Intel's 18A Chip Production Process Disappoints Broadcom in Recent Tests

5 Sources

5 Sources

[1]

New Intel chip production process reportedly underperformed in Broadcom test - SiliconANGLE

New Intel chip production process reportedly underperformed in Broadcom test A new chip manufacturing process from Intel Corp. failed to meet Broadcom Inc.'s expectations in a recent evaluation, Reuters reported today. The development may mark a setback for Intel's foundry business. The unit uses the company's fabs to make processors for other organizations based on their own custom designs. Broadcom, one of the world's largest chipmakers, could potentially become a major source of foundry revenue for Intel. Sources told Reuters that Broadcom is studying whether it can make chips using Intel's upcoming Intel 18A process. The process is scheduled to enter production next year. According to today's report, Broadcom received several prototype wafers made with Intel 18A last month and determined that the process is not yet ready for mass production. Intel 18A introduces two main innovations not available in the company's current chips. The first is a gate-all-around transistor design, while the other is a power management technology known as PowerVia. The gate is the part of the transistor that manages how electricity flows through its structure. In Intel 18A, the gate fully surrounds the transistor to which it's attached surrounds rather than only partly as before. This arrangement reduces the amount of electricity that leaks out of the transistor, which increases chips' power-efficiency, and boosts performance in the process. The other major feature of Intel 18A is a technology called PowerVia. Typically, the tiny wires that deliver electricity to a processor's transistors are placed above them. PowerVia moves the wires below the transistors, which allows Intel to place transistors closer apart and thereby include more of them in each chip to boost performance. It's unclear exactly why Intel 18A failed to meet Broadcom's requirements. There may be an issue with the yield, a metric used to track the number of chips that must be discarded because of production faults. Alternatively, the chips' performance may have fallen short of Broadcom's expectations. The speed of processors can vary significantly even if they share a common design and were manufactured as part of the same wafer. Today's report didn't specify what chips Broadcom might seek to make with Intel 18A technology. Because of their steep cost, cutting-edge chip production nodes are typically only used to make high-end processors. Broadcom may be considering having Intel produce its top-end processors for powering network devices. Those chips can process tens of terabits of data traffic per second as well as automate tasks such as fixing network bottlenecks. They're used in, among other environments, artificial intelligence clusters. Alternatively, Broadcom might be looking to use Intel 18A to make the custom AI chips it co-develops with customers such as Google LLC. According to a J.P. Morgan analysis cited by Reuters, those custom processors are expected to generate up to $12 billion in revenue for the company this year. That's up from $4 billion in 2023. Intel's foundry unit lost $7 billion on $18.9 billion in sales during the 2023 fiscal year. Much of that revenue was tied to the production of the company's own chips. Earlier this year, Intel projected that the unit would break even in 2027. A dozen foundry customers are currently reviewing the Intel 18A node. Earlier this month, the chipmaker disclosed that the process moved a step closer toward mass production after its engineers had successfully powered on a number of prototype Intel 18A chips. Moreover, they managed to boot operating systems on those chips. Intel said in a statement following today's report that "Intel 18A is powered on, healthy and yielding well, and we remain fully on track to begin high volume manufacturing next year." Broadcom stated that it's "evaluating the product and service offerings of Intel Foundry and have not concluded that evaluation."

[2]

Intel's Foundry Business Fails To Impress Broadcom With Latest 18A Process - Report

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy. Chip manufacturer Intel Corpration's contract manufacturing plans have apparently been dealt with a setback as wafer tests run by Broadcom's analysts have failed to yield satisfactory results, according to sources quoted by Reuters. These tests covered Intel's leading edge semiconductor technology, 18A, and after Intel shipped its customer the wafers last month, Broadloom's tests concluded that the process technology was not ready to move to high volume production. Semiconductor production takes place in phases, with high volume production being one of the final stages after chip manufacturers have fine tuned their equipment before feeling comfortable to risk thousands of wafers in production. Following its disastrous earnings report in August that saw Intel announce a 15% workforce reduction along with a dividend suspension and meek third quarter guidance, the spotlight is even sharper on the firm's contract manufacturing plans. These plans, part of Intel's Intel Foundry Services Business, seek to emulate the Taiwanese TSMC's successes in the semiconductor industry and offer firms such as NVIDIA, AMD and Broadcom a chance to have their chips manufactured by Intel. According to three sources quoted by Reuters, Intel used its leading edge 18A manufacturing technology to print circuits on wafers sent by Broadcom before sending them back last month. However, after Broadcom evaluated them, its engineers were doubtful of 18A's ability to move to high volume production. High volume production is typically one of the final stages in the production process , and success on this front would have provided some much needed life for Intel's shares, which are down 58% year to date. Both Intel and Broadcom responded to Reuters' requests for comments. Broadcom shared that it has been testing Intel Foundry Services' products and these tests remain ongoing with no final conclusions having been reached. Intel stressed that 18A remains on track for high-volume production in 2025. "Intel 18A is powered on, healthy, and yielding well, and we remain fully on track to begin high-volume manufacturing next year," the company said, adding that it does not comment on specific customer orders. Reuters' sources hint that the problems might have to do with 18A's yield. A manufacturing technology's yield is the number of usable chips in a wafer, and higher yields are necessary for stable customer partnerships. Yield troubles are also common in the early phases of a chip manufacturing technology, and unsurprising for Intel's 18A which, in marketing terms at least, is the most advanced semiconductor fabrication process in the world. The firm's Taiwanese rival TSMC aims to produce its 2-nanometer chips in 2025. 2-nanometer, or 2nm, is equivalent to 20A, and a successful 18A ramp in 2025 could provide Intel with a key edge over its Taiwanese rival right at a time when AI chips are becoming some of the most hotly demanded products in the world.

[3]

Broadcom disappointed with Intel 18A process technology -- says it's not currently viable for high-volume production

According to Reuters, Intel's ambitions to become the world's second-largest contract chipmaker by 2030 seem to have encountered a major hurdle after Broadcom's trial runs using Intel's 18A fabrication technology did not meet expectations. This setback adds pressure to Intel's revival plan and a goal to leave TSMC behind in manufacturing process advancements, but the situation is not that dramatic. To test Intel's 18A (1.8nm-class) process technology, Broadcom produced wafers with test patterns typical of the products it designs. After the company received these shuttle wafers, its engineers and executives were unsatisfied with the production node, claiming it was 'not yet viable to move to high-volume production,' according to Reuters. It could be a blow for Intel's foundry unit, but Intel disclosed defect density for its 18A process last week, and it looks healthy enough for a node that will enter mass production two or three-quarters down the road. "I am happy to update the audience that that we are now, for this production process, we are now below 0.4 d0 defect density, this is now a healthy process," said Pat Gelsinger, chief executive of Intel, at the Deutsche Bank's 2024 Technology Conference. Generally, it is considered that a defect density below 0.5 defects per square centimeter is a good result, so even keeping in mind that defect density varies by process and application, Intel 18A's defect density of 0.4 defects per square centimeter is a reasonably good result considering its timing. Yet, TSMC's N7 and N5 technologies had a defect density of 0.33 at a similar development stage, and when TSMC's N5 reached mass production, its defect density dropped to 0.1. Yet, TSMC's N3 started with a higher defect density but matched N5's defect rate after five to six quarters. Also, Broadcom has yet to finalize its assessment of Intel's 18A manufacturing technology, signaling that its evaluation is ongoing, the company's spokesperson told Reuters. Broadcom is a major supplier of chips for telecommunication equipment as well as one of the world's leading contract chip designers, which develops TPU AI processors for Google and is rumored to be working on AI processors for OpenAI, which makes Broadcom a particularly important customer for TSMC and a desired client for other foundries, including Intel. But it takes a lot to serve Broadcom properly. Earlier this year, Broadcom demonstrated what was considered the world's largest processor at the time. The XPU used two near the reticle limit (858mm^2, 26 mm by 33 mm) to compute chiplets with six HBM3 memory stacks each (i.e., 12 HBM3 stacks total). In context, Nvidia's B200 GPU consists of two near-reticle limits compute chiplets and eight HBM3E stacks. Creating a chiplet of this size is a significant achievement. Achieving a good yield with such a chiplet is another milestone, and Broadcom's and Nvidia's foundry partner TSMC has succeeded in this. It means that to serve Broadcom using its 18A process technology, Intel needs to be able to make chaplets of this scale with good yields, which is not easy. Whether or not the company will be able to meet Broadcom's requirements for defects and yields of big chips with its 18A in 2025 remains to be seen, but for now, Broadcom does not seem to be satisfied.

[4]

Exclusive-Intel manufacturing business suffers setback as Broadcom tests disappoint, sources say

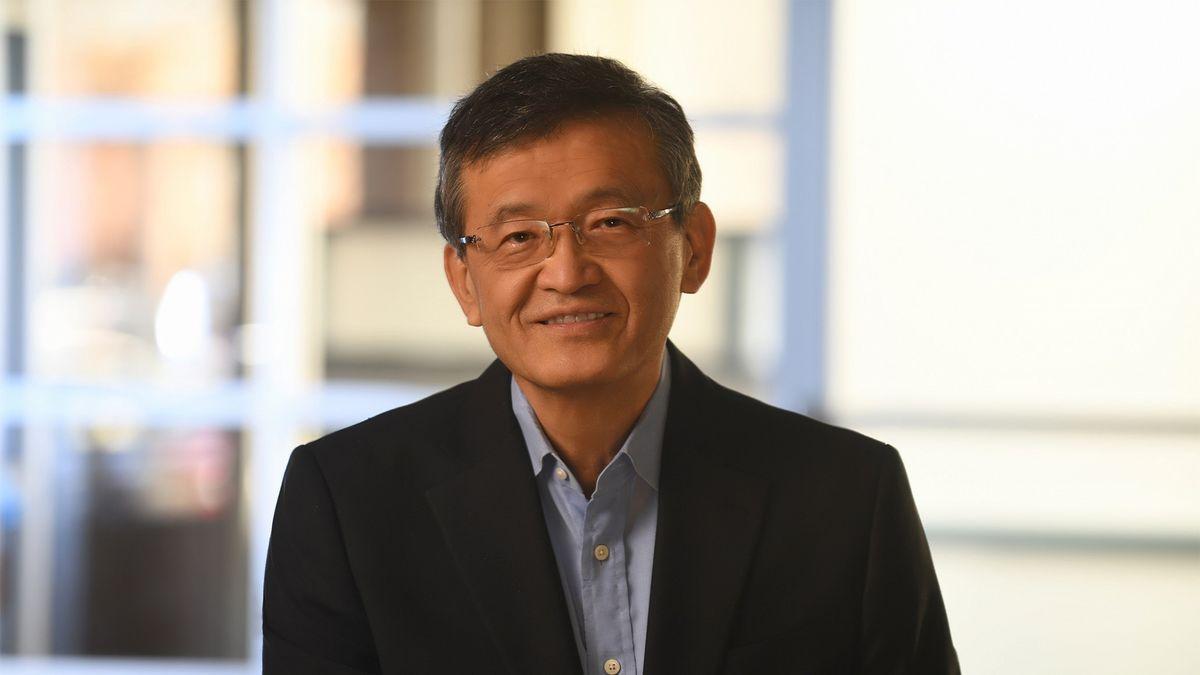

Reuters could not determine the current relationship between Broadcom and Intel or whether Broadcom had decided to walk away from a potential manufacturing deal. "Intel 18A is powered on, healthy and yielding well, and we remain fully on track to begin high volume manufacturing next year," an Intel spokesperson said in a statement. "There is a great deal of interest in Intel 18A across the industry but, as a matter of policy, we do not comment on specific customer conversations." A Broadcom spokesperson said the company is "evaluating the product and service offerings of Intel Foundry and have not concluded that evaluation." Intel's contract manufacturing business was launched in 2021 as a key part of Chief Executive Pat Gelsinger's turnaround strategy. Broadcom is not a household name but makes crucial networking gear and radio chips that helped generate $28 billion in overall chip sales in its last fiscal year. It has benefited from the boom in spending on artificial intelligence hardware, and J.P. Morgan analyst Harlan Sur estimated it will bank $11 billion to $12 billion from AI this year, up from $4 billion last year. Some of its chip sales are from agreements with companies such as Alphabet's Google and Meta Platforms to help produce in-house AI processors, which can include arrangements with a manufacturer, such as Intel or Taiwan Semiconductor Manufacturing Co. As part of a disastrous second-quarter earnings report that shaved more than a quarter from the company's market value, Intel announced a 15% job cut and a reduction in capital spending related to its factory construction. Gelsinger and other executives will present a plan to the board of directors in mid-September on possible cuts to business units and teams to reduce costs, Reuters reported on Sunday. Intel has committed to about $100 billion of expansion and new factory construction at several sites in the U.S. A crucial part of the company's expansion includes attracting big customers such as Nvidia or Apple to fill up capacity at all its new sites. Intel reported a $7 billion operating loss for the foundry business, wider than the $5.2 billion in losses the year earlier. Executives expect the contract chip business to achieve breakeven in 2027. Typically fabricating an advanced chip requires more than 1,000 separate steps inside a chip factory, or fab, and takes roughly three months to complete. Production success is determined by the number of working chips on each silicon wafer. Achieving a substantial yield is crucial to move to producing the tens of thousands or hundreds of thousands of wafers demanded by big chip designers. Broadcom's engineers had concerns with the viability of the process, the sources said. Typically that refers to the number of defects on each wafer or the quality of the chips fabricated. For an advanced manufacturing process used by TSMC, the Taiwanese giant charges roughly $23,000 per wafer at high volume, according to two sources familiar with wafer pricing. Reuters could not determine Intel's wafer pricing. Moving a chip design from a manufacturing process used by a company such as TSMC to another vendor such as Samsung or Intel can take months and requires dozens of engineers, depending on the complexity of the chip and the differences in manufacturing technology. Betting on a new manufacturing process such as Intel's 18A is impossible for some smaller chip companies because doing so would require resources they do not have. Intel released its manufacturing tool kit for its 18A process to other chipmakers over the summer, Gelsinger said on an earnings call last month. The company plans to be "manufacturing-ready" by the end of this year for its own chips and begin high volume production for external customers in 2025, Gelsinger said. At an investor conference last week, he said there are a dozen customers "actively engaged" with the tool kit. (Max A. Cherney in San Francisco; Editing by Kenneth Li and Matthew Lewis)

[5]

Intel manufacturing business suffers setback as Broadcom tests disappoint, sources say

Intel's contract manufacturing business has suffered a setback after tests with chipmaker Broadcom failed, three sources familiar with the matter told Reuters, dealing a blow to the company's turnaround efforts. The tests conducted by Broadcom involved sending silicon wafers - the foot-wide discs on which chips are printed - through Intel's most advanced manufacturing process known as 18A, the sources said. Broadcom received the wafers back from Intel last month. After its engineers and executives studied the results, the company concluded the manufacturing process is not yet viable to move to high-volume production. Reuters could not determine the current relationship between Broadcom and Intel or whether Broadcom had decided to walk away from a potential manufacturing deal. "Intel 18A is powered on, healthy and yielding well, and we remain fully on track to begin high volume manufacturing next year," an Intel spokesperson said in a statement. "There is a great deal of interest in Intel 18A across the industry but, as a matter of policy, we do not comment on specific customer conversations." A Broadcom spokesperson said the company is "evaluating the product and service offerings of Intel Foundry and have not concluded that evaluation." Intel's contract manufacturing business was launched in 2021 as a key part of Chief Executive Pat Gelsinger's turnaround strategy. Broadcom is not a household name but makes crucial networking gear and radio chips that helped generate $28 billion in overall chip sales in its last fiscal year. It has benefited from the boom in spending on artificial intelligence hardware, and J.P. Morgan analyst Harlan Sur estimated it will bank $11 billion to $12 billion from AI this year, up from $4 billion last year. Some of its chip sales are from agreements with companies such as Alphabet's Google and Meta Platforms to help produce in-house AI processors, which can include arrangements with a manufacturer, such as Intel or Taiwan Semiconductor Manufacturing Co. Crucial setback As part of a disastrous second-quarter earnings report that shaved more than a quarter from the company's market value, Intel announced a 15% job cut and a reduction in capital spending related to its factory construction. Gelsinger and other executives will present a plan to the board of directors in mid-September on possible cuts to business units and teams to reduce costs, Reuters reported on Sunday. Intel has committed to about $100 billion of expansion and new factory construction at several sites in the U.S. A crucial part of the company's expansion includes attracting big customers such as Nvidia or Apple to fill up capacity at all its new sites. Intel reported a $7 billion operating loss for the foundry business, wider than the $5.2 billion in losses the year earlier. Executives expect the contract chip business to achieve breakeven in 2027. Typically fabricating an advanced chip requires more than 1,000 separate steps inside a chip factory, or fab, and takes roughly three months to complete. Production success is determined by the number of working chips on each silicon wafer. Achieving a substantial yield is crucial to move to producing the tens of thousands or hundreds of thousands of wafers demanded by big chip designers. Broadcom's engineers had concerns with the viability of the process, the sources said. Typically that refers to the number of defects on each wafer or the quality of the chips fabricated. For an advanced manufacturing process used by TSMC, the Taiwanese giant charges roughly $23,000 per wafer at high volume, according to two sources familiar with wafer pricing. Reuters could not determine Intel's wafer pricing. TSMC declined to comment on its wafer pricing. Moving a chip design from a manufacturing process used by a company such as TSMC to another vendor such as Samsung or Intel can take months and requires dozens of engineers, depending on the complexity of the chip and the differences in manufacturing technology. Betting on a new manufacturing process such as Intel's 18A is impossible for some smaller chip companies because doing so would require resources they do not have. Intel released its manufacturing tool kit for its 18A process to other chipmakers over the summer, Gelsinger said on an earnings call last month. The company plans to be "manufacturing-ready" by the end of this year for its own chips and begin high volume production for external customers in 2025, Gelsinger said. At an investor conference last week, he said there are a dozen customers "actively engaged" with the tool kit. Read Comments

Share

Share

Copy Link

Intel's latest 18A chip manufacturing process has reportedly underperformed in tests conducted by Broadcom, potentially impacting Intel's foundry business ambitions and its competition with TSMC.

Intel's 18A Process Falls Short in Broadcom Tests

Intel's ambitious plans to compete with Taiwan Semiconductor Manufacturing Co (TSMC) in the chip foundry business have hit a significant roadblock. Recent tests of Intel's cutting-edge 18A manufacturing process by potential customer Broadcom have reportedly yielded disappointing results, casting doubt on the viability of Intel's latest technology for high-volume production

1

.Technical Challenges and Performance Issues

The 18A process, part of Intel's five-nodes-in-four-years strategy, was expected to be a game-changer in the semiconductor industry. However, sources familiar with the matter have revealed that Broadcom's evaluation of the process found it to be "currently not commercially viable" for large-scale chip production

2

. This assessment is particularly concerning given that the 18A process is crucial for Intel's plans to catch up with and potentially surpass TSMC in advanced chip manufacturing.Impact on Intel's Foundry Ambitions

Intel has been actively pursuing a strategy to open its factories to external customers, aiming to challenge TSMC's dominance in the contract chip manufacturing market. The company had previously announced that it was in talks with major customers like Nvidia and Apple. However, the setback with Broadcom could potentially deter other high-profile clients from committing to Intel's foundry services

3

.Related Stories

Industry Implications and Competitive Landscape

The news of Broadcom's disappointment with Intel's 18A process has sent ripples through the semiconductor industry. It highlights the intense competition and technical challenges in advanced chip manufacturing. TSMC, which has been leading the race in cutting-edge chip production, stands to benefit from Intel's setback as it continues to dominate the market for the most advanced chips

4

.Intel's Response and Future Outlook

Intel has not publicly commented on the specific results of Broadcom's tests. However, the company maintains that its roadmap for advanced chip manufacturing technologies remains on track. Intel CEO Pat Gelsinger has previously expressed confidence in the company's ability to regain technological leadership by 2025

5

.Despite this setback, Intel continues to invest heavily in its foundry services business, with plans to spend billions on new chip factories in the United States and Europe. The company's ability to overcome these technical challenges and deliver on its promises will be crucial for its future in the highly competitive semiconductor market.

References

Summarized by

Navi

[1]

[3]

[4]

Related Stories

Intel Considers Abandoning 18A Chip Process, Shifting Focus to 14A in Bid to Win Major Customers

03 Jul 2025•Business and Economy

Intel's Foundry Future Hangs in the Balance: Next-Gen Chipmaking Tech Needs Customer Commitment

25 Jul 2025•Business and Economy

Intel's 18A Chip Process Achieves Key Milestones, Set for 2025 Production

07 Aug 2024

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research