Confluent Stock: Mixed Analyst Views on AI Potential and Recent Acquisition

2 Sources

2 Sources

[1]

'Confluent stock needs more AI traction to have upside' - Goldman By Investing.com

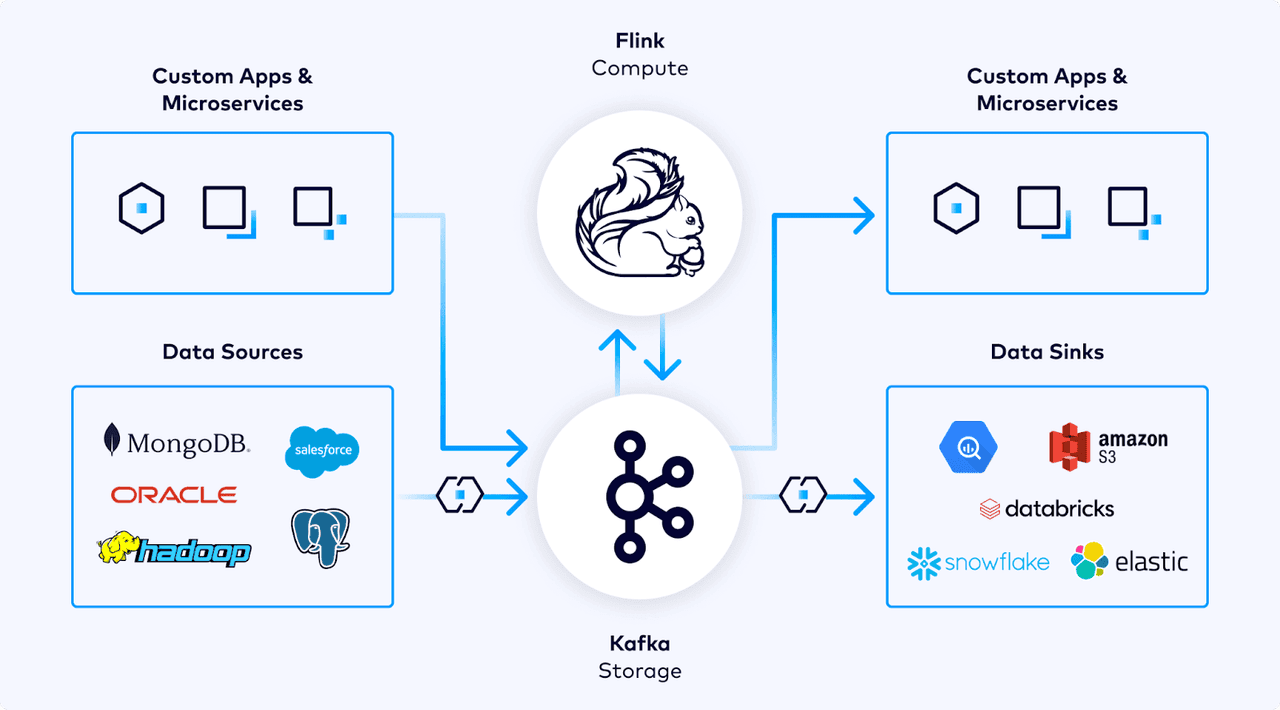

On Friday, Goldman Sachs (NYSE:GS) maintained a Neutral rating on Confluent Inc (NASDAQ:CFLT) stock, with a steady price target of $28.00. The investment firm's stance comes after participating in the Current 2024 conference, where insights into Confluent's product trajectory and market positioning were gained. The analysts took note of Confluent's advancements in product offerings, such as Flink-related developments, which now support Table APIs, allowing a broader developer base that includes those proficient in Java and Python. These languages are preferred for AI development. The firm also recognized Confluent's introduction of Private Networking, enhancing security for Confluent Cloud, and AI Model Inferencing, which integrates AI engines within Flink. Positive customer feedback was observed regarding Confluent's fully managed connector ecosystem, which could stand as a key advantage in a competitive market. Additionally, the management's presentation of WarpStream was acknowledged. WarpStream is a Bring Your Own Cloud (BYOC) solution that bridges the gap between Confluent Platform and Cloud, offering strong security and operational controls. Despite these product enhancements and customer engagement, Goldman Sachs awaits further evidence of Confluent's influence on customer AI strategies, which appears limited at this stage. The firm believes AI's role in IT budgets will expand and is looking for signs of Confluent's AI offerings gaining traction. Such traction could signal sustainable growth for the medium to long term. Goldman Sachs also indicated interest in observing how competitive dynamics evolve and Confluent's positioning within IT budgets. The firm's current neutral position hinges on witnessing these trends before adopting a more constructive outlook on Confluent's stock. As Confluent Inc (NASDAQ:CFLT) continues to innovate in its product offerings, it's crucial to consider the company's financial health and market performance. According to InvestingPro data, Confluent holds a market capitalization of $6.67 billion and has demonstrated a significant revenue growth of 26.55% in the last twelve months as of Q2 2024. This growth is indicative of the company's expanding market presence and the increasing adoption of its product offerings. Despite not being profitable over the last twelve months, Confluent's liquid assets exceed its short-term obligations, suggesting a strong liquidity position. This is reinforced by the fact that the company holds more cash than debt on its balance sheet, providing it with a buffer to navigate market uncertainties and invest in further product development. Moreover, analysts predict that Confluent will be profitable this year, which could be a turning point for the company's financial trajectory. While Confluent's stock has experienced a decline over the last six months, with a 36.5% drop in its 6-month price total return as of the data, the company's advancements in AI and fully managed connector ecosystem could be pivotal in reversing this trend. The current price to book ratio stands at 7.63, which might be considered high, but with the company's continued push into AI and the cloud, investors may see this as a reflection of Confluent's growth potential and innovative edge. For those looking to delve deeper into Confluent's financials and market potential, InvestingPro offers additional insights, including 7 more InvestingPro Tips, which can be found at https://www.investing.com/pro/CFLT. These tips provide a comprehensive analysis that could help investors make informed decisions regarding Confluent's stock.

[2]

Confluent stock upside cited in light of new AI use cases and Warpstream deal - JPMorgan By Investing.com

On Friday, JPMorgan (NYSE:JPM) reiterated its Overweight rating and $25.00 price target on Confluent Inc (NASDAQ:CFLT) stock following the company's in-person user conference, Current 2024, held in Austin, Texas. At the event, Confluent announced its Bring-Your-Own-Cloud offering, stemming from the Warpstream acquisition, and a series of product enhancements for Confluent Cloud. The conference provided an opportunity for discussions with Confluent's customers and partners, who expressed enthusiasm for the company's recent innovations such as Flink and Tableflow. These innovations are reportedly driving an increase in Confluent's usage in AI applications. JPMorgan highlighted the positive feedback received from these conversations, indicating a trend of growing adoption. JPMorgan analysts were particularly impressed by Confluent's ongoing organic innovation and strategic acquisitions, which they believe are expanding the company's addressable market. The Warpstream acquisition is seen as a significant move that could broaden Confluent's use cases and enhance its competitive edge. Confluent's comprehensive product portfolio now offers an end-to-end data streaming platform that spans operational and analytical data estates. The firm also noted Confluent's recent pricing and packaging initiatives, which are expected to facilitate the company's next phase of growth. In other recent news, Confluent Inc. has been in the spotlight due to several developments. The company reported a 27% increase in subscription revenue to $225 million and a 40% rise in Confluent Cloud revenue to $117 million. It also added 320 new customers during this period. However, the net revenue retention of 118% fell slightly short of its target range. Confluent's acquisition of WarpStream, a bring-your-own-cloud data streaming provider, was a significant move, enhancing its offerings and targeting open-source Kafka customers and cloud clients operating in highly regulated environments. The company also announced the appointment of Kong Phan as its new Chief Accounting Officer. In terms of analyst ratings, Evercore ISI reduced its price target for Confluent to $28 but maintained an Outperform rating. Goldman Sachs (NYSE:GS) and Citi maintained neutral ratings, while Guggenheim reaffirmed its buy rating, citing the company's strong positioning in the data streaming market. DA Davidson and TD Cowen also maintained Buy ratings on the company, despite some concerns about the fourth quarter and the full year. In light of JPMorgan's optimistic outlook on Confluent Inc (NASDAQ:CFLT), current InvestingPro data and metrics provide additional context for investors considering the stock. With a market capitalization of $6.67 billion, the company's financial health appears stable, holding more cash than debt on its balance sheet, and its liquid assets surpassing short-term obligations. These factors are essential for Confluent's flexibility in investing in future growth and innovation, aligning with JPMorgan's positive sentiment on the company's strategic acquisitions and product enhancements. Despite not being profitable over the last twelve months, analysts predict Confluent will turn a profit this year, offering a potential upside for investors. The stock has experienced a significant price decline over the past six months, currently trading at a high Price/Book multiple of 7.63. This could indicate that the market has high expectations for the company's future performance, especially considering the recent product announcements and the potential for increased adoption in AI applications. For those interested in a deeper dive, there are additional InvestingPro Tips available on Confluent, providing further insights into the company's performance and valuation. Visit InvestingPro for more exclusive tips and metrics to inform your investment decisions.

Share

Share

Copy Link

Analysts from Goldman Sachs and JPMorgan offer contrasting perspectives on Confluent's stock potential, with AI traction and the WarpStream deal at the center of discussions.

Confluent's Stock Performance and AI Potential

Confluent, Inc., a data streaming platform provider, has recently become the subject of divergent analyst opinions regarding its stock potential. The company's ability to capitalize on artificial intelligence (AI) trends and its recent acquisition of WarpStream are at the forefront of these discussions.

Goldman Sachs' Cautious Stance

Goldman Sachs analyst Kash Rangan has maintained a Neutral rating on Confluent stock, with a price target of $24

1

. Rangan argues that Confluent needs to demonstrate more traction in AI use cases to justify a higher valuation. The analyst acknowledges the company's efforts to position itself within the AI ecosystem but suggests that concrete evidence of AI-driven growth is necessary for a more bullish outlook.JPMorgan's Optimistic View

In contrast, JPMorgan analyst Mark Murphy has taken a more positive stance on Confluent's prospects

2

. Murphy maintains an Overweight rating on the stock, citing potential upside driven by emerging AI use cases and the recent acquisition of WarpStream. The analyst believes that these factors could contribute to Confluent's growth and market position.WarpStream Acquisition and Its Implications

Confluent's acquisition of WarpStream, a cloud-native streaming data warehouse, is seen as a strategic move to enhance its offerings. JPMorgan's Murphy views this acquisition positively, suggesting it could strengthen Confluent's competitive position in the data streaming market

2

. The integration of WarpStream's technology may allow Confluent to offer more comprehensive solutions to its customers, potentially driving adoption and revenue growth.Related Stories

AI Use Cases and Market Positioning

Both analysts recognize the importance of AI in Confluent's future growth. While Goldman Sachs' Rangan calls for more concrete evidence of AI traction, JPMorgan's Murphy appears more confident in Confluent's ability to capitalize on AI-related opportunities. The company's efforts to position itself within the AI ecosystem could be crucial for its long-term success in a rapidly evolving tech landscape.

Market Reaction and Investor Sentiment

The contrasting analyst views reflect the broader market uncertainty surrounding Confluent's growth prospects. Investors are likely to closely monitor the company's ability to leverage AI trends and successfully integrate the WarpStream acquisition. These factors, along with Confluent's financial performance in upcoming quarters, will be critical in shaping investor sentiment and the stock's trajectory.

References

Summarized by

Navi

Related Stories

Confluent's Q4 Earnings Beat Expectations, Expands Partnership with Databricks for AI-Driven Applications

12 Feb 2025•Business and Economy

Confluent Unveils Tableflow and Enhances Apache Flink for Advanced AI and Analytics Capabilities

19 Mar 2025•Technology

Confluent Unifies Batch and Stream Processing to Enhance AI Capabilities

20 May 2025•Technology

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Pentagon Summons Anthropic CEO as $200M Contract Faces Supply Chain Risk Over AI Restrictions

Policy and Regulation

3

Canada Summons OpenAI Executives After ChatGPT User Became Mass Shooting Suspect

Policy and Regulation