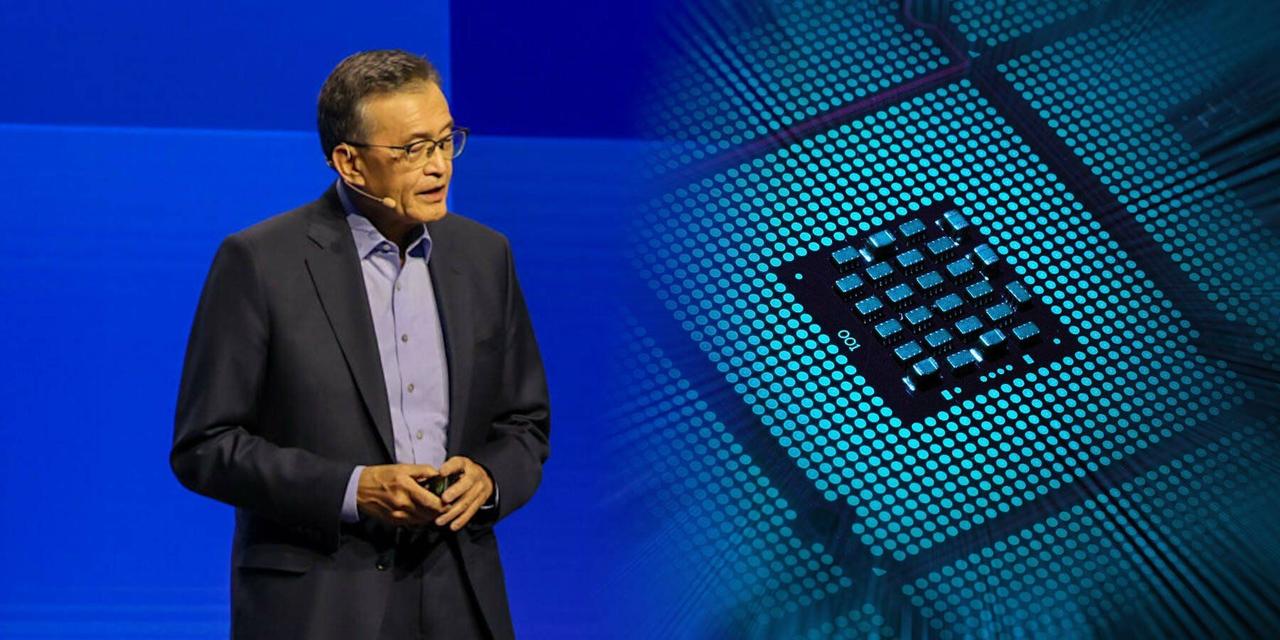

Intel's New CEO Lip-Bu Tan Plans Major Overhaul of Manufacturing and AI Operations

12 Sources

12 Sources

[1]

Exclusive: Intel's new CEO plots overhaul of manufacturing and AI operations

SAN FRANCISCO, March 17 (Reuters) - Intel's incoming CEO Lip-Bu Tan has considered significant changes to its chip manufacturing methods and artificial intelligence strategies ahead of his return to the company on Tuesday, two people familiar with Tan's thinking told Reuters, in a sweeping bid to revive the ailing technology giant. The new trajectory includes restructuring the company's approach to AI and staff cuts to address what Tan views as a slow-moving and bloated middle management layer. Revamping the company's manufacturing operations, which at one time only made chips for Intel but have been repurposed to make semiconductors for outside clients such as Nvidia, is one of Tan's core priorities, these sources said. At a town hall meeting following his appointment as CEO last week, he told employees that the company will need to make "tough decisions," according to two other people briefed on the meeting. Semiconductor industry expert Dylan Patel said a big problem under former Intel CEO Pat Gelsinger, who left the company in December, was that he was "too nice." "He did not want to fire a bunch of middle management in the way they needed to," he said. Tan, 65, former CEO of chip design software firm Cadence and tech investor, was a member of Intel's board until he resigned last August. In returning as CEO, Tan is set to take over the American icon after a decade of bad decisions by three CEOs in which it failed to build chips for smartphones and missed surging demand for AI processors, allowing competitors Arm Holdings and Nvidia (NVDA.O), opens new tab to dominate those markets. Intel (INTC.O), opens new tab reported an annual loss of $19 billion in 2024, its first since 1986. In the near term, Tan aims to improve performance at its manufacturing arm, Intel Foundry, which makes chips for other design companies such as Microsoft (MSFT.O), opens new tab and Amazon (AMZN.O), opens new tab, by aggressively wooing new customers, according to the people. It will also restart plans to produce chips that power AI servers and look to areas beyond servers in several areas such as software, robotics and AI foundation models. "Lip-Bu will be spending a lot of time listening to customers, partners and employees as he comes on board and works closely with our leadership team to position the business for future success," an Intel spokesman said in a prepared statement. Intel declined to comment further or make Tan available for an interview. Tan's venture firm, Walden Catalyst, did not respond to requests for comment. At the outset, Tan's strategy appears to be a fine-tuning of that of Gelsinger. The centerpiece of Gelsinger's turnaround plan was to transform Intel into a contract chip manufacturer that would compete with Taiwan Semiconductor Manufacturing Co. (2330.TW), opens new tab, or TSMC, which counts Apple (AAPL.O), opens new tab, Nvidia and Qualcomm (QCOM.O), opens new tab as customers. Gelsinger committed tens of billions of dollars to build factories in the U.S. and Europe to make chips for both Intel and for outside customers, but he was forced to scale back those ambitions as the market for Intel's core products cooled. BETTING ON AI Tan has been a vocal internal critic of Gelsinger's execution, according to the two sources familiar with Tan's plans. For most of its history, Intel has manufactured chips for only one client - itself. When Gelsinger became CEO in 2021, he prioritized manufacturing chips for others but fell short of providing the level of customer and technical service as rival TSMC, leading to delays and failed tests, former executives have told Reuters. Tan's views were shaped by months of reviewing Intel's manufacturing process after the board in late 2023 appointed him to a special role overseeing it, according to a regulatory filing. In his assessment, he expressed frustration with the company's culture, sources told Reuters, saying it had lost the "only the paranoid survive" ethos enshrined by former CEO Andy Grove. He also came to believe that decision-making was slowed down by a bloated workforce, Reuters reported. Tan presented some of his ideas to Intel's board last year, but they declined to put them into place, according to two people familiar with the matter. By August, Tan abruptly resigned over differences with the board, Reuters reported. When he returns as CEO this week, he will lay fresh eyes on Intel's workforce, which was slashed by roughly 15,000 to almost 109,000 at the end of last year, the sources said. Beyond the cuts, Tan has little choice but to make Intel's existing manufacturing operation work in the short run. Intel's next generation of advanced chips equipped with AI features, called Panther Lake, will depend on its in-house factories using a new set of techniques and technologies Intel calls "18A." Intel's financial success this year is tied to strong sales of the forthcoming chip. Tan signalled in a memo Intel published Wednesday that he plans to keep control over the factories, which remain financially and operationally separate from the design business and restore Intel's position as a "world-class foundry." Intel's contract manufacturing operation can succeed if Tan wins over at least two large customers to produce a high volume of chips, industry analysts and Intel executives told Reuters. Part of the effort to lure large customers will involve improving Intel's chip manufacturing process to make it easier for potential customers like Nvidia and Alphabet's (GOOGL.O), opens new tab Google to use. Intel has demonstrated improvements in its manufacturing processes in recent weeks and has attracted interest from Nvidia and Broadcom that have launched early test runs, Reuters reported. Advanced Micro Devices is also evaluating Intel's process. Tan is expected to work on ways to improve output or "yield" to deliver higher numbers of chips printed on each silicon wafer as they move to volume manufacturing of its first in-house chip using the so-called 18A process this year. The goal is to move to an annual release schedule of AI chips, similar to Nvidia, but that will take years. It will be at least 2027 before Intel can develop a compelling new architecture for a first AI chip, according to three industry sources, and one person familiar with Intel's progress. Max A. Cherney in San Francisco; editing by Kenneth Li and Michael Learmonth Our Standards: The Thomson Reuters Trust Principles., opens new tab Suggested Topics:Technology Max A. Cherney Thomson Reuters Max A. Cherney is a correspondent for Reuters based in San Francisco, where he reports on the semiconductor industry and artificial intelligence. He joined Reuters in 2023 and has previously worked for Barron's magazine and its sister publication, MarketWatch. Cherney graduated from Trent University with a degree in history.

[2]

Intel's new CEO plots overhaul of manufacturing and AI operations: Reuters

Lip-Bu Tan appointed chief executive officer of Intel Corporation Intel's incoming CEO Lip-Bu Tan has considered significant changes to its chip manufacturing methods and artificial intelligence strategies ahead of his return to the company on Tuesday, two people familiar with Tan's thinking told Reuters, in a sweeping bid to revive the ailing technology giant. The new trajectory includes restructuring the company's approach to AI and staff cuts to address what Tan views as a slow-moving and bloated middle management layer. Revamping the company's manufacturing operations, which at one time only made chips for Intel but have been repurposed to make semiconductors for outside clients such as Nvidia, is one of Tan's core priorities, these sources said. Intel shares rose more than 7% at the open on Nasdaq after the Reuters report. At a town hall meeting following his appointment as CEO last week, he told employees that the company will need to make "tough decisions," according to two other people briefed on the meeting. Semiconductor industry expert Dylan Patel said a big problem under former Intel CEO Pat Gelsinger, who left the company in December, was that he was "too nice." "He did not want to fire a bunch of middle management in the way they needed to," he said. Tan, 65, former CEO of chip design software firm Cadence and tech investor, was a member of Intel's board until he resigned last August. In returning as CEO, Tan is set to take over the American icon after a decade of bad decisions by three CEOs in which it failed to build chips for smartphones and missed surging demand for AI processors, allowing competitors Arm Holdings and Nvidia to dominate those markets. Intel reported an annual loss of $19 billion in 2024, its first since 1986. In the near term, Tan aims to improve performance at its manufacturing arm, Intel Foundry, which makes chips for other design companies such as Microsoft and Amazon, by aggressively wooing new customers, according to the people. It will also restart plans to produce chips that power AI servers and look to areas beyond servers in several areas such as software, robotics and AI foundation models. "Lip-Bu will be spending a lot of time listening to customers, partners and employees as he comes on board and works closely with our leadership team to position the business for future success," an Intel spokesman said in a prepared statement. Intel declined to comment further or make Tan available for an interview. Tan's venture firm, Walden Catalyst, did not respond to requests for comment. At the outset, Tan's strategy appears to be a fine-tuning of that of Gelsinger. The centerpiece of Gelsinger's turnaround plan was to transform Intel into a contract chip manufacturer that would compete with Taiwan Semiconductor Manufacturing Co., or TSMC, which counts Apple, Nvidia and Qualcomm as customers. Gelsinger committed tens of billions of dollars to build factories in the U.S. and Europe to make chips for both Intel and for outside customers, but he was forced to scale back those ambitions as the market for Intel's core products cooled.

[3]

Intel stock up as new CEO Lip-Bu Tan eyes cuts to 'slow-moving and bloated middle management': Report

Tan said he'll need to make "tough decisions" when he takes Intel's helm on Tuesday, after the company posted $19 billion in annual losses in 2024. Tan's appointment comes three months after the company ousted former CEO Pat Gelsinger, as it struggled after missing out on the generative artificial intelligence boom and losing market share to Nvidia and AMD. One problem with Gelsinger's leadership, a semiconductor industry expert told Reuters, was that Gelsinger was "too nice" and did not want to "fire a bunch of middle management in the way they needed to." The Reuters report also said Intel could have architecture ready for an AI chip by 2027, and would plan to release a new version of it each subsequent year. This would be a big coup for Intel, which is lagging behind Nvidia and Broadcom (AVGO) in the AI hardware market.

[4]

Intel jumps nearly 15% as investors cheer appointment of new CEO Tan

Tan will be tasked with reviving the company's fortunes after it missed out on the artificial intelligence-driven semiconductor boom while plowing billions of dollars into building out its chip-making business.Shares of Intel surged nearly 15% on Thursday, as Wall Street cheered its decision to name former board member Lip-Bu Tan as CEO, who left in August over differences about the chipmaker's direction, after several years of market underperformance. Tan will be tasked with reviving the company's fortunes after it missed out on the artificial intelligence-driven semiconductor boom while plowing billions of dollars into building out its chip-making business. Intel has posted several quarters of market share losses in data centers and PCs, as well as billion-dollar losses in its manufacturing business, and over the past five years, the stock has lost about 60% of its value, a period of time when the Nasdaq Composite Index and S&P 500 have both more than doubled. "Tan in as CEO at Intel was as good as stakeholders could have hoped for," said TD Cowen analysts, noting that he has "deep relationships" across the chip ecosystem that could draw customers to the company's contract manufacturing business. Tan will take the helm next week - three months after Intel ousted CEO Pat Gelsinger. Tan had been brought into the board two years earlier to help turn the company around, but left due to disagreements over the size of the company's workforce and its culture. Skepticism about Intel's future has deepened in recent months amid reports that rivals, including Broadcom , were evaluating the chip design and marketing business, while TSMC has separately studied controlling some or all of its plants. Analysts expect Tan to follow Gelsinger in keeping the chip design and manufacturing operations together - a plan that Tan hinted at in a letter to employees by vowing to make Intel a top foundry, an industry term for a contract chip manufacturer. Some analysts have said the foundry business may find it difficult to draw orders from chip designers wary of entrusting production to a rival. But Tan, who oversaw more than a decade of strong growth at Intel supplier and chip-design software Cadence Design Systems , enjoys strong credibility as a "neutral party" that could help Intel overcome some of the challenges, analysts said. Stacy Rasgon of Bernstein also said Tan's previous two-year tenure on the Intel board would aid his efforts. That "should have given him a pretty good idea of where all the bodies are buried, and he should be much realistic in his evaluations and outlook than prior leadership (it was unbridled optimism proved to be Pat's undoing)," Rasgon said. Still, any turnaround is expected to take years, as hinted by Tan in his letter to employees. Intel's market value has remained stuck below $100 billion for the first time in three decades after shares slumped 60% last year and its Gaudi AI chips have also missed sales targets. More analysts recommend investors "sell" the stock than "buy" it, with most having a "hold" rating, LSEG data shows. Rasgon said Tan "has a big job in front of him and a lot of wood to chop, though it does seem increasingly likely something will have to change giving investors something more concrete to play for (and if he fails, it was probably unfixable)."

[5]

Intel's new CEO plots overhaul of manufacturing and AI operations

Intel's incoming CEO Lip-Bu Tan has considered significant changes to its chip manufacturing methods and artificial intelligence strategies ahead of his return to the company on Tuesday, two people familiar with Tan's thinking said, in a sweeping bid to revive the ailing technology giant. The new trajectory includes restructuring the company's approach to AI and staff cuts to address what Tan views as a slow-moving and bloated middle management layer. Revamping the company's manufacturing operations, which at one time only made chips for Intel but have been repurposed to make semiconductors for outside clients such as Nvidia, is one of Tan's core priorities, these sources said. The plans are still being formulated and could yet change, these sources said. Intel shares rose more than 8% in mid-day trading on Nasdaq. At a town hall meeting following his appointment as CEO last week, he told employees that the company will need to make "tough decisions," according to two other people briefed on the meeting. Semiconductor industry expert Dylan Patel said a big problem under former Intel CEO Pat Gelsinger, who left the company in December, was that he was "too nice." "He did not want to fire a bunch of middle management in the way they needed to," he said. Tan, 65, former CEO of chip design software firm Cadence and tech investor, was a member of Intel's board until he resigned last August. In returning as CEO, Tan is set to take over the American icon after a decade of bad decisions by three CEOs in which it failed to build chips for smartphones and missed surging demand for AI processors, allowing competitors Arm Holdings and Nvidia to dominate those markets.

[6]

Intel's New CEO Charts Bold Revival Plan, Warns Of 'Tough Decisions' Ahead-Reports - Intel (NASDAQ:INTC), Cadence Design Systems (NASDAQ:CDNS)

Intel Corp's INTC incoming CEO, Lip-Bu Tan, is planning a major overhaul of the company's chip manufacturing and artificial intelligence operations, aiming to breathe new life into the struggling tech giant. What Happened: Tan is considering significant changes to the company's approach to AI and chip manufacturing. This includes staff cuts to address what he sees as a slow-moving and bloated middle management layer, according to a Reuters report on Monday. Revamping the manufacturing operations, which once exclusively produced chips, but now also cater to external clients like Nvidia, is one of Tan's key priorities. Tan, who was previously a member of Intel's board and CEO of chip design software firm Cadence Design Systems CDNS is poised to lead the company after a decade of setbacks under previous CEOs. These missteps led to Intel missing out on the booming demand for AI processors and smartphone chips, allowing competitors like Arm Holdings and Nvidia to dominate these markets. Under Tan's leadership, Intel is striving to enhance the performance of its manufacturing division, Intel Foundry, by actively securing new customers. The company also plans to restart the production of chips that drive AI servers and explore areas beyond servers, such as software, robotics, and AI foundation models. SEE ALSO: IBM CEO Arvind Krishna Says DeepSeek An Indicator Of What's To Come, Predicts AI Models Will Use Just 1% Of Today's Energy In 5 Years Why It Matters: Despite the ambitious plans, Tan's strategy seems to be an enhancement of former CEO Pat Gelsinger's turnaround plan, which sought to reshape Intel into a contract chip manufacturer. However, Gelsinger's plan had to be scaled back due to cooling demand for Intel's core products. Tan's appointment as CEO was announced on March 13, and it led to a surge in Intel's stock. His incoming leadership and the proposed changes are seen as a potential turning point for Intel, which has been struggling to keep up with competitors in the rapidly evolving tech industry. In a town hall address held after his appointment, the CEO cautioned employees that the company will need to make "tough decisions." As Tan steps into his new role, the tech industry will be watching closely to see if his planned changes can turn around the fortunes of the ailing tech giant. Intel stock has surged more than 18% over the past 5 days to close at $24.05 on Friday, as per Benzinga Pro. Intel holds a momentum rating of 31.37% and a growth rating of 80.60%, according to Benzinga's Proprietary Edge Rankings. The Benzinga Growth metric evaluates a stock's historical earnings and revenue expansion across multiple timeframes, prioritizing both long-term trends and recent performance. For an in-depth report on more stocks and insights into growth opportunities, sign up for Benzinga Edge. READ MORE: AstraZeneca Seals Deal For EsoBiotec To Advance Cell Therapy: Details Image via Shutterstock Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. CDNSCadence Design Systems Inc $246.61-0.33% Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full Score Edge Rankings Momentum28.36 Growth65.56 Quality72.26 Value7.58 Price Trend Short Medium Long Overview INTCIntel Corp $24.461.70% Market News and Data brought to you by Benzinga APIs

[7]

Intel AI Chip Breakthrough To Compete With NVIDIA Unlikely Before 2027 - Report

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy. According to a report, Intel's new CEO, Lip-Bu Tan, is set to significantly reduce the firm's workforce as he aims to turn around the firm and establish a foothold in the foundry and artificial intelligence industries. Lip-Bu has taken the helm as Intel's first permanent CEO since Patrick Gelsinger left in December, and as per today's report, he will continue Gelsinger's approach to focus on the foundry business. The new CEO takes the helm at the world's largest integrated chip manufacturer after speculation of a spinoff of its foundry business. However, he put the reports to rest in a letter to employees that outlined his aim to make Intel one of the top foundries worldwide. As per Reuters, Lip-Bu followed up his letter to Intel's employees by speaking at a company town hall meeting after his appointment. The new Intel boss has extensive experience overseeing the firm's affairs as he served on its board of directors as recently as in 2024. On an immediate basis, he wants to continue Gelsinger's approach and set up Intel to compete in the AI industry and establish a strong foothold in the foundry industry. Sources privy to the contents of the meeting believe that Lip-Bu will focus on streamlining Intel's middle management for agile operations and cost reduction. Intel already underwent sizable layoffs in 2024 as it struggled to control costs and posted quarterly losses. However, while Intel's shares fell on the layoff news last year, they are up by nearly 25% since Lip-Bu took over as investors express confidence in the veteran executive's ability to revive struggling companies. His letter to employees stressed the need to make Intel a world-class foundry, and in the town hall, the CEO reiterated his goal. Contract manufacturing has grown in urgency in America during the AI wave and the Trump administration's push to make advanced chips in America. Intel also received billions of dollars in funds through the CHIPS and Science Act under the Biden administration, and its shares saw considerable buying interest earlier this year on renewed hopes of a US manufacturing push. However, according to sources familiar with the plans, layoffs will be the short-term approach as AI chips are likely to take years to develop. Intel is unlikely to develop and design its first AI chip until 2027. While he aims to build Intel's foundry business and restart an AI push, Lip-Bu is also critical of Gelsinger's approach, Reuters reports. A key point of contention between him and his predecessor has been a bloated management structure, which has left Intel unable to focus on customer satisfaction. A key factor in his success will be winning over new customers for the foundry business. Intel is currently developing its leading-edge 18A chip manufacturing process. If 18A successfully enters production and ships, then the firm will have achieved technological parity with its key foundry rival, Taiwan's TSMC. The shares have gained 7.6% today as they build on the rally since Lip-Bu's appointment.

[8]

Intel Shares Surge As New CEO Plans Major Overhaul: What's Going On? - Intel (NASDAQ:INTC)

Intel Corporation INTC shares are trading higher Monday following reports that incoming CEO Lip-Bu Tan is preparing a sweeping overhaul of the company's chip design, manufacturing operations and AI strategy. What To Know: According to Reuters, Tan's plan includes cost-cutting measures, a restructuring of management and a renewed focus on AI chip production. Tan, who was previously a board member and CEO of chip design software firm Cadence, is stepping in after Intel's years of missteps under multiple CEOs. He has been openly critical of former CEO Pat Gelsinger's execution, particularly in manufacturing and decision-making. One of Tan's key priorities is revamping Intel Foundry, which produces chips for companies like Microsoft and Amazon. He is also expected to restart AI initiatives beyond servers, including software, robotics and AI foundation models. Intel has struggled to compete with industry leaders such as Nvidia and Taiwan Semiconductor Manufacturing Co. (TSMC). Under Gelsinger, Intel aimed to establish itself as a major contract chip manufacturer but execution problems and a weakening market forced cutbacks. Tan's strategy involves securing large customers for Intel's foundry business while improving manufacturing efficiency. Despite an annual loss of $19 billion in 2024, Intel's financial outlook is tied to the success of its next-generation AI chips, known as Panther Lake, which will rely on the company's new 18A manufacturing process. Tan is expected to push for an annual release schedule of AI chips to compete with Nvidia, though industry experts estimate it will take years before Intel can produce a truly competitive AI architecture. At an internal town hall, Tan acknowledged the need for "tough decisions" as he looks to streamline operations. His approach marks a significant shift in leadership style, with a focus on aggressive restructuring and efficiency. INTC Price Action: Intel shares were up 7.92% at $25.95 at the time of writing, according to Benzinga Pro. Read Next: Legendary Trader Says Tesla, Nvidia, Apple Shares Are Ready To Rally: 'I See What I Like To See' Image Via Shutterstock. INTCIntel Corp $26.078.38% Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full Score Edge Rankings Momentum30.69 Growth80.55 Quality- Value70.91 Price Trend Short Medium Long Overview Market News and Data brought to you by Benzinga APIs

[9]

Intel's new CEO Lip-Bu Tan wants to revamp chipmaking, cut jobs:...

Intel's incoming chief executive plans to revamp the embattled tech giant's chipmaking operations and slash jobs to better compete with industry rivals, according to a report. Lip-Bu Tan, a former Intel board member who takes over Tuesday, will be focused on streamlining Intel's manufacturing process to churn out more AI chips for clients like Nvidia, sources with knowledge of his thinking told Reuters. His plans also include staff cuts to the firm's bloated middle-management layer, which he has argued slows down Intel's decision-making process, the report said. After Intel announced Tan's appointment last week, he told employees at a town hall meeting that the company will need to make "tough decisions," according to sources briefed on the meeting. Tan takes the reins from Pat Gelsinger, who was pushed out in December after three years at the helm. One criticism of Gelsinger was that he was "too nice," according to semiconductor industry expert Dylan Patel. "He did not want to fire a bunch of middle management in the way they needed to," Patel said. Gelsinger did announce last August that the chipmaker would slash 15% of its massive workforce -- about 15,000 jobs. Tan, 65, the former chief executive of chip design software firm Cadence and the head of a venture capital firm, appears ready to shake things up even further after months of disappointing earnings. The flailing company reported an annual loss of $19 billion in 2024 - its first since 1986 as it struggled to compete with major semiconductor rivals like AMD, TSMC and Samsung. Intel missed out on the demand surge for AI processors, losing market share to Nvidia, since it initially only produced chips for itself. The company has since pivoted to manufacturing chips for customers. Tan wants to improve performance across Intel Foundry, the firm's manufacturing arm that produces chips for Microsoft and Amazon, by aggressively wooing new customers, sources said. The company will also restart plans to produce chips that can power AI servers, and look to future developments in software and robotics, according to the report. Gelsinger had previously unveiled a turnaround plan that sought to transform the company into a booming contract chip manufacturer that could take on TSMC. The former CEO pledged tens of billions of dollars to build factories in the US and Europe to boost chip production, but was forced to scale back those plans amid a slump in demand. The struggling company was one of the first to receive funding from former President Joe Biden's CHIPS Act, receiving $2.2 billion in federal grants earlier this year. Last month, President Trump vowed to repeal the CHIPS Act. As a board member, Tan was a vocal critic of Gelsinger, who failed to provide customer service on the same level as rival TSMC, sources said. Tan argued that Intel's work culture had lost the "Only the paranoid survive" ethos put in place by Andy Grove, who served as the firm's chief executive from the late 1980s to the late 1990s, according to sources. After months of reviewing Intel's manufacturing process in a special role, Tan presented some of his ideas to the company's board last year, but it declined to pursue them, according to sources. He abruptly resigned from the board in August. Now, Tan is expected to focus on ways to improve Intel's output so it can deliver more chips as it works toward producing its first in-house chip sometime this year. Intel is unlikely to produce a new AI chip until at least 2027, industry sources and a person familiar with Intel's progress said. He will also be taking over the company soon after its workforce was slashed by about 15,000 to around 109,000 at the end of last year.

[10]

Intel's New Hope: Is Lip-Bu Tan the Perfect Match? | Investing.com UK

Four months after Intel (NASDAQ:INTC) CEO Pat Gelsinger resigned, the struggling chip manufacturer appointed Lip-Bu Tan as new CEO last Wednesday. Effective March 18th, he will try to regain Intel's lost glory while also re-joining the company's board of directors. Over the week, INTC stock gained 30% value to the present price of $25.80, which is in line with the WSJ's average price target of $25.24 per share. Intel has much ground to make from its all-time high price of $62.07 in April 2021. But is even a higher INTC price level likely with Lip-Bu Tan at the helm? The fact that Intel no longer has a leadership vacuum is itself positive news. After all, Intel accrued $18.75 billion net loss in 2024 compared to $1.69 billion net income in 2023. Such 1,210% decline in profitability requires all hands on deck, led by someone with an effective plan. Lip-Bu Tan is a known quantity, having served on Intel's BoD from September 2022 to August 2024. At the time, it was reported that he resigned following disagreements with Pat Gelsinger. Namely, that Intel has a bloated middle management workforce, stagnating risk-averse culture, and has failed to onboard the AI hype train on time. Previously, Tan was the CEO of Cadence Design Systems (NASDAQ:CDNS) between 2009 and 2021. The company develops software tools that semiconductor manufacturers like TSMC use to design chips and integrated circuits (ICs). Following Tan's departure, Cadence shifted to AI-driven solutions with Cadence.AI initiative as a chips-to-systems intelligent design acceleration. More importantly, during Tan's tenure as Cadence CEO, CDNS stock gained over 3,000% value. Over the last five years, after Tan's departure, CDNS stock is up 360%, having further extended partnerships with Nvidia (NASDAQ:NVDA), TSMC and Apple (NASDAQ:AAPL). Just like TikTok CEO, Tan was raised in Singapore, although born in Malaysia. Following his education at MIT for nuclear engineering, Tan was naturalized as a US citizen. In his investing career via Walden International VC, he made the right call to gain a stake in Israeli chip designer startup Annapurna Labs, which Amazon (NASDAQ:AMZN) bought in 2015 for $350 million. Likewise, Tan's investment in Nuvia, a CPU design company, paid off when Qualcomm (NASDAQ:QCOM) acquired it for $1.4 billion in March 2021. In the most recent investment call, Tan contributed to the new funding round for Celestial AI startup, having raised $250 million last Tuesday. Suffice to say, 65-year old Lip-Bu Tan has a solid track record in both leadership and investing roles. And in these roles, he gained overview of the entire semiconductor design and manufacturing landscape. According to insider sources relayed to Reuters, Tan plans to continue Gelsinger's broader strategy. As covered previously, this consisted of delivering "five manufacturing technology nodes in four years". During 2025, the company will roll out its cutting-edge Intel 18A (1.8nm) chips, dubbed Panther Lake, which appear to be superior to TSMC's equivalent 2nm design. Tan aims to leverage this rare advantage for Intel, after fumbling the 10nm process rollout which landed the company in current financial woes. Therefore, Tan's immediate efforts will focus on improving Intel Foundry output, not only in terms of silicon wafer yields but ensuring it lands contracts for hyperscaler customers such as Amazon, Alphabet (NASDAQ:GOOGL) and Microsoft (NASDAQ:MSFT). "Together, we will work hard to restore Intel's position as a world-class products company, establish ourselves as a world-class foundry and delight our customers like never before. That's what this moment demands of us as we remake Intel for the future," said Lip-Bu Tan, new Intel CEO on March 12th. To further that goal, it is likely that Tan will start cutting the aforementioned middle management bloat as a part of "tough decisions" ahead. The timing is just right, following President Trump's wide-sweeping anti-DEI initiatives. Semiconductor analyst Dylan Patel likens Tan's efforts to resetting Intel's culture. "We expect significant restructuring of the slow and ineffective middle management at Intel. Although his recent time was spent in management, Lip-Bu has technical bona fides and should approach the role with a technical eye," said Dylan Patel of SemiAnalysis. Intel 18A process will power both client CPUs, Panther Lake, with new AI features but also Clearwater Forest lineup specifically designed for AI data center throughput. In early March, Broadcom (NASDAQ:AVGO) and Nvidia created an optimistic buzz around Intel 18A as they began early tests for large volume manufacturing. Long term, Intel should move to a regular AI chip release schedule on par with Nvidia, but this is not expected for at least two years. Prior to 18A rollout at scale, Intel will have to rely on the marketing for existing Xeon 6 and Gaudi 3 AI accelerators for the data center market. *** Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.

[11]

Intel's new CEO plots overhaul of manufacturing and AI operations

STORY: Intel's incoming CEO Lip-Bu Tan is reportedly considering significant changes to its chip manufacturing methods and artificial intelligence strategies. That's according to two people familiar with the matter. It comes ahead of his return to the company on Tuesday (March 18) in a sweeping bid to revive the ailing tech giant. The new trajectory includes restructuring the company's approach to AI. As well as staff cuts to address what Tan views as a slow-moving and bloated middle management layer. The sources added that one of his core priorities would be revamping the company's manufacturing operations. According to two other people briefed on the matter, at a town hall meeting following his appointment as CEO last week, Tan told employees that the company will need to make "tough decisions," Tan is former CEO of chip design software firm Cadence. He was a member of Intel's board until he resigned last August. In returning at the helm, Tan is set to take over the American icon after a decade of multiple CEOs and in which it failed to build chips for smartphones. It also missed surging demand for AI processors. That allowed rivals Arm and Nvidia to dominate those markets. Intel reported an annual loss of $19 billion last year - its first since 1986.

[12]

Intel appoints industry veteran Lip-Bu Tan as CEO

AFP - Intel announced tech industry veteran Lip-Bu Tan as its new chief executive, boosting shares of the United States (US) computer chipmaker struggling to catch up in the artificial intelligence (AI) race. Tan told the Intel team his focus would be on engineering, saying it "won't be easy" to overcome challenges faced by the company. Tan, who was born in Malaysia, will start as Intel chief on March 18, according to the company. Shares were up more than 10 per cent in after market trade. Intel is one of Silicon Valley's most iconic companies, but its fortunes have been eclipsed by Asian powerhouses TSMC and Samsung, which dominate the made-to-order semiconductor business. The company was also caught by surprise with the emergence of Nvidia, a graphics chip maker, as the world's preeminent AI chip provider. Nvidia's strength is in chips for powering AI, which are coveted by tech companies competing in that technology. Intel's niche has been in chips used in traditional computing processes being eclipsed by the AI rage. Tan's predecessor, Pat Gelsinger, was forced out as Intel chief in December after the board lost confidence in his plans to turn the company around. Gelsinger's abrupt departure came just months after the company vowed to cut more than 15,000 jobs in a draconian cost reduction plan and paused or delayed construction on several chipmaking facilities. "I believe with every fibre of my being that we have what it takes to win," Tan said in a message to his team, vowing that Intel will be an engineering-focused company. "In areas where we are behind the competition, we need to take calculated risks to disrupt and leapfrog." While chief of Cadence Design Systems from 2009 to 2021, Tan transformed the company and more than doubled its revenue, according to the Intel board. Former US president Joe Biden's administration last year finalised a USD7.9 billion award to Intel as part of an effort to bring semiconductor production to US shores. But Intel in February extended the timeline for completing two new fabrication plants in Ohio, saying it is taking a prudent approach to the USD28 billion project. "We will continue construction at a slower pace, while maintaining the flexibility to accelerate work and the start of operations if customer demand warrants," Intel Foundry Manufacturing general manager Naga Chandrasekaran told Intel employees at the time. For the full year 2024, Intel recorded a net loss of USD18.8 billion as the US chip giant continues to struggle to stake its place in the artificial intelligence revolution. In Europe, Intel late last year said it was delaying its plans to build two mega chip-making factories in Germany and Poland as the company faces lower demand than anticipated. Intel also said at the time that it would pull back on its projects in Malaysia.

Share

Share

Copy Link

Intel's incoming CEO Lip-Bu Tan is set to implement significant changes to the company's chip manufacturing methods and AI strategies, aiming to revive the tech giant after years of setbacks.

Intel's Leadership Transition and Strategic Overhaul

Intel Corporation is poised for a significant transformation as Lip-Bu Tan, the incoming CEO, prepares to take the helm on Tuesday. Tan, a 65-year-old industry veteran and former CEO of chip design software firm Cadence, is planning a sweeping overhaul of Intel's operations to revitalize the struggling tech giant

1

2

.Addressing Past Challenges

Intel has faced a decade of setbacks under previous leadership, including:

- Failure to capitalize on the smartphone chip market

- Missing the surge in demand for AI processors

- Losing market share to competitors like Arm Holdings and Nvidia

- Reporting an annual loss of $19 billion in 2024, its first since 1986

1

3

Key Areas of Focus

Tan's strategy involves several critical areas:

-

Manufacturing Revamp: A core priority is overhauling Intel's chip manufacturing operations, which have expanded from producing solely for Intel to making semiconductors for external clients like Nvidia

1

. -

AI Strategy Restructuring: The company plans to restart efforts in producing chips for AI servers and explore areas beyond servers, including software, robotics, and AI foundation models

1

3

. -

Management Restructuring: Tan views the current middle management layer as slow-moving and bloated, indicating potential staff cuts to streamline operations

1

2

. -

Customer Acquisition: There's a push to improve performance at Intel Foundry by aggressively wooing new customers, particularly in the contract chip manufacturing space

1

.

Foundry Business and Competition

Tan aims to position Intel as a "world-class foundry," continuing the strategy initiated by former CEO Pat Gelsinger to compete with Taiwan Semiconductor Manufacturing Co. (TSMC)

1

. To succeed, Intel needs to:- Win over at least two large customers for high-volume chip production

- Improve manufacturing processes to attract potential customers like Nvidia, Google, and AMD

- Overcome skepticism from chip designers wary of entrusting production to a competitor

4

AI Chip Development

Reports suggest that Intel could have architecture ready for an AI chip by 2027, with plans to release new versions annually thereafter. This development could be crucial in helping Intel catch up to Nvidia and Broadcom in the AI hardware market

3

.Related Stories

Market Response and Expectations

The announcement of Tan's appointment and his proposed strategies has been well-received by investors:

- Intel's stock surged nearly 15% following the news

- Analysts view Tan's "deep relationships" across the chip ecosystem as a potential draw for customers to Intel's contract manufacturing business

4

However, experts caution that any turnaround is expected to take years, and Intel still faces significant challenges in regaining its market position

4

5

.Conclusion

As Lip-Bu Tan prepares to lead Intel through this critical transition, the tech industry watches closely. His experience, coupled with Intel's resources, may provide the company with a chance to reclaim its position in the rapidly evolving semiconductor and AI markets. However, the road ahead remains challenging, and the success of these strategic changes will only become apparent in the coming years.

References

Summarized by

Navi

[3]

Related Stories

Intel's New CEO Lip-Bu Tan Outlines Ambitious Turnaround Strategy

01 Apr 2025•Business and Economy

Intel's New CEO Lip-Bu Tan Unveils Ambitious AI Strategy and Restructuring Plans

18 Mar 2025•Business and Economy

Intel's Turnaround Strategy: CEO Lip-Bu Tan Urges Patience Amid AI and Manufacturing Challenges

25 Apr 2025•Business and Economy

Recent Highlights

1

ByteDance Faces Hollywood Backlash After Seedance 2.0 Creates Unauthorized Celebrity Deepfakes

Technology

2

Microsoft AI chief predicts artificial intelligence will automate most white-collar jobs in 18 months

Business and Economy

3

Google reports state-sponsored hackers exploit Gemini AI across all stages of cyberattacks

Technology