Chinese chipmaker Iluvatar CoreX unveils ambitious GPU roadmap targeting Nvidia's Rubin by 2027

2 Sources

2 Sources

[1]

Newly-listed Chinese chipmaker targets beating Nvidia Rubin platform in just two years -- Shanghai Iluvatar CoreX unveils multi-year GPU architecture roadmap with 2027 deadline

Newly-listed chipmaker claims Hopper-class performance today, Rubin tomorrow. Chinese chip designer Shanghai Iluvatar CoreX Semiconductor has unveiled a multi-year GPU architecture roadmap that explicitly targets Nvidia's next-gen Rubin platform as its main competition, as China continues to push hard to establish viable domestic alternatives to Western silicon for AI training and inference hardware. According to reporting by the South China Morning Post, Iluvatar CoreX's roadmap outlines four successive GPU architectures, named after Chinese terms associated with the Big Dipper constellation. The company has said its current architecture, Tianshu, has already outperformed Nvidia's Hopper generation, while a follow-on design, Tianxuan, has been pitted against Blackwell. A third generation, Tianji, is earmarked as being capable of surpassing Blackwell this year, with a fourth, Tianquan, projected to exceed Rubin by 2027, claims the company. Following this, CoreX will attempt what it describes as a "breakthrough" architectural redesign. According to Iluvatar CoreX, Tianshu achieves more than 90% effective utilization of compute resources through architectural features that reduce redundant memory access and dynamically allocate workloads to ease resource contention. The company claims a roughly 20% higher average performance than Hopper on DeepSeek V3 through its own testing, a claim that comes conveniently soon after Nvidia's China business was dealt a new blow by the rejection of H200 GPUs by Chinese officials. Nvidia CEO Jensen Huang arrived in China on Friday, January 23, for meetings with partners and customers, amid efforts to stabilize the company's position in the market. Beyond data-center GPUs, Iluvatar CoreX has also unveiled four edge-focused components under its Tongyang (TY) series, spanning 100 to 300 TOPS. The company claims its TY1000 exceeded Nvidia's Jetson AGX Orin in a range of test scenarios, but no detailed third-party benchmarks have been published -- a suspiciously common theme when Chinese manufacturers make such lofty performance claims. Founded in 2015, Iluvatar CoreX introduced its first general-purpose training GPU, TG Gen 1, which it described as China's first domestically mass-produced AI training GPU. A second-gen component followed in 2023, while TG Gen3 is scheduled for mass production later this year. The company also launched an inference-oriented ZK product line in 2022. The company was listed in Hong Kong on January 8, joining a wave of Chinese companies going public all at the same time, and is currently valued at around HK$46.3 billion based on current market capitalization. That places Iluvatar CoreX well below its larger domestic peers but is still significant for a firm of its age and size. In the first half of 2025, the company reported revenue of 324 million yuan and reportedly shipped more than 52,000 general-purpose GPUs. Whether the company's ambitious Rubin-era claims come to fruition remains to be seen, but, at least on paper, its roadmap demonstrates just how aggressively China's domestic tech companies are organizing their ambitions against Nvidia. Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

[2]

Chinese GPU startup Iluvatar CoreX lays out roadmap targeting Nvidia's Rubin

Chinese GPU startup Iluvatar CoreX has unveiled a multi-generation product roadmap that it says could see its fourth-generation architecture surpass Nvidia's upcoming Rubin platform by 2027, marking one of the latest efforts by domestic Chinese chipmakers to advance their AI computing capabilities. According to the company's disclosed timeline, Iluvatar CoreX plans to introduce its "Tianshu" architecture in 2025, targeting performance beyond Nvidia's Hopper platform, including the H200 series. In 2026, the company expects its "Tianxuan" architecture to compete with Nvidia's Blackwell generation, including the B200, followed later the same year by the "Tianji" architecture, which aims to exceed Blackwell-class performance. By 2027, Iluvatar CoreX plans to roll out its "Tianquan" architecture, which is designed to surpass Nvidia's Rubin platform. Beyond 2027, the company said it will shift toward developing more breakthrough computing chip architectures. Chinese companies have previously made similar commitments to compete with Nvidia's future AI platforms, including Huawei Technologies, as domestic players seek to strengthen local alternatives. Edge products deliver competitive performance Alongside the roadmap, Iluvatar CoreX also unveiled its "Tongyang" series of edge computing products. The company said tests conducted in real-world scenarios, including computer vision, natural language processing, and inference for large language models such as DeepSeek 32B, showed its TY1000 chip delivering performance above Nvidia's AGX Orin. Positioning strategy sets it apart from rivals Iluvatar CoreX said it aims to position itself as a supplier of high-end general-purpose GPUs and large-scale computing systems, distinguishing its approach from domestic rivals such as Biren Technology and Moore Threads. Biren focuses on developing general-purpose GPUs designed for training, inference, and scientific computing based on unified architectures. Moore Threads, by contrast, has pursued a full-function GPU strategy covering AI acceleration, professional graphics, desktop GPU,s and intelligent system-on-chip products. Put simply, Moore Threads is building a full-function GPU ecosystem, while Iluvatar CoreX and Biren are more clearly segmenting their product lines around computing workloads, though with different technical approaches. As of June 30, 2025, Iluvatar CoreX had delivered more than 52,000 GPUs to approximately 290 enterprise customers, with applications spanning sectors including finance and healthcare. Supply chain hurdles persist Like other Chinese AI chip developers, Iluvatar CoreX faces challenges related to manufacturing capacity and supply-chain access. Further performance gains will depend on continued advances in process technology and packaging. China's push to develop domestic alternatives to Nvidia continues as demand for AI computing grows across cloud, enterprise, and edge deployments.

Share

Share

Copy Link

Shanghai Iluvatar CoreX has revealed a four-generation GPU architecture roadmap aimed at competing with Nvidia's next-gen platforms. The Chinese chipmaker claims its current Tianshu architecture already outperforms Nvidia Hopper, while its 2027 Tianquan design targets surpassing Rubin. The announcement highlights China's aggressive push to develop domestic alternatives in AI chips amid ongoing trade restrictions.

Chinese Chipmaker Sets Sights on Nvidia's Next-Gen Platform

Shanghai Iluvatar CoreX Semiconductor has unveiled an ambitious multi-year GPU architecture roadmap that positions the company to directly challenge Nvidia's dominance in AI computing hardware. The Chinese chipmaker's plan outlines four successive GPU architectures—named after Chinese terms associated with the Big Dipper constellation—with the explicit goal to surpass Nvidia's Rubin platform by 2027

1

. This bold strategy demonstrates how aggressively China's domestic tech companies are organizing their efforts to establish viable domestic alternatives in AI chips for AI training and inference workloads.

Source: DIGITIMES

According to reporting by the South China Morning Post, Iluvatar CoreX claims its current Tianshu architecture has already outperformed Nvidia Hopper generation GPUs, achieving more than 90% effective utilization of compute resources through architectural features that reduce redundant memory access and dynamically allocate workloads

1

. The company asserts a roughly 20% higher average performance than Hopper on DeepSeek V3 through its own testing, though these claims arrive conveniently as Nvidia's China business faces new challenges following the rejection of H200 GPUs by Chinese officials.Four Generations Targeting Successive Nvidia Platforms

The GPU roadmap lays out a clear competitive timeline. Following Tianshu's introduction in 2025, Iluvatar CoreX plans to launch its Tianxuan architecture in 2026 to compete directly with Nvidia Blackwell, including the B200 series

2

. Later in 2026, the company expects its third-generation Tianji architecture to exceed Blackwell-class performance. The fourth generation, Tianquan, is projected to surpass Nvidia's Rubin platform by 2027, after which the company plans what it describes as a "breakthrough" architectural redesign1

.

Source: Tom's Hardware

This aggressive timeline places Iluvatar CoreX among several Chinese companies making similar commitments to compete with Nvidia's future AI platforms, including Huawei Technologies, as domestic players seek to strengthen local alternatives amid ongoing trade restrictions and export controls.

Edge Computing Products and Market Positioning

Beyond data-center GPUs, Iluvatar CoreX has also unveiled four edge computing products under its Tongyang (TY) series, spanning 100 to 300 TOPS. The company claims its TY1000 exceeded Nvidia's Jetson AGX Orin in various test scenarios including computer vision, natural language processing, and inference for large language models such as DeepSeek 32B

2

. However, no detailed third-party benchmarks have been published to verify these performance claims.Iluvatar CoreX aims to position itself as a supplier of high-end general-purpose GPUs and large-scale computing systems, distinguishing its approach from domestic rivals such as Biren Technology and Moore Threads

2

. While Moore Threads pursues a full-function GPU strategy covering AI acceleration, professional graphics, and desktop GPUs, Iluvatar CoreX and Biren are more clearly segmenting their product lines around computing workloads.Related Stories

Market Position and Supply Chain Challenges

Founded in 2015, Iluvatar CoreX introduced its first general-purpose training GPU, TG Gen 1, which it described as China's first domestically mass-produced AI training GPU. A second-gen component followed in 2023, while TG Gen3 is scheduled for mass production later this year

1

. The company was listed in Hong Kong on January 8 and is currently valued at around HK$46.3 billion based on current market capitalization. In the first half of 2025, the company reported revenue of 324 million yuan and shipped more than 52,000 general-purpose GPUs to approximately 290 enterprise customers, with applications spanning sectors including finance and healthcare2

.Like other Chinese AI chip developers, Iluvatar CoreX faces supply chain challenges related to manufacturing capacity and supply-chain access. Further performance gains will depend on continued advances in process technology and packaging

2

. Whether the company's ambitious claims to beat Rubin come to fruition remains to be seen, but the roadmap demonstrates the intensity of China's push to develop competitive alternatives as demand for AI computing grows across cloud, enterprise, and edge deployments. Nvidia CEO Jensen Huang's recent arrival in China on January 23 for meetings with partners and customers underscores the competitive pressure both companies face in this critical market.References

Summarized by

Navi

Related Stories

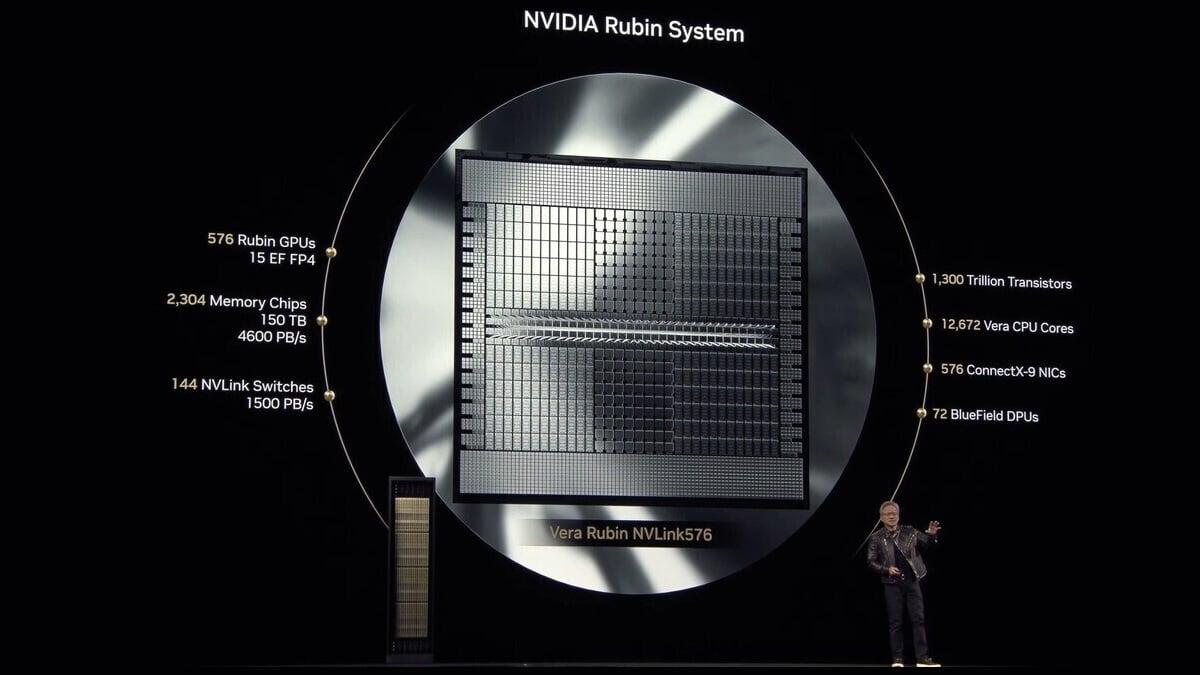

NVIDIA's Rubin Platform: Next-Gen AI Architecture Set for 2026 Launch

23 Aug 2025•Technology

China's GPU Advancements Spark Concerns for Nvidia's Market Dominance

30 May 2025•Technology

NVIDIA Accelerates Next-Gen 'Rubin' AI GPU Launch, Featuring Advanced 3nm Process and HBM4 Technology

04 Dec 2024•Technology

Recent Highlights

1

OpenAI secures $110 billion funding round from Amazon, Nvidia, and SoftBank at $730B valuation

Business and Economy

2

Anthropic stands firm against Pentagon's demand for unrestricted military AI access

Policy and Regulation

3

Pentagon Clashes With AI Firms Over Autonomous Weapons and Mass Surveillance Red Lines

Policy and Regulation