GlobalFoundries Announces $16 Billion Investment in U.S. Chip Production, Focusing on AI and Emerging Technologies

7 Sources

7 Sources

[1]

GlobalFoundries announces $16 billion U.S. chip production spend -- striking spending boom follows demand from domestic customers

GF's announcement outpaces its annual construction spend by 10x GlobalFoundries has announced new plans to dedicate $16 billion to expanding its U.S. chip production. The largest contract chipmaker in the U.S., GlobalFoundries announced the decision in response to "unmet demand" in the U.S. for local clients such as Apple and Qualcomm. GlobalFoundries specified that $13 billion of the funds will go towards expanding the company's existing New York and Vermont fabs, with the remaining $3 billion dedicated to researching advanced packaging and other new technologies. The company claims it is carving out "lucrative niches" in the chipmaking world, such as the research of photonic chips or the use of gallium nitride (GaN) in chips. The $16 billion commitment from GlobalFoundries is a major change in tradition for the company, which has spent around $1.4 billion every year for the past five years on new plants and equipment. Compare this to Intel's annual construction budget of $14 billion in 2024 and years prior. New CEO Tim Breen, appointed to the position in February of this year, makes no claims about when the new funds will be spent. Breen prefers to "stay flexible" in the face of endorsements from high-profile clients, including Apple, Qualcomm, and General Motors. Breen seemingly views GlobalFoundries as well-positioned in the face of much market and chip-industry insecurity prompted by the heavy tariffs consistently being issued from the White House. "Supply security matters," said Breen in an interview, claiming that GlobalFoundries' clients are looking for more local production and to "reduce dependence on suppliers that have their manufacturing concentrated in one location". The back half of the last quote is likely a dig at Taiwan-based TSMC, the largest contract chip fab in the world, which currently holds over 50% market share. Comparatively, GlobalFoundries' approximately 5% market share and inability to produce chips below its 12LP+ process node (comparable to TSMC's 10nm) would make it seem ill-positioned to be throwing meaningful digs at TSMC. GlobalFoundries' reliance on legacy process nodes is still a profitable existence thanks to the "AI boom" seen in enterprise spending. Breen claims this most recent announcement is "a strategic response to the explosive growth in artificial intelligence" seen in recent years. GlobalFoundries' website marketing seems largely reliant on the low power consumption of its legacy chips, a key concern for enterprise clients as data center power draw grows beyond 100 MW. How this $16 billion commitment manifests is yet to be seen. Thanks to GlobalFoundries' entrenchment in the U.S. and its commitment to plant expansions rather than new construction, it is thankfully highly unlikely that the company will pull a Foxconn and completely abandon its commitments. The insecurity and untrustworthiness of the barrage of tariff announcements, however, may lead to the timescale of these projects being pushed back later and later as time goes on.

[2]

GlobalFoundries boosts US fabs investments to $16B

GlobalFoundries plans to funnel another $3 billion into US semiconductor production, bringing its total investment to $16 billion, the New York-based foundry operator said on Wednesday. The additional funding will support the production of several emerging technologies, including silicon photonics, and comes as many tech firms look to American suppliers to minimize their exposure to US tariffs. "Today's announcement is a direct result of President Trump's leadership and his vision to bring back high-paying manufacturing jobs and reestablish secure, domestic supply chains for critical technologies," GlobalFoundries Executive Chairman Thomas Caulfield said in a canned statement. GlobalFoundries hasn't competed with foundry giants like Taiwan Semiconductor Manufacturing Co. (TSMC) on leading-edge process tech since abandoning its 7nm and smaller nodes back in 2018. But it remains a key supplier of special-purpose but often high-volume semis used in communications, imaging, automotive, industrial, and embedded devices. For example, GlobalFoundries has made unspecified parts for Apple's iDevices going back to 2010, as well as for SpaceX's Starlink satellite communications network. Perhaps more importantly, many of these components are still manufactured in the US, something that's become increasingly valuable with the specter of an up to 100 percent tariff on foreign made chips looming over the industry. With that said, much of GlobalFoundries' manufacturing push was announced long before Trump took office. Last year, the chipmaker earmarked roughly $13 billion to expand its manufacturing plants in New York and Vermont, for which it was awarded $1.5 billion in US CHIPS Act funding. The chipmaker has now carved off another $3B for research and development into silicon photonics, advanced packaging, and gallium nitride (GaN), a technology commonly used in power semiconductors. Silicon photonics, in particular, has become a major area of interest in recent years. Several chip designers, including Intel, Nvidia, Broadcom, and AMD, have embraced the technology in hopes of overcoming bandwidth bottlenecks and growing power consumption associated with ever-larger AI networks. Meanwhile, in the quantum computing realm, several vendors have embraced GlobalFoundries photonic tech. PsiQuantum has been working on quantum systems based on GF's silicon photonics tech since 2021. Quantum Motion, on the other hand, is looking to harness another GlobalFoundries technology called 22FDX. Short for 22nm fully-depleted silicon-on-insulator, the transistor tech promises 50 percent higher performance while consuming 70 percent less power than conventional CMOS technologies. These qualities have made it a go-to option for low analog signal and radio frequency processing, but it is by no means limited to these applications, with Quantum Motion looking to utilize the tech in its quantum processing units. GlobalFoundries is by no means the first to ratchet up its US manufacturing investments after President Donald Trump proposed massive tariffs on semiconductor imports back in January. As you may recall, back in March TSMC said it would plow another $100 billion to build three new chip fabs, two advanced packaging facilities, and a R&D facility in the US. The announcement was followed by several high-profile commitments from chip designers including Apple, Nvidia, and AMD to begin producing chips at TSMC's US factories. ®

[3]

GlobalFoundries Boosts Investment Plans to $16 Billion, With Research Focus

SAN FRANCISCO (Reuters) -Chip manufacturer GlobalFoundries said on Wednesday it planned to increase its investment plans to $16 billion, allocating an additional $1 billion to capital spending and $3 billion to research in several emerging chip technologies. The Malta, New York-based company said it is working with the Trump administration to bring chip manufacturing technology and various components of that supply chain onto U.S. soil. The chip manufacturer attributed the expansion to the boom in artificial intelligence hardware, a trend that has also benefited other chipmakers such as Taiwan Semiconductor Manufacturing Co. "The AI revolution is driving strong, durable demand for GF's technologies that enable tomorrow's data centers," GlobalFoundries Chief Executive Tim Breen said in a statement. The $1 billion capital spending boost is expected to support factory expansions in New York and Vermont, and is in addition to the $12 billion the company said in 2024 it planned to invest over the next 10 plus years. GlobalFoundries did not disclose a specific timeframe for the additional funding it announced on Wednesday. The $3 billion in research and development GlobalFoundries said it will spend will be split into three areas: chip packaging technologies, silicon photonics that can be used to make quantum computing processors, and gallium nitride which is used in electric vehicles and other power-related applications. In April, Intel and TSMC showed off their latest chip manufacturing and packaging capabilities at events, including the capability to stitch together multiple chips into a dinner-plate-sized device. (Reporting by Max A. Cherney and Stephen Nellis in San Francisco; Editing by Himani Sarkar)

[4]

Semiconductor Supplier GlobalFoundries to Spend $16B to Boost US Chip Production

GlobalFoundries noted that the decision was also driven by soaring demand for artificial intelligence products. GlobalFoundries (GFS) shares gained Wednesday when the maker of so-called essential semiconductors announced it would invest more than $16 billion to increase its production in the U.S. The Malta, N.Y.-based company said the move comes in response to President Donald Trump's effort to build more chips domestically, and the booming demand for more artificial intelligence (AI) products. GlobalFoundries supplies a wide range of tech companies, including Apple (AAPL) and Advanced Micro Devices (AMD). The firm explained that more than $13 billion of the spending would be to expand and modernize its current facilities in New York and Vermont, and fund its recently launched New York Advanced Packaging and Photonics Center. An additional $3 billion will be dedicated to advanced research and development initiatives focused on "packaging innovation, silicon photonics and next-generation GaN technologies." GaN stands for gallium nitride, used especially for power devices. CEO Tim Breen noted the company is proud to "partner with pioneering technology leaders to manufacture their chips in the United States -- advancing innovation while strengthening economic and supply chain resiliency." Breen added the skyrocketing growth of AI is driving "strong, durable demand" for GlobalFoundries technologies. Even with today's roughly 2.5% gains, shares of GlobalFoundries are down about 12% year-to-date.

[5]

GlobalFoundries boosts investment plans to $16 billion, with research focus

The Malta, New York-based company said it is working with the Trump administration to bring chip manufacturing technology and various components of that supply chain onto US soil.Chip manufacturer GlobalFoundries said on Wednesday it planned to increase its investment plans to $16 billion, allocating an additional $1 billion to capital spending and $3 billion to research in several emerging chip technologies. The Malta, New York-based company said it is working with the Trump administration to bring chip manufacturing technology and various components of that supply chain onto US soil. The chip manufacturer attributed the expansion to the boom in artificial intelligence hardware, a trend that has also benefited other chipmakers such as Taiwan Semiconductor Manufacturing Co. The $1 billion capital spending boost is expected to support factory expansions in New York and Vermont, and is in addition to the $12 billion the company said in 2024 it planned to invest over the next 10-plus years. GlobalFoundries did not disclose a specific timeframe for the additional funding it announced on Wednesday. Some of the work is already in progress, such as converting the factory in Vermont to produce chips using a technology called gallium nitride, which can be more power efficient than standard silicon in some applications. "The reason we're not sort of being super clear about exactly what's spent by when is because obviously some of this is demand-driven," GlobalFoundries CEO Tim Breen told Reuters. "We see a very strong demand, but it takes time to convert (demand) into specific ramps and project timing. And what you don't want to do is shoot too far ahead or fall too far behind." The $3 billion in research and development GlobalFoundries said it will spend will be split into three areas: chip packaging technologies, silicon photonics that can be used to make quantum computing processors, and gallium nitride, which is used in electric vehicles and other power-related applications, such as AI servers. In April, Intel and TSMC showed off their latest chip manufacturing and packaging capabilities at events, including the capability to stitch together multiple chips into a dinner-plate-sized device.

[6]

GlobalFoundries Commits $16B To US Chip Expansion - GLOBALFOUNDRIES (NASDAQ:GFS)

GlobalFoundries Inc. GFS plans to inject $16 billion into expanding its semiconductor manufacturing and packaging operations across New York and Vermont facilities. What Happened: The company announced on Wednesday that it aims to boost domestic chipmaking. The funding includes $13 billion for facility expansion and $3 billion for R&D. The focus is on silicon photonics, GaN power technologies, and advanced packaging. The announcement comes after the launch of the New York Advanced Packaging and Photonics Center -- the first U.S.-based facility dedicated to silicon photonics packaging. Also Read: Taiwan Semiconductor's Japan Chip Factory Faces Delays, While U.S. Expansion Takes Priority Why It Matters: CEO Tim Breen said the AI boom is fueling demand for GF's technologies. The company makes a proprietary FDX platform and silicon photonics solutions. GlobalFoundries aims to support next-gen data centers and edge devices with energy-efficient, high-performance chips built in America. Commerce Secretary Howard Lutnick said the move exemplifies America's latest reshoring efforts under the Trump administration. Industry leaders, including Apple Inc's AAPL Tim Cook, SpaceX's Gwynne Shotwell, Advanced Micro Devices Inc.'s AMD Lisa Su, and Qualcomm's QCOM Cristiano Amon, voiced support, citing the importance of a reliable U.S. semiconductor supply chain. Related ETFs: iShares Semiconductor ETF SOXX and VanEck Semiconductor ETF SMH. Price Action: GFS shares are trading higher by 1.50% at $37.42 on the last check on Wednesday. Read Next: Trump Threatened Tariffs On Apple And Mattel -- Why The Barbie Maker Could Slide Free, But Tim Cook's Company Might Not Image: Shutterstock GFSGLOBALFOUNDRIES Inc$37.732.32%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum22.08GrowthNot AvailableQualityNot AvailableValue59.61Price TrendShortMediumLongOverviewAAPLApple Inc$204.390.55%AMDAdvanced Micro Devices Inc$117.630.27%INTCIntel Corp$20.300.07%QCOMQualcomm Inc$149.750.55%SMHVanEck Semiconductor ETF$251.761.19%SOXXiShares Semiconductor ETF$216.851.51%TSMTaiwan Semiconductor Manufacturing Co Ltd$203.683.07% This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Market News and Data brought to you by Benzinga APIs

[7]

GlobalFoundries stock edges up on $16B U.S. expansion plan By Investing.com

Investing.com -- Shares of GlobalFoundries Inc (NASDAQ:GFS) inched up 0.3% following the company's announcement of a significant $16 billion investment to expand its semiconductor manufacturing capabilities in the United States. The investment aims to meet the burgeoning demand for advanced semiconductors fueled by the rise of artificial intelligence (AI) applications. GlobalFoundries revealed its plans to enhance production facilities in New York and Vermont, a move seen as a strategic response to the growing need for power-efficient, high-bandwidth semiconductors. The expansion is set to bolster manufacturing for datacenters, communications infrastructure, and AI-powered devices. The company's collaboration with tech giants, including Apple (NASDAQ:AAPL), SpaceX, AMD (NASDAQ:AMD), Qualcomm (NASDAQ:QCOM) Technologies, Inc., NXP (NASDAQ:NXPI), and GM, underscores its position as a trusted supplier and a key player in reinforcing supply chain security. These partnerships are expected to support the production of U.S.-made chips and contribute to the reshoring of semiconductor production. GlobalFoundries' CEO, Tim Breen, emphasized the company's commitment to partnering with leading technology firms to advance innovation and strengthen economic and supply chain resiliency. The investment will also support the company's silicon photonics, GaN for power applications, and proprietary FDX technology, which is touted for its low power consumption and AI capabilities. U.S. Secretary of Commerce Howard Lutnick praised the investment as a testament to the return of U.S. manufacturing for critical semiconductors, aligning with President Trump's objective to bring semiconductor manufacturing back to America. The expansion builds upon GlobalFoundries' existing plans, including over $13 billion previously allocated for facility upgrades in New York and Vermont, and the establishment of the New York Advanced Packaging (NYSE:PKG) and Photonics Center. An additional $3 billion is dedicated to research and development in packaging innovation, silicon photonics, and next-generation GaN technologies. This announcement follows the company's earlier plans to expand its factory in Dresden, Germany, with an investment of 1.1 billion euros, which is expected to receive substantial backing from the German federal government. GlobalFoundries' move is a strategic effort to secure U.S. semiconductor foundry capacity and technology capabilities for future generations, aligning with the company's goal of driving meaningful, long-term impact in collaboration with the U.S. government.

Share

Share

Copy Link

GlobalFoundries, the largest U.S. contract chipmaker, plans to invest $16 billion in expanding its domestic chip production and research, driven by AI demand and government initiatives to strengthen the U.S. semiconductor industry.

GlobalFoundries' Massive Investment in U.S. Chip Production

GlobalFoundries, the largest contract chipmaker in the United States, has announced plans to invest $16 billion in expanding its domestic chip production and research capabilities

1

. This significant investment marks a substantial increase from the company's previous annual construction spend of around $1.4 billion over the past five years1

.

Source: Tom's Hardware

Allocation of Funds

The investment will be divided as follows:

- $13 billion for expanding existing facilities in New York and Vermont

2

- $3 billion for research and development in emerging technologies

3

The R&D focus will be on three key areas: chip packaging technologies, silicon photonics for quantum computing processors, and gallium nitride (GaN) for power-related applications

3

.Driving Factors

Several factors have contributed to GlobalFoundries' decision to significantly increase its investment:

-

AI Boom: The company cites the "explosive growth in artificial intelligence" as a key driver of demand for its technologies

1

4

. -

Government Initiatives: GlobalFoundries is working with the Trump administration to bring chip manufacturing and supply chain components onto U.S. soil

5

. -

Supply Security: CEO Tim Breen emphasized the importance of local production and reducing dependence on suppliers concentrated in one location

1

.

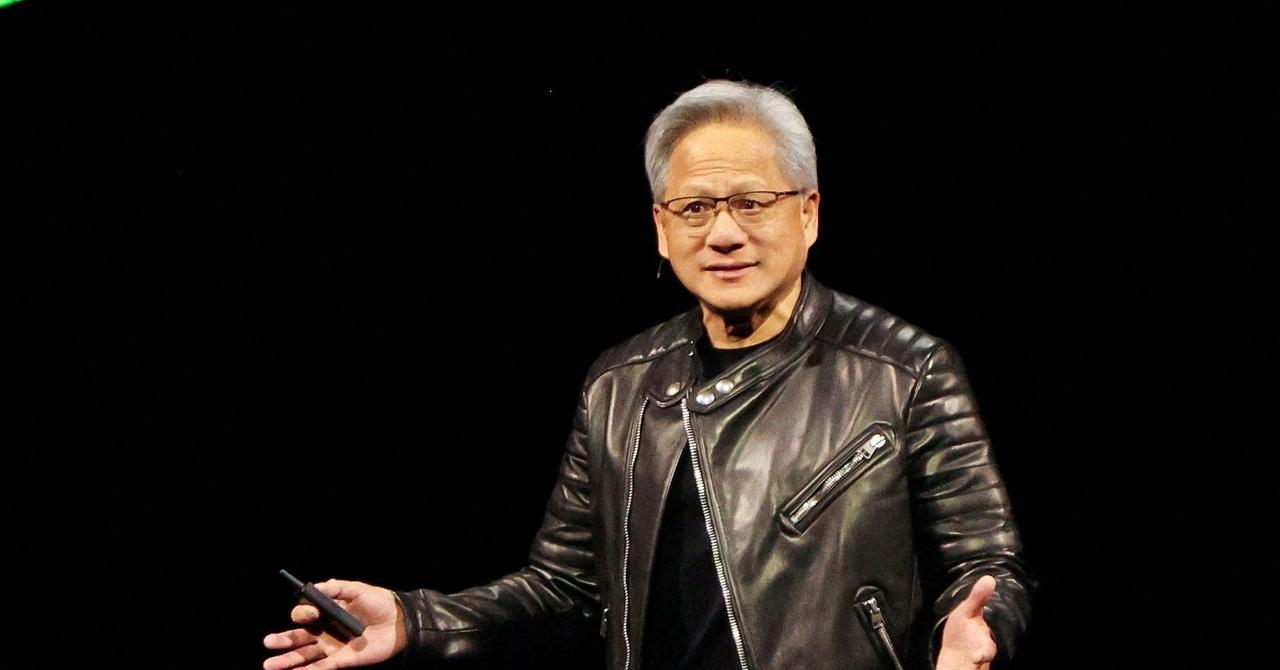

Source: The Register

Related Stories

Market Position and Strategy

GlobalFoundries currently holds approximately 5% market share in the contract chip manufacturing industry, compared to Taiwan-based TSMC's 50%

1

. The company focuses on legacy process nodes and specialized technologies, which have proven profitable due to their low power consumption – a critical factor for enterprise clients with growing data center power demands1

.Industry Impact and Future Outlook

Source: ET

GlobalFoundries' investment comes amid a broader trend of increased domestic semiconductor production in the United States. Other major players like TSMC have also announced significant investments in U.S. manufacturing facilities

2

.The company's focus on emerging technologies like silicon photonics and GaN positions it to cater to growing markets such as quantum computing and electric vehicles

3

. However, the specific timeline for these investments remains flexible, allowing GlobalFoundries to adapt to market demands and client needs5

.As the semiconductor industry continues to evolve, GlobalFoundries' substantial investment in U.S. chip production and research signals a strong commitment to maintaining its position as a key player in the domestic and global markets.

References

Summarized by

Navi

[1]

[2]

Related Stories

GlobalFoundries Announces New York Advanced Packaging and Photonics Center for AI and Critical Technologies

17 Jan 2025•Technology

GlobalFoundries beats estimates, bets big on Physical AI as data center chips fuel growth

11 Feb 2026•Business and Economy

Micron Expands US Investments to $200 Billion, Boosting Domestic Semiconductor Manufacturing

12 Jun 2025•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy