Huawei's AI Chip Ambitions Stalled by US Sanctions, Mass Production Planned for 2025

8 Sources

8 Sources

[1]

US restrictions slow down Huawei's AI chip ambitions

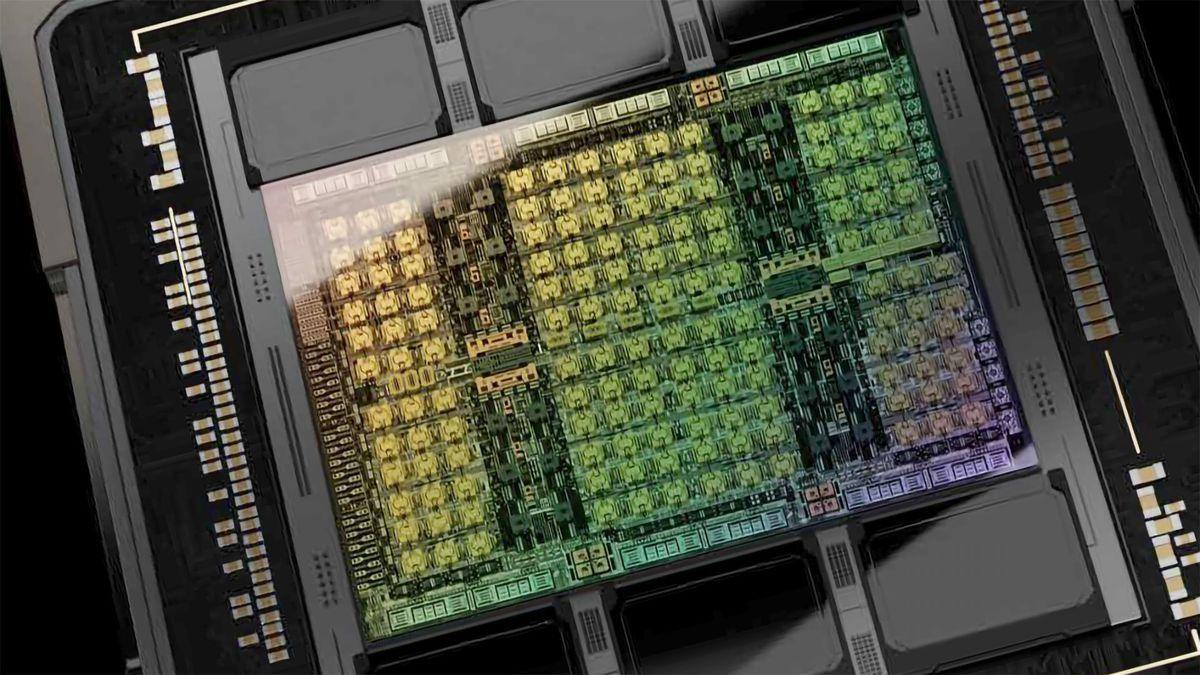

Huawei is designing its next two Ascend processors, its answer to Nvidia Corp.'s dominant accelerators, around the same 7-nanometer architecture that's been mainstream for years, people familiar with the matter said. That's because US-led restrictions prevent Huawei's chipmaking partners from procuring state-of-the-art extreme ultraviolet lithography systems from ASML Holding NV.Huawei Technologies Co.'s ambitions to create more powerful chips for AI and smartphones have hit major snags because of US sanctions, stalling a major Chinese effort to match American technology. Huawei is designing its next two Ascend processors, its answer to Nvidia Corp.'s dominant accelerators, around the same 7-nanometer architecture that's been mainstream for years, people familiar with the matter said. That's because US-led restrictions prevent Huawei's chipmaking partners from procuring state-of-the-art extreme ultraviolet lithography systems from ASML Holding NV. That means its marquee chips will be stuck at aging technology till at least 2026, the people said, asking to remain unidentified discussing a sensitive project. Huawei's smartphone processors, for the Mate lineup, face similar constraints, one of the people said. Huawei's stall has implications not just for its business, but also for China's broader AI ambitions. Its struggles suggest the country will lag further behind the US in 2025, when Taiwan Semiconductor Manufacturing Co. - chipmaker to Apple Inc. and Nvidia - begins to crank out 2nm chips about three generations ahead. Worse, Huawei's main production partner, Semiconductor Manufacturing International Corp., is struggling to churn out even 7nm chips at steady volumes. The Shanghai-based firm's 7nm production lines have been plagued by poor yield and reliability issues, according to another person. There's little guarantee that Huawei will be able to secure enough smartphone processors and AI chips in coming years, the person added. Representatives for Huawei and SMIC didn't respond to messages and calls seeking comment. Huawei's struggles reflect how years of US sanctions have scored initial success at freezing Chinese technology advancements at current levels, and deprived its national champions of the chance to graduate to the next level.

[2]

Huawei aims to mass-produce newest AI chip in early 2025, despite US curbs

Huawei, the Chinese tech giant, is set to launch mass production of its most advanced AI chip in early 2025. The company faces challenges due to US restrictions on technology access. Huawei has already begun sending samples and taking orders for the new chip. The chip aims to compete with those made by US-based Nvidia.China's Huawei plans to start mass-producing its most advanced artificial intelligence chip in the first quarter of 2025, even as it struggles to make enough chips due to US restrictions, said two people familiar with the matter. The telecoms conglomerate has sent samples of the Ascend 910C - its newest chip, meant to rival those made by US AI chipmaker Nvidia - to some technology firms and started taking orders, the sources told Reuters. Huawei is at the heart of US-China friction over trade and security. Washington has imposed a series of curbs on Huawei and other Chinese companies, arguing that their technological progress poses a national security risk to the US. Beijing, which is trying to make the world's second-biggest economy self-sufficient in advanced semiconductors, denies such claims. The restrictions have hampered Huawei's ability to get the yield - the proportion of chips that come off the manufacturing line fully functional - of its advanced AI chips high enough for them to be commercially viable. The 910C is being made by top Chinese contract chipmaker Semiconductor Manufacturing International Corp (SMIC) on its N+2 process, but a lack of advanced lithography equipment has limited the chip's yield to around 20%, said one source who was briefed on the results. Advanced chips need yields of more than 70% to be commercially viable. Even Huawei's current most advanced processor, the SMIC-made 910B, has a yield of only around 50%, forcing Huawei to slash production targets and delay filling orders for that chip, the sources said. Huawei and SMIC did not respond to requests for comment on Thursday. TikTok's Chinese parent, ByteDance, ordered more than 100,000 Ascend 910B chips this year but had received fewer than 30,000 as of July, a pace too slow meet the company's needs, Reuters reported in September. Other Chinese technology companies that have ordered from Huawei have complained of similar problems, sources have said. US curbs include barring China since 2020 from obtaining extreme ultraviolet lithography (EUV) technology from Dutch manufacturer ASML, used to make the world's most sophisticated processors. "Huawei knows there is no short-term solution, given the lack of EUVs, so it will give priority to strategic government and corporate orders," the source said. ASML has also stopped shipping its most advanced deep ultraviolet lithography (DUV) machines to China due to rules imposed by the Biden administration last year. Some fabs have also been restricted from buying older ASML DUV models. SMIC demands a premium of up to 50% for chips made on its advanced nodes, which are less advanced than those of Taiwanese chip-making giant TSMC, and are made using enhanced ASML DUVs. Huawei has supplemented its SMIC-made chips with ones made by rival TSMC, according to analysts and sources. TSMC notified the US Commerce Department several weeks ago that one of its chips had been found in a Huawei 910B process. The US has placed Huawei on a trade list that requires suppliers to obtain licenses to ship any goods or technology to the company. Washington has since clamped down further, ordering TSMC to halt shipments of advanced AI chips to Chinese customers, in a move targeting the diversion of chips to Huawei. US authorities are planning export controls on the semiconductor industry that will further restrict shipments for Chinese firms. Donald Trump, who was president from 2017 to 2021 and will return to the White House in January, has made tough-on-China trade policies core to his economic agenda.

[3]

China's chip advances stall as U.S. curbs hit Huawei AI Product

Huawei's ambitions to create more powerful chips for AI and smartphones have hit major snags because of U.S. sanctions, stalling a major Chinese effort to match American technology. Huawei is designing its next two Ascend processors, its answer to Nvidia's dominant accelerators, around the same 7-nanometer architecture that's been mainstream for years, people familiar with the matter said. That's because U.S.-led restrictions prevent Huawei's chipmaking partners from procuring state-of-the-art extreme ultraviolet lithography systems from ASML. That means its marquee chips will be stuck at aging technology till at least 2026, the people said, asking to remain unidentified discussing a sensitive project. Huawei's smartphone processors, for the Mate lineup, face similar constraints, one of the people said. Huawei's stall has implications not just for its business, but also for China's broader AI ambitions. Its struggles suggest the country will lag further behind the U.S. in 2025, when Taiwan Semiconductor Manufacturing Co. -- chipmaker to Apple and Nvidia -- begins to crank out 2nm chips about three generations ahead. Worse, Huawei's main production partner, Semiconductor Manufacturing International Corp., is struggling to churn out even 7nm chips at steady volumes. The Shanghai-based firm's 7nm production lines have been plagued by poor yield and reliability issues, according to another person. There's little guarantee that Huawei will be able to secure enough smartphone processors and AI chips in coming years, the person added. Representatives for Huawei and SMIC didn't respond to messages and calls seeking comment. Huawei's struggles reflect how years of U.S. sanctions have scored initial success at freezing Chinese technology advancements at current levels, and deprived its national champions of the chance to graduate to the next level. Huawei in recent years has assumed a pivotal role in China's efforts to pursue self-sufficiency in critical areas including semiconductors and AI. But the Shenzhen-based firm's stumble -- despite heavy R&D investment and the nation's backing -- highlights the sheer difficulty Beijing faces in trying to build a world-class supply chain and catch up with the US in emerging technologies. One of the biggest bottlenecks is the inferior quality of Chinese equipment. Beijing wants local chipmakers to deploy more machines from domestic suppliers, to galvanize a domestic ecosystem. But the moratorium on EUVs -- a must-have for modern chipmaking -- is snarling that campaign. In response, Huawei and its partners are resorting to rather novel methods to try and scale the tech ladder. State-backed chipmakers have been trying to push the limit of ASML's older deep ultraviolet lithography machines, the Dutch supplier's second-best lineup (after EUVs), with the so-called quadruple patterning technique. That requires lithographic machines to perform up to four exposures on a silicon wafer, with a total margin of error of no wider than hundredths the diameter of a human hair. Compared to EUV lithography, the multi-patterning technique with DUVs is not only resource-intensive but also prone to alignment errors and yield losses, according to Ying-Wu Liu, an analyst at research firm Yole Group. That effort isn't going well because of subpar local gear used in conjunction with ASML's DUV systems, according to one of the people. On at least one trial production line, engineers have been forced to replace Chinese gear with foreign equipment to ensure reasonable output, the person said. "Multi-patterning inherently introduces more process steps, increasing the risk of defects and variability," Liu said. "Additionally, the higher complexity and cost of multi-patterning make it less economically viable for high-volume production of advanced nodes like 5nm." The Biden administration has restricted China from buying the most sophisticated equipment from American suppliers including Applied Materials and Lam Research and Nvidia's most powerful AI chips, a red-hot commodity coveted by major tech firms and governments. Huawei needs tens of millions of Kirin-branded processors for its own smartphones every year, and aims to make hundreds of thousands of Ascend AI chips, according to a person familiar with the Shenzhen firm's business. This year, Beijing urged Chinese companies to avoid using Nvidia and instead adopt domestic alternatives such as Huawei's, Bloomberg News has reported. In 2023, it famously unveiled the Mate 60 Pro smartphone with a self-designed 7nm chip made by SMIC -- right when Commerce Secretary Gina Raimondo, Biden's chief sanctions enforcer, was touring Beijing. That cemented its tech credentials in the eyes of the Chinese public. Sales grew seven consecutive quarters on strong demand for that device. One sign of Huawei's woes is its silence in 2024 on the processor powering its upcoming flagship smartphones, which are emerging later than the Mate 60 Pro did. Huawei is set to unveil its next-generation Mate 70 on Nov. 26. But it didn't advertise any hardware specifications when it began taking orders this week. In past months, Huawei has instead touted progress with its Harmony mobile operating system. "Whether through improved multi-patterning or the creation of domestic EUV tools, China still faces significant challenges in achieving 5nm production with profitable yields and sufficient volume," Yole's Liu said.

[4]

US sanctions freeze Huawei's Ascend AI chips on older 7nm process node that's eight years behind TSMC, stalling progress until at least 2026

Huawei's ambitions for the AI market have faltered as the chipmaker struggles to procure bleeding-edge EUV (Extreme Ultraviolet) equipment from ASML - leaving its Ascend AI chips stuck at 7nm for many years, a significant disadvantage versus Nvidia, per Bloomberg. This major setback for China also portends that the technological gap will only widen in the coming years. To put this in perspective, while not entirely directly comparable, TSMC's 7nm node debuted back in 2018. SMIC's 7nm came to market in 2021, several years behind TSMC, and the rumored extension of 7nm into 2026 leaves it serving for five years as its leading-edge process node, an eternity in chip manufacturing. Huawei's Ascend AI chips recently saw a third iteration - the Ascend 910C - fabbed using an aging 7nm node from SMIC. Manufacturing wafers at sub-7nm levels requires the incorporation of EUV technology from companies like ASML. Recent sanctions have barred China and its respective chipmakers from securing EUV machines. Thus, domestic players have to fall back to local, sub-par equipment and resort to techniques such as quadruple patterning - which is resource-intensive and prone to alignment issues, resulting in poor yields. The report suggests that a few undisclosed individuals close to the matter revealed that in light of these sanctions, Huawei's flagship Ascend chips will be limited to 7nm technology until 2026 - while TSMC is gearing up to debut its 2nm-class N2 node next year. This also affects Huawei's Mate lineup of phones - now powered by its in-house Kirin chips, which compete against Qualcomm and MediaTek. It is plausible to infer that we might not see a 5nm Kirin SoC, at least in the near future. Rubbing salt in the wound, SMIC -- China's homegrown rival to TSMC -- is allegedly unable to meet rising demands and maintain a steady supply of its existing 7nm-class wafers. This casts a shadow over China's ventures into the semiconductor world, which are fueled by massive government-backed incentives. However, you'd be naive to think that China's the only country with high aspirations since Japan is prepping to ink a massive $65 billion plan to revive its chip industry. Huawei has been poaching TSMC employees - offering nearly 3x higher salaries to secure their expertise. Last month, TSMC revealed that Huawei was using a proxy to bypass US-led export restrictions for the Ascend 910B AI chip. China must overcome the EUV barrier if it wishes to keep up with the rest of the world, as its chip designers like Huawei depend on local manufacturers like SMIC.

[5]

Huawei To Reportedly Take On Nvidia With Mass Production Of New AI Chips By 2025 Amid US Restrictions - NVIDIA (NASDAQ:NVDA), Intel (NASDAQ:INTC)

Huawei Technologies Co., Ltd. is set to initiate mass production of its latest AI chip, the Ascend 910C, in early 2025, despite facing significant hurdles due to U.S. trade restrictions. What Happened: The Chinese telecom giant has already distributed samples of the Ascend 910C to various tech firms and begun accepting orders. The chip is designed to rival those from U.S. AI chipmaker Nvidia Corp. NVDA. Huawei remains a focal point in U.S.-China trade and security tensions, with Washington imposing restrictions over national security concerns, Reuters reported on Wednesday. These U.S. curbs have impacted Huawei's chip production, limiting its ability to achieve high yields necessary for commercial success. The Ascend 910C is produced by Semiconductor Manufacturing International Corp SMCI using its N+2 process. However, the absence of advanced lithography tools has restricted the chip's yield to about 20%, a source revealed. See Also: Sean Parker's Net Worth Touches $3B: From Launching Napster To Becoming Facebook Billionaire, The Story Of Teenage Hacker Turned Entrepreneur Huawei's current advanced processor, the 910B, also suffers from yield issues, leading to reduced production goals. U.S. restrictions have further complicated the situation by restricting access to critical lithography technology from Dutch manufacturer ASML. Despite these obstacles, Huawei plans to prioritize strategic government and corporate orders for its new chip. Why It Matters: The U.S. has been tightening its grip on Huawei. In May, the Biden administration revoked export licenses for major American semiconductor firms like Intel Corp. INTC and Qualcomm Inc. QCOM, preventing them from supplying crucial chips to Huawei. This marked a significant escalation in the U.S. strategy to curb Huawei's technological rise. In October, U.S. lawmakers urged the Department of Commerce to take tougher action against Huawei's alleged attempts to bypass sanctions through a secretive network of semiconductor facilities. This included leveraging companies like Pengxinxu and SwaySure Technology. Most recently, in November, the U.S. reportedly asked Taiwan Semiconductor Manufacturing Co TSM to halt shipments of advanced chips used in AI applications to Chinese customers after discovering one of its chips in a Huawei AI processor. Read Next: Satya Nadella Defends Bing's Rise Against Google's Search Dominance -- Says OpenAI's Partnership With Apple Is 'Incremental' For Microsoft Image via Shutterstock Market News and Data brought to you by Benzinga APIs

[6]

China's chip advances stall as U.S. curbs hit Huawei AI product

Huawei's ambitions to create more powerful chips for artificial intelligence and smartphones have hit major snags because of U.S. sanctions, stalling a major Chinese effort to match American technology. Huawei is designing its next two Ascend processors, its answer to Nvidia's dominant accelerators, around the same 7-nanometer architecture that's been mainstream for years, people familiar with the matter said. That's because U.S.-led restrictions prevent Huawei's chipmaking partners from procuring state-of-the-art extreme ultraviolet (EUV) lithography systems from ASML Holding. That means its marquee chips will be stuck at aging technology till at least 2026, the people said, asking to remain unidentified discussing a sensitive project. Huawei's smartphone processors, for the Mate lineup, face similar constraints, one of the people said.

[7]

Huawei's AI Chip Plans Pushed 3 Generations Behind NVIDIA Due To US Sanctions - Report

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy. Chinese technology giant Huawei is struggling to make advanced chips capable of supporting artificial intelligence workloads and meeting the performance of NVIDIA's older products due to US sanctions, according to sources quoted by Bloomberg. US sanctions under the Trump and Biden administrations have prevented Taiwan's TSMC from selling its most advanced chips to China and limited Chinese chip manufacturers' ability to procure the latest chip manufacturing machines from the Dutch firm ASML. As these machines are indispensable to making newer chips, Huawei's plans to develop its new chips capable of supporting AI workloads are limited to the 7-nanometer node and will continue to be so for the next two years. NVIDIA's latest AI chips, the H100 lineup, rely on TSMC's N4 process technology family for fabrication. The N4, or the 4-nanometer process, is an advanced variant of TSMC's 5-nanometer and it is more than a generation ahead of TSMC's 7-nanometer technology. Yet, the Biden administration's sanctions against China's SMIC which prevent it from procuring ASML's latest extreme ultraviolet (EUV) chip manufacturing machines have limited SMIC from moving below the 7-nanometer process to more advanced technologies, reports Bloomberg. Since ASML is the only company in the world which provides these machines, SMIC's options are limited to using older scanners that rely on deep ultraviolet (DUV) lithography. Consequently, as per the unnamed sources, the Chinese firm has had to resort to multi-patterning to try to churn ou 7-nanometer chips. In semiconductor fabrication, multi-patterning divides a mask (equipment with the circuit design) into parts to 'print' one part at a time on silicon and achieve the crisp resolution necessary for smaller feature sizes. Consequently, the process adds complexity to semiconductor fabrication, increases production time and presents quality problems. According to today's report, China's leading chip manufacturer SMIC is also suffering from these issues. The problems have arisen because US sanctions have left it unable to procure advanced EUV machines from ASML, and the resulting shift to DUV machines has made manufacturing the latest chips difficult. Not only is SMIC relying on multi-patterning to overcome the restrictions, but the government's pressure to use local equipment has also left it struggling to keep up with old Western chip manufacturing technologies. As a result, as it is cut off from TSMC's latest chip process families, Huawei has been forced to rely on SMIC's products and design its chips around the older 7-nanometer process. However, with TSMC set to produce 2-nanometer chips next year and SMIC struggling with multi-patterning and domestic chip manufacturing equipment, Huawei's plans to self-develop AI processors are struggling. These difficulties not only hamper Huawei's competitiveness in the consumer electronics market, where it has to face off with rivals such as Apple, but they also hamper Chinese attempts to develop semiconductor self-sufficiency in the AI era and remain at par with the United States. Apple's iPhone smartphones regularly use TSMC's latest products, with the 2024 iPhone relying on chips made through the 3-nanometer process technology family.

[8]

China's Chip Advances Stall as US Curbs Hit Huawei AI Product

Huawei Technologies Co.'s ambitions to create more powerful chips for AI and smartphones have hit major snags because of US sanctions, stalling a major Chinese effort to match American technology. Huawei is designing its next two Ascend processors, its answer to Nvidia Corp.'s dominant accelerators, around the same 7-nanometer architecture that's been mainstream for years, people familiar with the matter said. That's because US-led restrictions prevent Huawei's chipmaking partners from procuring state-of-the-art extreme ultraviolet lithography systems from ASML Holding NV.

Share

Share

Copy Link

Huawei faces significant challenges in advancing its AI chip technology due to US sanctions, forcing it to rely on older 7nm architecture. Despite obstacles, the company aims to mass-produce its newest AI chip by early 2025.

Huawei's AI Chip Ambitions Hindered by US Sanctions

Huawei Technologies Co., a leading Chinese tech giant, is facing significant challenges in its quest to develop advanced AI chips due to US-led sanctions. The company's efforts to compete with industry leaders like Nvidia have been severely impacted, forcing it to rely on older technology for the foreseeable future

1

2

.Technological Constraints and Production Challenges

Huawei is currently designing its next two Ascend processors, intended to rival Nvidia's AI accelerators, using 7-nanometer architecture. This technology has been mainstream for years and is significantly behind the cutting edge. The limitation is a direct result of US restrictions preventing Huawei's chipmaking partners from acquiring state-of-the-art extreme ultraviolet (EUV) lithography systems from ASML Holding NV

1

3

.The company's main production partner, Semiconductor Manufacturing International Corp (SMIC), is struggling to produce even 7nm chips at consistent volumes. SMIC's production lines have been plagued by poor yield and reliability issues, with the Ascend 910C chip reportedly achieving only about 20% yield

2

4

.Plans for Mass Production Amid Constraints

Despite these setbacks, Huawei aims to begin mass production of its most advanced AI chip, the Ascend 910C, in the first quarter of 2025. The company has already started sending samples and taking orders for the new chip

2

5

.Implications for China's AI Ambitions

Huawei's struggles have broader implications for China's AI aspirations. The technological gap between China and the US is expected to widen, with Taiwan Semiconductor Manufacturing Co (TSMC) planning to produce 2nm chips by 2025, approximately three generations ahead of Huawei's capabilities

1

3

.Related Stories

US Sanctions and Their Impact

The US has imposed a series of restrictions on Huawei and other Chinese companies, citing national security concerns. These sanctions have effectively frozen Chinese technological advancements at current levels, depriving national champions like Huawei of the opportunity to progress to the next level of chip technology

1

4

.Huawei's Response and Future Outlook

In response to these challenges, Huawei and its partners are exploring novel methods to advance their technology. This includes attempting to push the limits of older deep ultraviolet (DUV) lithography machines using techniques like quadruple patterning. However, these methods are resource-intensive and prone to alignment errors and yield losses

3

4

.As Huawei continues to navigate these obstacles, the company plans to prioritize strategic government and corporate orders for its new chips. The ongoing situation underscores the complex interplay between technological advancement, international trade policies, and geopolitical tensions in the global semiconductor industry

2

5

.References

Summarized by

Navi

[4]

Related Stories

Recent Highlights

1

OpenAI secures $110 billion funding round from Amazon, Nvidia, and SoftBank at $730B valuation

Business and Economy

2

Trump orders federal agencies to ban Anthropic after Pentagon dispute over AI surveillance

Policy and Regulation

3

Google releases Nano Banana 2 AI image model with Pro quality at Flash speed

Technology