Huawei's AI Chips Reveal Continued Reliance on Foreign Components

3 Sources

3 Sources

[1]

Huawei Used TSMC, Samsung, SK Hynix Components in Top AI Chips

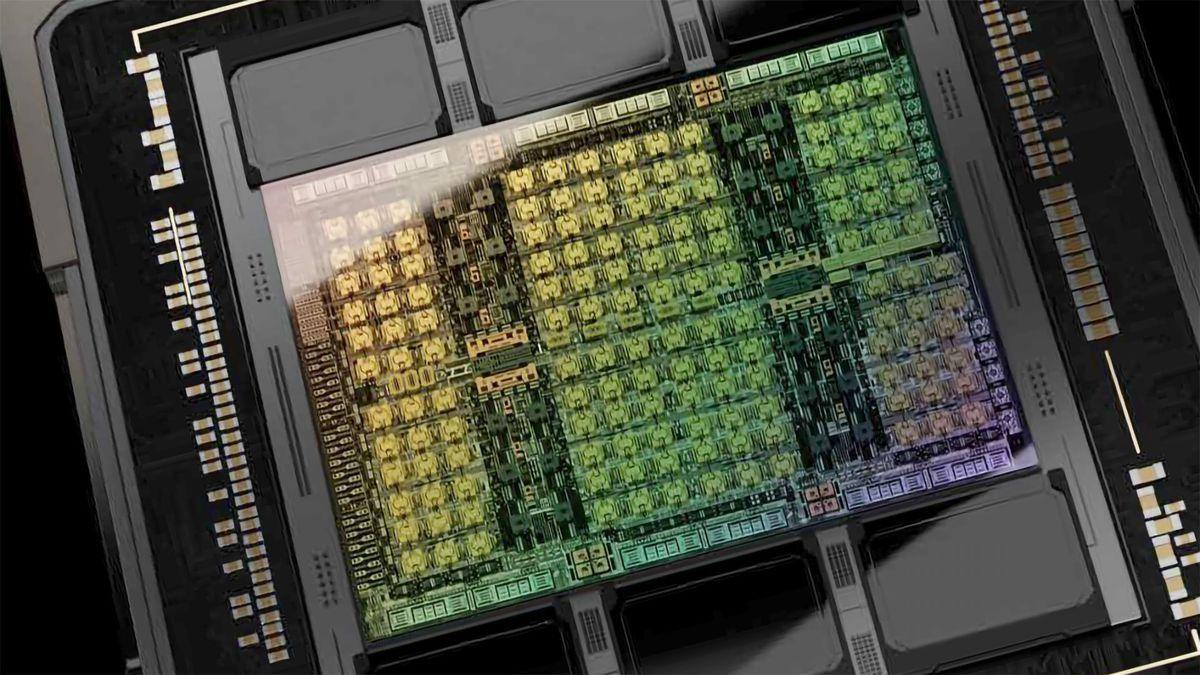

Huawei Technologies Co. used advanced components from Asia's largest technology firms in at least some of its leading Ascend AI processors, a research firm discovered during teardowns, highlighting China's reliance on foreign hardware as it works to boost domestic production of AI semiconductors. TechInsights discovered gear from Taiwan Semiconductor Manufacturing Co., Samsung Electronics Co. and SK Hynix Inc. in multiple samples of Huawei's third-generation Ascend 910C chips, the firm said in a statement.

[2]

What's Really Inside Huawei's 'Domestic' AI Chips? - Samsung Electronics Co (OTC:SSNLF), NVIDIA (NASDAQ:NVDA)

Huawei's latest AI chips, promoted as a milestone in China's push for technological self-reliance, continue to rely on critical components from Taiwan Semiconductor Manufacturing Co. (NYSE:TSM), Samsung (OTC:SSNLF), and SK Hynix, a teardown by TechInsights reveals. The findings highlight China's continued dependence on foreign hardware, even as Beijing pushes to expand its domestic semiconductor capabilities, Bloomberg reported on Friday. The report found that Taiwan Semiconductor produced the dies powering Huawei's Ascend 910C processors, while Samsung and SK Hynix supplied older-generation high-bandwidth memory (HBM2E) used in separate chip samples. Also Read: Taiwan Semiconductor Halts Shipments After Huawei Link Discovered, US Sanctions Cited Both Korean companies emphasized to Bloomberg that they halted sales to Huawei following U.S. export controls in 2020 and remain compliant with American regulations. Huawei, added to the U.S. Entity List under President Donald Trump, did not comment during China's Golden Week holiday. U.S. authorities have tightened controls on AI chips, HBM memory, and the equipment required to manufacture them, aiming to limit Beijing's ability to challenge Nvidia (NASDAQ:NVDA) in advanced computing. Despite these restrictions, Huawei has leveraged its stockpiled inventory. Analysts estimate the company acquired nearly 3 million Taiwan Semiconductor dies through intermediary Sophgo before sanctions severed the channel, and these continue to power the 910C chips, which entered mass shipment earlier this year. Still, supply risks are mounting. SemiAnalysis projects Huawei could face high-bandwidth memory shortages by the end of 2025 as domestic players like Changxin Memory Technologies (CXMT) race to bridge the gap. The pressure on Huawei's supply chain intensified after reports in December 2024 suggested the Biden administration was considering blacklisting Sophgo. Investigators discovered a Taiwan Semiconductor chip inside Huawei's Ascend 910B processor, prompting Taiwan Semiconductor to halt shipments to Sophgo and notify the U.S. Commerce Department. Washington flagged Sophgo, an affiliate of Bitcoin miner Bitmain and a supplier to Chinese state firms, as a national security concern. Huawei is pressing ahead with efforts to rival Nvidia in terms of AI performance. At its annual Huawei Connect conference, rotating Chairman Eric Xu unveiled a three-year plan to cluster large numbers of Ascend processors via a new UnifiedBus interconnect system, claiming it can transfer data up to 62 times faster than Nvidia's upcoming NVLink144. The presentation underscored Beijing's strategy of supporting Huawei as a national champion amid U.S. curbs, even as analysts caution that Huawei's chips still trail Nvidia's in raw processing power and remain at 7-nanometer designs. Huawei's high-profile chip rollout reflects China's ambition to achieve technological sovereignty, but analysts warn that supply chain vulnerabilities could slow its advance. Read Next: Huawei Technologies Challenges Nvidia AI Chip Dominance In China Photo via Shutterstock NVDANVIDIA Corp$189.650.40%OverviewSSNLFSamsung Electronics Co Ltd$42.480.34%TSMTaiwan Semiconductor Manufacturing Co Ltd$294.402.18%Market News and Data brought to you by Benzinga APIs

[3]

Huawei used Samsung, TSM and SK hynix's parts in its advanced AI chips

Huawei Technologies used advanced components from Asia's largest technology companies in at least some of its advanced Ascend AI processors, Bloomberg News reported, citing TechInsights. TechInsights discovered gear from Taiwan Semiconductor Manufacturing (NYSE:TSM), Samsung Electronics (OTCPK:SSNLF) and Huawei uses stockpiled dies and memory chips manufactured before restrictions, sourced from TSM, Samsung, and SK hynix, to produce its Ascend 910C chips. Huawei may face bottlenecks once its stockpile of high-bandwidth memory depletes, as domestic alternatives lag and foreign suppliers comply with export controls. Export controls halted shipments from TSM, Samsung, and SK hynix after 2020, leading Huawei to rely on inventory procured before the restrictions, as suppliers state they no longer do business directly with Huawei.

Share

Share

Copy Link

Teardown analysis of Huawei's Ascend AI processors shows use of components from TSMC, Samsung, and SK Hynix, highlighting China's ongoing dependence on foreign technology despite push for self-reliance.

Huawei's AI Chips: A Mix of Ambition and Foreign Dependence

A recent teardown analysis by research firm TechInsights has revealed that Huawei Technologies Co., China's tech giant, continues to rely on advanced components from major Asian technology firms in its leading Ascend AI processors. This discovery highlights the ongoing challenges China faces in its push for technological self-reliance, particularly in the semiconductor industry

1

.Key Findings and Implications

TechInsights found that Huawei's third-generation Ascend 910C chips contain components from Taiwan Semiconductor Manufacturing Co. (TSMC), Samsung Electronics Co., and SK Hynix Inc. Specifically, TSMC produced the dies powering the processors, while Samsung and SK Hynix supplied older-generation high-bandwidth memory (HBM2E) in separate chip samples

2

.This reliance on foreign components comes despite Huawei's promotion of these chips as a milestone in China's technological advancement. The findings underscore the complexities of the global semiconductor supply chain and the challenges faced by Chinese companies in developing fully domestic alternatives.

U.S. Export Controls and Their Impact

The situation is further complicated by U.S. export controls imposed in 2020, which have severely restricted Huawei's access to advanced chips and manufacturing equipment. Both Samsung and SK Hynix have emphasized their compliance with these regulations, stating that they halted direct sales to Huawei following the implementation of these controls

2

.Huawei's Strategy and Future Challenges

To circumvent these restrictions, Huawei has been leveraging its stockpiled inventory. Analysts estimate that the company acquired nearly 3 million TSMC dies through an intermediary, Sophgo, before sanctions severed this channel. These stockpiled components continue to power the 910C chips, which entered mass shipment earlier this year

2

.However, Huawei faces potential supply chain bottlenecks, particularly in high-bandwidth memory. SemiAnalysis projects that the company could face shortages by the end of 2025, as domestic players like Changxin Memory Technologies (CXMT) race to bridge the gap

3

.Related Stories

Huawei's Ambitions and Industry Response

Despite these challenges, Huawei is pressing ahead with efforts to rival industry leaders like Nvidia in AI performance. At its annual Huawei Connect conference, the company unveiled a three-year plan to cluster large numbers of Ascend processors via a new UnifiedBus interconnect system, claiming superior data transfer speeds compared to Nvidia's upcoming NVLink144

2

.Conclusion

The revelations about Huawei's AI chips underscore the complex interplay between technological ambition, geopolitical tensions, and global supply chains in the semiconductor industry. As China continues its push for technological sovereignty, the ability of companies like Huawei to overcome supply chain vulnerabilities and develop truly domestic alternatives will be crucial in determining the future landscape of the AI chip market.

References

Summarized by

Navi

Related Stories

TSMC Halts Chip Shipments After Discovering Potential Sanctions Breach with Huawei

19 Oct 2024•Policy and Regulation

TSMC Suspends Shipments to Chinese Firm After Chip Found in Huawei AI Processor

27 Oct 2024•Policy and Regulation

Huawei's AI Chip Ambitions Stalled by US Sanctions, Mass Production Planned for 2025

19 Nov 2024•Technology

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology