the bleeding-edge AI chips from NVIDIA entering China, worried that it would provide the country with a military edge. There's no explanation as to how China would acquire the high-end NVIDIA AI GPUs, which can't be purchased without licenses provided from the US government, permits that China hasn't been given. Bloomberg News spoke with over a dozen people who have been involved in or privy to US government investigations into the matter, as well as several people with direct knowledge of the black market in China. Bloomberg News reports that none of those familiar with the US probes said they previously knew about the data center buildout in Xinjiang. All of the sources said that while they believe there are indeed banned chips in China, they weren't aware of an illegal trade network that's sophisticated enough to secure 100,000 high-end AI GPUs and direct that hardware into a centralized location. NVIDIA said in a statement over email regarding questions about the Chinese AI companies' claims: "Posting a web page asking about restricted products is not the same as successfully licensing, building, and operating a datacenter. Datacenters are massive and complex systems, making smuggling extremely difficult, and we do not provide any support or repairs for restricted products". Bloomberg adds that even though no one has any idea how these Chinese AI companies would get their hands on high-end NVIDIA AI GPUs, construction on the data centers in Yiwu continues. The huge structure in the deserts of China is the height of the Golden Gate Bridge, radiating an intense light that "pierces the surrounding dust clouds". Arrays of reflectors focus the sun's energy into a received that allows the daytime heat of the arid plains to be stored, ensuring continuous power generation. This is one of the main reasons as to why the Chinese AI companies chose Yiwu, just to the south over a mountain pass. Bloomberg adds that on the barren hill behind one of the new buildings stands a wall with a slogan picked out in red Chinese letters two meters high that reads: "data-electricity fusion shows great promise".

[4]

Chinese AI Firms Plan Massive Domestic Data Centers With 100,000+ NVIDIA AI Chips -- But Where Will the Chips Come From?

It is reported that China's AI companies have put up a big ambition of installing a "hyperscale" level facility in the nation, utilizing more than 100,000 of NVIDIA's AI chips. Well, with nations across the globe racing to create AI infrastructure and achieve dominance in this segment, it seems like China is also pushing the pedals to get ahead, despite all the restrictions and trade barriers in place. A report by Bloomberg revealed that Chinese AI firms, along with the support of the state, are building a massive AI facility in Yiwu, China. Related tender documents and filings indicate that the parties plan to install over 115,000 of NVIDIA's high-end AI chips in 36 data centers across the country's western deserts, but the bigger question here is, how will Beijing acquire such compute power, with the US restrictions in place? While the project plans are under development, this still marks one of China's largest AI datacenter buildouts, considering the scale of chips being deployed across multiple facilities. And, while it is nowhere near what the US infrastructure is capable of, it does show that Beijing is making ground in this segment, by any kind of means it has access to. Interestingly, when Bloomberg asked about China's data center projects in the region, none of the US sources were familiar with the development, suggesting that either the project was strictly confidential, or something that is still in the planning phase. Now, the question is how China will access the chips it needs. The country is barred from getting chips from the US, so it would need to resort to other means, particularly through SEA nations like Malaysia and Singapore, which are rumored to have given Chinese engineers access to AI chips. Apart from this, China has a vast pool of H20 AI accelerators that is available to Chinese Big Tech organizations, so they might decide to leverage them in the buildouts, but Beijing still doesn't have a consistent source of NVIDIA's AI chips, and there is no solution by Team Green available for them as of now. There is no current evidence on whether Chinese AI firms could get their hands on such a large number of chips, but development is still ongoing in Yiwu. Despite the barriers, China's data center market is growing rapidly and is expected to be valued at 300 billion yuan in scale this year. The nation hasn't switched to domestic alternatives such as those from Huawei for hyperscalers, and they are relying on what appears to be "trade loopholes" for computing needs, suggesting that the US export control isn't completely effective for now.

Share

Share

Copy Link

Chinese firms plan to build massive data centers housing over 115,000 high-end Nvidia AI chips, despite US export restrictions. The project's scale and China's ability to acquire these chips have sparked concerns and speculation.

China's Ambitious AI Infrastructure Plans

Chinese companies are planning to construct massive data centers across the country's western deserts, with the aim of housing over 115,000 high-end Nvidia AI chips. This ambitious project, revealed through investment approvals, tender documents, and company filings, highlights China's determination to boost its AI capabilities despite ongoing US export restrictions

1

.Scale and Location of the Project

The planned infrastructure includes at least 36 data centers, with a significant portion of the AI processors intended for installation in a single compound in Xinjiang. If successful, this facility could be used to train foundational large-language models, potentially rivaling those of Chinese AI startup DeepSeek

1

.

Source: Bloomberg

Geopolitical Implications

This development has raised concerns in Washington, where officials worry that advanced AI could provide Beijing with a military advantage. The US government restricted the sale of leading-edge Nvidia chips to China in 2022, making the acquisition of these processors a significant challenge

1

.Uncertainty Surrounding Chip Acquisition

The Chinese documents detailing these plans do not explain how the companies intend to acquire the restricted Nvidia chips. US government investigations and industry experts are skeptical about the existence of an illicit trade network sophisticated enough to procure and direct such a large quantity of processors to a centralized location

1

.Conflicting Statements and Estimates

There appears to be no consensus on the number of restricted Nvidia chips currently in China. While some senior Biden administration officials estimate around 25,000 banned chips in the country, others offer differing figures

1

. Nvidia's CEO, Jensen Huang, has stated that there is "no evidence of any AI chip diversion"1

. However, the head of the US Bureau of Industry and Security contradicted this assertion, confirming that AI chip smuggling is indeed occurring1

.Related Stories

Strategic Location and Energy Resources

The choice of Yiwu for these data centers is strategic, leveraging the region's abundant wind, solar, and coal energy resources. The area's cool weather at altitude also helps counter the heat generated by server racks. This aligns with China's state strategy to meet the AI computing-power demand of more economically developed regions

1

.

Source: TweakTown

Potential Alternatives and Future Prospects

If China cannot import the desired Nvidia chips, it may turn to domestic alternatives. Some experts speculate that China might be preparing to fill its data centers with its own AI chips in the near future

2

. The country's data center market is growing rapidly and is expected to reach a value of 300 billion yuan this year4

.Ongoing Construction and Uncertainty

Source: PC Gamer

Despite the uncertainties surrounding chip acquisition, construction of the data centers in Yiwu continues. The scale of the infrastructure being built suggests a high level of confidence in the project's future, even as questions remain about how China will overcome the technological and regulatory hurdles it faces

3

.References

Summarized by

Navi

[3]

Related Stories

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation