Intel Delays €30 Billion German Chip Plant Amid Economic Uncertainty

6 Sources

6 Sources

[1]

Intel outlines plans to cut costs and boost chip business in turnaround push

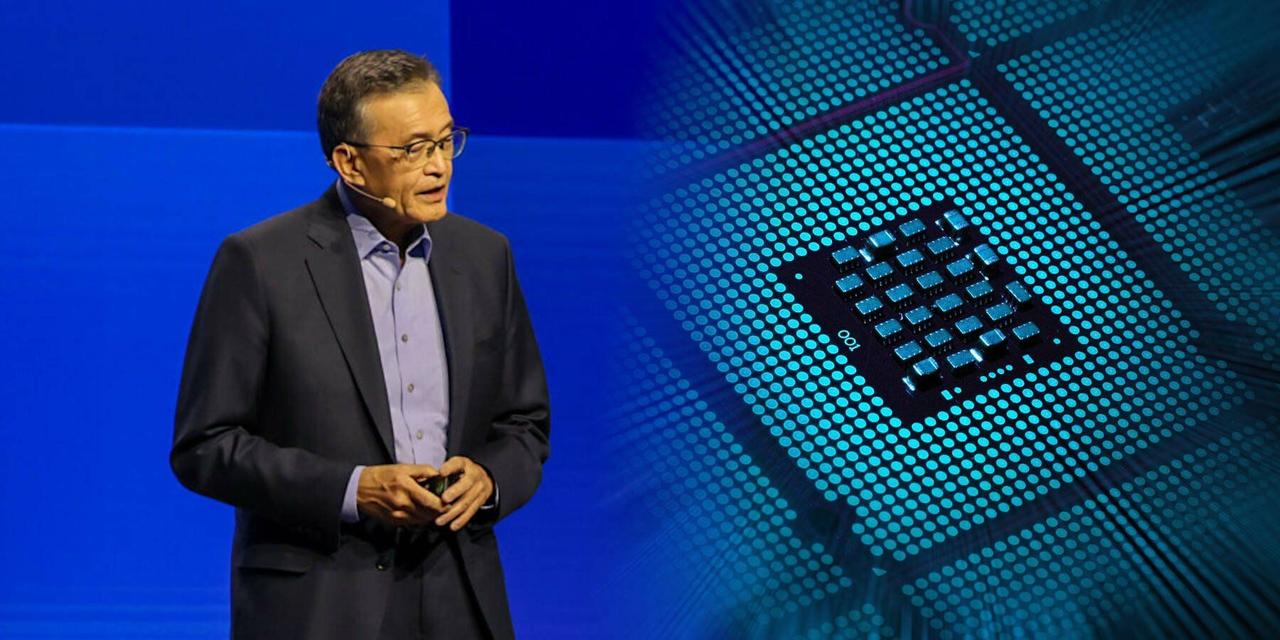

Intel unveiled cost-cutting and restructuring measures, including a two-year pause on planned chip plants in Germany and Poland, as chief executive Pat Gelsinger seeks to turn around the chipmaker's flagging fortunes. The announcement follows a crunch board meeting last week for the US chipmaker, whose shares have fallen sharply since August when it reported disappointing earnings results and an initial round of cuts, as well as a pause to its dividend. As well as making further moves to establish its chip manufacturing business as an independent subsidiary, Intel also plans to "reduce or exit" about two-thirds of its real estate globally by the end of the year. A plant in Ireland, which is being built with funding from private equity group Apollo, will remain the company's "lead European hub", Gelsinger said in a note to employees. The announcement of a pause to Intel's multibillion-dollar project in Magdeburg, Germany, is a major blow to the government of Olaf Scholz, which had touted the €30bn project as the largest foreign investment in Germany's postwar history. The plant was also seen as pivotal to EU plans to double its share of the global semiconductor market from less than 10 per cent today to 20 per cent by 2030. But some parts of the government will greet Intel's move with relief. Berlin had promised the company €9.9bn in subsidies, which many economists had criticised as excessive. With Intel pausing the project, the financial incentives may not now have to be paid -- a prospect that will relieve pressure on the German treasury at a time of intense focus on the country's budget. At the same time, Intel said it will build an artificial intelligence chip for Amazon using its new and most advanced "18A" manufacturing process, in what it described as a "multiyear, multibillion-dollar framework". The companies say they will co-invest in custom chip designs. Amazon has its own line of AI chips, dubbed Trainium and Inferentia, as it seeks to manage costs by designing chips in-house and reduce its reliance on market leader Nvidia. Analysts say securing major customers for 18A is critical for Intel's long-term fortunes. Microsoft is one of the first public customers for Intel's latest 18A manufacturing process. Intel shares were up almost 9 per cent in after-hours trading. Gelsinger has been working to separate the company's chip manufacturing business more clearly from its product business as he seeks to compete with Taiwan's TSMC and build a client-facing chip manufacturing powerhouse in the US. Filings earlier this year revealed a $7bn loss for its chipmaking business in 2023, as the company poured billions of dollars into building new facilities in Arizona, Ohio, New Mexico and Oregon. Gelsinger said the company's manufacturing unit would have a new governance structure with its own operating board of independent directors. Clearer separation from the rest of Intel, he wrote, would "unlock important benefits" including "flexibility to evaluate independent sources of funding" and optimising the capital structure of each business. The revelation of the $7bn loss in April added to anxieties about the company's financial health as it seeks to compete with Nvidia and AMD in the AI chip space and with PC chips built on Arm's architecture, which pose a challenge to its own X86 architecture. Gelsinger on Monday said the company would also be "streamlining" and "simplifying" its X86 portfolio by reorganising the company's internal product groups. Intel is in the middle of cutting 15,000 employees, and he said the group is "more than halfway" towards the target. Earlier on Monday, the US Department of Commerce and Department of Defence announced a further $3bn in direct funding for Intel to help it build chips for the US military. That comes on top of a preliminary agreement between the US government and the company for a $8.5bn grant and $11bn loan under the Chips Act, designed to boost domestic chipmaking capacity, unveiled in March. In his message to Intel staff, Gelsinger said the company had a "strong" board "whose job it is to challenge and push us to perform at our best". Discussions with them last week, he said, were "highly productive and supportive".

[2]

Here's why Intel's plan to shelve a €30bn German plant could rupture its government.

Intel has confirmed it will shelve plans to construct a mammoth €30 billion chip factory in Germany, sending its struggling government into a panic over the billions of euros it has committed to the project. The struggling computing giant announced plans to postpone its plant in Magdeburg by up to two years as part of a rejigged AI chip plan in a bid to woo burned investors. Intel's shares have more than halved this year amid falling revenues and an investor swarm to AI chipmaking competitors, leaving it at risk of being ousted from the Dow Jones. However, following the announcement, shares jumped more than 6% in pre-market trading on Tuesday. A significant part of Intel's turnaround plan involves a huge cost-cutting drive that includes slashing headcount by 15%. It is also holding off on unnecessary expenditure, with its German plant identified as one of those cases. Intel's Irish operation, though, was spared the sword in Intel's ruthless announcement. Reports swirled earlier this month that Intel was considering shelving or even abandoning plans for its €30 billion German plant. The postponement will offer some relief to Chancellor Olaf Scholz as Germany's manufacturing sector sits mired in a two-and-a-half-year-long recession. Intel said it could postpone production by up to two years, depending on demand. The decision leaves the future of 3,000 potential jobs in limbo as they await Intel's next move in Germany. In addition to its German plant, Intel said it was postponing plans for its €4.6 billion Poland factory, which was expected to create 2,000 jobs. At the same time as it cuts back on its European strategy, Intel has doubled down on its plans in the U.S., committing to expansion projects in Arizona, New Mexico, Oregon, and Ohio. While Intel says the giant factory in Magdeburg will go ahead eventually, it has caused members of Germany's coalition government to break rank as panic stews about the long-term prospects of its massive industrial sector. Germany committed €9.9 billion in public funding to the Intel plant when it was announced in June last year. In response to Intel's announcement, Germany's finance minister, Christian Lindner, who is aligned with a different party from Chancellor Scholz, has called for the funds to be redistributed to plug an urgent gap in Germany's finances. In a post on X, formerly Twitter, said. "All funds not required for Intel must be reserved to reduce open financial issues in the federal budget. Anything else would not be responsible policy." The German government faces a €12 billion hole in its finances for 2025, and there is little indication yet of how it will be closed. The government has already softened strict fiscal targets, reducing that hole from €19 billion in August, allowing it to run a bigger deficit next year. The immediate response of Germany's finance minister speaks to unrest within the ruling coalition government, which is facing pressure from a right-wing surge. Lindner hails from Germany's Free Democratic Party, while Chancellor Scholz is the leader of the Social Democratic Party. Pressure from Lindner could leave Scholz in a bind, fearing reprisals from Intel if the allocated €10 billion for the plant are removed while facing the ire of voters if he lets the sum sit unused for up to two years. For his part, Scholz doubled down on his government's partnership with Intel, suggesting Lindner won't get his wish. "The decision to postpone the project in Germany for two years is a decision that also includes the intention to stick with it," Scholz said on Tuesday. "It is important for us that we take this opportunity in this very volatile business of the semiconductor industry to help ensure that there is nevertheless a further expansion of the already profound capacities in Germany," he said. Lindner's compatriot in government, Scholz, is facing the worst approval ratings for a chancellor since Germany reunified in 1990. As he deals with the potential of thousands of job cuts at Germany's largest employer, Volkswagen, Intel's cooling interest in the country could scarcely have come at a worse time for Scholz.

[3]

US tech giant halts €30bn factory in latest blow to German economy

Intel's Saxony plant is scheduled to be the biggest ever foreign investment in the country James Titcomb Technology Editor 17 September 2024 11:40am Intel has halted plans for a €30bn (£25bn) microchip facility in Germany in a major blow to Europe's technology plans. The US chipmaking giant said it would delay construction at a site in Magdeburg by around two years, as well as postponing a facility in Poland, despite receiving billions of euros in state subsidies. The announcement came as the Silicon Valley icon unveiled a radical overhaul aimed at reversing a share price collapse, fuelled by concerns that Intel has lost its ability to make cutting-edge chips. Intel chief executive Pat Gelsinger told investors that it would separate its manufacturing arm from the rest of the business, signalling a possible future break-up of the company. German Chancellor Olaf Scholz last year agreed to award Intel €10bn in subsidies to encourage it to build a plant in Magdeburg, in the chipmaking hub of Saxony. It was part of an effort to wean Europe off semiconductors made in China and Taiwan, with Mr Scholz saying the plant would help Germany "become one of the world's major semiconductor production locations". The plant is scheduled to be the biggest-ever foreign investment in Germany, with Intel claiming it would create 3,000 permanent jobs and 7,000 construction jobs while it was being built. The EU has outlined tens of billions in funding to help it double its share of semiconductor manufacturing to 20pc. The subsidies, which will not be paid until the plant is being built, have been controversial in Germany at a time of economic pressure and concerns about public spending. Intel's decision to delay work on the facility, which was expected to begin next year, has already sparked a row among members of Germany's coalition government. Finance minister Christian Lindner, of the centre-right Free Democratic Party, said the proposed subsidies should be used to plug a black hole in Germany's budget, while economy minister Robert Habeck, of the Green party, said they should be deployed "for the good of the country". Mr Gelsinger said Intel's facility in Ireland, on the outskirts of Dublin, would "remain our lead European hub for the foreseeable future". The company recently sold a 49pc stake in the plant to private equity giant Apollo for $11bn (£8.3bn). Intel, the company that invented the microprocessor and was once seen as the world's most advanced semiconductor company, has fallen behind Asian rivals such as Taiwan's TSMC and Samsung in advanced chip manufacturing in recent years. It is also suffering as tech giants spend more on artificial intelligence chips designed by Nvidia rather than Intel's traditional processors when building data centres. The company is spending tens of billions of dollars as part of its turnaround, supported in part by US subsidies. However, its shares have fallen by 56pc this year and the company recently announced plans to cut 15,000 jobs, a sixth of its workforce, as well as suspending its dividend. Intel shares jumped in after-hours trading on Monday as Mr Gelsinger announced the Germany delays, as well as a deal with Amazon to manufacture an AI chip. Recommended Germany's left behind, 'second class citizens' fuel a backlash against Berlin Read more

[4]

Intel postpones construction of German chip factory for two years

US chip-maker Intel has announced plans to postpone the construction of a factory in Germany for at least two years. Intel chief executive, Pat Gelsinger, said on Monday that the company will postpone the construction of a chip factory in Magdeburg, Germany, for at least two years. According to news agency Deutsche Presse-Agentur (DPA), Intel was planning to build two chip factories in Saxony-Anhalt near Berlin, creating some 3,000 jobs, with a groundbreaking ceremony planned for this year. "It was an investment estimated at around €30 billion ($33 billion) and last year, the German government promised state aid worth €9.9 billion for the settlement," DPA reported. However, the plans have now been put on hold as Intel struggles to get on top of losses. The group launched a cost-saving plan earlier this year. "We must continue acting with urgency to create a more competitive cost structure and deliver the $10 billion in savings target we announced last month," Gelsinger said in a press release and letter to employees. "We will pause our projects in Poland and Germany by approximately two years based on anticipated market demand," he added. Production was expected to begin in 2027 or 2028. Gelsinger also announced on Monday Intel's partnership with Amazon Web Services. "This includes a co-investment in custom chip designs, and we have announced a multi-year, multi-billion-dollar framework covering product and wafers from Intel. "Specifically, Intel Foundry will produce an AI fabric chip for AWS on Intel 18A. We will also produce a custom Xeon 6 chip on Intel 3 that builds on our existing partnership, under which Intel produces Xeon Scalable processors for AWS. More broadly, we expect to have deep engagement with AWS on additional designs spanning Intel 18A, Intel 18AP and Intel 14A," he said in the statement. "This framework reflects the power of our "better together" strategy, anchored on our integrated portfolio across foundry services, infrastructure and x86 products. And with the 5N4Y finish line in sight, we are beginning to see a meaningful uptick in interest from foundry customers. This includes continued momentum in advanced packaging, which remains a meaningful differentiator for Intel Foundry as we have tripled our deal pipeline since the beginning of the year," he added.

[5]

Germany's Scholz Disappointed By Delay To Intel Chip Plant

Chancellor Olaf Scholz voiced disappointment Tuesday after US semiconductor giant Intel delayed plans to build a mega chip-making plant in Germany which had been championed by Berlin. The news also stoked fresh tensions in Scholz's uneasy ruling coalition, with a row breaking out over what should be done with around 10 billion euros ($11 billion) in subsidies earmarked for the project. The government "takes note of the announcement about the delay with disappointment and continues to believe the project is worthwhile and deserves support", said Scholz. The chancellor welcomed the fact that Intel had indicated it wants to "stick with" the project in the long term. Intel announced Monday that it was postponing the project in the eastern German city of Magdeburg, along with another one in Poland, by around two years due to lower expected demand. The chip-making giant announced plans for the German plant in 2022, in what was seen as a major boost for EU efforts to ramp up semiconductor production in the bloc. Construction work on the Intel project was due to begin in 2023 but it stalled after the Ukraine war sent inflation soaring. German officials and the company were then locked in talks on financing for months, but the two sides finally signed a deal in June 2023, which included higher government subsidies for the 30-billion-euro project. Since, Intel has reported disappointing results and announced major job cuts as it faces fierce competition, particularly from Nvidia, in the race to make cutting-edge chips for artificial intelligence. Despite the setback for Germany, Scholz stressed there were still over 30 semiconductor projects underway in Germany. Other chip giants, including Taiwan's TSMC, have announced major investments in Germany. "For the sake of our sovereignty, and for our technological leadership, we will continue to insist that semiconductor production takes place in Europe and especially in Germany," he said during a visit to Kazakh capital Astana. He refused to be drawn on what should be done with the public funds that had been set aside for the Intel plant. But shortly after Intel's announcement, Finance Minister Christian Linder from the pro-business FDP party said the money should be used to plug holes in the budget. "Anything else would not be responsible policy," he wrote on X. But sources from the economy ministry, which is headed by the Green party, the third member of the coalition led by Social Democrat Scholz, said the money should remain in a special "climate and transformation fund", and could not be used in the main budget.

[6]

Germany's Scholz disappointed by delay to Intel chip plant

Frankfurt (Germany) (AFP) - Chancellor Olaf Scholz voiced disappointment Tuesday after US semiconductor giant Intel delayed plans to build a mega chip-making plant in Germany which had been championed by Berlin. The news also stoked fresh tensions in Scholz's uneasy ruling coalition, with a row breaking out over what should be done with around 10 billion euros ($11 billion) in subsidies earmarked for the project. The government "takes note of the announcement about the delay with disappointment and continues to believe the project is worthwhile and deserves support", said Scholz. The chancellor welcomed the fact that Intel had indicated it wants to "stick with" the project in the long term. Intel announced Monday that it was postponing the project in the eastern German city of Magdeburg, along with another one in Poland, by around two years due to lower expected demand. The chip-making giant announced plans for the German plant in 2022, in what was seen as a major boost for EU efforts to ramp up semiconductor production in the bloc. Construction work on the Intel project was due to begin in 2023 but it stalled after the Ukraine war sent inflation soaring. German officials and the company were then locked in talks on financing for months, but the two sides finally signed a deal in June 2023, which included higher government subsidies for the 30-billion-euro project. Since, Intel has reported disappointing results and announced major job cuts as it faces fierce competition, particularly from Nvidia, in the race to make cutting-edge chips for artificial intelligence. Despite the setback for Germany, Scholz stressed there were still over 30 semiconductor projects underway in Germany. Other chip giants, including Taiwan's TSMC, have announced major investments in Germany. "For the sake of our sovereignty, and for our technological leadership, we will continue to insist that semiconductor production takes place in Europe and especially in Germany," he said during a visit to Kazakh capital Astana. He refused to be drawn on what should be done with the public funds that had been set aside for the Intel plant. But shortly after Intel's announcement, Finance Minister Christian Linder from the pro-business FDP party said the money should be used to plug holes in the budget. "Anything else would not be responsible policy," he wrote on X. But sources from the economy ministry, which is headed by the Green party, the third member of the coalition led by Social Democrat Scholz, said the money should remain in a special "climate and transformation fund", and could not be used in the main budget.

Share

Share

Copy Link

Intel has postponed the construction of its €30 billion chip manufacturing plant in Magdeburg, Germany, citing economic challenges. The delay has sparked concerns about Europe's semiconductor ambitions and Germany's economic policies.

Intel Halts Plans for Massive German Chip Factory

In a significant setback for Europe's semiconductor industry, Intel has announced a two-year delay in the construction of its €30 billion chip manufacturing plant in Magdeburg, Germany. The decision, revealed in September 2024, has sent shockwaves through the tech sector and raised questions about the future of Europe's chip manufacturing ambitions

1

.Economic Challenges and Government Subsidies

Intel cited economic uncertainties and the need for additional government subsidies as primary reasons for the postponement. The company had initially planned to begin construction in the first half of 2023, with chip production slated to start in 2027. However, rising inflation and energy costs have significantly impacted the project's viability

2

.The German government had already pledged €6.8 billion in subsidies for the project, representing a substantial portion of the country's €20 billion chip strategy budget. Intel's request for additional support has sparked debate within Germany's coalition government, with some members expressing concerns about the increasing costs

3

.Impact on Europe's Chip Strategy

The delay is a significant blow to the European Union's ambitious plan to boost its share of global chip production to 20% by 2030. The Magdeburg facility was intended to be a cornerstone of this strategy, aimed at reducing Europe's dependence on Asian manufacturers and strengthening the continent's technological sovereignty

4

.Related Stories

Political Fallout and Economic Implications

German Chancellor Olaf Scholz expressed disappointment over the delay, emphasizing the project's importance for Germany's technological future. The postponement has also reignited debates about Germany's economic policies and its ability to attract and retain major international investments

5

.Industry Reactions and Future Outlook

The semiconductor industry has reacted with concern to Intel's decision. Experts warn that the delay could have ripple effects across Europe's tech sector, potentially slowing down advancements in areas such as artificial intelligence, autonomous vehicles, and 5G networks.

Despite the setback, Intel has reaffirmed its long-term commitment to the project and to expanding its European operations. The company stated that it is working closely with the German government to address the challenges and move forward with the plant's construction as soon as economic conditions improve.

References

Summarized by

Navi

[3]

Related Stories

Recent Highlights

1

SpaceX acquires xAI as Elon Musk bets big on 1 million satellite constellation for orbital AI

Technology

2

French Police Raid X Office as Grok Investigation Expands to Include Holocaust Denial Claims

Policy and Regulation

3

UNICEF Demands Global Crackdown on AI-Generated Child Abuse as 1.2 Million Kids Victimized

Policy and Regulation