Google's AI Integration in Search Threatens Online News Publishers

3 Sources

3 Sources

[1]

Publishers fear AI summaries are hitting online traffic

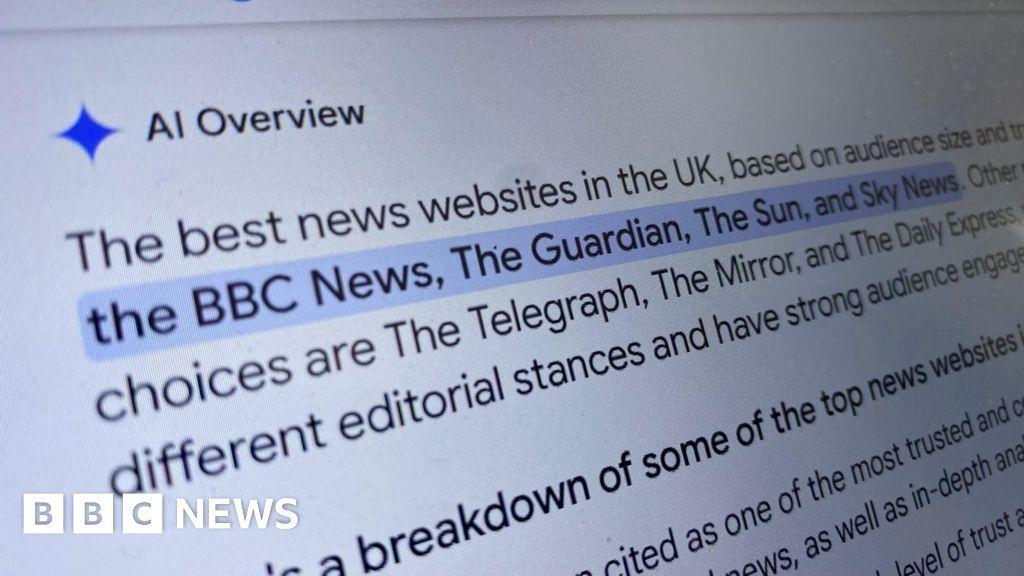

When actress Sorcha Cusack left the BBC drama Father Brown in January, it made headlines, including for the newspapers owned by Reach, among them The Mirror, and the Daily Express. But the story did not generate the traction the Reach newspapers would have expected a year ago, or even at the start of the year. Reach put this down to AI Overviews (AIO) - the AI summary at the top of the Google results page. Instead of clicking through to the story on a Reach newspaper site, readers were happy with the AI overview. The feature is a concern for newspapers and other media publishers, who have already seen much of their advertising revenue siphoned off by social media. In a tough market, readers coming via Google search is a valuable source of traffic. "A major worry, backed by some individual datapoints, has been that AI overviews would lead to fewer people clicking through to the content behind them, with negative knock-on effects for publishers," says Dr Felix Simon, research fellow in AI and news at the Reuters Institute for the Study of Journalism, University of Oxford. He points out that it's hard to know the scale of the problem, as Google does not publish data on click-through rates.

[2]

Google's AI Ambitions An â€~Existential Crisis’ For News Online

Amid mounting concerns over its monopoly in online search, Google’s intensified integration of artificial intelligence into how it presents the world's news outlets is prompting a seismic shift in the digital journalism landscape. Major publishers worldwide report plunging traffic and revenue, fueling fears that their traditional business models are under existential threat, The Guardian reports in a deep dive into how the industry is reacting. It posits that Google’s rapid rollout of AI-driven search features has ignited an industry-wide crisis, upending traditional publishing models and raising urgent questions about the future of journalism. The tech giant’s push into artificial intelligence has been met with mounting alarm from publishers, who fear that the technology is not only destabilizing revenue streams but also compromising the integrity of information. The Guardian reports that sources close to the matter describe a landscape where AI-generated summaries and personalized feeds are now the primary gateways for online content. But critics warn that this shift risks creating “echo chambers†filled with sensationalism and clickbait, at the expense of thorough, investigative journalism. Industry insiders and analysts warn that such trends threaten to undermine the trustworthiness of news ecosystems. Meanwhile, Google Discover, its personalized content feed, has become a dominant source of engagement, surpassing resulting from search. But industry analysts warn that this channel often rewards sensationalism and clickbait, undermining meaningful journalism. “Google Discover is of zero product importance to Google at all,†David Buttle, founder of the consultancy DJB Strategies, told The Guardian. “It allows Google to funnel more traffic to publishers as traffic from search declines â€| Publishers have no choice but to agree or lose their organic search. It also tends to reward clickbaity type content. It pulls in the opposite direction to the kind of relationship publishers want.†Adding to the industry's worries is the ongoing debate over copyright and data rights. Publishers and creative sectors have intensified lobbying efforts to prevent AI companies from scraping protected content without permission, a move that could safeguard the estimated $169 billion sector. Google’s rollout of AI-powered snippets, such as the Overview and Chatbot Mode, has rapidly altered user engagement patterns. These tools provide concise, AI-generated summaries at the top of search results, often eliminating the need for users to click through to original sources. Industry leaders contend that the decline threatens the foundation of digital journalism. Jon Slade, CEO of the Financial Times, said during a media summit this summer that a “pretty sudden and sustained†decline in search-driven traffic, which is down by as much as 30%, is linked to Google’s new AI features, The Guardian reports “This isn’t just a blip, it’s a trend that could redefine our industry,†he said. As a result, referral traffic to news sites has plummeted and internal data submitted to the UK’s Competition and Markets Authority indicates declines of as much as 90% at some outlets, The Guardian reports. Governments across Europe and North America are considering legislation to regulate AI’s use of copyrighted material, aiming to strike a balance between innovation and fair compensation. As the digital news ecosystem grapples with these disruptions, questions linger about the sustainability of the ad-supported model in an era increasingly dominated by AI and personalized content. Many experts believe regulatory intervention may be inevitable to preserve journalistic diversity and economic viability.

[3]

'Existential crisis': how Google's shift to AI has upended the online news model

Media sites are taking action on several fronts as traffic referrals dry up and AI companies plunder their content When the chief executive of the Financial Times suggested at a media conference this summer that rival publishers might consider a "Nato for news" alliance to strengthen negotiations with artificial intelligence companies there was a ripple of chuckles from attendees. Yet Jon Slade's revelation that his website had seen a "pretty sudden and sustained" decline of 25% to 30% in traffic to its articles from readers arriving via internet search engines quickly made clear the serious nature of the threat the AI revolution poses. Queries typed into sites such as Google, which accounts for more than 90% of the search market, have been central to online journalism since its inception, with news providers optimising headlines and content to ensure a top ranking and revenue-raising clicks. But now Google's AI Overviews, which sit at the top of the results page and summarise responses and often negate the need to follow links to content, as well as its recently launched AI Mode tab that answers queries in a chatbot format, have prompted fears of a "Google zero" future where traffic referrals dry up. "This is the single biggest change to search I have seen in decades," says one senior editorial tech executive. "Google has always felt like it would always be there for publishers. Now the one constant in digital publishing is undergoing a transformation that may completely change the landscape." Last week, the owner of the Daily Mail revealed in its submission to the Competition and Markets Authority's consultation on Google's search services that AI Overviews have fuelled a drop in click-through traffic to its sites by as much as 89%. DMG Media and other leading news organisations, including Guardian Media Group and the magazine trade body the Periodical Publishers Association (PPA), have urged the competition watchdog to make Google more transparent and provide traffic statistics from AI Overview and AI Mode to publishers as part of its investigation into the tech firm's search dominance. Publishers - already under financial pressure from soaring costs, falling advertising revenues, the decline of print and the wider trend of readers turning away from news - argue that they are effectively being forced by Google to either accept deals, including on how content is used in AI Overview and AI Mode, or "drop out of all search results", according to several sources. On top of the threat to funding, there are concerns about AI's impact on accuracy. While Google has improved the quality of its overviews since earlier iterations advised users to eat rocks and add glue to pizza, problems with "hallucinations" - where AI presents incorrect or fabricated information as fact - remain, as do issues with in-built bias, when a computer rather than a human decides how to summarise sources. In January, Apple promised to update an AI feature that issued untrue summaries of BBC news alerts, stamped with the corporation's logo, on its latest iPhones; alerts incorrectly claimed that the man accused of killing a US insurance boss had shot himself and that tennis star Rafael Nadal had come out as gay. In a blogpost last month, Liz Reid, Google's head of search, said the introduction of AI in search was "driving more queries and quality clicks". "This data is in contrast to third-party reports that inaccurately suggest dramatic declines in aggregate traffic," she said. "[These reports] are often based on flawed methodologies, isolated examples, or traffic changes that occurred prior to the rollout of AI features in search." However, she also said that while overall traffic to all websites is "relatively stable" she admitted that the "vast" web means that user trends are shifting traffic to different sites "resulting in decreased traffic to some sites and increased traffic to others". In recent years, Google Discover, which feeds users articles and videos tailored to them based on their past online activity, has replaced search as the main source of click-throughs to content. However, David Buttle, founder of the consultancy DJB Strategies, says the service, which is also tied to publishers' overall search deals, does not deliver the quality traffic that most publishers need to drive their long-term strategies. "Google Discover is of zero product importance to Google at all," he says. "It allows Google to funnel more traffic to publishers as traffic from search declines ... Publishers have no choice but to agree or lose their organic search. It also tends to reward clickbaity type content. It pulls in the opposite direction to the kind of relationship publishers want." Meanwhile, publishers are fighting a wider battle with AI companies seeking to plunder their content to train their large language models. The creative industry is intensively lobbying the government to ensure that proposed legislation does not allow AI firms to use copyright-protected work without permission, a move that would stop the "value being scraped" out of the £125bn sector. Some publishers have struck bilateral licensing deals with AI companies - such as the FT, the German media group Axel Springer, the Guardian and the Nordic publisher Schibsted with the ChatGPT maker OpenAI - while others such as the BBC have taken action against AI companies alleging copyright theft. "It is a two-pronged attack on publishers, a sort of pincer movement," says Chris Duncan, a former News UK and Bauer Media senior executive who now runs a media consultancy, Seedelta. "Content is disappearing into AI products without serious remuneration, while AI summaries are being integrated into products so there is no need to click through, effectively taking money from both ends. It is an existential crisis." While publishers are pursuing action on multiple fronts - from dealmaking and legal action to regulatory lobbying - they are also implementing AI tools into newsrooms and creating their own query-answering tools. The Washington Post and the FT have launched their own AI-powered chatbots, Climate Answers and Ask FT, that source results only from their own content. Christoph Zimmer, chief product officer at Germany's Der Spiegel, says that while its traffic is currently stable he expects referrals from all platforms to decline. "This is a continuation of a longstanding trend," he says. "However, this affects brands that have not focused on building direct relationships and subscriptions in recent years even more strongly. Instead, they have relied on reach on platforms and sometimes generic content. "What has always been true remains true - a focus on quality and distinct content, and having a human in charge rather than just in the loop." One publishing industry executive says the battle to strike deals to help train AI models to aggregate and summarise stories is rapidly being superseded by advances that are seeing models interpret live news. "The first focus has been on licensing deals for training AI, to 'speak English', but that is becoming less important over time," says the executive. "It is becoming about delivering the news, and for that you need accurate live sources. That is a potentially really lucrative market which publishers are thinking about negotiating next." Saj Merali, chief executive of the PPA, says a fair balance needs to be struck between a tech-driven change in consumers' digital habits and the fair value of trusted news. "What doesn't seem to be at the heart of this is what consumers need," she says. "AI needs trustworthy content. There is a shift in how consumers want to see information, but they have to have faith in what they are reading. "The industry has been very resilient through quite major digital and technological changes, but it is really important we make sure there is a route to sustain models. At the moment the AI and tech community are showing no signs of supporting publisher revenue."

Share

Share

Copy Link

Google's implementation of AI-powered features in search results is causing significant concern among news publishers. These AI tools are leading to decreased traffic and potential revenue loss for media outlets, sparking debates about the future of digital journalism.

Google's AI Integration Reshapes Digital News Landscape

Google's recent integration of artificial intelligence into its search results has sent shockwaves through the digital journalism industry, potentially threatening the very foundation of online news publishing

1

2

3

. The introduction of AI-powered features such as AI Overviews and AI Mode has led to a significant decline in traffic to news websites, raising concerns about the future viability of digital journalism2

3

.

Source: Gizmodo

Dramatic Traffic Declines and Revenue Concerns

Publishers are reporting alarming drops in traffic from search engines, with some experiencing declines of up to 89%

3

. Jon Slade, CEO of the Financial Times, revealed a "pretty sudden and sustained" decline of 25% to 30% in search-driven traffic to their articles2

3

. This trend is not isolated, as other major publishers, including Reach (owner of The Mirror and Daily Express), have observed similar patterns1

.The primary culprit appears to be Google's AI Overviews, which provide concise summaries at the top of search results, often eliminating the need for users to click through to the original sources

1

2

. This shift in user behavior is causing significant concern among publishers who rely heavily on search-driven traffic for revenue3

.

Source: BBC

Industry-Wide Impact and Calls for Action

The repercussions of this AI-driven change extend beyond individual publishers. The entire news ecosystem is grappling with what some describe as an "existential crisis"

2

3

. Industry leaders and analysts warn that the current trend could undermine the trustworthiness of news ecosystems and threaten the foundation of digital journalism2

.In response, publishers are taking action on multiple fronts:

-

Lobbying for transparency: News organizations, including DMG Media, Guardian Media Group, and the Periodical Publishers Association, are urging the UK's Competition and Markets Authority to mandate Google to provide traffic statistics from AI Overview and AI Mode

3

. -

Exploring alliances: Some industry leaders, like Jon Slade of the Financial Times, have suggested forming a "Nato for news" alliance to strengthen negotiations with AI companies

3

. -

Addressing copyright concerns: Publishers are intensifying efforts to prevent AI companies from scraping protected content without permission, aiming to safeguard the estimated $169 billion sector

2

.

Related Stories

Broader Implications and Future Outlook

The shift towards AI-generated summaries and personalized feeds raises concerns about the creation of "echo chambers" filled with sensationalism and clickbait, potentially compromising the integrity of information

2

. Additionally, the rise of Google Discover as a dominant source of engagement has been criticized for rewarding clickbait-type content at the expense of meaningful journalism2

3

.As the industry grapples with these challenges, many experts believe that regulatory intervention may be inevitable to preserve journalistic diversity and economic viability in the digital age

2

. The ongoing debate over copyright and data rights, coupled with considerations of legislation to regulate AI's use of copyrighted material, underscores the complex landscape that publishers and tech giants must navigate in the coming years2

3

.References

Summarized by

Navi

Related Stories

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation